Altcoin

XRP Whale Now Holds Mpeppe (MPEPE) Why The Move?

Published

3 months agoon

By

admin

In the ever-evolving world of cryptocurrency, major investors commonly known as “whales” are constantly on the lookout for the next big opportunity. Recently, a notable XRP whale made headlines by adding Mpeppe (MPEPE) to their portfolio. This move has sparked curiosity and speculation within the crypto community. Why would a seasoned XRP investor, deeply entrenched in the Ripple (XRP) ecosystem, shift their focus to Mpeppe? Let’s dive into the reasons behind this strategic decision.

Ripple (XRP) Continues Upward Momentum

Ripple (XRP) has been experiencing a resurgence, with its price recently climbing back to $0.60, marking a 7.74% gain within 24 hours. This rally aligns with a broader market recovery, making XRP one of the top gainers among leading cryptocurrencies. Analysts are optimistic that XRP’s price could reach $0.65 if this uptrend persists. This positive outlook is supported by a significant drop in whale-to-exchange transactions, which have fallen tenfold since August 18. This decrease in large-scale transactions suggests that Ripple (XRP) whales are holding onto their assets, a bullish sign that could support further price increases.

However, the world of cryptocurrency is notorious for its volatility. While Ripple’s (XRP) current trend is encouraging, it’s essential to acknowledge that the market can change rapidly. This uncertainty might be one reason why Ripple (XRP) whales are diversifying their portfolios, seeking out new opportunities that offer high growth potential—such as Mpeppe (MPEPE).

Mpeppe (MPEPE): A New Contender in the Meme Coin Space

Mpeppe (MPEPE) is quickly gaining attention as a promising new meme coin, particularly within the online gambling sector. Currently in its presale phase, Mpeppe is priced at $0.001777 USDT, and over 70% of the tokens have already been sold. The smart contract address for Mpeppe is 0xd328a1C97e9b6b3Afd42eAf535bcB55A85cDcA7B, which allows interested investors to join the presale easily.

But what makes Mpeppe stand out in a crowded meme coin market? For one, Mpeppe isn’t just about riding the meme coin wave it’s strategically positioned within the booming online gambling industry. This focus gives Mpeppe a clear use case, setting it apart from other meme coins that rely solely on community hype. The online gambling market is projected to reach over $100 billion by 2026, making Mpeppe an attractive investment for those looking to capitalize on this rapidly growing sector.

Why the XRP Whale Diversified with Mpeppe

So, why did an XRP whale decide to invest in Mpeppe? The reasons are multifaceted and strategic:

- Portfolio Diversification: While Ripple (XRP) remains a stronghold in the whale’s portfolio, the inherent volatility of the crypto market makes diversification a prudent strategy. By investing in Mpeppe, the whale is spreading risk and tapping into a different sector—online gambling—that offers significant growth potential.

- High Growth Potential: Mpeppe is in its early stages, and the presale has already shown strong investor interest. Early investments in successful projects can lead to exponential returns, a prospect that likely attracted the whale to Mpeppe.

- Market Sentiment: The current sentiment around Ripple (XRP) is cautiously optimistic. While the price could reach $0.65, there’s also the risk of a downturn if market demand falters. By investing in Mpeppe, the whale is hedging against potential XRP volatility while positioning themselves for high returns in a different market segment.

The Future of Ripple (XRP) and Mpeppe (MPEPE)

As Ripple (XRP) continues its upward trend, bolstered by a reduction in whale-to-exchange transactions and increased on-chain demand, it remains a formidable player in the crypto space. However, the market’s unpredictability makes it essential for investors to explore new opportunities. Mpeppe (MPEPE), with its strategic focus on the online gambling industry, offers a fresh and potentially lucrative avenue for investment.

The decision by an Ripple (XRP) whale to invest in Mpeppe (MPEPE) underscores the importance of diversification in the ever-changing world of cryptocurrency. While Ripple (XRP) may continue to perform well, Mpeppe presents a unique opportunity to capitalize on a burgeoning market. For investors, holding both Ripple (XRP) and Mpeppe could be a wise strategy to maximize returns while navigating the complexities of the crypto market.

Conclusion: A Strategic Move for Future Gains

In conclusion, the move by an XRP whale to acquire Mpeppe (MPEPE) reflects a calculated strategy to diversify and secure future gains. Ripple (XRP) continues to show promise, but the potential of Mpeppe in the online gambling market provides an additional layer of opportunity. As the crypto market evolves, the combination of XRP’s established presence and Mpeppe’s growth potential could prove to be a winning formula for forward-thinking investors.

For more information on the Mpeppe (MPEPE) Presale:

Visit Mpeppe (MPEPE)

Join and become a community member:

Source link

You may like

Trump calls up crypto pals, Senator says sell gold for Bitcoin | Weekly Recap

Where to Invest in November End?

XRP Price Hits 3-Year High At $1.6

Australia seeking advice on crypto taxation to OECD

Crypto Trader Records $2.5M Profit With This Token, Here’s All

Trump taps crypto bros to be in charge: What’s at stake?

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

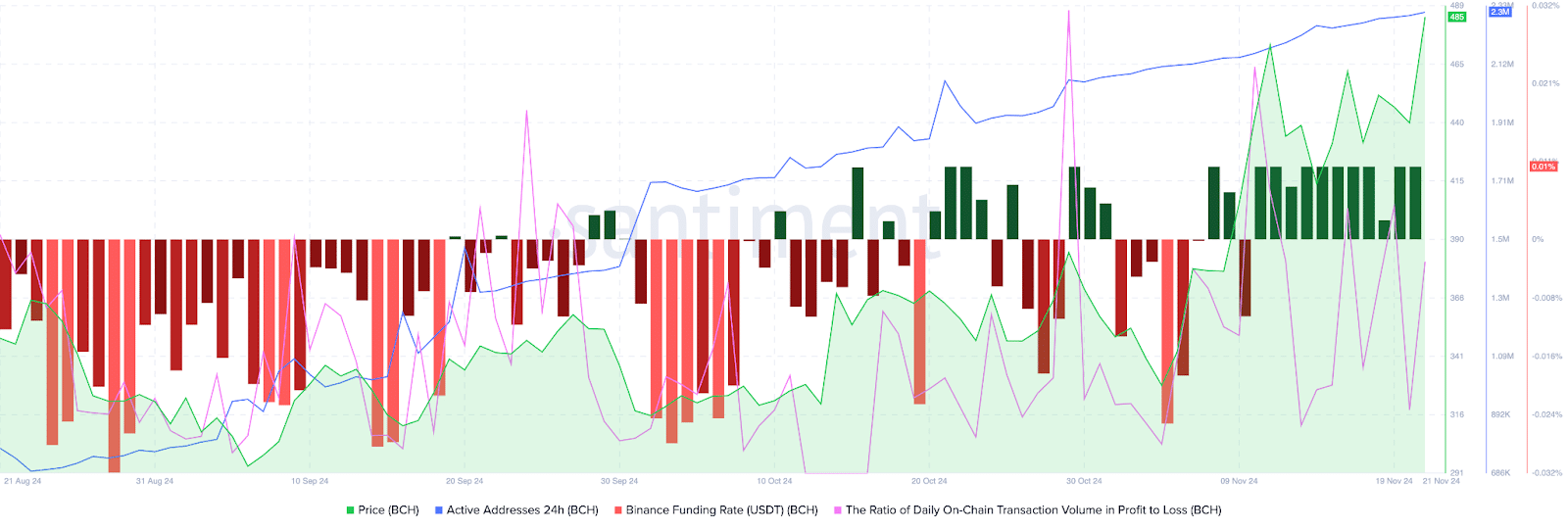

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

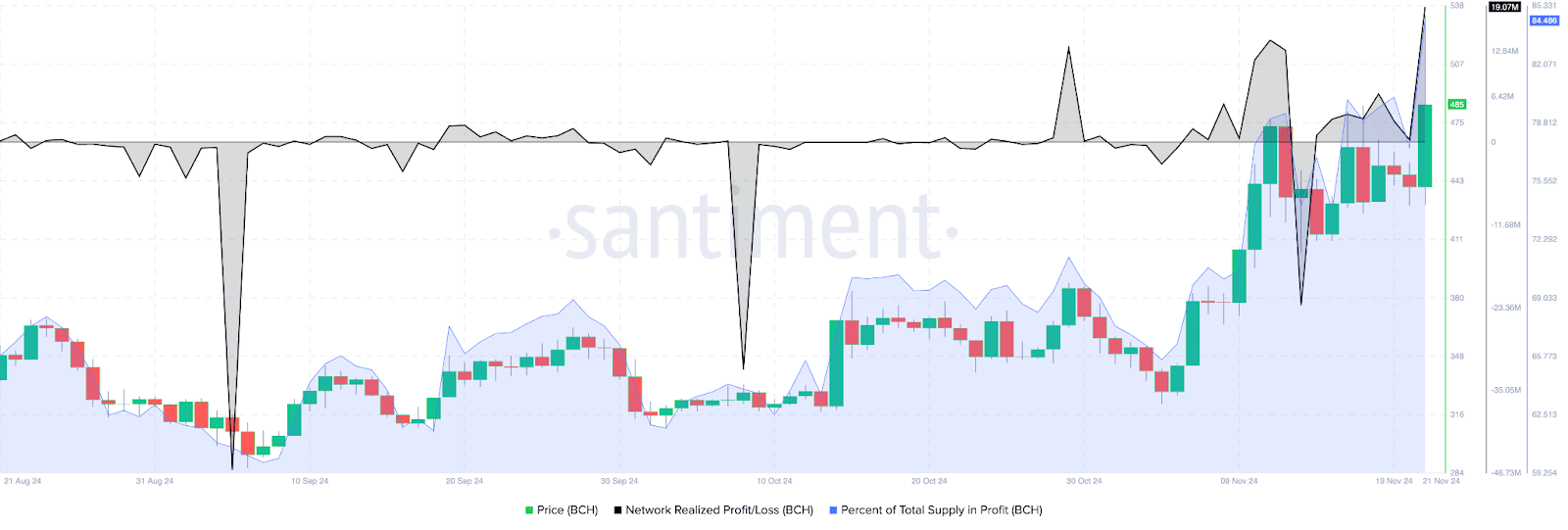

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

Derivatives traders are bullish on BCH

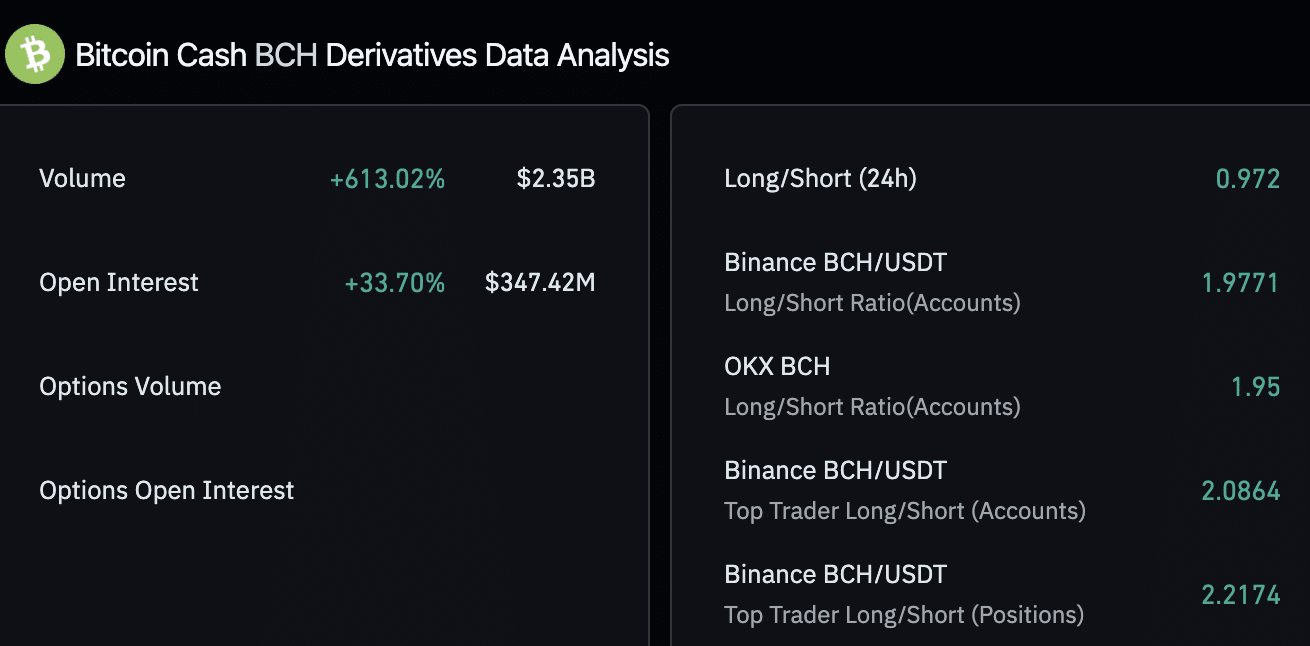

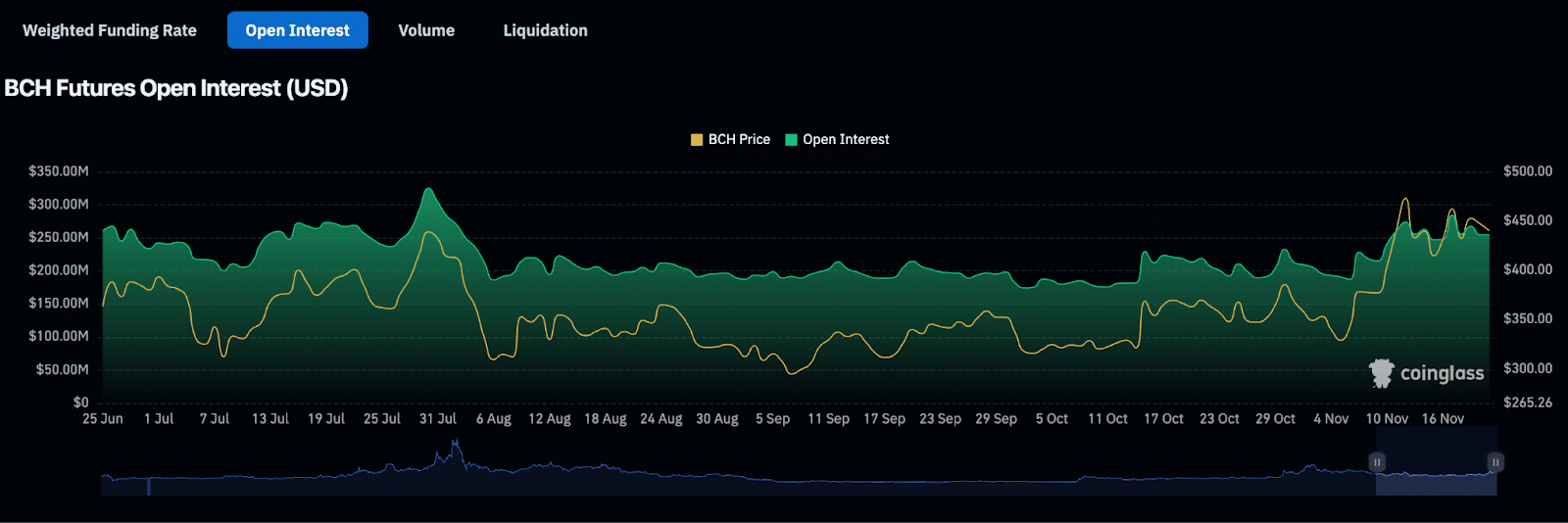

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

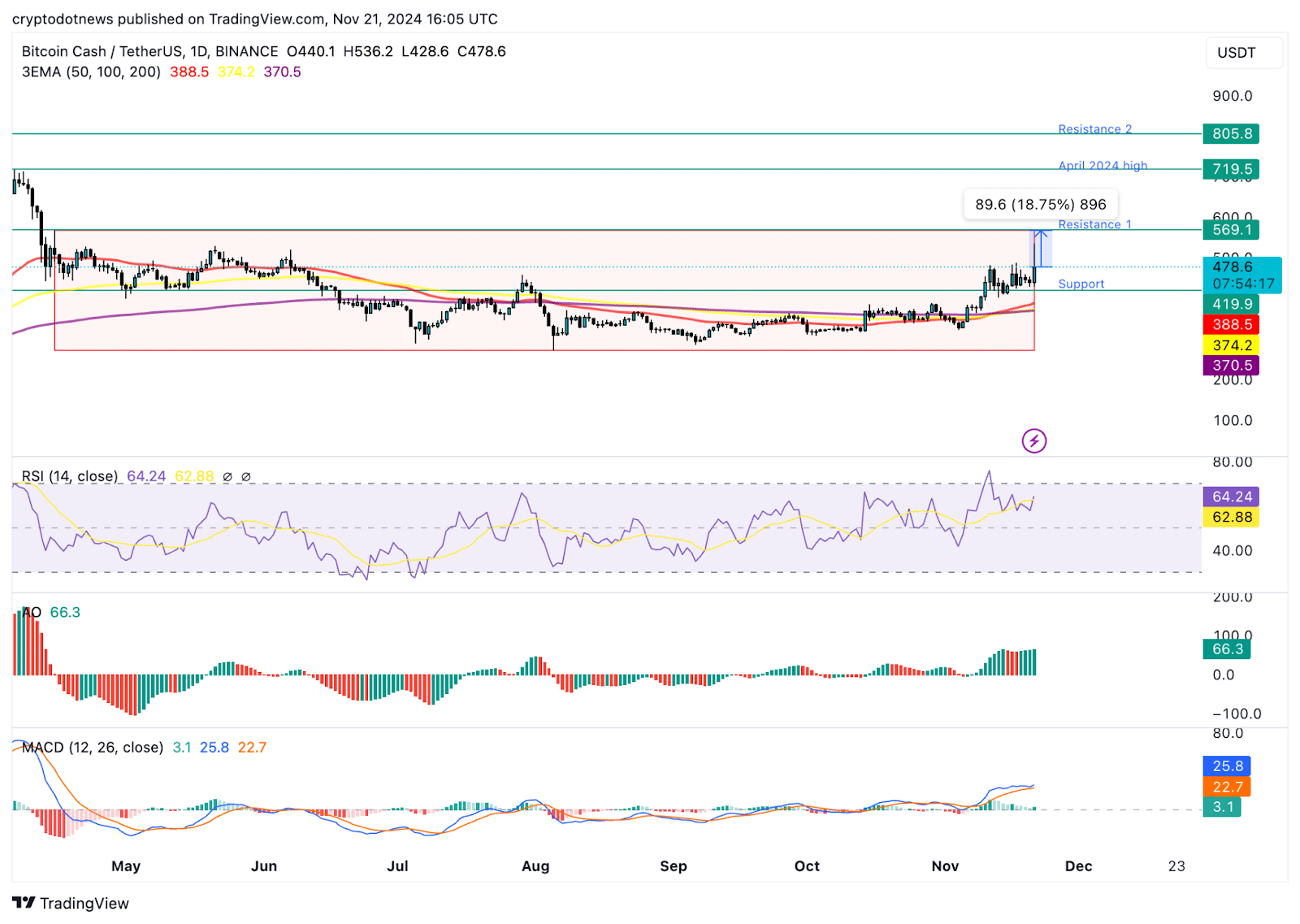

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Altcoin

Trader Says Telegram Gaming Token Primed To Rally by Nearly 100%, Updates Outlook on Ethereum and Dogecoin

Published

2 weeks agoon

November 8, 2024By

admin

A popular crypto strategist is suddenly flipping bullish on an altcoin connected to a viral game on the encrypted messaging platform Telegram.

Analyst Ali Martinez tells his 77,300 followers on the social media platform X that Notcoin (NOT) could soar 100% from its current value.

“Notcoin is showing a promising risk-to-reward setup. With a falling wedge pattern forming, it could be primed for a bullish breakout toward $0.012!”

A falling wedge breakout is a technical analysis pattern that is used to identify bullish reversals in an asset’s price. The pattern is characterized by a series of lower highs and lower lows that form a wedge-shaped pattern on the chart.

As the pattern progresses, the distance between the highs and lows decreases, which indicates that the selling pressure is weakening. When price breaks out of the upper trend line of the wedge, it’s traditionally considered bullish.

NOT is trading for $0.006 at time of writing, up 7.9% in the last 24 hours.

The analyst is also bullish on Ethereum (ETH), suggesting it could soon hit $6,000.

“The risk-to-reward ratio on Ethereum is too good to pass up for a long position! I’ve set my stop below $1,880 and am aiming for a target of $6,000.”

Looking at his chart, the analyst suggests ETH is holding the bottom trend line of the ascending channel as support and could soon re-test the upper bound at around $6,100.

Next up, the analyst suggests that Dogecoin (DOGE) may see an explosive rally, in part, due to billionaire Elon Musk. Musk, one of the memecoin’s most famous supporters, is now close to US President-elect Donald Trump, after playing a role in his election.

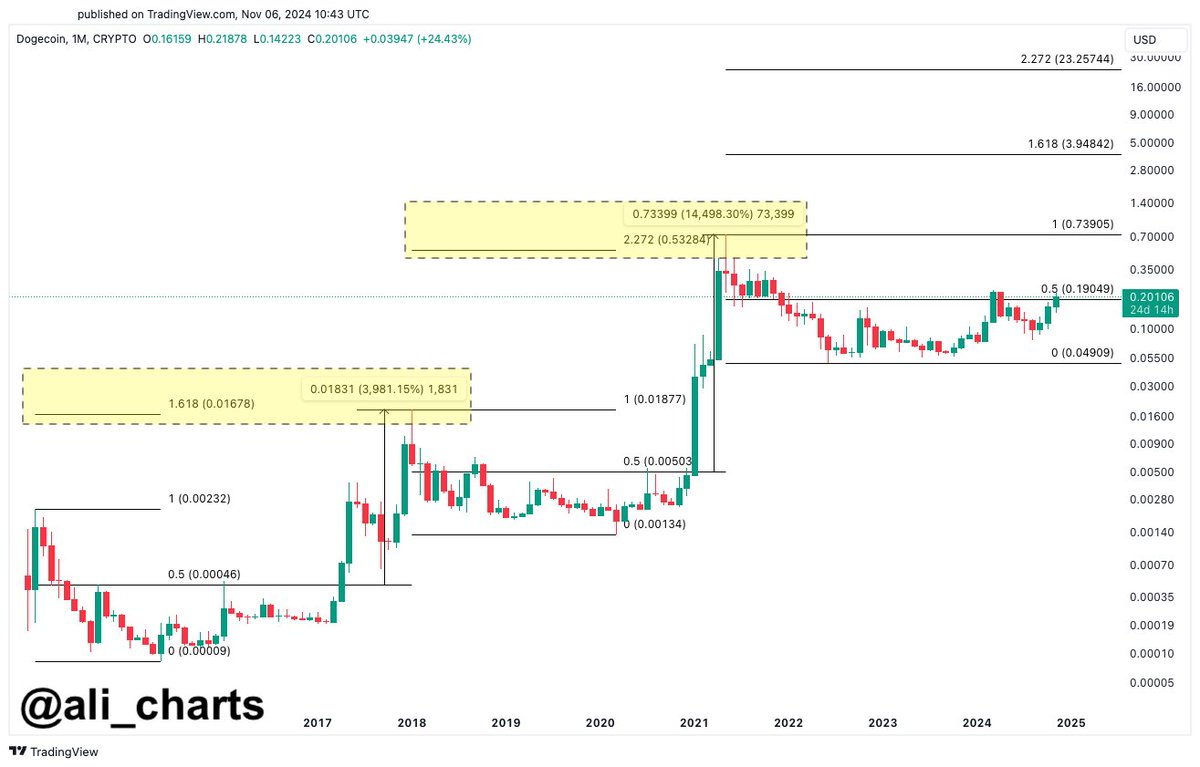

The analyst also believes DOGE may repeat a historic pattern based on Fibonacci extensions, which traders use in technical analysis to estimate profit targets and price pullbacks. They are based on Fibonacci ratios.

“With Elon Musk now influencing the 47th President, Donald Trump, Dogecoin could be primed for a wild ride! In past bull cycles, once DOGE broke the 0.50 Fibonacci retracement, it often rallied to the 1.618 or even 2.272 Fib levels. If history repeats, we could see DOGE hit somewhere between $4 and $23!

Dogecoin is trading for $0.1969 at time of writing, up 15% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

PONKE Price Skyrockets 19% On Binance Support, What’s Next?

Published

3 weeks agoon

November 4, 2024By

admin

The Solana meme coin Ponke (PONKE) saw its price soar by 19% following Binance’s announcement of a USDⓈ-Margined PONKEUSDT Perpetual Contract. Set to launch on November 4, 2024, this contract offers users up to 75x leverage, signaling increased opportunities for traders and heightened optimism among PONKE supporters.

PONKE Price Rockets Amid Major Binance Support

According to Binance’s official announcement, the PONKEUSDT perpetual contract will go live on November 4 at 12:30 UTC, providing traders with 75x leverage and 24/7 trading. Key features include a tick size of 0.00001 and a capped funding rate of ±2.00%, with funding fees settled every four hours. Binance’s Multi-Assets Mode further allows users to utilize BTC as collateral, offering flexibility in margin trading. However, the exchange may adjust contract specifications, such as funding fees, leverage, and tick size, based on evolving market conditions, ensuring the asset aligns with market risk levels.

#Binance Futures will launch the USDⓈ-Margined $PONKE Perpetual Contract at

🗓️ Nov 4 2024, 12:30 (UTC)

Read more ➡️ https://t.co/kqrmZqnEp6 pic.twitter.com/LQPUlMOBOR

— Binance Futures (@BinanceFutures) November 4, 2024

PONKE, built on Solana, benefits from the blockchain’s high-speed and low-cost transactions, catering to online traders and gaming enthusiasts. The coin’s community-driven design, distinct tokenomics, and accessibility through major exchanges contribute to its market appeal. Its #ponkyarmy community is particularly active, with governance roles and a dedicated social media presence that drive further engagement and growth.

Will The Rally Sustain?

Following the Binance listing news, PONKE’s price surged by 19%, currently trading at $0.49, with a 24-hour low of $0.43 and a high of $0.56. Its trading volume climbed to $77 million in the last 24 hours, indicating heightened interest. PONKE, with a market cap of $274 million, continues to capture the attention of meme coin enthusiasts. Besides, recent Coinglass data also highlights increased open interest for PONKE, signaling optimism for further gains.

Launched in late 2023 with a total supply of 555 million tokens, PONKE has already achieved an all-time high of $0.70 four months ago. Its deflationary burn mechanism and community-driven features have positioned PONKE uniquely within the Solana ecosystem, drawing both meme coin fans and investors seeking growth in Solana-based assets.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Trump calls up crypto pals, Senator says sell gold for Bitcoin | Weekly Recap

Where to Invest in November End?

XRP Price Hits 3-Year High At $1.6

Australia seeking advice on crypto taxation to OECD

Crypto Trader Records $2.5M Profit With This Token, Here’s All

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: