cryptocurrency

ZetaChain Price Prediction | Is ZETA a Good Investment?

Published

3 months agoon

By

admin

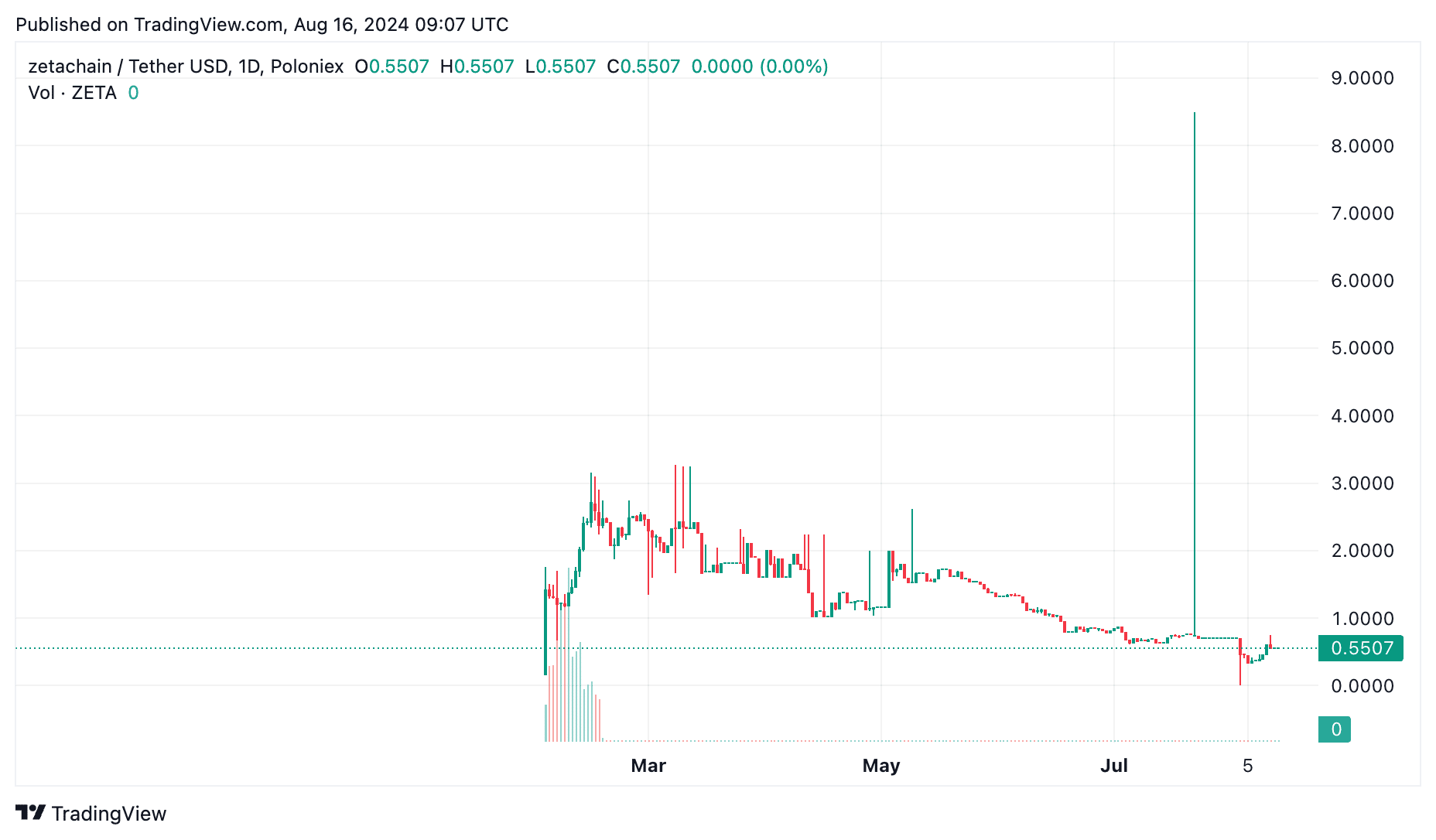

In early August, the native token of ZetaChain experienced quite a rollercoaster ride.

On August 5, 2024, it dropped to a new all-time low of $0.3448. However, six days later, it surged over 50% to $0.7524 following the listing of ZETA tokens on Coinbase.

As of August 16, the token is trading at approximately $0.56, still well below its all-time high of $2.85 reached in February 2024. What’s next for ZETA? Will it surpass its previous high, and if so, when might that happen? Check out our ZetaChain price prediction for 2024-2030.

What is ZetaChain and what are its goals

ZetaChain is a public blockchain that supports Omnichain functionality, universal smart contracts, and messaging between any blockchain. It aims to create a seamless, multi-chain crypto environment where users and developers can easily move between blockchains, taking advantage of their unique features — like payments, DeFi, liquidity, gaming, art, performance, security, and privacy.

ZETA coin: what is it and how is it used

The ZetaChain native token, ZETA, is used to pay for gas fees on the network. ZETA also underpins cross-chain transfers, exchanges, messaging, and security within ZetaChain.

What are the expectations for ZETA in the near term and beyond?

ZetaChain crypto price prediction: short-term outlook

According to CoinCodex’s ZetaChain coin price prediction, ZETA’s price is expected to increase by 226.21%, potentially hitting $1.868596 by September 15, 2024.

As of August 16, 2024, the overall sentiment for the ZetaChain price forecast remains bearish, with 4 technical analysis indicators showing bullish signals and 18 indicating bearish trends.

ZetaChain price prediction 2024

DigitalCoinPrice, drawing from insights from investors and market experts, suggests that ZetaChain might soon surpass its old high of $2.85 and settle between $1.15 and $1.23 in 2024.

According to CoinCodex’s projections for ZetaChain, ZETA is forecasted to trade between $0.572827 and $2.97 in 2024. If it reaches the upper end of this range, ZETA could see an increase of 377.05%.

Wallet Investor’s ZETA price prediction is not so optimistic. The resource anticipates that by the end of 2024, this token could achieve a maximum price of $0.08065.

ZetaChain price prediction 2025

According to DigitalCoinPrice’s ZetaChain price prediction for 2025, the price of ZETA could fluctuate between $1.20 and $1.41, with the most likely value stabilizing around $1.33 by year’s end.

CoinCodex’s forecast for 2025 is consistent with its prediction for 2024.

Wallet Investor expects that by the end of 2025, ZETA could potentially trade at only $0.0777.

ZetaChain price prediction 2030

DigitalCoinPrice’s forecasts and technical analysis project that ZETA’s price could reach a new high of $3.77 or $4.01 by the end of 2030. The years between 2024 and 2030 are set to be pivotal for ZetaChain’s growth.

According to CoinCodex’s ZetaChain price prediction for 2030, ZETA’s price could range from $1.425203 to $2.31.

Should you invest in ZETA?

The future value of ZetaChain coin depends on various factors, including market trends and investor sentiment. While there are times when the price might seem poised to rise, the market’s unpredictability means it could also decline. Deciding whether to invest in ZETA should hinge on your personal comfort with risk and investment objectives. Whether you’re considering investing or holding back, take your time to weigh the risks involved.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Adoption

Survival of the healthiest: Creating a successful crypto

Published

10 hours agoon

November 24, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Darwin’s theory of evolution suggests that living organisms best adjusted to their environment are the most successful at surviving. Organisms struggle against each other in competition for resources that are necessary for existence within their environment. The same principle can be applied to cryptocurrencies. In a volatile, decentralized world characterized by competition among networks, only the healthiest, most well-structured ecosystems survive. Developers should, therefore, focus on developing a ‘healthy’ underlying network for crypto to ensure they stand the best chance of surviving the next evolutionary cycle.

What makes a crypto ‘healthy’?

The nature of cryptocurrencies is vastly different from that of living organisms, so the resources that make a crypto ecosystem ‘healthy’ differ from those that make a living organism ‘fit.’

Cryptocurrencies are decentralized virtual assets existing in the web3 space, so they rely on many individual users to interact within this ecosystem to create a healthy store of value. Like fiat currencies, without this social network made up of token holders, a cryptocurrency asset has no value. Each cryptocurrency can represent its own ‘culture’ through a transactive coin, where value is rooted in the psychology of its holders. This is mirrored by the fact that social events, user perception, and supply often impact the value of the token.

Since all cryptocurrencies derive value from community and user interactions within the web3 environment, they compete within the same web3 parameters for user attention and transactions. The parameters used to define a ‘healthy’ crypto network relate to token holder activity and include the principles of distribution, variety of holders, variety of transactions, and token flow, where there must be a sustainable number of diverse transactions.

It is not just about having user activity, but the right kind. If one individual lived in a nation-state as its sole citizen with a bank account of $100 million, the GDP per capita of that nation would be the best in the world—yet its chances of survival would be non-existent. Since there is only one holder, there would be no scope for transactions or a variety of holders, rendering it defunct and with no value.

Whilst living organisms may be competing for things like food and resources in the real world, cryptocurrency tokens are competing for transactions and user attention in the web3 world.

Since cryptocurrencies rely on blockchain, an open-source ledger storing all transactions, it is possible to map all transactions between wallets within an ecosystem and measure the parameters that determine a ‘healthy’ network. In practice, we can see which token ecosystems are developing ‘healthy’ networks and which ones are slowly becoming extinct. Over time, any patterns that align with network failure, including manipulation or crime, like any other asset class, can increase the risk relating to a token. With this data, we can rate and rank ecosystems, determining which ones are winning the competition for survival.

Bitcoin & Matic: A success story

Bitcoin (BTC) has been able to construct a healthy network. It is estimated that 106 million people around the globe own Bitcoin, making it the most widely held token. Significantly, Bitcoin now represents 58% of the total value of crypto, showing that amongst web3 users, Bitcoin is overwhelmingly the most popular store of wealth. Not only is it widely held, but it is also widely transacted. Throughout the first half of 2024, Bitcoin’s blockchain regularly had over 400,000 transactions a day. This sustainable and high transaction volume is reflected in Bitcoin’s pricing. Whilst it has experienced several devaluations, it has been sitting above $50,000 for the past nine months, and it is one of the most stable cryptocurrencies in the market, having recently surpassed 90,000 USD.

Similarly, Polygon (MATIC), has constructed a healthy network. Around 633,588 wallets hold Matic, making it a widely held token. It is also widely transacted, in varying amounts and for a variety of reasons, making it robust. Throughout 2024, Matic has regularly had over 4100 transactions a day. This sustainable and high transaction volume is reflected in Matic’s 24-hour trading volume, which sits at 7.76m USD.

Dogecoin: A rapid unraveling

Although Dogecoin (DOGE) has rallied hard in recent years, it has failed to establish a ‘healthy’ network. At certain times, it has experienced a large amount of user activity, which has driven up prices momentarily. This includes early 2021, when Dogecoin’s price increased dramatically by 23,000%. However, the number of transactions that drove this price increase was not sustainable. The user activity here was driven by short-term hype, and the transactions taking place were not diverse. The majority of users were interacting with the network purely to ‘pump and dump‘ rather than for any long-term, sustainable utility. This was fuelled primarily by Elon Musk simply tweeting about the token, creating an anomalous spike in price. This rally demonstrated the token’s immense volatility and lack of an entrenched perception by users that Dogecoin has value rooted in something greater than a singular point of interest. Whilst it is still held by around 4 million people, and it still has relatively high levels of transactions, in October 2024, around 250,000 daily transactions. However, a significant 82% of the total circulating Dogecoin is held by a shockingly small amount of wallets, only 535, demonstrating a lack of variety of transactions.

Dogecoin is experiencing another surge thanks to the recent US election result and Elon Musk’s appointment to Trump’s Department of Government Efficiency. Yet, while it has moments of high price, these have not been driven by sustained and meaningful growth. Where Dogecoin has been unable to create a sustainable number of transactions from a diverse array of wallets, Bitcoin and Matic have been able to do so. The evidence is in Bitcoin and Matic’s comparatively stable growth and Dogecoin’s volatility. While DOGE is still holding on, this is driven by hype; like the dinosaurs that came before us, it will likely become extinct.

Focus on the network, not the price

The success of cryptocurrencies and sustainable price increases rests on the health of the web3 network underpinning the token. Rather than focusing on driving the price up for the sake of price, a cryptocurrency developer should, therefore, focus on developing a ‘healthy’ underlying network by harboring sustainable and diverse transactions. This will lay the groundwork for tokens to attract users, beat off competing networks, and ultimately lead tokens to grow in price.

Simon Peters

Simon Peters is the CEO and co-founder of Xerberus, a cryptocurrency risk rating protocol offering industry-leading analysis through its Wallet Graph™️ technology. Xerberus is designed to map and monitor the systemic health of a crypto asset in real-time through its investor wallet network.

Source link

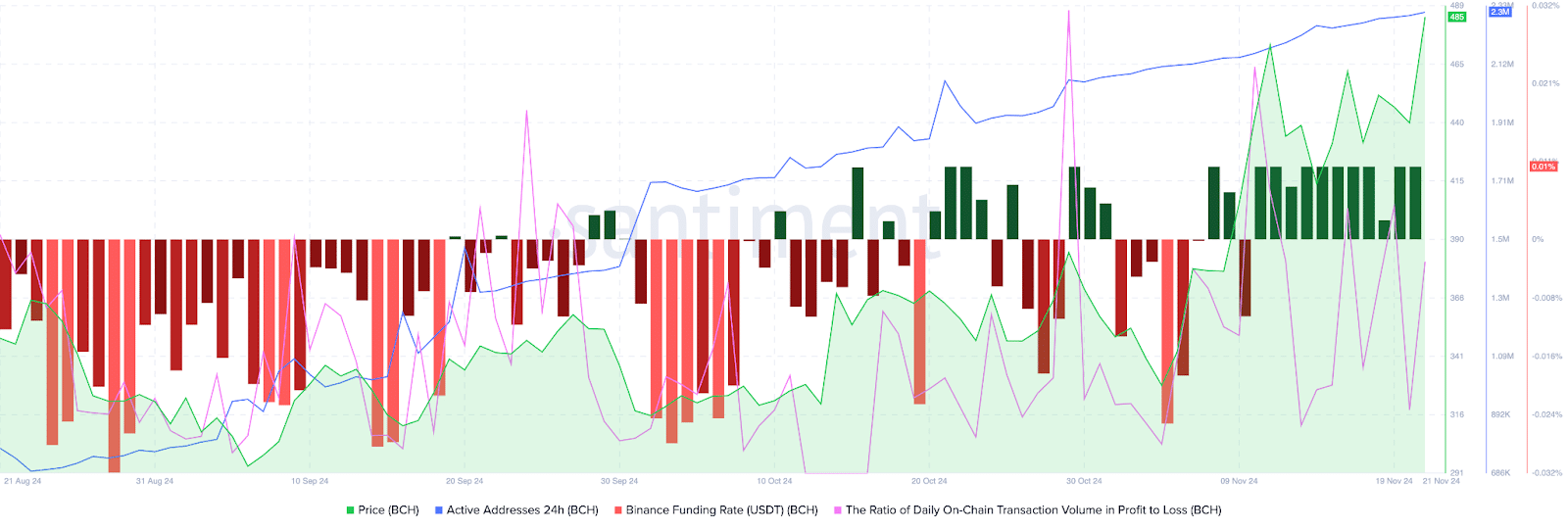

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

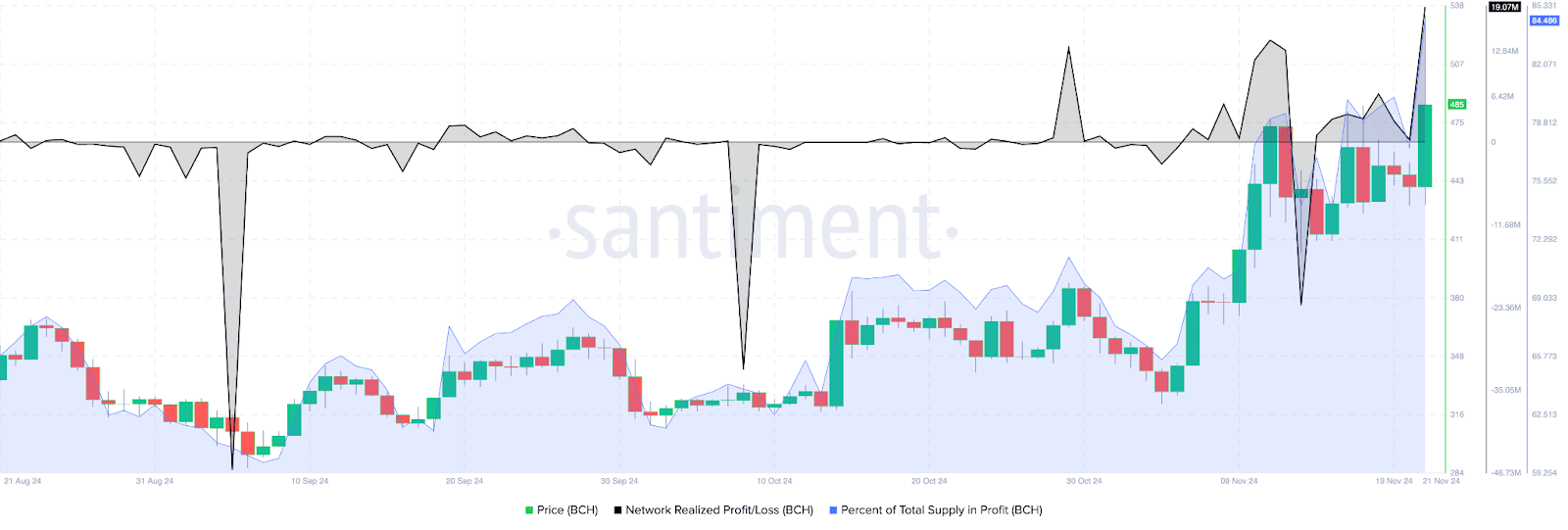

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

Derivatives traders are bullish on BCH

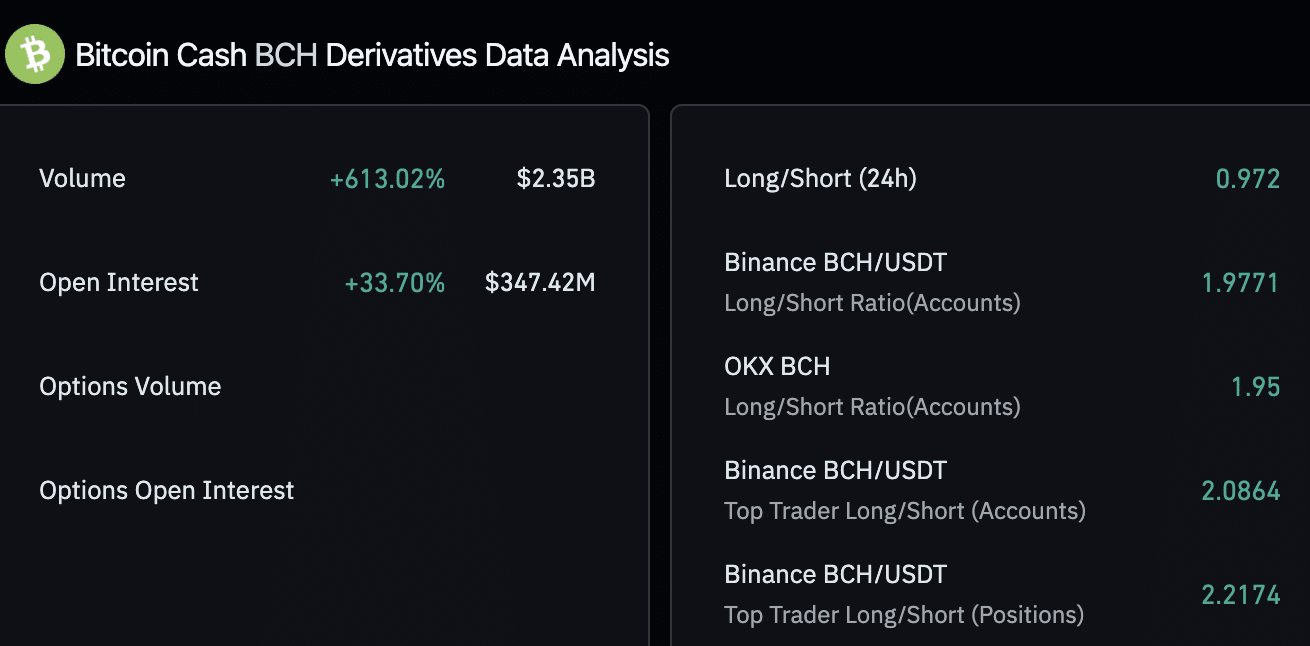

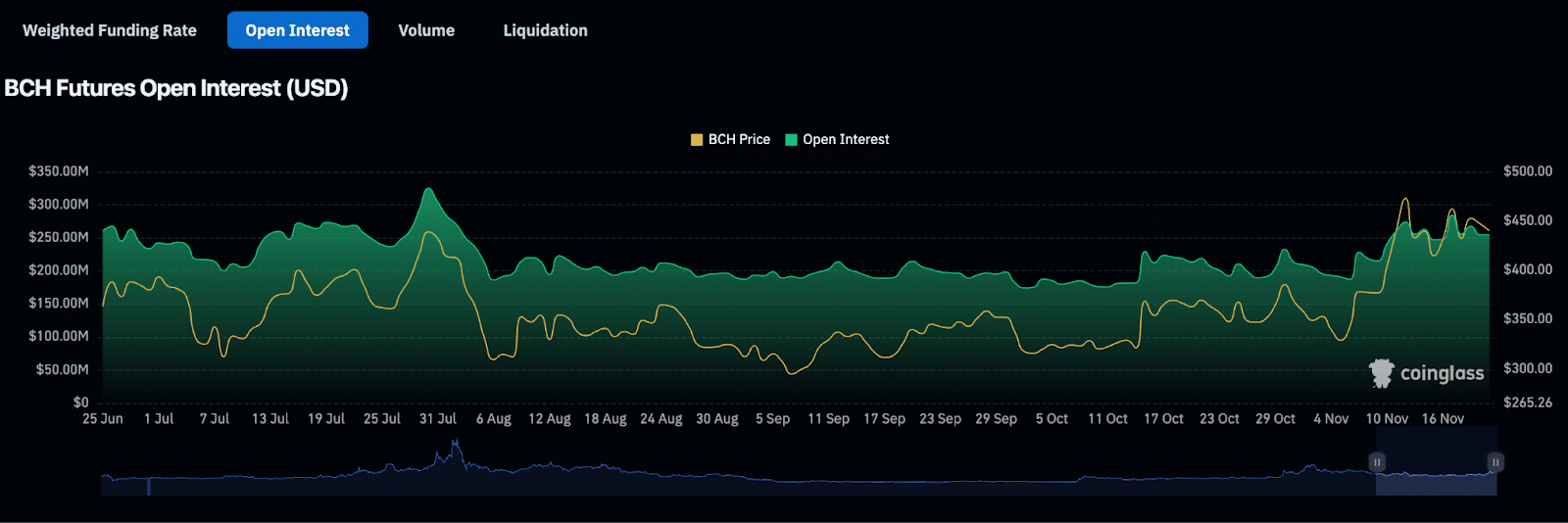

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

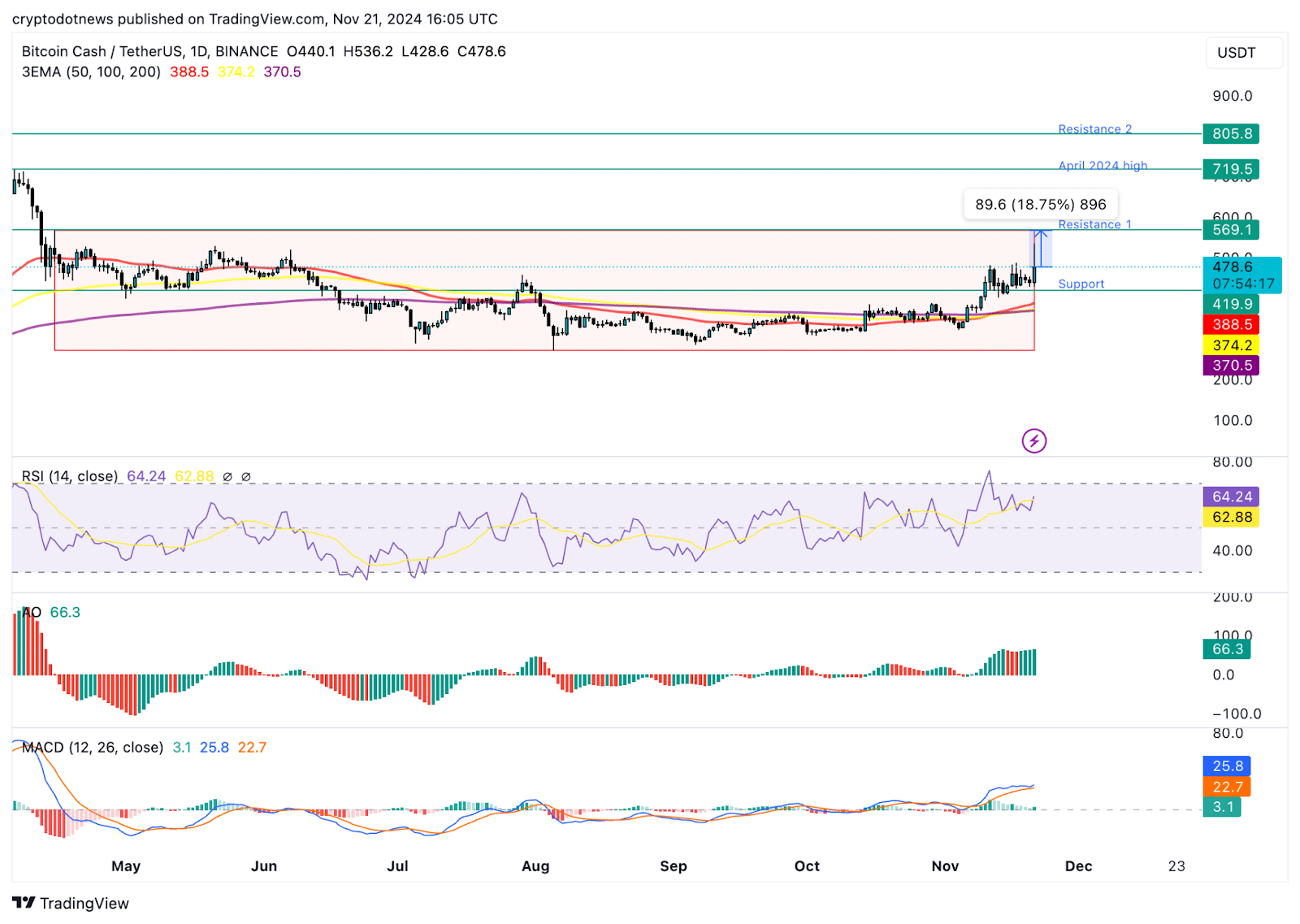

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Blockchain

Sui Network blockchain down for more than two hours

Published

3 days agoon

November 21, 2024By

admin

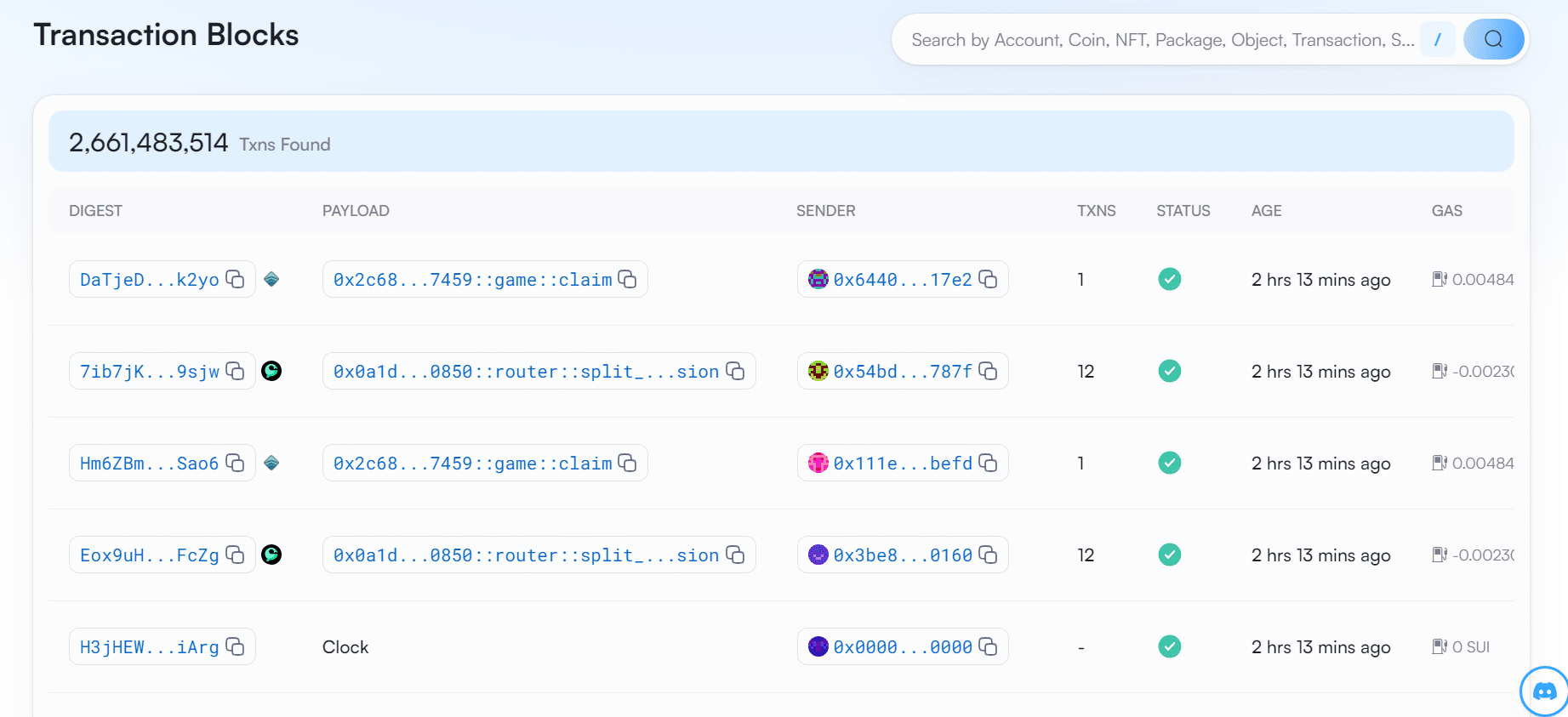

The Sui Network is suspected to be down for more than two hours. The protocol has not produced any new transaction blocks since Nov. 21 UTC 9:15.

Based on the latest data from Sui Network’s explorer site Sui Vision, the decentralized layer-1 blockchain has stopped producing blocks for more than two hours.

At the time of writing, the last transaction block took place on Nov. 21 at 9:15 am UTC. Since then, no new blocks have been produced on the blockchain.

The Sui Network confirmed the outage on its official X account, stating that the blockchain is currently unable to process transactions. However, it claims that the problem has been identified and will be back to normal soon.

“We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates,” wrote the protocol on X.

Service Announcement: The Sui network is currently experiencing an outage and not processing transactions. We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates.

— Sui (@SuiNetwork) November 21, 2024

Sui’s blockchain outage has seemingly impacted the SUI token price. According to data from crypto.news, the Sui token has gone down by nearly 2% in the past hour. It is currently trading hands at $3.41. In the past 24 hours, SUI has plummeted by 7.29%.

Even though, the token has gone up by nearly 75% in the past month.

SUI currently ranks in the 18th place in the lineup of cryptocurrencies, holding a market cap of $9.7 billion and a fully diluted valuation of $34 billion. The Sui token has a circulating supply of $2,8 billion tokens.

The South Korean crypto exchange, Upbit, announced it will be temporary suspending deposits and withdrawals for the Sui token due to its block generating outage.

The notice informs users that if they deposit or withdraw Sui tokens after the announcement was posted, then there is a chance that their funds cannot be recovered.

Several crypto industry figures took to X to comment on the recent Sui Network outage. Most of them teased Sui’s goal of becoming Solana’s biggest competitor. Ironically, the Solana blockchain also has a track record of outages in the past, with the latest one recorded in February this year.

“Sui [is] just repeating Solana history,” said one X user.

“Hasn’t Solana gone down multiple times?” asked another X user.

“SUI blockchain is down. And they claimed to be a Solana Killer,” wrote crypto YouTuber Ajay Kashyap on his X post.

Source link

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential