crypto liquidations

ZKasino scammer wallet lost $27.1m after long position ETH close

Published

6 days agoon

By

admin

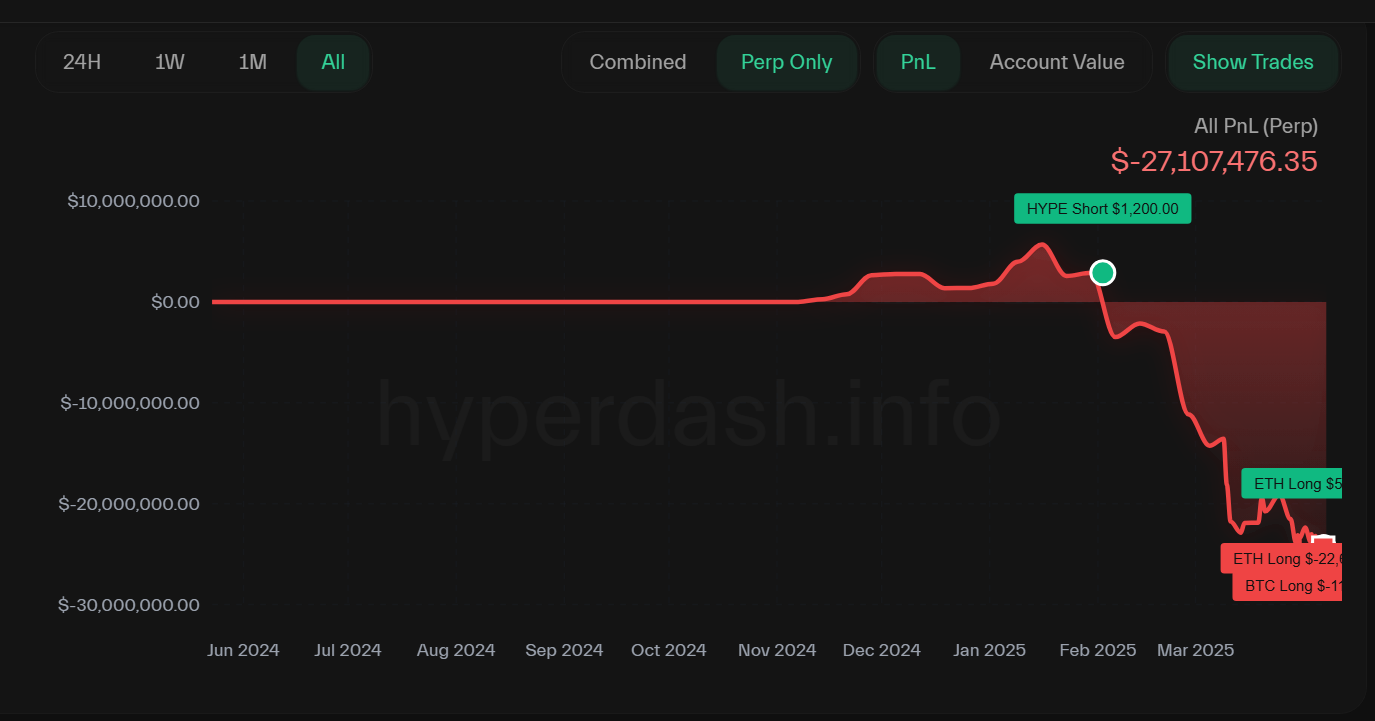

An account linked to ZKasino, a gambling platform that stole more than $30 million from its users in 2024, lost $27.1 million after closing a long position on Hyperliquid.

According to on-chain data on Hyperdash, the scammer address behind the blockchain-based betting platform had its 20x leveraged long ETH (ETH) position on Hyperliquid fully liquidated. As a result, the trader lost approximately $27.1 million. However, the trader still had around $147.38 in unrealized profit and losses.

The address is linked to a scammer behind the blockchain gambling platform that reportedly stole around $32 million last year. On the social media platform X, traders reacted positively to the news, with many stating that the scammer got what they deserved.

“A scammer gets a dose of karma,” wrote Onchain Lens in a recent post about the liquidation.

“Karma is real!” said another user on X.

Meanwhile, another user doxxed the scammer by sharing his full name and passport picture as well as the pictures of both his mother and sister. The user also tagged Donald Trump, Elon Musk and the FBI among other major U.S. government accounts in an attempt to alert them.

What is ZKasino?

ZKasino was introduced as a betting and gambling platform a decentralized gambling platform built on the Ethereum-based layer-2 blockchain platform, ZKsync. The platform was powered by its native token ZKAS and has around 75,000 followers on its official X account.

In April 2024, it received widespread backlash from users who claimed that the platform still had not returned their Ethereum funds two months after their initial “signup” deposits. Users at the time accused the platform was a scam, because it only swallowed up ZKAS tokens but did not give them the returns as promised.

Due to this controversy, the team behind ZKasino promised users that it would give them a refund after they launch a ZKasino mainnet. However the mainnet was never launched and users never got their Ethereum back. This resulted in a combined loss of more than $30 million worth of ETH from users.

Not only that, the founder of ZKsync DEX project ZigZag, Kedar Iyer, accused the ZKasino team of defrauding former contractors and employees by not paying them for their work in building the platform.

Source link

You may like

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

crypto liquidations

US court permits Three Arrows Capital to expand claim against FTX, rejects FTX’s objections

Published

1 month agoon

March 14, 2025By

admin

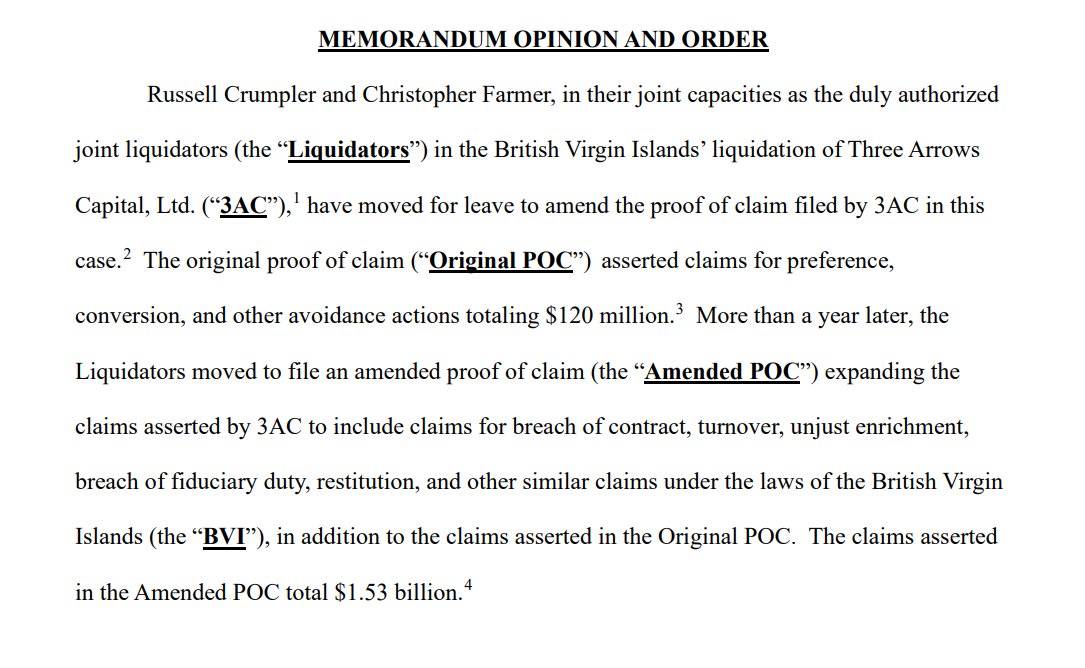

A U.S. bankruptcy court has allowed the liquidators of the defunct crypto hedge fund Three Arrows Capital to substantially increase its claim against the collapsed crypto exchange FTX from $120 million to $1.53 billion.

In a March 13 ruling by the US Bankruptcy Court for the District of Delaware, the judge ruled that FTX is to pay out $1.53 billion to Three Arrows Capital, increasing the claim from the original $120 million filed in June 2023. FTX objected to the decision, arguing it was too late and would slow down their bankruptcy process. However, the judge sided with 3AC’s liquidators, opining that they had provided sufficient notice of their claim. The judge determined that the delay in filing the larger claim was mainly due to FTX not promptly sharing relevant records with 3AC’s liquidators. 3AC liquidators needed that information to properly assess and detail their claim.

The 3AC’s liquidators are claiming that FTX held $1.53 billion in 3AC’s assets, which were then liquidated to pay off 3AC’s debts. Furthermore, 3AC liquidators argued that those transactions were avoidable and that FTX didn’t provide the information that would’ve uncovered the liquidation.

Both 3AC and FTX were once major players in the crypto world, but both are no defunct. Three Arrows Capital was one of the largest crypto hedge funds that collapsed in June 2022 due to forced liquidation of overleveraged positions in Bitcoin (BTC), Ethereum (ETH), and other altcoins. They filed for bankruptcy in July 2022. Its liquidators are now trying to recover funds by selling their remaining assets and through various lawsuits, most notably against FTX and Terraform Labs to repay its creditors.

FTX crypto exchange declared bankruptcy in Nov. 2022 and has also seen been trying to recoup funds through various lawsuits, including one against Binance and Changpeng Zhao. FTX recently started their repayment process facilitated through BitGo and Kraken exchanges.

Source link

Bitcoin

Bybit CEO estimates crypto wipeout crossed $8b, more than $2b reported

Published

2 months agoon

February 3, 2025By

admin

Bybit CEO Ben Zhou has suggested that the ongoing crypto market liquidation event may be significantly larger than widely reported.

According to CoinGlass data, over $2 billion in digital liquidations in 24 hours on Monday, Feb. 3, marking the single largest liquidation event in crypto history.

Several analysts estimated liquidations exceeded $2.2 billion, surpassing the COVID crash and FTX collapse, two of the most significant liquidation events ever recorded.

Yet, Zhou said the numbers may be underreported due to API limits. According to Bybit’s co-founder, the crypto exchange limits how much data is pushed to aggregators like CoinGlass. Other platforms likely use a similar capped system, Zhou said via X.

Zhou estimated that liquidations on Bybit alone accounted for $2.1 billion in losses, representing over 85% of the total reported figures. “I am afraid that today’s real total liquidation is a lot more than $2 billion. By my estimation, it should be at least $8 billion to $10 billion,” Zhou said.

Following Zhou’s comments, crypto community members debated the accuracy of the reported figures. Some speculated that previous liquidation events, such as the COVID crash and the FTX collapse, may have also been underreported.

Looking ahead, Zhou pledged that Bybit would begin sharing all liquidation data with the public. “We believe in transparency,” he stated, as digital assets reeled from a massive leverage flush.

need to dig out this data, but should be at least 4-6 times of what was reported basically.

— Ben Zhou (@benbybit) February 3, 2025

Source link

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Bitcoin price tags $86K as Trump tariff relief boosts breakout odds

Where Top VCs Think Crypto x AI Is Headed Next

India’s Leading Bitcoin And Crypto Exchange Unocoin Integrates Lightning

Solana Triggers Long Thesis After Pushing Above $125 – Start Of A Bigger Rally?

Popcat price surges as exchange reserves fall, profit leaders hold

Crypto Analyst Says Bitcoin Back in Business, Calls for BTC Uptrend if One Support Level Holds

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x