Bitcoin

Bitcoin Boosts MicroStrategy (MSTR) to Higher Trading Volume Than Tesla and Nvidia

Published

2 months agoon

By

admin

Today, MicroStrategy (MSTR) surpassed a $100 billion market cap to become the 93rd largest publicly-traded company in the U.S.

At the time of writing, MSTR has done more trading volume than both stock giants Tesla and Nvidia today, and has traditional stock traders like the Wall Street Bets community losing their minds.

Wow $MSTR is the most traded stock in America today.. to best $TSLA and $NVDA is crazy. It's been years since a stock has traded more than one of those two (it may have actually been $GME to last do it). It's also about double $SPY! Wild times.. pic.twitter.com/bUr8nycMX3

— Eric Balchunas (@EricBalchunas) November 20, 2024

This is absolutely mindblowing considering MicroStrategy was a mere $1 billion company when it first bought bitcoin for its treasury about four and a half years ago.

The big question I’m asking myself is, how and when does this end? Assuming MSTR continues to pump until the peak of this bull market, it’s anyone’s guess on how high MSTR may go.

But how hard will it crash in the bear market, considering it is essentially a leveraged trade on bitcoin? Dare I even suggest that this time may be different, and that the downside of the next bitcoin bear market won’t be as brutal as the 70%+ corrections we’re historically used to seeing?

Even with the spot bitcoin ETFs, and the notion that the US may lead the charge of nation states buying up mass amounts of bitcoin, I’m still not convinced that we don’t eventually see a massive downturn in bitcoin’s price. And I’m mentally preparing for a normal bitcoin bear market to commence after this bull market finishes sometime in the next year or so.

But back to MSTR — Michael Saylor has thus far proven that the Bitcoin for Corporations strategy works in stunning fashion. Public companies have been coming out of the woodwork this past week announcing that they’ve purchased bitcoin for their balance sheet or plan to do so, and it seems this trend will continue as the CEO of Rumble asked his X audience if he should add BTC to their balance sheet (almost 94% of his 42,522 voters voted “yes”).

Lets put this in a poll format…

Should Rumble add Bitcoin to its balance sheet?

— Chris Pavlovski (@chrispavlovski) November 19, 2024

Michael Saylor even offered to help explain how and why Rumble should adopt a corporate BTC strategy.

Institutional bitcoin adoption is here and it’s only going to grow for the foreseeable future. As companies figure out the logic behind adopting bitcoin as a strategic reserve asset, the number of publicly-traded companies that adopt this strategy is going to explode.

Companies that add bitcoin to their balance sheet will rise above most other companies — even top big tech giants — in terms of trading volume, as MicroStrategy has, until all companies add bitcoin to their balance sheet. I try to put myself in the shoes of a trader, with knowledge on Bitcoin and think to myself, “Why on earth would I buy any company’s stock if they don’t have bitcoin on their balance sheet?” I wouldn’t — it would be way too boring.

Putting BTC on the balance sheet helps create volatility, and therefore opportunity for stock traders, which is good for the traders, stock price, and company overall. If you are a publicly-traded company, it is a no brainer to adopt bitcoin as a treasury reserve asset.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Trump’s U.S. Treasury Secretary Bessent Approved, Likely Tackling Taxes Before Crypto

Shiba Inu Whale Buys 257.5B SHIB Amid Dip

Solana Plunges 12%, But This Pattern Could Mean Decline Isn’t Over Yet

President Trump’s Executive Orders Build Confidence With Institutional Crypto Investors: CoinShares

How Declining Short-Term U.S. Treasury Yields Impact Bitcoin Price

Is Chinese AI Sensation DeepSeek a Security Risk?

Bitcoin

How Declining Short-Term U.S. Treasury Yields Impact Bitcoin Price

Published

5 hours agoon

January 27, 2025By

admin

The recent divergence in U.S. Treasury yields, where shorter-term yields have been declining while longer-term yields are on the rise, has sparked significant interest across financial markets. This development provides critical insights into macroeconomic conditions and potential strategies for Bitcoin investors navigating these uncertain times.

We’ve recently observed a divergence in U.S. Treasury yields, with shorter-term yields declining while longer-term yields are rising. 🏦

What do you think this signals for the government bond market, Bitcoin, and the broader financial markets? 🤓

Let me know 👇 pic.twitter.com/eJmj6hhyKV

— Bitcoin Magazine Pro (@BitcoinMagPro) January 27, 2025

Treasury Yield Dynamics

Treasury yields reflect the return investors demand to hold U.S. government debt, and they are a critical barometer for the economy and monetary policy expectations. Here’s a snapshot of what’s happening:

- Short-term yields falling: Declining yields on short-term Treasury bonds, such as the 6-month yield, suggest that markets are anticipating the Federal Reserve will pivot to rate cuts in response to economic slowdown risks or lower inflation expectations.

- Long-term yields rising: Meanwhile, rising yields on longer-term bonds, like the 10-year Treasury yield, indicate growing concerns about persistent inflation, fiscal deficits, or higher-term premiums required by investors for holding long-duration debt.

This divergence in yields often hints at a shifting economic landscape and can serve as a signal for investors to recalibrate their portfolios.

Related: We’re Repeating The 2017 Bitcoin Bull Cycle

Why Treasury Yields Matter for Bitcoin Investors

Bitcoin’s unique properties as a non-sovereign, decentralized asset make it particularly sensitive to macroeconomic trends. The current yield environment could shape Bitcoin’s narrative and performance in several ways:

- Inflation Hedge Appeal:

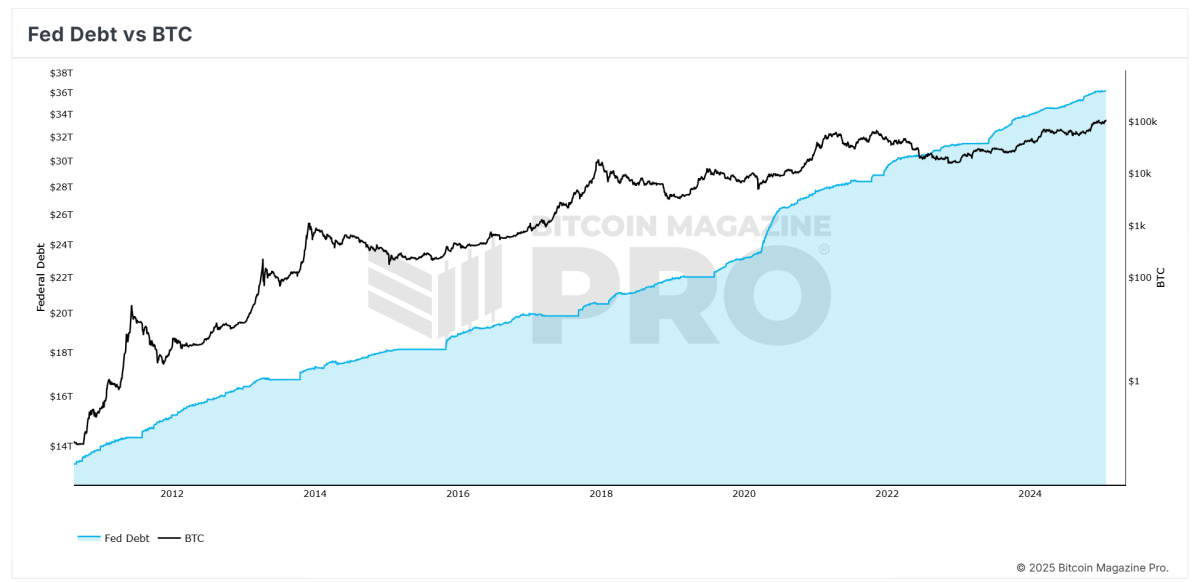

- Rising long-term yields may reflect persistent inflation concerns. Historically, Bitcoin has been seen as a hedge against inflation and currency debasement, potentially increasing its appeal to investors looking to protect their wealth.

- Risk-On Sentiment:

- Declining short-term yields could indicate looser financial conditions ahead. Easier monetary policy often fosters a risk-on environment, benefiting assets like Bitcoin as investors seek higher returns.

- Financial Instability Hedge:

- Divergence in yields, particularly if it leads to an inverted yield curve, can signal economic instability or recession risks. During such periods, Bitcoin’s narrative as a safe-haven asset and alternative to traditional finance may gain traction.

- Liquidity Considerations:

- Lower short-term yields reduce borrowing costs, potentially leading to increased liquidity in the financial system. This liquidity often spills into risk assets, including Bitcoin, fueling upward price momentum.

Broader Market Insights

The impact of yield divergence extends beyond Bitcoin to other areas of the financial ecosystem:

- Stock Market: Lower short-term yields typically boost equities by reducing borrowing costs and supporting valuation multiples. However, rising long-term yields can pressure growth stocks, particularly those sensitive to higher discount rates.

- Debt Sustainability: Higher long-term yields increase the cost of financing for governments and corporations, potentially straining heavily indebted entities and creating ripple effects across global markets.

- Economic Outlook: The divergence could reflect market expectations of slower near-term growth coupled with longer-term inflationary pressures, signaling potential stagflation risks.

Related: What Bitcoin Price History Predicts for February 2025

Takeaways for Bitcoin Investors

For Bitcoin investors, understanding the interplay between Treasury yields and macroeconomic trends is essential for informed decision-making. Here are some key takeaways:

- Monitor Monetary Policy: Keep a close eye on Federal Reserve announcements and economic data. A dovish pivot could create tailwinds for Bitcoin, while tighter policy might pose short-term challenges.

- Diversify and Hedge: Rising long-term yields could lead to volatility across asset classes. Diversifying into Bitcoin as part of a broader portfolio strategy may help hedge against inflation and economic uncertainty.

- Leverage Bitcoin’s Narrative: In an environment of fiscal deficits and monetary easing, Bitcoin’s story as a non-inflationary store of value becomes more compelling. Educating new investors on this narrative could drive further adoption.

Conclusion

The divergence in Treasury yields underscores shifting market expectations around growth, inflation, and monetary policy—factors that have far-reaching implications for Bitcoin and broader financial markets. For investors, understanding these dynamics and positioning accordingly can unlock opportunities to capitalize on Bitcoin’s unique role in a rapidly changing economic landscape. As always, staying informed and proactive is key to navigating these complex times.

For ongoing access to live data, advanced analytics, and exclusive content, visit BitcoinMagazinePro.com.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct thorough independent research before making investment decisions.

Source link

Bitcoin

Definition of a Bull Market Playing Out As Long-Term Holders Offload Coins, According to CryptoQuant CEO

Published

12 hours agoon

January 27, 2025By

admin

CryptoQuant CEO Ki Young Ju says that Bitcoin (BTC) is currently displaying classic bull market behavior on-chain.

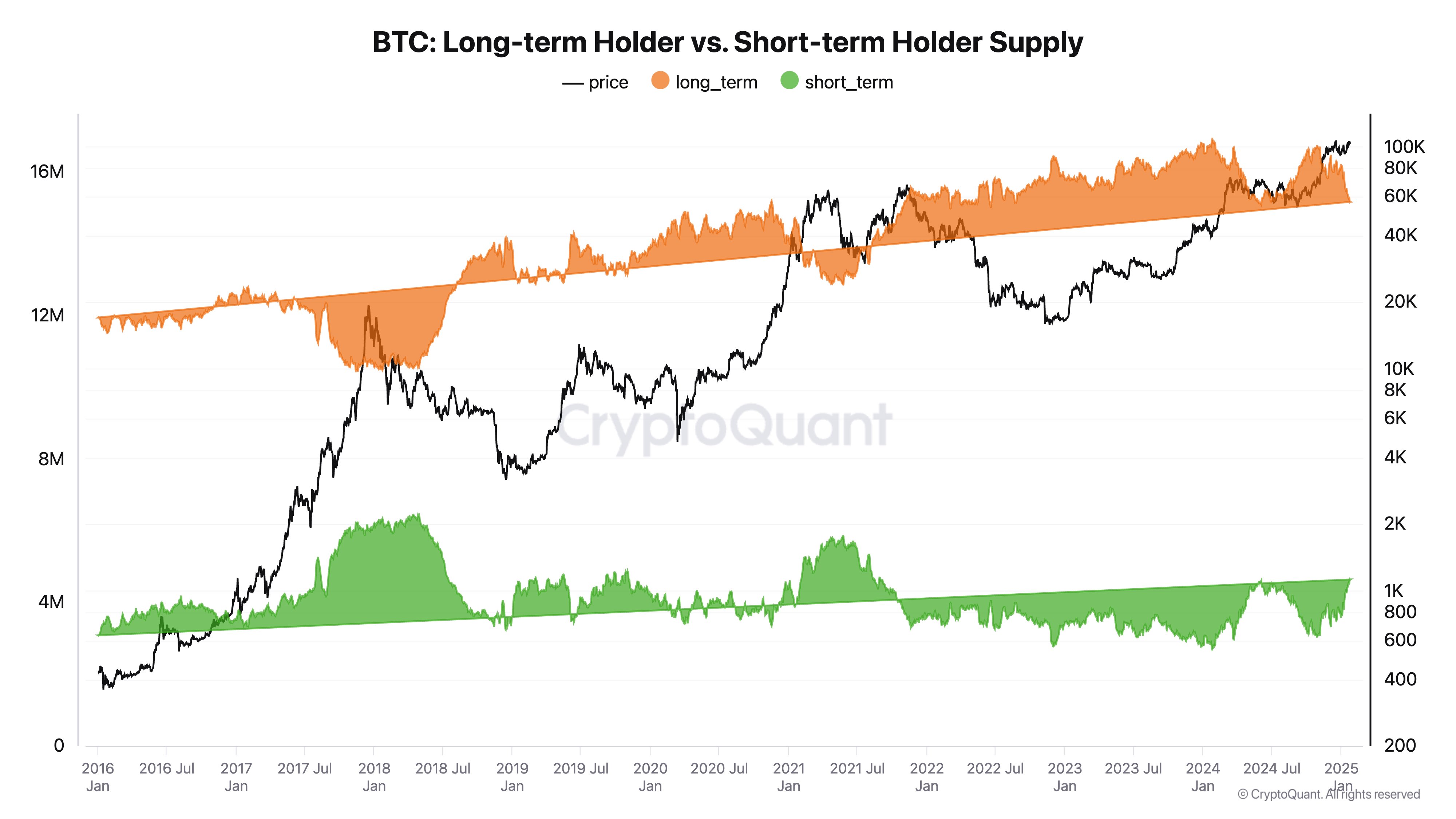

Ki tells his 400,500 followers on the social media platform X that short-term BTC holders are entering the market, scooping up long-term holders’ coins.

Short-term BTC holders are investors who have held their coins for less than 155 days while long-term holders are those who have kept their coins inactive for 155 days or more.

According to the chief executive of the analytics firm, the transfer of BTC from long-term to short-term holders is something typically seen in previous bull markets.

“Trump promoted Bitcoin globally.

Short-term holders keep entering, while long-term holders are offloading.

If you know, you know – this is the definition of a bull market.”

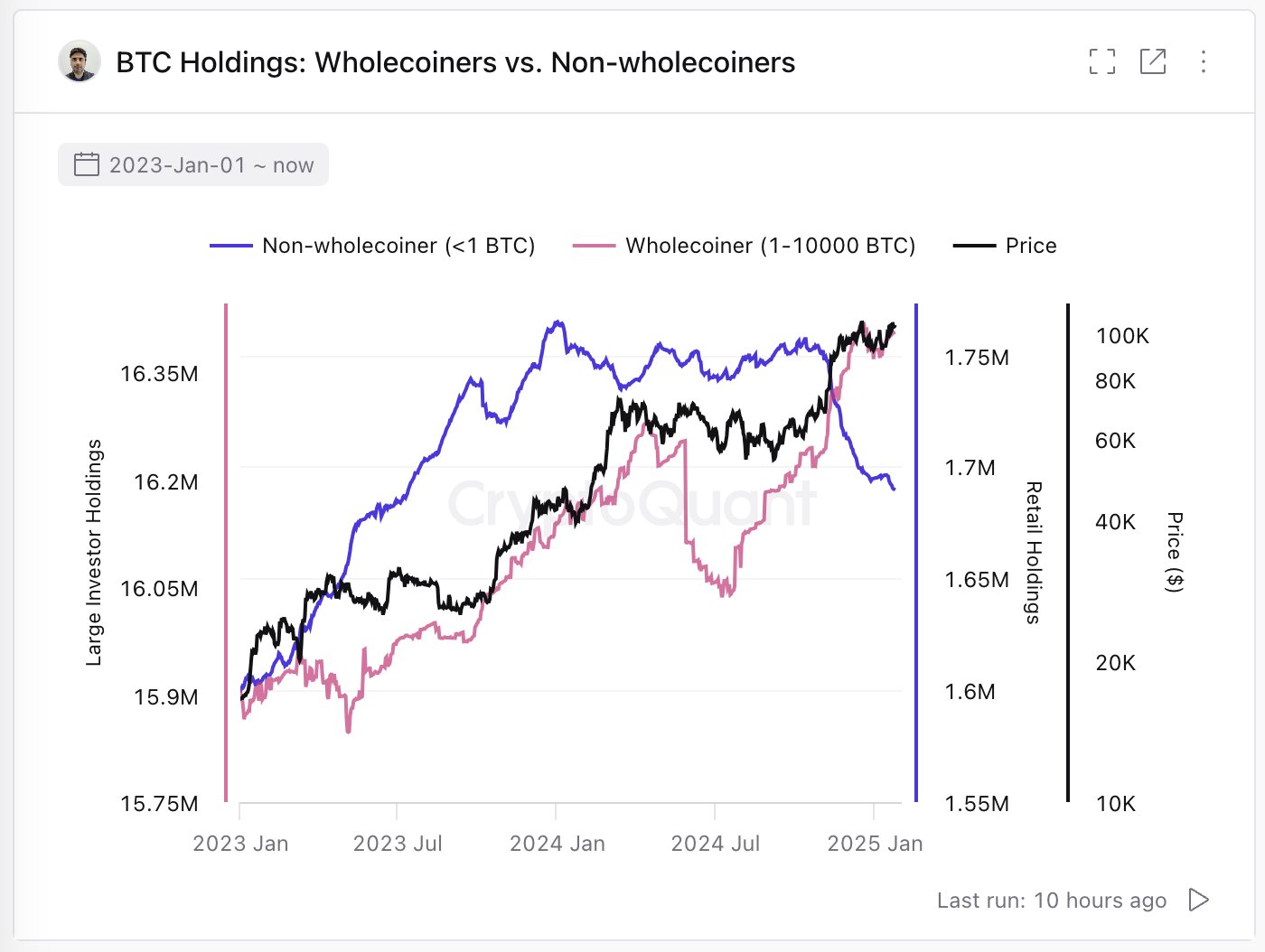

Citing CryptoQuant data, Ki also says that larger BTC investors with at least one whole coin are gobbling up Bitcoin while smaller entities with less than a coin are offloading.

“Bitcoin retail investors with <1 BTC are selling, while the others with 1 [or more] BTC are buying.”

Ki says it’s possible that with President Trump’s “global promotional impact,” the bull run could be extended by “another couple of quarters” longer than usual, perhaps into 2026.

“Typical BTC distribution:

Whales —-> Retail Investors

This cycle:

Retail Investors (OG) + Whales (OG) —-> Retail Investors (Paper Bitcoins) + Whales (Institutions)

———-

OGs leave footprints through on-chain activity and crypto exchanges, while paper Bitcoin (ETFs, corporate stocks) leaves custody wallet on-chain footprints at settlement.

———-

Final phase of distribution:

Retail Investors (OG) + Whales (OG) + Whales (Institutions) —-> Retail Investors (Paper Bitcoins)

———-

I expect this won’t happen until at least mid-year. It might even extend into next year.”

At time of writing, Bitcoin is worth $98,847.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Bitcoin Funding Rates Flip Negative as Nasdaq Futures Tank 700 Points

Published

16 hours agoon

January 27, 2025By

admin

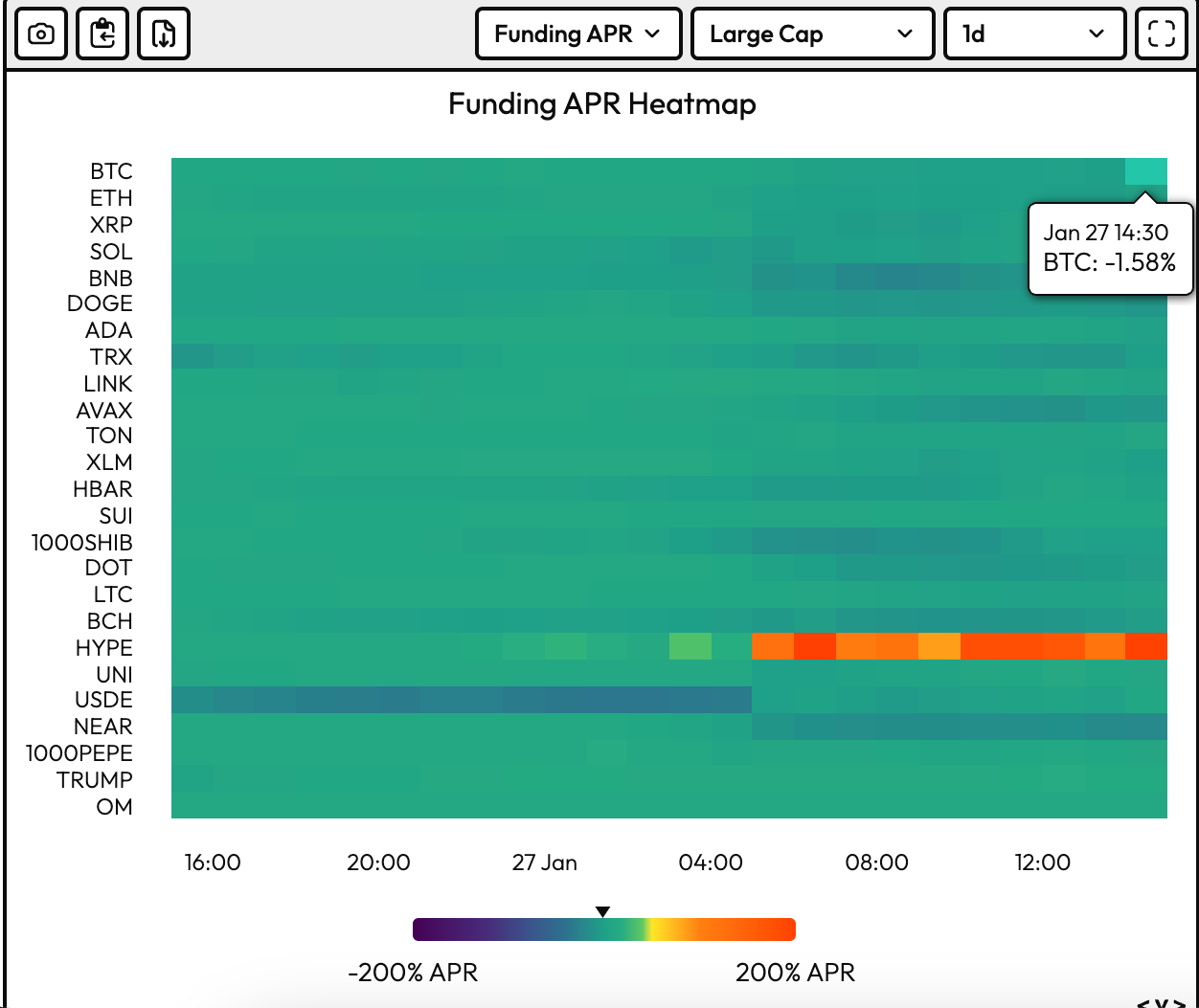

Bitcoin (BTC) market sentiment has turned bearish, with Wall Street’s tech-heavy Nasdaq futures trading 700 points lower. The risk aversion is driven by concerns that the cost-effective Chinese artificial intelligence startup DeepSeek could significantly challenge U.S. technological dominance.

Bitcoin’s perpetual futures funding rates, periodic payments made between long and short positions in perpetual futures contracts, have flipped negative, according to data source Velo Data. It’s a sign of more bearish sentiment in the market – traders are chasing short positions in anticipation of lower prices.

The leading cryptocurrency by market value has dropped over 3% since early Asian hours, reaching lows under $98,000 at one point, according to CoinDesk data. Futures tied to Nasdaq have dropped over 3.5%, with NVIDIA, the bell-wether for all things AI, down 10% in pre-market trading.

“Today’s sell-off comes after President Donald Trump last week gave the green light to a working group on crypto policy that notably stopped short of confirming that the US would set up a bitcoin reserve. Meanwhile, Chinese artificial intelligence startup DeepSeek appears to have spooked tech stocks as its success suggests it is possible to build AI models that cost less than AI incumbents in the U.S.,” Petr Kozyakov, co-founder and CEO at Mercuryo, said in an email.

Historically, however, the negative flip in funding rates has tended to mark local price bottoms. Besides, there is always a risk of a short squeeze – bears throwing in the towel and squaring off their bets, putting upward pressure on prices. That said, the funding rate has narrowly flipped bearish, meaning its too early to call short BTC as an overcrowded trade.

Source link

Trump’s U.S. Treasury Secretary Bessent Approved, Likely Tackling Taxes Before Crypto

Shiba Inu Whale Buys 257.5B SHIB Amid Dip

Solana Plunges 12%, But This Pattern Could Mean Decline Isn’t Over Yet

President Trump’s Executive Orders Build Confidence With Institutional Crypto Investors: CoinShares

How Declining Short-Term U.S. Treasury Yields Impact Bitcoin Price

Is Chinese AI Sensation DeepSeek a Security Risk?

This low-cap token could deliver massive profits

Elon Musk Said to Propose Blockchain Use at D.O.G.E. for Efficiency: Bloomberg

DeepSeek Limits Access Following Record Downloads and Disruptions

Bollinger Bands Tighten On XRP Daily Chart – Major Price Move Ahead?

Definition of a Bull Market Playing Out As Long-Term Holders Offload Coins, According to CryptoQuant CEO

Ethereum's Looming Collapse Is A Lesson In Blockchain Integrity

Trump signs crypto EOs, BoJ hikes, SOL ETF decision today

PEPE gets ready to surge, Yeti Ouro is predicted to surpass this rally

Bitcoin Funding Rates Flip Negative as Nasdaq Futures Tank 700 Points

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Blockchain groups challenge new broker reporting rule

Trending

DeFi4 months ago

DeFi4 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

News4 months ago

News4 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin3 months ago

Bitcoin3 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion3 months ago

Opinion3 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis3 months ago

Price analysis3 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x