Bitcoin

Human Rights Foundation Donates 700,000,000 Satoshis To Fund Bitcoin Development And Projects

Published

3 months agoon

By

admin

Today, the Human Rights Foundation (HRF) announced its most recent round of Bitcoin Development Fund grants, in a press release sent to Bitcoin Magazine.

700,000,000 satoshis (7 BTC) currently worth $706,000 at the time of writing, is being granted across 20 different projects around the world focusing on technical education for people living under authoritarian regimes, independent media outlets, decentralizing mining, and providing human rights groups with more private financial solutions — with a main areas of focus for these grants center around countries and regions in Latin America, Asia, and Africa.

While the HRF did not disclose how much money each project is receiving specifically, the following 20 projects are the recipients of today’s round of grants worth 7 BTC:

Stratum V2 Reference Implementation (SRI), an open-source software that decentralizes Bitcoin mining by enabling nodes to construct their own block templates. This helps promote solo mining, reduces reliance on large mining pools, and strengthens Bitcoin’s permissionless and censorship-resistant qualities. Funding will support developer bit-aloo’s full-time work on SRI, including benchmarking tools to evaluate the performance of Stratum V2, integration tests, codebase maintenance, and software documentation.

Public Pool, a free and open-source mining pool optimized for low hash rate devices (a mining device with limited computational power). Users can self-host a Stratum server and select their own block templates without relying on a third party. By making Bitcoin mining more accessible and decentralized, Public Pool strengthens the Bitcoin network. Funding will support hosting costs, hardware upgrades, and operational expenses.

Naiyoma, the first female Bitcoin Core developer from Africa. Hailing from Kenya, she is dedicated to fostering an open financial system rooted in transparency, freedom, and fairness. Her work focuses on reviewing pull requests (PRs), addressing bugs through new PRs, and improving Bitcoin Core’s codebase. Funds will support her full-time contributions to advancing Bitcoin Core.

Daniela Brozzoni, an experienced software developer. Previously, she contributed to the Bitcoin Development Kit (BDK), a software library that allows you to build cross-platform Bitcoin wallets. She is now shifting her focus to Bitcoin Core, where her work will be reviewing key pull requests (PRs), contributing to new features, and improving testing coverage. Through her efforts, Daniela aims to enhance Bitcoin’s decentralization, privacy, and resilience. This grant will support her full-time contributions to Bitcoin Core.

UX/UI Design for Bitcoin Core, redesign work by product designer Michael Haase that aims to bring the Bitcoin Core App to mobile devices (making it accessible beyond desktop use). This update will enable users to run nodes, access essential wallet features (such as Silent Payments and multisignature) directly on their phones, and improve their financial privacy. Funding will support the project’s design and development.

No BS Bitcoin, a newsdesk delivering the latest Bitcoin news and updates on open-source technologies in a clear and accessible format. Free from ads, tracking and paywalls, the platform consistently highlights privacy and freedom technologies essential for activists and citizens under authoritarian regimes. Funding will ensure the site’s continued operation, enable the hiring of an additional editor, and support the introduction of Nostr features (like Zaps and comments) to foster greater community engagement.

Tando, a new payment application co-founded by Sabina Gitau, empowering 54 million Kenyans to have the option to use Bitcoin for everyday transactions. By integrating with M-PESA, Kenya’s leading mobile payments system, Tando allows users to pay in Bitcoin via a Lightning wallet, while merchants receive Kenyan Shillings. The platform is KYC-free and has no fees, offering an affordable and private payment solution. Funds will help boost Tando’s liquidity, support a growing user base, and drive expansion across the African continent.

YakiHonne, a client for the decentralized Nostr protocol built by a team in East and Southeast Asia. It was developed by Wendy Ding to support free speech and promote Bitcoin payments across 170 countries. With innovative functionality and a blend of online and offline events, YakiHonne seeks to drive the adoption of decentralized social media. Funding will support smart widget development, relay network improvements, and influencer engagement to expand Nostr’s reach and impact.

SeedSigner Multi-language Support, a translation project by developer Ace to integrate multi-language functionality into the fully customizable, open-source SeedSigner hardware wallet. This will enhance accessibility for users worldwide and empower marginalized communities to achieve financial sovereignty through inexpensive and accessible self-custody. Funding will support the developer’s efforts to deliver a multi-language version of SeedSigner within the next year.

Vexl, a peer-to-peer Bitcoin trading application founded by Lea Petrasova to provide users with a private and Know-Your-Customer (KYC) free Bitcoin experience. By connecting users through their phone contacts, Vexl enables secure, direct Bitcoin transactions in a peer-to-peer manner. The app aims to make private Bitcoin usage more accessible while offering critical protection against authoritarian regimes. Funding will support Vexl’s growth, focusing on reaching African communities and driving improvements to its backend infrastructure.

Tomatech, a community focused on building a team of developers in India to advance Bitcoin infrastructure and Free and Open Source Software (FOSS) projects. By offering mentorship and training, it bridges the gap between education and practical experience. Additionally, its Goa-based cultural center and community space will foster a vibrant Bitcoin community through meetups, workshops, and residencies. Funding will support developer training, the creation of a developer hub, bounties and grants, and general operations.

Krux, open-source software that turns generic devices into hardware wallets for secure Bitcoin self-custody and transactions. It features air-gapped operations, key management and backups, an intuitive interface, and support for 10 languages. This project can help decentralize Bitcoin custody and safeguard freedom and property rights in authoritarian regimes. Funding will help developer Odudex further advance this innovative open-source project.

Iris, a Nostr web client created by developer Martti Malmi designed to make private and secure messaging simpler and safer. Using the MIT-licensed nostr-double ratchet library, it aims to improve protection for metadata and message content, ensuring conversations remain private—especially in surveillant environments. Funding will support hiring a developer to expand Iris’s features and functionality.

African UX Bitcoin Bootcamp, a program that empowers talented Bitcoin UX designers from authoritarian countries with the opportunity to attend the Africa Bitcoin Conference (ABC) for hands-on training and networking. Led by Bitcoin Design Foundation’s co-founder, Mogashni Naidoo, participants will receive on-ground training and test the usability of their products at ABC. Funds will cover the program expenses, including flights, accommodations, and logistics, ensuring accessibility for all participants.

Bitcoin History, a research project by Pete Rizzo dedicated to documenting and preserving key people, events, and materials (ie. photographs, videos, links, information) that shaped Bitcoin’s rise as a global monetary and human rights force. Focused on “the history of the future of money,” the project highlights Bitcoin’s role as a tool for financial freedom. The grant will support an additional researcher to investigate and document stories of Bitcoin’s use against authoritarian regimes.

Cashu-ts, the primary Software Development Kit (SDK) in the Cashu ecosystem developed by Gandlaf21. It simplifies wallet creation, integrates the latest protocol updates, and powers popular wallets (like Minibits, eNuts, and Nutstash). By enabling the development of secure, privacy-focused “digital cash” wallets, Cashu-ts plays a vital role in advancing the Cashu ecosystem and financial privacy. This grant will support the developers in maintaining and improving this essential library.

Unify, a Payjoin wallet developed by Fontaine to enhance privacy in Bitcoin transactions. Built using Nostr and Bitcoin Core, it leverages Payjoins to obscure transaction histories by enabling multiple parties to make collaborative payments (making Bitcoin inherently more private). This functionality is especially crucial for individuals navigating repressive regimes. Funding will support the developer’s full-time contributions, advancing Unify’s features and expanding its compatibility with other wallets.

The Financial Freedom Policy Coalition, a policy coalition founded by Venezuelan activist, Jorge Jraissati, brings together youth leaders, policymakers, and industry experts to promote economic opportunities for people living under authoritarian regimes. The coalition plans advocacy missions to educate policymakers on how Bitcoin can support human rights and create social benefits. Funds will cover the costs of organizing and running these missions.

Jon Atack, a Bitcoin Core contributor and Bitcoin Improvement Proposal (BIP) editor, recognized as one of the top all-time contributors to Bitcoin Core. As a dedicated developer, he plays a pivotal role in enhancing Bitcoin’s decentralization and robustness. Atack is also a staunch advocate for using Bitcoin and open-source software as tools to resist tyranny and advance global human rights. This grant will empower him to continue his vital contributions to Bitcoin development.

Brink, an organization committed to strengthening the Bitcoin protocol through research and development. Co-founded by Mike Schmidt, Brink supports Bitcoin protocol engineers with grants and offers training and mentorship to onboard new contributors to open-source development. This grant will cover operational expenses, ensuring continued support for open-source developers and the advancement of Bitcoin’s core infrastructure.

The HRF is a nonpartisan, nonprofit 501(c)(3) organization that promotes and protects human rights globally, with a focus on closed societies. The HRF continues to raise support for the Bitcoin Development Fund, and interested donors can find more info on how to donate here. Applications for grant support by the HRF can be submitted here.

Source link

You may like

Trump’s Crypto Dealings Are Making Regulation ‘More Complicated’: House Financial Services Chair

Pontus-X taps Oasis for private, cross-border data sharing in E.U.

Elon Musk, Dogecoin Proponent and U.S. Agency Figurehead, Says ‘No DOGE in D.O.G.E.’

Crypto Investor’s Brave Yet Hilarious Prediction Speculates If XRP Price Will Hit $3,000 This Cycle

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

California introduces ’Bitcoin rights’ in amended digital assets bill

Bitcoin price is at a pivotal level as ETF flows offloaded $93 million on Friday, ending a 10-day buying spree. While BTC holds key support at $82,000, BlackRock investors disposition may signal optimism.

Bitcoin ETFs End 10-day Buying Spree, But BlackRock Investors Hold

Bitcoin ETFs drew media attention on Friday as net outflows reached $93 million, marking the end of a 10-day buying spree that added over $1.07 billion in BTC.

FairSide data reveals that all of the outflows came from Fidelity’s FBTC, while BlackRock’s IBIT and eight other U.S.-approved spot ETFs recorded neutral flows, signaling diverging institutional investor sentiment.

Despite the selling pressure, BTC price showed resilience, bouncing from a 10-day low of $82,000 to reclaim the $84,000 level over the weekend.

This suggests that while some institutional players have turned cautious, BTC continues to find buyers at the $82,000 mark, likely driven by macroeconomic hedging.

Why Are Bitcoin ETFs Taking a Neutral Outlook Despite Bearish Market Sentiment?

While Bitcoin’s brief dip below $82,000 coincided with renewed regulatory uncertainty—following U.S. Congress’ scrutiny of Paul Atkins, Trump’s crypto-friendly SEC pick—the decision by major ETFs like BlackRock’s IBIT to hold rather than sell suggests a more calculated approach among institutional investors.

One possible explanation is that institutional investors are weighing broader macroeconomic risks. With concerns mounting over Trump’s proposed trade policies and their potential impact on traditional stock markets, Bitcoin remains an attractive hedge due to its independence from traditional financial structures. This could explain why ETF outflows have been concentrated in specific funds like FBTC rather than across the board.

- Large Un-realized Profits

Prior to the $93 million sell-off observed on Friday, Bitcoin ETFs had acquired over $1.07 billion in the previous 10-days. This sheer volume of Bitcoin accumulated by ETFs in recent weeks means that short-term supply is limited.

It also hints that majority on investors who began buying when BTC prices plunged below $77,000 over the past week are still in profit, hence the reluctance to sell.

This key dynamics may have contributed to Bitcoin price holding key support levels above $82,000. Notably, while BTC price rebounded, leading altcoins like Ethereum (ETH), Solana (SOL), and Ripple (XRP) have lagged behind, further reinforcing the narrative that institutional capital remains primarily focused on BTC.

What’s Next for Bitcoin ETFs and Institutional Demand?

The coming weeks will be crucial in determining whether Bitcoin ETFs resume their accumulation trend or if further outflows signal a shift in sentiment. Investors will closely watch developments in U.S. regulatory policy and broader market conditions to assess whether Bitcoin’s status as a safe-haven asset remains intact.

If the macroeconomic environment continues to favor Bitcoin as a non-correlated asset, ETF inflows could resume, pushing BTC to new highs. However, prolonged uncertainty or negative regulatory developments could trigger deeper corrections.

For now, BlackRock and other major institutional players appear to be maintaining their positions, indicating confidence in Bitcoin’s long-term trajectory.

Bitcoin Price Forecast: BTC Faces Critical Resistance at $84,400 Amid Bearish Pennant Formation

Bitcoin price forecast signals remains uncertain as BTC trades at $82,363, hovering near key support levels. The Bollinger Bands show tightening volatility, with resistance at $84,412 and $88,215. The Parabolic SAR at $80,237 suggests a continuation of the downtrend unless BTC breaks above the mid-range resistance.

A bearish pennant formation signals potential downside risk. If BTC fails to reclaim $84,400, selling pressure could drive the price towards $80,600 or even the lower Bollinger Band at $80,237. The volume delta reveals declining buying momentum, supporting the bearish case.

However, a bullish scenario emerges if BTC can hold above $82,000 and break past $84,400 with strong volume. This could lead to a rally toward $88,215, negating the bearish pennant. With key resistance intact, Bitcoin’s trajectory depends on its next move at this crucial level.

Frequently Asked Questions (FAQs)

Bitcoin price is declining due to ETF outflows, regulatory uncertainty, and shifting investor sentiment favoring safer assets like gold and cash.

Yes, if institutional demand returns, macroeconomic conditions improve, and key support levels hold, Bitcoin could regain bullish momentum.

Bitcoin ETFs drive large-scale buying and selling, influencing price volatility and overall market liquidity depending on institutional investor behavior.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Bitcoin Could Appear on 25% of S&P 500 Balance Sheets by 2030, Analyst Says

Published

22 hours agoon

March 30, 2025By

admin

Bitcoin is making its way from trading desks to corporate treasuries, and by the end of the decade, it could be standard practice, according to one analyst.

“Across all the different strategies and implementations, I anticipate that by 2030, a quarter of the S&P 500 will have BTC somewhere on their balance sheets as a long-term asset,” Elliot Chun, a partner at Architect Partners, wrote in a market snapshot.

The strategy—holding bitcoin as a treasury reserve asset—was unorthodox when Strategy, formerly known as MicroStrategy, first adopted it in August 2020. The firm framed BTC as a hedge against inflation, a diversification tool, and a way to distinguish itself in the market.

Then CEO Michael Saylor’s highly public embrace of bitcoin transformed the company into a de facto proxy for BTC exposure. Since then, MicroStrategy stock has surged more than 2,000%, far outpacing both the S&P 500 and bitcoin over the same period, Chun pointed out.

GameStop is the latest company to follow suit, announcing this week that it would raise $1.3 billion through a convertible note to acquire bitcoin. Its stock initially surged following the announcement but has since endured a correction, falling nearly 15% for the week.

Chun argued that treasurers may soon face career risk not for buying bitcoin, but for ignoring it altogether. “Doing nothing is no longer a defensible strategy,” he wrote.

According to BitcoinTreasuries data, publicly listed companies currently hold 665,618 BTC, around 3.17% of the cryptocurrency’s total supply. Strategy holds the lion’s share, 506,137 BTC.

Read more: U.S. Listed Firms Continue Bitcoin (BTC) Treasury Adoption

Source link

Bitcoin

Bitcoin Support Thins Below $78,000 As Cost Basis Clusters Shift Toward $95,000

Published

1 day agoon

March 30, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

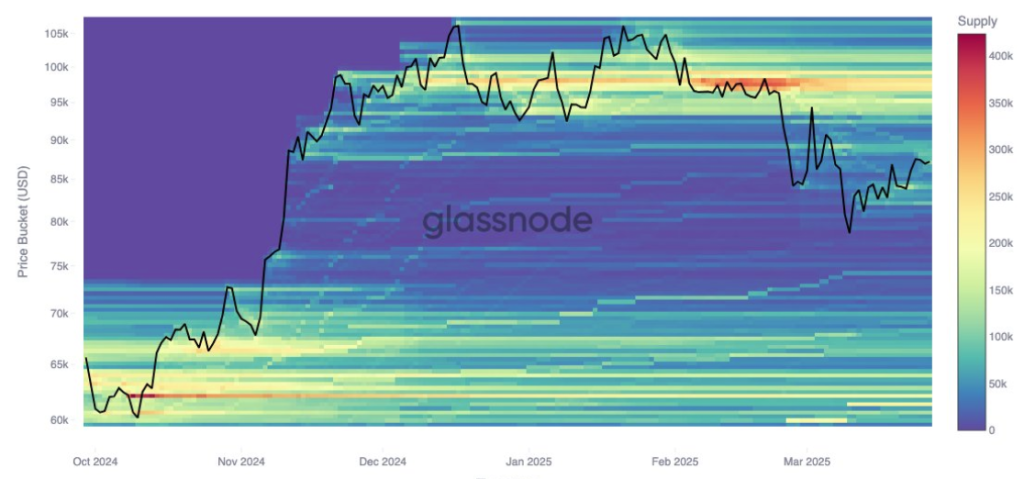

Bitcoin’s price action in the past 48 hours has seen it approaching the $80,000 price level again, with risks of breaking to the downside. Looking at on-chain data shows a notable support level between $80,920 and $78,000 that must not be broken.

Related Reading

Particularly, on-chain analytics from Glassnode point to a thinning of support at the $78,000 level, where only minimal cost basis clusters now exist. The insight follows a sharp move that saw savvy traders scoop up nearly 15,000 Bitcoin at the March 10 low before cashing out at the $87,000 local top.

Support Cushion Rises With Clusters Between $80,000 And $84,000

Bitcoin started the month of March with a crazy crash that saw its price hit below $77,000 on March 10 and March 11. Most of the month was spent by Bitcoin embarking on a recovery from this level, eventually reaching as high as $88,500 last week.

Interestingly, on-chain data from Glassnode shows that some Bitcoin traders took advantage of the crash and bought about 15,000 BTC at this low. However, many addresses from this same cohort sold at the $87,000 local top, leaving behind a depleted buffer zone that may no longer offer the same price stability.

Bitcoin’s strongest cost basis clusters have steadily migrated upward from $78,000 throughout the month, with the most prominent support levels now sitting between $80,920 and $84,100. Approximately 20,000 BTC were acquired at $80,920, 50,000 BTC at $82,090, and another 40,000 BTC at around $84,100. These fresh accumulations are now the new zones of confidence among recent buyers that may offer cushions for the recent market dip.

At the time of writing, Bitcoin is trading at $83,120, meaning that it has lost the zone of 40,000 BTC around $84,100. This puts the onus on $82,090 and, subsequently, the $80,920 price levels. However, if the correction sharpens further, it wouldn’t be until after $78,000 that structural support reappears at $74,000 and $71,000, where long-term conviction buying occurred, estimated at 49,000 BTC and 41,000 BTC, respectively.

Image From X: Glassnode

$95,000 Cost Basis Cluster Grows With Cooling Demand

As support continues to climb gradually, resistance appears to be firming near the $95,000 mark. Investor cost basis data shows an increase of 12,000 BTC clustered at this level since March 24.

This implies that some investors now anticipate a top forming around $95,000, and selling activity could become more pronounced if prices approach that zone. This resistance, alongside the support levels, could see Bitcoin confined within a narrowing range in the short term.

Related Reading

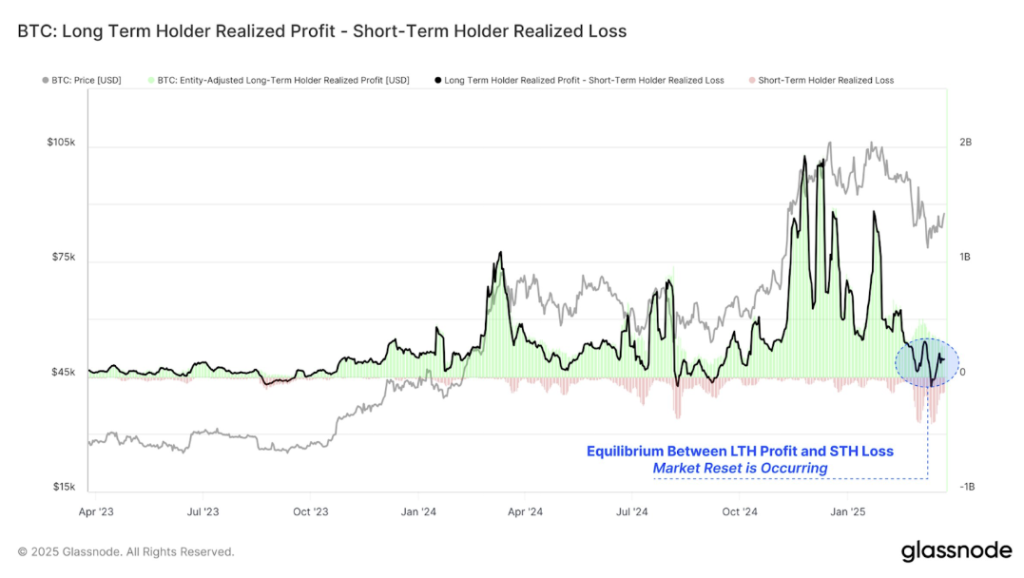

Glassnode data confirms that long-term holders (addresses holding Bitcoin for more than 150 days) have been the primary source of profit-taking for a while. Long-term holders’ profit-taking is now nearly matched by the losses endured by short-term traders who have been holding Bitcoin for less than 155 days.

Image From X: Glassnode

Featured image from Tech Research Online, chart from TradingView

Source link

Trump’s Crypto Dealings Are Making Regulation ‘More Complicated’: House Financial Services Chair

Pontus-X taps Oasis for private, cross-border data sharing in E.U.

Elon Musk, Dogecoin Proponent and U.S. Agency Figurehead, Says ‘No DOGE in D.O.G.E.’

Crypto Investor’s Brave Yet Hilarious Prediction Speculates If XRP Price Will Hit $3,000 This Cycle

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

California introduces ’Bitcoin rights’ in amended digital assets bill

MELANIA Insider Hayden Davis Selling Millions of Dollars Worth of Memecoin Amid 95% Drop: On-Chain Data

Toulouse starts to accept crypto for public transport

Bitcoin, Crypto Prices Slide as Trade Tensions, Inflation Risks Rattle Markets

Will BlackRock Investors Stay Bullish?

Bitcoin Could Appear on 25% of S&P 500 Balance Sheets by 2030, Analyst Says

Centralization and the dark side of asset tokenization — MEXC exec

Bitcoin Support Thins Below $78,000 As Cost Basis Clusters Shift Toward $95,000

Cryptocurrencies to watch this week: Solana, Cronos, DOT

EU Regulator Pushes for New Capital Rules for European Insurers Holding Crypto Assets

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: