Research

How DePIN’s Revenue Growth is Attracting Equity Investors – DePIN Token Economics Report

Published

2 weeks agoon

By

admin

A new report highlights how Decentralized Physical Infrastructure Networks (DePIN) are catching the eye of traditional equity investors with their revenue growth.

Recently released as The DePIN Token Economics Report by Tom Trowbridge, authored by the co-founder of Fluence and host of the DePINed Podcast, the report details how DePIN impacts real-world services including equity investors.

DePIN’s Scale and Revenue Traction

DePIN includes over 1,000 projects and 3 million providers delivering services like Wi-Fi, energy, and compute, as per the report.

Hardware costs have fallen 95% in recent years, bringing devices like routers to $500, while open-source software competes with centralized firms, Trowbridge notes. DePIN Scan reports Helium’s 145,000 users generated $350,000 in Q4 2024 revenue, while Hivemapper’s demand tripled due to new mapping devices.

Geodnet reports $3 million in annualized revenue, using an 80% buy-and-burn rate which hit an all-time high on January 25, 2024. Hivemapper’s growth shows DePIN’s potential. Helium claimed $70 million in revenue but faced an SEC charge on January 25, 2025, for misleading investors about clients like Lime, Nestlé, and Salesforce according to Trowbridge.

Why Traditional Investors Are Interested

Equity investors, once hesitant to value token projects, now see DePIN as a viable option, according to Trowbridge. The report states this investor group, much larger than alt-coin investors, values DePIN’s tangible services and revenue metrics. Geodnet’s $3 million revenue itself provides a clear benchmark.

DePIN’s token models further support this interest. Buy-and-burn mechanisms, used by Geodnet (80%), Glow (100%), Render (95%), and Hivemapper (50%), link revenue to token value.

Geodnet’s $500,000 Q4 2024 revenue bought the same tokens at $300,000 in Q3 2004, showing price growth. The report further highlights that the Fiat-linked rewards, like Fluence’s $10 per core monthly and Storj’s $1.50 per TB, stabilize income.

DePIN’s token economics are under review by equity investors. Trowbridge stresses simplicity, noting models should fit on one page to avoid confusion. Buy-and-burn offers on-chain revenue verification, vital in a sector without regulation or audits. Helium’s SEC charge underscores transparency needs, with Trowbridge noting Geodnet’s 80% buy-and-burn rate builds more trust than Nodle’s 5%, per the report.

Staking also appeals to investors. Fluence requires $12,000 per CPU in FLT—48,000 FLT at $0.25 or 12,000 at $1—while Filecoin mandates 30% of supply staked, and IO.net needs 200 IO tokens per GPU, valued at $250 to $1,200.

DePIN’s revenue focus shifts crypto from speculation to utility, per the report. With 32 million tokens and volatile meme coins, DePIN’s model stands out. Trowbridge writes, “DePIN will change the crypto narrative as projects offering real-world services are scaling faster and offering better services at lower prices than centralized competitors.”

Disclaimer: This article is solely based on the reports and research done by the mentioned entity. CoinGape and BrandTalk do not take responsibility for the market investment insights mentioned in it. Do your own research before any decision.

Source link

You may like

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Bitcoin Magazine Pro

The Month Bitcoin Shattered Records – Dive into The Bitcoin Report!

Published

4 months agoon

December 5, 2024By

admin

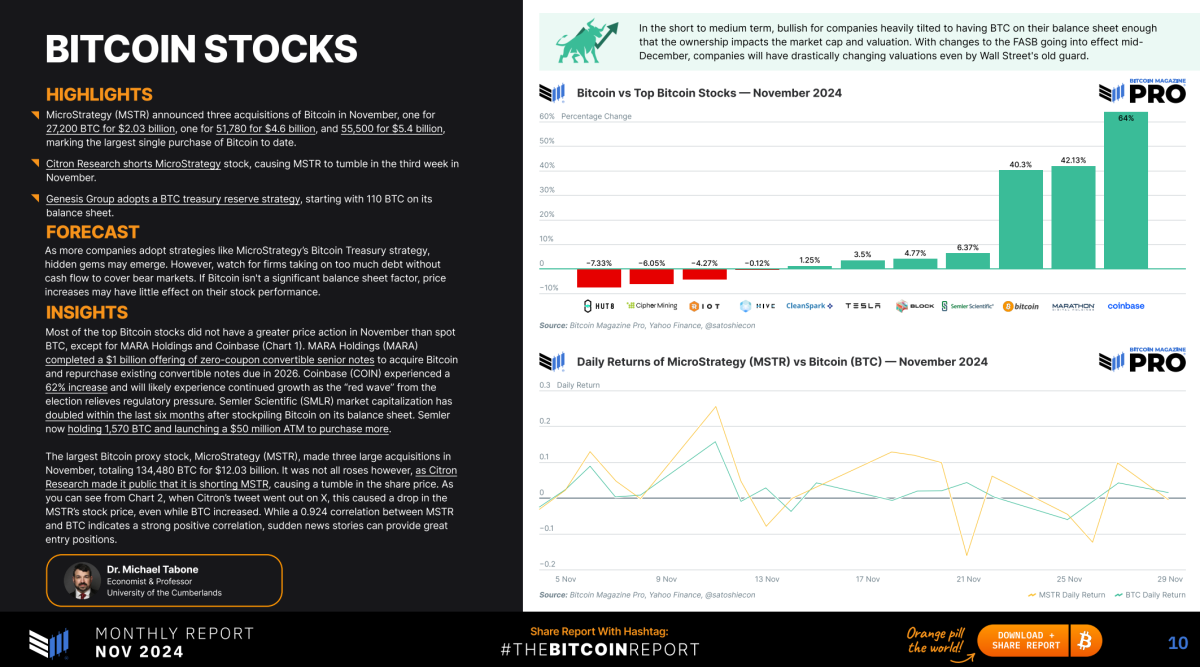

November 2024 will be remembered as one of the most significant months in Bitcoin’s history. With its value surging from $67,000 to just shy of $100,000, Bitcoin achieved its largest dollar growth in a single month. This performance was bolstered by record-breaking ETF inflows of $6.562 billion, institutional accumulation led by MicroStrategy’s massive acquisitions, and notable regulatory advancements worldwide. To unpack the trends, milestones, and what lies ahead, we present The Bitcoin Report – a comprehensive, free-to-download analysis for serious Bitcoin investors.

Dive Deeper with The Bitcoin Report

The Bitcoin Report is your ultimate resource for understanding the events that shaped this historic month and their implications for Bitcoin’s future. Authored by top industry experts, this free monthly publication provides a comprehensive analysis of market trends, regulatory shifts, on-chain data, and technical insights.

Highlights from the November Report:

- Market Cap Milestones: Bitcoin surpassed silver’s market cap, solidifying its position as a premier global monetary asset.

- ETF Dominance: BlackRock’s Bitcoin ETF outpaced its gold ETF in trading volume, demonstrating institutional investors’ growing confidence in Bitcoin.

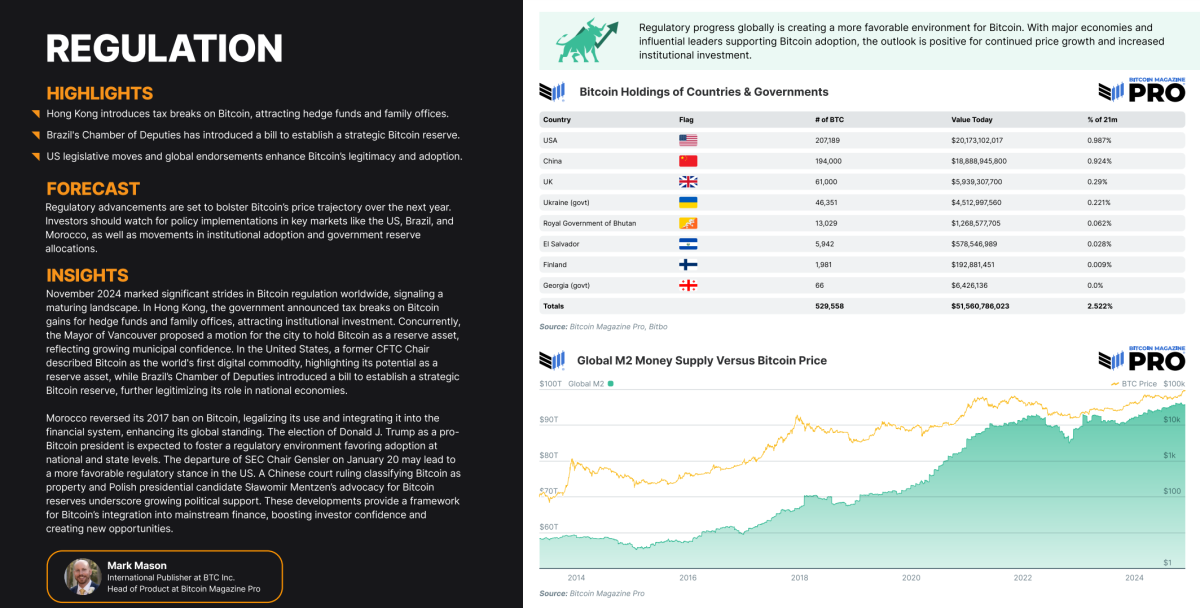

- Regulatory Advancements: Hong Kong’s tax breaks and Brazil’s proposed Bitcoin reserve legislation highlight Bitcoin’s expanding global adoption.

- Technical Analysis: Insights into Bitcoin’s consolidation and the bullish indicators pointing to potential new highs in the coming months.

These are just a few of the milestones detailed in this month’s report, accompanied by expert analysis and actionable insights.

Why November Matters for Investors

Bitcoin’s meteoric rise in November didn’t happen in isolation. This report delves into the macroeconomic trends, institutional activity, and on-chain analytics that fueled its growth. Gain an understanding of:

- The bullish market trends leading into 2025.

- How corporate Bitcoin strategies, like MicroStrategy’s record-breaking purchases, shape market dynamics.

- The role of Bitcoin ETFs in driving scarcity and upward price momentum.

Stay Informed – Download Now

Access The Bitcoin Report today and equip yourself with the data and insights you need to make informed investment decisions.

A Free Resource to Share

At Bitcoin Magazine Pro, we believe in empowering the community with actionable insights. The Bitcoin Report is available to the public for free.

Share The Bitcoin Report with your network using the hashtag #TheBitcoinReport, and help orange-pill the masses!

Opportunities for Sponsorship and Collaboration

Interested in sponsoring future editions of The Bitcoin Report or exploring joint-publication opportunities to reach a larger audience? Partner with us to gain exposure in the fast-growing Bitcoin space.

For more information, reach out to Mark Mason at mark.mason@btcmedia.org to discuss how your brand can be part of this exciting initiative.

Source link

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Share