Video

Blockchain Email Revolution

Published

2 months agoon

By

admin

Review of a New Web3 Email Platform

A pioneering platform integrates blockchain technology with traditional email services, aiming to redefine digital communication in the Web3 era. By offering anonymous, encrypted, and wallet-to-wallet communication, it provides users with enhanced privacy, security, and control over their inboxes.

Join here https://tinyurl.com/getethermailearly

Key Features

Anonymous and Encrypted Communication:

The platform ensures that all emails sent between its users are end-to-end encrypted, safeguarding the content from unauthorized access. This level of security is particularly beneficial for individuals who prioritize privacy in their digital communications.

Wallet Integration:

One of the standout features is its seamless integration with cryptocurrency wallets. Users can utilize their wallets as email addresses, facilitating encrypted wallet-to-wallet communication. This integration not only enhances security but also streamlines interactions within the Web3 ecosystem. JOIN HERE https://tinyurl.com/getethermailearly

Read-to-Earn Model:

The platform introduces an innovative “Read-to-Earn” mechanism, where users are compensated for engaging with promotional content. Companies pay users in native tokens to access their inboxes, turning email engagement into a potential source of passive income.

Privacy Wall and PayWall:

The platform offers tools like the Privacy Wall, allowing users to set preferences around content sources, and the PayWall, enabling users to define the type of content they’re willing to read in exchange for rewards. These features empower users to maintain control over their inbox content and interactions.

Dapplets and Aliases:

It supports Dapplets, which are third-party decentralized applications that expand inbox capabilities, and Aliases, allowing users to customize their email addresses for easier sharing and recall.

User Experience

The interface is designed with user-friendliness in mind. The onboarding process is straightforward, especially for those familiar with cryptocurrency wallets. For users without existing wallets, it offers an “Email-as-a-Wallet” feature, enabling the creation of a self-custodial wallet in under a minute using social logins like Google or Apple.

A mobile application ensures that users can access their Web3 inboxes on the go, catering to modern users who require constant connectivity.

Security Measures

Security is a paramount concern. The platform employs end-to-end encryption for emails exchanged between its users, ensuring that only the intended recipients can access the content. Additionally, it is developing a blockchain-backed protocol to combat phishing and spam, further enhancing user protection.

Community and Adoption

As of now, the platform boasts over 2 million verified accounts and collaborates with more than 100 Web3 communities that utilize it as their primary communication channel. This growing adoption underscores its potential and trust within the Web3 ecosystem.

Pros & Cons

Pros:

Cons:

Conclusion

This platform represents a significant advancement in merging traditional email services with blockchain technology. By prioritizing user privacy, security, and control, it offers a compelling alternative to conventional email platforms. While there may be a learning curve for some users, the benefits of enhanced security and potential monetization make it a noteworthy consideration for those looking to embrace Web3 communication solutions.

source

You may like

Stablecoin Transparency Bill Passes House Committee With Overwhelming Vote

Binance confirms FDUSD reserves are accurate after depegging

Kraken Secures Restricted Dealer Status in Canada Amid 'Turning Point' for Crypto in the Country

Binance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

XRP Price Reversal Toward $3.5 In The Works With Short And Long-Term Targets Revealed

Former New York governor advised OKX over $505M federal probe: Report

Following a sharp multi-week selloff that dragged Bitcoin from above $100,000 to below $80,000, the recent price bounce has traders debating whether the Bitcoin bull market is truly back on track or if this is merely a bear market rally before the next macro leg higher.

Bitcoin’s Local Bottom or Bull Market Pause?

Bitcoin’s latest correction was deep enough to rattle confidence, but shallow enough to maintain macro trend structure. Price seems to have set a local bottom between $76K–$77K, and several reliable metrics are beginning to solidify the local lows and point towards further upside.

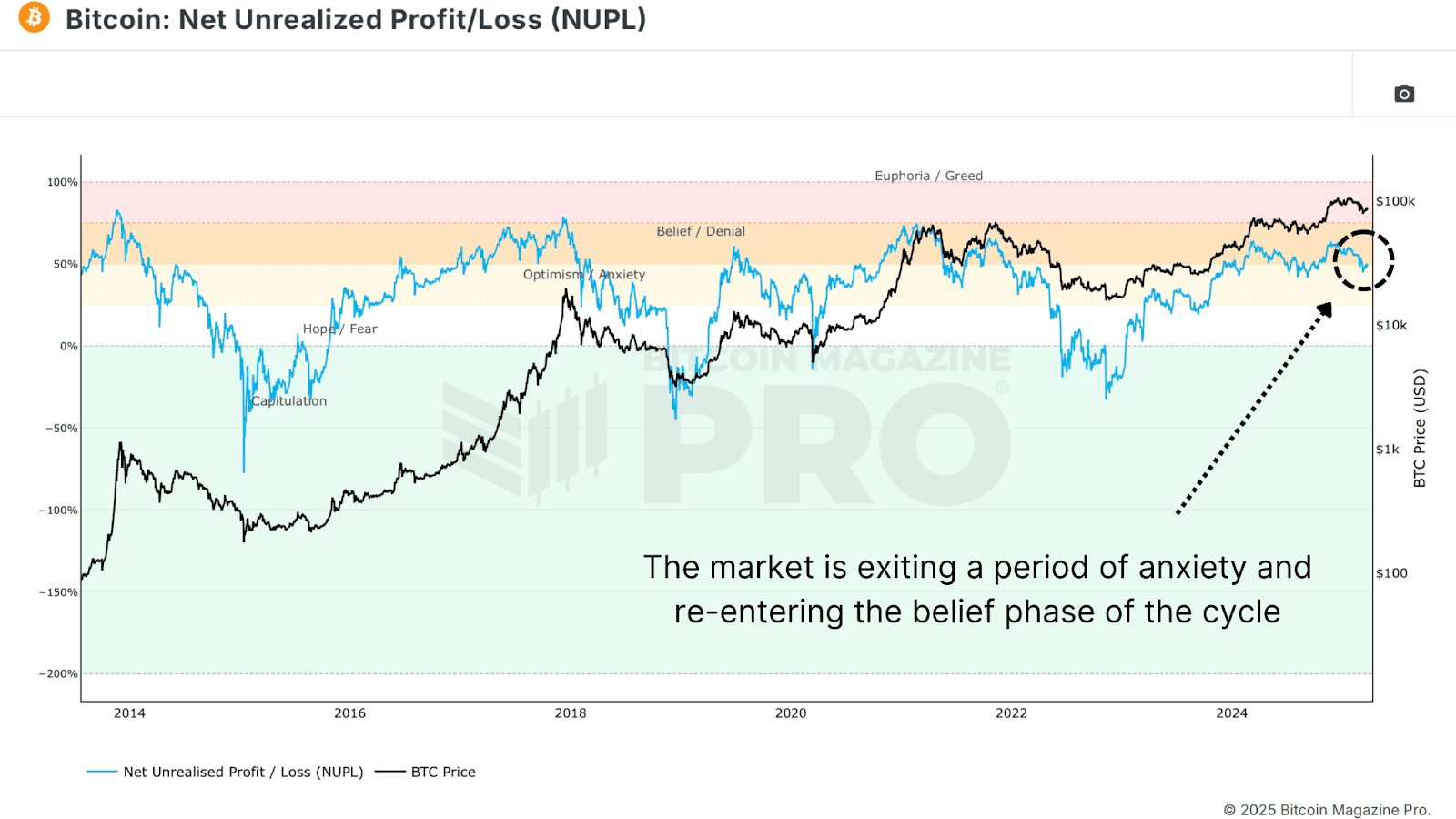

The Net Unrealized Profit and Loss (NUPL) is one of the most reliable sentiment gauges across Bitcoin cycles. As price fell, NUPL dropped into “Anxiety” territory, but following the rebound, NUPL has now reclaimed the “Belief” zone, a critical sentiment transition historically seen at macro higher lows.

The Value Days Destroyed (VDD) Multiple weighs BTC spending by both coin age and transaction size, and compares the data to a previous yearly average, giving insight into long term holder behavior. Current readings have reset to low levels, suggesting that large, aged coins are not being moved. This is a clear signal of conviction from smart money. Similar dynamics preceded major price rallies in both the 2016/17 and 2020/21 bull cycles.

Bitcoin Long-Term Holders Boost Bull Market

We’re also now seeing the Long Term Holder Supply beginning to climb. After profit-taking above $100K, long-term participants are now re-accumulating at lower levels. Historically, these phases of accumulation have set the foundation for supply squeezes and subsequent parabolic price action.

Bitcoin Hash Ribbons Signal Bull Market Cross

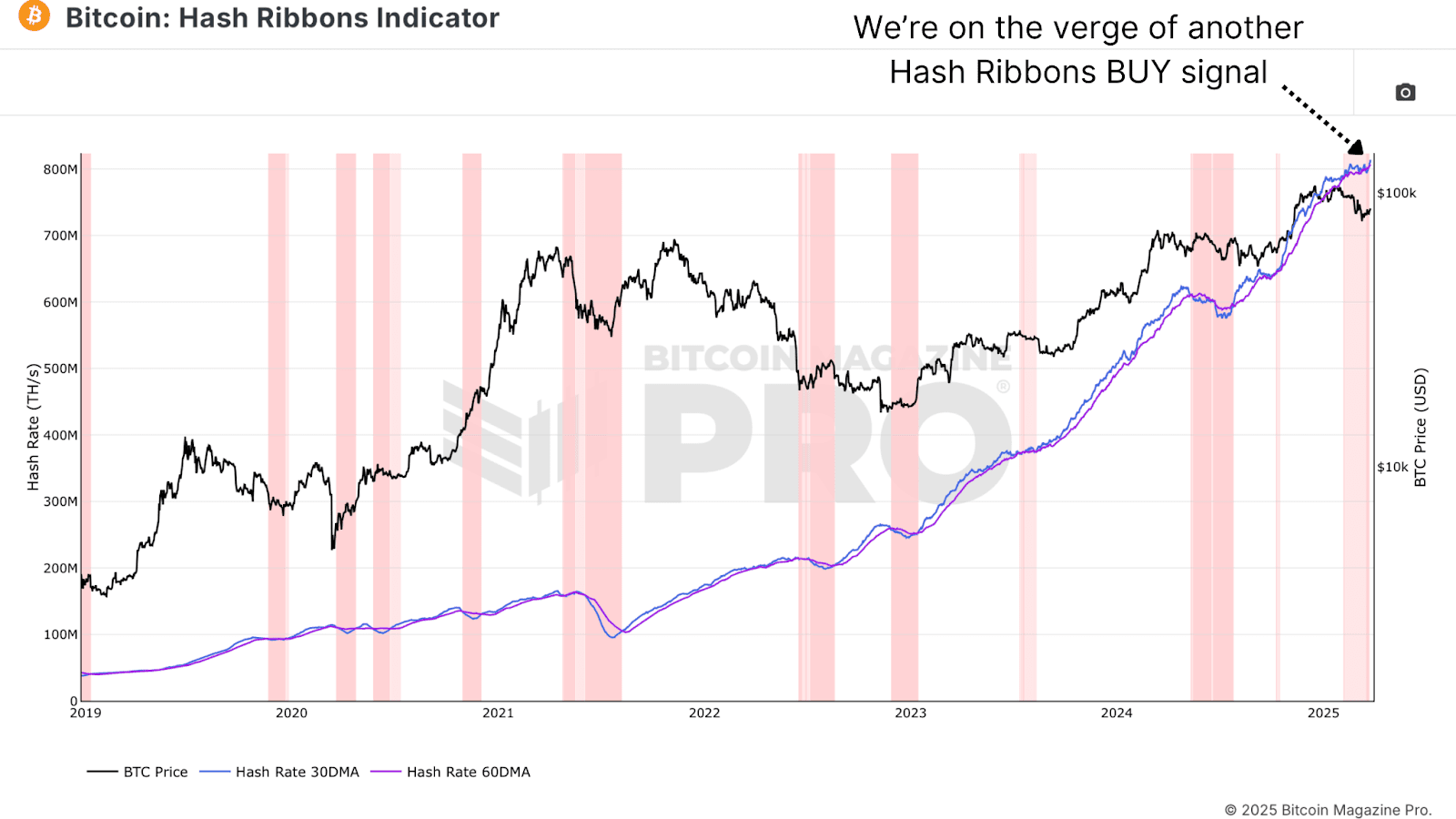

The Hash Ribbons Indicator has just completed a bullish crossover, where the short-term hash rate trend moves above the longer-term average. This signal has historically aligned with bottoms and trend reversals. Given that miner behavior tends to reflect profitability expectations, this cross suggests miners are now confident in higher prices ahead.

Bitcoin Bull Market Tied to Stocks

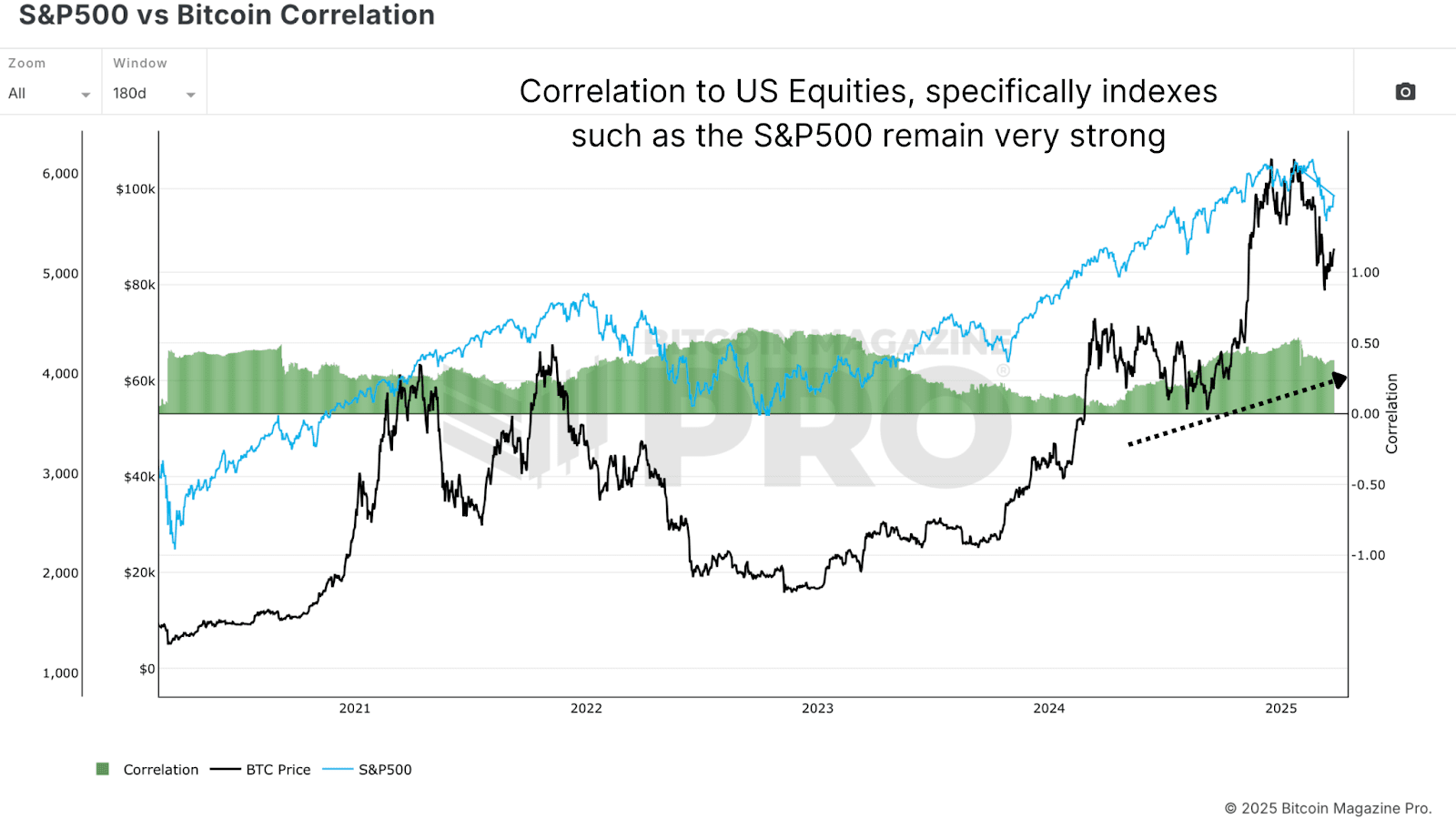

Despite bullish on-chain data, Bitcoin remains closely tied to macro liquidity trends and equity markets, particularly the S&P 500. As long as that correlation holds, BTC will be partially at the mercy of global monetary policy, risk sentiment, and liquidity flows. While rate cut expectations have helped risk assets bounce, any sharp reversal could cause renewed choppiness for Bitcoin.

Bitcoin Bull Market Outlook

From a data-driven perspective, Bitcoin looks increasingly well-positioned for a sustained continuation of its bull cycle. On-chain metrics paint a compelling picture of resilience for the Bitcoin bull market. The Net Unrealized Profit and Loss (NUPL) has shifted from “Anxiety” during the dip to the “Belief” zone after the rebound—a transition often seen at macro higher lows. Similarly, the Value Days Destroyed (VDD) Multiple has reset to levels signaling conviction among long-term holders, echoing patterns before Bitcoin’s rallies in 2016/17 and 2020/21. These metrics point to structural strength, bolstered by long-term holders aggressively accumulating supply below $80,000.

Further supporting this, the Hash Ribbons indicator’s recent bullish crossover reflects growing miner confidence in Bitcoin’s profitability, a reliable sign of trend reversals historically. This accumulation phase suggests the Bitcoin bull market may be gearing up for a supply squeeze, a dynamic that has fueled parabolic moves before. The data collectively highlights resilience, not weakness, as long-term holders seize the dip as an opportunity. Yet, this strength hinges on more than just on-chain signals—external factors will play a critical role in what comes next.

However, macro conditions still warrant caution, as the Bitcoin bull market doesn’t operate in isolation. Bull markets take time to build momentum, often needing steady accumulation and favorable conditions to ignite the next leg higher. While the local bottom between $76K–$77K seems to hold, the path forward won’t likely feature vertical candles of peak euphoria yet. Bitcoin’s tie to the S&P 500 and global liquidity trends means volatility could emerge from shifts in monetary policy or risk sentiment.

For example, while rate cut expectations have lifted risk assets, an abrupt reversal—perhaps from inflation spikes or geopolitical shocks—could test Bitcoin’s stability. Thus, even with on-chain data signaling a robust setup, the next phase of the Bitcoin bull market will likely unfold in measured steps. Traders anticipating a return to six-figure prices will need patience as the market builds its foundation.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin ETF

How Bitcoin ETFs And Mining Innovations Are Reshaping BTC Price Cycles

Published

2 weeks agoon

March 19, 2025By

admin

Bitcoin’s market structure is evolving, and its once-predictable four-year cycles may no longer hold the same relevance. In a recent conversation with Matt Crosby, lead analyst at Bitcoin Magazine Pro, Mitchell Askew, Head Analyst at Blockware Solutions, shared his perspective on how Bitcoin ETFs, mining advancements, and institutional adoption are reshaping the asset’s price behavior.

According to Askew, Bitcoin’s historical pattern of parabolic price increases followed by steep drawdowns is changing as institutional investors enter the market. At the same time, the mining industry is becoming more efficient and stable, creating new dynamics that affect Bitcoin’s supply and price trends.

Bitcoin’s Market Cycles Are Fading

Askew suggests that Bitcoin may no longer experience the extreme cycles of past bull and bear markets. Historically, halving events reduced miner rewards, triggered supply shocks, and fueled rapid price increases, often followed by corrections of 70% or more. However, the increasing presence of institutional investors is leading to a more structured, macro-driven market.

He explains that Spot Bitcoin ETFs and corporate treasury allocations are bringing consistent demand into Bitcoin, reducing the likelihood of extreme boom-and-bust price movements. Unlike retail traders, who tend to buy in euphoria and panic-sell during downturns, institutions are more likely to sell into strength and accumulate Bitcoin on dips.

Askew also notes that since Bitcoin ETFs launched in January 2024, price movements have become more measured, with longer consolidation periods before continued growth. This suggests Bitcoin is beginning to behave more like a traditional financial asset, rather than a speculative high-volatility market.

The Role of Bitcoin Mining in Price Stability

As a mining analyst at Blockware Solutions, Askew provides insight into how Bitcoin mining dynamics influence price trends. He notes that while many assume a rising hash rate is always bullish, the reality is more complex.

In the short term, increasing hash rate can be bearish, as it leads to higher competition among miners and more Bitcoin being sold to cover electricity costs. However, over the long term, a rising hash rate reflects greater investment in Bitcoin infrastructure and network security.

Another key observation from Askew is that Bitcoin’s hash rate growth lags behind price growth by 3-12 months. When Bitcoin’s price rises sharply, mining profitability increases, prompting more capital to flow into mining infrastructure. However, deploying new mining rigs and setting up facilities takes time, leading to a delayed impact on hash rate expansion.

Why Mining Profitability Is Stabilizing

Askew also highlights that mining hardware efficiency is reaching a plateau, which has significant implications for miners and Bitcoin’s supply structure.

If you’re thinking about Bitcoin mining, you MUST watch this clip.

There’s a trend developing in mining hardware that will bode extremely well for miners:

– Longer machine lifespans

– Slowing hashrate growth

– Increased lag between price growth and hashrate growthBitcoin… pic.twitter.com/H0ZjsCm7Rc

— Mitchell

(@MitchellHODL) March 19, 2025

In Bitcoin’s early years, new mining machines offered dramatic efficiency improvements, forcing miners to upgrade hardware every 1-2 years to remain competitive. Today, however, new models are only about 10% more efficient than the previous generation. As a result, mining rigs can now remain profitable for 4-8 years, reducing the pressure on miners to continuously reinvest in new equipment.

Electricity costs remain the biggest factor in mining profitability, and Askew explains that miners are increasingly seeking low-cost power sources to maintain long-term sustainability. Many companies, including Blockware Solutions, operate in rural U.S. locations with stable energy prices, ensuring better profitability even during market downturns.

Could the U.S. Government Start Accumulating Bitcoin?

Another important discussion point raised by Askew is the potential for a U.S. Strategic Bitcoin Reserve (SBR). Some policymakers have proposed that the U.S. government accumulate Bitcoin in the same way it holds gold reserves, recognizing its potential as a global store of value.

Askew explains that if such a reserve were implemented, it could create a massive supply shock, pushing Bitcoin’s price significantly higher. However, he cautions that government action is slow and would likely involve gradual accumulation rather than sudden large-scale purchases.

Even if implemented over several years, such a program could further reinforce Bitcoin’s long-term bullish trajectory by removing available supply from the market.

Bitcoin Price Predictions & Long-Term Outlook

Based on current trends, Askew remains bullish on Bitcoin’s long-term price trajectory, though he believes the market’s behavior is shifting toward more gradual, sustained growth rather than extreme speculative cycles.

- Base Case: $150K – $200K

- Bull Case: $250K+

- Base Case: $500K – $1M

- Bull Case: Bitcoin flips gold’s $20T market cap → $1M+ per BTC

Askew sees several key factors driving Bitcoin’s price over the next decade, including:

He emphasizes that as Bitcoin’s market structure matures, it may become less susceptible to sharp price swings, making it a more attractive long-term asset for institutions.

Conclusion: A More Mature Bitcoin Market

According to Askew, Bitcoin is undergoing a structural shift that will shape its price trends for years to come. With institutional investors reducing market volatility, mining innovations improving efficiency, and potential government adoption, Bitcoin’s market behavior is beginning to resemble that of gold or other long-term financial assets.

While dramatic parabolic runs may become less frequent, Bitcoin’s long-term trajectory appears stronger and more sustainable than ever. Askew’s perspective reinforces the idea that Bitcoin is no longer just a speculative asset—it is evolving into a key financial instrument with increasing global adoption.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin

How Global Liquidity Fuels Bitcoin Price Growth

Published

4 weeks agoon

March 8, 2025By

admin

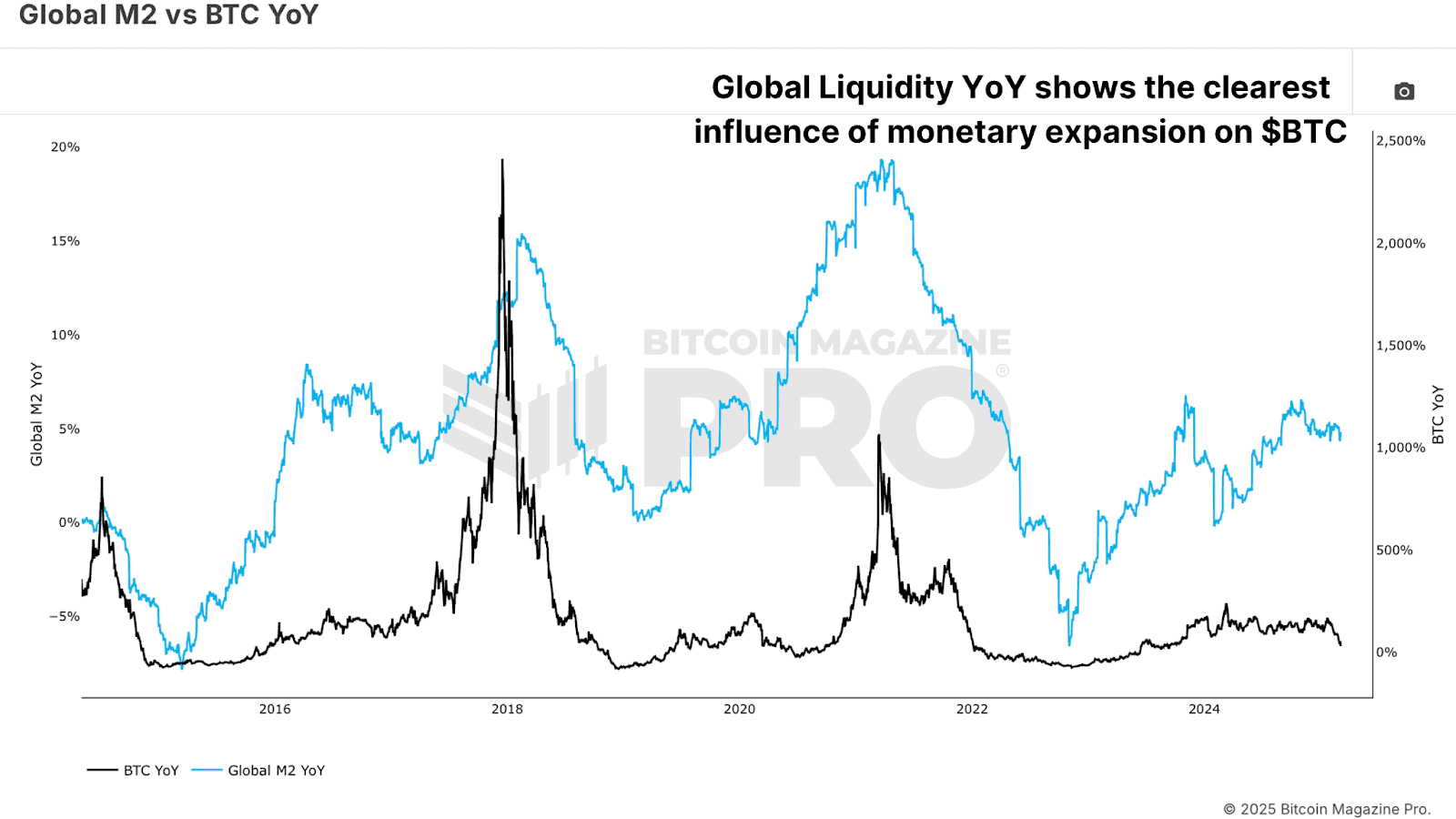

Bitcoin price fluctuations are frequently evaluated using on-chain metrics, technical indicators, and macroeconomic trends. However, one of the most underappreciated yet significant factors in Bitcoin’s price action is Global Liquidity. Many investors may be underutilizing this metric or even misunderstanding how it impacts BTC’s cyclical trends.

Impact on Bitcoin

With increasing discussions on platforms like Twitter (X) and analysts dissecting liquidity charts, understanding the relationship between Global Liquidity and Bitcoin has become crucial for traders and long-term investors alike. However, recent divergences suggest that traditional interpretations might require a more nuanced approach.

Global M2 money supply refers to the total liquid money supply, including cash, checking deposits, and easily convertible near-money assets. Traditionally, when Global M2 expands, capital seeks higher-yielding assets, including Bitcoin, equities, and commodities. Conversely, when M2 contracts, risk assets often decline in value due to tighter liquidity conditions.

Historically, we’ve seen Bitcoin’s price follow the Global M2 expansion, rising when liquidity increases and suffering during contractions. However, in this cycle, we’ve seen a deviation: despite a steady increase in Global M2, Bitcoin’s price action has shown inconsistencies.

Year-on-Year Change

Rather than simply tracking the absolute value of Global M2, a more insightful approach is to analyze its year-on-year rate of change. This method accounts for the velocity of liquidity expansion or contraction, revealing a clearer correlation with Bitcoin’s performance.

When we compare the Bitcoin Year-on-Year Return (YoY) with Global M2 YoY Change, a much stronger relationship emerges. Bitcoin’s strongest bull runs align with periods of rapid liquidity expansion, while contractions precede price declines or prolonged consolidation phases.

For example, during Bitcoin’s consolidation phase in early 2025, Global M2 was steadily increasing, but its rate of change was flat. Only when M2’s expansion accelerates noticeably can Bitcoin break out towards new highs.

Liquidity Lag

Another key observation is that Global Liquidity does not impact Bitcoin instantly. Research suggests that Bitcoin lags behind Global Liquidity changes by approximately 10 weeks. By shifting the Global Liquidity indicator forward by 10 weeks, the correlation with Bitcoin strengthens significantly. However, further optimization suggests that the most accurate lag is around 56 to 60 days, or approximately two months.

Bitcoin Outlook

Throughout most of 2025, Global Liquidity has been in a flattening phase following a significant expansion in late 2024 that propelled Bitcoin to new highs. This flattening coincided with Bitcoin’s consolidation and retracement to around $80,000. However, if historical trends hold, a recent resurgence in liquidity growth should translate into another leg up for BTC by late March.

Conclusion

Monitoring Global Liquidity is an essential macro indicator for anticipating Bitcoin’s trajectory. However, rather than relying on static M2 data, focusing on its rate of change and understanding the two-month lag effect offers a much more precise predictive framework.

As Global economic conditions evolve and central banks adjust their monetary policies, Bitcoin’s price action will continue to be influenced by liquidity trends. The coming weeks will be pivotal; Bitcoin could be poised for a major move if Global Liquidity continues its renewed acceleration.

Enjoyed this? Explore more on Bitcoin price shifts and market cycles in our recent guide to mastering Bitcoin on-chain data.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Stablecoin Transparency Bill Passes House Committee With Overwhelming Vote

Binance confirms FDUSD reserves are accurate after depegging

Kraken Secures Restricted Dealer Status in Canada Amid 'Turning Point' for Crypto in the Country

Binance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

XRP Price Reversal Toward $3.5 In The Works With Short And Long-Term Targets Revealed

Former New York governor advised OKX over $505M federal probe: Report

First Digital USD (FDUSD) Depegs After Justin Sun Alleges Firm Is ‘Insolvent’ and Not Fulfilling Redemptions

Gen Z’s Bitcoin Bet, The Largest Wealth Transfer In History?

Trump’s Crypto Conflicts Dominate Stablecoin Legislation Debate

First Digital denies allegations, threatens legal action

Crypto Firm Galaxy Secures UK FCA Approval for License to Expand Derivatives Trading

Why Is The Bitcoin Price Surging Today?

Cardano Founder Reveals What Will Onboard 3 Billion New Users Into Crypto

Sentient open-source AI search outperforms GPT-4o and Perplexity

Memecoin Collapse Creates Perfect Moment for TradFi To Launch ‘Trusted Assets,’ According to Chris Burniske

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x