Bitcoin

Is Bitcoin’s Bull Market Truly Back?

Published

3 days agoon

By

admin

Following a sharp multi-week selloff that dragged Bitcoin from above $100,000 to below $80,000, the recent price bounce has traders debating whether the Bitcoin bull market is truly back on track or if this is merely a bear market rally before the next macro leg higher.

Bitcoin’s Local Bottom or Bull Market Pause?

Bitcoin’s latest correction was deep enough to rattle confidence, but shallow enough to maintain macro trend structure. Price seems to have set a local bottom between $76K–$77K, and several reliable metrics are beginning to solidify the local lows and point towards further upside.

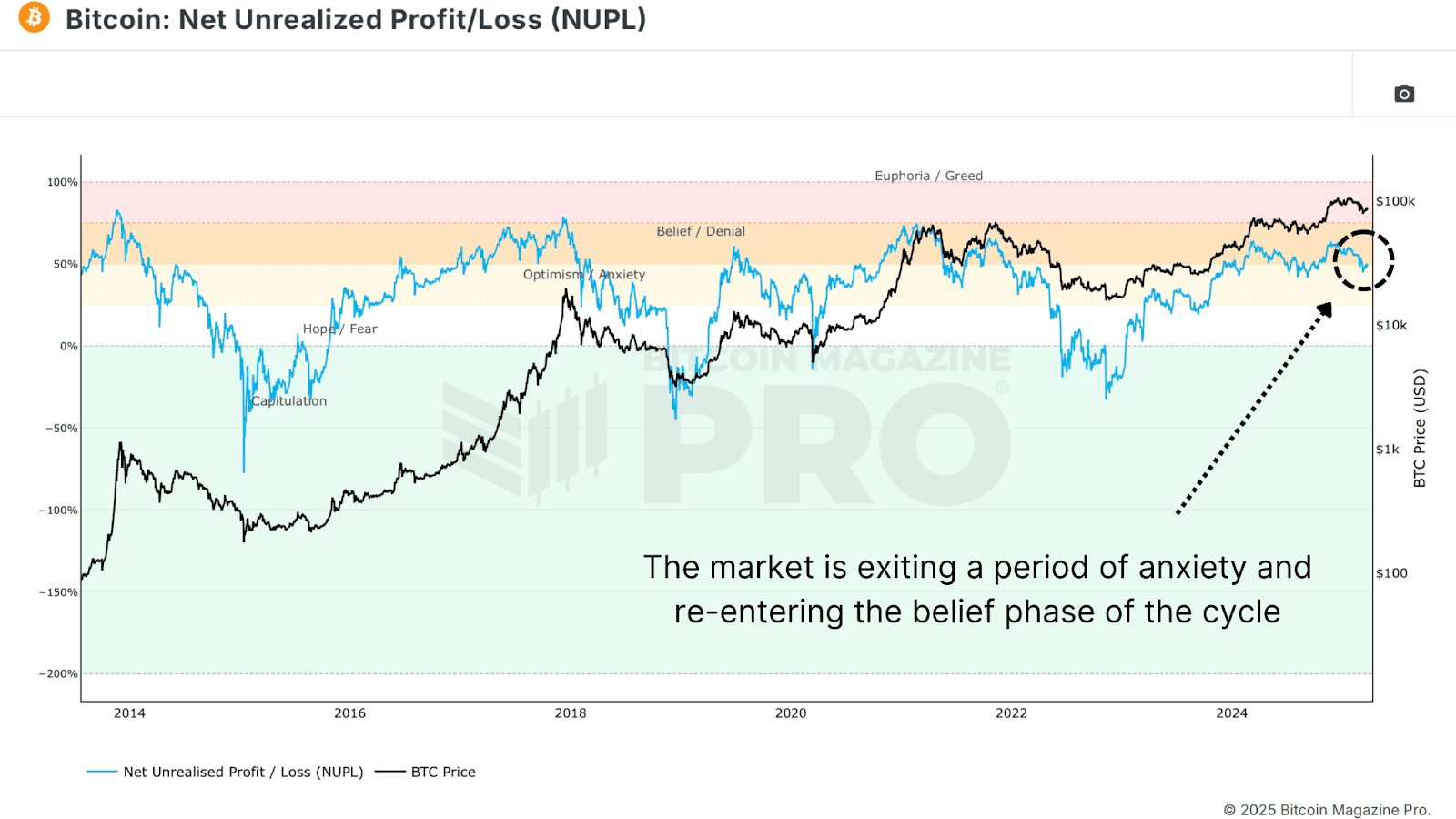

The Net Unrealized Profit and Loss (NUPL) is one of the most reliable sentiment gauges across Bitcoin cycles. As price fell, NUPL dropped into “Anxiety” territory, but following the rebound, NUPL has now reclaimed the “Belief” zone, a critical sentiment transition historically seen at macro higher lows.

The Value Days Destroyed (VDD) Multiple weighs BTC spending by both coin age and transaction size, and compares the data to a previous yearly average, giving insight into long term holder behavior. Current readings have reset to low levels, suggesting that large, aged coins are not being moved. This is a clear signal of conviction from smart money. Similar dynamics preceded major price rallies in both the 2016/17 and 2020/21 bull cycles.

Bitcoin Long-Term Holders Boost Bull Market

We’re also now seeing the Long Term Holder Supply beginning to climb. After profit-taking above $100K, long-term participants are now re-accumulating at lower levels. Historically, these phases of accumulation have set the foundation for supply squeezes and subsequent parabolic price action.

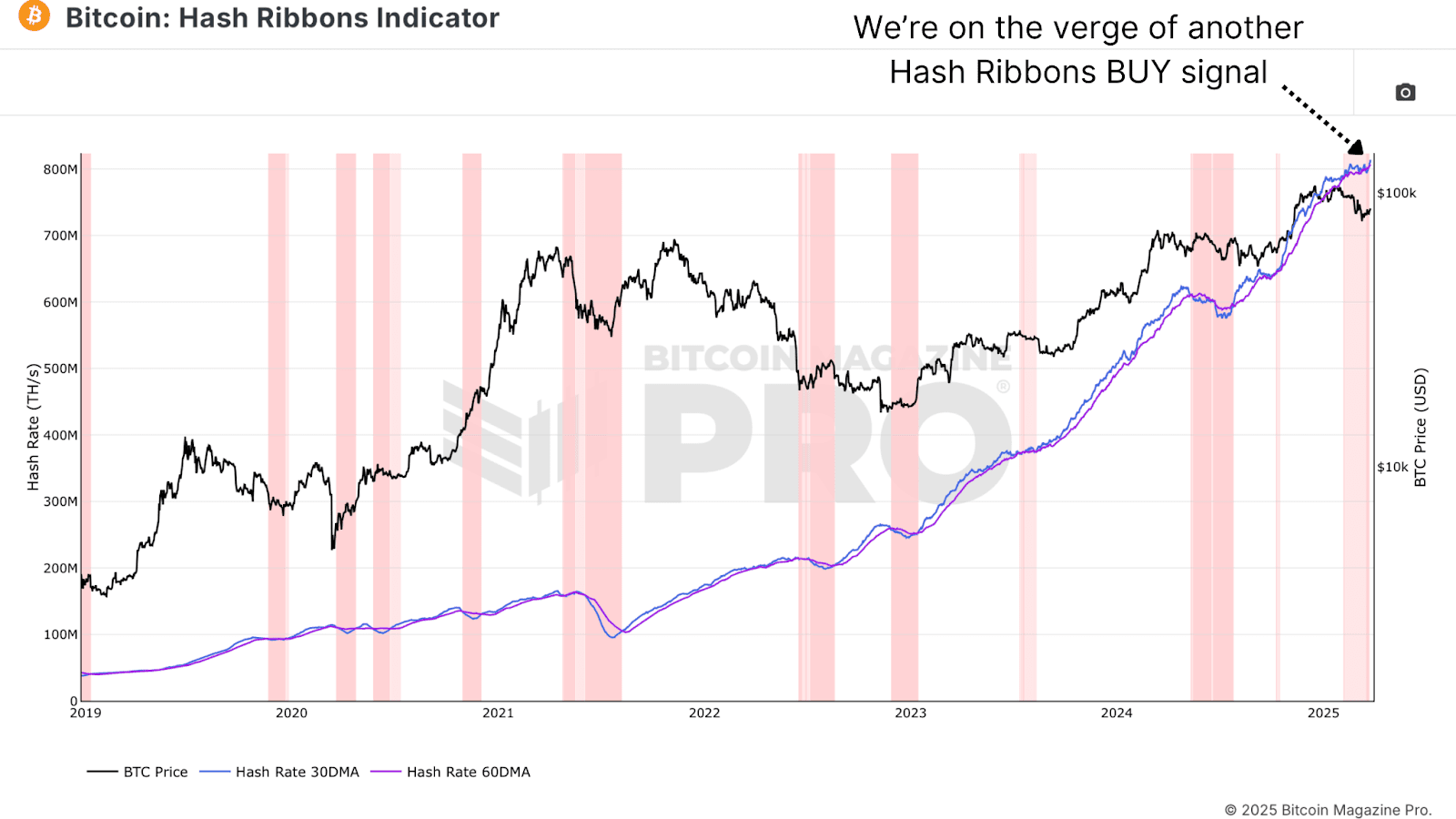

Bitcoin Hash Ribbons Signal Bull Market Cross

The Hash Ribbons Indicator has just completed a bullish crossover, where the short-term hash rate trend moves above the longer-term average. This signal has historically aligned with bottoms and trend reversals. Given that miner behavior tends to reflect profitability expectations, this cross suggests miners are now confident in higher prices ahead.

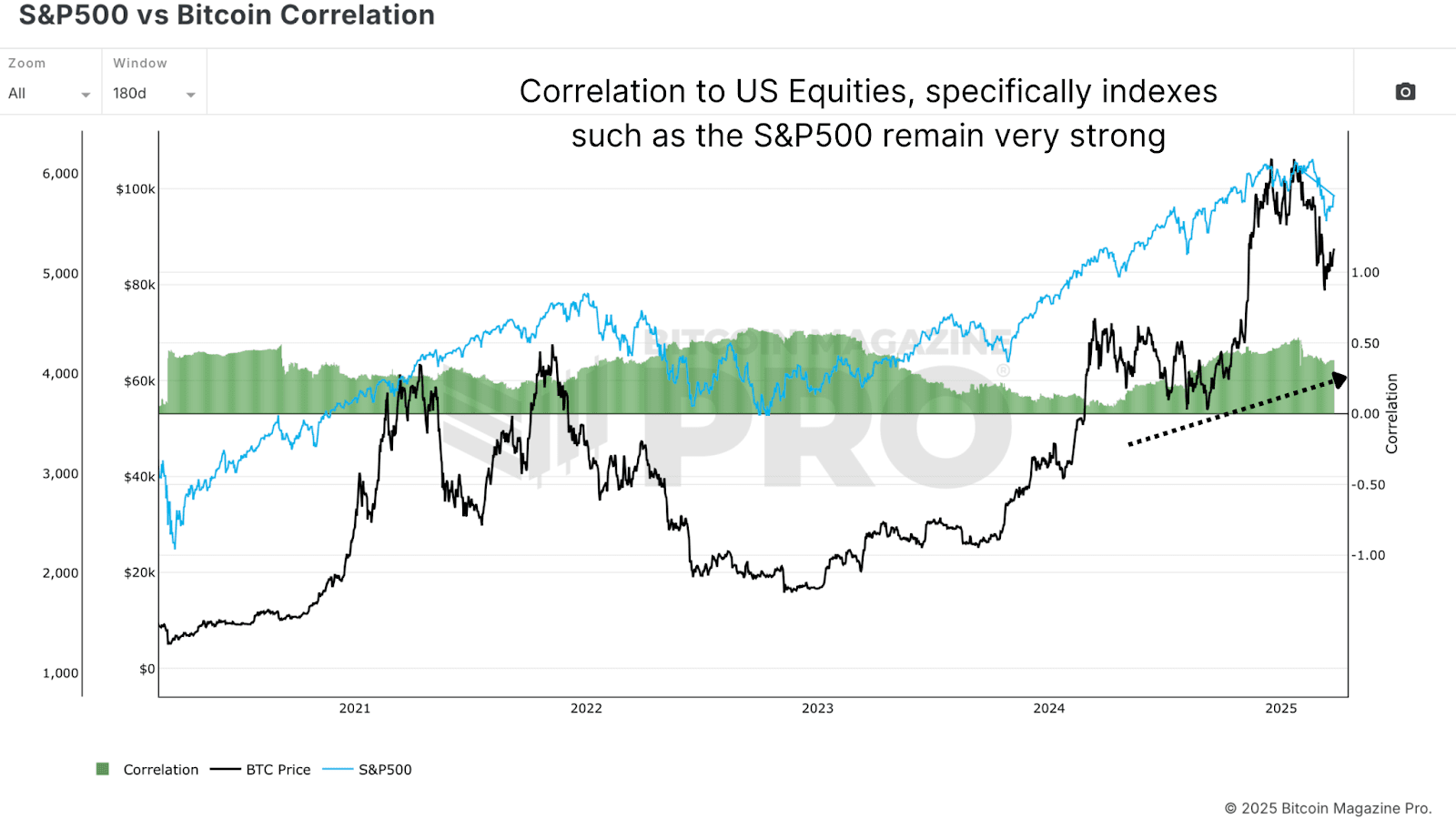

Bitcoin Bull Market Tied to Stocks

Despite bullish on-chain data, Bitcoin remains closely tied to macro liquidity trends and equity markets, particularly the S&P 500. As long as that correlation holds, BTC will be partially at the mercy of global monetary policy, risk sentiment, and liquidity flows. While rate cut expectations have helped risk assets bounce, any sharp reversal could cause renewed choppiness for Bitcoin.

Bitcoin Bull Market Outlook

From a data-driven perspective, Bitcoin looks increasingly well-positioned for a sustained continuation of its bull cycle. On-chain metrics paint a compelling picture of resilience for the Bitcoin bull market. The Net Unrealized Profit and Loss (NUPL) has shifted from “Anxiety” during the dip to the “Belief” zone after the rebound—a transition often seen at macro higher lows. Similarly, the Value Days Destroyed (VDD) Multiple has reset to levels signaling conviction among long-term holders, echoing patterns before Bitcoin’s rallies in 2016/17 and 2020/21. These metrics point to structural strength, bolstered by long-term holders aggressively accumulating supply below $80,000.

Further supporting this, the Hash Ribbons indicator’s recent bullish crossover reflects growing miner confidence in Bitcoin’s profitability, a reliable sign of trend reversals historically. This accumulation phase suggests the Bitcoin bull market may be gearing up for a supply squeeze, a dynamic that has fueled parabolic moves before. The data collectively highlights resilience, not weakness, as long-term holders seize the dip as an opportunity. Yet, this strength hinges on more than just on-chain signals—external factors will play a critical role in what comes next.

However, macro conditions still warrant caution, as the Bitcoin bull market doesn’t operate in isolation. Bull markets take time to build momentum, often needing steady accumulation and favorable conditions to ignite the next leg higher. While the local bottom between $76K–$77K seems to hold, the path forward won’t likely feature vertical candles of peak euphoria yet. Bitcoin’s tie to the S&P 500 and global liquidity trends means volatility could emerge from shifts in monetary policy or risk sentiment.

For example, while rate cut expectations have lifted risk assets, an abrupt reversal—perhaps from inflation spikes or geopolitical shocks—could test Bitcoin’s stability. Thus, even with on-chain data signaling a robust setup, the next phase of the Bitcoin bull market will likely unfold in measured steps. Traders anticipating a return to six-figure prices will need patience as the market builds its foundation.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

You may like

‘Positive But Cautious’ Investors Pour Capital Into Ethereum, Solana, XRP and Sui: CoinShares

Bitcoin As The Global Denominator Of Capital

Trump’s Crypto Dealings Are Making Regulation ‘More Complicated’: House Financial Services Chair

Pontus-X taps Oasis for private, cross-border data sharing in E.U.

Elon Musk, Dogecoin Proponent and U.S. Agency Figurehead, Says ‘No DOGE in D.O.G.E.’

Crypto Investor’s Brave Yet Hilarious Prediction Speculates If XRP Price Will Hit $3,000 This Cycle

Bill Miller IV

Bitcoin As The Global Denominator Of Capital

Published

12 minutes agoon

March 31, 2025By

admin

Summary: The Bill Miller IV Interview

Bill Miller IV, CIO of Miller Value Partners and Bitcoin 2025 speaker, joins Bitcoin Magazine’s “The Culture Bit” to lay out a markets-first case for Bitcoin as the world’s ultimate denominator of capital.

Bill explains why Bitcoin is more than digital gold: it’s a response to engineered outcomes, financial entropy, and institutional inertia. He hits hard on why Michael Saylor and Strategy’s ‘strategy’ matters, why more corporations will follow, and why the time for fence-sitting on Bitcoin is over for investors of all-types.

This should come as no surprise given comments on Bitcoin by his father Bill Miller III who revealed a “very big” Bitcoin position in 2022 after the cryptocurrency made up approximately half of his asset allocation.

Drawing from over a decade of investing experience in the space, Bill walks through how Bitcoin solves fundamental failures in fiat monetary systems—not with hype, but with game theory, governance, and first-principle design. Bill offers a powerful endorsement of Bitcoin, noting: “I buy Bitcoin every single day. It’s the last thing I’d ever sell.”

Follow along for a deep dive on how one of Bitcoin’s biggest bulls and longest-time investors is navigating the Bitcoin market in 2025 and beyond.

WATCH the full on Bitcoin Magazine YouTube, X, Rumble and the Bitcoin Magazine Podcast

Source link

Bitcoin price is at a pivotal level as ETF flows offloaded $93 million on Friday, ending a 10-day buying spree. While BTC holds key support at $82,000, BlackRock investors disposition may signal optimism.

Bitcoin ETFs End 10-day Buying Spree, But BlackRock Investors Hold

Bitcoin ETFs drew media attention on Friday as net outflows reached $93 million, marking the end of a 10-day buying spree that added over $1.07 billion in BTC.

FairSide data reveals that all of the outflows came from Fidelity’s FBTC, while BlackRock’s IBIT and eight other U.S.-approved spot ETFs recorded neutral flows, signaling diverging institutional investor sentiment.

Despite the selling pressure, BTC price showed resilience, bouncing from a 10-day low of $82,000 to reclaim the $84,000 level over the weekend.

This suggests that while some institutional players have turned cautious, BTC continues to find buyers at the $82,000 mark, likely driven by macroeconomic hedging.

Why Are Bitcoin ETFs Taking a Neutral Outlook Despite Bearish Market Sentiment?

While Bitcoin’s brief dip below $82,000 coincided with renewed regulatory uncertainty—following U.S. Congress’ scrutiny of Paul Atkins, Trump’s crypto-friendly SEC pick—the decision by major ETFs like BlackRock’s IBIT to hold rather than sell suggests a more calculated approach among institutional investors.

One possible explanation is that institutional investors are weighing broader macroeconomic risks. With concerns mounting over Trump’s proposed trade policies and their potential impact on traditional stock markets, Bitcoin remains an attractive hedge due to its independence from traditional financial structures. This could explain why ETF outflows have been concentrated in specific funds like FBTC rather than across the board.

- Large Un-realized Profits

Prior to the $93 million sell-off observed on Friday, Bitcoin ETFs had acquired over $1.07 billion in the previous 10-days. This sheer volume of Bitcoin accumulated by ETFs in recent weeks means that short-term supply is limited.

It also hints that majority on investors who began buying when BTC prices plunged below $77,000 over the past week are still in profit, hence the reluctance to sell.

This key dynamics may have contributed to Bitcoin price holding key support levels above $82,000. Notably, while BTC price rebounded, leading altcoins like Ethereum (ETH), Solana (SOL), and Ripple (XRP) have lagged behind, further reinforcing the narrative that institutional capital remains primarily focused on BTC.

What’s Next for Bitcoin ETFs and Institutional Demand?

The coming weeks will be crucial in determining whether Bitcoin ETFs resume their accumulation trend or if further outflows signal a shift in sentiment. Investors will closely watch developments in U.S. regulatory policy and broader market conditions to assess whether Bitcoin’s status as a safe-haven asset remains intact.

If the macroeconomic environment continues to favor Bitcoin as a non-correlated asset, ETF inflows could resume, pushing BTC to new highs. However, prolonged uncertainty or negative regulatory developments could trigger deeper corrections.

For now, BlackRock and other major institutional players appear to be maintaining their positions, indicating confidence in Bitcoin’s long-term trajectory.

Bitcoin Price Forecast: BTC Faces Critical Resistance at $84,400 Amid Bearish Pennant Formation

Bitcoin price forecast signals remains uncertain as BTC trades at $82,363, hovering near key support levels. The Bollinger Bands show tightening volatility, with resistance at $84,412 and $88,215. The Parabolic SAR at $80,237 suggests a continuation of the downtrend unless BTC breaks above the mid-range resistance.

A bearish pennant formation signals potential downside risk. If BTC fails to reclaim $84,400, selling pressure could drive the price towards $80,600 or even the lower Bollinger Band at $80,237. The volume delta reveals declining buying momentum, supporting the bearish case.

However, a bullish scenario emerges if BTC can hold above $82,000 and break past $84,400 with strong volume. This could lead to a rally toward $88,215, negating the bearish pennant. With key resistance intact, Bitcoin’s trajectory depends on its next move at this crucial level.

Frequently Asked Questions (FAQs)

Bitcoin price is declining due to ETF outflows, regulatory uncertainty, and shifting investor sentiment favoring safer assets like gold and cash.

Yes, if institutional demand returns, macroeconomic conditions improve, and key support levels hold, Bitcoin could regain bullish momentum.

Bitcoin ETFs drive large-scale buying and selling, influencing price volatility and overall market liquidity depending on institutional investor behavior.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Bitcoin Could Appear on 25% of S&P 500 Balance Sheets by 2030, Analyst Says

Published

23 hours agoon

March 30, 2025By

admin

Bitcoin is making its way from trading desks to corporate treasuries, and by the end of the decade, it could be standard practice, according to one analyst.

“Across all the different strategies and implementations, I anticipate that by 2030, a quarter of the S&P 500 will have BTC somewhere on their balance sheets as a long-term asset,” Elliot Chun, a partner at Architect Partners, wrote in a market snapshot.

The strategy—holding bitcoin as a treasury reserve asset—was unorthodox when Strategy, formerly known as MicroStrategy, first adopted it in August 2020. The firm framed BTC as a hedge against inflation, a diversification tool, and a way to distinguish itself in the market.

Then CEO Michael Saylor’s highly public embrace of bitcoin transformed the company into a de facto proxy for BTC exposure. Since then, MicroStrategy stock has surged more than 2,000%, far outpacing both the S&P 500 and bitcoin over the same period, Chun pointed out.

GameStop is the latest company to follow suit, announcing this week that it would raise $1.3 billion through a convertible note to acquire bitcoin. Its stock initially surged following the announcement but has since endured a correction, falling nearly 15% for the week.

Chun argued that treasurers may soon face career risk not for buying bitcoin, but for ignoring it altogether. “Doing nothing is no longer a defensible strategy,” he wrote.

According to BitcoinTreasuries data, publicly listed companies currently hold 665,618 BTC, around 3.17% of the cryptocurrency’s total supply. Strategy holds the lion’s share, 506,137 BTC.

Read more: U.S. Listed Firms Continue Bitcoin (BTC) Treasury Adoption

Source link

‘Positive But Cautious’ Investors Pour Capital Into Ethereum, Solana, XRP and Sui: CoinShares

Bitcoin As The Global Denominator Of Capital

Trump’s Crypto Dealings Are Making Regulation ‘More Complicated’: House Financial Services Chair

Pontus-X taps Oasis for private, cross-border data sharing in E.U.

Elon Musk, Dogecoin Proponent and U.S. Agency Figurehead, Says ‘No DOGE in D.O.G.E.’

Crypto Investor’s Brave Yet Hilarious Prediction Speculates If XRP Price Will Hit $3,000 This Cycle

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

California introduces ’Bitcoin rights’ in amended digital assets bill

MELANIA Insider Hayden Davis Selling Millions of Dollars Worth of Memecoin Amid 95% Drop: On-Chain Data

Toulouse starts to accept crypto for public transport

Bitcoin, Crypto Prices Slide as Trade Tensions, Inflation Risks Rattle Markets

Will BlackRock Investors Stay Bullish?

Bitcoin Could Appear on 25% of S&P 500 Balance Sheets by 2030, Analyst Says

Centralization and the dark side of asset tokenization — MEXC exec

Bitcoin Support Thins Below $78,000 As Cost Basis Clusters Shift Toward $95,000

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: