Culture

Recounting Ethiopia’s Bitcoin Developments In 2024

Published

3 months agoon

By

admin

Ethiopia’s state-owned power producer, and a population of 126 million Ethiopians, welcomed the bitcoin mining industry in 2024 with an attractive electricity rate of USD 3.2 cents KWh. In this past year EEP has generated USD 55 million in revenues from bitcoin miners and expects USD 123 million in the year to come.

As we look forward to 2025, let’s take time to recognize the efforts and events in Ethiopia from the year 2024. These highlights can serve as a blueprint for how other energy-potential rich nations, even those too small or timid to challenge historical assertions about money, can also join in this race for energy and add-value to the bitcoin network.

First Quarter

- December 13, 2023, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update that addresses the accounting for and disclosure of “crypto” assets. Google Developers Group Addis (GDG Addis) invited Kal Kassa of BitcoinBirr and Dr. Nemo Semret of QRB Labs to speak at DevFest’23.

- RT published news of Russian investors setting up bitcoin mining facilities in Ethiopia. Shega features QRB Labs along with a Bloomberg Article on Chinese investors also working in bitcoin mining.

- February 12, 2024, BBC News Day Live interviewed Kal Kassa about bitcoin mining in Ethiopia. Then on February 21, 2024, Addis Standard published revenue figures of USD 2 million earned by Ethiopian Electric Power (EEP) from bitcoin miners. Within the year we will see this sales figure grow significant multiples.

- As the first signs of return in the bitcoin mining industry were reported, within days of each other, Bitcoin Magazine published 5 Ways Bitcoin Mining Benefits Ethiopia, then The Economist published Why Africa is Crypto’s Next Frontier and finally Addis Standard published From Shadows to Spotlight: Why Ethiopia Became Latest scene for Cryptocurrency Rush. In the first quarter of this year CNBC’s MacKenzie Sigalos also visited Addis Ababa to learn about this new industry.

Second Quarter

- Dr. Nemo Semret of QRB Labs published Bitcoin Mining in Ethiopia; the good, the bad and the ugly ahead of his interview with Hashrate Up Podcast and Gugut Podcast to talk about experiences building his facility and recent developments in the energy sector.

- May 3, 2024, Bloomberg’s Next Africa Podcast host Jennifer Zabasajja spoke with reporter Fasika Tadesse in a segment titled Ethiopia: An African Paradise For Crypto Miners?

- And on May 23, 2024, Addis Standard published revenue figures of USD 10.1 million earned by Ethiopian Electric Power (EEP) from bitcoin miners.

Third Quarter

- Blink publishes Bitcoin Mining in Africa: All Roads Lead to Ethiopia.

- August 25, 2024, Addis Standard published revenue figures of USD 27 million earned by Ethiopian Electric Power (EEP) from bitcoin miners.

- The Prime Minister of Ethiopia, Abiy Ahmed announces the Private Key Infrastructure (PKI) initiative in partnership with the Information Network Security Administration (INSA) to support local offices with cryptographic messaging and private-key related issues.

- BitCluster shared photos of its facilities in Ethiopia after deploying 12,000 bitcoin mining machines. In the third quarter of 2024 we also saw the eCrypto GitHub page publish an Amharic translation of the bitcoin whitepaper.

Fourth Quarter

- DINK TV and Genet Shiberu interview West Data Group in Bole Lemi for a tour of an operational 30 MW bitcoin mining facility.

- Ethan Vera of Luxor and Kal Kassa of BitcoinBirr joined The Mining Pod with Will Foxley to talk about Ethiopia’s Bitcoin Mining Boom.

- In the fourth quarter of 2024 we also learned that BitFuFu (NASDAQ: FUFU) was to acquire a 80-MW Bitcoin mining facility in Ethiopia. A few weeks later, Morningstar’s Newswire published BIT Mining Limited (NYSE: BTCM) completed the first phase of acquisition in Ethiopia for a deal that includes USD 2.265 million in cash and USD 12.015 million in shares.

- October 3rd, 2024, the Green Africa Mining Alliance (GAMA) hosted the Africa Bitcoin Mining Summit (ABMS ‘24) at Kuriftu Resort in Entoto Park, Addis Ababa.

- November 4, 2024, Fred Harter of The Africa Report published revenue figures of USD 55 million earned by Ethiopian Electric Power (EEP) from bitcoin miners. Forecasts for next year’s revenue from bitcoin miners stands at USD 123 million.

- November 5, 2024, The Bitcoin Summit ‘24 was hosted by BitcoinBirr at Sheraton Hotel in Addis Ababa. The event’s leading sponsor, West Data Group, announced news of a 20 MW facility in Wolaita Sodo breaking ground.

- Business correspondent Charles Gitonga of the BBC Africa interviews Kal Kassa on the Focus on Africa Podcast titled Why is Ethiopia a Major Hub for Bitcoin Mining? Addis Insight shared its article on the subject titled From Hydroelectric Power to Bitcoin: Ethiopia’s Rise as a Mining Hub.

- November 29, 2024, Ato Henok Assefa published How Bitcoin Mining Can Help Achieve Universal Electrification in Africa. That same week Henok Assefa joined the board of the state-owned Commercial Bank of Ethiopia (CBE). And days later we learned that Ethiopian Electric Power (EEP) will be under the new ownership of the Ethiopian Investment Holdings (EIH).

- Closing out the year, on December 5, 2024, the “Bitcoin” Telegram channel posts that 2.5% of the global Bitcoin hashrate now comes out of Ethiopia and that this number is poised to double in the next year.

Ethiopia’s next objective, if it’s to be supported by the various market actors and individuals involved, will be to contribute 1 GW of energy into the Bitcoin network.

The future of Bitcoin mining in Ethiopia depends on how the Ethiopian government will treat the industry. Since the industry is sensitive to energy, government offices should focus on electricity production, distribution, stability, immutability of commercial contract terms, clear customs procedures, and transparent tax laws. As I work with brilliant bitcoiners around the world, I am optimistic we will reach these goals. Stay humble, stack sats and have a beautiful new year!

This is a guest post by Kal Kassa. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

There’s More to North Korea’s Hacking Ops Than Just Lazarus Group: Paradigm

zkLend hacker loses 2,930 ETH to Tornado Cash phishing scam

23andMe Is a Wake-Up Call on Data Sovereignty

ChatGPT To Launch Next Big Model, New Studio Ghibli Ahead?

Coinbase Stocks Slide Over 30% This Quarter, Matching Post-FTX Collapse Lows

North Korean crypto attacks rising in sophistication, actors — Paradigm

As bitcoin moves into the mainstream of American life, people from every background and corner of the planet are contributing to its historic rise. In the spirit of the age, the bitcoin industry is largely a meritocracy. It is the quality of contributions—rather than any singular identity—that drives bitcoin forward.

March is recognized as International Women’s Month, a tradition rooted in early-20th century labor and suffrage movements. It provides an occasion to reflect on the role of women in bitcoin. Rather than focusing on the experience of being a woman in a technical field, this article spotlights the real contributions and leadership from individuals who happen to be women but who have each, in their own right, helped shape the bitcoin ecosystem.

Whether they come from legal, financial, or technical backgrounds, individuals with strong foundational skills often transition naturally into the bitcoin industry. Much of bitcoin’s growth can be credited to those able to distill complex technical concepts into accessible language. Women are excelling in this role, using skills in marketing, community organizing, and storytelling to broaden understanding and trust in bitcoin. It’s one thing to code or invest in bitcoin, but quite another to convey its principles effectively to the uninitiated. As more people demonstrate real skill in bridging that knowledge gap—through podcasts, workshops, or online content—bitcoin’s base of educated users expands exponentially.

“Women can be powerful communicators and community builders, finding ways to distill complex topics into easily understandable and relatable bites,” says Kelley Weaver, CEO of Melrose PR & Founder of Bitwire. “Since bitcoin fundamentally grows through network effects, this is essential! I’ve seen firsthand how women’s approaches to explaining bitcoin can reach people who might otherwise be intimidated. Approachability is essential for bitcoin’s long-term success.”

In recent years, bitcoin ownership among women has risen significantly. One survey showed that women’s share of digital asset ownership jumped from 29% to 34% in a single quarter. While these numbers vary depending on the source, there’s a clear upward trend. If finance was once perceived as a male-dominated space, that narrative is shifting—particularly for a technology-driven asset like bitcoin, which democratizes participation by removing traditional gatekeepers.

“Across ‘Main Street’ America and the world… decentralized networks of female leaders can be a catalyst for financial education and increasing understanding about the transformative nature of bitcoin,” says Cleve Mesidor, Executive Director of Blockchain Foundation. “Particularly because of scarcity, most individuals will never own even a fraction of bitcoin, which is why women cannot afford to be late adopters.”

Mesidor points to a key dynamic: informal, community-driven networks excel at spreading education. Because bitcoin can be learned and shared peer-to-peer, it finds fertile ground in the natural social structures that women have historically led, such as book clubs, parent associations, and charitable groups. Such networks become informal “nodes” of adoption, where knowledge flows more freely than it might in a top-down environment.

In the past, popular culture often portrayed men as the family financiers while women managed daily household tasks. Yet a recent study revealed that about 84% of women say they are responsible for their family’s finances, from paying bills to setting budgets to overseeing savings and debt obligations. Perhaps more remarkable is that almost all women in couples (94%) report being actively involved in shaping household financial decisions. Many women effectively act as Chief Financial Officers for their families, handling budgeting, strategic planning, and long-term goal setting.

As bitcoin continues to gain traction worldwide, it is increasingly one of the tools under consideration, especially for those who like to plan with a low-time-preference mindset. Bitcoin’s design fits neatly with the mindset that prudent financial planners rely upon. Its limited supply and disinflationary monetary policy reward disciplined saving. As families look for ways to preserve purchasing power, it is natural to add bitcoin in the mix. Whether it’s a small allocation every month or a larger diversification strategy, bitcoin attracts those seeking reliability over the long run.

“For long-term investments, bitcoin is a top choice. While short-term fluctuations are inevitable, its overall trajectory shows a clear path toward growth and stability.” says Frieda Bobay, co-founder of Bitcoin Sports Network. “I never plan to sell my bitcoin; instead, I view it like real estate—an asset I can borrow against while it continues to grow in value.”

While it’s easy to over-generalize, data does suggest that women, on average, tend to adopt disciplined approaches to money management. They trade less frequently in stock markets, are more likely to stick to a plan, and often do deeper research before making an investment. One of bitcoin’s most emblematic qualities is its alignment with low-time-preference thinking: favoring long-term wealth building over short-term speculation. Studies have shown that women are often methodical, patient, and focus on fundamentals rather than jumping in and out of markets. This mindset leads to outperformance in traditional investment contexts.

“A common misconception is that bitcoin is ‘too expensive’—in reality, this is a matter of unit bias,” says Hailey Lennon, General Counsel at Fold. “Many people don’t realize you can own fractions of a bitcoin, and by that measure, it’s still incredibly early and relatively cheap when you compare it to traditional assets. If women empower themselves with the basic knowledge of how bitcoin works, they’ll see that we’re just at the beginning of its potential, making it a compelling opportunity rather than an exclusive, high-priced investment.”

Lennon’s perspective highlights a key barrier for new entrants: bitcoin’s per-coin price might intimidate some, but the option to purchase fractions (satoshis) lowers that barrier significantly. That’s often an eye-opener for people new to bitcoin—especially those who excel in careful, long-term budget allocation. By embracing the possibility of stacking small amounts, methodically and regularly, one can build a meaningful position over time.

Weaver agrees: “Slow and steady wins the race! My personal strategy is to DCA, or “dollar cost average” meaning that I purchase small amounts daily. This spreads out risk. I ultimately think it’s more risky to NOT own bitcoin in the long term, but I also recognize that it’s incredibly volatile. I always say in the short term it may never be a good time to buy bitcoin but in the long term it’s ALWAYS a good idea to buy bitcoin.”

Another reason for the surge in interest among women is that bitcoin, as a universal asset, offers financial independence and sovereignty. This resonates strongly with individuals who value autonomy. “Bitcoin is the pathway to financial sovereignty. It removes traditional gatekeepers and allows for independent wealth management without intermediaries,” says Evie Phillips, Founder of Creeds Collective & Founding Board Member of Crypto Connect, now Eve Wealth. “The blockchain’s immutability means assets can’t be frozen or seized—this is specifically valuable in relational situations and regions where women face financial restrictions. Bitcoin doesn’t have geographic limitations, making global transactions seamless, and that opens up a flood of opportunities that aren’t available through centralized financial systems.” Phillips’s point highlights bitcoin’s advantages in personal control over assets. The economy is fundamentally transforming, and many are drawn to the reliability of an asset that exists beyond the reach of institutions.

The novelty of bitcoin can be intimidating, especially because the mainstream media frequently associates it with scams and hype-driven speculative bubbles. Thought leaders in bitcoin address this by pointing to the facts of the technology. “The more I learn about bitcoin, the more I trust this trustless financial system,” says Weaver. “The network has had zero downtime since it launched in 2009 and has never been hacked. Over the course of bitcoin’s history, the price has risen and fallen, but consistently trends upward in the long term.”

Bitcoin is a protocol, and using it does not require trust in any central authority. Yet it thrives on trust, education, and consensus among people. This is why communicators matter so much. “I often see women’s entire perspective shift when they recognize bitcoin’s potential—not just as an investment, but as a vehicle for financial empowerment,” says Megan Nilsson, host of the Crypto Megan Podcast. “By leveraging their ability to build networks, drive education, and advocate for broader adoption, women can play a leading role in shaping the future of bitcoin and decentralized finance… Bitcoin has fundamentally redefined the concept of financial independence. It has leveled the playing field, offering financial tools that were once only available to accredited investors. It eliminates reliance on centralized systems, providing individuals with true ownership and control over their wealth.”

In the coming years, the world economy, and society itself, will be reshaped by the convergence of transformative technologies including AI, robotics, and space travel, all underwritten and financed with bitcoin. It’s no wonder that as families, institutions, and communities discover bitcoin’s utility, so many of those leading the charge are women. They do so not because they want to check a box, but because the technology itself demands the best talent available. In celebrating the achievements of women this month, we also celebrate bitcoin’s potential to reshape our collective future. It is a global experiment buoyed by those who see beyond the hype and dedicate themselves to building, teaching, and expanding the Bitcoin Network for future generations.

This is a guest post by Dave Birnbaum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

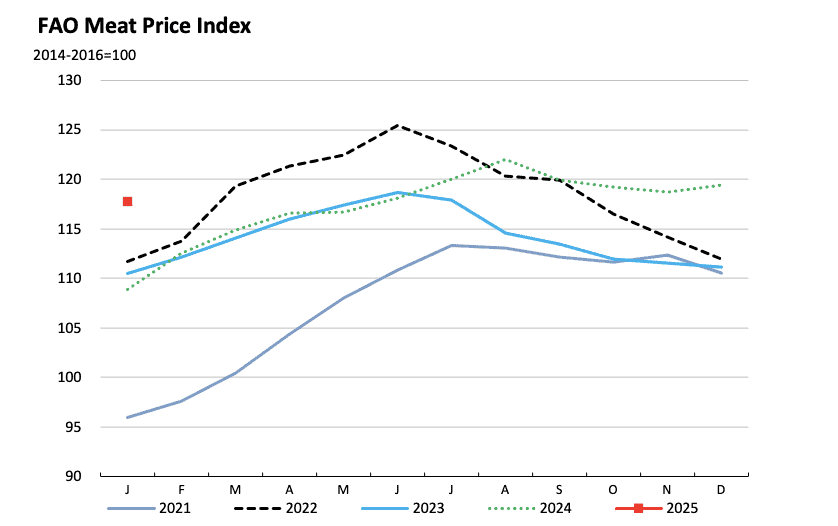

South Africa Reserve Bank(SARB) governor’s question, “Why not strategic beef reserve?” at the 2025 World Economic Forum in Davos may have been rhetorical, but Lesetja Kganyago’s seemingly sarcastic remark about “strategic bitcoin reserves” inadvertently underscored the need for Africa to rethink its economic strategies in the face of global financial shifts. In a world increasingly defined by digital transformation, the concept of money and value storage is evolving rapidly. Africa is no stranger to commodity-based economies. From oil to gold, beef to cocoa, the continent has long relied on natural resources for economic sustenance. However, these commodities are fraught with challenges. Global commodity prices are highly susceptible to market fluctuations, geopolitical tensions, and climate change. For instance, the price of beef can swing dramatically due to disease outbreaks or trade restrictions, just the way the value of fiat currencies swings and remains unpredictable when traded against digital assets like bitcoin due to regional financial policies and currency devaluation. According to the Food and Agriculture Organization (FAO), beef prices have experienced volatility of up to 30% year-over-year due to factors like foot-and-mouth disease and export bans.

Image Source : FAO

Even though Brian Armstrong, CEO of Coinbase, responded to Kganyago’s question with a compelling argument: Bitcoin is not just a better form of money than gold, it is also more portable, divisible, and utility-driven. Over the past decade, Bitcoin has outperformed every major asset class, cementing its position as a superior store of value. For Africa, a continent often marginalized in the global financial system, a Strategic Bitcoin Reserve could be the key to unlocking economic independence, fostering innovation, and securing long-term prosperity. How?

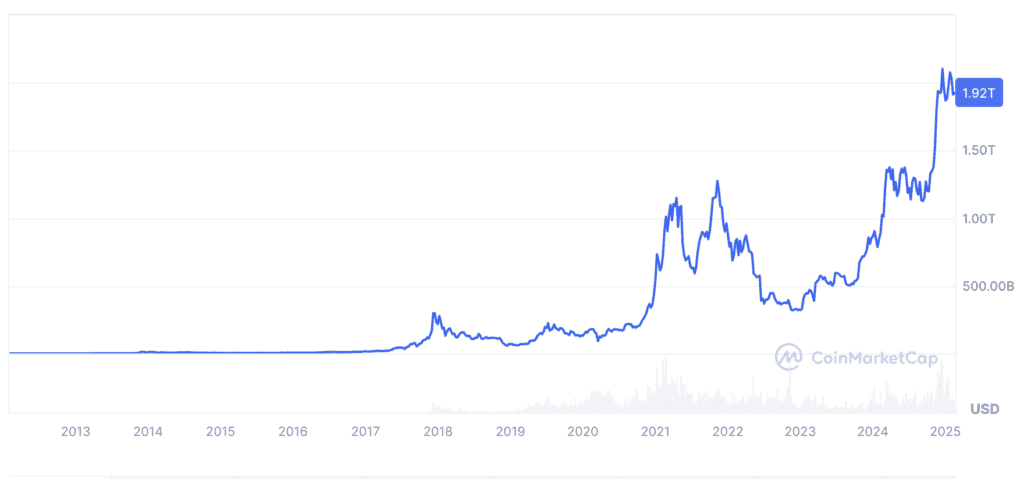

It’s time to be factual and realistic in our comparison. Bitcoin exists digitally and requires no physical storage, commodities like beef and mutton are perishable and costly to maintain. The World Bank estimates that post-harvest losses for agricultural products in Africa amount to $48 billion annually, highlighting the inefficiencies of commodity-based reserves. While commodities have intrinsic value, their utility is restricted to specific industries. Bitcoin, on the other hand, is a global, borderless asset with applications in finance, technology, and beyond while its unique properties make it an ideal candidate for a strategic reserve asset. With a capped supply of 21 million coins, Bitcoin is inherently deflationary, unlike fiat currencies that can be printed indefinitely or beef with endless reproductive mechanisms. According to CoinMarketCap, Bitcoin’s market capitalization has grown from less than 1 billion in 2013 to over 1 trillion in 2025, demonstrating its rapid adoption and value appreciation.

Image Source : CoinMarketCap

WHY BITCOIN OVER BEEF ?

Bitcoin can be transferred across borders in minutes and divided into smaller units (satoshis), making it more practical than gold or beef. Over the past decade, Bitcoin has delivered an average annual return of over 200%, outperforming gold, stocks, and real estate. A study by Fidelity Investments found that Bitcoin’s risk-adjusted returns are superior to traditional assets, making it an attractive option for long-term wealth preservation. Globally, nations are beginning to recognize Bitcoin’s potential as a reserve asset. El Salvador made history in 2021 by adopting Bitcoin as legal tender, while countries like Switzerland and Singapore have integrated Bitcoin into their financial systems. This is 2025 and The United States “Strategic Bitcoin Reserve” Bill is already in the pipeline. According to a 2023 report by Chainalysis, Africa is one of the fastest-growing cryptocurrency markets, with Nigeria, Kenya and South Africa leading in adoption.

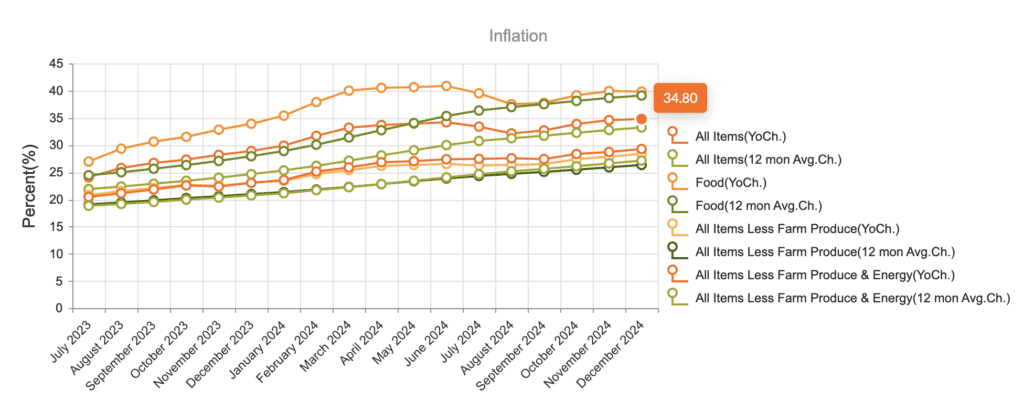

Bitcoin’s deflationary nature makes it an effective hedge against inflation, which has plagued many African economies. For example, Nigeria’s inflation rate hit 34.80% in 2024, eroding the value of the Naira. A Bitcoin reserve could protect national wealth from such devaluation. By allocating just 1% of its reserves to Bitcoin, Africa could unlock billions in value. For instance, if the continent’s combined foreign reserves of 500 billion included 5 billion in Bitcoin, a 10x appreciation in Bitcoin’s value would yield $50 billion in returns. Unlike beef production, which contributes to deforestation and greenhouse gas emissions, Bitcoin mining can be powered by renewable energy. According to the Cambridge Bitcoin Electricity Consumption Index, 58.5% of global Bitcoin mining is powered by renewable energy as of 2021. Africa’s vast solar and hydroelectric potential makes it an ideal location for sustainable Bitcoin mining operations. Storing and managing Bitcoin reserves is far more cost-effective than maintaining commodity reserves. There are no storage costs, no risk of spoilage, and no need for complex logistics.

Image Source : Central Bank of Nigeria.

El Salvador’s adoption of Bitcoin as legal tender provides valuable insights for Africa. Despite initial skepticism, Bitcoin has boosted tourism and foreign investment in El Salvador. According to the Central Reserve Bank of El Salvador, tourism revenue increased by 30% in the first year following Bitcoin adoption. Over 70% of Salvadorans previously lacked access to banking services. Bitcoin has enabled millions to participate in the global economy. By reducing reliance on the U.S. dollar, El Salvador has taken a bold step toward financial independence. Many African nations rely heavily on the U.S. dollar for trade and reserves, leaving them vulnerable to external economic policies. Bitcoin offers a decentralized alternative, reducing reliance on traditional financial systems.

By establishing a Strategic Bitcoin Reserve, Africa can secure its economic future, protect its wealth from inflation, and position itself as a global leader in the digital economy. The time has come for Africa to move beyond outdated economic models and embrace the future of money. As Brian Armstrong aptly stated, Bitcoin is not just a better form of money; it is the foundation of a new financial paradigm. For Africa, the choice is clear: Bitcoin, not beef, is the path to prosperity. Bitcoin represents a transformative asset class that offers unparalleled advantages over traditional commodities like beef or mutton.

This is a guest post by Heritage Falodun. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Think back through Bitcoin’s history. I guarantee you a handful of events just popped into your mind first, like landmarks. If you kept thinking your mind probably started filling in from there with those landmark events as anchors.

Don’t take these as hard predictions, ignore the coating of hyperbole I can’t stop myself from adding everywhere, and note these don’t come with dates. I’m going to run through a list of “watershed moments” or macro-scale shifts in things that I think are practically guaranteed to happen or begin in the next decade.

— A Visit To The US Supreme Court —

Bitcoin creates an inherent contradiction within the current regulatory and legal framework, at least in the US and everywhere the US effectively dictates things, relating to how Bitcoin itself inherently works and two major themes in regulations and law.

- KYC/AML Laws: These exist to ensure that financial institutions know the individuals they are dealing with for the purposes of preventing criminal operations, money laundering, or terrorist financing occurs through the use of their services. This requires incredibly invasive information collection, tracking, and communication of said information between different institutions. It requires throwing privacy out the window. Or does it?

- Financial Privacy Laws: The reason things like KYC/AML exist in a country like the United States with the 4th Amendment to our Constitution is because of things like the Right to Financial Privacy Act. There are laws that restrict the situations and conditions under which the government can obtain financial records on its citizens. These laws were implemented after a Supreme Court case challenging KYC/AML law (ironically called the Bank Secrecy Act) held that financial records are the property of the institution and not customer.

See the contradiction? All of this is based on the notion that the record of financial activity is privately held in privileged silos not visible to the general public. That the government access doesn’t equate to the public’s access. That is not how Bitcoin works. Everything is right there on the blockchain for everyone to see. So while financial institutions are required to enforce KYC/AML laws and identify their customers, are they also not required to protect the privacy of their customers financial activity short a legal order to divulge it?

We’re at the point where privacy tools are actually starting to make real developments in the Bitcoin ecosystem, and we’re already starting to see behavior indicating a trend of this being marked as “bad behavior” by Bitcoin exchanges that leads to account scrutiny(and possible closure and/or seizure down the line) in response to use of privacy tools. Now, I don’t see anything in the near future in the United States smashing down all KYC/AML laws in the land, but I do see an incredibly strong argument to make against this type of reaction by exchanges and institutions to their customers using privacy tools.

The argument is this simple: they have a right to protect their privacy from the point of view of the general public at large. This system doesn’t keep all the records private by default, only revealing selectively to authority. Everything is in the open and publicly verified, by architectural requirement. So if I have a Constitutional right to privacy in the old model, do I not have one in this new model?

Now again: this is in no way a strong enough basis to smash down all KYC/AML and requirements to identify customers. But I do think this is a strong enough basis to potentially cement by Supreme Court ruling that businesses are not allowed to censor or target customers simply on the basis of using privacy preserving tools in activities not related to those businesses. If things continue in the direction they seem to be going, I think this type of legal challenge to such practices is inevitable. How will it turn out if I am right? I guess we’ll find out if I am right.

— Inevitable Mining Landscape Evolution —

Mining is probably the easiest thing to point at besides the price to really demonstrate to a normal person how far Bitcoin has come in the last decade. Consumer desktops to data centers in a decade. That change will continue to happen at a rapid pace, and part of the next shift is already underway. Vertical integration. Things went from desktop CPUs, to GPUs, to special ASICs. But those ASICs were still something easily accessible to retail consumers, small group buyers, smaller professional operations. It was still easy to get efficient and current hardware at different scales (though different prices depending on your scale).

That is going to change, and the starting signs of it are already here. Mining is going to become less and less accessible profitably to the retail and smaller market (ignoring professional hosting arrangements) participants as companies start battening down the hatches. This market is still incredibly volatile, and miners all the way from producers to equipment operators have very large capital investments that can be very risky during market downswings. Things tend to get into a frenzy when the market swings up, and go very badly for unprepared people on the swing down. This time around things are going to get serious in terms of minimizing and managing risk.

Bitmain’s finances becoming public during their IPO attempt in Hong Kong showed how they took massive profits and turned right around and lost them continuing to take massive risks that just happened to work out in a bull market. It hit them very hard, and the HKEX looking at that general pattern due to overall market volatility playing out with all the manufacturers attempting IPOs to differing degrees denied all of them. The overall market these companies compete in was deemed too risky for listing a business that directly exposed on the HKEX. This cuts them off from the capital necessary to continue expansion as Bitcoin grows by orders of magnitude. That is very bad.

The response from Bitmain in terms of adapting (ignoring the recent “coup” attempt internally) has been to make moves to restructure their business to adapt to this harsh lesson. They have numerous farms they operate themselves in China to both self-operate mining equipment and host other peoples’. These types of operations have expanded internationally to Texas and Washington state in the US and Quebec in Canada. The strategic value in operating these farms is creating predictable power costs, and having the dual option of deploying hardware you produce to mine yourself or sell capacity to other miners. Now if you put this together…they’ve positioned themselves to 1) make and sell the metaphorical shovel, 2) dig with it themselves, 3) sell the shovel to someone else and also try to sell them a place to dig. That’s exactly what Bitmain is doing with a new service.

Jihan has also established new financial services and tools Bitmain is offering to help customers hedge some of their risk by taking it on themselves, as well as other more granular arrangements in Bitmain’s favor. It’s unclear whether this specific strategy will stick given drama resulting from the internal struggle between Micree Zhan and Jihan Wu, but it shows an acknowledgement of and a strategy to deal with the risk inherent with this level of market volatility. This is absolutely necessary to survive in the long term in this sector of the ecosystem.

This is the direction this is going, with massive momentum behind it. Actors playing different roles in the mining sector will slowly start to try to sprawl out and handle every layer of the stack they can internally: Production | Research & Design | Hosting | Operation | Electricity Sourcing | Financial Risk Hedging | Lobbying. As economies of scale continue applying pressure to actors in the mining sector and trimming them down to the leanest and most efficient, they will start attempting to internally integrate as much of the entire stack to be able to control and hedge the financial risks.

A second order effect will result from this economy of scale effect playing out Darwinianly amongst all of the miners. Governments will start to creep in at a foundational layer and begin realizing they have influence to exert. To really get across my thinking here, I want to go back in the past for a second and look at some of the mining dynamics in China to my understanding from both “official” reporting and personal sources of mine. Mining exploded in China because of two factors: 1) there is surplus power in many places, 2) the finances of local governments being pretty rekt and lots of local governments being totally fine with mining because they can shave something off the top and see revenue. This dynamic might even be why we haven’t seen the Communist Party crack down on mining despite all the statements and hints to that end except in criminal cases such as power theft.

That dynamic is already playing out everywhere that mining operations are growing to scale. Step one: appease the local government. We’ve seen how things can get with the situation in Quebec with Hydro-Quebec attempting to block and auction power after seeing a huge increase in demand for electricity to mine Bitcoin. Numerous projects across the United States have been established in partnership or cooperation with the local government, in Texas, Washington, Georgia, etc. This is just how it works, you put boots on the ground and that most immediately local government at the very least is sinking their hooks in. Then the one above that can sink in. Then the one above that. The hierarchy of parasites.

We need to be very, VERY conscious of this dynamic. Unless you find Harry Potter’s wand and the magic spell that instantly whisks away every government in the whole world, they’re there and we have to deal with them. There’s only two real strategies to deal with this, and one isn’t really viable.

The non-viable strategy is attempt to take things completely off the grid and into the black market. That’s not happening. You are talking about hiding data centers, with the cumulative network energy consumption being on the scale of whole countries. Non option, and if you want to try and solve this with a POW change fork, good luck. You know where the door is.

The viable strategy is to simultaneously: 1) push at the most local levels for non-restrictive and non-draconian policies where these operations are located (and Bitcoin in general where you live) if you can while 2) pushing at the non-local levels in general for policies that leave sovereignty and power as localized as possible. If Bitcoiners and other interested groups do not stay vigilant and active in this area, then those initial local hooks will lead to State hooks which lead to Federal hooks from the national government of your country in the foundation of the mining sector: power availability. These hooks are undeniably already there in some places. If action at the social layer is not effective in dealing with this issue, then we fall down a very slippery slope:

- Eventual slide to national level regulation and direct hands poking around in how mining operations are run.

- If Bitcoin continues growing and expanding in value and market relevance exponentially, the situation works out to whichever nation has the cheapest energy reserves to burn through dominates mining.

- This could easily devolve into a super power like dynamic in terms of mining distribution, which if a stable (or “stable enough”) equilibrium, could wind up leading to a base layer in a much more centralized and restricted access state not conducive to Bitcoin’s full potential.

This aspect of the Bitcoin network/system is the weakest in terms of defensibility from real world “meatspace” threats. Ultimately if the population of a nation empowers its government to do so, they can show up and seize your mining equipment. It would have to be an amazingly resource strapped government or a very unique geographic area for that to be impractical. The only way to deal with this is socially.

And coercion is not the only mechanism for interfering at this layer of Bitcoin. Distorting incentives is another means. Chain Anchor was a protocol proposal out of MIT to effectively bribe miners into initially preferentially, and then exclusively mining KYCed transactions. The end goal was orphan non-compliant blocks. (This out of all citations, READ YOURSELF when you are done with this). These issues of economic incentive distortions can ultimately be resolved only through economic incentive corrections.

This is the “shift” I am most confident on in this piece. I would not call it short-term “OMG we’re fucked!” urgent, but this is not an issue Bitcoiners can afford to be complacent about.

— Neo-Switzerland —

I spoke above of Binks, and the technology possible to “port” subsets of Bitcoin’s properties to them, and the incentives to do so. It’s a jurisdictional arbitrage play with massive potential profits. But there is one interesting potential twist to how that could play out given it is the 21st century and all: cyberspace could itself arguably constitute a jurisdiction. Does anyone remember Darknet Markets? So there are two ways “Neo-Switzerland” could play out: an actual physical jurisdiction legalizing KYC-less or KYC-lite financial businesses and safe havening such operations, or an “extra-jurisdictional” (quotation marks because servers get hosted somewhere) dark net business.

Meatspace Neo-Switzerland

Let’s go through the possibility of a real world nation-state deciding to become a haven jurisdiction for KYC-less or KYC-lite binks. Well to start, Bitcoin is a borderless global currency/settlement network that anyone with internet access can interact with. So the potential customer base that can deposit and withdraw Bitcoin at one of these binks is anyone in the world with an internet connection that can get their hands on Bitcoin. That’s the potential capital inflow that could be attracted in the most insanely optimistic scenario. That’s what you can collect taxes on. Secondly, given a host jurisdiction, these binks can be legally incorporated and accountable entities. Even with no KYC cryptography offers a basis of both assertions of fraud, and refutations of these assertions, at least in terms of a foundation or initial filter from which to start legal disputes. These binks can offer anonymous accounts denominated in BTC, anonymous untraceable cybercash denominated in BTC, loans, escrow services, oracle services for complex smart contracts enforced by the Bink. All the financial services of the legacy world become accessible with a smartphone and either no KYC or so little it feels like 2013 again, and then some with a cherry on top.

This is a giant pile of potential profit for a jurisdiction to seize. And being a jurisdiction, an actual nation-state with a legal system, there is the potential to create enough trust to actually make this workable for international customers. Okay, so from a customers point of view how do you handle something going wrong between you and your bink? If you’re a citizen of that nation simple: you take legal recourse. If you aren’t a citizen? Well…taking legal action across international jurisdictions can be complicated to say the least. And expensive. But if we’re at the point where this bink is operating then we assume the government of this nation wants this to work and attract business right? So the government can account for this asymmetry between citizens bink customers and non-citizens bink customers and craft legislation easing the complexity of non-citizens dealing with disputes between them and their bink. And more importantly, the government can actually enforce this legislation evenly with regards to citizens versus non-citizens.

The other end of the stick is how do the other nations of the world react? The US in particular likes to tell the world how to run their affairs. Especially their financial affairs. How far can you really push things before the US drone-strikes your country into the ground? No one will know unless someone tries this.

That said, I think the type of jurisdiction where this could practically happen would be one of a very few unique profiles. Potentially somewhere such as North Korea, Iran, Venezuela, somewhere that is being heavily sanctioned and shut out from the global financial situation. Desperation is a powerful motivator. Or maybe a Spanish or Italian secession movement is successful, or France slow boils until we see a 21st century French Revolution. Big changes happen after big political upheaval. What if the King of Thailand decided to host KYC-less(or KYC-lite) binks? Thailand is already massively economically dependent on foreign tourism dollars. Why not foreign Bitcoin deposits? Tourism has had many negative consequences for the country…Bitcoin binking wouldn’t unless you thought you would be invaded by China or the US.

This is not something I’m saying is a very likely thing to occur in such a relatively short time period as the next decade, but I’m saying it’s absolutely not crazy to think it might.

Cyberspace Neo-Switzerland

Alright, let’s look at the “darknet, no known jurisdiction, totally pseudonymous” scenario. Things are the exact same as the previous scenario as far as deposits and customers, they can process BTC withdrawals and deposits for anyone in the world. But a bink that operates extra-legally cannot legally incorporate in any jurisdiction, or establish any legally accountable entity. That is a major difference in terms of trade offs versus a bink being hosted by a complicit jurisdiction. This is a much more difficult place to attempt bootstrapping a network effect as a bink, in terms of acceptance of your cybercash and deposits rather than direct BTC settlement. A bink’s network effect is rooted entirely on trust in the operator(s) of the bink. That is much easier to build as a legally incorporated and accountable entity of a known jurisdiction. The landscape your relationship with that bink takes place in is established crystal clearly. That is the opposite of how a darknet bink would work.

There would be no legal accountability for a darknet bink, no government to go to, no legal processes to take, nothing. You get the guarantees you can enforce purely with cryptography, and everything else is enforced through blind trust with no recourse. That’s it. This presents a major bootstrapping problem for this variety of bink. How do you get customers to trust you with their deposits when they have no recourse to take if you defraud them? This quandary in my opinion guarantees that this type of bink would never be able to grow to the size of one that had a legal identity in a safe haven jurisdiction.

A darknet bink would likely never be something used by mainstream users, they would be businesses patronized solely by users in very constrained circumstances. People engaged in risky illegal activity. Scammers. People who have been censored and completely walled out of the legacy financial system. I just don’t see normal people being willing to take the risk of depositing BTC with a bink against which they have no legal recourse, and which is associated only with pseudonyms. There is the potential of creating stronger guarantees than possible now through cryptography, but that starts getting into a strange area. Like I said above when talking about the possible technical developments in the next decade, there is potential for constructs that totally blur the line between service and protocol. If things work out well enough, maybe a darknet bink could make up for the difficulties in establishing trust by building stronger cryptographic safeguards.

I think there is a very good chance things like this start operating in the next decade (especially a simple trust based darknet bink), the only question is how rampant will the exit scams be?

— Birth Of A New Market —

Bitcoin is evolving into money, that’s what we’re all witnessing and participating in. Speculation, to value transmission, to unit of account. A core and absolutely required dynamic for this evolution to be completed is a massive and liquid arbitrage between Bitcoin, fiat, and goods & services. This arbitrage is what will allow businesses to actually accept and use Bitcoin. Once Bitcoin is large and relatively stable enough, a business can accept it and pay suppliers without the kind of volatility risk that exists currently. The closer Bitcoin’s stability gets to a respective fiat currency, the safer it is to accept and use Bitcoin directly rather than immediately sell for fiat. Arbitrage traders will trade these gaps, businesses will probably arbitrage these pairs themselves! Is it a better return for you to accept Bitcoin or fiat for something? Incentivize with discounts. Is it a better return for you to pay your supplier in Bitcoin or fiat? That’s what you’ll make your decision on. This dynamic is what will truly launch Bitcoin into the realm of money.

Now, the world is shifting rather rapidly in terms of geopolitical balance. The US has spent the last 20 years playing Empire in the wake of 9/11, destroying numerous countries, pressuring the world to isolate others. We are clearly starting to see the reaction to this in the form of other nations beginning to develop alternative settlement systems and moving to lessen dependence on the USD. China and Russia have begun building their own SWIFT alternatives to settle payments. They’re also even trading oil against non-USD currencies. Venezuela is even trying to foster an oil trade in its own centralized “cryptocurrency” the Petro. The world is sick of American over-reach, and they are starting to take action to create platforms and systems not subject to American control and censorship.

This trend will undeniably continue, and inevitably begin to envelop Bitcoin itself. There is no reason why the arbitrage dynamic between Bitcoin fiat good & services has to start in the retail market. In fact, I think it very likely won’t. Within the next decade I am very confident that a coalition of nations in alignment against the United States will begin trading and settling oil against Bitcoin. If Bitcoin’s market capitalization, liquidity, and price continue growing at the rates they have historically then it is inevitable. The protocol and network can handle it, the products and services to hedge against the risk of volatility are becoming more numerous every year, and the overall liquidity would offer more utility than individual non-USD fiat currencies and nation-state funny “crypto” money.

An event like this would bring massive capital influxes and price movements like you could not comprehend, and I think the chances of this not happening some time in the next decade are extremely low. Buckle up.

In Conclusion

This next decade is going to bring change and evolution on such a massive scale it will melt your faces off. I really don’t think many people in this ecosystem really grasp that. Obviously the people building things, the company CEOs, the players actually involved in these shifts and changes know. It’s also definitely fair to say that the astute and balanced observers know as well. But most people who hold Bitcoin, or casually participate or spectate in this space…I don’t think they have any idea.

The last decade was the shift from cypherpunk pipe dream to playing in the minor leagues. This next decade is going to be the shift to the major leagues. Do we all fuck up? Do we knock it out of the park? Does someone get hit in the stands if we hit a homer?

Who knows. I think observant people are capable of seeing inevitable outcomes from large trends, of seeing the large trends themselves and projecting different ways they can go.

Things are serious now, and that requires acting and thinking seriously.

Source link

There’s More to North Korea’s Hacking Ops Than Just Lazarus Group: Paradigm

zkLend hacker loses 2,930 ETH to Tornado Cash phishing scam

23andMe Is a Wake-Up Call on Data Sovereignty

ChatGPT To Launch Next Big Model, New Studio Ghibli Ahead?

Coinbase Stocks Slide Over 30% This Quarter, Matching Post-FTX Collapse Lows

North Korean crypto attacks rising in sophistication, actors — Paradigm

‘Positive But Cautious’ Investors Pour Capital Into Ethereum, Solana, XRP and Sui: CoinShares

Bitcoin As The Global Denominator Of Capital

Trump’s Crypto Dealings Are Making Regulation ‘More Complicated’: House Financial Services Chair

Pontus-X taps Oasis for private, cross-border data sharing in E.U.

Elon Musk, Dogecoin Proponent and U.S. Agency Figurehead, Says ‘No DOGE in D.O.G.E.’

Crypto Investor’s Brave Yet Hilarious Prediction Speculates If XRP Price Will Hit $3,000 This Cycle

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

California introduces ’Bitcoin rights’ in amended digital assets bill

MELANIA Insider Hayden Davis Selling Millions of Dollars Worth of Memecoin Amid 95% Drop: On-Chain Data

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x