Cryptocurrency Market News

Top Conglomerate Adds 580 $BTC Amid Unprecedented Crypto Popularity. Here’s Why BTC Bull Token Could 100x

Published

4 days agoon

By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Blockchain Group recently bought another 580 Bitcoins, marking its third significant Bitcoin purchase since Trump’s election victory.

It became the latest to join the long list of companies buying record amounts of Bitcoin in what’s a crystal-clear industrial shift towards digital assets.

Read on as we explore TBG’s Bitcoin strategy, which other companies are sharing a similar love for $BTC, and how a latest pro-crypto regulatory change could mean a bright future for BTC Bull Token, a Bitcoin-themed meme coin.

The Blockchain Group’s Bitcoin Purchases

As mentioned earlier, this is The Blockchain Group’s third Bitcoin purchase. Interestingly, all three purchases happened on important dates.

- The first purchase (15 $BTC) was on November 15, which is when Donald Trump won the presidential elections.

- The second purchase (25 $BTC) was on December 4 – just a day before the King Crypto surged past $100K for the first time.

- The third and most recent purchase (580 $BTC) comes just five days before the close of Q1 2025 – as well as the first anniversary of the Bitcoin halving, which occurred on April 20.

Other Companies Buying $BTC

The Blockchain Group isn’t the only one keen on following the buy and HODL strategy for Bitcoin. GameStop made the news last week when it announced plans to buy Bitcoin through debt financing. This immediately saw the company’s stock surge over 12% in a single day.

A huge reason for this large shift towards digital assets is the new Trump administration’s pro-crypto attitude.

For instance, Trump’s SEC nominee, Paul Atkins, said that the ‘ambiguous and non-existent’ digital asset regulation under Biden would see a complete 180-degree shift should he be appointed as the SEC chairman.

‘A top priority of my chairmanship will be to work with my fellow Commissioners and Congress to provide a firm regulatory foundation for digital assets through a rational, coherent, and principled approach’ – Paul Atkins.

Bitcoin Is a Great Investment – But There Could Be a Better One

Bitcoin’s popularity is on full display right now. Institutions, companies, and even countries are rushing to buy the ‘digital gold.’ Absolutely no one wants to miss out on possibly the greatest modern-day investment opportunity.

What’s more, Bitcoin is also showing multiple positive signs on the technical analysis front, confirming its strong fundamentally bullish sign. For instance, it’s bouncing almost perfectly from the 50 EMA on the weekly chart, which also happens to be the 50% Fibonacci level.

Simply put, Bitcoin has had the perfect amount of correction after its November 2024 rally and looks ripe to rally higher – potentially beyond the $109K level. Time to get in and ride the crypto wave? Certainly.

Needless to say, however, Bitcoin is an expensive investment, particularly if you want to generate sizable gains. Enter BTC Bull Token ($BTCBULL), a new meme coin designed to follow the coattails of Bitcoin.

What’s BTC Bull Token?

BTC Bull Token is the only crypto project offering real (and completely free) $BTC to its token holders. Whenever Bitcoin reaches a new significant all-time high (such as $150K, $200K, and $250K), $BTCBULL holders (who store their tokens in Best Wallet) will receive Bitcoins as a reward for their loyalty.

We dug deeper into BTC Bull Token‘s proposed roadmap and found that it plans to organize regular token burn events – every time $BTC’s price increases by $25K, to be precise.

This simply means that at price points of $125K, $150K, $175K, and so on, the $BTCBULL developers will shave off a part of the total token supply.

It’s a tried-and-tested strategy used by the best cheap cryptos to artificially reduce supply and boost demand – and ultimately bring about a jump in the token’s price.

Combined with the fact that 40% of the total supply has been reserved for PR and marketing purposes, $BTCBULL is highly unlikely to fall flat after its launch.

Why $BTCBULL Could Be the Next Crypto to Explode?

All in all, BTC Bull Token has provided their investors with multiple reasons to put their faith in $BTCBULL for the long haul.

To sum it up, $BTCBULL’s price will:

- Increase as Bitcoin’s price rises, i.e., the next $BTC airdrop edges closer.

- Increase whenever there’s a token burn event.

The best part, however, is that $BTCBULL is still in its presale, which is easily the best stage to become an investor in a high-potential crypto project.

It’s also worth noting that BTC Bull Token is among the hottest crypto presales going around. It raised $1M within just 24 hours of its launch, after all.

More good news comes from our detailed BTC Bull Token price prediction. According to our analysis, $BTCBULL can reach a high of $0.0084 by the end of 2025 – and then $0.0096 by 2026. That would result in a 345% and 395% ROI, respectively. Oh, and let’s not forget the extra income through free $BTC airdrops.

For more information, check out $BTCBULL’s X feed and Telegram channel.

But, and you probably know this by now, nothing is guaranteed in crypto. The market’s pretty volatile and reactive to the larger macroeconomic conditions.

This calls for a healthy mix of caution and aggression. For example, do invest in the best meme coins like $BTCBULL but only an amount you’re comfortable sidelining.

Lastly, kindly do your own research before investing. None of the above should be misunderstood as financial advice from a professional.

Source link

You may like

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

California introduces ’Bitcoin rights’ in amended digital assets bill

MELANIA Insider Hayden Davis Selling Millions of Dollars Worth of Memecoin Amid 95% Drop: On-Chain Data

Toulouse starts to accept crypto for public transport

Bitcoin, Crypto Prices Slide as Trade Tensions, Inflation Risks Rattle Markets

Will BlackRock Investors Stay Bullish?

Cryptocurrency Market News

Hyperliquid Delists $JELLY, Potentially Causing $900K in Losses. Here’s Why Best Wallet Token Can 100x

Published

16 hours agoon

March 30, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto community was just recovering from the aftermath of the Bybit hack, which saw North Korean hackers loot $1.3B from the exchange’s cold storage, and now we’ve had yet another sensational malicious activity.

This time it’s Hyperliquid in the firing line. Read on to find out exactly what went down and how a privacy-first crypto project like Best Wallet Token ($BEST) could potentially 100x as a result?

Dissecting the Hyperliquid-Jelly Meltdown

The popular decentralized crypto exchange Hyperliquid recently delisted the Jelly-my-Jelly ($JELLY) meme coin on the grounds of suspicious trading activity

$JELLY, by the way, fell from $0.21 all the way to $0.01 in just 10 days after its launch on January 30. However, it skyrocketed 400% on March 26, which is when chaos unfolded.

Here’s what happened prior to $JELLY’s delisting by Hyperliquid last week:

Here’s what happened prior to $JELLY’s delisting by Hyperliquid last week:

- A large crypto whale deposited $7M across three Hyperliquid accounts.

- Two of those accounts took long positions on $JELLY – one of $2.15M another another of $1.9M respectively.

- The third account took a $4.1M short position in order to cancel out the two long trades above.

- As $JELLY’s price rose from $0.01 to nearly $0.45 in a matter of just hours, the short position was liquidated. But the catch is that it was too large a position to be liquidated normally.

- As a result, the short trade was sent to the Hyperliquidity Provider Vault (HLP) for settlement.

- However, when Hyperliquid restricted the whale’s withdrawals, they resorted to selling their remaining $JELLY positions.

- This led to Hyperliquid shutting down the $JELLY market entirely.

All in all, the trader deposited a total of $7.17M but was only able to withdraw $6.26M. Around $900K still remains with Hyperliquid.

Hyperliquid’s Criticism

Big-name crypto personalities, such as the CEO and COO of Bitget, criticized Hyperliquid, saying that the exchange deliberately caused losses to the user.

One of them even said that Hyperliquid ‘may be on track to become FTX 2.0.’

Although the world is torn between Hyperliquid’s recent debacle, the fact remains that there’s a dire need for a reliable crypto storage and management solution. Enter Best Wallet.

What Is Best Wallet?

Best Wallet is a new-age crypto wallet that’s helping users reclaim their privacy. For starters, it’s a non-custodial wallet, meaning you alone have the ownership of your private keys. Therefore, none apart from you will be able to access your crypto assets.

The app also comes with Fireblock’s MPC-CMP wallet technology, which uses cutting-edge cryptographic techniques to safeguard your digital wealth.

We were also impressed to find out that fantastic in-app and crypto-related security is complemented by excellent app access controls.

Thanks to a plethora of 2FA/MFA options, which include biometrics, you don’t have to worry about the unfortunate scenario of your mobile ending up in the wrong hands.

The good news keeps coming, as Best Wallet also offers its users third-party insurance for all their crypto assets stored with Best Wallet. This is a brilliant offering and one you should definitely opt for, especially at a time when hacks and scams are as prevalent as they are.

In addition to rock-solid security, Best Wallet also hits it out of the park when it comes to being user-friendly. It has sleek apps for both Android and iOS – and a browser extension for desktop is on its way.

Last but not least, Best Wallet is also a joy for smart crypto investors who like getting in before the coins are listed on exchanges. That’s because Best Wallet is the only crypto wallet that allows its users to invest in new meme coins on presale directly from within the app.

Buy $BEST – The Next Crypto to Explode

Apart from the above, Best Wallet’s roadmap suggests that it’s soon going to offer support for over 60 chains. This would then make it a one-stop solution for managing all your crypto assets.

If you want to be a part of Best Wallet’s remarkable growth story, consider investing in Best Wallet Token ($BEST) – the native cryptocurrency of Best Wallet and one of the best cryptos to buy now.

Owning $BEST won’t just allow you to ride Best Wallet’s market takeover – it plans to capture over 40% of the non-custodial crypto wallet market by 2026 – but it also comes with its own special perks.

First and foremost, $BEST investors will have to pay lower transaction fees on Best Wallet.

Second, they’ll get priority access to the best crypto presales. This way, they’ll be able to become early investors (which means more profits) in some of the best projects going around.

Third, $BEST investors will have the opportunity to earn extra income through staking. The current rewards rate is 136%. However, it’s worth noting that this rate is dynamic and will likely reduce as the $BEST presale proceeds.

Speaking of the Best Wallet Token presale, it has so far raised over $11.4M, and you can buy each token for just $0.024525 if you get in now.

If this is your first presale purchase, here’s a detailed guide on how to buy $BEST. Also, check out our Best Wallet Token price prediction for more details on the crypto’s future.

Best Wallet’s potential aside, do note that the crypto market is unpredictable. It’s rife with volatility, which is why you must only invest an amount that’s small enough for you.

As always, we urge our readers to do their own research. This article isn’t a substitute for financial advice, after all.

Source link

Bitcoin

Chainlink Monthly Close To Determine LINK’s Fate, $19 Next?

Published

2 days agoon

March 29, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

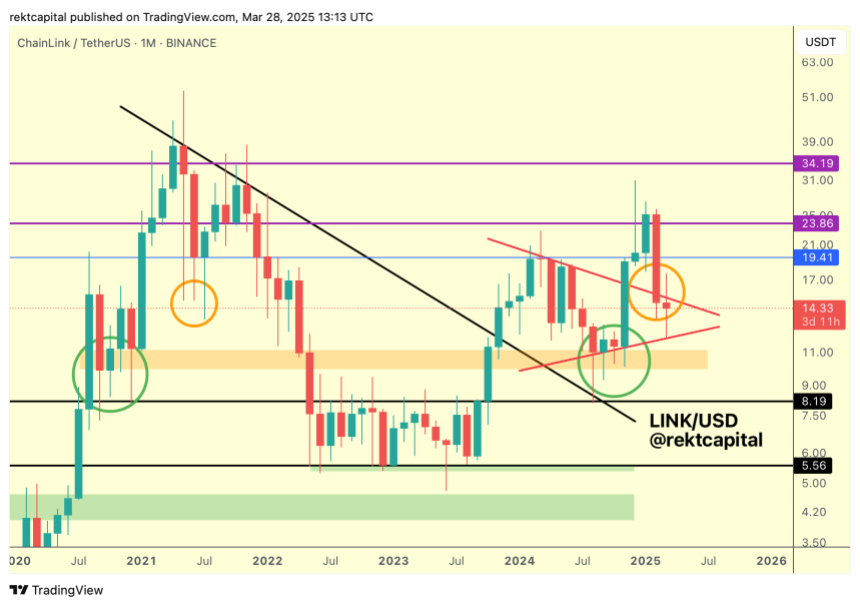

Amid today’s market correction, Chainlink (LINK) has lost its recent gains, falling back to a crucial support level. An analyst suggests a monthly close above its current range could position the cryptocurrency for a 35% surge.

Related Reading

Chainlink Retest Crucial Price Zone

Chainlink has retraced 9.1% in the past 24 hours to retest the key $14 support zone again. The cryptocurrency surged 15.7% from last Friday’s lows to hit an 18-day high of $16 on Wednesday, momentarily recovering 35% from this month’s low.

However, the recent market correction halted the momentum of most cryptocurrencies, with Bitcoin (BTC) falling back to the $83,700 mark and Ethereum (ETH) dipping to the $1,860 support zone.

Today, LINK dropped from $15 to $14.07, losing all its Wednesday gains. Previously, analyst Ali Martinez noted that the cryptocurrency has been in an ascending parallel channel since July 2023.

Chainlink has hovered between the pattern’s upper and lower boundary for the last year and a half, surging to the channel’s upper trendline every time it retested the lower zone before dropping back.

Amid its recent price performance, the cryptocurrency is retesting the channel’s lower boundary, suggesting a bounce to the upper range could come if it holds its current price levels.

Meanwhile, Rekt Capital highlighted that the token is testing its multi-month symmetrical triangle pattern, which could determine the cryptocurrency’s next move.

As the analyst explained, Chainlink consolidated inside a “Macro Triangular market structure” for most of 2024 before breaking out of the pattern during the November market rally.

During the Q4 2024 breakout, the cryptocurrency hit a two-year high of $30.9 but failed to hold this level in the following weeks. As a result, it has been in a downtrend for the past three months, with LINK’s price falling back into the Macro Triangle.

“The main goal for LINK here is to retest the top of the pattern to secure a successful post-breakout retest,” Rekt Capital detailed, adding, “It’s possible this is a volatile post-breakout retest.”

LINK Needs To Hold This Level

Rekt Capital pointed out that, historically, Chainlink has had downside deviations into this price range: “Back in mid-2021, LINK produced a downside deviation into this price area in the form of multiple Monthly downside wicks.”

Nonetheless, the cryptocurrency is downside deviating “but in the form of actual candle-bodies closes rather than downside wicks” this time.

The analyst also highlighted that, like in 2021, LINK is trading within a historical demand area, at around $13-5 and $15.5, testing this zone as support. Based on this, the cryptocurrency must successfully hold this area to “position itself for upside going forward.”

Related Reading

Moreover, the retest is key for reclaiming the top of its triangular market structure. Breaking and recovering that level would “exact a successful post-breakout retest” and enable the price to target the $19 resistance in the future.

The analyst concluded that if LINK closes the month above the triangle top, it “would position price for a successful retest, despite the downside deviation.”

As of this writing, Chainlink trades at $14.09, a 6.9% drop in the monthly timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

crypto

Crypto Braces For April 2 — The Most Crucial Day Of The Year

Published

7 days agoon

March 24, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto market is on high alert ahead of April 2, a date some analysts are calling “the biggest event of the year by an order of magnitude.” Macro economist Alex Krüger (@krugermacro), warns that President Donald Trump’s upcoming announcement of new reciprocal tariffs could deliver a seismic jolt to global markets — including crypto.

Why April 2 Is Massive For Crypto

In a post shared on X, Krüger describes the looming announcement, which the president has dubbed “Liberation Day,” as “10x more important than any FOMC” meeting: “April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen.”

According to Krüger, Trump might choose one of several paths: “Trump could go soft, in which case markets would rally fast and furiously. Or could go half-way, adding uncertainty on timelines, in which case markets would take out the stops of all longs and shorts. Or go all out, in which case markets could easily crash another 10% to 15%, fast.“

Related Reading

Krüger also suggests that “the US economy is still strong, but will highly likely slow down due to tariffs regardless of the path Trump chooses.” Nevertheless, he notes that many economists have already factored in a sharp year-end slowdown. He stresses that April 2 could mark the peak of market anxiety, aligning with the arrival of US Tax Day just two weeks later. “Either way, you all want to be prepared and ready to act on ‘Liberation Day.’ It will be big.”

Trump’s “Liberation Day” announcement will reportedly focus on “reciprocal tariffs” targeting specific countries or blocs deemed to maintain unfair trade barriers. Although this strategy appears “more targeted than the barrage he has occasionally threatened,” officials familiar with the matter believe it could still prove far-reaching.

President Trump has repeatedly signaled that these tariffs would be significant. Citing trade disparities with nations such as the European Union, Mexico, Japan, South Korea, Canada, India, and China, he asserts the US has been treated unfairly for too long. In remarks from the Oval Office, he declared: “April 2nd is going to be liberation day for America. We’ve been ripped off by every country in the world, friend and foe.”

Worst Case Scenario

Aides and allies suggest that while some countries may be excluded, Trump is looking for immediate impact. Tariff rates could take effect right away, adding to market fears of spiraling retaliation. In this case, Krüger says: “In worst case scenario sh*t would hit the fan then tariffs would start coming off as Trump negotiates hard in the following month, in which case peak negativity would hit around week 2 of April, which would coincide with US Tax Day.”

Related Reading

Senior officials, including National Economic Council Director Kevin Hassett and Treasury Secretary Scott Bessent, have indicated that the administration is focusing on a “dirty 15” group of countries where tariff and non-tariff barriers are allegedly most egregious. Hassett recently remarked, “It’s not everybody that cheats us on trade, it’s just a few countries, and those countries are going to be seeing some tariffs.”

For the crypto market, global macroeconomic events have increasingly played a pivotal role in price action in recent weeks. The April 2 “Liberation Day” announcement arrives at a time when digital asset traders already face headwinds from monetary policy shifts and a slowing global economy. Krüger believes that if the tariffs come in softer than expected, “markets would rally fast and furiously.” On the other hand, a maximalist tariff approach could deliver a significant shock, potentially denting cryptocurrencies.

At press time, the total crypto market cap stood at $2.81 trillion.

Featured image from iStock, chart from TradingView.com

Source link

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

California introduces ’Bitcoin rights’ in amended digital assets bill

MELANIA Insider Hayden Davis Selling Millions of Dollars Worth of Memecoin Amid 95% Drop: On-Chain Data

Toulouse starts to accept crypto for public transport

Bitcoin, Crypto Prices Slide as Trade Tensions, Inflation Risks Rattle Markets

Will BlackRock Investors Stay Bullish?

Bitcoin Could Appear on 25% of S&P 500 Balance Sheets by 2030, Analyst Says

Centralization and the dark side of asset tokenization — MEXC exec

Bitcoin Support Thins Below $78,000 As Cost Basis Clusters Shift Toward $95,000

Cryptocurrencies to watch this week: Solana, Cronos, DOT

EU Regulator Pushes for New Capital Rules for European Insurers Holding Crypto Assets

Japan Set To Classify Cryptocurrencies As Financial Products, Here’s All

This Week in Crypto Games: ‘Off the Grid’ Token, GameStop Goes Bitcoin, SEC Clears Immutable

Binance debuts centralized exchange to decentralized exchange trades

Why Is the Crypto Market Down Today? Bitcoin Drops to $82K as Traders Flee Risk Assets Amid Macro Worries

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x