Bitcoin

BTCFi: From passive asset to financial powerhouse?

Published

2 days agoon

By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Bitcoin (BTC) has always been the face of crypto, the first thing that comes to mind when you think of this market. But for years, its role has been largely static—held as a store of value, yet rarely used for anything else. Then BTCFi entered the scene: unlike traditional DeFi, which has been dominated by Ethereum (ETH) and other smart contract platforms, BTCFi is built around Bitcoin as the core asset.

In the last quarter of 2024, BTCFi’s total value saw a massive surge—from $800 million all the way to $6.5 billion. The momentum is impressive, to say the least. More institutional players are taking notice, and analysts predict that by 2030, roughly 2.3% of Bitcoin’s circulating supply (about $47 billion) could be actively used in decentralized finance.

So clearly, BTCFi is not just a passing trend. But why is it gaining so much traction? Can it really be called the future of Bitcoin’s utility as a financial asset?

Let’s try to figure it out.

What is BTCFi, and why is it growing now?

BTCFi represents the intersection of Bitcoin and decentralized finance, with the first crypto playing the role of the core asset in this case. Typically, DeFi platforms have been built on blockchains like Ethereum, while Bitcoin holders had to wrap their BTC into ERC-20 tokens (like wBTC) to participate in this field.

This kind of tokenization started picking up the pace around 2020, allowing BTC holders to access DeFi services that are typically not available on the Bitcoin blockchain. These “wrapped” tokens are built in a way that makes them compatible with other blockchain networks. And so, they effectively extended Bitcoin’s functionality.

However, advancements in Bitcoin L2 solutions and LRTs, or layered rollup technologies, are now changing the rules. It is becoming unnecessary for Bitcoin to use “second class citizen” ERC-20 tokens anymore.

BTC LRTs, for example, operate on Ethereum and other chains as well, but use Bitcoin as the primary collateral in transactions. This means unlocking the use of Bitcoin as a yield-generating asset in other networks beyond its native chain.

The emerging Bitcoin L2s, meanwhile, are tackling this blockchain’s long-standing scalability issues, allowing for faster and more cost-efficient transactions. These innovations are going to fundamentally redefine Bitcoin, turning it from a passive store of value to an actively utilized financial asset.

Why is BTCFi the gateway for Bitcoin whales in 2025?

Large Bitcoin holders—miners, in particular—have often used CeFi loans backed by their BTCs to fund their operations since they didn’t want to outright sell those assets. This practice is still going on today, but BTCFi promises to make some changes. And that’s where everything will start from, really: by BTCFi enabling new opportunities for Bitcoin holders to put their assets to work.

Soon enough, Bitcoin whales will start looking at BTCFi as a powerful gateway that can be used to enter the DeFi space. And the way I see it, there are two key factors in 2025 that will influence that perception.

The first is the rise of Bitcoin ETFs. BTC ETFs currently account for almost 6% of all Bitcoin supply, having crossed $100 billion in holdings at the beginning of 2025. With them gaining mainstream traction, Bitcoin is increasingly perceived as the safest and most stable cryptocurrency asset.

This makes it a prime choice for DeFi, attracting large-scale holders who want to use their BTC without selling. Earlier in February this year, Goldman Sachs announced that it had invested $1.63 billion in Bitcoin ETFs. That’s easy proof right there.

The second major factor is the appearance of BTC L2 technologies, which we’ve already covered earlier. Until recently, the lack of scalability and transaction efficiency held Bitcoin back from DeFi adoption. Now, we are going to see a surge of L2 solutions that will enhance the network’s performance. And here’s the important part: they will do so while preserving Bitcoin’s core principles of decentralization and simplicity (and, hence, its robustness).

What DeFi platforms need to do for proper BTCFi integration

There are several challenges that will need to be overcome before BTCFi can achieve truly seamless integration. The biggest technical issue will be ensuring that Bitcoin-based L2 solutions become genuinely trustless. At the present time, they are not quite there, often relying on intermediaries and centralized elements, which goes against Bitcoin’s core philosophy.

The good news is that there’s a lot of R&D going on to make it happen. If successful, it could make the vast amounts of BTCs that are currently just lying there “collecting dust” be useful in DeFi.

Another big challenge is going to stem from people’s trust. Among Bitcoin holders, there are many who do not quite trust Ethereum and the existing Bitcoin tokenization methods. The key to winning them over will lie in creating robust and cost-effective solutions on the native Bitcoin network. Having a fully trustless and inexpensive execution layer on the BTC blockchain could really become the dealbreaker for these people.

The future of Bitcoin: More than just ‘digital gold’

For years, Bitcoin has been carrying the moniker of “digital gold”—a safe-haven asset meant for holding rather than using. These days, this is becoming increasingly untrue. As more institutional players enter the crypto space, the potential for BTCFi to become Bitcoin’s next-level evolution is very real.

The demand is on the rise, and the infrastructure is already being built. For Bitcoin whales looking to maximize their assets without selling, BTCFi could become the perfect answer.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Michael Egorov

Michael Egorov is a physicist, entrepreneur, and crypto maximalist who stood at the origins of DeFi creation. He is a founder of Curve Finance, a decentralized exchange designed for efficient and low-slippage trading of stablecoins. Since the inception of Curve Finance in 2020, Michael has developed all his solutions and products independently. His extensive scientific experience in physics, software engineering, and cryptography aids him in product creation. Today, Curve Finance is one of the top three DeFi exchanges regarding the total volume of funds locked in smart contracts.

Source link

You may like

Analyst Reveals ‘Worst Case Scenario’ With Head And Shoulders Formation

Bitcoin traders are overstating the impact of the US-led tariff war on BTC price

Bybit Shuts Down Its NFT Marketplace As Crypto Sector Struggles To Recover

Bill That Authorizes Texas Comptroller To Invest $250 Million Into Bitcoin Moves To Committee

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

Published

8 hours agoon

April 1, 2025By

admin

Recently very shaky risk assets — crypto among them — are attempting a rally on Tuesday, perhaps. buoyed by chatter that Donald Trump’s tariffs won’t be as stringent as feared.

In early afternoon U.S. action, bitcoin (BTC) had climbed to just above $85,000, ahead 2.1% over the past 24 hours. Previously really roughed up crypto majors like ether (ETH), dogecoin (DOGE) and cardano (ADA) had put in gains of roughly twice that amount.

Crypto stocks are also performing well, with bitcoin miners Core Scientific (CORZ) and CleanSpark (CLSK) jumping almost 10% on the day. Strategy (MSTR) is up 5.4% and Coinbase (COIN) 2.1%.

U.S. stocks reversed early session losses to turn higher as well, with the Nasdaq now ahead just shy of 1% for the day.

The action comes ahead of the Trump administration’s so-called “Liberation Day” tariff rollout set for tomorrow after the close of U.S. trading.

Hope?

A report from NBC News suggested the market’s most feared option — blanket 20% tariffs across the board — is “less likely” to be the direction taken by the White House. Instead, according to the report, a “tiered system” of different rates or country-by-country rates could be announced.

Also maybe helping is what appears to be the first acknowledgement that the administration is aware of the market tumult resulting from all the tariff chatter. Speaking today at her daily briefing, White House Press Secretary Karoline Leavitt said that there were legitimate concerns about market swings.

Meanwhile, Israel’s Minister of Finance Bezalel Smotrich announced on Tuesday that a process had been launched to get rid of tariffs on U.S. imports in that country.

Source link

adx

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Published

10 hours agoon

April 1, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

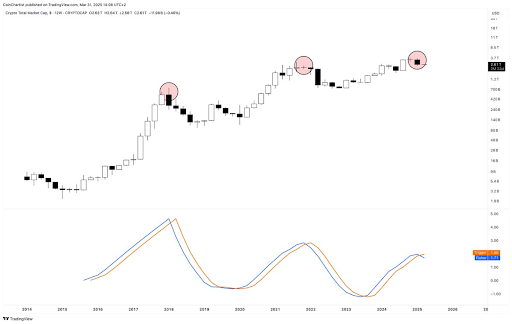

Technical expert Tony Severino has warned that the Bitcoin and altcoins Fischer Transform indicator has flipped bearish for the first time since 2021. The analyst also revealed the implications of this development and how exactly it could impact these crypto assets.

Bitcoin And Altcoins Fischer Transform Indicator Turns Bearish

In an X post, Severino revealed that the total crypto market cap 12-week Fisher Transform has flipped bearish for the first time since December 2021. Before then, the indicator had flipped bearish in January 2018. In 2021 and 2018, the total crypto market cap dropped 66% and 82%, respectively. This provides a bearish outlook for Bitcoin and altcoins, suggesting they could suffer a massive crash soon enough.

Related Reading

In another X post, the technical expert revealed that Bitcoin’s 12-week Fischer Transform has also flipped bearish. Severino noted that this indicator converts prices into a Gaussian normal distribution to smooth out price data and filter out noise. In the process, it helps generate clear signals that help pinpoint major market turning points.

Severino asserted that this indicator on the 12-week timeframe has never missed a top or bottom call, indicating that Bitcoin and altcoins may have indeed topped out. The expert has been warning for a while now that the Bitcoin top might be in and that a massive crash could be on the horizon for the flagship crypto.

He recently alluded to the Elliott Wave Theory and market cycles to explain why he is no longer bullish on Bitcoin and altcoins. He also highlighted other indicators, such as the Parabolic SAR (Stop and Reverse) and Average Directional Index (ADX), to show that BTC’s bullish momentum is fading. The expert also warned that a sell signal could send BTC into a Supertrend DownTrend, with the flagship crypto dropping to as low as $22,000.

A Different Perspective For BTC

Crypto analyst Kevin Capital has provided a different perspective on Bitcoin’s price action. While noting that BTC is in a correctional phase, he affirmed that it will soon be over. Kevin Capital claimed that the question is not whether this phase will end. Instead, it is about how strong Bitcoin’s bounce will be and whether the flagship crypto will make new highs or record a lackluster lower high followed by a bear market.

Related Reading

The analyst added that Bitcoin’s price action when that time comes will also be trackable using other methods, such as money flow, macro fundamentals, and overall spot volume. The major focus is on the macro fundamentals as market participants look forward to Donald Trump’s much-anticipated reciprocal tariffs, which will be announced tomorrow.

At the time of writing, the Bitcoin price is trading at around $83,000, up around 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Source link

Altcoins

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Published

12 hours agoon

April 1, 2025By

admin

A closely followed crypto strategist believes that the native asset of a layer-2 scaling solution could witness an over 3x rally this year.

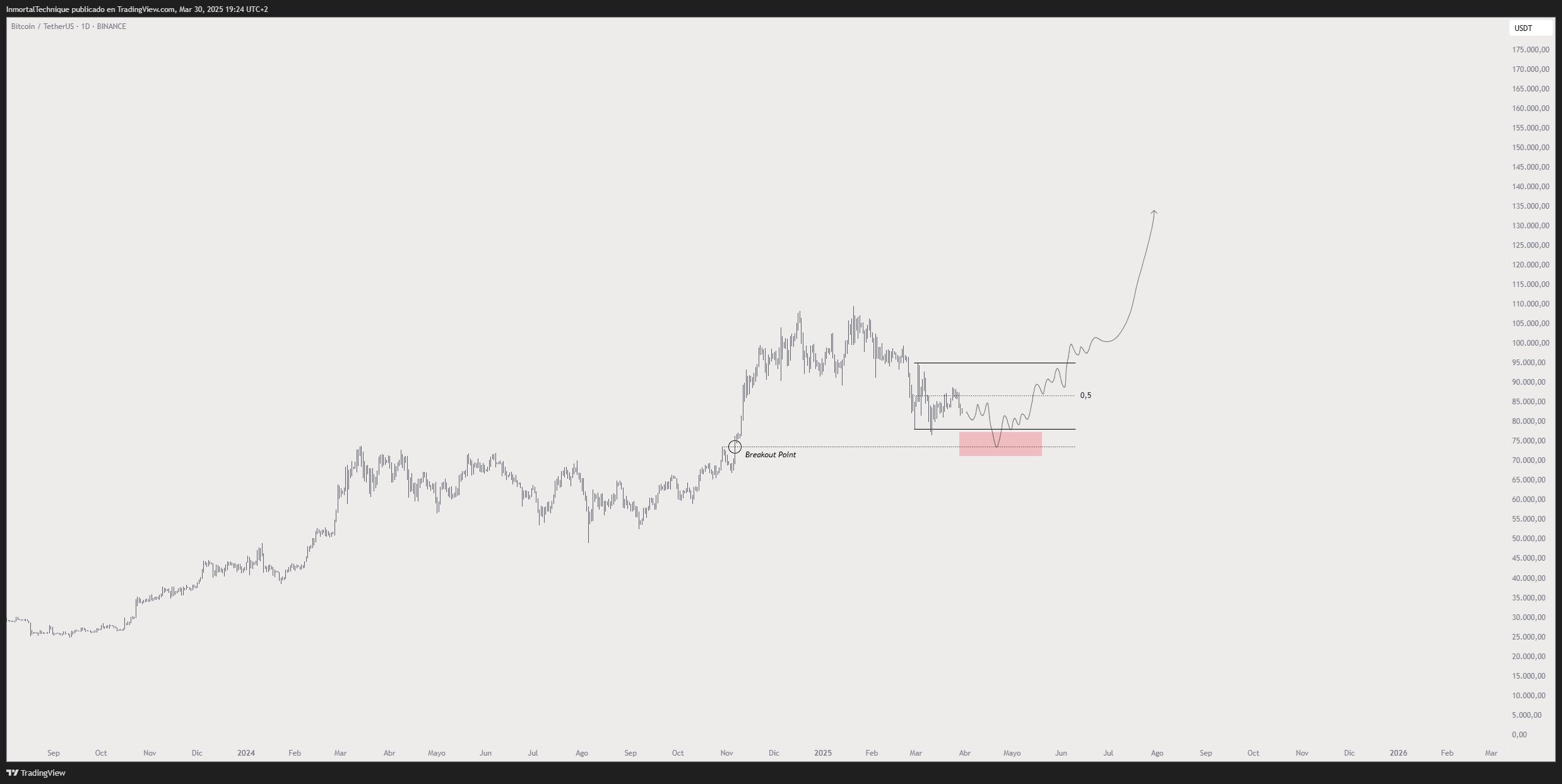

Pseudonymous analyst Inmortal tells his 231,000 followers on the social media platform X that he’s bullish on Mantle (MNT), noting that he believes the altcoin has already printed a 2025 bottom at around $0.6.

According to the trader, a 279% rally for MNT this year is a high-probability scenario.

“Starting to feel like bottom is in.

Big players have been buying over the last few weeks, and it shows.

$3 in 2025 is very likely, high-conviction play for me.”

Based on the trader’s chart, he seems to predict that MNT will surge to $1.30 in the coming months.

At time of writing, MNT is worth $0.79.

Turning to Bitcoin, the trader unveils a potential path for BTC to print a durable bottom this year. According to Inmortal, BTC could temporarily drop below $70,000 before igniting the next stage of the bull market en route to a new all-time high of $135,000.

“They will try to shake you out, but this is the bottom.

Save the tweet.

BTC.”

At time of writing, BTC is trading for $82,374.

As for Ethereum, Inmortal predicts that the price of ETH may plummet below $1,500 before sparking a short-term rally toward $2,000.

“Expansions lead to retraces. Retraces lead to bounces.

Bounce soon.”

At time of writing, ETH is trading at $1,822.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Analyst Reveals ‘Worst Case Scenario’ With Head And Shoulders Formation

Bitcoin traders are overstating the impact of the US-led tariff war on BTC price

Bybit Shuts Down Its NFT Marketplace As Crypto Sector Struggles To Recover

Bill That Authorizes Texas Comptroller To Invest $250 Million Into Bitcoin Moves To Committee

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Human Rights Foundation Donates 1 Billion Satoshis To Fund Bitcoin Development

Dogecoin, Cardano Lead Gains as Crypto Majors Rally

Fartcoin price surges 35% as recovery gains momentum

$1M Premium Paid for $70K Bitcoin Put Option

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x