ChainLink (LINK)

2 Cryptocurrencies To Buy Boosting Into Top 10

Published

3 days agoon

By

admin

Cryptocurrencies entered July with a strong conviction to reverse the negative trend in June. Bitcoin rebounded above $60,000, sending bullish signals among altcoins which not only followed Ethereum’s reversal past $3,400 but posted remarkable gains. Cryptocurrencies to buy like Solana (SOL), Dogecoin and Cardano pushed upwards amid growing optimism for spot ETFs in the US.

As investors beam with the hope of a bull run in H2 of the year, it is important to identify cryptocurrencies to buy showing potential to grow exponentially and reach new all-time highs in price and market capitalization.

For many crypto projects, reaching the coveted top ten tier is not a small feat. Such an achievement often signifies commendable network growth, ecosystem expansion, and high competitiveness.

Seeking exposure to such cryptocurrencies to buy opens investors to tremendous gains including portfolio growth. In this article, CoinGape commits to exploring 2 unique digital assets; Chainlink (LINK) and Floki.

1. Cryptocurrencies To Buy – Chainlink

With renewed buying interest among whales, the Chainlink price rebounded by 16.2% from a multi-month support zone at $12.63, reaching $14.678. This surge suggests that the LINK coin could sustain above the 38.2% Fibonacci retracement level— a healthy correction level for buyers to counterattack.

During the June correction, the Chainlink coin experienced significant outflows, with its price plummeting from $19.2 to $12.6, resulting in a 34.2% decline. The $12.6 low accompanied by a 32.8% FIB level and 100W EMA creates a high area of interest (AOI) for buyers.

In the last six months, the LINK price rebounded support times from the aforementioned support indicating the buyers are aggressively defending this level to prevent prolonged correction. The recent reversal from bottom support has propelled the LINK price to $14.5, while the market cap jumped to $8.85 Billion.

Recent on-chain data analysis from Lookonchain reveals that whales and institutions are accumulating Chainlink (LINK). Over the past seven days, 54 fresh wallets have withdrawn a total of 2.08 million LINK, valued at approximately $30.28 million, from Binance.

The support trendline on the daily chart, which has been in place since June 2023, underpins the current recovery. Buyers must maintain this level to carry a prolonged bull run.

2. Floki

According to data from CoinMarketCap, the current market cap has risen to approximately $1.66 billion, marking an increase of 2.80%. Notably, the trading volume has spiked by 47% in the past 24 hours, reaching $226 million, underscoring the increasing investor interest and market activity surrounding this cryptocurrency.

Over the last week, Floki has enjoyed a 4% increase in value. Currently, the coin fluctuates within a narrow price range of $0.00016 to $0.00018, marking a notable appreciation in its market price.

FLOKI could encounter a major obstacle if it surpasses the $0.00018 mark, with a strong resistance point at $0.0002. If it sustain above this threshold, the path could open for an upward move toward $0.0003. A continued rally might even take it to $0.0005.

On the flip side, a decline below $0.00017 might send FLOKI down to its lower support trendline at $0.00016. Further market downturns could pressure it to a support level of $0.00015. This could indicate a bearish trend for the coin.

Frequently Asked Questions (FAQs)

This is a period where cryptocurrencies other than Bitcoin rally achieving new highs and market capitalisations.

No. However, LINK has the potential to become a top 10 crypto in 2024. It currently ranks #17 on CoinGecko.

High net worth individuals are investing in the crypto market. They buy and sell tokens in large volumes often impacting prices.

Related Articles

John is a seasoned crypto expert, renowned for his in-depth analysis and accurate price predictions in the digital asset market. As the Price Prediction Editor for Market Content at CoinGape Media, he is dedicated to delivering valuable insights on price trends and market forecasts. With his extensive experience in the crypto sphere, John has honed his skills in understanding on-chain data analytics, Non-Fungible Tokens (NFTs), Decentralized Finance (DeFi), Centralized Finance (CeFi), and the dynamic metaverse landscape. Through his steadfast reporting, John keeps his audience informed and equipped to navigate the ever-changing crypto market.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

ChainLink (LINK)

Will LINK Correction Slip Under $10 By June End?

Published

2 weeks agoon

June 22, 2024By

admin

Chainlink Price Prediction: The weekends are quite stable for the cryptocurrency market as Bitcoin price is struggling hard to sustain above $64000. However, the bearish momentum is still active of several major altcoins including Chainlink projecting a continued downward trajectory. The LINK price falling for three consecutive days recorded an 8.3% loss and was dumped to $13.57. Will this correction extend if BTC plunges to the $60000 mark?

21M $LINK Unlocked from Chainlink Noncirculating Supply Contracts

Amid the current market correction, the Chainlink price shows a V-top reversal from the $19.2 mark. This first lower high formation after a notable uptrend indicates an initial sign of traders’ sentiment changing in the LINK token.

The bearish turnaround has tumbled the asset 29% down to trade at $13.62, while the market cap fell to $8.281 Billion. If the selling pressure persists, the LINK price could fall another 9-10% before hitting multi-month support of $12.26.

The support coinciding close with the 200-weekly EMA and an ascending trendline creates a strong confluence point for buyers to counterattack.

Furthermore, Chainlink has recently unlocked 21 million LINK tokens, valued at $295 million, from its noncirculating supply contracts, according to Spot On Chain. This includes:

- 18.25 million $LINK ($264 million) to Binance.

- 2.25 million $LINK ($31.3 million) to a multisig wallet.

Since August 2022, Chainlink has unlocked 127 million $LINK and sent 107.7 million $LINK to Binance, maintaining an average price of $9.89. Currently, 391.5 million $LINK tokens ($5.4 billion) remain in 24 contracts.

21M $LINK ($295M) was unlocked from @chainlink Noncirculating supply contracts ~3hrs ago, including:

• 18.25M $LINK ($264M) to #Binance

• 2.25M $LINK ($31.3M) to Multisig 0xD50fNotably:

– Chainlink has unlocked 127M $LINK and sent 107.7M $LINK to Binance at ~$9.89 since Aug… https://t.co/bVUDTMDFgZ pic.twitter.com/jxaO5Glxjb— Spot On Chain (@spotonchain) June 21, 2024

Despite these movements, the $LINK price has remained stable, indicating a well-maintained market. This suggests that the market has been able to absorb the increased supply without significant volatility, indicating a strong demand.

This increases the price potential for a bullish reversal offering a dip opportunity for sidelines traders. However, for buyers to regain better control over the asset, a breakout from the overhead trendline is needed.

The potential breakout will accelerate the buying momentum and bolster buyers to challenge the $22.8 high followed by $28.7.

However, a breakdown below the trendline will signal the continuation of the downward trend and plunge the price to $9.46.

Technical Indicator:

- Experimental Moving Average: A bearish crossover between the 20-and-200-day EMA should accelerate the selling pressure for a prolonged downfall.

- ADX: An uptick in ADX 37% indicates the sellers leading an exhausted fall will need short bounced to recuperate the selling momentum.

Related Articles

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Shiba Inu, Chainlink, Ethereum Exchange Supply Plummets, Price Recovery Ahead?

Published

3 weeks agoon

June 14, 2024By

admin

In recent developments, the top 10 exchange wallets for Shiba Inu (SHIB), Chainlink (LINK), and Ethereum (ETH) have seen a significant decrease in their holdings since May 27. Specifically, Shiba Inu’s exchange supply has shrunk by 2.4%, Chainlink by 2.9%, and Ethereum by 8.6%.

Moreover, such reductions in exchange reserves are generally interpreted as bullish indicators by traders. Hence, a potential for price recovery could be witnessed for SHIB, ETH, and LINK. Currently, all these cryptocurrencies are grappling with a downtrend.

Shiba Inu (SHIB) Price Analysis

At the time of writing, the Shiba Inu price was $0.00002175, up by 0.38% on Friday, June 14. This price movement places SHIB at a pivotal point, encountering a significant barrier at $0.000022. If Shiba Inu can surpass this resistance, it may climb to $0.000025, with the possibility of reaching $0.00003.

On the other hand, increased selling pressure could push Shiba Inu down to $0.000021, and it might fall further to $0.00002 if market sentiment deteriorates. Whilst, technical analysis indicates that SHIB might be entering a consolidation phase. The MACD indicator reveals a convergence towards the signal line, hinting at a possible slowdown or reversal in momentum.

With the MACD line currently beneath the signal line, it signifies weak bullish momentum. Currently, the Shiba Inu RSI is at 37, suggesting a neutral market stance, as SHIB is neither overbought nor oversold. However, the RSI is nearing 30, which signals a oversold condition is looming. In the aftermath of such conditions, the price generally rebounds.

Moreover, the reduction in Shiba Inu supply due to decreasing exchange reserve and frequent burns could also catalyze a rebound. On the flip side, most oscillators and moving averages on the daily chart are issuing sell signals. The 50-EMA being above the 20-EMA suggests a potential downward trend.

Also Read: Shiba Inu Coin Bull Run Ahead As SHIB Burn Rate Spikes Further

Chainlink (LINK) Outlook

Chainlink is currently trading at $15.32, down by 0.90%. This decline has triggered long liquidations, which account for over 95% of total liquidations, signaling a short-term price decline. However, the diminishing exchange reserve could lead to a rebound in the long term due to a reduced supply.

As exchange supplies decrease, it often points to accumulation by investors, which can drive prices up as supply dwindles. Moreover, the Chainlink price has sustained a profit of over 14% in the last 30 days despite the recent bearish turn. Hence, it could mirror the momentum for a reversal as the LINK open interest has also surged.

Ethereum (ETH) Prospect Following ETF Approval

According to Santiment, Ethereum’s exchange supply has seen the most significant reduction among the three cryptocurrencies, dropping by 8.6%. This substantial decrease is viewed positively by bullish traders as it may indicate strong accumulation and potential for future price increases.

Recently, Ethereum’s market narrative is also being shaped by regulatory developments. Crypto analyst Michaël van de Poppe highlighted a statement from SEC Chair Gary Gensler, suggesting that an Ethereum ETF might be listed during the summer. This anticipation signals a final correction before a substantial price surge, according to Poppe.

The approval of Spot Ethereum ETF S-1 filings is expected to have a profound impact on ETH’s price. It could potentially push the ETH price above $4,000 immediately after the ETF listing. Furthermore, Standard Chartered has projected that this development could even drive Ether’s price to exceed $8,000 by the end of the year. Such optimistic forecasts are underpinned by the expected influx of institutional investment following the ETF’s approval.

Also Read: Whale Heavily Bags SHIB, ETH, CRV, & Others, What’s Next?

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ChainLink (LINK)

Chainlink Bulls Anticipate Explosive Growth Following $216 Million Whale Accumulation

Published

5 months agoon

February 18, 2024By

admin

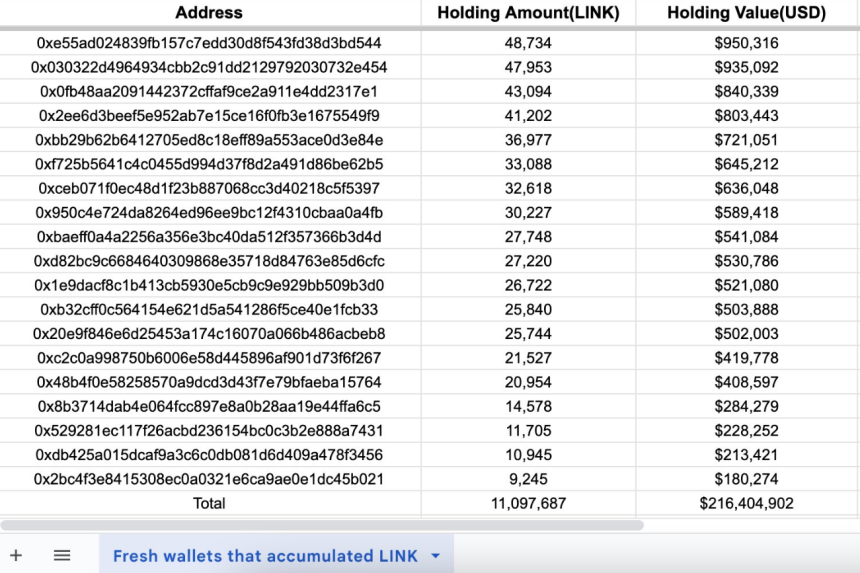

Chainlink (LINK), the oracle network powering smart contracts across the crypto landscape, is making waves with a recent surge in whale activity. Data reveals $216 million worth of LINK tokens withdrawn from the Binance exchange by a staggering 83 separate wallets, sending the token price on a parabolic trajectory.

Whales On A Feeding Frenzy

On-chain analytics platform Lookonchain paints a fascinating picture of the ongoing accumulation binge. Their findings suggest a coordinated effort, with distinct wallets withdrawing massive amounts of LINK. While the possibility of a single entity pulling the strings remains unconfirmed, the sheer volume of tokens amassed hints at a major shift in institutional participation within the Chainlink ecosystem.

This coordinated accumulation, especially the withdrawal of such a significant sum from a major exchange like Binance, raises intriguing questions, some analysts say. It could reflect growing institutional confidence in Chainlink’s long-term potential, particularly with initiatives like the Cross-Chain Interoperability Protocol (CCIP) expanding its reach.

83 fresh wallets(may belong to the same institution) withdrew a total of 11,097,687 $LINK($216.4M) from #Binance in the past 2 weeks.

Address list:https://t.co/cYgH52rHzxhttps://t.co/JNuXc43l2I pic.twitter.com/u178vVVGiT

— Lookonchain (@lookonchain) February 17, 2024

Adding fuel to the fire, IntoTheBlock data reveals an additional $129 million stacked up by whales over the past 24 hours alone. This relentless buying pressure has translated directly to price action, with LINK experiencing a meteoric rise of 6% in the past week and a staggering 20% in the past month.

Source: Lookonchain

Chainlink Fundamentals Shine

While whale activity often grabs headlines, Chainlink’s underlying fundamentals paint an equally compelling picture. As the leading oracle provider in the Web3 space, Chainlink acts as a bridge between smart contracts and real-world data, enabling them to access secure and reliable information off-chain. This critical role fuels countless DeFi projects, positioning Chainlink as a cornerstone of the burgeoning decentralized finance landscape.

Chainlink currently trading at $20.11 on the daily chart: TradingView.com

Moreover, Chainlink boasts a relentless development team, consistently rolling out new features and upgrades. Notably, the recent introduction of CCIP further enhances the network’s cross-chain compatibility, opening doors to a wider range of smart contract applications. This unwavering commitment to innovation further strengthens the investor case for Chainlink.

LINK price action in the last week. Source: Coingecko

Parabolic Dreams: Will LINK Take Flight?

With bullish sentiment surging and whales circling, the question on everyone’s lips is: can LINK sustain its upward trajectory? While predicting the future of any crypto asset remains a perilous endeavor, analysts are cautiously optimistic. The confluence of strong fundamentals, whale accumulation, and a growing user base creates a fertile ground for further price appreciation.

Analysts said the ongoing accumulation by whales, coupled with Chainlink’s solid fundamentals, suggests a potential parabolic run. However, caution is warranted. The crypto market remains volatile, and profit-taking could trigger corrections. Nevertheless, LINK’s long-term prospects appear bright, making it an asset worth watching closely.”

Whether LINK’s price soars to parabolic heights or faces turbulence in the near future, one thing remains clear: the recent whale activity and unwavering developer commitment have thrust Chainlink back into the spotlight, solidifying its position as a key player in the ever-evolving blockchain landscape.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin’s quick dip below $57k forces beginners to capitulate, CryptoQuant says

$PRDT

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: