Bitcoin miners

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Published

2 years agoon

By

admin

While the worth of bitcoin is holding on top of the $21K per unit vary, four bitcoin block rewards well-mined in 2010 were spent for the primary time in over eleven years. The four block rewards were well-mined between Sept and Oct 2010 and therefore the two hundred bitcoin price $4.27 million were transferred to an unknown notecase.

4 Consecutive Block Rewards Spent on June 24, Data Suggests Spends Were Executed by a Entity

A large range of supposed ‘sleeping bitcoins’ have awoken from slumber as four block rewards were spent at block height 742,183. The recent coins spent on Fri were block rewards well-mined on Sept fifteen, 16, 26, and Oct 29, 2010. Throughout that point frame, bitcoin miners received fifty BTC for each block found in distinction to the vi.25 BTC per block reward miners get these days.

The block rewards rapt came from four addresses that embody “18cxWU,” “1BJmWW,” “1FVVcE,” and “1Hdo8D.” The 2010 spends were caught by the blockchain computer programme btcparser.com and altogether four addresses, the owner failed to pay the associated bitcoin money (BCH) and bitcoinsv (BSV) as those coins still stay idle.

Blockchain explorers show the two hundred virgin bitcoins were sent to one address (bc1q92) and therefore the coins stay idle at the time of writing. A consecutive range of 2010 block rewards spent within the same block suggests one entity was seemingly the owner of the block rewards. The bitcoins well-mined in 2010 over a two-month span (September and October) conjointly counsel the disbursal was dead by one entity.

Transfers Had Low Privacy Ratings, ‘Sleeping Bitcoin’ String Spends From 2010 Have Slowed

It looks as if the addresses were swept back, and therefore the transactions have a really low privacy rating for varied reasons. Blockchair.com’s privacy-o-meter indicates that the ultimate consolidation into bc1q92 had a privacy score of 0 out of 100. The transactions contained vulnerabilities like matched addresses, co-spending, and therefore the same address is employed in multiple inputs.

There haven’t been several strings of 2010 block reward spends since the 2010 mega-whale appeared months past back in March. The 2010 mega whale sometimes spent strings of 20 block rewards from that year all right away. before the string of 4 block subsidies from 2010 spent, every week past the address “1Li8RF” spent 50 bitcoins, and “1LNqDK” spent fifty BTC from 2010 a couple of month ago.

The post A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday first appeared on BTC Wires.

Source link

You may like

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

DOGE Price Prediction – Dogecoin Below $0.14 Could Spark Larger Degree Drop

Ali Martinez

Bitcoin Sees Massive Sell-Off From Miners, As Price Holds Steady

Published

3 months agoon

January 18, 2024By

admin

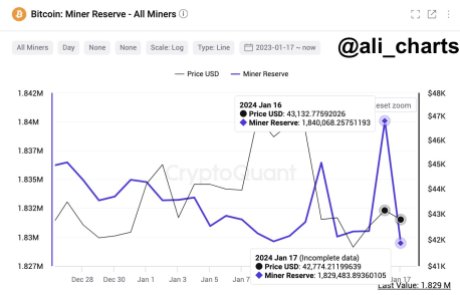

Amid the excitement encompassing the approval of Bitcoin Spot Exchange-Traded Funds (ETFs), BTC miners have been spotted carrying out an aggressive selling spree leaving the community to ponder on the impact of the sell-off.

Bitcoin Miners Engage In Selling Spree

Well-known cryptocurrency analyst Ali Martinez shared this information with the community on the social media network X (formerly Twitter), noting a “substantial increase in selling activity” from Bitcoin miners lately.

According to data shared by Ali, miners have sold about 10,600 Bitcoin in less than 24 hours. This was valued at an estimated $455.8 million as of the time of the report.

The recent increase in sales by the Bitcoin miners indicates a responsive market. In addition, the sizable amount involved signifies an impactful development in the cryptocurrency landscape.

Several reasons could be traced back to the massive selling spree by these miners. One potential reason could be attributed to the decline in the Bitcoin hash rate, which generally affects the profitability of miners.

BTC miners must make several guesses at a challenging mathematical problem in order to process transactions. A greater hash rate indicates that the miners are carrying out more guesses, suggesting more effort to secure the network.

The crypto asset’s hash rate saw a notable decrease of 25% during the last weekend. This raises speculations regarding the security of BTC’s network ahead of the much-awaited “Halving.”

It was reported that the total real-time rate from all mining pools decreased from 570 exahashes per second (EH/s) to as low as 425 EH/s. However, the hash rate is currently sitting at 550 exahashes per second (EH/s).

The reduction occurred due to the restrictions placed on businesses’ use of electricity by ERCOT (Electric Reliability Council of Texas) because of unfavorable cold weather.

Interest In BTC Mining From Institutions

Top financial companies have been demonstrating interest in Bitcoin mining companies for a while now. Various financial institutions have made significant investments, which have also helped the mining industries.

Even those who have historically opposed Bitcoin or have been hostile to it have invested millions of dollars in the industry throughout 2023.

Since August 2023, Blackrock has been a significant stakeholder in four of the five biggest mining companies. The asset manager increased its level of involvement with these firms only during the second half of last year.

As of the time of writing, Bitcoin was trading at $42,710, indicating an over 7% decrease in the past seven days. Its market cap is up slightly by 0.02% in the past 24 hours, while its trading volume is down by 17.17%.

Featured image from iStock, chart by Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Bitcoin Miners Show Accumulation Again, Bullish Sign?

Published

9 months agoon

August 8, 2023By

admin

On-chain data shows that Bitcoin miners have been expanding their reserves recently, a sign that could be bullish for the asset’s price.

Bitcoin Miner Reserve Has Been Trending Up Recently

As pointed out by an analyst in a CryptoQuant post, BTC miners have been accumulating during the past 48 days. The indicator of interest here is the “miner reserve,” which measures the total amount of Bitcoin that all miners are holding in their wallets right now.

Related Reading: These Bitcoin Metrics Are At Important Retests, Will Bullish Trend Prevail?

When the value of this metric goes down, it means that the miners are withdrawing coins from their wallets currently. Generally, these chain validators only transfer coins out of their reserve whenever they want to sell them, so this kind of trend can have bearish implications for the price.

On the other hand, the indicator increasing in value implies the miners are adding a net amount of BTC to their wallets. Such a trend can be a sign that these investors are accumulating at the moment, and hence, can be bullish for the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the last couple of months:

The value of the metric has been steadily going up in recent days | Source: CryptoQuant

As shown in the above graph, the Bitcoin miner reserve had observed a large rise back in May, but soon after this increase, this cohort started selling as the asset’s price continued to show struggle.

After the rally had taken place in June, however, the indicator’s value had stabilized, meaning that these investors were selling the same amount as they were adding to their holdings.

In the last few weeks, this sideways trend has slowly turned into an uptrend, as the miners have been gradually expanding their reserves. In the past 48 days, these chain validators have added a total of around 4,060 BTC to their holdings.

This amount is worth around $118 million at the current exchange rate, which isn’t a ton given the scale of the total miner reserve, but it’s still nonetheless a positive sign that the miners have been accumulating despite the cryptocurrency’s price observing some decline recently.

A notable portion of this latest accumulation by the miners has come from one mining pool, AntPool, as the below chart displays.

Looks like miners belonging to this pool have been accumulating | Source: CryptoQuant

In the past 52 days, the AntPool Bitcoin mining pool has added a total of about 1,020 BTC to their reserves, which is more than 25% of the total accumulation that all the miners have participated in during this period.

The quant has also attached the data for the exchange flows (as well the normal outflows/inflow) for this mining pool. Earlier, there was some concern around the market that these miners may have been selling as they were depositing to exchanges, but as it turned out, this cohort was merely transferring their coins back and forth from these platforms.

BTC Price

At the time of writing, Bitcoin is trading around $29,100, up 1% in the last week.

BTC has been moving sideways recently | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, CryptoQuant.com

Source link

Bitcoin

Bitcoin hashrate recovers after huge freeze shuts down miners

Published

1 year agoon

December 26, 2022By

admin

The Bitcoin network hashrate has come to 241.29 EH/s once a short lived 38% fall to a hundred and 70.60 EH/s from a weekly peak of 276.40 EH/s.

Bitcoin’s network hashrate has come back to regular levels once more, days once chilling temperatures across the U.S. place a strain on the nation’s electricity grid — resulting in a short lived drop by hashrate.

In the days leading up to Christmas, bone-chilling temperatures swept across the U.S., resulting in millions while not powered and claiming a minimum of 28 lives.

According to reports, Bitcoin miners in Texas, which accounts for a big portion of the country’s hashrate, voluntarily curtailed operations to allow power back to the grid — so residents will keep their homes heated.

The disruptions seem to place a dent in Bitcoin’s hashrate, which generally hovers around 225-300 Exahashes per second (EH/s). This fell to a hundred and seventy.60 EH/s on Dec. 25.

As of Dec. 26 however, the hashrate has come to 241.29 EH/s, consistent with information from hashrate mining calculator CoinWarz.

Bitcoin’s hashrate is calculated by measuring the quantity of hashes made by Bitcoin miners attempting to unravel the ensuing block. It’s considered a key metric in assessing how secure the Bitcoin network is.

The recent events prompted a moot statement from FutureBit founder John Stefanop, UN agency recommended the autumn in hashrate was thanks to a variety of “highly centralized mines” in Texas turning off at an equivalent time.

“I know, don’t modify the actual fact that many giant mines in Texas have an effect on the complete network to the tune of 33%…everyone’s transactions are currently being confirmed 30% slower as a result of the hashrate not being decentralizing enough,” he said.

“If hashrate was distributed equally round the world by 10’s of innumerable tiny miners rather than many dozen large mines, this event wouldn’t have even registered on the network,” Stefanop intercalary.

Bitcoin bull Dan commanded but refuted Stefanop’s war the events, difference of opinion that weather patterns don’t mean centralized possession or management.

According to the Cambridge Bitcoin Electricity Consumption Index, the U.S. accounts for 37.84% of the common monthly hashrate share. The highest four states within the country for Bitcoin mining embody New York, Kentucky, Georgia and Texas — all of which had veteran power outages thanks to the winter storm.

However, Dennis Porter, the business executive of Bitcoin mining support cluster Satoshi Action Fund noted to his 127,400 Twitter followers on Dec. 25 that whereas the inclement weather, notably in Texas, caused 30% of Bitcoin’s hashrate within the U.S.to travel offline, the network “continues to work perfectly.”

Cheap power and favorable mining regulation in Texas has led to a Bitcoin mining boom in Texas in recent months, which is currently host to a number of the biggest mining corporations within the world.

Among those Riot Blockchain, Argo, Bitdeer, Argo, work out North, Genesis Digital Assets and Core Scientific — who’ve recently received a $37.4 million bankruptcy loan to remain afloat.

However recent weather events have solely intercalary to Bitcoin mining companies’ list of headaches.

The securities industry has infested Bitcoin mining corporations to the tune of $4 billion in debt, consistent with recent information.

Many notable U.S. primarily based mining corporations have filed for bankruptcy in recent months too, whereas several alternative corporations square measure approaching near-insurmountable debt-to-equity ratios that need immediate restructuring.

The tragic weather events haven’t wedged the value of Bitcoin (BTC) to date, that is presently priced at $16,826 — solely down 0.27 over the last 24 hours.

The post Bitcoin hashrate recovers after huge freeze shuts down miners first appeared on BTC Wires.

Source link

Bitcoin Raises Bull Flag, Formation Triggers Calls For $100,000

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

DOGE Price Prediction – Dogecoin Below $0.14 Could Spark Larger Degree Drop

WhalesNight AfterParty 2024 – Blockchain News, Opinion, TV and Jobs

‘Violent to the Upside’: This Catalyst Could See Bitcoin Explode by up to 1,486%, Says Strike CEO Jack Mallers

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Ethereum, Solana and Altcoins Approaching ‘Banana Zone,’ According to Macro Guru Raoul Pal – Here’s His Outlook

Bullish March Marks Record for Bitcoin – Blockchain News, Opinion, TV and Jobs

Why Is The Dogecoin Price Down Today?

The AI-Based Smart Contract Audit Firm “Bunzz Audit” Has Officially Launched – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoFriends or Enemies? – Blockchain News, Opinion, TV and Jobs