Bitcoin

Bitcoin Miners Show Accumulation Again, Bullish Sign?

Published

9 months agoon

By

admin

On-chain data shows that Bitcoin miners have been expanding their reserves recently, a sign that could be bullish for the asset’s price.

Bitcoin Miner Reserve Has Been Trending Up Recently

As pointed out by an analyst in a CryptoQuant post, BTC miners have been accumulating during the past 48 days. The indicator of interest here is the “miner reserve,” which measures the total amount of Bitcoin that all miners are holding in their wallets right now.

Related Reading: These Bitcoin Metrics Are At Important Retests, Will Bullish Trend Prevail?

When the value of this metric goes down, it means that the miners are withdrawing coins from their wallets currently. Generally, these chain validators only transfer coins out of their reserve whenever they want to sell them, so this kind of trend can have bearish implications for the price.

On the other hand, the indicator increasing in value implies the miners are adding a net amount of BTC to their wallets. Such a trend can be a sign that these investors are accumulating at the moment, and hence, can be bullish for the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the last couple of months:

The value of the metric has been steadily going up in recent days | Source: CryptoQuant

As shown in the above graph, the Bitcoin miner reserve had observed a large rise back in May, but soon after this increase, this cohort started selling as the asset’s price continued to show struggle.

After the rally had taken place in June, however, the indicator’s value had stabilized, meaning that these investors were selling the same amount as they were adding to their holdings.

In the last few weeks, this sideways trend has slowly turned into an uptrend, as the miners have been gradually expanding their reserves. In the past 48 days, these chain validators have added a total of around 4,060 BTC to their holdings.

This amount is worth around $118 million at the current exchange rate, which isn’t a ton given the scale of the total miner reserve, but it’s still nonetheless a positive sign that the miners have been accumulating despite the cryptocurrency’s price observing some decline recently.

A notable portion of this latest accumulation by the miners has come from one mining pool, AntPool, as the below chart displays.

Looks like miners belonging to this pool have been accumulating | Source: CryptoQuant

In the past 52 days, the AntPool Bitcoin mining pool has added a total of about 1,020 BTC to their reserves, which is more than 25% of the total accumulation that all the miners have participated in during this period.

The quant has also attached the data for the exchange flows (as well the normal outflows/inflow) for this mining pool. Earlier, there was some concern around the market that these miners may have been selling as they were depositing to exchanges, but as it turned out, this cohort was merely transferring their coins back and forth from these platforms.

BTC Price

At the time of writing, Bitcoin is trading around $29,100, up 1% in the last week.

BTC has been moving sideways recently | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, CryptoQuant.com

Source link

You may like

New Global Currency Designed To Ditch US Dollar, Avert Sanctions Emerging As BRICS Leaders Prepare To Meet: Report

Analyst Says Bitcoin Price Is Headed To $90,000, Here’s Why

Venture Capitalists Funnel Nearly $2,500,000,000 Into Crypto in Q1 of 2024: Galaxy Research

Injective (INJ) Price In Danger If It Falls To Crucial Support Level: Analyst

Bitcoin and Other Cryptos Set To Begin ‘Slow Grind Higher,’ Says Arthur Hayes – Here Are His Top Altcoin Picks

Daily Active Addresses Hit 514,000 As DOT Price Surges 7%

Bitcoin

Analyst Says Bitcoin Price Is Headed To $90,000, Here’s Why

Published

6 hours agoon

May 4, 2024By

admin

Bitcoin is now at a critical junction, which many determine its price trajectory for the rest of the year. The crypto has managed to return into $60,000 territory after dropping down to $56,000 for the first time since April. Some analysts are of the notion that the Bitcoin bulls haven’t actually started on their momentum yet, with many expecting a surge above $74,000 in the coming weeks.

According to a crypto analyst, impulse waves formed by Bitcoin over the past 1.5 years are indicating that the price of Bitcoin will soon jump to between $90,000 and $100,000.

Bitcoin To $90,000

A crypto analyst known pseudonymously as TechDev recently shared a Bitcoin price outlook on social media platform X with over 448,000 followers. Interestingly, his analysis is based on Elliot impulse waves, a technical analysis tool that has become extremely popular among crypto analysts when forecasting Bitcoin’s price.

According to the BTC/US Dollar 2D timeframe shared by the analyst, Bitcoin has been forming impulse waves on an uptrend since May 2023. The chart indicated that the recent correction since Bitcoin reached an all-time high of $73,780 is the fourth impulse wave formation, which is generally known to be a corrective wave. Interestingly, the asset is now at a critical junction after bouncing up at $56,800.

As noted by the analyst, Bitcoin is set to form its fifth (bullish) impulse wave and go parabolic in the coming months. The first price target is around $90,000 to $100,000 in the short term. The second price target is around the projected peak of the fifth impulse wave, which sits just below $150,000.

TechDev’s analysis is based on a similar five-impulse wave formation in the 2020 to 2021 bull market cycle. A similar fourth impulse wave correction during this period saw Bitcoin falling from $41,000 to $29,000 in early 2021. However, a rebound led to the formation of a fifth (bullish) impulse wave, pushing the price of Bitcoin to its former all-time high.

The impulsive structure of the last 1.5 years says 90-100K is next. $BTC pic.twitter.com/jboA0rQ3Qs

— TechDev (@TechDev_52) May 3, 2024

What’s Next For Bitcoin Price?

At the time of writing, Bitcoin is trading at $63,275 and up by 6% in the past 24 hours. Since the launch of Spot Bitcoin ETFs in the US, Grayscale’s GBTC recorded its first day of inflow, totaling $63 million on May 3. Investors are hopeful and speculating how this might kickstart a new bull run for the cryptocurrency.

According to an analyst, Bitcoin has successfully defended a correction below the 21-day exponential moving average (EMA). The next step is crossing above resistance around $63,488.

BTC bulls push price toward $64,000 | Source: BTCUSD on Tradingview.com

Featured image from The TechBullion, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Venture Capitalists Funnel Nearly $2,500,000,000 Into Crypto in Q1 of 2024: Galaxy Research

Published

10 hours agoon

May 4, 2024By

admin

New data from crypto insights firm Galaxy Research finds that during the first quarter of the year, venture capitalists poured in billions of dollars into the digital assets industry.

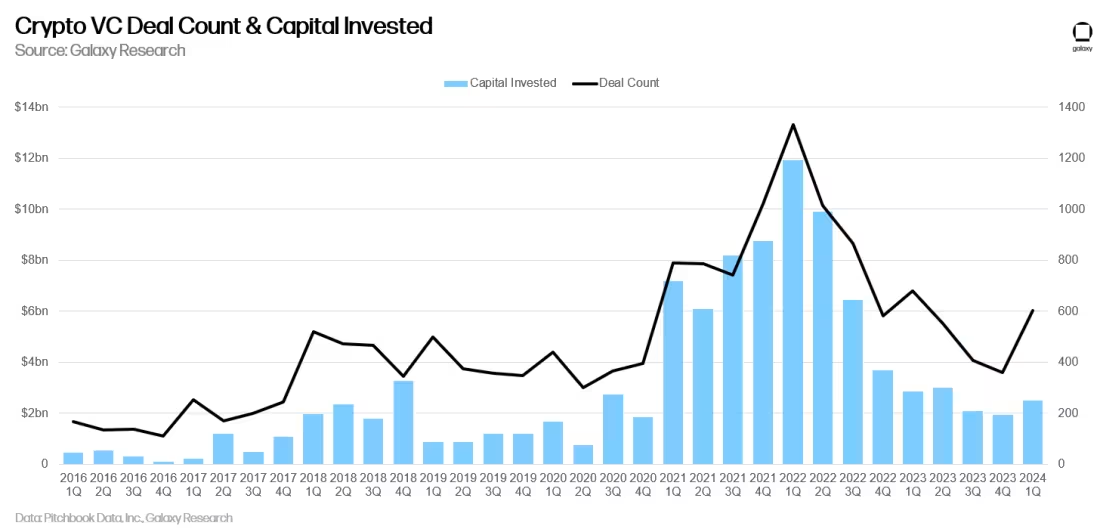

In a new article, Galaxy Research says that venture capitalists invested $2.49 billion into cryptocurrencies during Q1 of 2024, a 29% quarter-over-quarter (QoQ) rise.

The analytics platform says that heavy investments during Q1 of 2024 signal that Q4 of 2023 could have been the bottom of the market.

“In Q1 2024, venture capitalists invested $2.49 billion (+29% QoQ) into crypto and blockchain-focused companies across 603 deals (+68% QoQ).

This was the first rise in both capital invested and deal count in three quarters, perhaps signaling that Q4 2023 was the ‘bottom,’ although a continuation of QoQ increases – and a more meaningful increase – would confirm that over the coming quarters.”

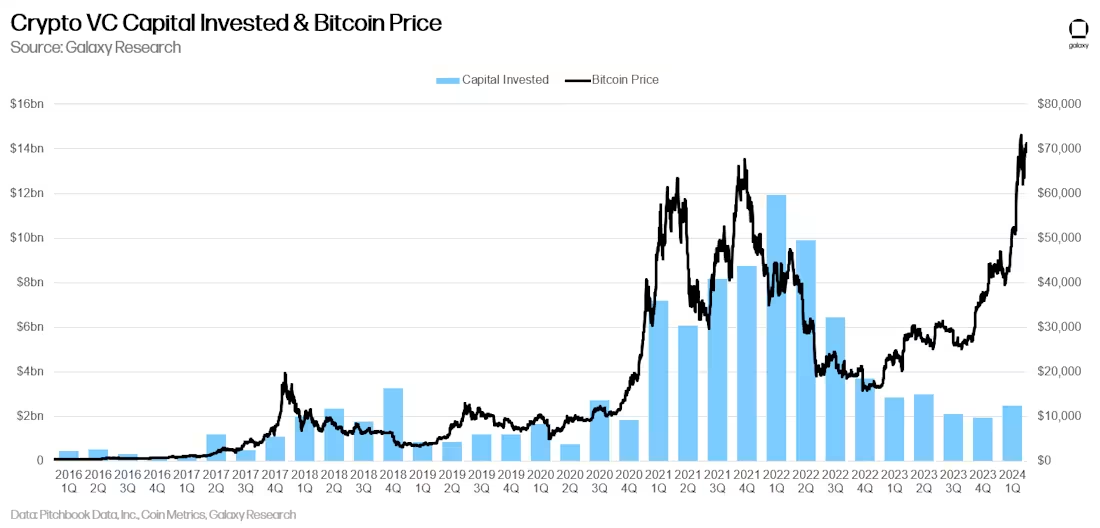

Galaxy Research goes on to note that while venture capitalist investments into the crypto space have correlated with the price of Bitcoin (BTC) in the past, the crypto king’s massive rise in 2024 caused them to decouple.

“While venture capital investment in the crypto sector has typically correlated to the Bitcoin price, that correlation has broken down over the past year, with bitcoin rising significantly since January 2023 but VC activity mostly languishing.

Q1 2024 saw a significant rise in BTC, and while capital invested also rose, the investment activity is still nowhere near the levels when Bitcoin last traded over $60,000.

The combination of crypto industry-native catalysts (Bitcoin exchange-traded funds, new areas like restaking, modularity, Bitcoin layer-2s, etc.) and macro headwinds (rates) contributed to the notable divergence.”

Bitcoin is trading for $62,754 at time of writing, a 5.2% increase during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Bitcoin and Other Cryptos Set To Begin ‘Slow Grind Higher,’ Says Arthur Hayes – Here Are His Top Altcoin Picks

Published

18 hours agoon

May 4, 2024By

admin

BitMEX co-founder Arthur Hayes is saying that crypto assets are likely to benefit from the US monetary policy going forward.

In a new essay, Hayes says that the U.S. Treasury and the Federal Reserve are engaging in “stealth money printing policies.”

According to the BitMEX co-founder, the “slow addition of billions of dollars of liquidity each month will dampen negative price movement” for crypto assets.

“While I don’t expect crypto to fully realize the recent US monetary announcements’ inflationary nature immediately, I expect prices to bottom, chop, and begin a slow grind higher.”

Hayes says that the recent fall in the prices of crypto assets has offered an excellent opportunity to accumulate.

“I’m buying Solana and doggie coins (memecoins) for momentum trading positions. For longer-term sh*tcoin positions, I’m upping my allocations in Pendle and will identify other tokens that are ‘on sale.’

I will use the rest of May to increase my exposure. And then it’s time to set it, forget it, and wait for the market to appreciate the inflationary nature of the recent US monetary policy announcements.”

The BitMEX founder is an advisor and investor in Pendle (PENDLE), a decentralized finance crypto project that lets users tokenize and sell future yields.

On his Bitcoin (BTC) forecast between now and August, Hayes says,

“A rally to above $60,000 and then range-bound price action between $60,000 and $70,000 until August.”

Bitcoin is trading at $62,726 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

New Global Currency Designed To Ditch US Dollar, Avert Sanctions Emerging As BRICS Leaders Prepare To Meet: Report

Analyst Says Bitcoin Price Is Headed To $90,000, Here’s Why

Venture Capitalists Funnel Nearly $2,500,000,000 Into Crypto in Q1 of 2024: Galaxy Research

Injective (INJ) Price In Danger If It Falls To Crucial Support Level: Analyst

Bitcoin and Other Cryptos Set To Begin ‘Slow Grind Higher,’ Says Arthur Hayes – Here Are His Top Altcoin Picks

Daily Active Addresses Hit 514,000 As DOT Price Surges 7%

Announces $1,000,000 Creator and Community Member Grants & Bybit IDO – Blockchain News, Opinion, TV and Jobs

JPMorgan Chase, Bank of America and Citibank Holding $7,427,000,000,000 Off-Balance Sheet in Potentially Dangerous Cocktail of Unknown Assets: Report

Crypto Expert Turns Bullish On Bitcoin, Predicts Quantitative Easing Will Begin Soon

US DOJ Indicts Manhattan Man on Fraud Charges Related to $43,000,000 Fake Crypto Ponzi Scheme

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs