Altcoin

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Published

2 weeks agoon

By

admin

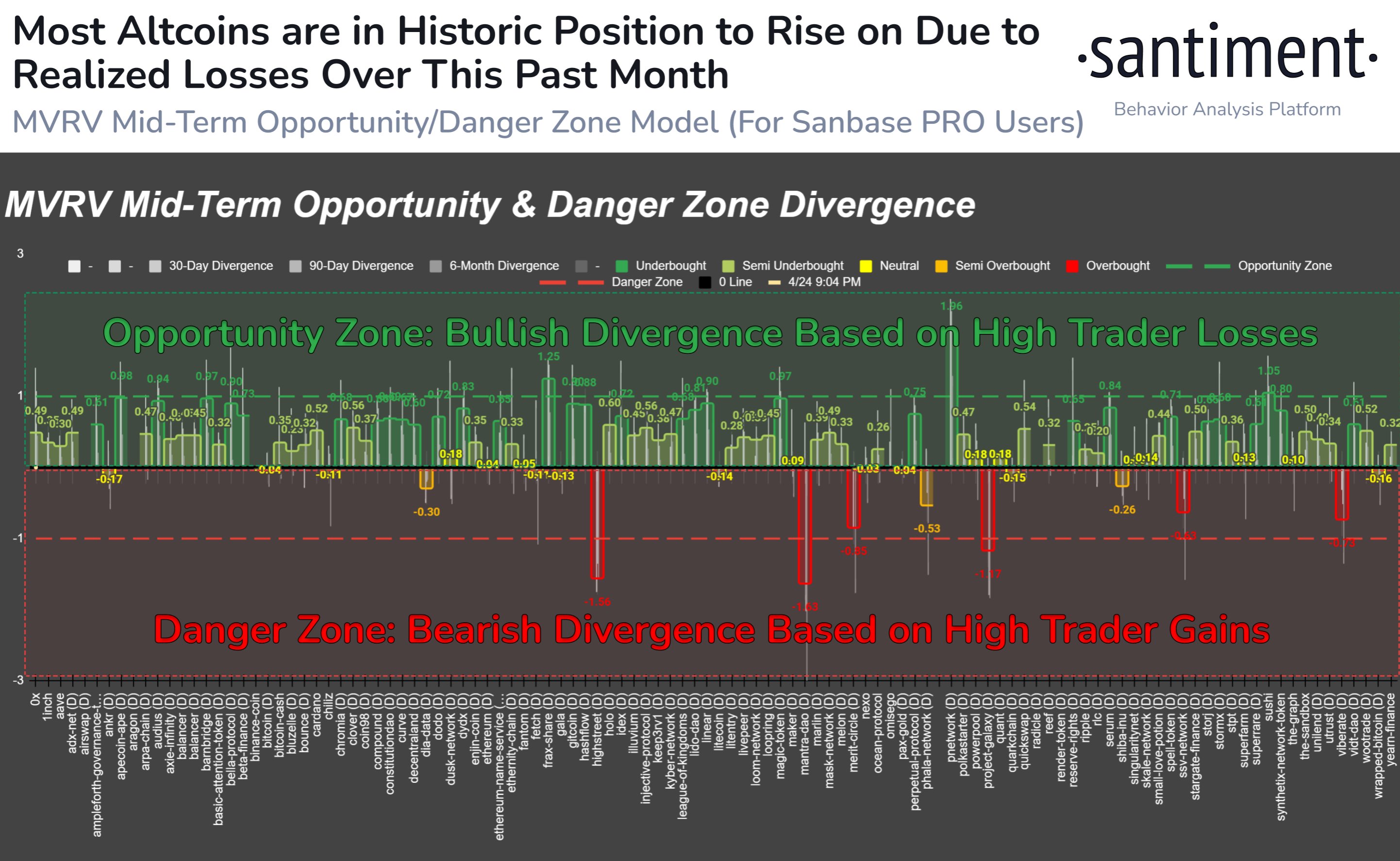

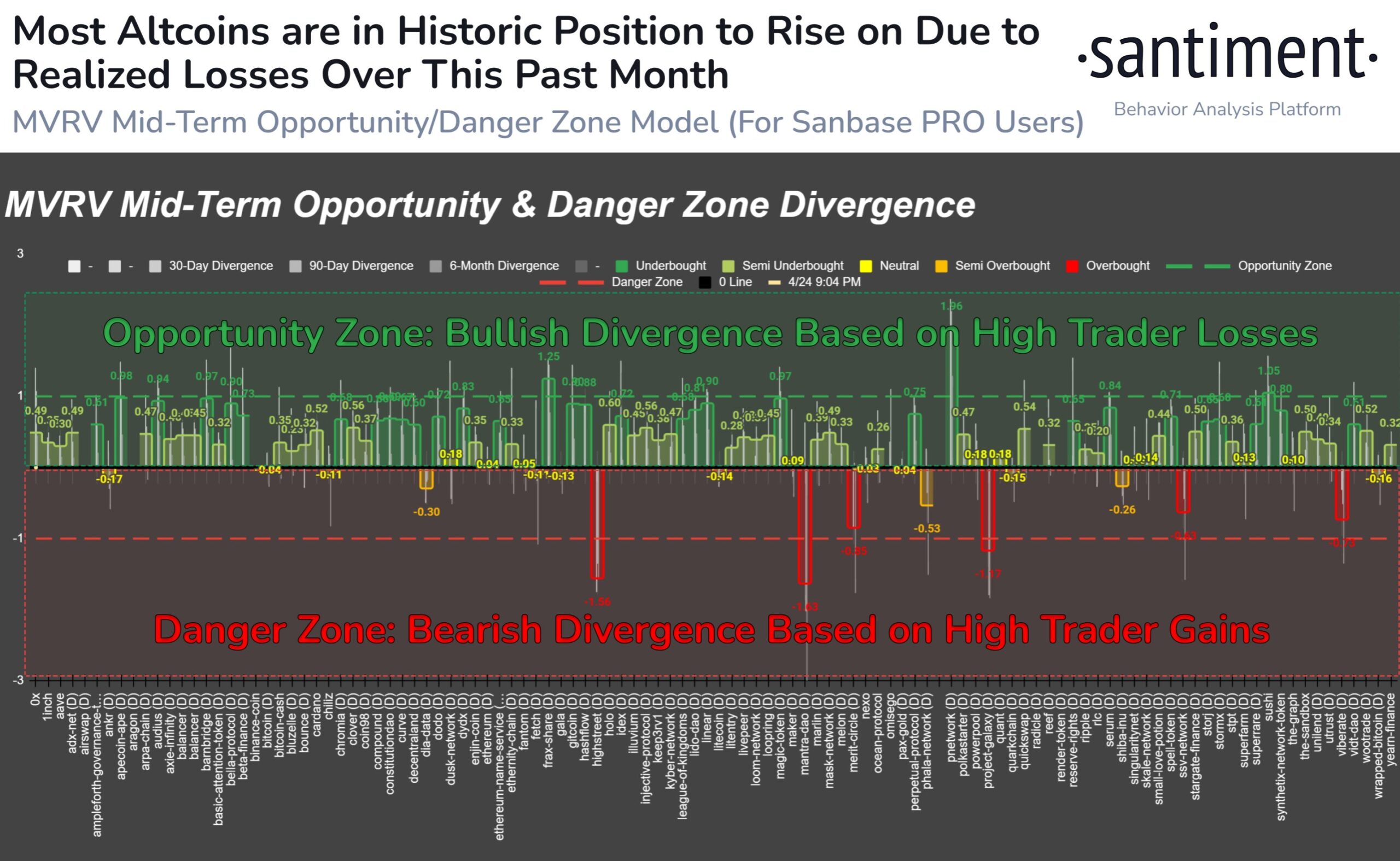

The on-chain analytics firm Santiment has revealed that over 85% of all altcoins in the sector are currently in the historical “opportunity zone.”

MVRV Would Suggest Most Altcoins Are Ready For A Bounce

In a new post on X, Santiment discussed how the altcoin market looks based on their MVRV ratio model. The “Market Value to Realized Value (MVRV) ratio” is a popular on-chain indicator that compares the market cap of Bitcoin against its realized cap.

The market cap here is the usual total valuation of the asset’s circulating supply based on the current spot price. At the same time, the latter is an on-chain capitalization model that calculates the asset’s value by assuming the “true” value of any coin in circulation is the last price at which it is transferred on the blockchain.

Given that the last transaction of any coin would have likely been the last time it changed hands, the price at its time would act as its current cost basis. As such, the realized cap essentially sums up the cost basis of every token in the circulating supply.

Therefore, one way to view the model is as a measure of the total amount of capital the investors have put into the asset. In contrast, the market cap measures the value holders are carrying.

Since the MVRV ratio compares these two models, its value can tell whether Bitcoin investors hold more or less than their total initial investment.

Historically, when investors have been in high profits, tops have become probable to form, as the risk of profit-taking can spike in such periods. On the other hand, a dominance of losses could lead to bottom formations as selling pressure runs out in the market.

Based on these facts, Santiment has defined an “opportunity” and “danger” zone model for altcoins. The chart below shows how the market currently looks from the perspective of this MVRV model.

The data for the MVRV divergence for the various altcoins | Source: Santiment on X

Under this model, when the MVRV divergence for any asset on some timeframe is higher than 1, the coin is considered to be inside the bullish opportunity zone. Similarly, if it is less than -1, it suggests it’s in the bearish danger zone.

The chart shows that MVRV divergence for a large part of the market is in the opportunity zone right now. As the analytics firm explains,

Over 85% of assets we track are in a historic opportunity zone when calculating the market value to realized value (MVRV) of wallets’ collective returns over 1-month, 3-month, and 6-month cycles.

Thus, if the model is to go by, now may be the time to go around altcoin shopping.

ETH Price

Ethereum, the largest among the altcoins, has observed a 3% surge over the past week, which has taken its price to $3,150.

Looks like the price of the asset has gone up over the last few days | Source: ETHUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Trader Calls Memecoin One of Strongest Altcoins, Updates Outlook on Dogecoin and Three Other Crypto Assets

Crypto Analyst Says Massive Surge Is Coming, Here’s The Target

Paolo Ardoino Dismisses Rumors That Bitfinex Suffered Database Breach Last Month

Is Avalanche About To Blow? Don’t Miss This Potential Breakout

GBM Auctions to Host Memorabilia Auction with Polkadot Creator Dr. Gavin Wood – Blockchain News, Opinion, TV and Jobs

Weakening Dollar Could Boost Crypto and Push One Altcoin to Astronomical Price Target: Economist Henrik Zeberg

Altcoin

Is Avalanche About To Blow? Don’t Miss This Potential Breakout

Published

13 hours agoon

May 6, 2024By

admin

Smart contracts platform Avalanche (AVAX) is generating excitement in the crypto community with a potential breakout signal. Prominent analyst World of Chart has identified a bullish technical pattern that could propel AVAX prices significantly higher in the coming days.

Falling Wedge Pattern Hints At Upside

World of Chart points to the presence of a “falling wedge” pattern on AVAX’s price chart. This pattern typically forms during a consolidation phase, with price action confined between two converging trendlines that slope downwards.

Forming Falling Wedge Incase Of Breakout Expecting Upside Continuation Successful Breakout Can Lead Massive Rally In Coming Days#Crypto #Avax pic.twitter.com/YJHJYarrSw

— World Of Charts (@WorldOfCharts1) May 5, 2024

The key aspect of this pattern lies in the diminishing price range within the wedge, suggesting a buildup of buying pressure. A breakout from the upper trendline is often interpreted as a bullish signal, indicating a potential reversal of the downtrend and the start of a price surge.

Avalanche Poised For Takeoff?

AVAX might see a significant upswing if it is able to break above the upper trendline of the falling wedge, according to World of Chart.

Following the breakout, there may be a substantial price increase as a result of this ascent, which would confirm the bullish formation. The expert draws attention to the possibility of significant momentum and an explosive upward advance.

Total crypto market cap currently at $2.3 trillion. Chart: TradingView

The possibility of an AVAX breakout has ignited discussions and speculation among crypto investors and traders, particularly those who actively follow technical analysis.

Investor Caution Advised Despite Bullish Outlook

While the potential for a bullish breakout is high, World of Chart emphasizes the inherent volatility and uncertainty of the cryptocurrency market. External factors beyond technical analysis can significantly impact price movements.

Technical Indicators Paint A Positive Picture

Beyond the falling wedge pattern, other technical indicators seem to be adding weight to the bullish narrative for AVAX. The recent price increase of over 16% in a single week suggests a potential shift in investor sentiment.

Additionally, the impressive surge in trading volume signifies heightened market activity and growing investor interest in AVAX.

Source: Coingecko

Eyes On The Prize: Will Avalanche Deliver?

The coming days will be crucial, with all eyes glued to the price action and any signs of a breakout. A successful breakout could lead to significant gains for AVAX holders, while a failed breakout could dampen investor enthusiasm.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoin

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Published

5 days agoon

May 2, 2024By

admin

Dogecoin (DOGE), the Shiba Inu-faced darling of the 2021 memecoin frenzy, has found itself shivering in the current crypto winter. Once a symbol of retail investor exuberance, DOGE has plummeted over 70% from its sky-high peak, leaving its future shrouded in uncertainty.

DOGE Feels The Crypto Frost

While Bitcoin, the heavyweight champion of the crypto world, grabs headlines with its recent wobble, the impact on memecoins like DOGE has been brutal. Unlike Bitcoin’s divided analyst opinions, the sentiment surrounding DOGE is decidedly bearish.

At the time of writing, the memecoin was trading at $0.132, down 5.4% up the last 24 hours but sustained a 20% loss in the last seven days, data from Coingecko shows.

Dogecoin price action in the last 30 days. Source: Coingecko

Is DOGE A Canary In The Crypto Coal Mine?

Some analysts believe DOGE’s struggles are a canary in the coal mine for the entire crypto market. They said if even a historically high-flying memecoin like Dogecoin can’t hold onto gains, it raises serious concerns about risk appetite in the crypto space in general.

Dogecoin market cap currently at $18 billion. Chart: TradingView.com

Whales Accumulating DOGE: A Glimmer Of Hope?

However, a glimmer of hope flickers for the dethroned meme king. On-chain data suggests an increase in large wallet purchases of DOGE, hinting at potential accumulation by wealthy investors. This “contrarian” behavior could be a sign that some whales are using Coinglass or similar platforms to track Dogecoin derivatives and believe the coin is undervalued and ripe for a comeback.

Source: Coinglass

Coinglass, a popular cryptocurrency data provider, offers insights into factors that might be influencing the whales’ decisions. By analyzing metrics like open interest, funding rates, and liquidations on Coinglass, these investors might see an opportunity to buy DOGE at a discount.

Related Reading: Solana Crawls: Network Update Fails To Fix Traffic Jam, Price Feels The Pinch

In a similar development, Whale Alert, a well-known blockchain tracker, has reported that a DOGE whale arranged two large transactions in a single day. Some 150,000,000 Dogecoins were transferred in the first transaction, and an additional 76,316,694 DOGE were transferred in the second, for a total of almost 226 million DOGE. At the time, the meme cryptocurrency was worth around $40 million in fiat money.

🚨 150,000,000 #DOGE (21,281,922 USD) transferred from #Robinhood to unknown wallethttps://t.co/7U1CEfr2ZT

— Whale Alert (@whale_alert) April 29, 2024

Can Dogecoin Thaw The Crypto Winter?

The coming weeks will be critical for DOGE. The return of positive social media sentiment, coupled with continued accumulation by whales who might be strategically using Coinglass for market analysis, could be the spark that reignites the DOGE rally. However, if the broader market weakness persists, DOGE’s summer might be spent shivering in the doghouse.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Stellar (XLM), a prominent player in the digital asset landscape, is experiencing a surge in optimism as analysts forecast a significant price increase in the near future. The cryptocurrency, currently priced at $0.1126, has demonstrated stability amidst market fluctuations, attracting investor interest and propelling a potential bullish trend.

Source: Coingecko

Stellar Breaks Out Of Technical Pattern

This newfound optimism stems from a recent technical breakout. XLM successfully emerged from an Ascending Triangle pattern, a bullish indicator that often precedes price surges. This breakout was further bolstered by a retest of the breakout level, solidifying the potential for an upward trajectory.

Technical analysts are leveraging the measured move technique to predict XLM’s future price movement. This analysis suggests a target range spanning from 0.38 to 0.47 cents, aligning with Fibonacci levels 0.70 to 0.78. This range signifies substantial growth potential, enticing investors seeking profitable opportunities.

Total crypto market cap currently at $2.2 trillion. Chart: TradingView

Investor Confidence On The Rise

Beyond technical indicators, investor confidence is playing a significant role in Stellar’s projected rise. The recent 2.50% price increase over the last 24 hours underscores this growing momentum. This shift in market sentiment indicates a bullish trend, potentially leading to a notable price appreciation in the coming months.

Analyst Projects Stellar To Reach $0.47

Adding fuel to the fire, crypto analyst EGRAG CRYPTO recently shared a bullish forecast for XLM’s price trajectory. The analyst predicts a surge towards a promising target of $0.47, highlighting the potential for substantial growth. This bullish sentiment resonates with investors and enthusiasts, further bolstering confidence in Stellar’s future.

#XLM Rockets Towards 0.47c!

🔥 #XLM has successfully broken out of the Ascending Triangle and is currently retesting the breakout level. This sets the stage for a potential bullish move.

📈 The measured move suggests a target range between Fib 0.702-0.786 (0.38-0.47c),… pic.twitter.com/bmezGMnrTI

— EGRAG CRYPTO (@egragcrypto) April 23, 2024

The analysis digs deeper, identifying key Fibonacci retracement levels as crucial milestones for XLM. These levels not only serve as potential profit-taking targets for investors but also signify the strength of the upward momentum.

XLM seven-day price action. Source: Coingecko

Interestingly, the analysis suggests that XLM has the potential to surpass traditional technical indicators. Should the cryptocurrency surpass the formidable Fib 1.618 level, it could embark on a remarkable ascent, exceeding expectations and venturing into uncharted territory.

Market Volatility Warns For Caution

While the outlook for Stellar appears promising, it’s crucial to remember the inherent volatility of the cryptocurrency market. Unforeseen events and market fluctuations can significantly impact prices.

Despite the inherent risks, the technical indicators and growing investor confidence paint a compelling picture for Stellar’s future. As the digital asset landscape continues to evolve, Stellar’s potential for significant growth is undeniable.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Trader Calls Memecoin One of Strongest Altcoins, Updates Outlook on Dogecoin and Three Other Crypto Assets

Crypto Analyst Says Massive Surge Is Coming, Here’s The Target

Paolo Ardoino Dismisses Rumors That Bitfinex Suffered Database Breach Last Month

Is Avalanche About To Blow? Don’t Miss This Potential Breakout

GBM Auctions to Host Memorabilia Auction with Polkadot Creator Dr. Gavin Wood – Blockchain News, Opinion, TV and Jobs

Weakening Dollar Could Boost Crypto and Push One Altcoin to Astronomical Price Target: Economist Henrik Zeberg

Ethereum Price Reclaims 100 SMA But Bulls Still Lack Strength To Clear Hurdles

Crypto Trader Says Three Altcoins Are His Golden Tickets, Flips Bullish on One Memecoin With ‘Monster’ Chart

XRP Holders Stack Coins Despite Price Dip: Bullish Signal?

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Employee at Billion-Dollar Bank Arrested, Accused of Stealing $44,000 From Account of Deceased Customer

Analyst Reveals Why It’s Time To Get Back Into ADA

Six to Twelve Months of ‘Parabolic Advance’ on the Horizon for Bitcoin, According to On-Chain Analyst

10x Research Reveals Next Steps From Here

New Global Currency Designed To Ditch US Dollar, Avert Sanctions Emerging As BRICS Leaders Prepare To Meet: Report

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs