Altcoins

Weakening Dollar Could Boost Crypto and Push One Altcoin to Astronomical Price Target: Economist Henrik Zeberg

Published

2 weeks agoon

By

admin

Economist Henrik Zeberg says that a loss of strength for the dollar could be the catalyst that breathes new life into crypto assets.

Zeberg tells his 136,000 followers on the social media platform X that lower bond yields and a weakening dollar index (DXY), which pits the dollar against a basket of other major foreign currencies, will create an “amazing environment” for risk assets like crypto.

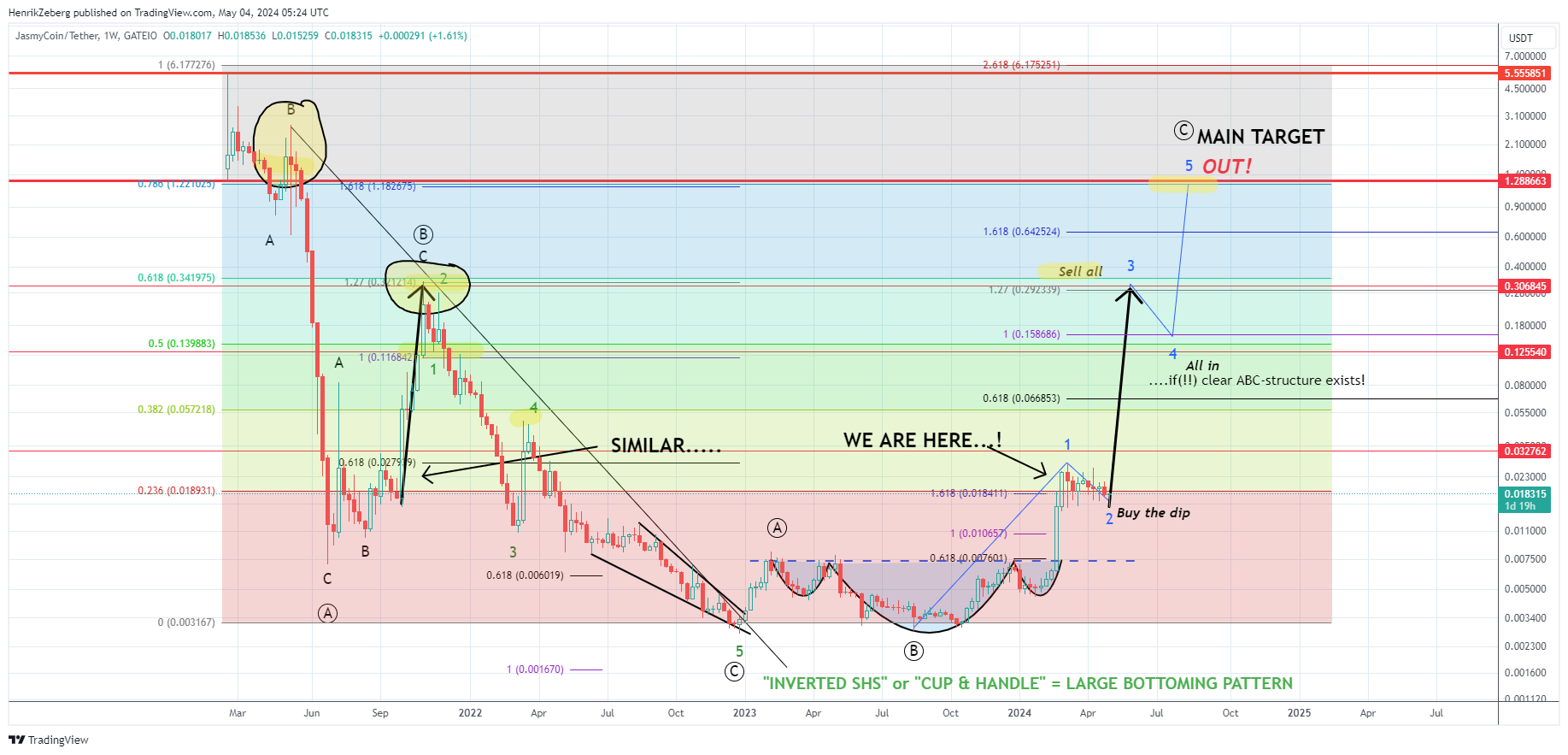

To ride the crypto rally, Zeberg says he has his eye on JasmyCoin (JASMY), a blockchain-based personal data storage project.

“I think a push lower in DXY and yields will create an amazing environment for crypto into the last phase of this risk asset bull market.

I think the next phase for Jasmy is wave three!

Later wave four into summer (while DXY bounces) – and then the final boost into late summer – early Autumn.

It may be that the target “only” becomes $0.3ish… but for now, the above is my main thesis.

I AM THE JASMY-FATHER!”

The economist appears to be using the Elliott Wave theory in his analysis. The theory states that a bullish asset will witness a five-wave move to the upside before topping out.

Zooming in on JASMY’s technicals, Zeberg says that the moving average convergence divergence (MACD) and the relative strength index (RSI) indicators are in the process of crossing bullish on the daily chart.

The RSI and MACD are both momentum indicators that traders use to spot points of potential trend reversals.

Says Zeberg,

“Bullish cross-over on MACD.

RSI breaking the downward trend.

We have seen that before….. just before the 400-500% Run higher.

This time, I expect the move to be BIGGER!

All onboard?”

At time of writing, JASMY is worth $0.02, up over 6% in the past day.

As for Bitcoin (BTC), Zeberg previously said the crypto king will be ready to enter a “melt-up” phase once its monthly RSI hits 70.

”So I got $110,000-$115,000 for Bitcoin. It is actually a part of a larger pattern. I see that this is either the beginning of a new bull [run], but it needs to take a long break after the blow-off top.

But we haven’t gotten to the really steep part of it yet. We see that we get to [an] RSI above 70, that is really when we see the steep part.”

At time of writing, Bitcoin is trading for $64,400 with its monthly RSI hovering at 68.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Altcoins

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Published

1 week agoon

May 9, 2024By

admin

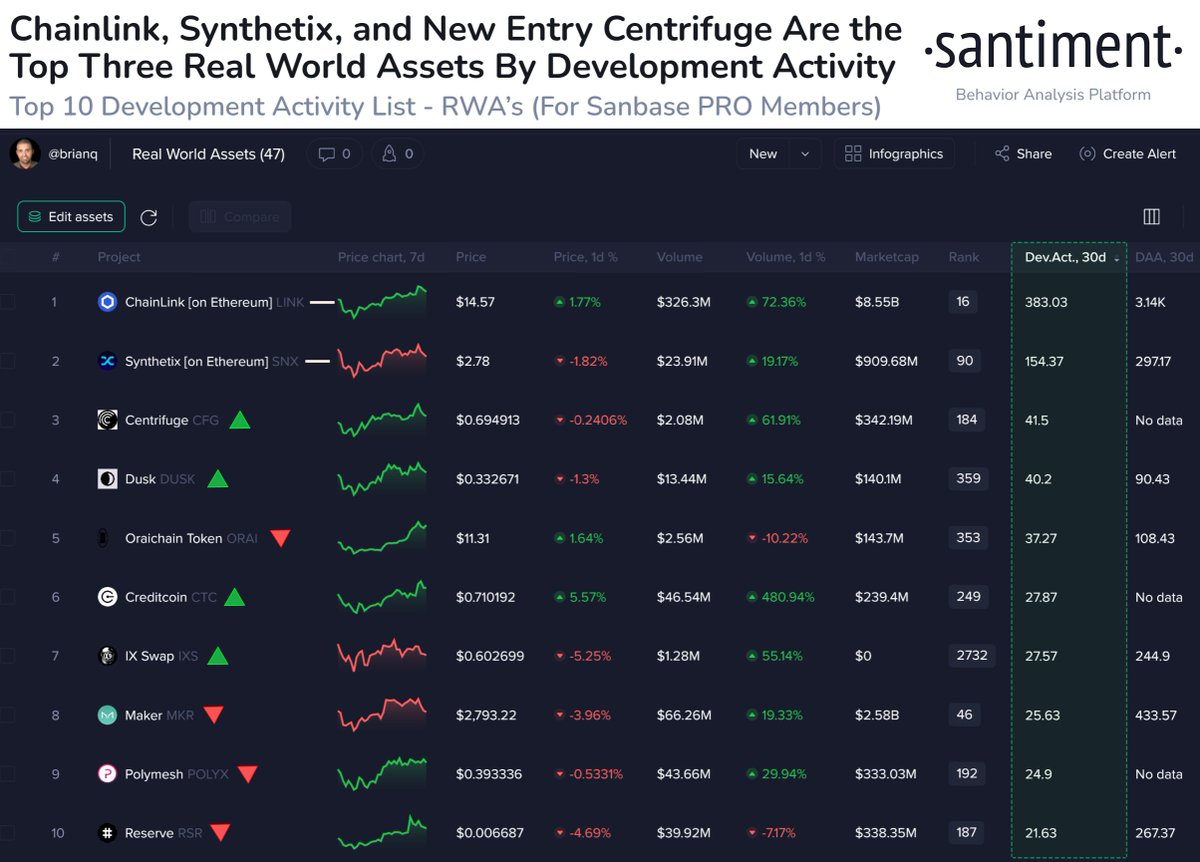

Blockchain analytics platform Santiment says one Ethereum (ETH)-based altcoin project is leading in the real-world asset (RWA) sector based on development activity.

Santiment says that blockchain oracle Chainlink (LINK) is seeing the greatest amount of daily activity on the development hosting platform GitHub.

LINK Is seeing more than two times the amount of development activity compared to the second most active blockchain project, Synthetix (SNX), a decentralized finance (DeFi) crypto that allows synthetic asset creation on Ethereum.

“Here are crypto’s top real-world assets by development. This list is compiled by counting any non-redundant GitHub activity, and averaging this daily activity over the past 30 days. Chainlink currently produces 2.49x more daily activity than the next most active project, Synthetix, in the RWA sector.”

Santiment’s ranking list is as follows: 1. Chainlink 2. Synthetix.io 3. Centrifuge (CFG) 4. Dusk (DUSK) 5. Oraichain (ORAI) 6. Creditcoin (CTC) 7. IX Swap (IXS) 8. Maker (MKR) 9. Polymesh Network (POLYX) 10. Reserve Rights (RSR).

Santiment also says that the native asset of decentralized oracle protocol Tellor (TRB) is outperforming most other digital assets so far this month.

“Tellor is one of the top performing assets thus far in May, exactly doubling in market cap since the calendar month turned. Whale transactions and address activity have both seen sudden spikes, which are suggesting potential TRB profit takes.”

Tellor is trading for $111.64 at time of writing, up 16% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Published

2 weeks agoon

May 8, 2024By

admin

The hacker who looted the crypto exchange Poloniex has started moving Ethereum (ETH) to the mixing service Tornado Cash, according to the digital asset de-anonymizing platform Arkham.

Arkham notes the hacker moved 1126.1 ETH worth more than $3.4 million into Tornado Cash across a series of 20 transactions on Monday and Tuesday.

They represent the exploiter’s first moves into the controversial Ethereum-based crypto mixer, which helps users conceal their digital assets.

The hacker raided Poloniex in early November, stealing $56 million worth of ETH, $48 million worth of Tron (TRX) and $18 million worth of Bitcoin (BTC), as well as smaller amounts of other crypto assets.

The exchange, which is owned by Tron founder Justin Sun, offered a 5% white hat bounty that went unaccepted. and the hacker still holds $181.47 million worth of crypto in their primary address, according to Arkham.

Justin Sun-affiliated projects have endured a prolific string of attacks in the past several months: In September, hackers exploited the Sun-linked exchange giant HTX for approximately 4,999 Ethereum worth $7.9 million, according to the blockchain security firm PeckShield.

Then in November, hackers hit HTX and Heco Bridge, another Sun-linked project that’s used to move funds between Ethereum and energy-saving blockchain Heco Chain, for a combined $100 million, according to cybersecurity firm Cyvers.

And in January, hackers once again struck HTX, hitting the exchange with a distributed denial of service (DDoS) attack that caused a brief outage.

A DDoS attack is a malicious attempt by bad actors to flood the target website with traffic to overwhelm the site’s infrastructure.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

‘Last Dip Ever’ – Analyst Predicts Solana Rally, Says Three Memecoins Will Surge Alongside SOL

Published

2 weeks agoon

May 8, 2024By

admin

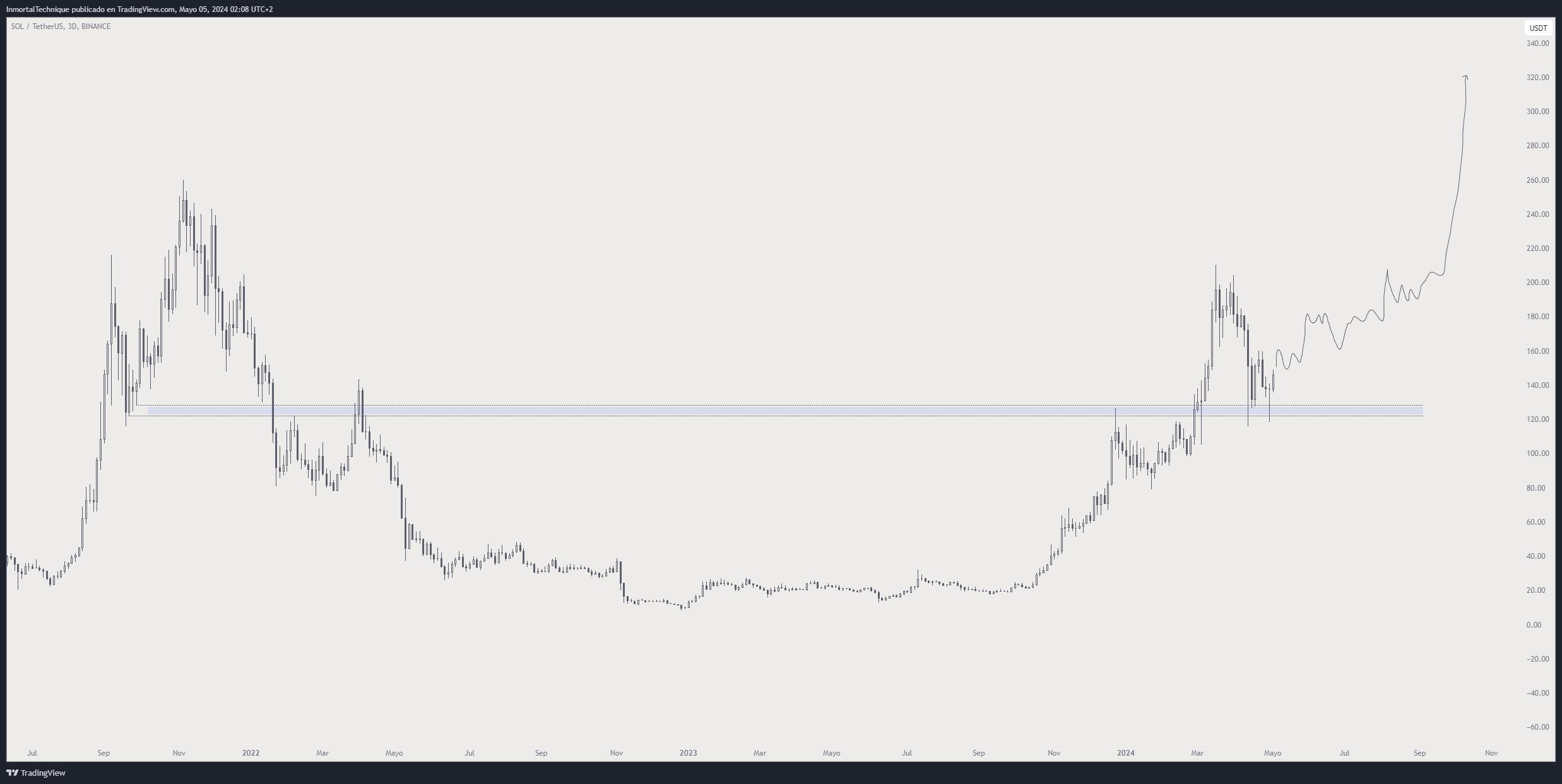

A closely followed crypto trader believes that Solana (SOL) just witnessed its last major correction for this market cycle.

Pseudonymous analyst Inmortal tells his 213,300 followers on the social media platform X that SOL bulls successfully defended support at around $120.

The trader shares a chart suggesting that the blue-chip altcoin is now poised to rally to a fresh 2024 high at $320.

“Last dip ever.

SOL.”

At time of writing, SOL is worth $153.45, suggesting an upside potential of nearly 110% if the altcoin hits the analyst’s target.

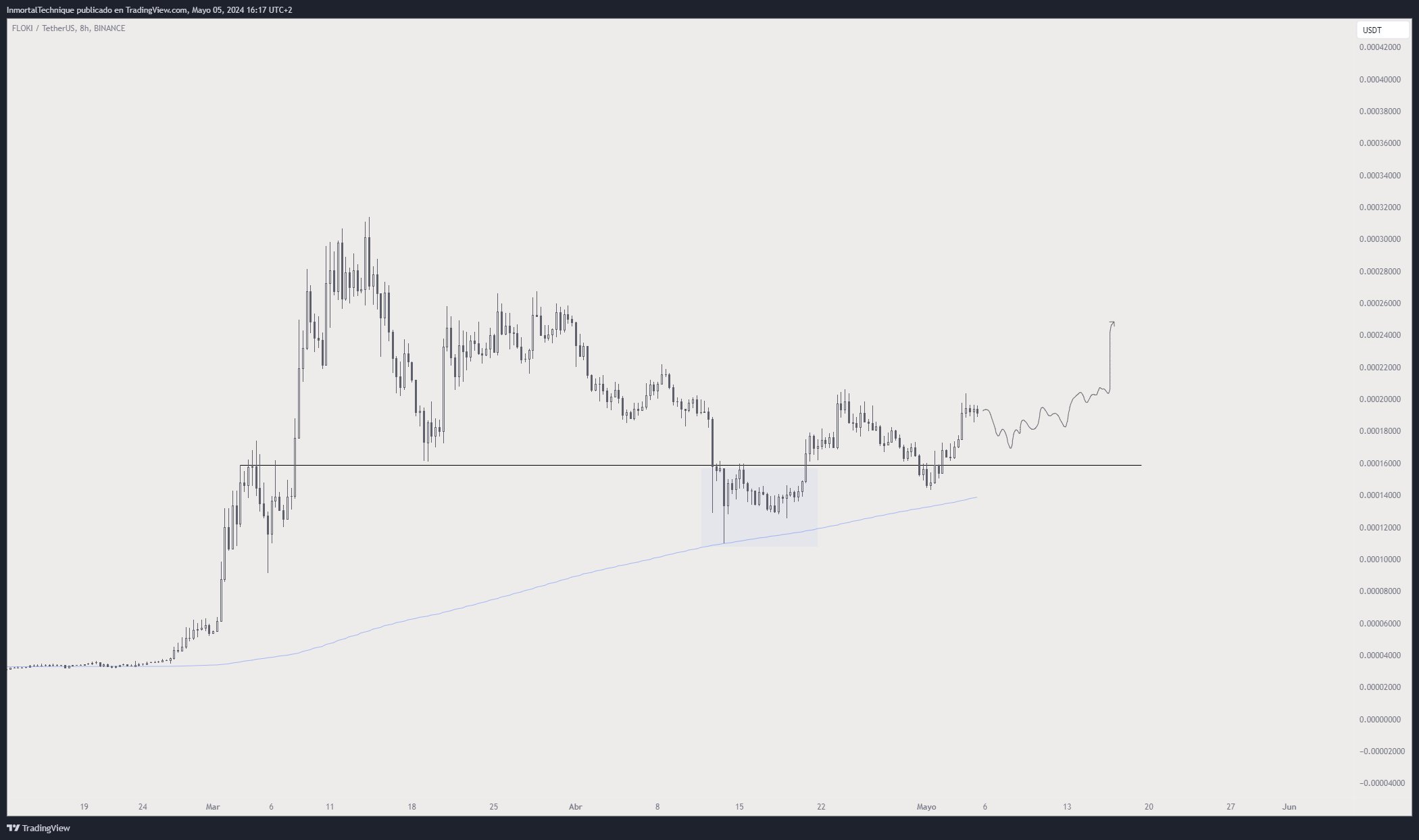

Inmortal also predicts that a trio of memecoins will rally alongside Solana. The trader is taking a close watch on Floki (FLOKI), which he says looks bullish after retesting the 200 moving average (MA) on the eight-hour chart and reclaiming support at $0.00015.

Inmortal believes that FLOKI will dip to around $0.00017 before surging to $0.00025 later this month.

“IF SOL goes up, THEN FLOKI, DOGE, PEPE go up too.

Especially interested in FLOKI

> Deviation + Retest + 200 MA

> A bit lagged.”

At time of writing, FLOKI is trading at $0.000179.

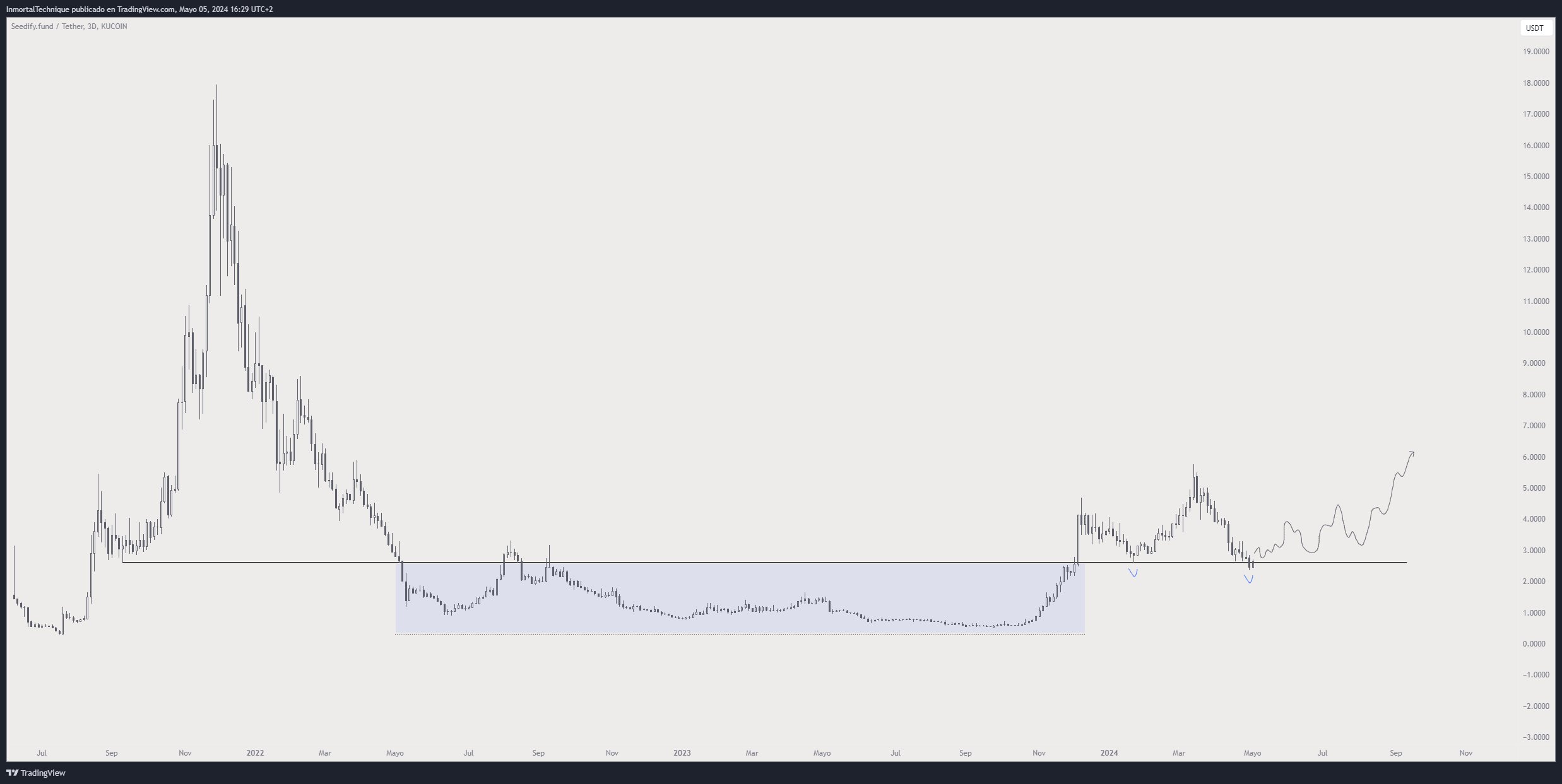

Another coin on the trader’s radar is Seedify.Fund (SFUND), an incubator and launchpad specializing in blockchain gaming. According to the analyst, SFUND is currently in the process of cementing the $2.60 level as support.

“Retesting a 578 days accumulation, for the second time.

Definitely, you don’t see this every day.

SFUND.”

Looking at the trader’s chart, he seems to predict that SFUND will rally to $6 in the coming months. At time of writing, SFUND is trading at $2.65.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs