Bitcoin

‘Violent to the Upside’: This Catalyst Could See Bitcoin Explode by up to 1,486%, Says Strike CEO Jack Mallers

Published

1 week agoon

By

admin

The CEO of Bitcoin’s Lightning Network wallet Strike Jack Mallers is predicting that the flagship crypto asset could reach a seven-figure price during the current cycle.

Mallers says in an appearance on the David Lin YouTube channel that efforts to save the bond market could lead to a looser monetary policy, consequently triggering Bitcoin (BTC) to appreciate by between 297% and 1,486% from the current level.

“The bond market is in trouble for really arguably the first time in modern financial history. Bondholders are getting absolutely demolished and crushed. Now who owns bonds? All of our banks. So our bank deposits aren’t there because the bonds that were purchased with my deposit are underwater.

And so if central banks and governments are going to try and save that market, the amount of liquidity that’s needed is going to send assets very high…

So if that happens it’s impossible to speculate on an asset as scarce as Bitcoin. But I think $250,000 to one million is the imagination I have in that range of just how big this can get. And that’s based on all the liquidity that’s going to be required to make this market solvent.”

According to the Strike CEO, the price is the “most accurate key performance indicator (KPI)” concerning Bitcoin adoption.

“What price tells me is a rather accurate measurement of how much of the world is using Bitcoin as money.

And so I expect more of the world to take on Bitcoin as money whether it be for any form of use case or value to them because it is so appealing in solving so many different problems.

So I expect the adoption of Bitcoin as a monetary unit to go up. And then against the dollar in particular and other fiat currencies, I expect it to be violent to the upside.”

Bitcoin is trading at $63,035 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

You may like

Paolo Ardoino Dismisses Rumors That Bitfinex Suffered Database Breach Last Month

Is Avalanche About To Blow? Don’t Miss This Potential Breakout

GBM Auctions to Host Memorabilia Auction with Polkadot Creator Dr. Gavin Wood – Blockchain News, Opinion, TV and Jobs

Weakening Dollar Could Boost Crypto and Push One Altcoin to Astronomical Price Target: Economist Henrik Zeberg

Ethereum Price Reclaims 100 SMA But Bulls Still Lack Strength To Clear Hurdles

Crypto Trader Says Three Altcoins Are His Golden Tickets, Flips Bullish on One Memecoin With ‘Monster’ Chart

Altcoins

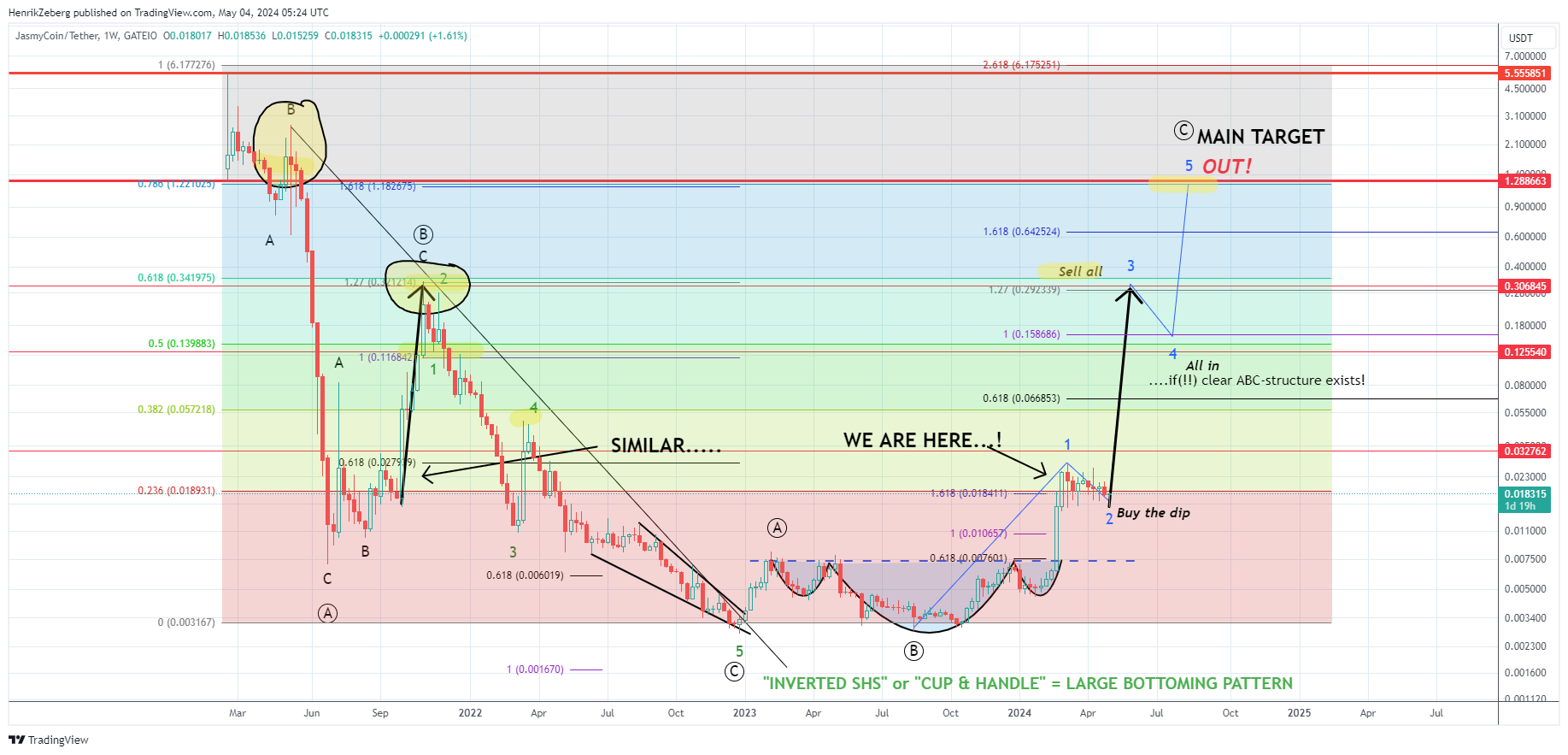

Weakening Dollar Could Boost Crypto and Push One Altcoin to Astronomical Price Target: Economist Henrik Zeberg

Published

10 hours agoon

May 6, 2024By

admin

Economist Henrik Zeberg says that a loss of strength for the dollar could be the catalyst that breathes new life into crypto assets.

Zeberg tells his 136,000 followers on the social media platform X that lower bond yields and a weakening dollar index (DXY), which pits the dollar against a basket of other major foreign currencies, will create an “amazing environment” for risk assets like crypto.

To ride the crypto rally, Zeberg says he has his eye on JasmyCoin (JASMY), a blockchain-based personal data storage project.

“I think a push lower in DXY and yields will create an amazing environment for crypto into the last phase of this risk asset bull market.

I think the next phase for Jasmy is wave three!

Later wave four into summer (while DXY bounces) – and then the final boost into late summer – early Autumn.

It may be that the target “only” becomes $0.3ish… but for now, the above is my main thesis.

I AM THE JASMY-FATHER!”

The economist appears to be using the Elliott Wave theory in his analysis. The theory states that a bullish asset will witness a five-wave move to the upside before topping out.

Zooming in on JASMY’s technicals, Zeberg says that the moving average convergence divergence (MACD) and the relative strength index (RSI) indicators are in the process of crossing bullish on the daily chart.

The RSI and MACD are both momentum indicators that traders use to spot points of potential trend reversals.

Says Zeberg,

“Bullish cross-over on MACD.

RSI breaking the downward trend.

We have seen that before….. just before the 400-500% Run higher.

This time, I expect the move to be BIGGER!

All onboard?”

At time of writing, JASMY is worth $0.02, up over 6% in the past day.

As for Bitcoin (BTC), Zeberg previously said the crypto king will be ready to enter a “melt-up” phase once its monthly RSI hits 70.

”So I got $110,000-$115,000 for Bitcoin. It is actually a part of a larger pattern. I see that this is either the beginning of a new bull [run], but it needs to take a long break after the blow-off top.

But we haven’t gotten to the really steep part of it yet. We see that we get to [an] RSI above 70, that is really when we see the steep part.”

At time of writing, Bitcoin is trading for $64,400 with its monthly RSI hovering at 68.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Published

22 hours agoon

May 5, 2024By

admin

ETFswap (ETFS) is reshaping how the crypto industry interacts with Spot Bitcoin ETFs through the tokenization of assets, triggering massive demand for its token presale.

The approval of the first Spot Bitcoin ETFs in January 2024 by the United States Security and Exchange Commission (SEC) opened up the industry for fresh investment from new investors. However, Spot Bitcoin ETFs are not very accessible to the broader crypto community members, but to the deep pockets in the crypto industry.

Thankfully, ETFswap (ETFS) is reshaping the whole dynamics by making it possible for all in the crypto industry to invest in Spot Bitcoin ETFs and other related products. With ETFswap (ETFS) changing the status quo, its token presale has seen massive demand, with over $250,000 raised in a few days.

ETFSwap Brings Spot Bitcoin ETFs To The Blockchain With Tokenization

ETFswap (ETFS) is a blockchain platform that bridges the gap between decentralized and traditional finance by tokenizing exchange-traded funds (ETFs). By tokenizing ETFs and bringing them on-chain, the platform makes it accessible to all crypto community members for trading. By tokenizing traditional assets such as Spot Bitcoin ETFs, ETFSwap (ETFS) will enable investors to easily monitor the progress of this asset before making any trading decisions, thereby minimizing losses for users.

For a smooth trading experience, ETFswap (ETFS) will provide a comprehensive web3 marketplace tailored to the needs of crypto newbies and experts when trading tokenized ETFs. However, experienced traders can take it a notch further by using the up to 10x leverage provided by the platform to increase their earnings significantly.

To protect its ecosystem and investors, ETFswap has undergone an audit of its smart contract by world-renowned blockchain security expert Cyberscope. After thorough checking, Cyberscope saw no critical issues or underlying conditions that could make the platform vulnerable to cyber attacks, making it safe. This means users can invest in Spot Bitcoin ETFs, as well as ETFs from other industries, right on the blockchain without fear of losing their funds to a third-party.

At the heart of the platform is its native token ETFS, which will make it possible to trade tokenized ETFs and also access all the other features on the platform, which includes staking and governance. Finally, as a DeFi platform, new users can access the network without filling out a Know Your Customer (KYC) form, which involves divulging sensitive information online.

ETFS Token Presale Takes Off Following $750,000 Private Sale Raise

ETFswap (ETFS) held a private sale event to introduce its token and ecosystem to large investors in the crypto industry. The event saw two institutional and three angel investors invest a total of $750,000 in just 3 days. To provide user interest, ETFswap (ETFS) refrained from including venture capitalists (VCs) in the sale due to their long-term goal of developing products that will benefit its ecosystem and users instead of catering to VCs.

This is because seeking investment from VCs could result in a deviation from that plan as they will be obligated to work along with the strategies of these investors even if it is not in the platform’s best interest.

Following these achievements, ETFswap (ETFS) is working towards accelerating its platform launch with the funds raised during the private sale. At the end of the private sale, the public presale went live, with the platform offering the token at $0.00854 per coin in Stage one.

By Stage two, the token price will increase to $0.01831, cementing profit for all stage one investors. This assurance of profit has brought in crowds of investors eager to buy this undervalued asset, bringing the number of tokens sold to over 40 million. Further, experts are optimistic that the ETFS token is geared for a massive surge that will take its price to the $1 mark, increasing by 10,000%.

Also, the platform, after launch, intends to partner with other renowned DeFi firms in the crypto industry to advance the growth of decentralized finance. Undoubtedly, such an alliance will bring about more industry adoption for the token.

For a platform that is yet to launch, ETFswap is the real deal with the potential to increase investors’ portfolios massively and also ensure the security of their investment. What are you waiting for? Join ETFswap today by buying ETFS at presale to make a 100x yield on investment.

For more information about the ETFS Presale:

Source link

Bitcoin

Six to Twelve Months of ‘Parabolic Advance’ on the Horizon for Bitcoin, According to On-Chain Analyst

Published

1 day agoon

May 5, 2024By

admin

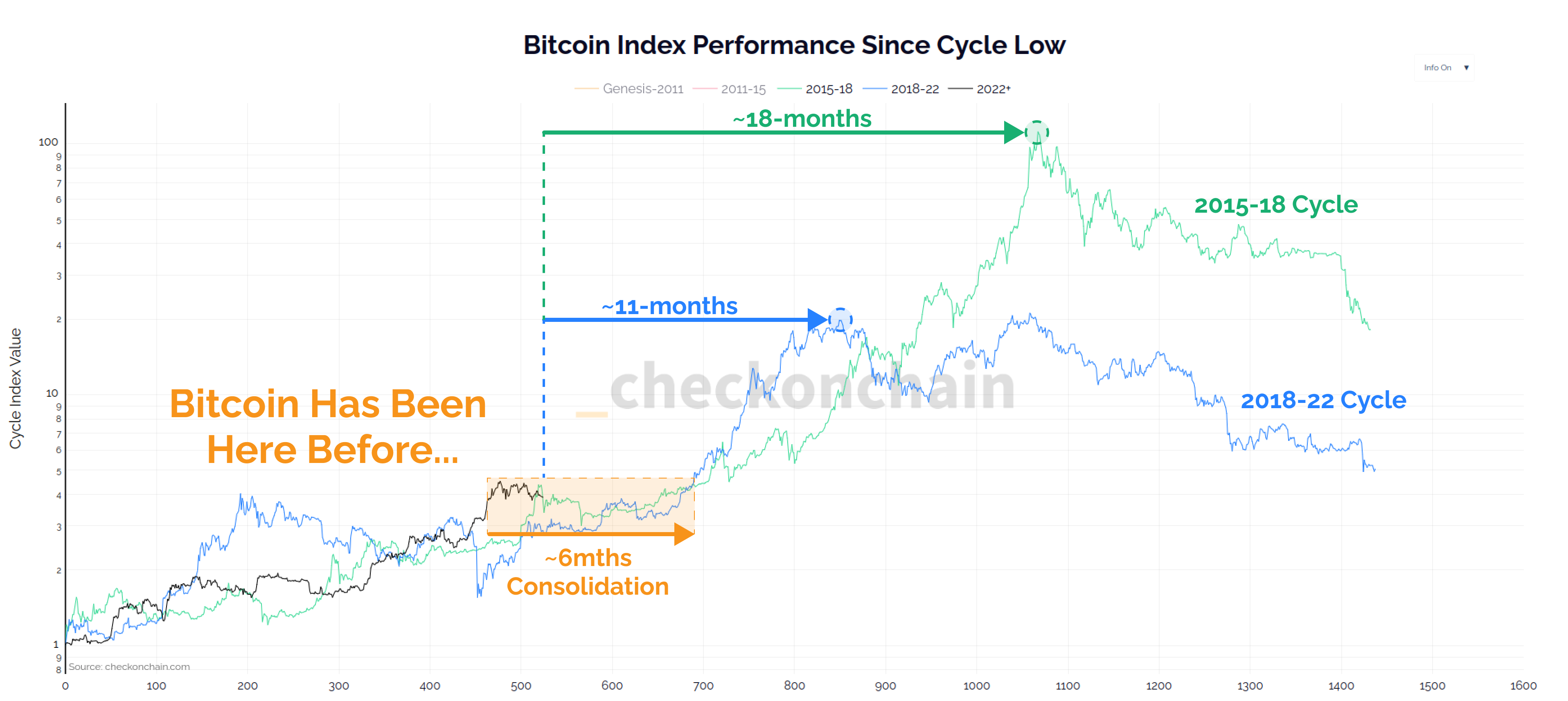

Prominent on-chain analyst Checkmate is updating his outlook on Bitcoin’s (BTC) current market cycle and says that a parabolic move to the upside is likely in sight.

The pseudonymous analyst tells his 90,000 followers on the social media platform X that based on previous cycles, Bitcoin is most likely in for about six months of “chopsolidation” – or a choppy period of consolidation with no real trend shift.

After six months, Checkmate says that six months to a year’s worth of parabolic moves could be in store, based on historical precedence.

“Bitcoin history tends to rhyme, and thus far, this cycle is no different.

The song sung during the last two cycles paints around six-months of chopsolidation ahead of us, followed by 6-12 months of parabolic advance.”

While some are speculating that Bitcoin’s bull run may have already seen its top, Checkmate says such a scenario would be a major break from the “norm” of BTC’s past market cycles.

“If we measure from the cycle high, we see the same chorus.

Establishing a bull market top here would no question be a major break from the Bitcoin norm. It could for sure happen, but we must dig deeper to investigate…

April so far has seen prices drop by over $8,250 MoM (month over month)

I’m expecting text messages from the sidelines saying ‘Hey man, what’s up with Bitcoin, it’s down a lot, I hope you sold it?’”

Checkmate isolates every year in which a Bitcoin halving takes place, and notes that corrections like the one BTC has had since March are par for the course. The analyst also notes that the end of halving years tend to be quite bullish for Bitcoin.

“If we isolate Bitcoin halving years only (2012, 2016, 2020, 2024) we can see MoM performance via table and chart.

MoM corrections of this magnitude are the norm, not the exception, and the end of the year is usually pretty powerful (as per first charts).”

At time of writing, Bitcoin is worth $63,433.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Paolo Ardoino Dismisses Rumors That Bitfinex Suffered Database Breach Last Month

Is Avalanche About To Blow? Don’t Miss This Potential Breakout

GBM Auctions to Host Memorabilia Auction with Polkadot Creator Dr. Gavin Wood – Blockchain News, Opinion, TV and Jobs

Weakening Dollar Could Boost Crypto and Push One Altcoin to Astronomical Price Target: Economist Henrik Zeberg

Ethereum Price Reclaims 100 SMA But Bulls Still Lack Strength To Clear Hurdles

Crypto Trader Says Three Altcoins Are His Golden Tickets, Flips Bullish on One Memecoin With ‘Monster’ Chart

XRP Holders Stack Coins Despite Price Dip: Bullish Signal?

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Employee at Billion-Dollar Bank Arrested, Accused of Stealing $44,000 From Account of Deceased Customer

Analyst Reveals Why It’s Time To Get Back Into ADA

Six to Twelve Months of ‘Parabolic Advance’ on the Horizon for Bitcoin, According to On-Chain Analyst

10x Research Reveals Next Steps From Here

New Global Currency Designed To Ditch US Dollar, Avert Sanctions Emerging As BRICS Leaders Prepare To Meet: Report

Analyst Says Bitcoin Price Is Headed To $90,000, Here’s Why

Venture Capitalists Funnel Nearly $2,500,000,000 Into Crypto in Q1 of 2024: Galaxy Research

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs