Bitcoin ETF

21Shares files spot Solana ETF with SEC

Published

2 days agoon

By

admin

Solana ETF bids have started to trickle in at the SEC as Wall Street is abuzz with cryptocurrency talk and the digital asset regulatory scene shifts course.

Following VanEck’s punt for a Solana (SOL) Trust, fellow wealth manager 21Shares has filed its “21Shares Core Solana ETF” with the Securities and Exchange Commission (SEC), documents submitted on Friday showed. Both filings notably removed crypto staking from bids, a common decision for crypto-backed ETFs lately.

The 21Shares spot Solana ETF application is the second of its kind, as SOL has taken centerstage during this cycle alongside heavy hitters like Bitcoin (BTC) and Ethereum (ETH). After successful Bitcoin ETF and forthcoming Ethereum ETF approvals, SOL has made the rounds as the next cryptocurrency to assume the exchange-traded fund wrapper used to attract institutional capital.

Despite the hype, experts, and industry leaders, like Wintermute CEO Evgeny Gaevoy, argue that bringing spot SOL ETFs to market will be nearly impossible until at least next year. Gaevoy also predicted that low capital inflows into spot ETH ETFs might discourage investors from buying another crypto investment product.

Solana ETF issuers chant SOL commodity status

Classifying Solana’s native token as a commodity instead of a security has been a shared theme among spot SOL ETF filings thus far. The strategy and underlying thesis for SOL-backed funds mirror the pathway followed by would-be spot Ethereum ETF issuers.

On June 27, VanEck’s head of digital assets research, Matthew Sigel, wrote that SOL functions similarly to other digital commodities like Bitcoin and Ether as a transaction fee facility and payment currency for blockchain computational services.

Additionally, Sigel posited that no single entity or intermediary controls the SOL network, further solidifying its decentralized framework and commodity status. “The broad range of applications and services supported by the SOL ecosystem, from decentralized finance (defi) to NFTs, underscores SOL’s utility and value as a digital commodity,” per Sigel.

Source link

You may like

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

Bitcoin ETF

Experts Bullish On Ethereum ETFs Launching July 4, Predicting Potential Surge Beyond $7,000

Published

3 days agoon

June 28, 2024By

admin

As the highly anticipated launch of the first spot Ethereum ETFs in the United States nears, experts are predicting a significant price appreciation for the second-largest cryptocurrency in the market.

Ethereum ETFs On The Horizon

According to a recent Reuters report, the US Securities and Exchange Commission (SEC) could approve Ethereum ETFs as soon as July 4, as discussions between asset managers and regulators enter the final stages.

Industry executives and other participants who requested anonymity due to the confidential nature of the talks revealed that the process of amending the offering documents has progressed to resolving only “minor” issues, and approval is “probably not more than a week or two away.”

Related Reading

According to Morningstar Direct data, the launch of Bitcoin-based ETFs in the US in January was a major success, drawing around $8 billion in assets. By late June, these nine new products had nearly $38 billion in assets, although the holdings of Grayscale Bitcoin Trust – which converted its $27 billion BTC trust into an ETF simultaneously – dipped to $17.8 billion.

However, experts believe the launch of the new spot Ethereum ETFs may not be as impressive as the Bitcoin ETF debut. James Butterfill, head of research at Coinshares, noted that “Ethereum is not the same size in terms of market cap, nor does it have the same volumes” as BTC.

Given the differences in market size and nature of the two cryptocurrencies, Bryan Armour, an ETF analyst at Morningstar, believes inflows may be much more muted when the Ethereum ETFs launch.

“With Bitcoin, there had been pent-up demand for a decade, and investor interest was off the charts,” Armour said. “This just isn’t going to command the same excitement.” However, not everyone shares the same cautious outlook.

ETH Eyes Potential Rally Toward $7,500

Quinn Thompson, the founder and CIO of Lekker Capital, has recently stated that the market is in the middle of “one of the most obvious and attractive crypto buying opportunities of recent memory.”

Thompson further claimed that it was “cool” to be bullish in the past, but now, it appears that “Twitter has become a contest to see who can have the most negative ETH ETF take.” Thompson further noted:

Personally, I think ETH will reach $7,000 and BTC will make its first attempt at $100,000 by the election in November.

The Glassnode co-founders also shared a bullish price analysis for Ether, stating that if investors look at Ether’s history, similar patterns are developing as in the early stages of the 2021 bull market.

They believe the current structure gives a target of around $7,500 as a final high for Ether, mirroring the Fibonacci extension seen in 2021 and implying a strong rally in Ether “soon!”

Related Reading

While caution remains regarding the possibility of further price declines, experts argue that such a scenario would require a new exogenous event to occur. Overall, market sentiment is leaning towards Ethereum reaching $7,000 and Bitcoin’s first attempt at $100,000.

At the time of writing, ETH was trading at $3,460, up more than 3% over the past 24 hours as the broader market recovers from the corrections seen over the weekend and into the beginning of the week.

Featured image from DALL-E, chart from TradingView.com

Source link

Bitcoin ETF

Over Half Of Top US Hedge Funds Own Bitcoin ETFs

Published

3 weeks agoon

June 10, 2024By

admin

In hindsight, all it took for real institutional adoption of Bitcoin to take place was the introduction of a risk-minimized, easy-to-use product in the form of an exchange-traded fund (ETF). In January, the SEC approved nine new ETFs that provide exposure to Bitcoin through the spot market, a strict improvement over the futures-based ETFs that began trading back in 2021. In the first quarter of trading, both the size and number of institutional allocations to these ETFs have blown away consensus expectations. Blackrock’s ETF alone set a record for the shortest time an ETF has hit $10 billion in assets.

Beyond the eye-popping AUM figures these ETFs have drawn, this past Wednesday marked the deadline for institutions with over $100 million in assets to report their holdings to the SEC through 13F filings. These filings reveal a complete picture of who owns Bitcoin ETFs—the results are nothing short of bullish.

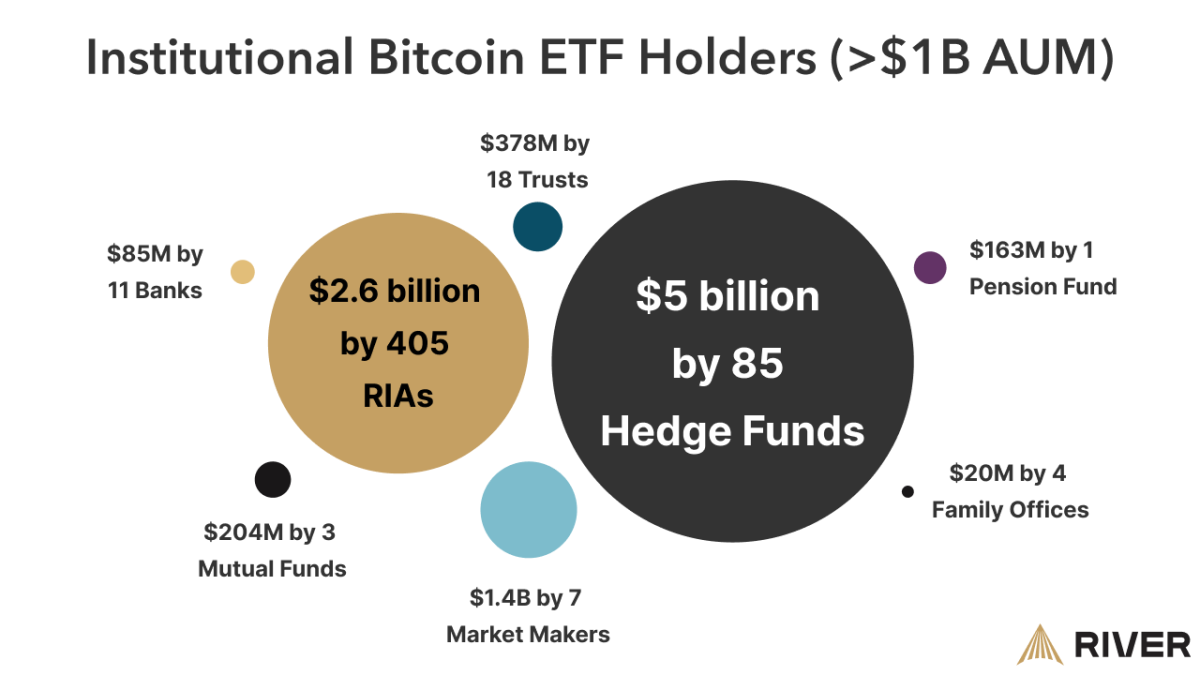

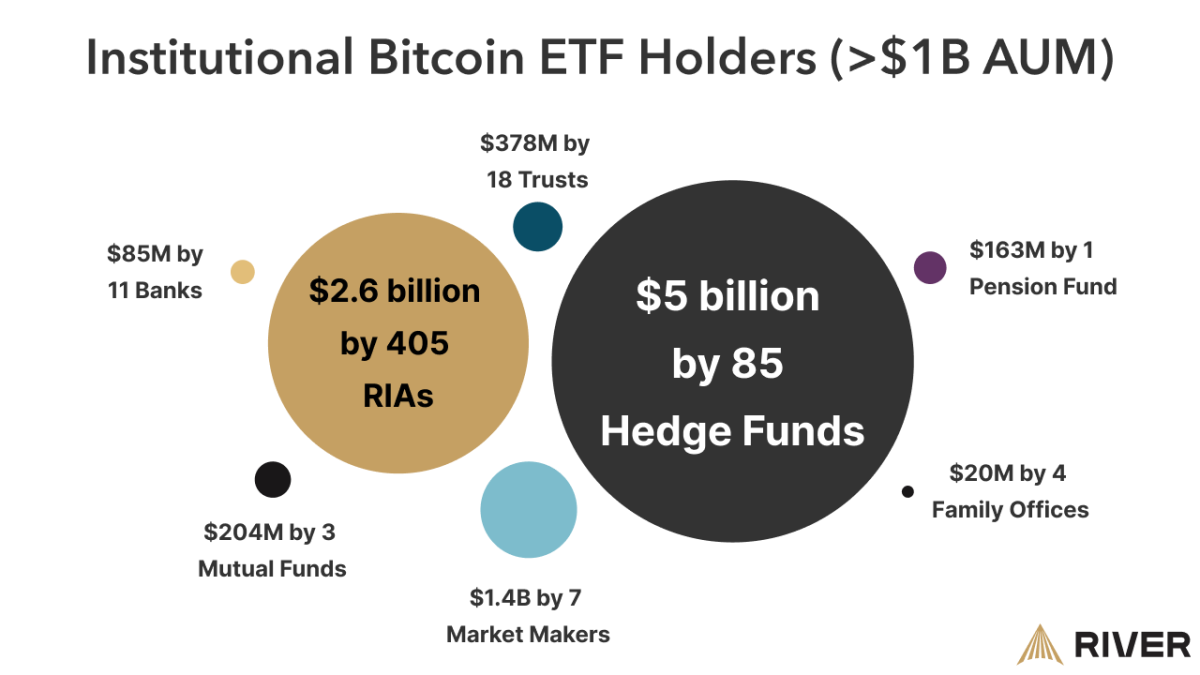

Institutional Adoption is Broad-Based

In years past, a single institutional investor reporting ownership of bitcoin would be a newsworthy, even market moving event. Just three years ago, Tesla’s decision to add bitcoin to their balance sheet sent bitcoin up over 13% in a single day.

2024 is clearly different. As of Wednesday, we now know of 534 unique institutions with over $1 billion in assets that chose to begin allocating to bitcoin in Q1 of this year. Ranging from hedge funds to pensions and insurance companies, the breadth of adoption is remarkable.

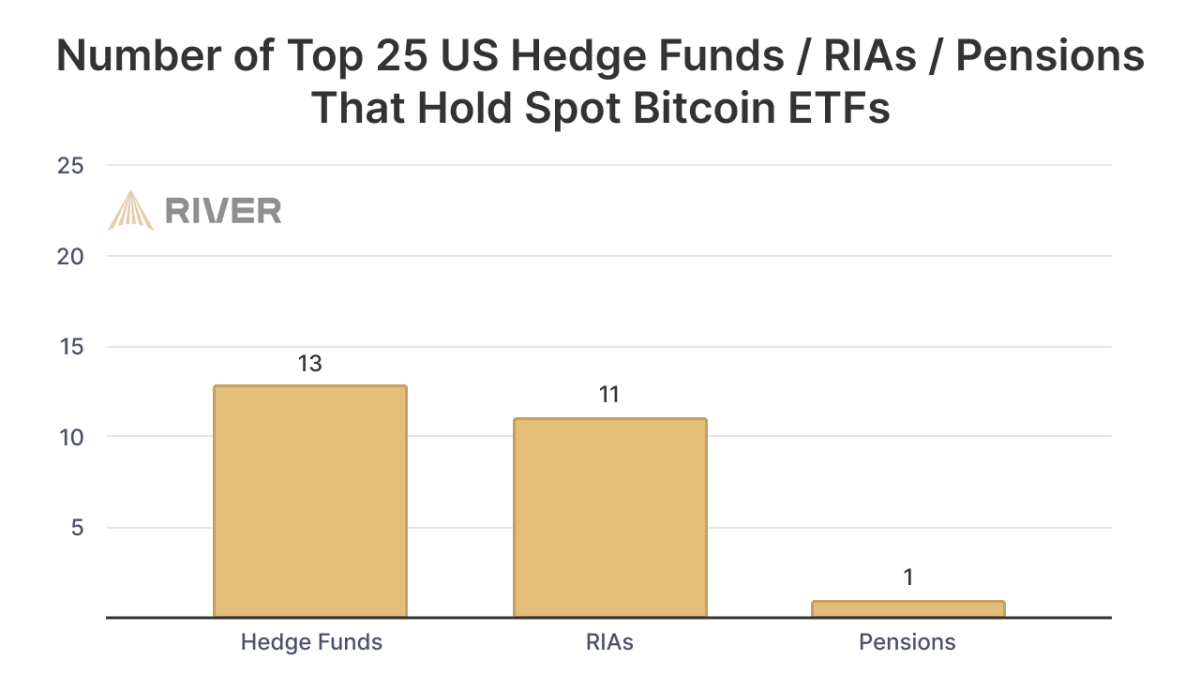

Of the largest 25 hedge funds in the US, over half now have exposure to bitcoin, most notably a $2 billion position from Millennium Management. Additionally, 11 of the largest 25 Registered Investment Advisors (RIAs) are now allocated.

But why are Bitcoin ETFs so appealing to institutions who could’ve just bought bitcoin?

Large institutional investors are slow moving creatures from a financial system steeped in tradition, risk management, and regulations. For a pension fund to update its investment portfolio requires months, sometimes years of committee meetings, due diligence, and board approvals that are often repeated multiple times.

To gain exposure to bitcoin by purchasing and holding real bitcoin requires a comprehensive vetting of multiple trading providers (e.g. Galaxy Digital), custodians (e.g. Coinbase), and forensics services (e.g. Chainalysis), in addition to forming new processes for accounting, risk management, etc.

To gain exposure to bitcoin by purchasing an ETF from Blackrock is easy by comparison. As Lyn Alden put it on a TFTC podcast, “All the ETF is, is in developer terms, it’s basically an API for the fiat system. It just allows the fiat system to plug into Bitcoin a little bit better than it used to.”

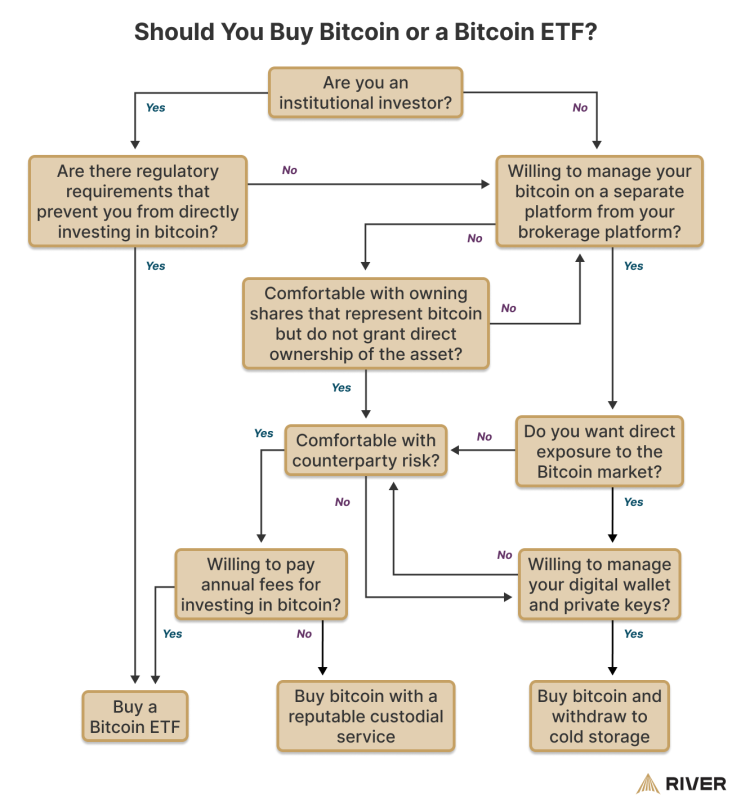

This is not to say that ETFs are the ideal way for people to gain exposure to bitcoin. In addition to the management fees that come with owning an ETF, there are many tradeoffs that come with such a product that may compromise the core value provided by Bitcoin in the first place—incorruptible money. While these tradeoffs are beyond the scope of this article, the flowchart below depicts some of the considerations at play.

Why hasn’t Bitcoin rallied more this quarter?

With such a strong rate of ETF adoption, it may come as a surprise that the price of bitcoin is only up 50% year-to-date. Indeed, if 48% of the top hedge funds are now allocated, how much upside could really be left?

While the ETFs have broad-based ownership, the average allocations of the institutions that own them are quite modest. Of the major ($1b+) hedge funds, RIA’s, and pensions that have made an allocation, the weighted average allocation is less than 0.20% of AUM. Even Millennium’s $2 billion allocation represented less than 1% of their reported 13F holdings.

The first quarter of 2024, therefore, will be remembered as the time when institutions ‘got off of zero’. As for when they will get past dipping their toes in the water? Only time will tell.

This is a guest post by Sam Baker from River. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Published

2 months agoon

May 5, 2024By

admin

ETFswap (ETFS) is reshaping how the crypto industry interacts with Spot Bitcoin ETFs through the tokenization of assets, triggering massive demand for its token presale.

The approval of the first Spot Bitcoin ETFs in January 2024 by the United States Security and Exchange Commission (SEC) opened up the industry for fresh investment from new investors. However, Spot Bitcoin ETFs are not very accessible to the broader crypto community members, but to the deep pockets in the crypto industry.

Thankfully, ETFswap (ETFS) is reshaping the whole dynamics by making it possible for all in the crypto industry to invest in Spot Bitcoin ETFs and other related products. With ETFswap (ETFS) changing the status quo, its token presale has seen massive demand, with over $250,000 raised in a few days.

ETFSwap Brings Spot Bitcoin ETFs To The Blockchain With Tokenization

ETFswap (ETFS) is a blockchain platform that bridges the gap between decentralized and traditional finance by tokenizing exchange-traded funds (ETFs). By tokenizing ETFs and bringing them on-chain, the platform makes it accessible to all crypto community members for trading. By tokenizing traditional assets such as Spot Bitcoin ETFs, ETFSwap (ETFS) will enable investors to easily monitor the progress of this asset before making any trading decisions, thereby minimizing losses for users.

For a smooth trading experience, ETFswap (ETFS) will provide a comprehensive web3 marketplace tailored to the needs of crypto newbies and experts when trading tokenized ETFs. However, experienced traders can take it a notch further by using the up to 10x leverage provided by the platform to increase their earnings significantly.

To protect its ecosystem and investors, ETFswap has undergone an audit of its smart contract by world-renowned blockchain security expert Cyberscope. After thorough checking, Cyberscope saw no critical issues or underlying conditions that could make the platform vulnerable to cyber attacks, making it safe. This means users can invest in Spot Bitcoin ETFs, as well as ETFs from other industries, right on the blockchain without fear of losing their funds to a third-party.

At the heart of the platform is its native token ETFS, which will make it possible to trade tokenized ETFs and also access all the other features on the platform, which includes staking and governance. Finally, as a DeFi platform, new users can access the network without filling out a Know Your Customer (KYC) form, which involves divulging sensitive information online.

ETFS Token Presale Takes Off Following $750,000 Private Sale Raise

ETFswap (ETFS) held a private sale event to introduce its token and ecosystem to large investors in the crypto industry. The event saw two institutional and three angel investors invest a total of $750,000 in just 3 days. To provide user interest, ETFswap (ETFS) refrained from including venture capitalists (VCs) in the sale due to their long-term goal of developing products that will benefit its ecosystem and users instead of catering to VCs.

This is because seeking investment from VCs could result in a deviation from that plan as they will be obligated to work along with the strategies of these investors even if it is not in the platform’s best interest.

Following these achievements, ETFswap (ETFS) is working towards accelerating its platform launch with the funds raised during the private sale. At the end of the private sale, the public presale went live, with the platform offering the token at $0.00854 per coin in Stage one.

By Stage two, the token price will increase to $0.01831, cementing profit for all stage one investors. This assurance of profit has brought in crowds of investors eager to buy this undervalued asset, bringing the number of tokens sold to over 40 million. Further, experts are optimistic that the ETFS token is geared for a massive surge that will take its price to the $1 mark, increasing by 10,000%.

Also, the platform, after launch, intends to partner with other renowned DeFi firms in the crypto industry to advance the growth of decentralized finance. Undoubtedly, such an alliance will bring about more industry adoption for the token.

For a platform that is yet to launch, ETFswap is the real deal with the potential to increase investors’ portfolios massively and also ensure the security of their investment. What are you waiting for? Join ETFswap today by buying ETFS at presale to make a 100x yield on investment.

For more information about the ETFS Presale:

Source link

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

XRP Price May Soar Past $6, Here’s Why

Popcat up over 90%, as SHIB and DOGE see price declines

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs