Bitcoin

87% Of Bitcoin Hodlers Laughing All The Way To The Bank

Published

2 weeks agoon

By

admin

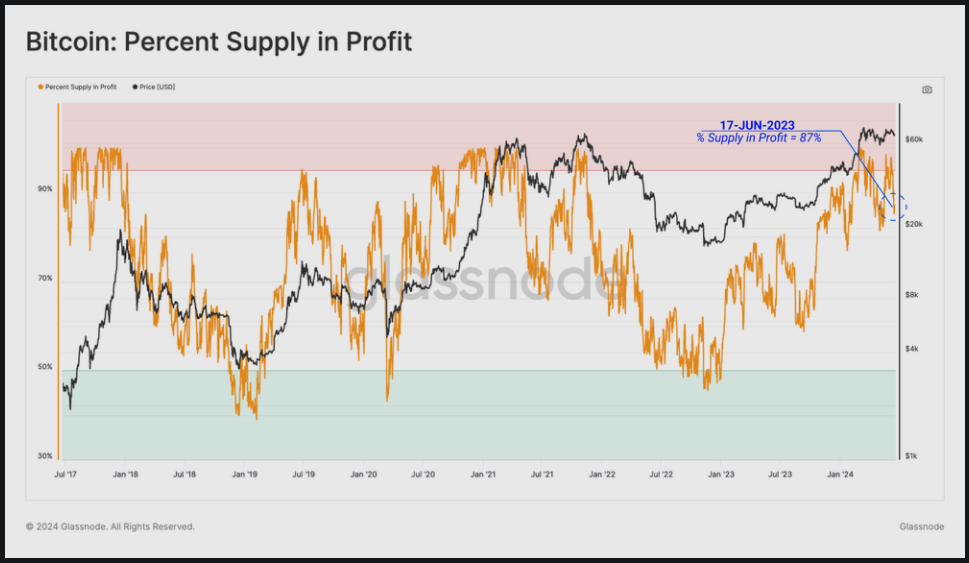

The current state of the Bitcoin market offers a mix of optimism and caution for investors. Over 87% of Bitcoin holders are in profit, with their investments valued higher than their initial purchase prices.

Related Reading

On average, these investors are seeing unrealized gains of 120%, a significant figure that reflects the substantial rally that pushed Bitcoin to its all-time high in March, according to Glassnode data. However, despite these gains, the market exhibits both encouraging long-term trends and some short-term uncertainties that merit closer examination.

Profitability And Market Metrics

The profitability among Bitcoin investors is notable. The MVRV (Market Value to Realized Value) metric, a key indicator of market sentiment, remains comfortably above its yearly baseline. This metric measures the ratio of Bitcoin’s market value to its realized value and serves as a gauge of average unrealized profit across the market.

A high MVRV ratio indicates that most investors are sitting on substantial unrealized gains, painting a positive picture of the market’s health. This upward trend contrasts with the recent price volatility, underscoring the resilience of long-term investors who bought the dip and are now seeing their foresight rewarded.

Reduced Trading Activity And Demand

Despite the overall profitability, the Bitcoin market is experiencing a notable reduction in trading activity. The vibrant speculative trading that once characterized the market has significantly diminished.

Day traders, who previously capitalized on price swings, have retreated, resulting in reduced trading volumes and tepid demand. This lack of speculative trading has led to a stagnation in Bitcoin prices, which are now confined to a well-defined range. The market’s current state can be likened to a calm period after a storm, where activity is subdued, and prices sway gently without significant movement.

Investor Caution And Market Sentiment

The reduced trading activity reflects a broader sentiment of caution among investors. The current period of consolidation suggests that many investors are taking a wait-and-see approach, carefully assessing the market landscape before making any decisive moves.

This cautious sentiment is further evidenced by on-chain data showing a significant decrease in the flow of Bitcoin into exchanges. Typically, an increase in Bitcoin transfers to exchanges is a precursor to selling activity, as holders look to liquidate their positions. The current decline in these transfers indicates that both short-term and long-term holders are refraining from selling, preferring to hold onto their assets.

Related Reading

Short-term holders, who once actively traded Bitcoin for quick profits, are now transferring significantly fewer coins compared to the peak levels seen in March. This behavior suggests a shift towards a more conservative strategy, possibly in anticipation of future price movements. Long-term investors, on the other hand, appear content to maintain their positions, exhibiting confidence in Bitcoin’s long-term potential despite the short-term market stagnation.

Featured image from Adobe Stock, chart from TradingView

Source link

You may like

Reasons Why Bitcoin Falls To $60K After A Weekend Pump

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Bitcoin

crypto will get positive regulation ‘no matter who wins’ election

Published

6 hours agoon

July 3, 2024By

admin

Galaxy Digital founder and CEO Mike Novogratz told CNBC’s ‘Squawk Box’ on Tuesday that the US crypto sector is headed for positive regulations regardless of who wins the upcoming election.

Mike Novogratz, one of the biggest crypto bulls, shared his outlook during an interview that touched on the current US political scene, Biden’s disastrous debate and crypto. The billionaire asserted that despite the current status of crypto regulation in the US, he believes the next regime will take a positive stance and help the industry grow.

“I am not a single issue voter and I do fundamentally believe crypto should be a bipartisan and needs to be bipartisan. We cannot have one party that likes this and another party that doesn’t like it,” Novogratz said.

Crypto regulatory landscape “shifting”

According to Novogratz, crypto is already largely a bipartisan issue in the US, with only a small group of Democrats taking a negative stance against this burgeoning industry. While it’s been frustrating, in terms of lack of regulatory clarity or the negative impact of government crackdown on the industry, Novogratz believes it’s “all shifting.”

“I’ll tell you that most Democrats, outside of Elizabeth Warren and a small group of people, are pretty pro-innovation and pro-crypto… Listen, no matter who wins the next election, we are going to get positive crypto legislation. I know that” he added.

Novogratz says BTC is a core holding

Commenting on Bitcoin following the ETF-buoyed upside that pushed prices above $73k in March, Novogratz referred back to earlier comments he shared about BTC price post-ETF approval. In his opinion, the benchmark cryptocurrency was likely to stay in the $55k-$73k range until the market got a dose of new news.

“It takes a while for things to digest,” he noted, adding that Bitcoin’s surge to its all-time high this year was “a huge move up.”

Novogratz believes BTC as a core portfolio holding makes sense, especially as the US debt balloons amid the government’s “spending like drunken sailors.”

Bitcoin traded around $61,862 at the time of writing, about 9% down in the past 30 days. However, its up 44% year-to-date and 102% in the past year.

Source link

Bitcoin

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Published

10 hours agoon

July 2, 2024By

admin

CleanSpark capped a busy June with an uptick in mined Bitcoin and a 2x increase in hashrate compared to December.

According to a Tuesday press statement, CleanSpark mined 445 Bitcoin (BTC) in June after adding five new mining facilities in Georgia. The mining startup also surpassed its 20 EH/s operational hashrate target set for mid-year.

“We continue to maximize efficiency at our existing sites and look forward to the opportunities ahead of us in Wyoming and Tennessee,” said CEO Zach Bradford.

CleanSpark’s mining numbers for last month indicate strength from the company after the Bitcoin halving event in April. A halving happens every four years and cuts mining rewards in half. The company mined 46 less BTC than last June, a modest difference considering Bitcoin’s code change.

Bradford added that the firm is “laser-focused” on increasing mining hashrate and generating more revenue following the halving. Meanwhile, other miners are facing difficulties and exploring business sales to maximize shareholder value.

CleanSpark’s post-halving performance has been the envy of the mining landscape as the startup has improved its hashrate and mined more BTC in recent months. Per crypto.news, Bradford’s firm also acquired GRIID facilities in a $155 million deal, and analysts at H.C. Wainright are bullish on the CLSK stock. CLSK is up 58% year-to-date and changed hands for $17.19 on the Nasdaq as of writing.

Source link

Bitcoin

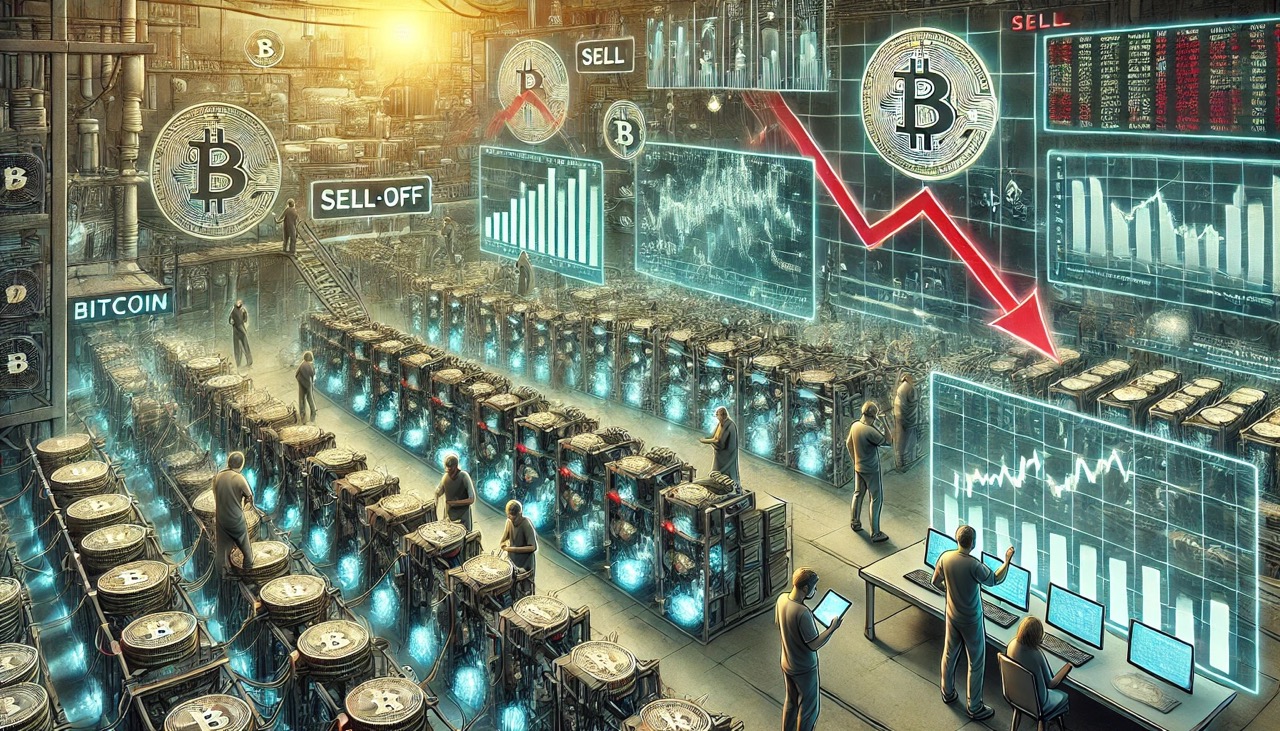

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Published

16 hours agoon

July 2, 2024By

admin

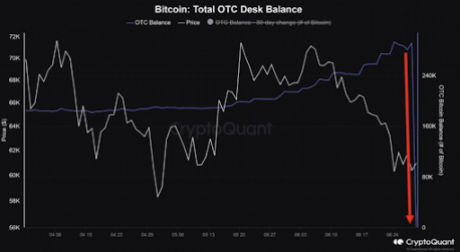

On-chain data shows that selling pressure from Bitcoin miners has recently slowed down. This is significant considering the impact it could have on Bitcoin’s price heading into the third quarter of the year.

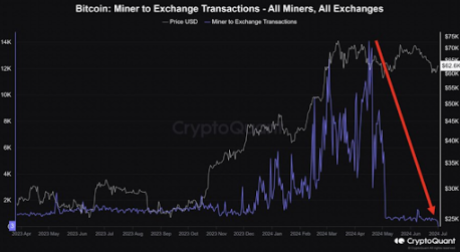

Bitcoin Miners’ Selling Pressure Has Significantly Declined

Referencing data from the on-chain analytics platform CryptoQuant, crypto analyst Crypto Dan noted that selling pressure from miners has significantly declined for two reasons. One is that the quantity of Bitcoin these miners sent to exchanges to sell has reduced drastically since May.

Related Reading

Secondly, the crypto analyst mentioned that the volume of the OTC Desk that miners use for selling has been consumed, suggesting that someone recently bought up all the available Bitcoin supply from these miners. The volume of the OTC Desk is said to have piled up until June 29th, as there was no willing buyer to purchase these crypto tokens.

Bitcoin miners greatly contributed to the price crashes the flagship crypto suffered in June. Data from the market intelligence platform IntoTheBlock showed that these miners sold 30,000 BTC ($2 billion) throughout the month. This put significant selling pressure on Bitcoin, which caused it to drop below $60,000 at some point.

As such, the decline in selling pressure presents a bullish development for Bitcoin and could continue the bull run for the flagship crypto. Crypto Dan noted that this development has created “sufficient conditions” to continue the upward rally for Bitcoin in this third quarter of the year.

Crypto analyst Willy Woo had also previously predicted that Bitcoin’s price would recover once miners capitulate. With that out of the way, Bitcoin could enjoy an upward trend this month and make massive moves to the upside.

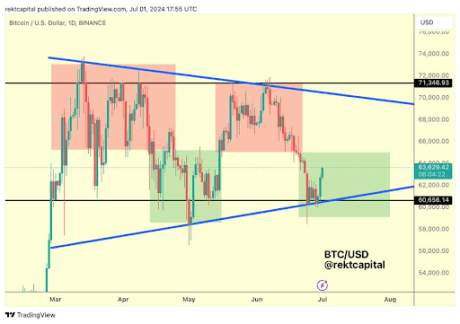

BTC’s Uptrend Has Begun

Crypto analyst Rekt Capital noted in a recent X (formerly Twitter) post that Bitcoin’s uptrend has begun. He claimed that the macro higher low has been confirmed, and Bitcoin is now rallying to the upside. He added that the flagship crypto is developing a macro bull flag, providing a bullish outlook for the crypto token.

Related Reading

In another X post, the crypto analyst remarked that the goal for Bitcoin following its strong start to July is to build a “foundation from which it will be able to springboard to the Range High area at $71,500 over time.”

Crypto analyst Michaël van de Poppe also suggested that Bitcoin’s downtrend is over and a bullish reversal was underway as the flagship crypto makes significant moves to the upside. He also mentioned that he believes that Bitcoin has bottomed out and has found support at $60,000, meaning a decline below that price level anytime soon was unlikely.

At the time of writing, Bitcoin is trading at around $62,900, down in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Reasons Why Bitcoin Falls To $60K After A Weekend Pump

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs