bear market

Could an Earnings Recession Lead to More Pain for Crypto? – Blockchain News, Opinion, TV and Jobs

Published

2 years agoon

By

admin

By Marcus Sotiriou, Analyst at the UK based digital asset broker GlobalBlock

Bitcoin fell further this morning to $19,000, as it trades below the 200-weekly SMA. So far, Bitcoin has not retested this level as resistance, but if it does and rejects back down, this would be a very bearish signal. This is because it would be the first time that this level has been broken on a long-time frame and could suggest an extended bear market is on the horizon.

There is a “risk off” tone in European markets this morning which has contributed to sell pressure on U.S. stock market futures and the crypto market. Spain’s year-over-year headline inflation for June came in at 10.2% which is significantly higher than the expected 9% as well as May’s 8.7%. This is contrast to Germany’s year-over-year CPI data showing a decrease from 8.7% to 8.2%, and less than the expected 8.8%. Despite Germany’s reading coming in lower than anticipated, the ECB (European Central Bank) will be forced to raise rates. This means that a recession is more likely to occur in Germany as growth is due to slow. Inflation in Spain, Belgium and France soaring to the highest levels since the 1980s led ECB President Christine Lagarde to concede yesterday that “low inflation is unlikely to return”. This has resulted in more fear around European economies in the near future.

In the U.S., consumer sentiment is now lower than what it was during the GFC (Global Financial Crisis) in 2008, shown by the University of Michigan Index of Consumer Sentiment. This gives further indication of growth slowing in the U.S. in the coming months, coinciding with elevated inflation. This relates to crypto as crypto correlates extremely impacted by high inflation data (demonstrated by the chart below showing BTC and ETH plotted alongside inflation prints).

Stock prices are driven by two main aspects – future earnings and a multiple of what you are willing to pay for those forward earnings. Multiples have been compressed due to expectations of rising interest rates, hence leading to the downtrend in equities. A recession may not be fully priced in by most investment fund analysts, many of whom have not experienced a macro environment similar to what we are currently experiencing. Hence the following months could result in iterations of lower earnings revisions. If this is the case, equities could be forced lower and bring crypto along too.

Source link

You may like

Multicoin to Match Up to $1 Million in Solana Donations to Pro-Crypto Candidates

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

24/7 Cryptocurrency News

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Published

16 hours agoon

July 5, 2024By

admin

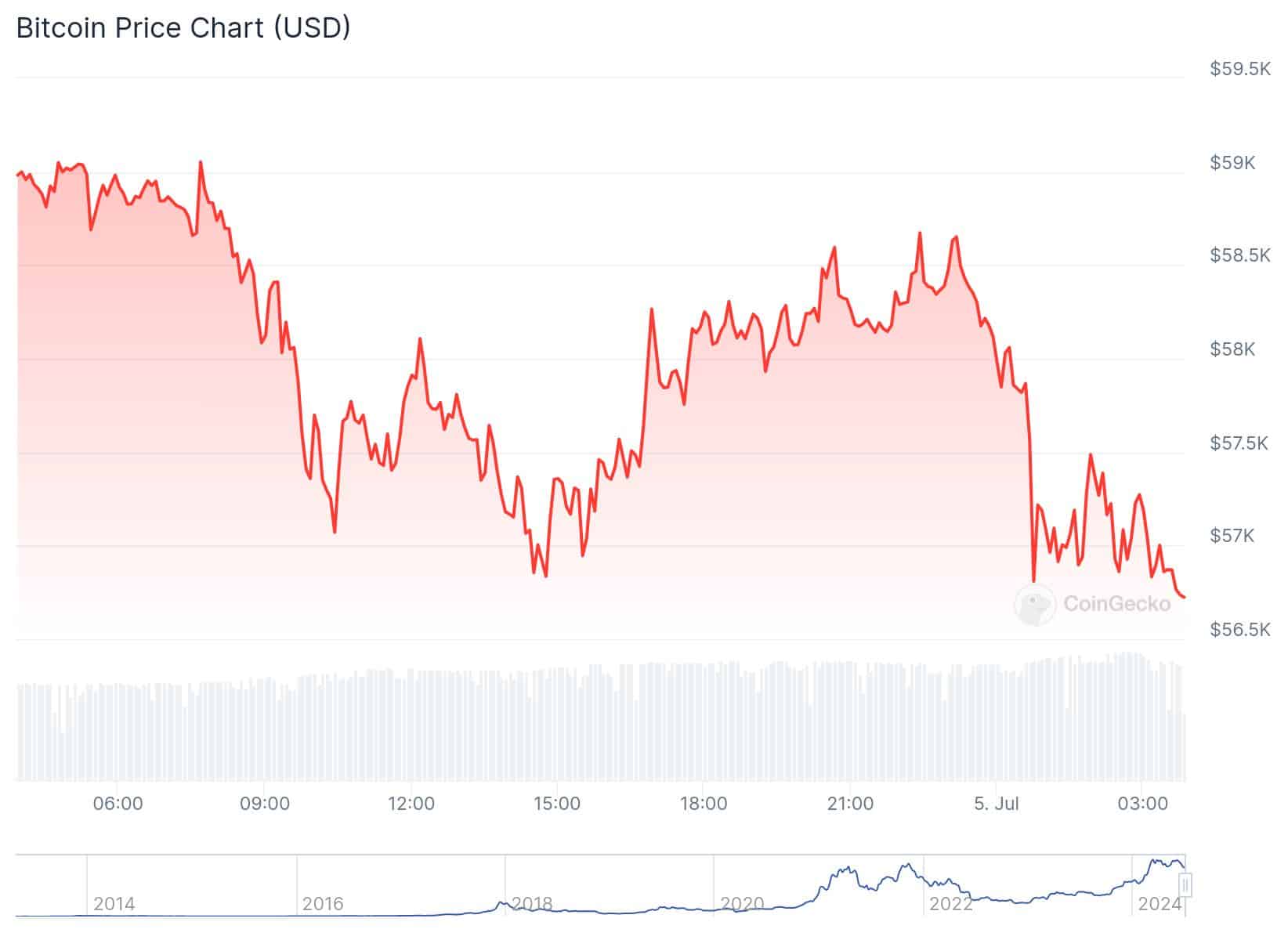

Ethereum and other altcoins have tumbled to lows not recorded in several weeks. This bearish outlook was also recorded in Bitcoin (BTC) and other decentralized finance (DeFi) tokens. Ethereum price has taken steps back wiping out previously recorded gains this week. A major reason for the market decline is a fall in sentiments with many pointing to major market corrections.

The total crypto market fell to $2.11 trillion, a 4.8% decline in the last 24 hours. Meanwhile, several altcoins notched wider losses today deepening the negative sentiments. The drop in the ETH price also coincides with lower on-chain numbers and a transfer of assets to centralized exchanges which signals potential sales.

Ethereum Price Nears $3K

This year, Ethereum and other crypto assets surged to new highs amid the approval of spot Bitcoin ETFs in the United States. Despite the previous price gains and institutional inflows, massive sell-offs recorded in recent times have deepened sentiments. Ethereum trades at $3,075, a 7% drop in the last 24 hours. Weekly losses pierced double digits at 11% while monthly figures topped 19% in the red zone.

These outflows have sparked similar numbers in other altcoins. ETH’s market cap tanked to $367 billion while daily trading volume is over $20 billion. This year came with projections of sustained growth above $4k but plummeting price now sees ETH moving near $3k. The drop in crypto assets might force prices lower although many holders believe a rebound might be on the cards.

Altcoins Are Sinking

Like most commentators opine, Ethereum price can surge with positive mainstream factors. The listing of ETH ETFs can lead to a jump in the asset’s price. The recent slump has also affected altcoin prices with Solana trading below $130 and $126 and Ripple plunging over 8% in the last 24 hours. Toncoin and Cardano were also down today with larger numbers posted by meme coins.

Also Read: End of The Road for Meme Coins? Dogecoin Takes Heavy Losses

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

3 Signs Of a Sustained Bearish Sentiment

Published

2 days agoon

July 4, 2024By

admin

Digital assets are facing sharp corrections after an attempted rebound with some users pointing to a long-term bearish sentiment. This year, crypto asset prices moved up the ladder following huge institutional inflows in the market. While this heightened the bull cycle, certain events have drawn lines of a creeping bear sentiment in the market.

The recent market correction sparked major sell-offs leading to liquidations as traders repositioned their holdings. For slight and sustained bearish sentiments, there are signs to watch out for. The current sentiment is largely viewed as short-term as bulls look forward to a price boost on the back of historical trajectories. As Bitcoin and other crypto assets plummet, here are key points to watch out for a bearish sentiment.

Massive Transfers to Exchanges

A bull cycle comes with price highs as most users buy assets with limited sell pressure. However, where signs of sales are recorded, a bearish sentiment builds with traders. Large transfers of assets to centralized exchanges are perceived as potential sales while move-off exchanges show signs of long-term holding. Some of the reasons include the ease of a sale on exchanges. This year, large amounts of BTC were taken off exchanges during the price highs.

Frequent Price Correction

Crypto assets are volatile so certain price swings are expected. However, when top asset prices fall for consistent periods, a bearish sentiment could form in the market. This could also happen in persistent downward fluctuations taking the assets far below the achieved highs. This occurred after the 2021 bull season when the price of Bitcoin dropped below $25,000 from over $62,000.

Miner Reserves

A look at miner reserves points to present market conditions to know if there’s a bearish sentiment. If Bitcoin miners sell reserves, it often means the market is on a downward slope. This is because, in a price correction, BTC miners tend to sell assets to cover losses from declined market activity. On the other hand, miners will hold on to assets where there is positive momentum.

Also Read: Market Fluctuations Take Uniswap Exits Near Weekly Double Digits

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

bear market

Bitcoin ‘tends to bounce back’ in July after negative June

Published

5 days agoon

June 30, 2024By

admin

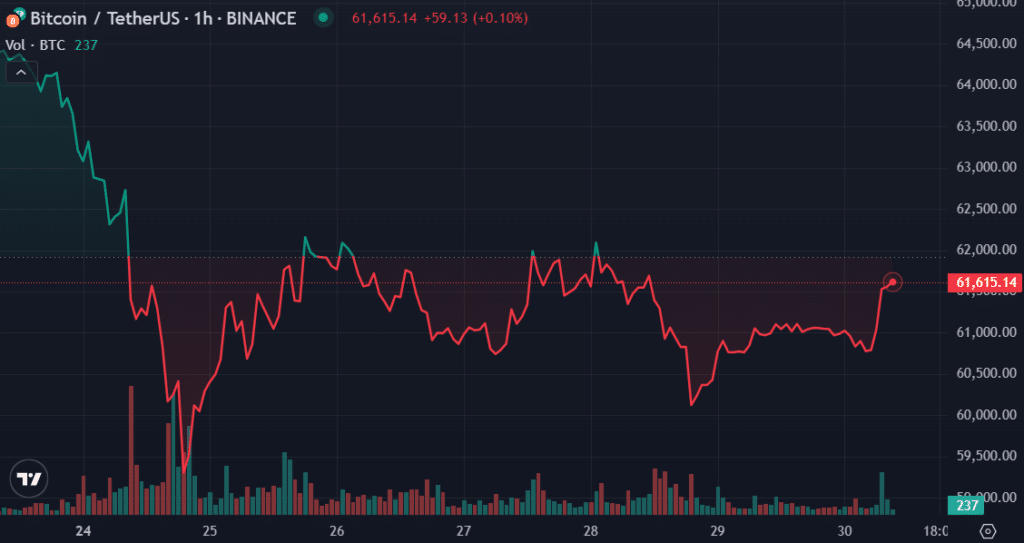

Crypto market analyst Ali Martinez expects a price rebound for the Bitcoin (BTC) price in July after a month of bearish momentum.

According to Martinez’s X post on Sunday, the Bitcoin price recorded an average price rebound of 7.98% in July after a “negative June.” Data shows that the BTC price plunged by 9.25% over the past 30 days.

Historically, when #Bitcoin has had a negative June, it tends to bounce back strongly in July. In fact, $BTC has shown an average return of 7.98% and a median return of 9.60% during this month. pic.twitter.com/fJaIwc7Eob

— Ali (@ali_charts) June 30, 2024

Bitcoin recorded a 30-day-high of $71,907 and a low of $58,554 in the mentioned timeframe.

Moreover, data provided by Martinez shows that Bitcoin’s largest average price return of 46.81% happened in November.

Bitcoin gained a slightly bullish momentum over the past 24 hours, rising by 0.94%. The flagship cryptocurrency is currently trading at $61,450 at the time of writing. BTC’s market cap again surpassed the $1.2 trillion mark with a daily trading volume of $13.1 billion.

Due to the declining trading volume, lower price volatility and liquidations would be expected for Bitcoin.

On the other hand, Billionaire entrepreneur and Bitcoin supporter Peter Thiel believes that the BTC price might not witness a dramatic rally. Thiel’s comments come while he still holds a portion of Bitcoin.

Last year, Thiel’s Founders Fund invested roughly $200 million in Bitcoin when the asset’s price was hovering at around $30,000.

Bitcoin’s downward momentum started on June 10 when the spot BTC exchange-traded funds (ETFs) in the U.S. recorded their first set of net outflows in one month.

Last week, spot BTC ETFs saw $137.2 million in net inflows in their last four trading days. This pushed the total amount of ETF net flows past the $14.5 billion mark.

Source link

Multicoin to Match Up to $1 Million in Solana Donations to Pro-Crypto Candidates

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: