cryptocurrency

The Ethereum merge: what you need to know | by Blockchain.com | @blockchain | Aug, 2022

Published

2 years agoon

By

admin

You may have seen the Ethereum token, known as ether or ETH, rally as of late.

One big reason for this rally? The upcoming Ethereum merge.

What is the Ethereum (ETH) merge?

The ETH merge refers to developers changing Ethereum’s consensus mechanism, the process the blockchain uses to ensure every transaction and new block added on the network is valid. Ethereum will move from an energy-intensive proof-of-work consensus mechanism to a more energy-efficient proof-of-stake one.

To find out more about Ethereum check out

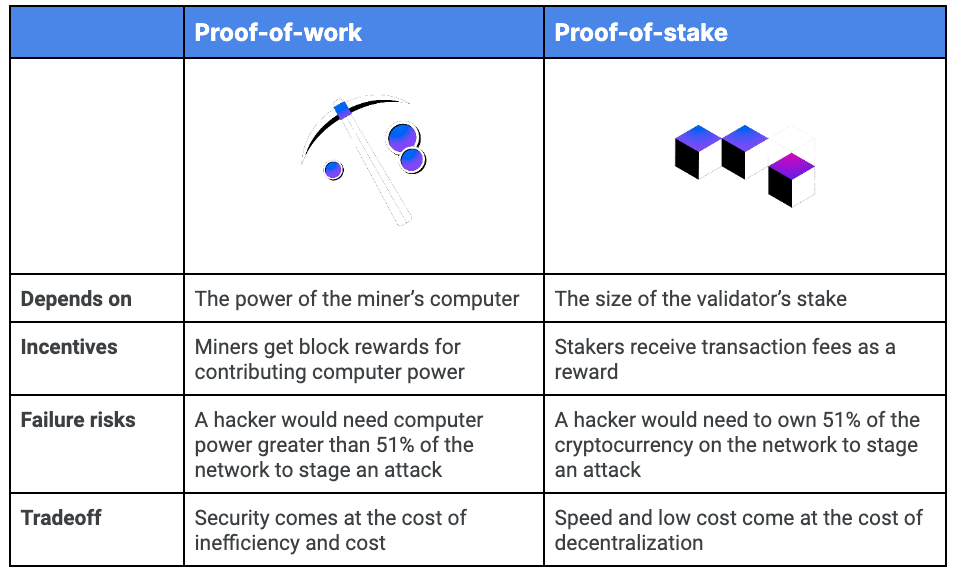

What is the difference between proof-of-work and proof-of-stake?

Proof-of-work and proof-of-stake are the two major consensus mechanisms that cryptocurrencies use to validate transactions on the blockchain.

Proof of work blockchains are verified by miners (networks of computers that help with the creation of new bitcoin).

Miners use large amounts of computer processing power in a race to solve a mathematical puzzle. As a result, the miner who solves the puzzle the quickest earns cryptocurrency as a reward, and newly verified transactions get added to the blockchain.

Alternatively, proof of stake blockchains have a network of “validators” who “stake” (put up) their own crypto to verify transactions and add them to the blockchain.

Instead of the block rewards received by proof of work miners, stakers earn a share of fees for transactions. As opposed to contributing vast amounts of computer processing power, validators stake their crypto.

What impact will moving to proof-of-stake have?

The merge to proof-of-stake will reduce Ethereum’s energy consumption by approximately 99.95%. The merge will make Ethereum more efficient and scalable.

It will also mean more competition for the project as many Ethereum competitors run on proof of stake technology.

What impact will the merge have on price?

While it’s impossible to tell the future, one effect of the merge should be to make Ethereum more cost effective. This may attract users to the ecosystem.

When is the Merge happening?

Source link

You may like

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

cryptocurrency

Top cryptocurrencies to watch this week: MOG, KAS, FET

Published

3 hours agoon

July 1, 2024By

admin

The prevailing bearish sentiment in the cryptocurrency market extended throughout June. Last week, Bitcoin (BTC) fell below the $59,000 threshold for the first time in eight weeks.

Widespread losses ensued across the market.

Some assets bucked the trend, recording new all-time highs. Selective bullishness wasn’t enough to prevent the overall crypto market cap from decreasing by 4.6% to $2.24 trillion.

Based on their strong performances last week, here are our top cryptocurrencies to watch this week:

MOG hits new ATH

MOG Coin (MOG) witnessed a bullish week. Dubbed the first culture coin on the internet, the meme coin started the week with the same bearish trend as the broader market, collapsing by 11.07% on June 23.

MOG spiked 45.32% on June 24 and June 25 thanks to increased social volume. Whale Insider confirmed that the rally solidified the token’s spot as the largest cat-themed meme coin by market cap.

JUST IN: Ethereum memecoin $MOG (@MogCoinEth) reclaims its spot as the #1 ‘cat meme’ in the world by market cap, as price rallies 30% in the past 24 hours.

— Whale Insider (@WhaleInsider) June 25, 2024

MOG hit a new all-time high of $0.00002123 on June 29 amid increased interest.

The asset closed the week at $0.0000018355, posting a 67% increase. Its Commodity Channel Index (CCI) currently sits at 130.83, suggesting that the asset is overbought, and a pullback might be imminent.

Kaspa slips into price discovery after new ATH

Kaspa (KAS) also witnessed an uptrend last week. With a 25% weekly rise, KAS recorded a less bullish performance than MOG.

However, the PoW community-based asset slipped into a price discovery phase after breaching its previous all-time high of $0.1939 on June 30. This rally was partly due to reports of Marathon Digital mining $16 million in KAS.

While MOG dropped following its new ATH, Kaspa continued to reach new record prices, entering the new week with this bullish push amid an 8.96% increase over the past 24 hours.

Consequently, KAS has flipped PEPE to become the 23rd largest cryptocurrency, with a market cap of $4.725 billion.

However, caution is advised as the new week begins. Notably, Kaspa’s daily relative strength index (RSI) has entered overbought territories, currently stationed at 71.76.

This suggests a looming retracement as the buying pressure reduces. The last time KAS became oversold, its price dropped 31% over two weeks.

FET drops 27% in three days

Fetch.ai (FET) is also among our top cryptocurrencies to watch this week. The Ethereum token looked to record a similar bullish momentum, but bearish pressure erased most of its gains toward the end of the week.

From June 23 to 26, FET spiked 26% from $1.472 to a near 3-week high of $1.860 as AI-focused tokens saw a massive uptrend.

However, this peak coincided with the upper Bollinger Band, a region that presented robust resistance from the bears.

Fetch.ai, a decentralized machine learning platform for applications such as asset trading and gig economy, saw its corresponding coin collapse from this high. Buying pressure was not sufficient to breach this resistance, resulting in massive declines over the following three days.

FET dropped by 27% from June 27 to June 29. It ultimately closed the week with an 8.56% loss. Despite a rebound effort, the asset remains below the 20-day SMA. While this might indicate a bearish trend, FET’s MACD line remains above the signal line, suggesting bullish momentum. The market remains indecisive at the moment.

Source link

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Stock trading and investment are never meant for the faint of heart, but one can certainly ease into them without losing their head and hard-earned money.

Blue-chip fiat investing is established, is typically easy to understand, and has many avenues where traders can ask for help. It might be slightly boring and slow to grow if only investing in reliable, “sure thing” stocks, but they’re still relatively approachable.

Derivatives

Derivatives such as futures or options ramp up the intensity, as the investments become more speculative and complex—even more so than just looking at numbers on the screen.

The earning potential here is incredibly vast, but so is the potential for loss. This is why derivatives are usually left to institutional investors or experienced traders who have a better grasp of how to navigate these sectors and, to say it plainly, are better equipped to lose their investment.

Now, imagine throwing crypto into the mix here.

Crypto derivatives are not a new concept, and many leading exchanges and platforms have launched services for experienced traders to try their hand at it. However, entering a speculative market dealing with notoriously volatile assets is not so easy. And just because someone has found success in futures and options trading in fiat doesn’t mean the same fortune will befall them in crypto.

Simply put, crypto derivatives are frightening to the average trader. But is there any way to make it less intimidating?

Fiat investment services have only become more accessible with the rise of mobile-first products that use simple and understandable language to guide newcomers. Any sensible financial advisor at a retail bank will also likely advise clients to store funds in an investment account rather than a traditional savings account, solidifying legitimacy that gives people a sense of security.

Plenty of blockchain-based services attempt the same thing, but the success has been middling.

Any way you slice it, crypto will always have a more daunting learning curve than fiat currencies due to how the technology and market function. And in most cases, someone interested in crypto can’t simply walk into a bank and get sound advice on derivatives trading strategies.

Making crypto derivatives more approachable requires a clear push in both education and creating services that don’t require a doctorate to operate.

Projects such as Thalex, for instance, have made this their mandate. Thalex is an exchange specializing in crypto derivatives, namely in perpetuals, futures, and options, but its no-frills approach serves its mission to remove the friction from trade ideation to execution and to empower traders by offering tools that help even out the playing field.

Likewise, Thalex offers a “paper trading” platform. This enables those interested in its platform to test out its services and try out trades before going live—creating an environment where users can learn the ropes on crypto derivatives.

Futures and options aren’t an impossible concept to grasp, but the unpredictability and lack of education on how they work in crypto make investors less inclined to explore them. To overcome this fear of crypto derivatives from fiat and crypto traders alike, there has to be a way to soften the landing. Not only will this help make the pros and cons of derivatives trading clearer, but also help create a roadmap that traders can feasibly follow.

Source link

cryptocurrency

Conduit raises $37m while MegaLabs, Ora secure $20m each

Published

1 day agoon

June 30, 2024By

admin

The blockchain space saw a big week of venture capital (VC) activity, with 23 startups securing over $154 million in funding.

According to data from Crypto Fundraiser, the amount of money that flooded the crypto space exceeded last week’s total by almost $91 million.

VC firms also funded 10 more projects this week than last week.

Here’s a breakdown of the top deals:

Conduit, $37 million

Conduit led the pack. The crypto infrastructure dominated with a $37 million series A round.

Paradigm and Haun Ventures co-led the effort. Robot Ventures, Credibly Neutral, Coinbase Ventures, Bankless Ventures and several angel investors participated as well.

Funds are expected to go toward developing Conduit’s customizable blockchain-based products, such as rollups. The funds will also help the firm realize its vision of making on-chain computing more accessible, thus simplifying the development process for blockchain innovators.

MegaLabs, $20 million

MegaLabs, the brain behind a new Ethereum (ETH) scaling protocol, raised $20 million in a seed round led by Dragonfly Capital.

Announced on June 27, the round included noteworthy angel investors like Ethereum co-founder Vitalik Buterin, ConsenSys CEO Joseph Lubin, EigenLayer creator Sreeram Kannan, and Hasu of Flashbots.

According to MegaLabs, the fresh capital injection will accelerate the development of its MegaETH protocol. The company plans to launch a testnet within the coming months.

Ora, $20 million

Ora, a blockchain project focused on integrating AI into decentralized applications, also raised $20 million. Investors like Polychain, HF0, and Hashkey Capital participated.

Ora plans to use the funds to develop its technology and infrastructure for tokenizing AI models and bringing decentralized AI to the Ethereum ecosystem.

Central to Ora’s innovation is their optimistic machine learning (opML) technology, which underpins their flagship product, opp/ai. It uses optimistic systems and zero-knowledge technology to create secure and efficient on-chain machine learning with privacy-preserving features.

Additionally, Ora has introduced the concept of the “initial model offering” (IMO), which allows the tokenization of ownership of open-source AI models.

Crossover Markets, $12 million

Another big beneficiary of crypto VC activity this week was technology firm Crossover Markets. It raised $12 million in a series A round led by Illuminate Financial and DRW Venture Capital.

The round also attracted strategic investors, including Flow Traders and Wintermute, as well as retail brokers, such as Exness, Gate.io, and Think Markets.

Crossover Markets is renowned for its execution-only electronic communication network, CROSSx, which serves as an institutional trading venue for digital assets.

In the first quarter of 2024, the company reported over $3.15 billion in notional trading value, 415,450 trades, and over 141 billion quotes processed on CROSSx. It said it will use the new funding to continue investing in its team and technology in the hope of further solidifying its market position.

Redacted, $10 million

Elsewhere, Redacted, a web3 entertainment and gamification platform, raised $10 million in a round led by Spartan Group, with Animoca and P2 Ventures also participating.

Prominent crypto figures like Dingaling and Grail also contributed, underscoring their support for Redacted’s vision of a more engaging and rewarding user experience.

The project’s marketing is said to have captured the attention of web3 investors and enthusiasts alike. Over 150 influential figures in the web3 space have reportedly adopted “Redacted” profile pictures, signaling their involvement and backing the initiative.

It also uses a catchy slogan, “Don’t get rekt, get redacted,” which plays on crypto culture and encourages investors to choose reputable projects.

The funding will support the development of Reducted’s ecosystem, which will offer a range of entertainment and gamification products powered by the RDAC token.

AnchorZero, $8 million

AnchorZero, a New York-based platform enabling founders to leverage Roth IRAs for tax savings, secured $8 million in seed funding.

We’re announcing that AnchorZero raised $8M in seed funding to make sophisticated tax strategies available to everyone. Our first product is the AnchorZero Founder Roth IRA, which can save tech founders and early employees billions of dollars on their exits.

AnchorZero Founder… pic.twitter.com/YA2rYQ8FwG

— AnchorZero (@anchorzero) June 25, 2024

The round was led by Bain Capital Crypto and Spark Capital, with additional support from Ethereal Ventures, Robot Ventures, and Mischief Capital. Angel investor Sarah Meyohas also provided funding.

The platform offers a flagship product aiming to simplify the transfer of startup equity into Roth IRAs. This approach could unlock hundreds of millions in tax savings and allow for tax-free compounding of gains.

By holding equity within a Roth IRA, founders can benefit from significant tax advantages. Any gains realized upon exit are shielded from capital gains taxes, and these initial gains can be reinvested to grow tax-free.

Covalent, $5 million

Covalent, a blockchain data infrastructure firm, closed a $5 million strategic funding round led by RockTree Capital.

The round also had significant participation from CMCC Global, Moonrock Capital, and Double Peak Group.

Following the successful funding round, Covalent has launched the New Dawn Initiative, a comprehensive rebranding effort aimed at aligning it more closely with its crypto-native community and reducing corporate influences.

Covalent’s co-founder, Ganesh Swami, plans to expand the startup’s operations across Asia, particularly in China, Korea, and Singapore, supporting blockchain and AI innovations in the region.

SoSoValue, $4.15 million

SoSoValue successfully closed a $4.15 million seed round led by HongShan and GSR Markets. Other participants included Alumni Ventures, One Piece Labs, and CoinSummer Labs.

The platform, which aims to empower investors with AI-driven data services, says it will use the funds to expand its global researcher community.

In just five months since its launch, SoSoValue has reportedly attracted over 1.2 million organic registered users. The platform is designed to empower investors at all levels, providing them with the tools and resources necessary to make informed decisions in the fast-paced crypto market.

Source link

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

XRP Price May Soar Past $6, Here’s Why

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs