Altcoins

BLUR Rules Today’s Top 100 Crypto Ranking With 88% Rally

Published

8 months agoon

By

admin

The news of BLUR, which saw an impressive 88% increase in price in the last week, has the cryptocurrency industry buzzing. This abrupt increase in value is directly related to what happened after the Season 2 airdrop. Coincidentally, the price spike also occurred following news of Binance CEO Changpeng Zhao’s resignation.

The cryptocurrency market saw a consecutive two-day period of downward trading activity subsequent to the disclosure of legal accusations against Zhao. Today, it seemed to have changed course and exhibited a favorable trend, with a notable increase of over 2.5% in value within the past 24 hours.

Blur trading at $0.626. Source: Coingecko

BLUR On A Tear: 200% Price Boost

In the 42 days since clearing a long-term descending resistance trend line, the price of BLUR has surged by more than 200%. The market movement indicates a positive outlook, despite the daily timeframe Relative Strength Index (RSI) providing a bearish reading.

Market analysts have reported a significant surge in purchasing activity, wherein a total of 51.3 million BLUR tokens were acquired by 19 entities. This acquisition amounts to a remarkable investment of $21 million in the aforementioned commodity.

BLUR is pumping after the Season 2 #airdrop!

19 addresses bought a total of 51.3M $BLUR($21M) after the Season 2 #airdrop. pic.twitter.com/hvgByltM5I

— Lookonchain (@lookonchain) November 22, 2023

BLUR’s recent price surge followed a consolidation phase, indicating market indecision as its value consistently traded below a critical resistance level. The subsequent airdrop triggered a substantial increase in token ownership, particularly among major stakeholders, signaling a surge in bullish sentiment and highlighting positive prospects for BLUR’s long-term potential.

New Yearly High Still In The Cards

Notably, experienced investors, possibly foreseeing enduring value, have actively engaged in sizeable BLUR positions, emphasizing a deliberate and informed move in response to the cryptocurrency’s potential.

The charts tell a tale of cautious optimism evolving into confidence in BLUR’s future. The consolidation phase hinted at a market awaiting direction, and the subsequent increase in token volume, especially post-airdrop, indicates a shift toward positivity.

BLURUSD trading at $0.620 on the 24-hour chart: TradingView.com

Though there has been a noticeable rising trend, BLUR has not yet hit a new annual high. Since February, BLUR has been trading below a trend line of declining resistance. The decline reached a low on August 17 at $0.15.

After that, the price started to rise, reaching a higher low on October 12. It emerged from the trend line of downward resistance after five days. The trend line had been in place for 245 days at that point.

As more investors became aware of the increase in activity, they might have joined the buying momentum that followed the airdrop. This kind of movement is common in the cryptocurrency space, where important transactions and news can cause asset values to fluctuate quickly.

Keeping A Close Tab On The Crypto

Even after substantial increases, BLUR is still warranting caution in this area. Waiting for confirmation of the bullish crossover could increase the risk-reward scenario for fresh long positions on a recovery off critical support zones, thus letting the RSI reset could be a good strategy.

Blur seven-day price action. Source: Coingecko

It will be very important to keep an eye on the important support level that is right now where the rise started. If the price of BLUR stays above this support, it could mean that the market has adjusted to the effects of the airdrop and is now setting a new price floor.

But if this level doesn’t hold, the price might go back down to the next important support zone. This could be a good chance for people who missed the first wave to buy again.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Pexels

Source link

You may like

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

Altcoins

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Published

8 hours agoon

July 8, 2024By

admin

Justin Sun has announced that developers are now working on a stablecoin transfer solution that can function without gas fees on the TRON (TRX) network.

The crypto billionaire says the new service is set to roll out later this year, initially on TRON before expanding to Ethereum (ETH) and other EVM-compatible chains.

“Our team is developing a new solution that enables gas-free stablecoin transfers. In other words, transfers can be made without paying any gas tokens, with the fees being entirely covered by the stablecoins themselves.

This innovation will first be implemented on the Tron blockchain and later support Ethereum and all EVM-compatible public chains.

We anticipate launching this service in Q4 of this year. I believe that similar services will greatly facilitate large companies in deploying stablecoin services on the blockchain, elevating blockchain mass adoption to a new level.”

At time of writing, it’s unclear how the new service will be able to operate without gas fees.

Last month, market intelligence firm Lookonchain reported that the 24-hour trading volume of Tether’s USDT on TRON stood at $53 billion while payment giant Visa’s was only at $42 billion.

“The 24-hour trading volume of USDT on TRON Network is $53 billion, exceeding Visa’s average daily trading volume. Visa’s trading volume in Q1 2024 was $3.78 trillion and the average daily trading volume was $42 billion.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

Is Dogwifhat (WIF) Out? Price Tanks 15% On Whale Exodus

Published

2 days agoon

July 6, 2024By

admin

Dogwifhat, the once-high-flying Solana-based meme coin, suffered a brutal week, mirroring a broader crypto market correction and raising questions about the sustainability of the meme coin craze.

Related Reading

Meme Coin Mania Meets Market Mayhem

WIF, the token powering Dogwifhat, saw its price plummet 15% in just 24 hours. This dramatic drop erased all the gains from a recent rebound rally. The sell-off wasn’t isolated to Dogwifhat; the entire crypto market experienced a double-digit tumble, with major altcoins like Ethereum and Cardano feeling the heat.

Analysts point to a combination of factors behind the downturn, including renewed concerns about inflation and a recent sell-off by the German government and Mt. Gox, a defunct cryptocurrency exchange.

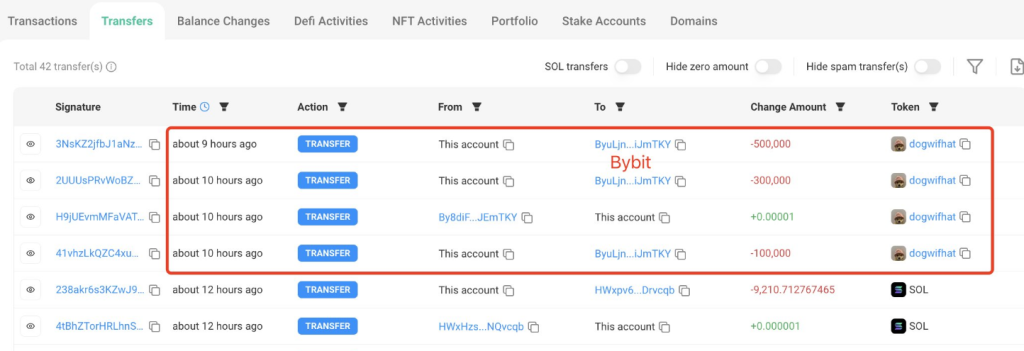

The price of $WIF dropped 15% as the market fell.

A whale deposited 900K $WIF($1.64M) to #Bybit 10 hours ago, leaving 974K $WIF($1.76M).https://t.co/qJwlxcWy15 pic.twitter.com/amIkvwKfNG

— Lookonchain (@lookonchain) July 4, 2024

The pain for Dogwifhat was further amplified by a whale of a different kind: a large investor. LookOnChain, a blockchain whale tracking agency, identified a major Solana whale dumping 900,000 WIF tokens in a series of transactions. This fire sale, amounting to roughly $1.64 million, undoubtedly contributed to the downward spiral.

Dogfight On Derivatives: Bulls Trampled, Bears Feast

While the Spot market witnessed a bloodbath, the WIF derivatives market displayed a curious mix of activity. Trading volume surged by a surprising 25%, propelling Dogwifhat to the coveted title of third most-demanded meme coin behind Dogecoin and Pepe Token. This surge in volume might suggest increased interest, but a closer look reveals a different story.

Lurking beneath the surface was a brutal battle between bullish and bearish investors. More than $3 million in WIF positions were liquidated in the last 24 hours. This liquidation primarily targeted long positions, meaning investors who bet on the price going up were forced to sell at a loss as the price plummeted.

While some might see the increased volume as a sign of potential revival, the liquidation figures paint a starker picture – many bulls got trampled by the bears feasting on the market downturn.

A Buying Opportunity Or A Boneheaded Move?

Despite the carnage, not everyone has lost faith in Dogwifhat. The plummeting price has attracted some opportunistic “Solana whales” who view the current price as an attractive entry point. This glimmer of hope hinges on the possibility that Dogwifhat can recapture its past glory.

Related Reading

In Q1 2024, Dogwifhat was a meme coin darling, riding the wave of the meme coin craze to a $4 billion market cap and a place in the top 30 global crypto rankings. However, the recent downturn serves as a stark reminder of the inherent volatility of meme coins, which often lack the utility or strong fundamentals of established cryptocurrencies.

The future of Dogwifhat remains uncertain. Whether it can claw its way back from the doghouse or fade into obscurity depends on several factors, including broader market trends, community support, and potential developments within the Dogwifhat ecosystem.

Featured image from Shutterstock, chart from TradingView

Source link

Altcoins

Solana-Based Memecoin Defies Market Downturn, Jumps Over 30% in 24 Hours Amid Listing on Multiple Exchanges

Published

3 days agoon

July 5, 2024By

admin

One Solana-based (SOL) meme asset is defying market doldrums and rallying after being listed on numerous crypto exchange platforms.

New data reveals that Billy (BILLY), a dog-themed memecoin built over Solana, has jumped over 30% during the last 24 hours after multiple crypto exchange platforms added support for it.

The crypto exchange platforms that listed Billy include Bittrue, Bitget, MEXC, and Gate.io, who all announced support for the meme asset earlier this week.

Billy is trading for $0.1659 at time of writing, a 36% gain during the last day. On June 26th, Billy was moving for just $0.0286.

Billy, which was launched earlier this year in June and features a picture of a puppy, is outpacing other prominent meme assets during the market’s current consolidation period, which has caused sharp decreases across the board.

Other dog-theme assets, such as dogwifhat (WIF), Shiba Inu (SHIB), Bonk (BONK), and Dogecoin (DOGE), are trading for $1.91, $0.000014, $0.000023, and $0.1046 at time of writing, respectively.

However, DOGE, WIF, SHIB, and BONK are all down between 30-40% during the last month while BILLY is up a staggering 150% during the same time frame.

According to data from blockchain tracker Dexscreener, Billy’s market cap is sitting at $161 million at time of writing while its 24-hour volume is at $24.6 million.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Quardia/Sensvector

Source link

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs