bear market

Veteran Trader Peter Brandt Issues Ethereum Alert, Says ETH Could Crash by up to 70% – Here Are His Targets

Published

7 months agoon

By

admin

A widely followed crypto analyst is issuing a warning about the second-largest digital asset by market cap.

Veteran trader Peter Brandt warns his 707,300 followers on the social media platform X that top altcoin Ethereum (ETH) could soon see an epic crash that sends it below $700.

“Classical chart patterns in price charts are not sacred – they fail to perform according to the textbooks all the time.

But, if the rising wedge in Ethereum complies with the script, the target is $1,000, then $650.

I shorted ETH on Friday — I have a protective B/E stop.”

When questioned by a follower if the pattern Brandt characterized as a rising wedge was not interpreted as an ascending triangle, a typically more bullish technical analysis pattern, Brandt offers further insight into his technical analysis process.

“1. I did consider (and still might consider) the ascending triangle interpretation.

- When in doubt on a pattern I look at [the] closing price line chart — in this case, a wedge.

- Too many on Twitter are calling this an ascending triangle – my contrarian tendencies.

- Super low risk shorting set up.”

With ETH currently worth $2,156 at time of writing, a fall to $650 would represent a nearly 70% decline for the leading smart contract platform.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/CYB3RUSS

Source link

You may like

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

bear market

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

Published

2 hours agoon

July 8, 2024By

admin

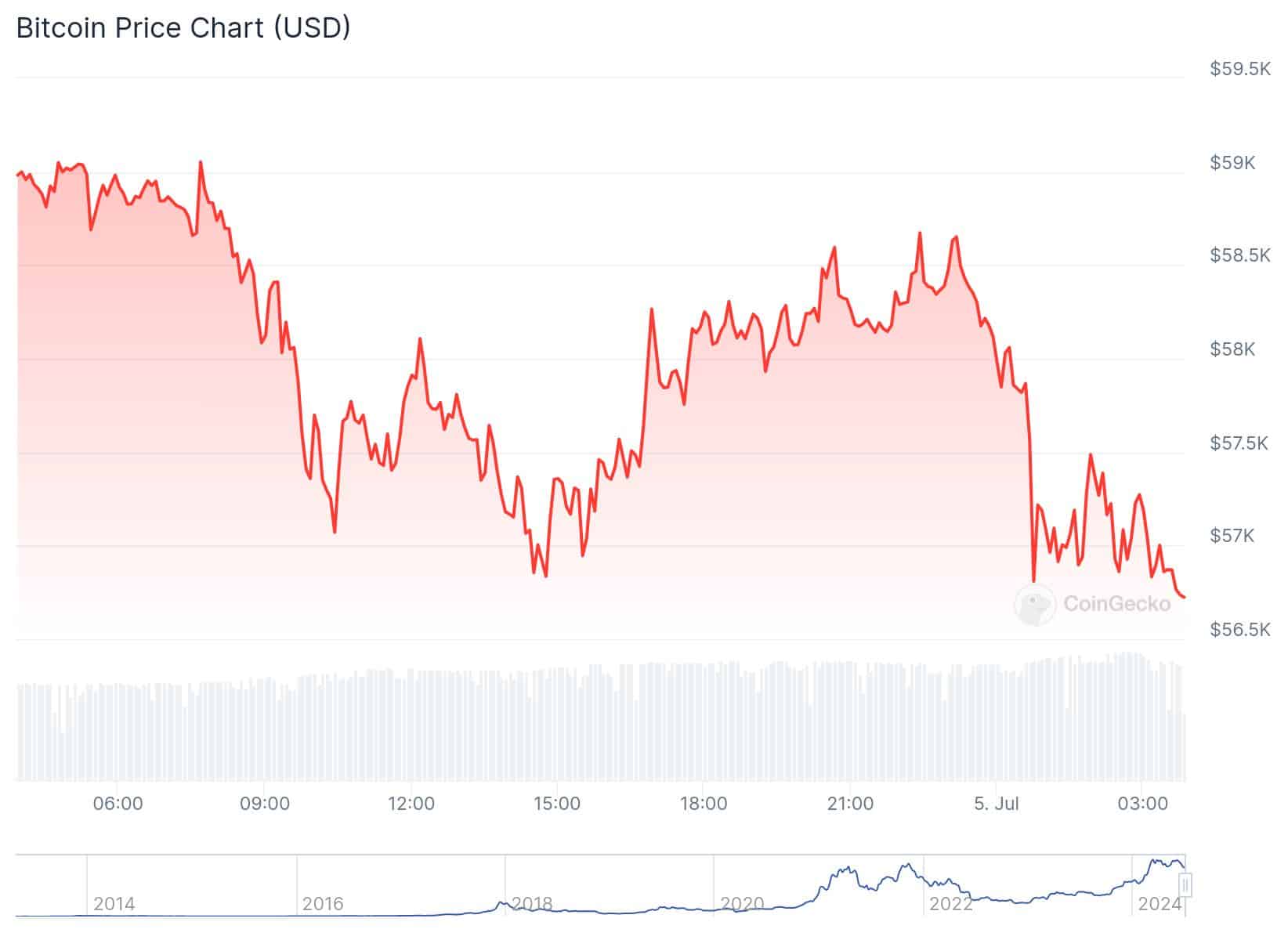

Bitcoin struggled amid recent Mt. Gox repayments and market trends, but the bearish behavior shouldn’t be interpreted as unfavorable.

Last week, Bitcoin (BTC) concluded the week at approximately $55,850, marking an 11% drop from the prior week’s closing price of $62,775. The week saw signficant selling pressure, with BTC dipping to as low as $53,500 on Thursday before rebounding to $58,250 and finally settling at $55,850.

BTC Spot ETFs recorded $238 million in net inflows during the downturn. Cumulative trading volume since inception stands at around $315 billion, showcasing a decline in trading activity. This aligns with typical market behavior, as Q3 usually witnesses lower trading activity.

“This data should not be seen negatively but rather as a seasonal trend, especially among traditional finance investors,” noted Matteo Greco, Research Analyst at Fineqia International.

Interestingly, the decline showed no correlation with BTC Spot ETF flows, a deviation from historical patterns where ETF flows significantly influenced price movements.

“However, for the first time since their inception, there is a noticeable decoupling between price action and capital flows, indicating that recent price behaviour has been driven mainly by trading activity within the crypto-native space,” added Greco.

Mt. Gox

The high on-chain selling pressure is partly due to the commencement of long-awaited Mt. Gox repayments.

Founded in 2010, Mt. Gox quickly became the world’s largest Bitcoin exchange. Its success was short-lived as it abruptly halted trading, shut down its website, and filed for bankruptcy protection in early 2014, revealing the loss of approximately 850,000 BTC, worth about $450 million at the time, due to thefts from its hot wallets over several years starting as early as late 2011.

Official confirmation of repayments, marked by the movement of 47,228 BTC from a Mt. Gox-associated cold wallet, has triggered market reactions. Additionally, after a recent halving that reduced mining rewards by 50%, miners’ selling pressure continues to affect prices, though it has decreased recently.

The recent drawdown has notably reduced unrealized profits, driven by long-term holders selling their coins. The MVRV ratio now stands at around 1.5, indicating an average unrealized profit of 50% among market participants, down from over 200% in March.

“This trend suggests that recent price action was mainly due to long-term holders taking profits and selling their coins to new buyers at higher purchase prices,” Greco added.

Source link

24/7 Cryptocurrency News

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Published

4 days agoon

July 5, 2024By

admin

Ethereum and other altcoins have tumbled to lows not recorded in several weeks. This bearish outlook was also recorded in Bitcoin (BTC) and other decentralized finance (DeFi) tokens. Ethereum price has taken steps back wiping out previously recorded gains this week. A major reason for the market decline is a fall in sentiments with many pointing to major market corrections.

The total crypto market fell to $2.11 trillion, a 4.8% decline in the last 24 hours. Meanwhile, several altcoins notched wider losses today deepening the negative sentiments. The drop in the ETH price also coincides with lower on-chain numbers and a transfer of assets to centralized exchanges which signals potential sales.

Ethereum Price Nears $3K

This year, Ethereum and other crypto assets surged to new highs amid the approval of spot Bitcoin ETFs in the United States. Despite the previous price gains and institutional inflows, massive sell-offs recorded in recent times have deepened sentiments. Ethereum trades at $3,075, a 7% drop in the last 24 hours. Weekly losses pierced double digits at 11% while monthly figures topped 19% in the red zone.

These outflows have sparked similar numbers in other altcoins. ETH’s market cap tanked to $367 billion while daily trading volume is over $20 billion. This year came with projections of sustained growth above $4k but plummeting price now sees ETH moving near $3k. The drop in crypto assets might force prices lower although many holders believe a rebound might be on the cards.

Altcoins Are Sinking

Like most commentators opine, Ethereum price can surge with positive mainstream factors. The listing of ETH ETFs can lead to a jump in the asset’s price. The recent slump has also affected altcoin prices with Solana trading below $130 and $126 and Ripple plunging over 8% in the last 24 hours. Toncoin and Cardano were also down today with larger numbers posted by meme coins.

Also Read: End of The Road for Meme Coins? Dogecoin Takes Heavy Losses

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

3 Signs Of a Sustained Bearish Sentiment

Published

5 days agoon

July 4, 2024By

admin

Digital assets are facing sharp corrections after an attempted rebound with some users pointing to a long-term bearish sentiment. This year, crypto asset prices moved up the ladder following huge institutional inflows in the market. While this heightened the bull cycle, certain events have drawn lines of a creeping bear sentiment in the market.

The recent market correction sparked major sell-offs leading to liquidations as traders repositioned their holdings. For slight and sustained bearish sentiments, there are signs to watch out for. The current sentiment is largely viewed as short-term as bulls look forward to a price boost on the back of historical trajectories. As Bitcoin and other crypto assets plummet, here are key points to watch out for a bearish sentiment.

Massive Transfers to Exchanges

A bull cycle comes with price highs as most users buy assets with limited sell pressure. However, where signs of sales are recorded, a bearish sentiment builds with traders. Large transfers of assets to centralized exchanges are perceived as potential sales while move-off exchanges show signs of long-term holding. Some of the reasons include the ease of a sale on exchanges. This year, large amounts of BTC were taken off exchanges during the price highs.

Frequent Price Correction

Crypto assets are volatile so certain price swings are expected. However, when top asset prices fall for consistent periods, a bearish sentiment could form in the market. This could also happen in persistent downward fluctuations taking the assets far below the achieved highs. This occurred after the 2021 bull season when the price of Bitcoin dropped below $25,000 from over $62,000.

Miner Reserves

A look at miner reserves points to present market conditions to know if there’s a bearish sentiment. If Bitcoin miners sell reserves, it often means the market is on a downward slope. This is because, in a price correction, BTC miners tend to sell assets to cover losses from declined market activity. On the other hand, miners will hold on to assets where there is positive momentum.

Also Read: Market Fluctuations Take Uniswap Exits Near Weekly Double Digits

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Pepe Price Analysis Reveals Bullish Strength As Bitcoin Plummets

Taiwan is not in a CBDC rush as central bank lacks timetable

Will SHIB Price Reclaim $0.00003 Mark By July End?

The power of play: Web2 games need web3 stickiness

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: