Bitcoin

Why Joe Biden Hates Bitcoin

Published

4 weeks agoon

By

admin

Over the last four years, President Joe Biden has demonstrated a clear reluctance to support the Bitcoin and cryptocurrency industry, as recently evidenced by his veto of significant legislation and the broader stance of his administration. On May 31, Biden vetoed a pivotal bill that would have allowed highly trusted financial institutions to custody Bitcoin and other cryptocurrencies.

BREAKING: 🇺🇸 President Biden vetoes bill that would allow highly regulated financial firms to custody #Bitcoin and crypto. pic.twitter.com/TMHavdWRx7

— Bitcoin Magazine (@BitcoinMagazine) May 31, 2024

The legislation in question had garnered bipartisan support in both the House and Senate. It aimed to provide a regulatory framework that would enable banks and other financial entities to securely hold digital assets, thereby further integrating Bitcoin into the mainstream financial system. Proponents of the bill argued that such a framework would enhance security of spot Bitcoin ETF funds by distributing the honeypot of coins currently held by only a couple institutions, promote innovation, and help facilitate the growth of the Bitcoin industry. However, Biden’s veto reflects his administration’s lack of support for the industry, where the President previously compared crypto traders to “wealthy tax evaders”.

The Biden Administration also published a report attacking Bitcoin and Proof of Work mining, promoting a Central Bank Digital Currency (CBDC) instead, stating “A U.S. CBDC would have the potential to offer significant benefits”. Biden wanting to embrace a CBDC, which would allow the Federal government to have complete control over their citizens finances, further shows his true colors and reasoning for not supporting Bitcoin.

Recently, Joe Biden’s Department of Justice arrested the founders of popular privacy focused Bitcoin mixing service, Samourai Wallet, and charged them with money laundering. U.S. Senator Cynthia Lummis defended the Samourai founders, stating that “this stance contradicts existing Treasury guidance, common sense, and violates the rule of law.” Renowned whistleblower Edward Snowden also commented on the arrest:

NEW: Edward Snowden on the U.S. Department of Justice arresting #Bitcoin mixing service Samourai Wallet founders and CEO pic.twitter.com/qmigHJzmZU

— Bitcoin Magazine (@BitcoinMagazine) April 24, 2024

In addition, the Democratic Party in general has also shown a reluctance to support pro-Bitcoin legislation. Key figures like Senator Elizabeth Warren have been particularly vocal in their opposition to the crypto industry. Warren has often criticized cryptocurrencies for their environmental impact and regulatory challenges, and infamously stated that she is “building an anti-crypto army” to address what she perceives as the industry’s threats to financial stability and consumer protection.

In stark contrast, former President Donald Trump has recently embraced Bitcoin and cryptocurrencies. On June 1, 2024, Trump announced that his campaign would accept Bitcoin payments through the Lightning Network, facilitated by OpenNode, a Bitcoin and Lightning Network infrastructure provider. Trump has recently said that he “will ensure that the future of crypto and Bitcoin will be made in the USA…I will support the right to self custody to the nations 50 million crypto holders”. Trump has also recently stated that he is “very positive and open minded to crypto companies,” and that “Our country must be the leader in the field. There is no second place.”

Despite the Democrats’ stance, the Bitcoin industry is becoming an increasingly influential force in U.S. politics. Recent polls indicate that crypto voters are largely nonpartisan, with no significant leaning towards either the Republican or Democratic parties. This demographic represents a substantial and growing portion of the electorate, with over 50 million Bitcoin and crypto holders in the United States. As the 2024 Presidential election approaches, Bitcoin policy is emerging as a critical issue for candidates to address.

The evolving stance of political leaders on Bitcoin and cryptocurrencies underscores the growing importance of these assets in shaping economic and regulatory policies. For Biden, his reluctance to embrace Bitcoin is alienating a significant segment of the voter base. Crypto advocates argue that clear regulatory frameworks and mainstream acceptance of Bitcoin would drive economic growth, foster innovation, and enhance financial inclusion. However, the Biden administration’s focus remains on preventing that from happening.

The rise of Bitcoin has introduced new dynamics into the political landscape. While Bitcoin operates in a nonpartisan manner, appealing to individuals across the political spectrum, this does not mean all politicians will embrace it. Joe Biden and the Democrats are turning a non-partisan technology into a partisan issue.

In conclusion, the Biden administration and majority of Democrats favor a CBDC over a decentralized cryptocurrency like Bitcoin. A CBDC aligns more with Biden and the Democrats than Bitcoin, as Bitcoin is less appealing to them because it does not help them achieve their aspiring authoritarian goals.

As the 2024 Presidential election looms, the role of Bitcoin policy in shaping voter preferences and political strategies is becoming increasingly evident. With over 50 million Bitcoin and crypto holders in the United States, the decisions of political leaders on digital assets will likely play a pivotal role in the upcoming election, reflecting the growing significance of Bitcoin in the broader economic and political landscape.

Source link

You may like

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

Bitcoin

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

Published

40 mins agoon

July 8, 2024By

admin

Today, a Republican National Committee panel approved a draft of its 2024 party platform, that strongly supports Bitcoin.

On page nine, the draft explicitly states, “We will defend the right to mine Bitcoin, and ensure every American has the right to self-custody of their digital assets, and transact free from Government Surveillance and Control.”

JUST IN: 🇺🇸 Republican National Committee panel passes draft of party platform, pledging to "defend the right to mine #Bitcoin" and protect self custody. pic.twitter.com/CnH8nMOuUO

— Bitcoin Magazine (@BitcoinMagazine) July 8, 2024

Additionally, it promises to end what it calls the Democrats’ “unlawful and unAmerican Crypto crackdown” and opposes the creation of a Central Bank Digital Currency (CBDC). According to The Hill, the platform committee overwhelmingly approved the new draft and it will face a final vote on Tuesday.

This decision further marks a clear stance by the Republican party in favor of Bitcoin and cryptocurrency innovation, positioning itself against the current unwelcoming stance by the Biden Administration and Democrats.

The draft reflects the growing interest and advocacy for protecting and supporting Bitcoin within the party, aligning with broader trends of Bitcoin adoption and support among various Republican politicians. In May, Donald Trump said he “will ensure that the future of crypto and Bitcoin will be made in the USA.”

The full approved draft can be read here:

View the original article to see embedded media.

Source link

Bitcoin

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Published

3 hours agoon

July 8, 2024By

admin

Recent data shows that the Bitcoin mining difficulty is on the decline and has hit its lowest since May. This is significant considering what this could mean for the Bitcoin ecosystem, specifically Bitcoin’s price.

Bitcoin Mining Difficulty Drops To 79.5 T

Data from CoinWarz shows that Bitcoin mining difficulty has dropped to 79.5 T at block 851,204 and hasn’t changed in the last 24 hours. This mining difficulty has continued to fall for a while, with further data from CoinWarz showing that it is down 5% in the last seven and 30 days.

Bitcoin mining difficulty refers to how hard it is for miners to mine a new block on the Bitcoin network. The difficulty usually reduces when there is less computational power on the power and increases when miners are mining faster than the block average time of ten minutes. The recent drop in mining difficulty suggests that more miners are leaving the Bitcoin network.

This is most likely due to the effects of the Bitcoin halving, which cut miners’ rewards in half. This has reduced the revenue from their mining operations, with many miners struggling to stay afloat, especially with increased competition. Bitcoin’s price action since the halving has also not helped, as the drop in the flagship crypto’s price has also affected their income.

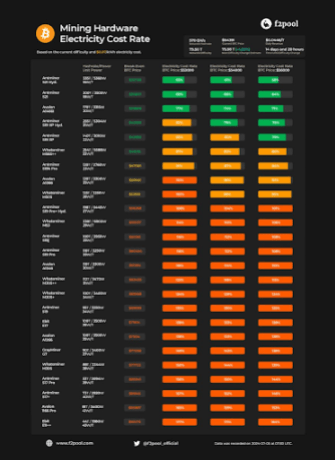

Bitcoin miner f2pool recently highlighted the profitability of various categories of miners at Bitcoin’s current price. The mining firm noted that only ASICs with a Unit Power of 26 W/T or less can make a profit at Bitcoin’s current price range.

Crypto analyst James Van Straten also recently highlighted how “weak and inefficient miners” continue to be purged from the Bitcoin network. He claimed that the recent drop in mining difficulty shows that miner capitulation is closer to ending. Due to the low profitability that miners have faced since the halving, some have had to offload a significant amount of their Bitcoin reserves to meet operational costs, and others have had to exit the Bitcoin ecosystem entirely.

What This Means For Bitcoin’s Price

The decline in mining difficulty suggests that miner capitulation might be ending soon, which is a positive for Bitcoin’s price considering the selling pressure these miners have put on it. Bitcoinist reported that Bitcoin miners sold over 30,000 BTC ($2 billion) last month, which ultimately caused the flagship crypto to experience significant price crashes.

Crypto expert Willy Woo also attributed Bitcoin’s tepid price action to these miners and mentioned that the flagship crypto will only recover when the “weak miners die and hash rate recovers.” He stated that Bitcoin would have to shed weak hands for this to happen, with inefficient miners going into bankruptcy while other mines are forced to buy more efficient hardware.

Source link

24/7 Cryptocurrency News

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

Published

4 hours agoon

July 8, 2024By

adminThe price of Bitcoin (BTC)e is yet to wriggle off from its bearish sentiment. It has doubled down on its selloffs from the past week.

BTC Trading Volume Records 94% Surge

At the time of this writing, Bitcoin was trading at $55,677.54 with a 2.34% drop in the last 24 hours. This has been the trend with the cryptocurrency in the last few weeks.

Markedly, this downtrend has been since the German government began to transfer Bitcoin to cryptocurrency exchanges, in addition to Mt.Gox repayment of its customers. The frequent offloads are an indication that Bitcoin investors including wallets that have stayed dormant for several years, are beginning to exit their positions, both short and long.

On the flip side, Bitcoin trading volume is moving upward. According to CoinMarketCap, Bitcoin’s trading volume has shot up by approximately 94.66% within the last 24 hours. Currently, BTC has hit a trading volume of $38,838,830,710. This suggests that investors are still showing interest in the coin amidst a broad market downturn. It reflects the change in market dynamics on the upside. This suggest that the market may be heading towards a bullish sentiment and probably hit a new all-time-high (ATH) as earlier projected.

For now, the selling pressure is still mounting. According to QCP Capital analysts, Bitcoin prices are continuing “to chop violently on very thin liquidity.”

Bitcoin Liquidation Continues With Mt.Gox And the German Government

More Bitcoin are still leaving the German government wallet, triggering more selling pressure. In the early hours of Monday, the German government dumped BTC to crypto market maker Cumberland DRW and Flow Traders, including crypto exchanges Coinbase, Bitstamp, and Kraken and other wallet addresses. This time around, almost 5,000 BTC were sent out by the German government.

The transfer to Cumberland DRW was made in two transactions. Markedly, the first one was a transfer of 0.001, likely a test transfer to follow with large transfers in the future. The total Bitcoin transfer to the crypto market maker summed up to 133.723 BTC worth nearly $7.63 million.

Just before publishing this story, the government moved another 2,300 BTC in its ongoing liquidations. It is believed that the German government still has as much as 32,488 BTC with an estimated worth of $1.855 billion

Similarly, Bitstamp is working on hastening the Mt.Gox repayment process. The exchange has a 60-day window to distribute tokens but aims to compensate investors much sooner. When this Bitcoin hit the market, the trajectory of Bitcoin is bound to change but the direction remains uncertain.

Read More: Bitcoin Miner Bitfarms Appoints New CEO Amid Riot Takeover Bid

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture. Follow him on Twitter, Linkedin

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: