Bitcoin

Between Bitcoin Layers: Boltz Builds Trustless Transfers

Published

3 weeks agoon

By

admin

Company Name: Boltz

Founders: Kilian and Michael

Date Founded: Project began in 2019 | Incorporated in 2023

Location of Headquarters: Remote | Incorporated in El Salvador

Amount of Bitcoin Held in Treasury: 100% of treasury is BTC

Number of Employees: 5

Website: https://boltz.exchange/

Public or Private? Private

Swapping sats between Bitcoin layers can be difficult, but Boltz makes it easier.

Boltz is a non-custodial exchange that lets users send their bitcoin between the Bitcoin base chain, the Lightning Network and the Liquid Network.

While Boltz is now used by both everyday bitcoin users and institutions alike, the platform, which is almost as old as the Lightning Network itself, was born out of necessity and was foundational in helping the Lightning Network function in its early days.

The History of Boltz

“Boltz as an idea started in 2018,” Kilian told Bitcoin Magazine.

“I was working on a Lightning-based decentralized exchange and realized pretty quickly that it was very tough to keep Lightning channels balanced,” he added.

“Boltz was really born as a band-aid to fix this, a service provider that would take care of your Lightning channel balances and keep them balanced for you.”

In creating Boltz, one of the primary non-negotiables Kilian and his team established was that it had to be non-custodial so to best align with the Bitcoin ethos of decentralization.

The Boltz mainnet launched in April 2019 and facilitated Bitcoin base chain to Lightning swaps only until early 2023, when Kilian and Boltz’s other co-founder, Michael, realized that Boltz needed more attention.

“We saw it organically growing and we felt that it deserved more,” said Kilian.

“We decided in early 2023 to go in full time and that the next major feature would be Liquid Swaps, which we then launched in May 2023,” he added.

It was around this time that Kilian and Michael turned Boltz into a proper business, as opposed to a passion project, which it had been up until that point. In doing so, they went after a new user base and experienced some growing pains in the process.

Liquid Swaps

“In 2023, when we started Liquid Swaps, we targeted more professional users, specifically for the channel rebalance use case in a fee sensitive [environment],” explained Kilian. “We launched it during the fee spike in May 2023.”

The fee spike to which Kilian referred was the result of the introduction of Ordinals onto the Bitcoin base chain. Bitcoin transaction fees had reached all-time highs by late-April 2023.

As fees rose to 500-600 sats/vByte, resulting in transaction fees hitting over $100 in some cases, things began to break and even Boltz felt the heat.

“We had to shut down Boltz for three or four days,” recalled Kilian.

“Boltz was not available because we had all our working capital locked up in the mempool and we were not able to pump it out because fees kept on rising. A lot of similar services had this problem,” he added.

Kilian then pointed out that Liquid was a solution for many companies facing this predicament.

“If you imagine the typical use case of getting inbound liquidity on Lightning, you can do so multiple times with Liquid,” explained Kilian.

“You send out via Lightning, thus getting inbound liquidity, and get Liquid LBTC back. This really made a lot of sense to users when we launched it. The launch was successful, [and we] breathed a little bit of life into the Liquid ecosystem,” he added.

Kilian also shared that Boltz’s swap service underpins the Aqua Wallet, a wallet that enables Liquid to Lightning swaps that became popular in mid-2023.

Boltz — Behind the Scenes

Aqua isn’t the only Bitcoin-related product that employs Boltz on the backend.

Breez Wallet, a non-custodial Lightning wallet, was actually the first bitcoin wallet that utilized Boltz’s swap service.

“Sometimes Breez users want to send to an on-chain regular Bitcoin address because the merchant only accepts on-chain,” said Kilian. “So, Breez integrated our open, publicly-available API in order to offer these swaps directly within the app.”

For a Breez Wallet user to spend some of their sats on Lightning for an on-chain purchase, they simply have to scan a Bitcoin QR code and the bitcoin swap from Lightning to the Bitcoin base chain happens in the background via Boltz.

Kilian said that Boltz plans to work with more companies in providing its service behind the scenes.

“It’s crucial for great UX that users do not have to open our website but can stay in whatever product/wallet they [are using] and move their bitcoin between layers right where they are,” Kilian said. “Our non-custodial API is something we pioneered and we are very proud of.”

How Boltz Works — Atomic Swaps

According to Kilian, creating a non-custodial service — especially one that integrates well with other non-custodial services — was not an easy task.

As mentioned, keeping the service non-custodial was a must for Kilian and the Boltz team, partially because they didn’t want to be regulated as an entity that custodies user funds and partially because they didn’t want users to have to trust intermediaries to execute the transactions.

“You do not want to trust a random website, a random project that you find on the internet,” explained Kilian.

“We also want to be available to users that say, ‘Okay, I don’t know them necessarily, but I hear these guys saying it’s non-custodial. Probably some technical person checked that it’s actually non-custodial, so I’m going to give it a shot,’” he added.

The key technology that enables Boltz to be non-custodial is the Atomic Swap. And Boltz utilizes a subcategory of Atomic Swap called the Submarine Swap.

Submarine Swaps employ hash time-locked contracts (HTLC), which in layperson’s terms, enable two transactions (both sides of the swap) to happen simultaneously by linking them together cryptographically inside of a smart contract. Using this technology, there is no way for one exchange to occur without the other occurring at the same moment.

This is the most trustless solution that exists for moving sats between Bitcoin layers.

And in January of this year, Boltz took this technology to the next level when it enabled Taproot Swaps, which has helped make issuing refunds on failed Lightning transactions more efficient.

“Until January, when a swap to a Lightning invoice or to a Lightning destination failed, you had to wait until you could get your refund back,” said Kilian.

“That’s a drawback and just bad UX in the end. With Taproot, there’s a new way you can spend coins. It’s called ‘key path.’ And with this key path spent, basically what we could do is we could issue refunds immediately,” he added.

Kilian added that Taproot Swaps also enhance privacy, as they don’t reveal anything about the swap on-chain.

“If a chain observer is looking at the chain, one cannot tell that this is part of an Atomic Swap or even a Boltz swap,” explained Kilian. “There’s no way to do that.”

A “Privacy-Respecting” Solution

After Kilian said the “P” word — privacy — I inquired as to whether or not he was worried that Boltz might end up in the crosshairs of the authorities, especially in the wake of the US Department of Justice (DoJ) pressing charges against the Samourai Wallet developers.

“I’d be lying if I’d be saying we’re not worried at all because everyone is worried and everyone was very worried, especially in the first couple of days after the Samourai incident happened,” responded Kilian.

However, he was quick to point out that Boltz itself isn’t a privacy solution but a “privacy-respecting” solution.

“We are in no way to be compared with a coinjoin or with a solution that you are using in order to gain privacy,” said Kilian.

“When you do a swap on Boltz, there’s minimum one party that has the information of incoming and outgoing payments — and that is us. You shouldn’t trust us to not reveal this information one day,” he added.

“That being said, we are respecting privacy in the sense that we are not requiring more information than is strictly necessary — the destination address or the destination invoice — in order to do this work. We do not need your email address. We also do not need your IP address. And you can access our service via Tor.”

The Future of Boltz

Moving forward, there’s one main role Kilian would like for Boltz to play.

“Our vision really is to be the bridge between the Bitcoin layers,” he said.

“We’re seeing Bitcoin layer 2 sidechains, different sorts of layers are gaining traction, and this box won’t just close. This is unstoppable now, and we want to be the place that connects these layers,” he added.

At the same time, Kilian stressed that Lightning will continue to be Boltz’s primary focus as he considers it the “connecting tissue” between Bitcoin layers. On that note, he mentioned that Boltz recently launched a new client that automates the task of rebalancing Lightning nodes.

It’s clear that while Kilian and the team at Boltz are keeping their eyes open for new opportunities, they will continue iterating on what they do best.

Whatever the future holds for Boltz, Kilian said repeatedly that it will continue to focus on being “the easiest place with the best UX to non-custodially move [sats] in between Bitcoin layers.”

Source link

You may like

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Bitcoin

crypto will get positive regulation ‘no matter who wins’ election

Published

5 hours agoon

July 3, 2024By

admin

Galaxy Digital founder and CEO Mike Novogratz told CNBC’s ‘Squawk Box’ on Tuesday that the US crypto sector is headed for positive regulations regardless of who wins the upcoming election.

Mike Novogratz, one of the biggest crypto bulls, shared his outlook during an interview that touched on the current US political scene, Biden’s disastrous debate and crypto. The billionaire asserted that despite the current status of crypto regulation in the US, he believes the next regime will take a positive stance and help the industry grow.

“I am not a single issue voter and I do fundamentally believe crypto should be a bipartisan and needs to be bipartisan. We cannot have one party that likes this and another party that doesn’t like it,” Novogratz said.

Crypto regulatory landscape “shifting”

According to Novogratz, crypto is already largely a bipartisan issue in the US, with only a small group of Democrats taking a negative stance against this burgeoning industry. While it’s been frustrating, in terms of lack of regulatory clarity or the negative impact of government crackdown on the industry, Novogratz believes it’s “all shifting.”

“I’ll tell you that most Democrats, outside of Elizabeth Warren and a small group of people, are pretty pro-innovation and pro-crypto… Listen, no matter who wins the next election, we are going to get positive crypto legislation. I know that” he added.

Novogratz says BTC is a core holding

Commenting on Bitcoin following the ETF-buoyed upside that pushed prices above $73k in March, Novogratz referred back to earlier comments he shared about BTC price post-ETF approval. In his opinion, the benchmark cryptocurrency was likely to stay in the $55k-$73k range until the market got a dose of new news.

“It takes a while for things to digest,” he noted, adding that Bitcoin’s surge to its all-time high this year was “a huge move up.”

Novogratz believes BTC as a core portfolio holding makes sense, especially as the US debt balloons amid the government’s “spending like drunken sailors.”

Bitcoin traded around $61,862 at the time of writing, about 9% down in the past 30 days. However, its up 44% year-to-date and 102% in the past year.

Source link

Bitcoin

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Published

9 hours agoon

July 2, 2024By

admin

CleanSpark capped a busy June with an uptick in mined Bitcoin and a 2x increase in hashrate compared to December.

According to a Tuesday press statement, CleanSpark mined 445 Bitcoin (BTC) in June after adding five new mining facilities in Georgia. The mining startup also surpassed its 20 EH/s operational hashrate target set for mid-year.

“We continue to maximize efficiency at our existing sites and look forward to the opportunities ahead of us in Wyoming and Tennessee,” said CEO Zach Bradford.

CleanSpark’s mining numbers for last month indicate strength from the company after the Bitcoin halving event in April. A halving happens every four years and cuts mining rewards in half. The company mined 46 less BTC than last June, a modest difference considering Bitcoin’s code change.

Bradford added that the firm is “laser-focused” on increasing mining hashrate and generating more revenue following the halving. Meanwhile, other miners are facing difficulties and exploring business sales to maximize shareholder value.

CleanSpark’s post-halving performance has been the envy of the mining landscape as the startup has improved its hashrate and mined more BTC in recent months. Per crypto.news, Bradford’s firm also acquired GRIID facilities in a $155 million deal, and analysts at H.C. Wainright are bullish on the CLSK stock. CLSK is up 58% year-to-date and changed hands for $17.19 on the Nasdaq as of writing.

Source link

Bitcoin

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Published

15 hours agoon

July 2, 2024By

admin

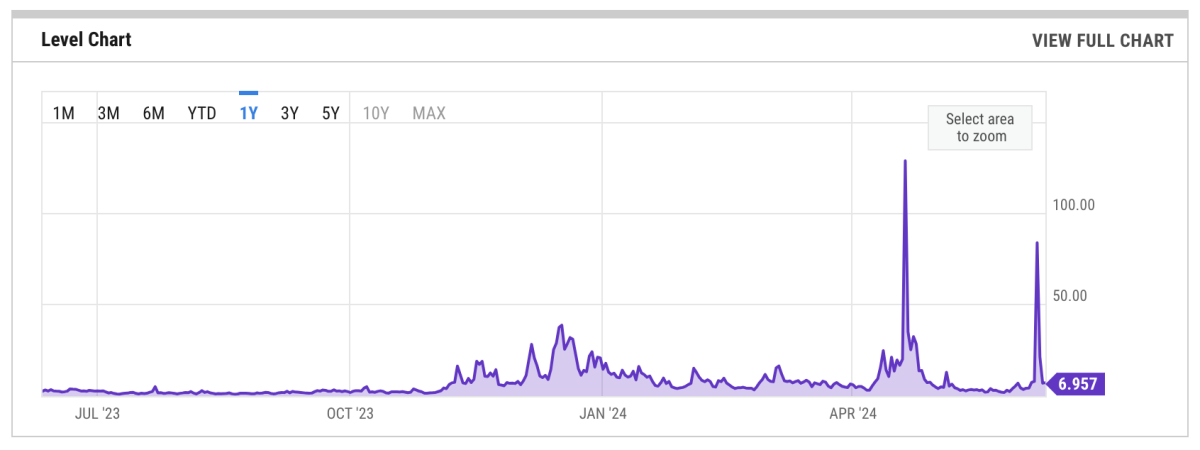

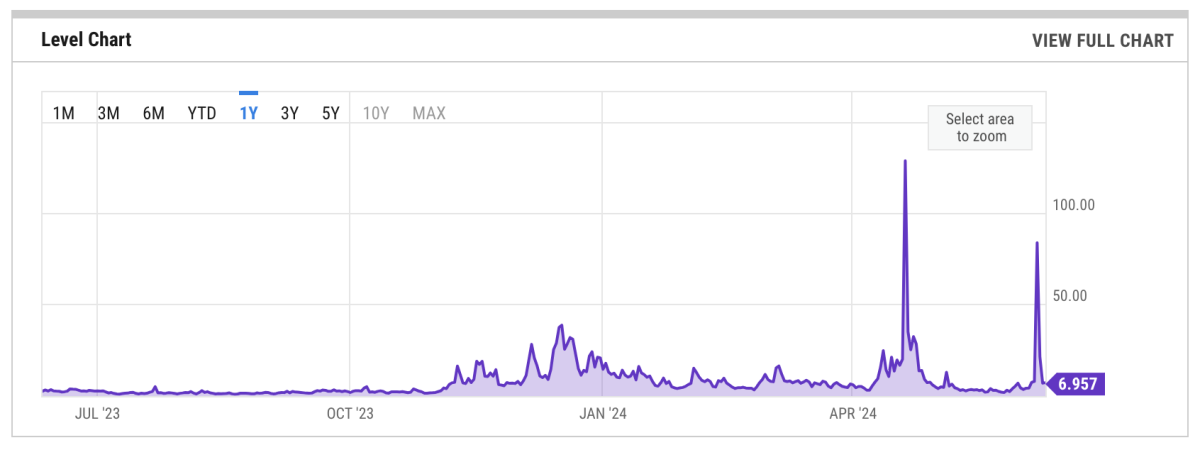

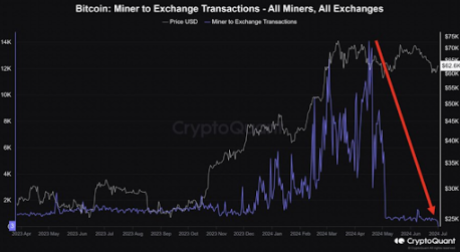

On-chain data shows that selling pressure from Bitcoin miners has recently slowed down. This is significant considering the impact it could have on Bitcoin’s price heading into the third quarter of the year.

Bitcoin Miners’ Selling Pressure Has Significantly Declined

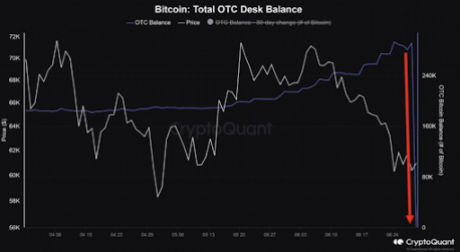

Referencing data from the on-chain analytics platform CryptoQuant, crypto analyst Crypto Dan noted that selling pressure from miners has significantly declined for two reasons. One is that the quantity of Bitcoin these miners sent to exchanges to sell has reduced drastically since May.

Related Reading

Secondly, the crypto analyst mentioned that the volume of the OTC Desk that miners use for selling has been consumed, suggesting that someone recently bought up all the available Bitcoin supply from these miners. The volume of the OTC Desk is said to have piled up until June 29th, as there was no willing buyer to purchase these crypto tokens.

Bitcoin miners greatly contributed to the price crashes the flagship crypto suffered in June. Data from the market intelligence platform IntoTheBlock showed that these miners sold 30,000 BTC ($2 billion) throughout the month. This put significant selling pressure on Bitcoin, which caused it to drop below $60,000 at some point.

As such, the decline in selling pressure presents a bullish development for Bitcoin and could continue the bull run for the flagship crypto. Crypto Dan noted that this development has created “sufficient conditions” to continue the upward rally for Bitcoin in this third quarter of the year.

Crypto analyst Willy Woo had also previously predicted that Bitcoin’s price would recover once miners capitulate. With that out of the way, Bitcoin could enjoy an upward trend this month and make massive moves to the upside.

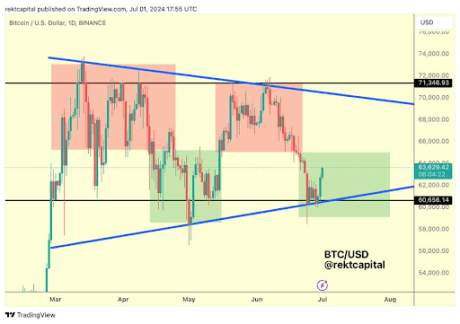

BTC’s Uptrend Has Begun

Crypto analyst Rekt Capital noted in a recent X (formerly Twitter) post that Bitcoin’s uptrend has begun. He claimed that the macro higher low has been confirmed, and Bitcoin is now rallying to the upside. He added that the flagship crypto is developing a macro bull flag, providing a bullish outlook for the crypto token.

Related Reading

In another X post, the crypto analyst remarked that the goal for Bitcoin following its strong start to July is to build a “foundation from which it will be able to springboard to the Range High area at $71,500 over time.”

Crypto analyst Michaël van de Poppe also suggested that Bitcoin’s downtrend is over and a bullish reversal was underway as the flagship crypto makes significant moves to the upside. He also mentioned that he believes that Bitcoin has bottomed out and has found support at $60,000, meaning a decline below that price level anytime soon was unlikely.

At the time of writing, Bitcoin is trading at around $62,900, down in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs