Bitcoin

Bitcoin Crashes To $65,000, Expert Unpacks Drivers Of Crypto Market Bloodbath

Published

2 weeks agoon

By

admin

The cryptocurrency market has been experiencing a significant downturn, with Bitcoin leading the way by retracing to the $65,000 mark after failing to retest its all-time high of $73,700 reached in March.

Market expert Michael van de Poppe has shed light on the reasons behind this ongoing bloodbath, highlighting several key factors that have contributed to the current state of the market.

Crypto Market Battles Uncertainties

A key event highlighted by van de Poppe is last Wednesday’s release of the Consumer Price Index (CPI) data, which has a major impact on the Federal Reserve’s decision on interest rates.

The data, which came in lower than expected, favored risk assets. A lower-than-expected headline CPI of 3.3% (vs. 3.4% expected) and core CPI of 3.4% (vs. 3.5% expected) pointed to potential rate cuts or a positive outlook for future rate cuts, providing favorable market conditions.

Related Reading

Another significant event was the release of the Producer Price Index (PPI) data, which provides inflation data from the producer’s perspective. The data revealed a lower-than-expected regular PPI score of 2.2% (versus an expected 2.5%) and Core PPI Y/Y score of 2.3% (versus an expected 2.4%).

Additionally, the monthly data showed negative figures, further favoring risk-on assets. However, van de Poppe contends that despite these positive indicators, the crypto market has continued its downward trend.

According to van de Poppe, the release of consumer sentiment data on Friday also impacted the market. Consumer sentiment is considered a market leader and a gauge of market strength or weakness. The data came in lower than expected, with a score of 65.6 (versus an expected 72.1).

This data signaled a lack of economic strength, potentially fueling bullish sentiments for risk-on assets and a shift toward crypto-native markets.

However, Federal Reserve Chairman Jerome Powell delivered an unexpectedly hawkish speech. Despite data pointing towards the need for rate cuts and worsening economic conditions, Powell maintained a hawkish tone and revised the potential rate cuts in 2024.

According to Michael van de Poppe, this outlook did not bode well for the markets, adding to existing uncertainties and the notorious price volatility seen in recent days.

Bitcoin Price’s Struggle Continues As Bond Yields Drop

The analyst further pointed out that Market indicators, such as Treasury Bond Yields, declined. The 2-year Treasury Bond Yield dropped to the lowest point in two months, while the 10-year Yield continued its fall to the lowest point since the beginning of April.

These indicators typically suggest favorable conditions for Bitcoin and risk-on assets, implying a higher probability of a potential rate cut. However, the strength of the US Dollar persisted due to the rate cut by the European Central Bank (ECB).

Van de poppe believes that this unexpected Dollar strength, driven by the ECB’s actions, further complicated the market dynamics, as rate cuts are usually necessary for economic stability.

Related Reading

In sum, the cryptocurrency market, particularly Bitcoin, has substantially declined as it struggles to regain its previous highs. Despite positive economic data pointing towards potential rate cuts and market indicators favoring risk-on assets, the market has failed to respond positively.

The ongoing uncertainties surrounding events, such as the listing of the Ethereum ETF, have contributed to the market’s weakness. With rate cuts on the horizon and the Dollar’s strength persisting, the upcoming weeks will likely be critical in determining the market’s direction.

When writing, Bitcoin was trading at $65,280, down by 2% in the past 24 hours and over 5% in the past seven days.

Featured image from DALL-E, chart from TradingView.com

Source link

You may like

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

Bitcoin

Bitcoin ATM installations reach 38k, below the all-time high

Published

6 hours agoon

July 1, 2024By

admin

The global Bitcoin ATM market has seen significant growth. There are now over 38,000 Bitcoin ATMs worldwide, up from just over 10,000 in October 2020 and down by 2,000 from its all-time high (ATH) of nearly 40,000 in December 2022.

According to data available on Coin ATM Radar, the global tally of installed Bitcoin ATMs stands at 38,279 as of the latest count.

This expansion is driven by factors such as accessibility and ease of use, profitability for operators who earn transaction fees above the Bitcoin spot price, and favorable regulatory environments in many countries that support setup and expansion.

Additionally, Bitcoin ATMs provide enhanced privacy and security, allowing users to transact without divulging personal information and enabling direct deposits into digital wallets.

Despite their advantages, the industry faces challenges. Many operators lack the necessary experience, financial backing, or business acumen required for success, compounded by regulatory uncertainties in certain regions.

To address these issues, industry leaders emphasize the importance of public education on the benefits of cryptocurrencies and the need for reliable customer support. Building greater understanding and trust among users could encourage broader adoption of Bitcoin ATMs and digital assets.

As demand grows for convenient and secure cryptocurrency transactions, the Bitcoin ATM market is poised for further expansion. Strategic approaches and supportive regulatory frameworks could propel this industry into a pivotal role in the global adoption of digital assets.

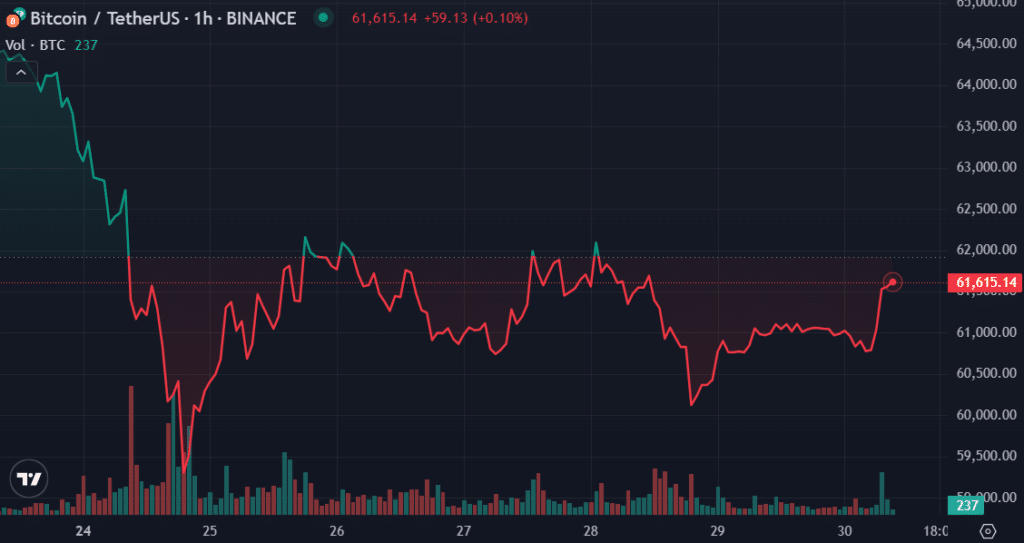

Bitcoin holds steady at $60k

Bitcoin’s (BTC) price trajectory in 2024 has been marked by significant volatility and a bullish momentum. March saw Bitcoin achieving a new all-time high, surpassing $69,000 and briefly touching $73,000 before undergoing a correction.

This surge was driven by pivotal events this year: regulators approved the first spot Bitcoin ETFs in January, and April’s halving event reduced the block reward from 6.25 BTC to 3.125 BTC.

Experts anticipate a new growth cycle in the crypto market, potentially peaking between 2024 and 2025, in line with the four-year market cycle theory.

However, external factors such as global developments and regulatory changes could also influence Bitcoin’s price trajectory. Despite ongoing scrutiny of Bitcoin’s long-term prospects, its historical resilience suggests the possibility of a rebound.

Analysts maintain optimism regarding Bitcoin’s future price movements, with some forecasting it could surpass $80,000 in the coming years.

Over the past 60 days, the Bitcoin price has risen by 7.3%, climbing from approximately $57,000 to its current level of $61,532.

Source link

Bitcoin

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

Published

16 hours agoon

June 30, 2024By

adminJune was much rougher for Bitcoin than many expected at the beginning of the month. This is because the price of Bitcoin virtually declined throughout the month, leaving many investors, especially short-term holders, disappointed.

Related Reading

However, despite the price decline, on-chain data suggests that Bitcoin adoption is growing. New data shows the number of new Bitcoin addresses being created has surged to the highest level in two months. This growth suggests the long-term prospects for Bitcoin remain strong.

New BTC Addresses Surge To 2-Month High

Despite the price slump, the network is exhibiting a promising trend that signals future growth for the world’s largest cryptocurrency. According to Glassnode chart data initially shared on social media platform X by crypto analyst Ali Martinez, new BTC wallet addresses have risen steadily over the past week to reach 352,124, their highest level since April.

Interestingly, the chart shows that the recent uptick in new addresses contrasts with a larger decrease in the creation of new addresses since November 2023. This new increase points to an influx of new users entering the crypto space. As more people adopt Bitcoin, demand will inevitably grow, which is a catalyst for price surges down the line.

Furthermore, Martinez suggested that the uptick in new addresses is from retail investors making a comeback. While institutional investors often drive major market moves, retail interest is crucial for Bitcoin’s mainstream adoption.

Retail #Bitcoin investors are making a comeback! The number of new $BTC addresses on the network surged to 352,124, marking the highest level since April. pic.twitter.com/GFOHnsokz0

— Ali (@ali_charts) June 29, 2024

A major part of the increase in new addresses can be attributed to recent adoption in the Brazilian market. Nubank, Brazil’s biggest neobank, recently announced plans to integrate Bitcoin’s lightning network into its services. As the largest fintech bank in Latin America, this integration could potentially expose a significant portion of its 100 million customers to the digital asset.

What’s Next For Bitcoin?

At the time of writing, Bitcoin was trading at $61,446. The leading digital asset has lost over 10% of its market cap in a 30-day time frame and the bulls are struggling to break above $61,000. This downtrend could be attributed to a selloff by miners and many long-term holders. Specifically, around 40,000 BTC were sold by long-term holders in June.

Bear markets are temporary. Bull runs will return. It’s just a matter of when, not if. With the second half of the year now approaching, time can only tell how the price of Bitcoin unfolds. Of course, new wallet addresses don’t directly impact price, but they are a leading indicator of growing Bitcoin adoption.

Related Reading

This adoption and demand, coupled with a recent decrease in the number of new Bitcoins entering the market, points to an increase in the price of Bitcoin in July.

Featured image from CNBC, chart from TradingView

Source link

bear market

Bitcoin ‘tends to bounce back’ in July after negative June

Published

21 hours agoon

June 30, 2024By

admin

Crypto market analyst Ali Martinez expects a price rebound for the Bitcoin (BTC) price in July after a month of bearish momentum.

According to Martinez’s X post on Sunday, the Bitcoin price recorded an average price rebound of 7.98% in July after a “negative June.” Data shows that the BTC price plunged by 9.25% over the past 30 days.

Historically, when #Bitcoin has had a negative June, it tends to bounce back strongly in July. In fact, $BTC has shown an average return of 7.98% and a median return of 9.60% during this month. pic.twitter.com/fJaIwc7Eob

— Ali (@ali_charts) June 30, 2024

Bitcoin recorded a 30-day-high of $71,907 and a low of $58,554 in the mentioned timeframe.

Moreover, data provided by Martinez shows that Bitcoin’s largest average price return of 46.81% happened in November.

Bitcoin gained a slightly bullish momentum over the past 24 hours, rising by 0.94%. The flagship cryptocurrency is currently trading at $61,450 at the time of writing. BTC’s market cap again surpassed the $1.2 trillion mark with a daily trading volume of $13.1 billion.

Due to the declining trading volume, lower price volatility and liquidations would be expected for Bitcoin.

On the other hand, Billionaire entrepreneur and Bitcoin supporter Peter Thiel believes that the BTC price might not witness a dramatic rally. Thiel’s comments come while he still holds a portion of Bitcoin.

Last year, Thiel’s Founders Fund invested roughly $200 million in Bitcoin when the asset’s price was hovering at around $30,000.

Bitcoin’s downward momentum started on June 10 when the spot BTC exchange-traded funds (ETFs) in the U.S. recorded their first set of net outflows in one month.

Last week, spot BTC ETFs saw $137.2 million in net inflows in their last four trading days. This pushed the total amount of ETF net flows past the $14.5 billion mark.

Source link

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

XRP Price May Soar Past $6, Here’s Why

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs