AI

Expect Opportunities Within Small and Mid-Cap Altcoins Once Correction Settles: Analyst Jamie Coutts

Published

2 weeks agoon

By

admin

Crypto analyst Jamie Coutts says that the current correction in digital assets is likely a mid-cycle dip that could be taken advantage of.

Coutts says on the social media platform X that Bitcoin (BTC) and Ethereum (ETH) have held up much stronger than other crypto assets, implying that a potential mean reversion is on the table for smaller projects.

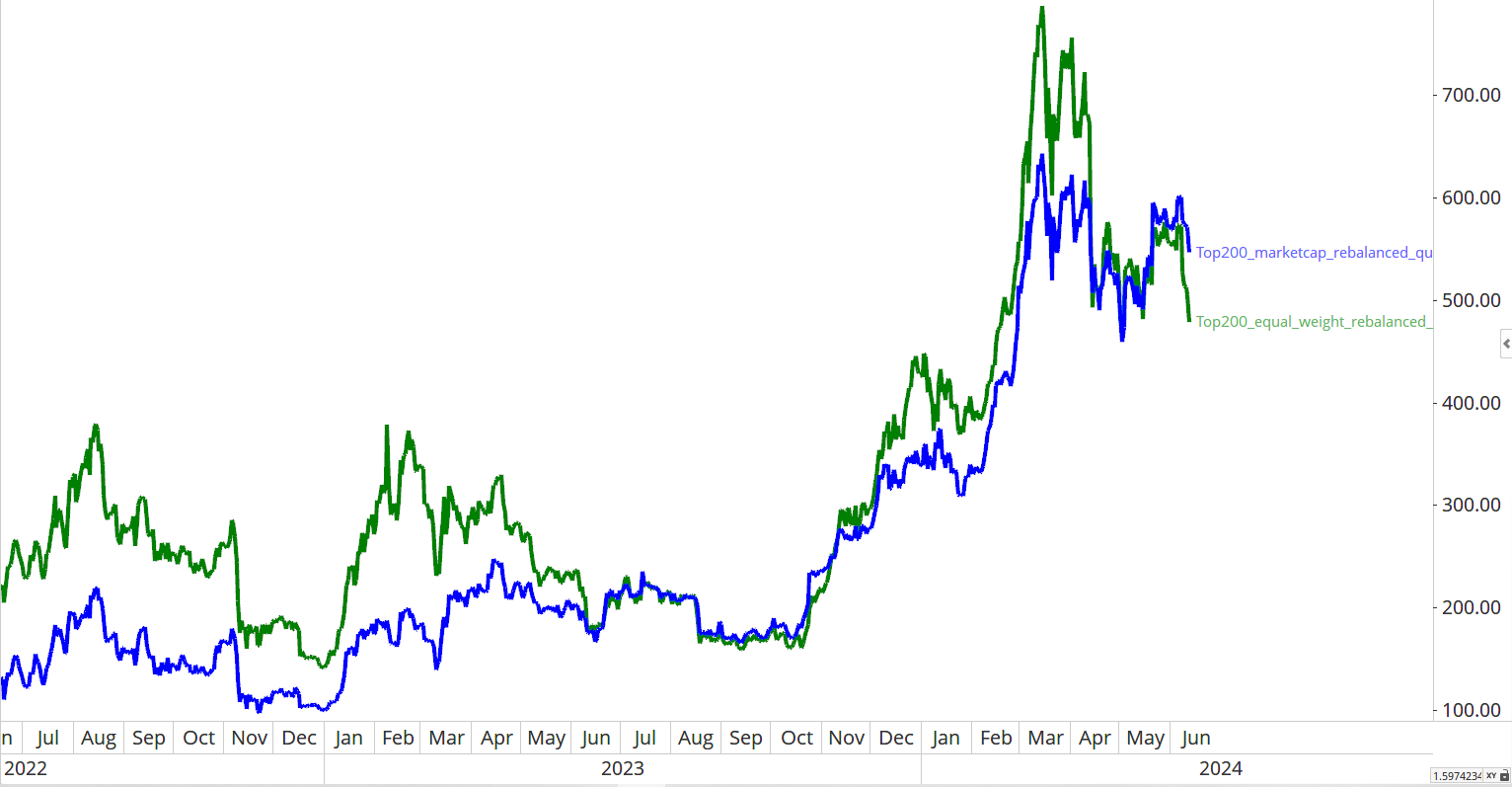

“Smaller cap crypto assets have been taking it on the chin since March high of this year. The past three months have seen the Top 200 equal weight index fall 33% vs. the Market Cap index, which is down around 12%.

This is the breakdown of the three-month sector returns from my crypto classification framework:

Smart Contract Platform -31.58%

Infrastructure -43.28%

Digital World -44.13%

Digital Currency -31.59%

DeFi -31.15%

Applications -38.33%

BTC and ETH have held up -11% and 5%, respectively.

If this is a regular mid-cycle correction we are experiencing, which I believe is likely, then expect some opportunities to be had in the mid and small caps once the market settles.”

When the rebound happens, Coutts says decentralized artificial intelligence (AI) is another sector that has “genuine opportunity,” but the analyst doesn’t mention any specific coin or project.

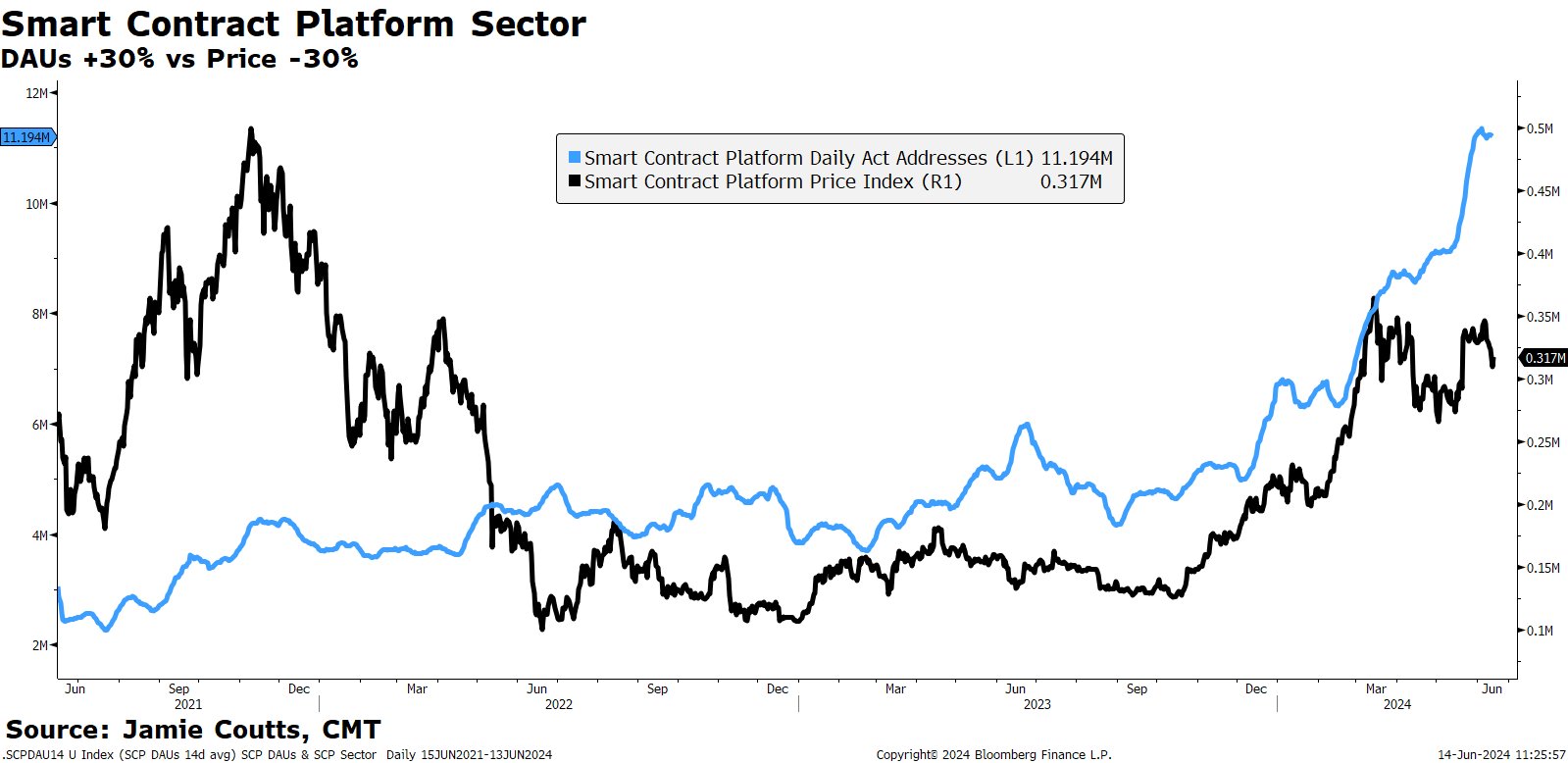

Coutts also shares a chart comparing a declining price index of layer-1 smart contract platforms to an increasing number of their daily active users (DAUs). The analyst suggests that the divergence is one of the best signals of health in the crypto ecosystem.

“Web3 users seem less price-sensitive than in the previous cycle.

The number of daily active addresses (DAUs) on SCP (smart contract platform) blockchains is up 30% since March, while the SCP sector index is down approx 30%.

In a sign of how wild the last cycle was, prices are 37% below the all-time high, yet DAUs are 2.6x higher (4.2 million to 11.2 million).

One doesn’t equal the other but if you are looking for a signal on the health of the crypto ecosystem, this is one of the best.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Book of Meme sees gains as Pepe Unchained ICO raises $1 million

Coinbase Won’t Support Upcoming AI Token Merger Between Fetch.ai, Ocean Protocol and SingularityNET

BTC Back To $60K Amid ETF Outflows, Top Cryptos Prices Fall

21Shares files spot Solana ETF with SEC

Google Releases Supercharged Version of Flagship AI Model Gemini

Coinbase, MicroStrategy, and Crypto Stocks Record Weekly Upswing

AGIX

Coinbase Won’t Support Upcoming AI Token Merger Between Fetch.ai, Ocean Protocol and SingularityNET

Published

20 mins agoon

June 29, 2024By

admin

Top US exchange Coinbase is not going to facilitate the planned merger of multiple artificial intelligence altcoin projects into a single new crypto.

In an announcement via the social media platform X, Coinbase says that customers will have to initiate the merger on their own.

“Ocean (OCEAN) and Fetch.ai (FET) have announced a merger to form the Artificial Superintelligence Alliance (ASI). Coinbase will not execute the migration of these assets on behalf of users.”

In March, Fetch.ai (FET), Singularitynet (AGIX) and Ocean Protocol (OCEAN) announced a plan to merge with an aim to create the largest independent player in artificial intelligence (AI) research and development, which they are calling the Artificial Superintelligence Alliance (ASI).

The merger is happening in phases, beginning July 1st, according to a recent project update.

“Starting July 1, the token merger will temporarily consolidate SingularityNET’s AGIX and Ocean Protocol’s OCEAN tokens into Fetch.ai’s FET, before transitioning to the ASI ticker symbol at a later date. This update enables an efficient execution of the token merger, and outlines the timelines and crucial steps for token holders, ensuring a smooth and transparent process.”

Coinbase says users can effect the merger on their own using their wallets.

“Once the migration has launched, users will be able to migrate their OCEAN and FET to ASI using a self-custodial wallet, such as Coinbase Wallet. The ASI token merger will be compatible with all major software wallets.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

AI

TARS AI, AIOZ Network prices rise after ecosystem update

Published

17 hours agoon

June 28, 2024By

admin

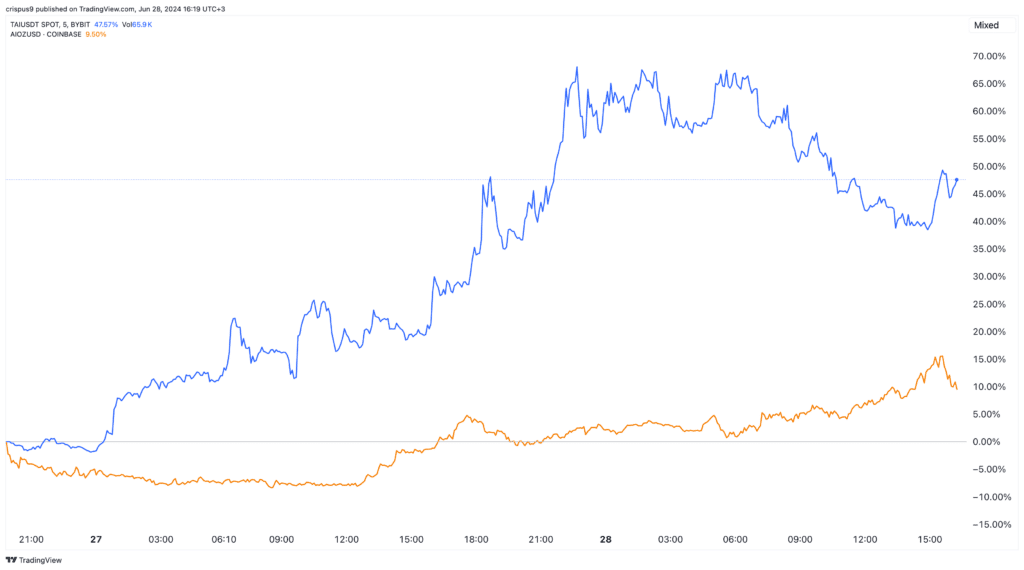

TARS AI (TAI) and AIOZ Network tokens were among the best-performing cryptocurrencies on Friday as demand for artificial intelligence (AI) rebounded. TAI jumped to an intraday high of $0.2200, its highest point since June 16th.

Similarly, AIOZ Network rebounded to $0.60, its highest level since June 15th. It has risen by more than 41% from its lowest level this year. Other AI tokens like Akash Network, SingularityNET, and Fetch also rebounded.

AIOZ Network vs TARS AI

TARS AI token burn

This performance also happened in the stock market, where companies like Nvidia, C3.ai, and AMD rose by over 0.50%.

These tokens also rose after they made several important news. Tars, an AI infrastructure network on Solana, announced that it had burned 100 million tokens worth over $15 million. These tokens accounted for about 10% of those in circulation.

A token burn is an important aspect of the crypto industry that permanently removes tokens in circulation by sending them in an address that cannot be accessed. It is meant to improve a token’s value by reducing its supply.

Tars also announced that it would bring .ai domains to Solana. Its goal is to replicate the success of Ethereum Name Service (ENS), which has registered millions of domains in the past few years.

Earlier this month, the developers announced that they would launch an AI fund worth 10 million TAI tokens. The funding will go to developers in key sectors like DePin, retail products, computation, and finance.

TARS is taking a monumental step towards developments in AI.

Today, TARS announces the AI Fund that will dedicate 10,000,000 $TAI to creating the most advanced AI ecosystem natively on Solana.

Sectors we are focused on:

✧ DePin

✧ Retail products

✧ Computation

✧ Finance… pic.twitter.com/y8kRaW7Vbx— TARS AI 🤖 (@tarsprotocol) June 14, 2024

AIOZ Network node upgrade

Meanwhile, AIOZ Network’s token rose after the developers launched the latest version of the AIOZ Node. The new version brought new functionalities, including the introduction of the transcoding functionality. Transcoding enables users to participate in video transcoding, a process that converts video files into different formats.

We are excited to unveil the latest version of the AIOZ Node: The Version 4.0 update!

This update includes a new user interface and brings substantial functional improvements, enhancing your overall experience for increased productivity and efficiency.

More information below:… pic.twitter.com/9S9Cyrgbsh

— AIOZ Network (@AIOZNetwork) June 28, 2024

The TAI and AIOZ gains will likely be sustainable if Bitcoin bounces back. Its recent attempts to rebound have faded at around $61,000, where it has been stuck in the past few days. In most cases, altcoins move in the same direction as Bitcoin.

Source link

Akash Network (AKT) price was up 12% on Thursday as the cryptocurrency ranked second behind Book of Meme (BOME) as the top gainers.

While BOME leads top 100 gainers by market cap with a 24-hour gain of over 14%, AKT traded to highs of $3.45. The AI related token led other coins in this category, with only Render (RNDR) and The Graph (GRT) in the green among top AI and Big Data cryptocurrencies.

SingularityNET, Fetch.ai and Ocean Protocol, which are headed for a merger under the Artificial Superintelligence Alliance (ASI), were all dumping more than 10% at the time of writing.

The all-time high for AKT was $8.07 reached in April 2021.

However, while in the current market cycle, the cryptocurrency peaked at $6.22 on March 10, 2024. A surge amid Upbit listing in April saw AKT break to above $6.03 before paring gains.

Akash Network price up amid RenAIssance Hackathon

The broader crypto market was up just 1% to about $2.29 trillion, but Akash Network appeared to defy this with its double-digit gain.

As well as the announcement that Crypto.com now supports AKT staking with up to 19% in rewards, positive vibes around Akash Network may have come from another major network related event.

On June 25, the Akash team revealed a collaboration with Flock, a platform for decentralized training of AI models.

With FLock.io, AKT holders can participate in an open and collaborative ecosystem, contributing to training of models, for on-chain rewards. Users can also contribute data and other computing resources to earn AKT.

The RenAIssance Hackathon offers rewards in AKT, USDC and native FLock token FML. Top 3 models in the hackathon will earn 400 USDC and $400 worth of AKT for the winner; 300 USDC plus $300 worth of AKT will go to the runner up and 200 USDC plus $200 in AKT for the third-place model.

Participants also stand to win 200 USDC and $200 worth of AKT for winning validators.

Source link

Book of Meme sees gains as Pepe Unchained ICO raises $1 million

Coinbase Won’t Support Upcoming AI Token Merger Between Fetch.ai, Ocean Protocol and SingularityNET

BTC Back To $60K Amid ETF Outflows, Top Cryptos Prices Fall

21Shares files spot Solana ETF with SEC

Google Releases Supercharged Version of Flagship AI Model Gemini

Coinbase, MicroStrategy, and Crypto Stocks Record Weekly Upswing

CleanSpark’s acquisition of GRIID reiterates CLSK as a Buy

Treasury and IRS Finalize Broker Rule, Defers DeFi Decision

U.S. Treasury Issues Crypto Tax Regime For 2025, Delays Rules for Non-Custodians

Lido and Rocket Pool tokens tank after SEC sues Consensys

Consensys Responds to SEC Lawsuit Over MetaMask

BREAKING: 21Shares Joins Race To Launch Spot Solana ETF

Supreme Court Decision Overturns Chevron: A Victory for Judicial Authority and Bitcoin

ADA short positions spike; experts double down on Dogecoin, Angry Pepe Fork

Crypto Airdrops To Watch Out For in July

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs