Bitcoin Trading

Standard Chartered is Building a Bitcoin Trading Desk

Published

2 weeks agoon

By

admin

Global banking giant Standard Chartered is launching a spot trading desk for Bitcoin and ether, positioning itself as one of the first major banks to offer direct spot Bitcoin trading services.

BREAKING: $800 billion Standard Chartered Bank is building a spot #Bitcoin trading desk – Bloomberg

Gradually, then suddenly 👏 pic.twitter.com/iwmjFcHgBd

— Bitcoin Magazine (@BitcoinMagazine) June 21, 2024

According to recent reports from Bloomberg, the new London-based Bitcoin trading desk will start operations soon and be part of the bank’s FX trading unit. Standard Chartered has been positive on Bitcoin for years and is now moving to meet surging institutional demand.

Standard Chartered said, “We have been working closely with our regulators to support demand from our institutional clients to trade Bitcoin and Ether.”

The bank already offers crypto custody through its stake in Zodia Custody. It is also an investor in Zodia Markets, which trades institutional Bitcoin and crypto. This bolt-on trading desk represents the next phase in Standard Chartered’s Bitcoin push.

The move comes as Bitcoin ETFs gain approval and launch across major markets like the US, UK, Hong Kong and Australia. With institutional appetite growing, banks realize they must adapt to remain competitive.

Standard Chartered’s offering of direct Bitcoin trading capabilities reflects the accelerating mainstream adoption of Bitcoin. It indicates that banks consider Bitcoin a crucial new asset class they can no longer avoid.

This infrastructure buildout will, in turn, enable wider institutional adoption. Other major banks will likely follow Standard Chartered’s lead in rolling out spot Bitcoin trading.

Source link

You may like

Multicoin Capital To Fund Crypto-Friendly US Candidates In Solana

Multicoin to Match Up to $1 Million in Solana Donations to Pro-Crypto Candidates

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

Bitcoin

Bitcoin Is Up 2X But Speculators Are Underwater: Will The Sell-off Continue?

Published

2 days agoon

July 4, 2024By

admin

Bitcoin is down at press time, wiping the weekend’s gains and inching closer to $60,000. If bears press on, increasing their shorts, the odds of the coin sliding below the psychological number and $56,800 remain high.

Glassnode: STHs Are In Red

As the world’s most valuable coin finds itself at a critical juncture, fast approaching $60,000, on-chain data points to weakness at spot rates.

Related Reading

In a post on X, Glassnode, a blockchain analytics firm, highlighted how BTC finds itself in a unique situation.

While Bitcoin is in green, rallying by over 100% over the last year, data shows that many short-term holders (STHs), primarily traders and speculators, are underwater. STHs are entities or addresses that bought their coins in the last 155 days or before the end of 2023.

During this time, not only did prices soar to an all-time high, meaning all coins were in circulation by mid-March 2024, but speculators were raving, expecting prices to continue soaring. However, this didn’t come to pass because no sooner had BTC breached $70,000, rising to $73,800, prices fell sharply.

By mid-May, BTC cratered to $56,800 before briefly bouncing to around $71,500. The failure of bulls to break $72,000, a level closely monitored by traders, means sellers have the upper hand at press time.

Glassnode’s assessment suggests that though STHs are feeling the pressure, only those who bought and HODL over the last year are in the money. With a 2X surge over the previous 12 months, BTC is technically in an uptrend, aligning with gains from the second half of 2023.

HODLers Are In The Money: Why Are BTC Whales Selling?

Other parallel data shows that long-term holders (LTHs), especially those who bought in the last five to seven years, enjoy a realized price of less than $7,300. This means that regardless of the current volatility, these HODLers are in the money and can wait for the current shake-out to end.

Related Reading

Amid this state of affairs, Lookonchain data shows that Bitcoin whales have been moving coins to Binance. Often, transfers to centralized exchanges are considered bearish. Therefore, the more coins sent, the more bearish the sentiment and the net negative it is on prices.

As of July 3, the analytics platform noted that one whale sent 1,023 BTC, worth roughly $62 million, to Binance. Earlier, another whale transferred 1,723 BTC, worth over $106 million, to the world’s largest crypto exchange.

Feature image from DALLE, chart from TradingView

Source link

Bitcoin

Increased Bitcoin ETF Adoption Propels BTC Dominance To Highest Level Since 2021

Published

3 months agoon

April 15, 2024By

admin

Bitcoin’s dominance within the cryptocurrency market has reached a three-year high, signaling strong demand for US spot Bitcoin ETF holding the largest digital asset and a challenging period for smaller tokens.

Bitcoin accounted for nearly 55% of the $2.4 trillion digital asset market at the end of last week, a level not seen since April 2021. On Saturday, in particular, BTC’s dominance jumped to 57% as it briefly touched the $67,000 mark.

The next largest tokens by market share include Ethereum (ETH), Tether’s USDT stablecoin, Binance exchange’s native token Binance Coin (BNB), and Solana (SOL).

BTC’s Rise Fueled By Successful US Bitcoin ETF Launches

According to Bloomberg, the recent success of the recently approved US spot Bitcoin ETFs from prominent issuers such as BlackRock and Fidelity Investments has played a significant role in Bitcoin’s rise.

These ETFs have garnered approximately $56 billion in assets, making their debut one of the most successful in fund category history.

The inflows into these ETFs drove BTC to its current all-time high (ATH) of $73,798 in mid-March, a clear resistance level for the largest cryptocurrency on the market, as evidenced by its inability to consolidate above the $70,000 level following this achievement.

Although BTC is down about 6% since then, smaller digital assets such as Avalanche (AVAX), Polkadot (DOT), and Chainlink (LINK) have seen more significant declines of nearly 30% over the past month.

This drop coincided with reduced expectations for looser US monetary policy settings, often fueling speculative gains.

Hong Kong-Listed ETFs Boosts Bitcoin And Ethereum

Institutional investors’ allocations to the US Bitcoin ETF have greatly influenced Bitcoin’s performance relative to the rest of the market. Benjamin Celermajer, director of digital-asset investment at Magnet Capital, noted that strong institutional demand is a key driver.

On Monday, Bitcoin and Ethereum, the second-largest cryptocurrency, saw notable price jumps following indications that asset managers are preparing to launch Hong Kong-listed ETFs on both tokens. Bitcoin rose 4.3% to $66,575, while ETH jumped 6.2% to $3,260.

These rallies had a positive impact on the broader crypto market, lifting other notable tokens such as Polygon (MATIC), Cardano (ADA), the dog-themed meme coin Dogecoin (DOGE), and Solana, which is now the top 5 cryptocurrency market winner, up over 8% on Monday.

Interestingly, the Bloomberg Galaxy Crypto Index, which measures the performance of the largest digital assets traded in US dollars, has more than tripled since the beginning of last year, marking a significant rebound from the bear market experienced in 2022.

Lastly, investors and traders eagerly anticipate the upcoming Bitcoin Halving, an event that will cut the new supply of the token in half, expected around April 20th.

Previous Halving events have acted as a tailwind for prices, although there are growing doubts about whether history will repeat itself given BTC’s recent all-time high achievement.

BTC has successfully maintained its position above the $66,000 threshold and has consolidated in this range. However, it is important to note that losses have accumulated over longer time frames.

Over the past fourteen and thirty days of trading, the cryptocurrency has experienced significant declines of over 21% and 24% respectively.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

BlackRock’s IBIT Joins Elite ‘$10 Billion Club’ Amidst Soaring Demand

Published

4 months agoon

March 1, 2024By

admin

The demand for spot Bitcoin exchange-traded funds (ETFs) has surged since their recent approval on January 10, with BlackRock’s IBIT Bitcoin ETF leading the way. This ETF has reached impressive milestones in less than two months, attracting significant investor interest and opening doors for various market participants to invest in the largest cryptocurrency directly.

As institutional and retail investors flock to these new investment vehicles, market experts predict a bullish trend and anticipate a potential price surge.

Bitcoin ETF Frenzy

According to Bloomberg ETF expert Eric Balchunas, BlackRock’s IBIT Bitcoin ETF has quickly joined the esteemed “$10 billion club,” reaching the milestone faster than any other ETF, including Grayscale’s Bitcoin Trust (GBTC), noting that only 152 ETFs out of 3,400 have crossed the threshold.

Balchunas notes that IBIT’s ascent to this club was primarily driven by significant inflows, which accounted for 78% of its assets under management (AUM). This reflects the growing appetite for Bitcoin exposure among investors seeking diversified and regulated investment options.

In particular, the current trajectory of the ETF market paints a picture of resilience and bullish sentiment in the market. Equity ETF flows, and leveraged trading levels are positive indicators, although they have not yet reached the euphoria seen in 2021, Balchunas notes.

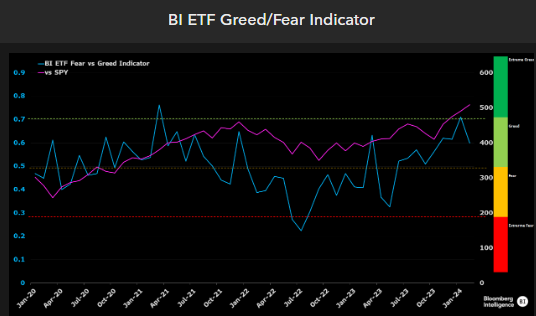

However, Bloomberg’s new BI ETF Greed/Fear Indicator, which incorporates various inputs, highlights the optimistic outlook shared by ETF investors, as seen in the chart below.

On this matter, crypto analyst “On-Chain College” went to social media X (formerly Twitter) to emphasize the significant demand for Bitcoin as evidenced by its rapid departure from exchanges.

In its analysis, On-Chain College highlights that Bitcoin ETFs buy approximately ten times the daily amount of BTC mined. At the same time, the upcoming halving event will further reduce the mining supply. The analyst predicts when demand will exceed available supply, leading to potential upward price pressure.

Highest Monthly Close Since 2021

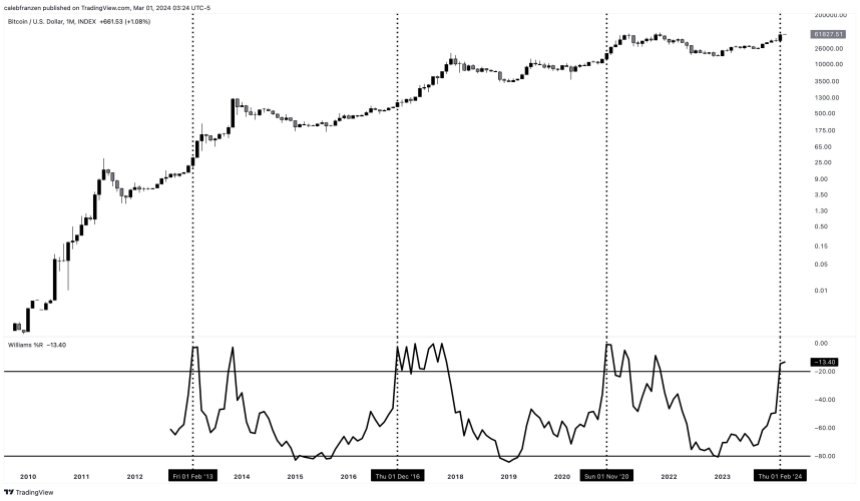

Bitcoin’s recent market performance has caught the attention of wealth manager Caleb Franzen, who highlights the significance of the highest monthly close since October 2021.

Franzen further emphasizes the bullish momentum by pointing out that the 36-month Williams%R Oscillator has closed above the overbought level for only the fourth time in history. Historical data reveals impressive returns following such signals, indicating the potential for substantial gains in the coming months.

Additionally, Franzen notes the changing dynamics of the market, with increased institutional participation and the ease of retail onboarding through ETFs.

Franzen presents a compelling case for the bullish nature of overbought signals, urging market participants to view them as momentum indicators rather than signals to fade. Previous instances of overbought signals have resulted in significant Bitcoin price appreciation:

- February 2013: +3,900% in 9 months

- December 2016: +1,900% in 12 months

- November 2020: +260% in 12 months

While acknowledging diminishing returns in each cycle, Franzen highlights the unprecedented level of institutional participation and the ease of retail access through ETFs.

Even if Bitcoin were to match the +260% gain from the November 2020 signal, it would reach a price of $180,000, surpassing Franzen’s minimum cycle target of $175,000.

Ultimately, Franzen notes that bull markets are typically characterized by a rising ETHBTC ratio and a falling BTC.D (Bitcoin dominance). While these characteristics have yet to manifest fully, Franzen suggests that a multi-quarter rally in the broader cryptocurrency market may be on the horizon.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Multicoin Capital To Fund Crypto-Friendly US Candidates In Solana

Multicoin to Match Up to $1 Million in Solana Donations to Pro-Crypto Candidates

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs