Ethereum

Lisk DAO to decide what to do with 25% of LSK supply

Published

2 weeks agoon

By

admin

The Lisk community will soon have to decide whether it should burn 100 million LSK tokens as its first major vote for a newly-formed decentralized organization.

Starting September 27, the Lisk community will have seven days to vote on whether to burn 100 million LSK tokens, which represents 25% of the total LSK supply or allocate these tokens for community incentives until 2033.

In a press release shared with crypto.news, the Lisk team says this will be the “first major vote” of the newly-formed decentralized autonomous organization Lisk DAO, which recently migrated to the Optimism Superchain to lower access to the network’s products across the Ethereum ecosystem.

If the community votes to burn the tokens, the total LSK supply will decrease to 300 million tokens from the current 400 million mark. Conversely, if the community chooses to allocate the tokens, they will be vested into the Lisk DAO Fund from 2027 – 2033 to enable the community to “drive initiatives, support growth campaigns, and finance innovative projects over the next decade,” according to the press release.

Lisk’s chief project officer, Dominic Schwenter, emphasized that the Onchain Foundation (formerly Lisk Foundation) will not participate in the vote “to ensure a fair and community-focused decision-making process.”

Launched back in 2016, Lisk first unveiled its migration plans in late 2023. The team said at the time in a blog post that the decision was driven by the necessity “to upgrade” the Lisk ecosystem and make the network, which was initially designed as a layer-1 chain, to be more “cost-effective for users and developers.”

Source link

You may like

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

24/7 Cryptocurrency News

Is Ethereum Becoming Scarcer than Bitcoin on Exchanges?

Published

21 hours agoon

July 8, 2024By

admin

Ethereum (ETH) metrics have shown that the digital currency might be suffering from scarcity than earlier projected. According to on-chain data, Ethereum is now being accumulated at a faster rate than Bitcoin.

The Ethereum and Bitcoin Divergence

According to data insights from Leon Waidmann from BTC-Echo, Ethereum is becoming scarcer than Bitcoin. While there are metrics that show the individual performance of BTC and ETH, their correlation per exchange balances is also a crucial one.

🚨HUGE divergence between #Ethereum and #Bitcoin!

ETH is becoming SCARCER than BTC.#ETH Exchange Balance: 10.189% 📉#BTC Exchange Balance: 15.086% 📈

The gap is WIDENING! pic.twitter.com/UnuejbnS8l

— Leon Waidmann | Onchain Insights🔍 (@LeonWaidmann) July 7, 2024

According to the accompanying Glassnode data shared by Waidmann, the current Ethereum exchange balance is pegged at 10.189%. In contrast, that of Bitcoin comes in at 15.08%, a figure that suggests a tightening gap.

Since the conversation around spot Ethereum ETF came into the limelight, demand for ETH has grown. Investors suddenly started buying Ethereum at a frantic pace, accounting for the drain on trading platforms. The investor action is explainable, considering how Wall Street money is projected to buy Ethereum upon ETF launch.

This projection is not unfounded judging by the trend seen in spot Bitcoin ETF products. When the BTC ETF came into the market in January, top firms like Susquehanna International Group (SIG) went all out to buy the asset. The buyups played a crucial role in sending the price of Bitcoin to an All-Time High (ATH) of $73,750.07.

Despite the exchange balance for Ethereum draining fast, the impact on the price of ETH is not visible. At the time of writing, Ethereum is changing hands for $2,983.03, down by 2.31% in the past 24 hours. The coin’s 24-hour low and high trading price comes in at $2,956.99 and $3,080.11 respectively.

Revival Plans for ETH

The future growth of ETH is now hinged on the new long-awaited decision from the US SEC. After it greenlighted the 19b-4 forms for the spot Ethereum ETF application weeks ago, the wait for S-1 is near.

Though the timeline for launch remains largely speculative, the coming 2 weeks appear pivotal. ETF Store President Nate Geraci believes the regulator will do everything it has to do to make Ethereum ETF start trading in 2 weeks.

Read More: Peter Schiff Claims Bitcoin Whales Set Up ETF Investors As “Bag Holders”

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture. Follow him on Twitter, Linkedin

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ETH

Experts Eye Ethereum ETF Launch By Mid-July, Predict Price Rally

Published

5 days agoon

July 3, 2024By

admin

The crypto industry is on the verge of a potentially significant development as key figures in the sector hint at the imminent approval of a spot Ethereum ETF in the United States, possibly triggering a notable price rally for ETH.

Nate Geraci, president of The ETF Store, shared insights into the expected timeline for the launch of the first spot Ethereum ETF.

According to Geraci, current forecasts by Bloomberg predict a mid-July launch. He detailed the procedural timeline via X, stating, “Wen spot eth ETF? BBG sticking w/ mid-July. Amended S-1s due July 8th. Potential final S-1s by July 12th. Would theoretically mean launch week of July 15th.”

In parallel, Steve Kurz, head of asset management at Galaxy Digital, confirmed to Bloomberg on July 2 that the U.S. Securities and Exchange Commission (SEC) might greenlight a spot Ethereum ETF before the month’s end.

Related Reading

Kurz emphasized the extensive groundwork laid in collaboration with the SEC, drawing parallels between the proposed Ethereum ETF and Galaxy’s existing spot Bitcoin ETF (BTCO), created with Invesco. Kurz expressed confidence in their preparedness, remarking, “We know the plumbing, we know the process… The SEC is engaged.”

Bloomberg ETF analyst Eric Balchunas also chimed in, aligning with the mid-July expectations. He highlighted the SEC’s recent instructions to Ethereum ETF issuers for amending their S-1 registration forms by July 8, suggesting possible further amendments. Notably, the SEC approved rule changes under 19-b4 in May, facilitating the listing and trading of such funds, though the issuance of funds remained pending final approvals.

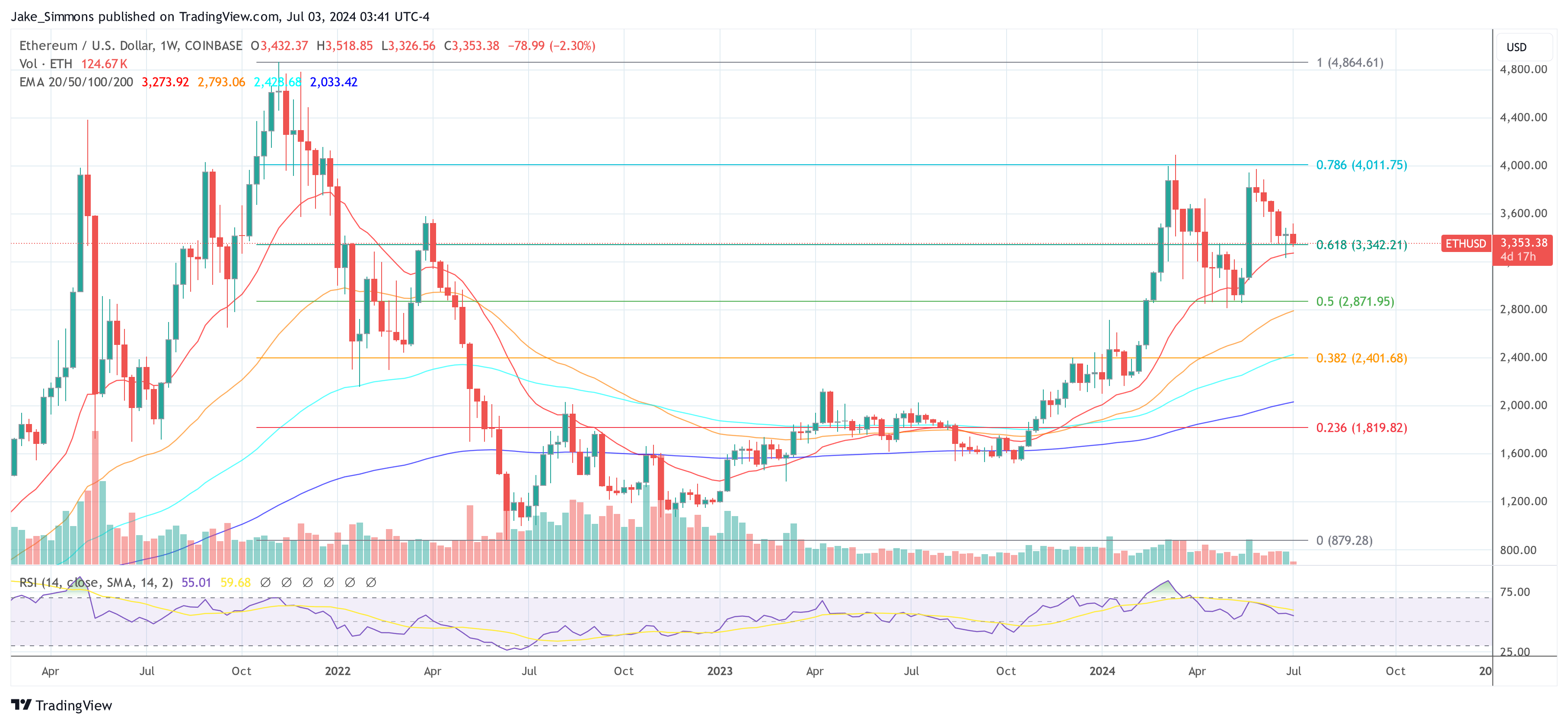

Ethereum Price Holds Above Key Support

The anticipation of these approvals appears to be having a stabilizing effect on Ethereum prices. Crypto analyst IncomeSharks, commenting on Ethereum’s current price trajectory via X, noted optimism for a near-term breakout, stating, “ETH – Looking more optimistic for a Q3 breakout. Liking the chances of a run towards $4,000 this or next month.” According to the chart shared by him, ETH price needs to hold the region of $3,300 to $3,350 in order to rally to $4,000.

Supporting this sentiment, Cold Blooded Shiller highlighted the crucial need for Ethereum to demonstrate momentum at the current price levels, specifically around the $3,400 mark, as a key indicator for a potential high-time-frame impulse.

Related Reading

“ETH is still in a fine position but it really needs to start showing some momentum soon. LTF divergences around this $3400 low are probably where I take one stab at trying to capture any HTF impulse away from the consolidation,” he remarked via X.

Adding historical perspective, analyst Jelle (@CryptoJelleNL) compared the current market phase to Ethereum’s long consolidation in 2016-2017 before its massive rally, urging persistence and optimism: “In 2016-2017, ETH consolidated for 50+ weeks before rallying nearly 12000 percent. Today, people are giving up after less than 20 weeks, with ETH ETFs right around the corner. Stick to the plan boys. The best is yet to come.”

At press time, ETH traded at $3,353.

Featured image created with DALL·E, chart from TradingView.com

Source link

crypto

Ethereum (ETH) Products See Largest Institutional Outflows Since August 2022: CoinShares

Published

7 days agoon

July 1, 2024By

admin

Digital assets manager CoinShares says that institutional crypto products sustained outflows last week for the third week in a row.

In its latest Digital Asset Fund Flows report, CoinShares says digital asset investment products suffered $30 million in outflows last week.

“Digital asset investment products saw a third consecutive week of outflows totaling US$30m, with last week indicating a significant stemming of the outflows. In contrast to prior weeks, most providers saw minor inflows, although this was offset by incumbent Grayscale seeing US$153m outflows.”

Despite overall outflows, the US, Brazil and Australian regions saw $43 million, $7.6 million and $3 million in inflows, respectively.

“Negative sentiment pervaded Germany, Hong Kong, Canada and Switzerland with outflows of US$29m, US$23m, US$14m and US$13m respectively.”

While the leading crypto by market cap Bitcoin (BTC), multi-asset investment vehicles, Solana (SOL) and Litecoin (LTC) brought in $18 million, $10 million, $1.6 million and $1.4 million in inflows, Ethereum (ETH) had one of its worst weeks in years.

“Ethereum saw the largest outflows since August 2022, totaling US$61m, bringing the last two weeks of outflows to US$119m, making it the worst performing asset year-to-date in terms of net flows.”

Chainlink (LINK) and XRP also brought in $0.6 million and $0.3 million, respectively.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/phive/Sensvector

Source link

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: