cryptocurrency

Turkey’s parliament passes crypto bill with prison terms and fines up to $182k

Published

6 days agoon

By

admin

The Turkish parliament passed a crypto bill regulating crypto use, with fines ranging from $7,500 to $182,600 and prison terms of three to five years for violations.

Turkish legislators approved the crypto bill introduced by ruling party chairman Abdullah Güler, which includes fines of up to $182,600 and imprisonment of up to five years for violations, as first reported by crypto.news Türkiye.

The bill has now been sent to Turkish President Recep Tayyip Erdoğan for approval. If approved, the decision will be published in the Official Gazette by the end of the week, bringing the bill into effect.

Under the new bill, crypto exchanges that wish to operate legally in the country must be licensed by the Capital Markets Board, Turkey’s financial regulatory and supervisory agency. Unauthorized crypto platforms offering trading services could face prison sentences of three to five years.

Crypto providers will also be responsible for implementing and reporting measures such as seizures and other legal enforcement actions. Additionally, crypto platforms must ensure that customer fund transfers — including deposits and withdrawals — are accessible and traceable by legal authorities.

Although not included in the bill, a transaction tax of 0.04% may be levied on investors’ crypto trades, though it is unclear when and how this will be regulated.

Turkey has been considering crypto regulation since 2021, after the Financial Action Task Force (FATF) included the country in its “grey list” for failing to supervise its banking, real estate, and other sectors vulnerable to money laundering practices.

In November 2023, Turkey’s Treasury and Finance Minister Mehmet Şimşek said that the country was finally introducing crypto legislation. Speaking to the nation’s planning and budget commission, he noted that Turkey has met 39 of the 40 FATF standards and was in the “final stage” of compliance.

In early 2024, Şimşek emphasized that the upcoming regulations aim to mitigate the risks associated with crypto trading and protect retail investors. Key aspects of these regulations allegedly include legal definitions of crucial crypto-related terms such as “crypto assets,” “crypto wallets,” and “crypto asset service providers.”

Source link

You may like

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

cryptocurrency

Taliban jailed 8 traders for holding and using crypto

Published

27 mins agoon

July 3, 2024By

admin

Afghanistan’s government, under the Taliban’s control, arrested eight cryptocurrency traders in Herat, a city on the Northwest side of the country.

One of the crypto traders who prefers to stay anonymous told crypto.news that the Taliban arrested him and seven others for using crypto in May. They were imprisoned for 28 days in Herat’s central prison, he added.

It’s important to note that the Central Bank of Afghanistan banned using cryptocurrencies in August 2022 — closing more than 30 crypto-related businesses in the region. The government called digital currencies and Forex trading “haram,” an Arabic term used for forbidden things in Islam.

Another crypto dealer says that he earned a small commission of between 1% and 2% for selling USDT to traders and could barely feed his family. He says:

“Now I don’t know what to do. The prices of goods are very high, and the economy is on the brink of a collapse while there’s nothing else to do.”

He added that selling USDT might put his life in danger, but “there’s no other way.”

Both traders claim the Taliban didn’t seize any of their crypto assets. However, people familiar with the matter told crypto.news that a group of cryptocurrency dealers were recently arrested, with the government taking all their digital holdings.

People familiar with the matter said that the government might put some of the crypto traders to six months in jail.

Another individual claimed that before the Taliban banned crypto in the country, he used to receive his family’s expenses from his brother who lives in the U.S. via Bitcoin (BTC) and USDT. Now that cryptocurrencies are “forbidden,” it sometimes takes weeks for him to receive and withdraw the money. He added:

“It’s all because this country, with thousands of years of history, doesn’t have access to standard banks and bans its only way out.”

Source link

cryptocurrency

Polkadot’s multi-million marketing expenses spark fury in blockchain community

Published

21 hours agoon

July 2, 2024By

admin

Blockchain project Polkadot is under fire after revealing $37 million in expenses on the marketing budget, triggering criticism and scrutiny from its community.

Polkadot, a sharded multi-chain network founded by the Ethereum co-founder Gavin Wood, is facing backlash after disclosing $37 million in marketing expenses, leading to criticism and scrutiny from its community.

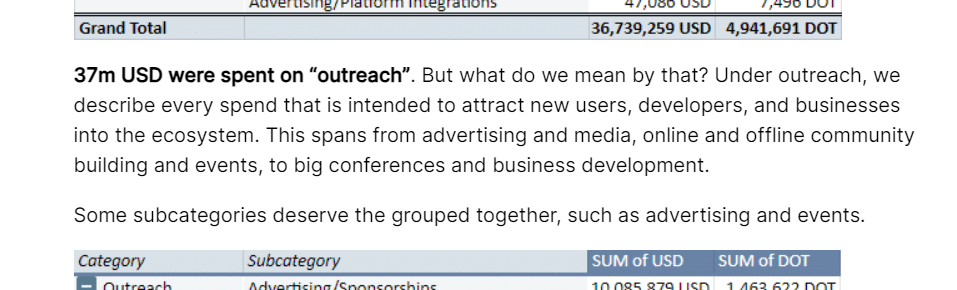

In its H1 2024 treasury report, Polkadot said that nearly $40 million was spent on “outreach,” saying that under outreach, the company describes “every spend that is intended to attract new users, developers, and businesses into the ecosystem.”

“This spans from advertising and media, online and offline community building and events, to big conferences and business development.”

Polkadot

Of the total marketing budget, over $20 million was allocated to advertising, while $10 million worth of DOT tokens were used for sponsorships. These sponsorships included sports deals, collaborations with a race car driver, and a partnership with an e-sports tournament organizer. For comparison, the report noted that Polkadot spent $23 million on developments in the first half of the year.

The marketing expenses quickly triggered outrage within the blockchain community, with accusations of centralization and frivolous financial campaigns. Victor Ji, co-founder of Manta Network, expressed his dissatisfaction in an X thread, calling Polkadot a “highly toxic ecosystem that lacks any real value for web3” and accusing it of discrimination and lack of support for network-built projects.

A concrete example is the Polkadot Academy event held in Hong Kong this February, where less than a quarter of the participants were Asian, even though this was an event in Asia (costing over a million dollars). It was at this event that I first encountered Gavin Wood, and when I… https://t.co/JxyvyIM6S9

— victorji.eth ✨ (@victorJi15) July 2, 2024

Another core developer at Polkadot, using the alias @seunlanlege, also criticized the project’s approach, saying it’s “insane to me how much money the Polkadot treasury is wasting on misplaced marketing,” and drawing parallels between Polkadot and the bankrupt FTX crypto exchange.

The report noted that at the current spending rate, Polkadot’s treasury has about “two years of runway left,” while acknowledging the unpredictable nature of crypto-denominated treasuries. As of now, Gavin Wood has not made any public statements on the matter.

Source link

Speaking with crypto.news, James Toledano, Chief Operating Officer at Savl, delved into money laundering and how tainted assets are putting crypto users at risk. Cryptocurrencies are increasingly becoming a tool that is being exploited for money laundering. The anonymity and…

Source link

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs