Bitcoin

What can be done about crypto scam ads?

Published

6 days agoon

By

admin

Crypto scam ads promising wild riches have appeared on Facebook for years, yet there seems to be little progress in stopping them once and for all.

With every passing week, the number of audacious crypto scam ads online — and the unsuspecting victims losing eye-watering sums of money — continues to grow.

And to make matters worse, they’re often found on the social networks we trust the most, Facebook and X among them.

Both tech giants are losing in the battle to protect their users from fraudsters attempting to entice them with too-good-to-be-true crypto investments.

Many of these bogus ads mimic official news sites and contain false quotes from celebrities in an attempt to generate a sheen of credibility.

And while they are rapidly taken down after being reported, it’s like a game of Whac-A-Mole, with dozens more subsequently popping up in their place.

But how big of a problem is this, and what can social networks do to eradicate scam ads once and for all?

Lawsuits galore

High-profile individuals are fed up with their names and pictures being used in scam ads — prompting some to take legal action against the sites they appear on.

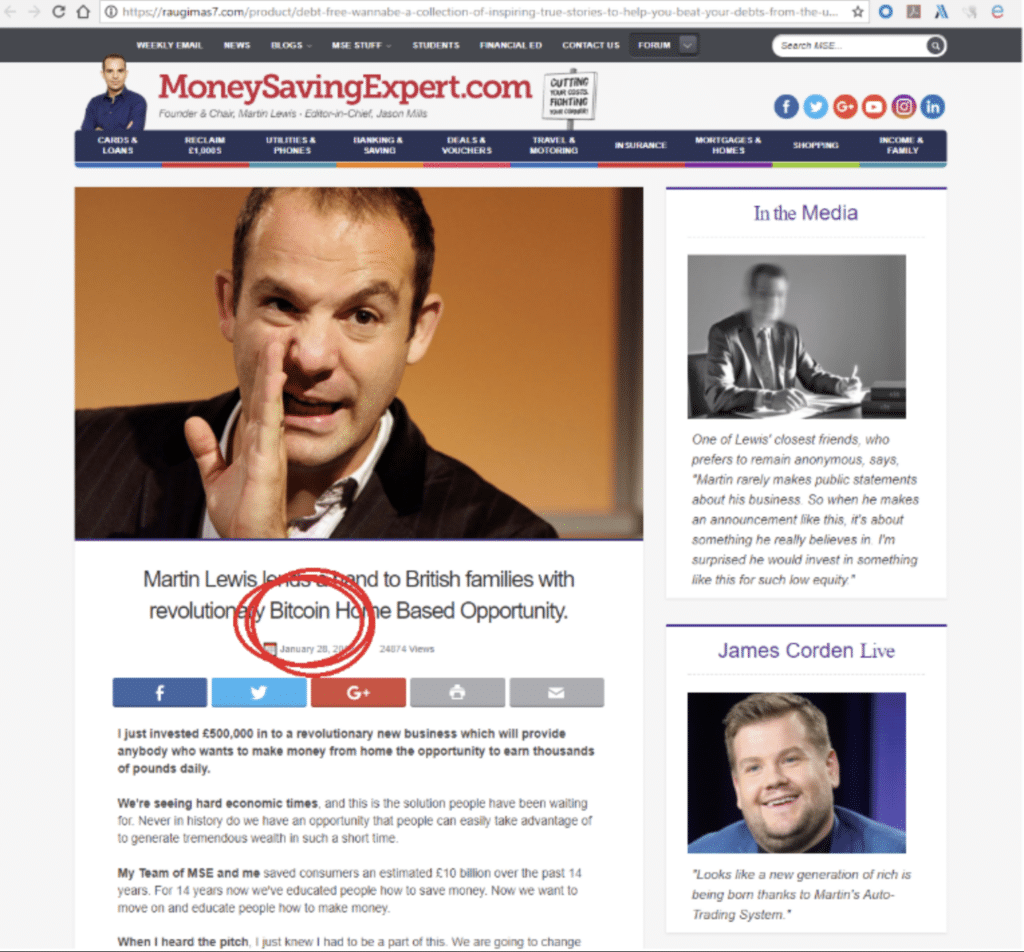

One of the first to head to the courts was Martin Lewis, a British journalist who is known as “Money Saving Expert” for his personal finance tips.

Given how he has long been a trusted voice on money matters, it’s easy to see how someone could be drawn into a bogus ad touting a once-in-a-lifetime opportunity.

Back in April 2018, he sued Facebook for defamation with a goal of pressuring the company into stepping up its efforts in preventing these ads from appearing.

By January 2019, Lewis had reached a settlement that included a $3.8 million donation to a new, independent project tasked with clamping down on scams.

This was certainly a step in the right direction. But more than five years on, Facebook users around the world are still being bombarded with these dangerous pages.

In a sign that history is repeating itself, an Australian billionaire has now been given the green light to sue Meta, amid claims Facebook has also profited from these adverts.

Andrew Forrest has alleged that thousands of people ended up losing millions of dollars after over 1,000 ads were plastered on the social network last year.

A common defense used by U.S. internet companies is Section 230 of the Communications Decency Act, which states it cannot be liable for content released by third parties. But Meta’s efforts to dismiss the case on this basis were rejected by a judge.

How is this happening?

BBC News recently wrote a deep dive into these scam ads, noting that its branding had often been used by criminals.

It explained that scammers are able to dupe Facebook’s detection systems by launching ads that appear to be going to a legitimate source, then quickly redirecting users.

The company says it’s now taking action to stop fraudsters using this technique.

Scam ads have also become much more prolific on X since Elon Musk’s takeover — and at times, has even rendered the site borderline unusable.

But this particular social network has a distinct problem of its own: malicious actors managing to take over the accounts of people with millions of followers.

Just last week, 50 Cent revealed that his X profile and website had been taken over by hackers to promote a crypto pump-and-dump scam — with the rapper stressing he had nothing to do with the project.

“Whoever did this made $3,000,000 in 30 minutes,” he claimed on Instagram.

Put together, it doesn’t seem like there’s been much success in making crypto scam ads a thing of the past.

That’s a big problem for the crypto industry in particular as it attempts to win round the public and shake off its image of being a “Wild West.”

So… what can be done about all of this?

Well, regulators might need to step up more.

In the U.K, one policy that’s being considered could see social networks face a fine of 10% of their global annual revenue if they fail to protect users. That could make them sit up and take notice.

And while artificial intelligence is widely being used to create these bogus ads, AI tools could also play a valuable role in tracking them down before they gain traction.

Meta’s previously said that scam ads are increasingly sophisticated, and it has ensured that fake ads can be easily reported by any of its users. Meanwhile, X says its teams “work around the clock to safeguard the platform.”

Unfortunately though, this is likely to be a problem that gets worse before it gets better.

Source link

You may like

Bitcoin stuck in ‘indecision’ trajectory as it fails to break $64k, Glassnode says

Experts Eye Ethereum ETF Launch By Mid-July, Predict Price Rally

Reasons Why Bitcoin Falls To $60K After A Weekend Pump

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Bitcoin

Bitcoin stuck in ‘indecision’ trajectory as it fails to break $64k, Glassnode says

Published

16 mins agoon

July 3, 2024By

admin

According to Glassnode’s latest analysis, Bitcoin is stuck below the $64,000 mark, facing uncertainty in a slow-moving market.

Bitcoin‘s price has stagnated between $60,000 and $64,000, indicative of a market grappling with indecision as investors await decisive movements. In a recent research report, analysts at blockchain research firm Glassnode noted that despite the uncertainty, the majority of the market remains profitable, primarily due to long-term holders.

“As BTC prices sold off down into the $60k region, a degree of fear and bearish sentiment could be discerned amongst many digital asset investors. […] Nevertheless, from the lens of MVRV Ratio, aggregate investor profitability remains remarkably robust, with the average coin still holding a 2x profit multiple.”

Glassnode

The analysts highlight that for Bitcoin the range between $58,000 to $60,000 still remains critical as its breach would put a “significant number” of short-term holders into loss, and trade below the 200DMA price level.

“Overall, this indicates a risk that many investors may be sensitive to any price drops below $60k.”

Glassnode

While Bitcoin navigates this period of uncertainty, Glassnode advises investors to monitor the market closely, as movements around key levels like $64,000 could determine the “next range expansion.” Until then, however, a degree of investor “apathy and boredom” has taken hold, Glassnode says, adding that the market sentiment has led to “widespread indecision.”

Despite the lack of positive trading activity, Bitcoin’s historical data suggests that July might be a positive month for BTC holders. As crypto.news reported earlier, in previous years, an average Bitcoin increase of almost 8% in July followed a red candle close in June. BTC shed value on six occasions in June between 2013 and 2024, but the asset boomed by at least 9.6% in July during these six years.

As of press time, Bitcoin is trading at $60,427, according to data from CoinGecko.

Source link

Bitcoin

crypto will get positive regulation ‘no matter who wins’ election

Published

7 hours agoon

July 3, 2024By

admin

Galaxy Digital founder and CEO Mike Novogratz told CNBC’s ‘Squawk Box’ on Tuesday that the US crypto sector is headed for positive regulations regardless of who wins the upcoming election.

Mike Novogratz, one of the biggest crypto bulls, shared his outlook during an interview that touched on the current US political scene, Biden’s disastrous debate and crypto. The billionaire asserted that despite the current status of crypto regulation in the US, he believes the next regime will take a positive stance and help the industry grow.

“I am not a single issue voter and I do fundamentally believe crypto should be a bipartisan and needs to be bipartisan. We cannot have one party that likes this and another party that doesn’t like it,” Novogratz said.

Crypto regulatory landscape “shifting”

According to Novogratz, crypto is already largely a bipartisan issue in the US, with only a small group of Democrats taking a negative stance against this burgeoning industry. While it’s been frustrating, in terms of lack of regulatory clarity or the negative impact of government crackdown on the industry, Novogratz believes it’s “all shifting.”

“I’ll tell you that most Democrats, outside of Elizabeth Warren and a small group of people, are pretty pro-innovation and pro-crypto… Listen, no matter who wins the next election, we are going to get positive crypto legislation. I know that” he added.

Novogratz says BTC is a core holding

Commenting on Bitcoin following the ETF-buoyed upside that pushed prices above $73k in March, Novogratz referred back to earlier comments he shared about BTC price post-ETF approval. In his opinion, the benchmark cryptocurrency was likely to stay in the $55k-$73k range until the market got a dose of new news.

“It takes a while for things to digest,” he noted, adding that Bitcoin’s surge to its all-time high this year was “a huge move up.”

Novogratz believes BTC as a core portfolio holding makes sense, especially as the US debt balloons amid the government’s “spending like drunken sailors.”

Bitcoin traded around $61,862 at the time of writing, about 9% down in the past 30 days. However, its up 44% year-to-date and 102% in the past year.

Source link

Bitcoin

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Published

11 hours agoon

July 2, 2024By

admin

CleanSpark capped a busy June with an uptick in mined Bitcoin and a 2x increase in hashrate compared to December.

According to a Tuesday press statement, CleanSpark mined 445 Bitcoin (BTC) in June after adding five new mining facilities in Georgia. The mining startup also surpassed its 20 EH/s operational hashrate target set for mid-year.

“We continue to maximize efficiency at our existing sites and look forward to the opportunities ahead of us in Wyoming and Tennessee,” said CEO Zach Bradford.

CleanSpark’s mining numbers for last month indicate strength from the company after the Bitcoin halving event in April. A halving happens every four years and cuts mining rewards in half. The company mined 46 less BTC than last June, a modest difference considering Bitcoin’s code change.

Bradford added that the firm is “laser-focused” on increasing mining hashrate and generating more revenue following the halving. Meanwhile, other miners are facing difficulties and exploring business sales to maximize shareholder value.

CleanSpark’s post-halving performance has been the envy of the mining landscape as the startup has improved its hashrate and mined more BTC in recent months. Per crypto.news, Bradford’s firm also acquired GRIID facilities in a $155 million deal, and analysts at H.C. Wainright are bullish on the CLSK stock. CLSK is up 58% year-to-date and changed hands for $17.19 on the Nasdaq as of writing.

Source link

Bitcoin stuck in ‘indecision’ trajectory as it fails to break $64k, Glassnode says

Experts Eye Ethereum ETF Launch By Mid-July, Predict Price Rally

Reasons Why Bitcoin Falls To $60K After A Weekend Pump

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs