News

Tackling Bitcoin MEV Opportunities With Rebar Labs

Published

1 week agoon

By

admin

Rebar Labs, a team of seasoned veterans from the cryptocurrency industry, is bringing their expertise to Bitcoin to tackle the emerging challenges posed by on-chain Maximal Extractable Value (MEV). The company has successfully raised $2.9 million in seed funding, led by 6th Man Ventures, with participation from ParaFi Capital, Arca, Moonrock Capital, and UTXO Management.

Carl Vogel of 6th Man Ventures commented, “As the ecosystem of the world’s largest digital asset grows, Rebar’s products will enable good MEV for fair and efficient markets, creating more value for users and miners and enabling the foundation for a flourishing ecosystem.”

Rebar Labs’ Focus Areas

Rebar Labs has unveiled three key areas of focus in their quest to enhance the Bitcoin ecosystem:

- Infrastructure: An alternative to the public mempool via private transactions will allow miners to capture potential MEV revenues and optimize block construction and fees. Other ecosystem participants affected by the issues created by MEV will be able to leverage wallet integrations provided byRebar’s upcoming products

- Products: To highlight the growing MEV-generating activity on the Bitcoin protocol, the company is expected to build data products and dashboards allowing for easy access to the relevant information.

- Research: Rebar Labs intends to produce analysis, articles, and reports on new, unexplored activities on Bitcoin, with a focus on MEV.

What is MEV?

Maximal Extractable Value (MEV) involves various techniques used by market actors to capture additional value by exploiting price inefficiencies in blockchain transactions. This concept has become increasingly relevant in Bitcoin with the rise of on-chain activities such as NFTs and token protocols like BRC-20s and Runes.

We cover the idea in more detail here.

The announcement comes at a curious time as Bitcoin on-chain activity has significantly subsided following a significant ramp-up earlier this year. Runes, a new token proposal launched during the halving last April has faced significant headwinds since its release. Concern over MEV has also led to significant research efforts looking to move most of this activity to secondary layers to improve user experience and avoid miner incentives issues.

In a conversation with Bitcoin Magazine, the team expressed confidence in the idea that activity involving MEV would continue to grow moving forward.

Earlier this year, US-based Marathon Digital Holdings announced their own proprietary service for users to submit transactions to their MARA pool.

Rebar Labs hopes that harnessing MEV can help mitigate the impact of diminishing block rewards by offering opportunities to subsidize mining revenue through MEV activity. Users could also benefit from Rebar’s infrastructure to defend themselves against frontrunning, sandwich attacks, and other strategies that could impact market fairness.

The company plans to launch its first products this summer.

“Bitcoin is entering a new era of programmability and increased trading activity,” said Alex Luce, CEO of Rebar Labs. “Our mission is to develop infrastructure and products that help the Bitcoin community — its users, miners, and developers — navigate the emerging MEV landscape on Bitcoin, ensuring a more equitable and transparent ecosystem.”

Rebar Labs is a portfolio company of UTXO Management, a regulated capital allocator focused on the digital assets industry. Bitcoin Magazine is owned by BTC Inc., which operates UTXO Management. UTXO invests in a variety of Bitcoin businesses, and maintains significant holdings in digital assets.

Source link

You may like

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

Donation

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

Published

1 hour agoon

July 5, 2024By

admin

Multicoin Capital, one of the biggest crypto-focused investment firms in the United States, announced plans to pledge up to $1 million to support pro-crypto candidates.

Multicoin plans to donate to the conservative super political action committee (PAC) Sentinel Action Fund to support four Senate candidates: Sam Brown in Nevada, David McCormick in Pennsylvania, Bernie Moreno in Ohio, and Tim Sheehy in Montana.

Multicoin plans to support Senate candidates who take a positive stance toward crypto.

All four of these candidates are Republican.

Sentinel and Solana (SOL)

Sentinel’s crypto donation drive will be the catalyst for all of Multicoin’s contributions. According to Sentinel, Multicoin will match 100% of Solana (SOL) token donations sent to the PAC from now until July 14.

Gemini is hosting the group’s crypto donations portal and accepting various tokens, including SOL. The Winklevoss twins, Gemini’s founders, have been very vocal in their support of Presidential nominee Donald Trump and have donated to his cause.

Sentinel is conservatively minded and Multicoin tries to stay bipartisan, even though they are very vocal about their support for pro-crypto candidates.

“We’re doing this because we realize that political engagement matters, and it starts with supporting the candidates who believe America needs to remain free for innovation,” said Multicoin Managing Partner Kyle Saman on their support of the four candidates.

America-first crypto

Multicoin wants to support candidates that support America-first crypto mining and pro-crypto mining legislation. The four candidates have expressed a positive stance towards crypto in their campaigns, making them ideal funding recipients.

Kyle Samani and Tushar Jain are the funds leaders and have supported pro-crypto candidates on a bipartisan basis, even though their most recent support only involves Republican candidates.

Multicoin identified Sentinel as a great partner for these funds as the specific candidates in question are pro-crypto, regardless of their political party.

The four Republicans supported by Sentinel and now Multicoin received “A” ratings from Stand With Crypto.

Other political funding

On June 26, Fairshake PAC announced plans to spend over $100 million in the general election to back pro-crypto lawmakers. Fairshake achieved significant victories in recent congressional primaries, proving that pro-crypto stances can help sway electoral decisions.

Fairshake was created to support candidates who are favorable to the crypto industry.

Sentinel and Fairshak PACs usually support campaigns that could potentially help the Republicans gain control of the Senate. A change in Senate control could impact the balance of power in agency appointments — like the SEC — and other important areas where crypto companies engage with the federal government.

Source link

Donations

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Published

3 hours agoon

July 5, 2024By

admin

These candidates’ opponents aren’t uniformly critical of cryptocurrency on the level of Elizabeth Warren, the Massachusetts senator despised by the crypto industry for her rhetoric of hosting an “anti-crypto army.” Three of the four are rated as “neutral” or better by Stand With Crypto, though Ohio Senator Sherrod Brown touts an “F.”

Source link

Crypto scam

Crypto heists near $1.4b in first half of 2024: TRM Labs

Published

4 hours agoon

July 5, 2024By

admin

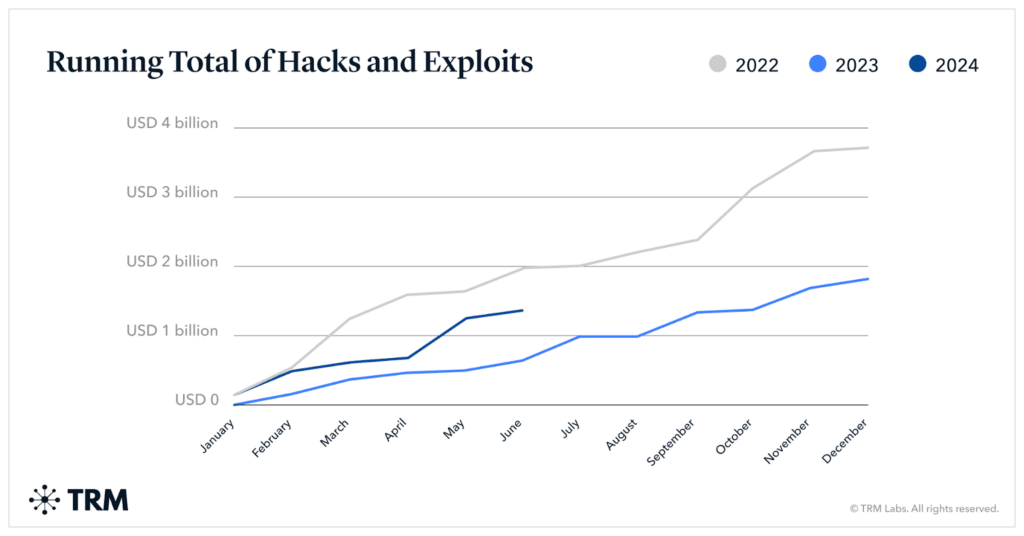

Cybercrime in the crypto sector has soared in the first half of 2024, with hackers stealing nearly $1.38 billion, nearly doubling last year’s figures.

Cybercriminals have pilfered a staggering $1.38 billion from crypto investors in the first half of 2024, nearly doubling the $657 million stolen during the same period in 2023, according to data compiled by blockchain forensic firm TRM Labs.

Consistent with 2023 trends, a handful of major breaches have dominated this year’s thefts, with the top five incidents accounting for 70% of the total haul, analysts say. The most significant attack to date occurred in May when DMM Bitcoin, a Japanese crypto exchange, suffered a hacker attack, losing over 4,500 BTC valued at over $300 million at the time.

While the nature of the hack remains unclear, TRM Labs attributes “stolen private keys or address poisoning” to potential attack vectors. “Private key and seed phrase compromises remain a top attack vector in 2024, alongside smart contract exploits and flash loan attacks,” the analysts say.

The New York-headquartered firm notes that the first six months of 2024 have seen higher theft volumes each month than the corresponding months in 2023, “with the median hack 150% larger.” Despite this surge, the analysts say thefts from hacks and exploits are a “third below the same period in 2022, which remains a record year.”

In the meantime, data from Scam Sniffer indicates that phishing scammers made over $300 million across EVM chains by targeting around 260,000 victims, marking a 6.44% increase compared to 2023. According to researchers, around $58 million worth of crypto was drained from 20 victims alone, with one victim losing $11 million, becoming the second-largest theft victim in crypto history.

Source link

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs