24/7 Cryptocurrency News

Impact & Future of Artificial Intelligence (AI) in Cryptocurrency Market

Published

1 week agoon

By

admin

Artificial Intelligence is fast becoming popular in most industries including the crypto. The thought of high-end machine learning and programming to perform advanced tasks has ignited widespread research. This led to an increase in buzzwords infused in many sectors creating positives and controversies.

AI has already left its footprint on the crypto market with investors looking forward to more trading functionalities, market utility, and analysis. On the part of developers, the technology makes things easier by scaling up programs and decentralized applications. However, there are some challenges involved pointed out by policy watchers. Here are the impact of AI on the crypto market.

Artificial Intelligence on Trading

Artificial intelligence can be used to analyze large amounts of data with seamless algorithms which can help traders in some cases. AI tools can point out key market indices, trends, and technical analysis for trades. Most technologies can also be used to execute trades automatically making seamless transactions for users.

The machine language can help the technology source news and industry data for community spaces as well as current sentiments.

Regulations and Security

Authorities can leverage AI to provide an added layer of security to flush out certain types of scams. Crypto executives can also deploy the technology for a similar purpose on applications. The advanced algorithm can help with hack cases and fraud detection.

However, Artificial Intelligence can be wrongly used to float some advanced-level scams that can cause losses running into millions. This is a downside to the positives widespread losses can cause a decline in sentiments plunging the asset class.

Impact on AI Coins

Apart from price and market analysis artificial intelligence has contributed to the growth of the market cap through AI coins. AI coins tend to surge with developments with big firms like Nvidia. This month, the chip maker became the largest company by market cap, and AI coin prices went through the roof.

Also Read: Solana Hits Double Digit Weekly Gains: Is the Bear Trend Over?

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

24/7 Cryptocurrency News

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Published

3 hours agoon

July 5, 2024By

admin

New allegations have surfaced surrounding Sam Bankman-Fried (SBF), the founder of the now-collapsed crypto exchange FTX. SBF’s family is now accused of being involved in a $100 million illicit political donation scheme. Moreover, these claims can lead to intense legal trouble for the accused.

Sam Bankman-Fried’s Family Accused Of Illegal Political Donation

Emails disclosed by The Wall Street Journal (WSJ) have brought to light the extensive involvement of SBF’s family in orchestrating these political contributions. Furthermore, an important point to note is that these donations were allegedly funded by misappropriated FTX customer assets.

Prosecutors asserted that Bankman-Fried orchestrated a sprawling influence campaign ahead of the 2022 election, leveraging stolen customer funds to the tune of over $100 million. The newly revealed emails suggest that key family members played pivotal roles in the scheme. These include SBF’s parents, Joe Bankman and Barbara Fried, along with his brother, Gabriel Bankman-Fried. They managed these funds and directed donations to various political causes and candidates.

Moreover, Joe Bankman, a Stanford University law professor, is accused of advising on financial strategies to facilitate these political donations. The WSJ reports that emails show Joe Bankman’s direct involvement in the illicit operations, indicating he was well aware of the illegal straw-donor scheme.

Barbara Fried, who co-founded the political action committee (PAC) Mind the Gap, allegedly used her position to channel funds towards progressive groups and initiatives. Meanwhile, Gabriel Bankman-Fried is accused of directing donations to pandemic prevention efforts. This coordinated effort to disperse funds across the political spectrum aimed to amplify their influence and support favored causes without drawing attention to the origin of the donations.

Also Read: Fmr Obama Solicitor Says Regulators Are “Deliberately Debanking Crypto”

Former FTX Execs Also Involved

David Mason, ex-chairman of the Federal Election Commission (FCE), weighed in on the matter. Mason highlighted that the evidence presented in the emails constituted “strong evidence” of Joe Bankman’s knowledge and participation in the scheme.

The political donation scheme, as detailed by the WSJ, also involved Ryan Salame and Nishad Singh, two former FTX executives. They have already pleaded guilty to participating in the illegal straw-donor scheme. According to prosecutors, Salame directed funds to Republican candidates to dissociate the contributions from Bankman-Fried, while Singh supported liberal candidates.

The allegations have led to several legal proceedings, with the potential for significant legal liabilities for those involved. Moreover, Mason’s remarks underscore the gravity of the situation. It suggests that Joe Bankman could face direct legal consequences under campaign finance laws if the allegations are substantiated.

Despite the mounting evidence, a spokesperson for Joe Bankman has refuted claims of his involvement. They stated that Bankman had “no knowledge of any alleged campaign finance violations.” This defense, however, stands in stark contrast to the detailed emails that have surfaced.

Also Read: Just-In: Mt. Gox Starts Repaying Creditors, Bitcoin To Dip Further?

Kritika boasts over 2 years of experience in the financial news sector. Currently working as a crypto journalist at Coingape, she has consistently shown a knack for blockchain technology and cryptocurrencies. Kritika combines insightful analysis with a deep understanding of market trends. With a keen interest in technical analysis, she brings a nuanced perspective to her reporting, exploring the intersection of finance, technology, and emerging trends in the crypto space.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Published

7 hours agoon

July 5, 2024By

admin

Taiwan Mobile, the second largest telecom operator in Taiwan, has become the 26th virtual asset service provider (VASP) in the country. The move positions Taiwan Mobile to potentially launch its cryptocurrency exchange, a massive step ahead for the integration of digital assets within mainstream services.

Taiwan Mobile Enters Crypto Exchange Space

431.90 billion TWD-valued telecom company Taiwan Mobile has become the 26th VASP operator in Taiwan, according to the latest details on the Financial Supervisory Commission website on July 5.

As per local media, Taiwan Mobile submitted an application with the agency with Zhichen Lin, general manager of Taiwan Mobile, as the person in charge. The move has positioned the company to become a member of the VASP Association. Also, it signals a massive step forward in the integration of digital assets within mainstream services.

“We also look forward to the future, where the combination of Taiwan Mobile and exchanges will bring about different cryptocurrency application scenarios.”

There have been reports of Taiwan Mobile exploring opportunities for collaboration with local crypto platforms, including investing in a crypto business. With the latest move, the company may open a crypto exchange in the country as demand surges.

Also Read: Over 18000 Bitcoin Options to Expire, Real Panic Selloff Isn’t Even Here Yet

Crypto Resurgence in the Country

In June, Taiwan established the Taiwan Virtual Asset Service Provider Association to regulate its cryptocurrency sector, aiming to enhance oversight, combat fraud, and ensure AML compliance. It will develop guidelines for classifying and managing virtual asset service providers.

Meanwhile, Taiwan’s Financial Supervisory Commission (FSC) intends to submit a revised draft of digital asset rules in September. The regulator has been monitoring Bitcoin ETFs throughout to assess public demand and readiness. The FSC could greenlight Taiwanese investors to resume buying overseas Bitcoin ETFs, reflecting an openness to crypto innovations within proper regulatory guardrails.

Also Read: Labour Party Wins UK Election, What It Means For Crypto?

Varinder has 10 years of experience in the Fintech sector, with over 5 years dedicated to blockchain, crypto, and Web3 developments. Being a technology enthusiast and analytical thinker, he has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers. With CoinGape Media, Varinder believes in the huge potential of these innovative future technologies. He is currently covering all the latest updates and developments in the crypto industry.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Published

13 hours agoon

July 5, 2024By

admin

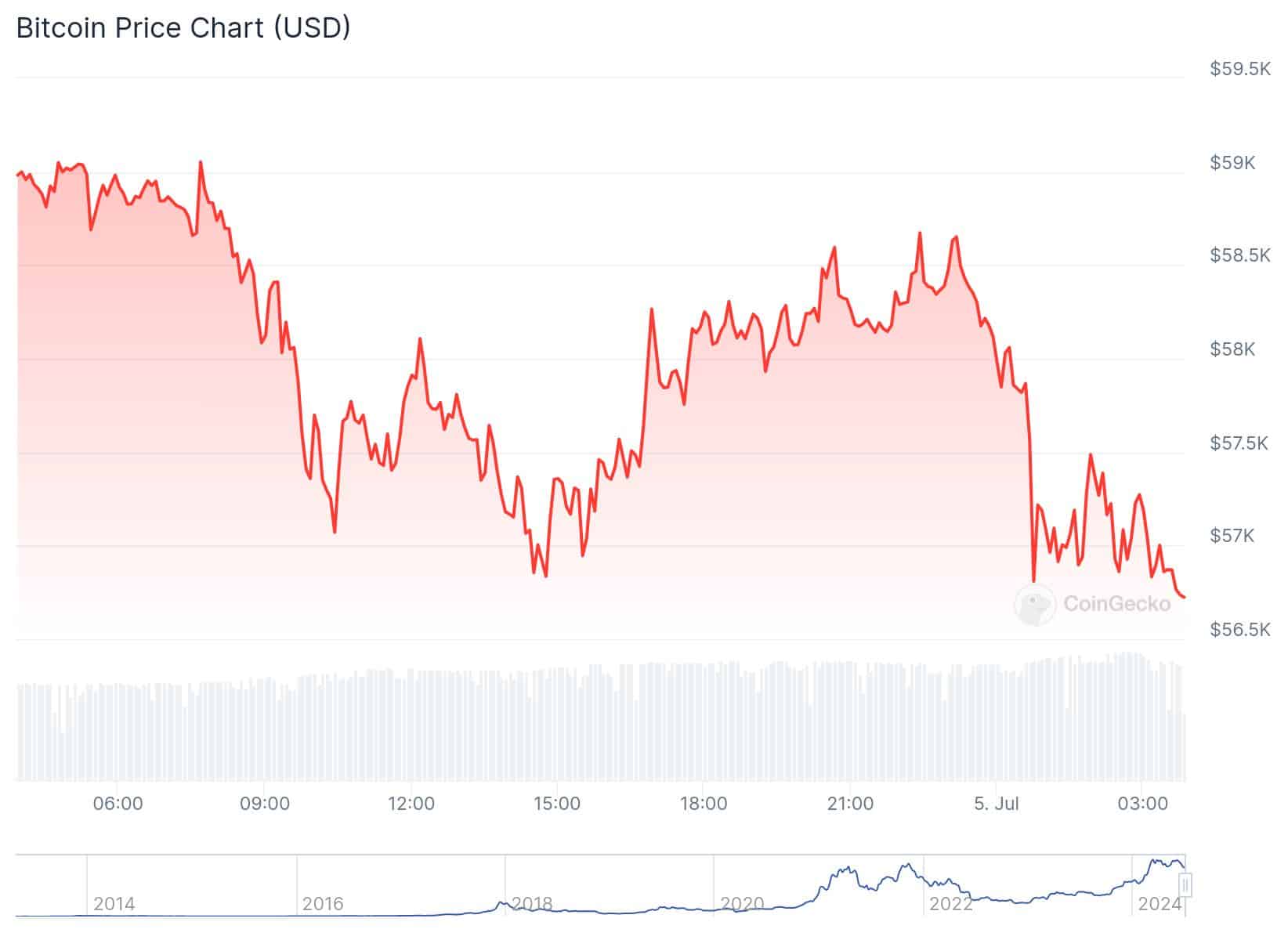

Ethereum and other altcoins have tumbled to lows not recorded in several weeks. This bearish outlook was also recorded in Bitcoin (BTC) and other decentralized finance (DeFi) tokens. Ethereum price has taken steps back wiping out previously recorded gains this week. A major reason for the market decline is a fall in sentiments with many pointing to major market corrections.

The total crypto market fell to $2.11 trillion, a 4.8% decline in the last 24 hours. Meanwhile, several altcoins notched wider losses today deepening the negative sentiments. The drop in the ETH price also coincides with lower on-chain numbers and a transfer of assets to centralized exchanges which signals potential sales.

Ethereum Price Nears $3K

This year, Ethereum and other crypto assets surged to new highs amid the approval of spot Bitcoin ETFs in the United States. Despite the previous price gains and institutional inflows, massive sell-offs recorded in recent times have deepened sentiments. Ethereum trades at $3,075, a 7% drop in the last 24 hours. Weekly losses pierced double digits at 11% while monthly figures topped 19% in the red zone.

These outflows have sparked similar numbers in other altcoins. ETH’s market cap tanked to $367 billion while daily trading volume is over $20 billion. This year came with projections of sustained growth above $4k but plummeting price now sees ETH moving near $3k. The drop in crypto assets might force prices lower although many holders believe a rebound might be on the cards.

Altcoins Are Sinking

Like most commentators opine, Ethereum price can surge with positive mainstream factors. The listing of ETH ETFs can lead to a jump in the asset’s price. The recent slump has also affected altcoin prices with Solana trading below $130 and $126 and Ripple plunging over 8% in the last 24 hours. Toncoin and Cardano were also down today with larger numbers posted by meme coins.

Also Read: End of The Road for Meme Coins? Dogecoin Takes Heavy Losses

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin’s quick dip below $57k forces beginners to capitulate, CryptoQuant says

$PRDT

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: