24/7 Cryptocurrency News

Top Reasons Why Bitcoin Price Could Dip To $50K

Published

6 days agoon

By

admin

The recent slump in Bitcoin price below the $61K range has sparked discussions in the crypto market over the potential movements in the coming days. Meanwhile, several investors appear to be staying on the sideline given the recent volatile scenario noted in the broader crypto market, let alone Bitcoin price.

However, amid this, a renowned cryptocurrency firm QCP Capital has shared insights on the potential future moves of the BTC price. It’s worth noting that QCP Capital has highlighted potential factors that could pull down Bitcoin to as low as $50,000.

Bitcoin Price To Hit $50K, QCP Capital Predicts

Bitcoin’s slip below the $61,000 mark has reignited fears of a deeper decline, with market analysis pointing to several factors that could drive the price down to $50,000. QCP Capital, a prominent cryptocurrency firm, has highlighted a series of developments contributing to the current bearish sentiment in its recent weekend brief.

QCP Capital notes that Bitcoin’s $60,000 support level, historically resilient in the second quarter, faces new pressures. According to QCP, the market is going to witness a heightened volatile scenario with robust supply influx from the Mt. Gox payouts. In addition, the hefty Bitcoin sales by government bodies also weighed on the sentiments.

Notably, the defunct Mt. Gox exchange, set to begin repaying creditors in Bitcoin and Bitcoin Cash starting July 2, introduces a potential influx of Bitcoin into the market, which could amplify volatility. In addition to the Mt. Gox situation, significant Bitcoin transfers by the U.S. government to crypto exchanges have weighed heavily on investor sentiment.

Meanwhile, the same pattern was seen with the German government’s large-scale Bitcoin offload. These developments have led to apprehensions about further downward pressure on Bitcoin’s price. In other words, the market participants are bracing for the potential impact of these transactions on liquidity and market stability.

Also Read: Bitcoin ETF Records 4-Day Streak As BlackRock Boosts With $82M Influx

What’s Next?

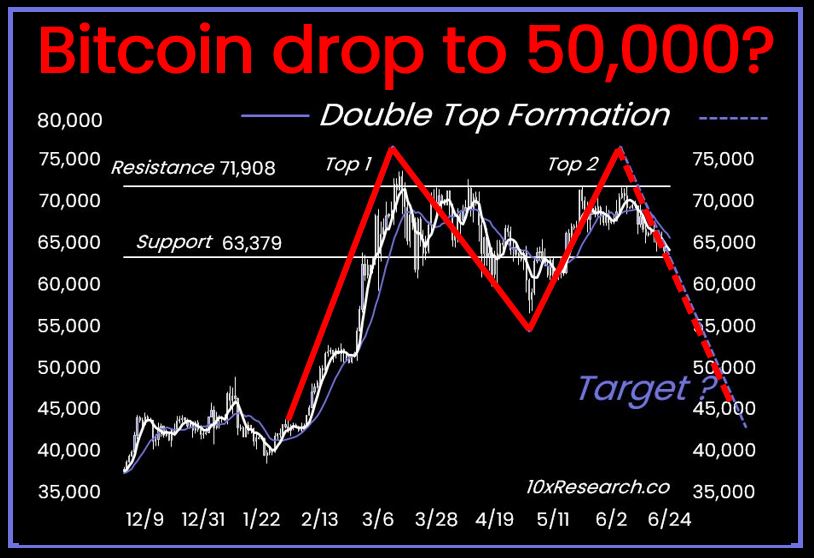

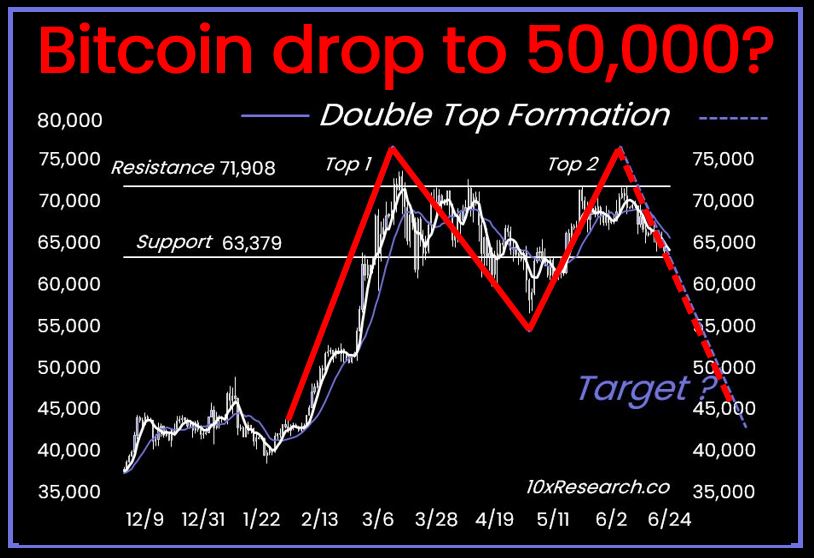

Another factor contributing to the cautious outlook is the current liquidity situation. 10X Research, a popular on-chain analytics firm, has issued a warning regarding Bitcoin’s precarious position. They highlight the increasing market anxiety over a potential “double top” formation, a chart pattern that often signals an impending significant price drop.

Meanwhile, their recent analysis on X suggests that Bitcoin could test lower levels, possibly BTC reaching $50,000 or even dropping further to $45,000. Besides, the ongoing uncertainty and liquidity challenges add to the bearish sentiment surrounding Bitcoin, making it more susceptible to downward pressure.

However, it’s not all doom and gloom. QCP Capital believes that while the potential BTC drop to $50,000 is plausible, the market will likely find robust support at this level. They argue that traditional finance interest remains strong, supported by general regulatory easing worldwide, which could provide a stabilizing effect.

On the other hand, the anticipated trading of the U.S. Spot Ethereum ETF in the next week could inject some excitement and positive momentum back into the market. Besides, the hype over the Solana ETF also fueled discussions in the market.

As of writing, Bitcoin price traded near the flatline and crossed the brief $61,000 mark. Its trading volume rose 9% from yesterday to $23.62 billion, and its price saw a low of $59,985.40. According to CoinGlass, the Bitcoin Futures Open Interest rose 0.13% over the last four hours, while dropping about 2% from yesterday.

Also Read: Binance’s BNB Sales Don’t Qualify As Securities, Judge Dismisses SEC’s Claims

Rupam, a seasoned professional with 3 years in the financial market, has honed his skills as a meticulous research analyst and insightful journalist. He finds joy in exploring the dynamic nuances of the financial landscape. Currently working as a sub-editor at Coingape, Rupam’s expertise goes beyond conventional boundaries. His contributions encompass breaking stories, delving into AI-related developments, providing real-time crypto market updates, and presenting insightful economic news. Rupam’s journey is marked by a passion for unraveling the intricacies of finance and delivering impactful stories that resonate with a diverse audience.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

24/7 Cryptocurrency News

MATIC Price Crash: Reaching A Two Year Low

Published

2 hours agoon

July 5, 2024By

admin

The last two days have not been easy on the investors, as the crypto market crash has wiped $260 Billion from the market cap. Additionally, based on the Coinglass data, around 230K traders have lost around $662.90 Million in liquidation in the last 24 hours. Out of which, $565.08 Million liquidation is from the long-position crypto investors. Overall, the investors have lost most of their profits due to cryptocurrencies hitting rock bottom. Polygon (MATIC) is among those cryptocurrencies that are struggling the most today. Officially, MATIC’s price has hit a two-year low after a 20% loss over the week.

MATIC Price Maintains Loss Throughout The Year

Despite being among the most popular blockchain networks, Polygon’s position in the market has continuously declined since the last year. Polygon was in trend when the market was down last year, but with the bullish conditions this year, other cryptos took over, limiting the MATIC price.

The MATIC price charts clearly show the continuation of the loss from a day to a year interval, Out of which the last 24 hours have been the most crucial as an 11% value dropped during this period, whereas over the year, it has maintained a 33% decline. It is currently trading at $0.4565, hitting the two-year low, despite its March rally to $1.2714.

This decline is the result of the drastic change in the daily active addresses over time. The token price-DAA Divergence return, which is at -35.59%, clearly indicates the declining network activity as the main reason behind this drop. The last time the value went below the zero mark was on October 24, 2023, which later led to an uptrend.

The MATIC Price Might Continue To Drop

Based on a few crypto analysts’ predictions, it is just the start of the MATIC price crash and might continue to decline another 15-20%.

#MATIC Weekly Chart Update

After reaching a local high of $1.29 in March 2024, MATIC has been on a downtrend for almost 112 days. With the current market scenario, it is likely to see MATIC dropping a further 15% to 20% from the CMP.

The lower support ranging between $0.316 and… pic.twitter.com/6F9nssm53m

— Cryptorphic (@Cryptorphic1) July 5, 2024

The technical indicators hint at the strong selling zone for the altcoin as the MACD (12,26) is −0.0357, followed by Momentum (10) at −0.1084. The Moving averages are indicating the same, as the time frames from 5 to 200 intervals are in the selling zone. Only the Williams Percent Range (14) is in the buy zone, which is a sign of the overselling of the token and upcoming trend reversal. However, the Relative Strength Index is at 25.0396, which is neutral, indicating the continuation of the ongoing trend.

Lastly, the MATIC price has already crossed the second support level at 0.4656 and is moving towards the third at 0.3788. If it fails to bounce from that, the downtrend will likely continue.

Continue Reading Is Bitcoin Price Crash Far from Over? Here is the Untold Story

With years of love for reading and 5 years of content writing experience, I’m here, working on my favorite writings about cryptocurrency. I’m actively looking for trending topics and informational statistics to curate the best content pieces for crypto enthusiasts. Staying updated with trends and learning the basis and advancements of this field is the best part of the day.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Published

5 hours agoon

July 5, 2024By

admin

New allegations have surfaced surrounding Sam Bankman-Fried (SBF), the founder of the now-collapsed crypto exchange FTX. SBF’s family is now accused of being involved in a $100 million illicit political donation scheme. Moreover, these claims can lead to intense legal trouble for the accused.

Sam Bankman-Fried’s Family Accused Of Illegal Political Donation

Emails disclosed by The Wall Street Journal (WSJ) have brought to light the extensive involvement of SBF’s family in orchestrating these political contributions. Furthermore, an important point to note is that these donations were allegedly funded by misappropriated FTX customer assets.

Prosecutors asserted that Bankman-Fried orchestrated a sprawling influence campaign ahead of the 2022 election, leveraging stolen customer funds to the tune of over $100 million. The newly revealed emails suggest that key family members played pivotal roles in the scheme. These include SBF’s parents, Joe Bankman and Barbara Fried, along with his brother, Gabriel Bankman-Fried. They managed these funds and directed donations to various political causes and candidates.

Moreover, Joe Bankman, a Stanford University law professor, is accused of advising on financial strategies to facilitate these political donations. The WSJ reports that emails show Joe Bankman’s direct involvement in the illicit operations, indicating he was well aware of the illegal straw-donor scheme.

Barbara Fried, who co-founded the political action committee (PAC) Mind the Gap, allegedly used her position to channel funds towards progressive groups and initiatives. Meanwhile, Gabriel Bankman-Fried is accused of directing donations to pandemic prevention efforts. This coordinated effort to disperse funds across the political spectrum aimed to amplify their influence and support favored causes without drawing attention to the origin of the donations.

Also Read: Fmr Obama Solicitor Says Regulators Are “Deliberately Debanking Crypto”

Former FTX Execs Also Involved

David Mason, ex-chairman of the Federal Election Commission (FCE), weighed in on the matter. Mason highlighted that the evidence presented in the emails constituted “strong evidence” of Joe Bankman’s knowledge and participation in the scheme.

The political donation scheme, as detailed by the WSJ, also involved Ryan Salame and Nishad Singh, two former FTX executives. They have already pleaded guilty to participating in the illegal straw-donor scheme. According to prosecutors, Salame directed funds to Republican candidates to dissociate the contributions from Bankman-Fried, while Singh supported liberal candidates.

The allegations have led to several legal proceedings, with the potential for significant legal liabilities for those involved. Moreover, Mason’s remarks underscore the gravity of the situation. It suggests that Joe Bankman could face direct legal consequences under campaign finance laws if the allegations are substantiated.

Despite the mounting evidence, a spokesperson for Joe Bankman has refuted claims of his involvement. They stated that Bankman had “no knowledge of any alleged campaign finance violations.” This defense, however, stands in stark contrast to the detailed emails that have surfaced.

Also Read: Just-In: Mt. Gox Starts Repaying Creditors, Bitcoin To Dip Further?

Kritika boasts over 2 years of experience in the financial news sector. Currently working as a crypto journalist at Coingape, she has consistently shown a knack for blockchain technology and cryptocurrencies. Kritika combines insightful analysis with a deep understanding of market trends. With a keen interest in technical analysis, she brings a nuanced perspective to her reporting, exploring the intersection of finance, technology, and emerging trends in the crypto space.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Published

9 hours agoon

July 5, 2024By

admin

Taiwan Mobile, the second largest telecom operator in Taiwan, has become the 26th virtual asset service provider (VASP) in the country. The move positions Taiwan Mobile to potentially launch its cryptocurrency exchange, a massive step ahead for the integration of digital assets within mainstream services.

Taiwan Mobile Enters Crypto Exchange Space

431.90 billion TWD-valued telecom company Taiwan Mobile has become the 26th VASP operator in Taiwan, according to the latest details on the Financial Supervisory Commission website on July 5.

As per local media, Taiwan Mobile submitted an application with the agency with Zhichen Lin, general manager of Taiwan Mobile, as the person in charge. The move has positioned the company to become a member of the VASP Association. Also, it signals a massive step forward in the integration of digital assets within mainstream services.

“We also look forward to the future, where the combination of Taiwan Mobile and exchanges will bring about different cryptocurrency application scenarios.”

There have been reports of Taiwan Mobile exploring opportunities for collaboration with local crypto platforms, including investing in a crypto business. With the latest move, the company may open a crypto exchange in the country as demand surges.

Also Read: Over 18000 Bitcoin Options to Expire, Real Panic Selloff Isn’t Even Here Yet

Crypto Resurgence in the Country

In June, Taiwan established the Taiwan Virtual Asset Service Provider Association to regulate its cryptocurrency sector, aiming to enhance oversight, combat fraud, and ensure AML compliance. It will develop guidelines for classifying and managing virtual asset service providers.

Meanwhile, Taiwan’s Financial Supervisory Commission (FSC) intends to submit a revised draft of digital asset rules in September. The regulator has been monitoring Bitcoin ETFs throughout to assess public demand and readiness. The FSC could greenlight Taiwanese investors to resume buying overseas Bitcoin ETFs, reflecting an openness to crypto innovations within proper regulatory guardrails.

Also Read: Labour Party Wins UK Election, What It Means For Crypto?

Varinder has 10 years of experience in the Fintech sector, with over 5 years dedicated to blockchain, crypto, and Web3 developments. Being a technology enthusiast and analytical thinker, he has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers. With CoinGape Media, Varinder believes in the huge potential of these innovative future technologies. He is currently covering all the latest updates and developments in the crypto industry.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: