Bitcoin

Bitcoin Weekend Trading Volumes Plunge To Record Lows

Published

4 days agoon

By

admin

Bitcoin has long been a hallmark of the cryptocurrency markets, thriving on its 24/7 accessibility. Weekend trading, once a notorious breeding ground for volatility, has been especially significant in the cryptocurrency landscape.

However, a recent report by Kaiko reveals a not so rosy picture – BTC weekend trading volumes have plunged to historic lows, potentially marking a new era dominated by institutional weekday warriors.

Related Reading

Bitcoin Trading Activity Takes A Nap

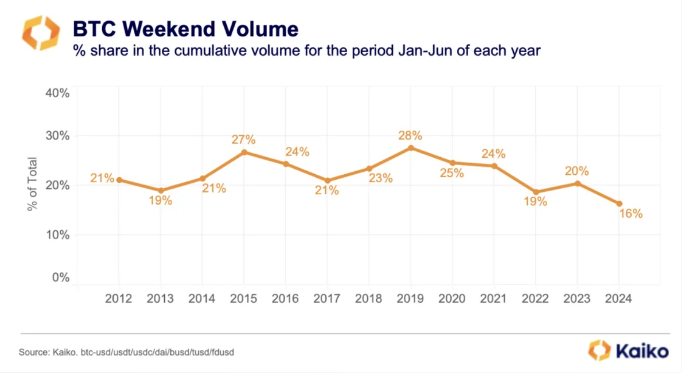

Kaiko’s data is straightforward: Bitcoin weekend trading activity has shrunk dramatically, dropping from a high of 28% in 2019 to a mere 16% in 2024. This dramatic decline coincides with the highly anticipated launch of spot Bitcoin ETFs in the US. These exchange-traded funds, mirroring the behavior of stocks, can only be traded during traditional market hours.

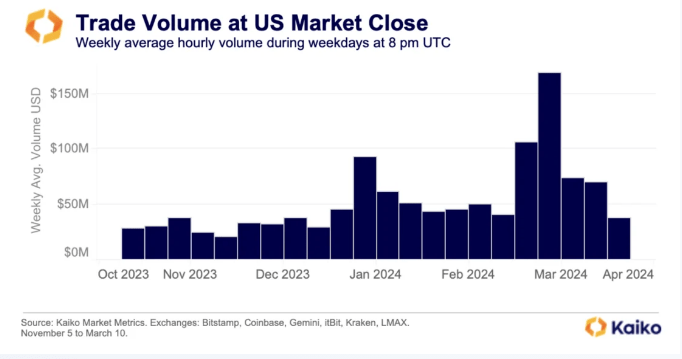

The influence of institutional investors, who tend to favor these regulated products, is evident. The report highlights a surge in Bitcoin trading activity during the “benchmark fixing window” – the final hour of US stock market trading. This suggests institutions are shaping new trading patterns, prioritizing weekdays over the once-active weekends.

Beyond Weekends: A Multifaceted Market Transformation

The decline in weekend activity isn’t solely attributable to ETFs. The closure of crypto-friendly banks like Signature and Silicon Valley Bank in March 2023 is another contributing factor. These institutions provided 24/7 infrastructure that enabled market makers to constantly place buy and sell orders. Their absence has created a void in weekend liquidity, further dampening trading activity.

However, the changing landscape isn’t all doom and gloom. The report offers a glimmer of hope for investors seeking stability. The reduced weekend volatility could make Bitcoin a more predictable asset, potentially attracting a new wave of institutional interest. Additionally, the historical trend suggests July could be a positive month for Bitcoin, with price increases observed in seven out of the past 11 Julys.

Jitters On The Horizon?

While the weekend trading scene may be quieting down, the coming weeks look to be somewhat turbulent for the crypto market. The potential approval of Ethereum ETFs could further fuel institutional involvement and potentially impact Bitcoin’s dominance.

Related Reading

The Road Ahead

The dwindling weekend trading activity signifies a potential paradigm shift in the Bitcoin market. While the once-volatile weekends may become a relic of the past, the coming months promise to be eventful.

Institutional investors are now in the spotlight, shaping new trading patterns and potentially ushering in an era of greater stability. However, this month could still introduce significant volatility, keeping investors on the edge of their seats.

Featured image from Inc. Magazine, chart from TradingView

Source link

You may like

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

Altcoins

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Published

11 hours agoon

July 5, 2024By

admin

A closely followed crypto strategist and trader is revealing his price targets for Bitcoin (BTC) and two altcoin projects.

In a new strategy session, analyst Jason Pizzino tells his 329,000 YouTube subscribers that based on the average true range (ATR) indicator Bitcoin could soon break through key price target resistance levels.

The ATR indicator measures volatility by showing an asset’s trading range over a specified period.

“You can see the dying off here of the average true range of the bar. Previous cycles, look what happened. Average true range picks up, dies off, dies off, dies off, and then you start to get a higher low form and by that stage, you’re really a decent way from the stealth zone.”

According to the analyst, Bitcoin has historically made “stealth moves” to the upside when the ATR indicator reaches a local low and price continues to consolidate or puts in higher lows.

The analyst’s key price targets to the upside include $63,300 on the daily chart, $65,200 on the weekly chart and $72,000 on the monthly chart.

Bitcoin is trading for $60,176 at time of writing, down nearly 3% in the last 24 hours.

Next up, the analyst believes that Ethereum (ETH) competitor Solana (SOL) will move toward its current cycle top.

“With the higher lows and now trying to push higher above the 50% at $137. Next target on the weekly chart is $165. And then we go towards $190, $210. So $190 is above these tops. Then $210 is the current top for Solana. So it’s on its way. It hasn’t got those longer-term time frames confirmed yet, and those longer terms are the weeklies.”

Solana is trading for $141 at time of writing, down more than 8% in the last 24 hours.

Lastly, the analyst predicts that Render (RNDR), the graphics processing unit (GPU) rendering blockchain, will reclaim a double-digit value.

“Now, what do we need to see until it gets there? Obviously higher lows, and that would happen throughout this next couple of months, maybe even up to four months as we get to that [US presidential] election… If I keep seeing higher lows, it’s not going to stop me from getting into the market if it breaks out through that period.”

Render is trading for $7.04 at time of writing, down 7.7% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Published

11 hours agoon

July 5, 2024By

admin

The price of Bitcoin has continued its descending movement, sliding under the $55,000 threshold, returning back to levels last seen in February.

Bitcoin’s (BTC) sell-off has intensified amid reports that the collapsed crypto exchange Mt. Gox moved over 47,000 BTC (worth around $2.6 billion) to a new wallet ahead of its $9 billion payout. At the time of writing, the price of Bitcoin is $54,561, a mark last witnessed in February, when the largest by market capitalization cryptocurrency was surging to a new all-time high.

Following the transaction, Mt. Gox trustee officially confirmed on Jul. 5 during Friday’s Asian trading hours that the collapsed exchange “made repayments in Bitcoin and Bitcoin Cash to some of the rehabilitation creditors.” The trustee didn’t specify though the amount of BTCs sent to creditors.

The crypto market has faced significant pressure recently, affecting both investor sentiment and miner operations following the April halving, which reduced mining rewards from 6.25 BTC to 3.125 BTC. At Bitcoin’s current price, only five ASIC rigs from Avalon and Antminer remain profitable, according to f2pool’s X post.

⛏️With #Bitcoin trading below $58k, what is the current profitability for mining?

At a rate of $0.08/kWh, ASICs less efficient than 23 W/T operate at a loss.

For more details on mainstream miners, please refer to the table below. pic.twitter.com/hJS1lsVnmK

— f2pool 🐟 (@f2pool_official) July 4, 2024

The rapid drop below $55,000 has pressured speculators, resulting in $682 million in liquidations of both long and short positions across multiple exchanges, according to Coinglass.

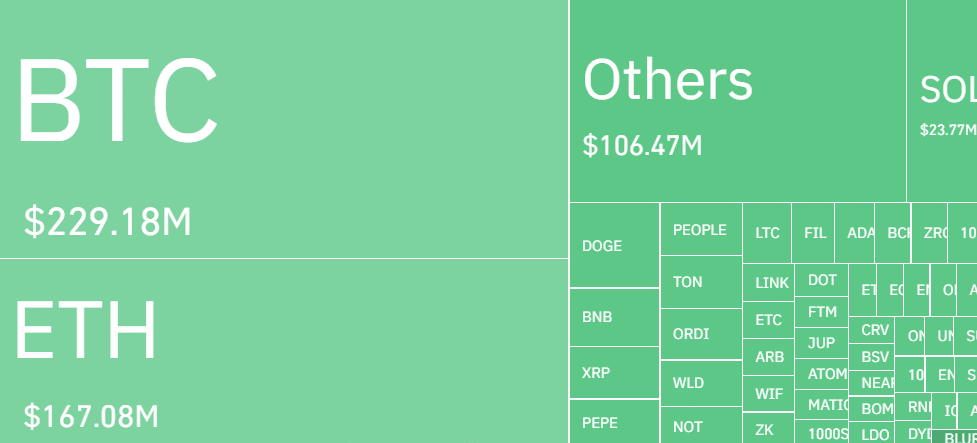

Over the past 24 hours, more than 235,000 traders were liquidated, with the largest single liquidation order on Binance’s ETH/USDT trading pair valued at over $18.4 million. According to CoinGecko, the total crypto market capitalization dropped by over 8% to $2 trillion, increasing sell-offs among speculators.

As crypto.news reported earlier, TRON founder Justin Sun offered to help the industry by teasing his “willingness” to buy confiscated Bitcoins from the German government over-the-counter. It’s unclear when these negotiations will begin, but with the recent movement of Bitcoins to centralized exchanges from Germany-labeled addresses, Mt. Gox’s repayments have seemingly become the primary concern among traders.

Source link

Bitcoin

Bitcoin’s quick dip below $57k forces beginners to capitulate, CryptoQuant says

Published

17 hours agoon

July 5, 2024By

admin

As Bitcoin plunged below the $57,000 mark, concerns surged among investors about potential market volatility and its impact on miners.

On Thursday morning, speculators continued their selling pressure, forcing Bitcoin (BTC) to dip below $57,000 for the first time since February. As of press time, Bitcoin rebounded above the $57,000 mark, but its previous quick plunge might signal weakness, potentially impacting sentiment among retail traders.

Blockchain research firm CryptoQuant noted that crypto beginners — who bought BTC over the past six to three months — have started moving their coins amid the plunge and “increasing selling pressure.” According to the platform’s data, approximately $2.4 billion worth of BTC controlled by crypto beginners began moving, likely signaling their intention to sell at current market prices.

The market turbulence might also be worsened by miners, who are facing a rapid drop in hashprice, a metric representing miner revenue per terahash. Crypto mining analytics firm Hashrate Index noted that the hashprice mark amid Bitcoin’s plunge is “scratching its all-time low,” a level last seen during the bear market. As of press time, hashprice is at $44.69, potentially pushing some miners to liquidate their reserves to sustain operational expenses.

In a May exclusive interview with crypto.news, CryptoQuant head of research Julio Moreno noted that the market is “likely to see a miner capitulation if prices don’t recover significantly during the summer,” adding that the hashprice (average miner revenue per hash) is repeatedly “making new lows” following the latest halving. At the time of writing, Bitcoin is trading at $57,336, according to data from crypto.news.

Source link

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs