cryptocurrency

Polkadot’s multi-million marketing expenses spark fury in blockchain community

Published

6 days agoon

By

admin

Blockchain project Polkadot is under fire after revealing $37 million in expenses on the marketing budget, triggering criticism and scrutiny from its community.

Polkadot, a sharded multi-chain network founded by the Ethereum co-founder Gavin Wood, is facing backlash after disclosing $37 million in marketing expenses, leading to criticism and scrutiny from its community.

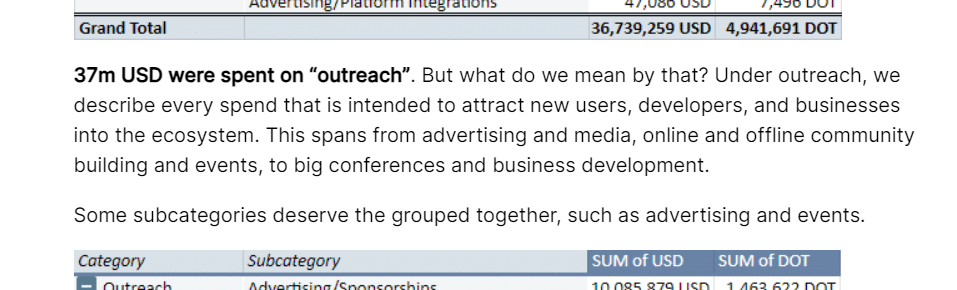

In its H1 2024 treasury report, Polkadot said that nearly $40 million was spent on “outreach,” saying that under outreach, the company describes “every spend that is intended to attract new users, developers, and businesses into the ecosystem.”

“This spans from advertising and media, online and offline community building and events, to big conferences and business development.”

Polkadot

Of the total marketing budget, over $20 million was allocated to advertising, while $10 million worth of DOT tokens were used for sponsorships. These sponsorships included sports deals, collaborations with a race car driver, and a partnership with an e-sports tournament organizer. For comparison, the report noted that Polkadot spent $23 million on developments in the first half of the year.

The marketing expenses quickly triggered outrage within the blockchain community, with accusations of centralization and frivolous financial campaigns. Victor Ji, co-founder of Manta Network, expressed his dissatisfaction in an X thread, calling Polkadot a “highly toxic ecosystem that lacks any real value for web3” and accusing it of discrimination and lack of support for network-built projects.

A concrete example is the Polkadot Academy event held in Hong Kong this February, where less than a quarter of the participants were Asian, even though this was an event in Asia (costing over a million dollars). It was at this event that I first encountered Gavin Wood, and when I… https://t.co/JxyvyIM6S9

— victorji.eth ✨ (@victorJi15) July 2, 2024

Another core developer at Polkadot, using the alias @seunlanlege, also criticized the project’s approach, saying it’s “insane to me how much money the Polkadot treasury is wasting on misplaced marketing,” and drawing parallels between Polkadot and the bankrupt FTX crypto exchange.

The report noted that at the current spending rate, Polkadot’s treasury has about “two years of runway left,” while acknowledging the unpredictable nature of crypto-denominated treasuries. As of now, Gavin Wood has not made any public statements on the matter.

Source link

You may like

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Published

8 hours agoon

July 8, 2024By

admin

The Ethereum-based BUIDL fund from the leading asset manager BlackRock has gulped over $5 million in assets over the past week despite the ongoing market turbulence.

Market analytics resource IntoTheBlock (ITB) revealed this in a recent disclosure, stressing that the fund has commanded considerable interest among investors.

While the crypto market struggles, BlackRock’s $BUIDL fund, operating on the Ethereum network, continues to attract new investors.

The fund requires a minimum entry of $5 million, and its total assets have now reached $491 million. pic.twitter.com/Bl19tVVxbW

— IntoTheBlock (@intotheblock) July 8, 2024

Launched in March on Ethereum, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) marks the company’s first tokenized fund. It allows qualified investors to procure yields in U.S. dollars by subscribing through the fintech company Securitize.

Notably, two months after the fund’s launch, Securitize secured a $47 million funding round from multiple investors, including BlackRock.

The BUIDL fund allocates investments into U.S. Treasury bills, cash, and repurchase agreements. This enables investors to generate yield while maintaining their holdings as tokens on the blockchain. Despite a correlation with the crypto industry, the fund has maintained a positive path amid the ongoing market turmoil.

According to data sourced by ITB, BUIDL now boasts $491 million in assets under management (AUM) amid a sustained growth trajectory. This feat comes as the broader global crypto market lost $290 billion in July, with Bitcoin (BTC) collapsing below $57,000.

On-chain data shows that BUIDL’s AUM stood at $486.46 million as of July 2. Interestingly, this figure has since increased to $491.83 million, recent data confirms. The growth rate indicates an addition of $5.37 million in the last week despite the bearish atmosphere.

With this bullish performance, BUIDL has maintained its position as the largest blockchain-based money market fund. Notably, BUIDL surpassed the BENJI fund from Franklin Templeton to become the largest money market fund in May, when its AUM soared to $375 million.

1/ Blackrock’s BUIDL has surpassed Franklin Templeton’s BENJI (FOBXX) in AUM and became the largest On-Chain Money Market Fund

– BUIDL has grown 36.5% MoM from $274M to $375M

– BENJI only grew 2.1% MoM from $360M to $368M pic.twitter.com/zcMzThfAAh— Tom Wan (@tomwanhh) April 30, 2024

As such, BUIDL has recorded inflows totaling $116.83 million. Meanwhile, BENJI has only seen $33.97 million in capital inflows within the same period.

Source link

cryptocurrency

Top cryptocurrencies to watch this week: BTC, LTC, TRX

Published

1 day agoon

July 7, 2024By

admin

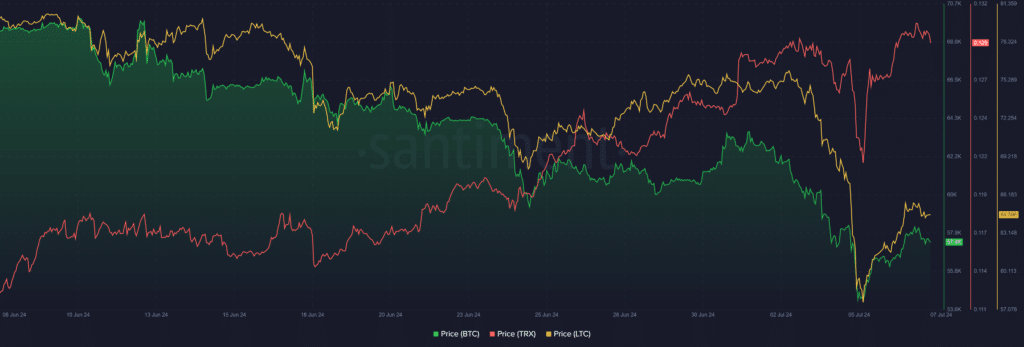

The first week of July introduced bearish pressure, leading to massive losses in the crypto market. Bitcoin (BTC) led the downtrend, as it consistently recorded lower lows amid sustained selling pressure.

Notably, the rest of the market experienced similar losses. Consequently, the global crypto market cap lost $140 billion, as it dropped further to $2.11 trillion, its lowest level since late February. While most assets remained down, a few witnessed remarkable recoveries.

Here are our top picks for cryptocurrencies to watch this week following their noteworthy performances during the downtrend last week:

Bitcoin drops to 5-month low

Bitcoin’s start to the week was mildly bullish following a consolidation phase two weeks back. However, bearish pressure emerged as the leading crypto asset maintained a divergence from U.S. equities, currently in their bullish stage.

BTC was subjected to its toughest bearish selling pressure this year, as bankrupt exchange Mt. Gox began creditor repayments, the German government distributed thousands of BTC tokens, new holders began selling off their assets and miners showed signs of capitulation.

Last week alone, Bitcoin gave up multiple psychological thresholds from $63,000 to $58,000. The asset slumped to a 5-month low of $53,485 on July 5 but immediately rebounded from this position. Despite the mild recovery, BTC ended last week with a 4.5% drop, slightly above $58,000.

At press time, the asset has again forfeited the $58,000 threshold amid an additional 1.13% drop. Nonetheless, it has maintained a position above the lower Bollinger Band ($56,347). Bitcoin’s hopes of a full recovery hinge on its ability to reclaim the 20-day SMA ($61,509) and the upper Bollinger Band ($66,676).

LTC slumps 12%

Litecoin (LTC) was one of the numerous victims of last week’s market collapse. The asset showed resilience at the start of the week, largely consolidating from June 30 to July 2.

However, as pressure mounted, LTC recorded three consecutive intraday losses from July 3 to 5, dropping 18.6% within this period. When the market staged a mild rebound on July 6, LTC gained 5.72% but closed the week with a 12.7% loss.

Litecoin’s MACD line crossed below the Signal line on July 4, confirming the bearish momentum.

With both lines currently sloping downward, this suggests the bearish momentum is increasing. LTC needs to decisively close above Fib. 0.236 ($64.60) to mount a formidable defense against any more declines this week.

TRX bucks the trend, hits 4-month high

Tron (TRX) was one of the few assets that bucked the overall bearish trend last week.

TRX started the week with an indecisive bearing, but eventually increased 3.5% over four days to $0.12997 on July 3, looking to recover the $0.13 territory. The last time Tron saw this level was on March 13.

The retest of the $0.13 region coincided with the widespread drop in the market. Tron crashed 6.7% to a low of $0.12117 on July 5, but immediately rebounded.

A recovery push on July 6 helped it reclaim the bullish momentum, leading to a four-month high of $0.13028. Tron closed last week with a 3.5% increase.

Source link

cryptocurrency

House to revisit crypto regulation bill vetoed by Biden

Published

1 day agoon

July 7, 2024By

admin

The U.S. House of Representatives is set to reconsider a bill aimed at overturning a contentious Securities and Exchange Commission (SEC) directive that critics claim hampers crypto companies from collaborating with banks.

House Majority Leader Steve Scalise has slated the bill, previously vetoed by President Joe Biden in May, for reconsideration on July 9 or later.

.@SECGov SAB 121 resolution returns to House Floor next week says Majority Leader …“Legislation that may be considered:

Veto message to accompany H. J. Res. 109 – Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the…— blockchain tipsheet (@blockchaintpsht) July 5, 2024

Although the measure had previously passed both the House and Senate with bipartisan support, achieving the two-thirds majority needed to override Biden’s veto may be challenging.

The SEC issued Staff Accounting Bulletin No. 121 (SAB 121) in March 2022, advising financial institutions that hold crypto on behalf of customers to include those assets on their balance sheets as if they owned them.

The guidance was criticized for discouraging investment banks and other traditional financial entities from providing crypto custody services on a large scale.

House majority whip Tom Emmer even called SAB 121 “illegal” and a “violation” of the SEC’s statutory mission.

The SEC’s statutory mission is to protect investors, facilitate capital formation, and maintain fair, orderly, and efficient markets.

Chairman Gensler is violating all three of these with his illegal SAB 121 rule. pic.twitter.com/Wky2K8zglR

— Tom Emmer (@GOPMajorityWhip) May 7, 2024

The Senate had voted on the resolution to repeal this accounting guidance, which many critics argued was unnecessary and deterred investment.

Despite the controversial nature of SAB 121, there was sufficient bipartisan support for the measure to pass through Congress.

Lawmakers, investment banks, crypto investors, and even some crypto skeptics—typically divided on many issues—united in their desire to see SAB 121 repealed. They argued that the guidance forces banks to treat crypto assets differently from other types of assets, creating unnecessary complexity and uncertainty.

While the guidance is not a formal rule, the lack of clarity on how much banks would need to hold against crypto assets or how the SEC would enforce it has deterred several large firms from entering the crypto custody business.

When President Biden vetoed the bill, he posted a letter on the White House website explaining his decision. He emphasized that his administration would not support measures that jeopardize consumer and investor well-being.

He also noted that SAB 121 reflected considered technical views on the accounting obligations of firms safeguarding crypto assets.

Biden further stated that the Republican-led resolution to disapprove of SAB 121 would improperly limit the SEC’s ability to establish appropriate regulatory frameworks and address future issues.

The U.S. President explained that overturning the guidance would undermine the SEC’s broader authority over accounting practices. He also asserted the necessity of appropriate guardrails to protect consumers and investors, which are essential for harnessing the potential benefits of crypto innovation.

He further expressed his administration’s readiness to collaborate with Congress to develop a comprehensive and balanced regulatory framework for digital assets, building on existing authorities to promote responsible development and maintain U.S. leadership in the global financial system.

As the House prepares to revisit the bill, the crypto industry and its supporters are watching closely to see if the measure can gather enough support to override the presidential veto and repeal SAB 121. The outcome could significantly impact how banks handle crypto assets and the future of crypto custody services in the U.S.

Source link

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Pepe Price Analysis Reveals Bullish Strength As Bitcoin Plummets

Taiwan is not in a CBDC rush as central bank lacks timetable

Will SHIB Price Reclaim $0.00003 Mark By July End?

The power of play: Web2 games need web3 stickiness

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs