Donald Trump

Трамп обирає менеджера прокрипто-хедж-фонду Скотта Бессента на посаду міністра фінансів

Published

4 months agoon

By

admin

Обраний президент США Дональд Трамп назвав менеджера хедж-фонду Скотта Бессента, ентузіаста Криптовалюта , своїм обранцем на посаду міністра фінансів.

Якщо Сенат затвердить його, наступною особою, чий підпис прикрашає паперову валюту США, стане шанувальник екосистеми цифрових валют, створеної для заміни традиційної фінансової системи.

Бессент керує Key Square Group, компанією макроінвестування. Він працював на видатного інвестора Джорджа Сороса три десятиліття тому і, як пише The Wall Street Journal , був «ONE з рушійних сил» знаменитої ставки Soros Fund Management — яка принесла понад 1 мільярд доларів прибутку — що британський фунт стерлінгів обвалиться.

Bitcoin (BTC) і Крипто в цілому тепер у його полі зору.

«Я був у захваті від того, як [Трамп] прийняв Крипто , і я вважаю, що це дуже добре підходить до Республіканської партії, до її духу. Крипто — це свобода, і Крипто тут, щоб залишитися», — сказав він в інтерв’ю Fox. Бізнес у липні. «Крипто залучає молодих людей, людей, які не брали участі в Ринки».

Трейдери Polymarket поспорили, що він лідер. У ONE момент генеральний директор Cantor Fitzgerald Говард Лутнік також вважався ONE, але зрештою його обрали міністром торгівлі . Лутнік також займався цифровими активами, допомагаючи емітенту стейблкойнів Tether керувати гігантським запасом казначейських зобов’язань США, які забезпечують його стейблкоїн USDT з 2021 року.

Source link

You may like

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

adx

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Published

5 hours agoon

April 1, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

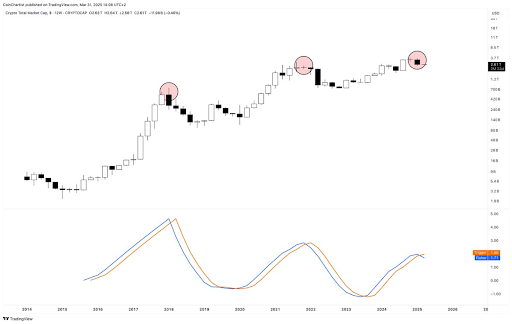

Technical expert Tony Severino has warned that the Bitcoin and altcoins Fischer Transform indicator has flipped bearish for the first time since 2021. The analyst also revealed the implications of this development and how exactly it could impact these crypto assets.

Bitcoin And Altcoins Fischer Transform Indicator Turns Bearish

In an X post, Severino revealed that the total crypto market cap 12-week Fisher Transform has flipped bearish for the first time since December 2021. Before then, the indicator had flipped bearish in January 2018. In 2021 and 2018, the total crypto market cap dropped 66% and 82%, respectively. This provides a bearish outlook for Bitcoin and altcoins, suggesting they could suffer a massive crash soon enough.

Related Reading

In another X post, the technical expert revealed that Bitcoin’s 12-week Fischer Transform has also flipped bearish. Severino noted that this indicator converts prices into a Gaussian normal distribution to smooth out price data and filter out noise. In the process, it helps generate clear signals that help pinpoint major market turning points.

Severino asserted that this indicator on the 12-week timeframe has never missed a top or bottom call, indicating that Bitcoin and altcoins may have indeed topped out. The expert has been warning for a while now that the Bitcoin top might be in and that a massive crash could be on the horizon for the flagship crypto.

He recently alluded to the Elliott Wave Theory and market cycles to explain why he is no longer bullish on Bitcoin and altcoins. He also highlighted other indicators, such as the Parabolic SAR (Stop and Reverse) and Average Directional Index (ADX), to show that BTC’s bullish momentum is fading. The expert also warned that a sell signal could send BTC into a Supertrend DownTrend, with the flagship crypto dropping to as low as $22,000.

A Different Perspective For BTC

Crypto analyst Kevin Capital has provided a different perspective on Bitcoin’s price action. While noting that BTC is in a correctional phase, he affirmed that it will soon be over. Kevin Capital claimed that the question is not whether this phase will end. Instead, it is about how strong Bitcoin’s bounce will be and whether the flagship crypto will make new highs or record a lackluster lower high followed by a bear market.

Related Reading

The analyst added that Bitcoin’s price action when that time comes will also be trackable using other methods, such as money flow, macro fundamentals, and overall spot volume. The major focus is on the macro fundamentals as market participants look forward to Donald Trump’s much-anticipated reciprocal tariffs, which will be announced tomorrow.

At the time of writing, the Bitcoin price is trading at around $83,000, up around 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Source link

Bitcoin

Trump pardons BitMEX, is ‘Bitcoin Jesus’ Roger Ver next?

Published

3 days agoon

March 30, 2025By

admin

Vitalik Buterin, Ross Ulbricht, and Tucker Carlson are among those urging President Donald Trump to pardon Roger Ver, aka Bitcoin Jesus.

Known as Bitcoin Jesus for his early advocacy of Bitcoin, Ver faces up to 109 years in prison on tax charges, including allegations of evading $48 million in taxes. Despite renouncing his U.S. citizenship in 2014 to avoid prosecution, Ver’s legal troubles resurfaced when he was arrested in Spain in 2024. But following the president’s earlier pardons of figures like Ulbricht and BitMEX co-founders, observers wonder whether Ver’s would catch a break. Is a pardon on the way, or will Ver’s legal troubles continue?

Read on for a closer look.

Crypto cronies

After Trump embraced cryptocurrency, many crypto leaders rallied to support him by donating funds to his inauguration and hobnobbing at galas.

Trump also , which industry brass celebrated.

In return, Trump signed an order to stockpile tokens and swiftly acted in favor of the industry. Under Trump-appointed SEC chair Mark Uyeda, investigations into several cryptocurrency companies, including Immutable, Crypto.com, Ripple, and Coinbase, were dismissed.

In a notable move on Thursday, March 27, Trump pardoned BitMEX co-founders Arthur Hayes, Benjamin Delo, and Samuel Reed, who had pleaded guilty to federal charges related to money laundering and regulatory violations. The trio was convicted for failing to implement anti-money laundering measures at BitMEX, which prosecutors had labeled a “money laundering platform.” Reed had also violated the Bank Secrecy Act and paid a $10 million fine. But under Trump, it seems all is forgiven.

This has sparked speculation on whether Ver, a prominent figure in the crypto world, could also receive the same courtesy.

Ver, a Silicon Valley native with a libertarian streak, was deeply involved in the early days of cryptocurrency, investing in companies like Kraken, Ripple, and Blockchain.com. In 2017, Ver hyped Bitcoin Cash (BCH) as more suitable for everyday payments.

Roger Ver was there for me when I was down and needed help. Now Roger needs our support.

No one should spend the rest of their life in prison over taxes. Let him pay the tax (if any) and be done with it. #FreeRoger pic.twitter.com/flP573hm0N

— Ross Ulbricht (@RealRossU) February 20, 2025

Ver’s past

In 2000, by the age of 20, Ver began to participate in libertarian party debates.

During these debates, he made critical statements about the agents of the Bureau of Alcohol, Tobacco, and Firearms, calling them “murderers” and referencing their involvement in the scandalous Waco Siege in which dozens of children were killed in a standoff between FBI and ATF agents and Branch Davidian cult followers. Ver didn’t know that ATF agents were present during these debates.

In the 2000s, Ver became involved in e-commerce. On top of tech enterprises, Ver was selling firecrackers on eBay. After selling unlicensed firecrackers in 2001, he was charged and spent 10 months in prison. The fact that he was locked in jail instead of being fined or notified about the necessity of obtaining a license led Ver to think that the case was politically motivated and that his criticism of ATF was the real reason behind his prosecution. Without fear of further persecution, Ver left the U.S. after his post-prison probation ended.

By 2011, Ver learned about Bitcoin and became one of its first investors. He also advocated for Bitcoin long before it went mainstream, with multi-million investments and national leaders talking about its importance for the future of their countries.

The key points of Ver’s advocacy for Bitcoin were the financial freedom of individuals and the stopping of government and banks from interfering in people’s lives.

The legal fight

Since February 2014, Ver has been a citizen of Saint Kitts and Nevis. He claims that he had to renounce his U.S. citizenship after long-lasting targeting from the U.S. government.

In April 2024, he was indicted and arrested in Spain on charges of U.S. tax evasion and mail fraud. Ver is accused of dodging $48 million in taxes after earning up to half a billion dollars through cryptocurrencies.

According to prosecutors, Ver failed to pay his “exit tax” on 131,000 BTC owned by his two companies when he left the U.S. and provided false info to the law firms filing Ver’s tax returns. Allegedly, he sold his bitcoins in 2017 without notifying the financial attorneys.

Ver clarifies that three charges of mail fraud (combined, punishable by 19 years behind bars) are based on the three letters with his tax returns he sent to the Internal Revenue Service (IRS).

Ver denies he committed crimes such as tax evasion and mail fraud. He insists he was doing his best to comply with the nascent Bitcoin taxation rules, and that his prosecution was politically motivated.

In December, he began his legal fight against the prosecution, denying all the charges. He filed a motion to dismiss charges, but the government rejected it in January.

Ver’s legal team challenged an exit tax as “an unconstitutional burden on the fundamental right to expatriate.” For people like Ver, who have substantial amounts of low-liquidity assets, the exit tax may be prohibitive. The government suggests Ver is a fugitive. He disagrees with this status as he doesn’t hide and didn’t commit crimes for which he is judged while living in the U.S.

On March 1, Ethereum’s Buterin published an X post arguing that the exit tax doesn’t exist in most other countries and called it the “tax-by-citizenship” and “extreme.”

In addition, Buterin mentioned that the IRS obtained some of the information by intimidating Ver’s lawyers. The Ethereum founder added:

“Genuine good faith mistakes should be treated by giving the actor the opportunity to pay back taxes if needed with interest and penalties, not with prosecution.”

Going to prison for the rest of your life over non-violent tax offenses is absurd. The case against Roger seems very politically motivated; like with @RealRossU, there have been plenty of people and corporations who have been accused of far worse and yet faced sentences far… https://t.co/7G3zDkn2F2

— vitalik.eth (@VitalikButerin) March 1, 2025

Will Bitcoin Jesus be pardoned?

Trump promised to pardon Ross Ulbricht if get elected. Ulbricht, the man behind the Silk Road marketplace charged for money laundering and drug trafficking, is an important figure in the history of Bitcoin as his marketplace drove Bitcoin’s adoption. After the inauguration, Trump indeed pardoned Ulbricht to much acclaim.

Soon, various crypto advocates began to urge Trump to pardon Roger Ver. On Jan. 21, 2025, following the pardon of Ross Ulbricht, an X influencer using the moniker Rothmus published a short post calling for the pardon of Ver to which Elon Musk replied: “will inquire.” This reply gave the community hope for the pardon of Bitcoin Jesus.

https://twitter.com/Rothmus/status/1881536312710402268

On March 17, Marla Maples, Trump’s ex-wife, took to X to share a touching video where people who met Ver tell their stories of his generosity.

It is not clear, though, if the POTUS paid attention to this post.

The hope for a pardon of Ver was seriously undermined on Jan. 26, when Elon Musk suddenly, via an X post, stated that Ver would not be pardoned because he gave up his U.S. citizenship.

Roger Ver gave up his US citizenship. No pardon for Ver. Membership has its privileges.

— Elon Musk (@elonmusk) January 26, 2025

The statement drew much criticism, as Musk is not an elected official and cannot decide who to pardon and who not to. He is, however, Trump’s advisor and was a major donor to his “MAGA” campaign.

More than that, the POTUS is not prohibited from pardoning non-U.S. citizens. Finally, many commented that Ver had to renounce his citizenship under pressure from ATF and a U.S. prison sentence.

I missed this tweet.

Another time I will publicly criticize Elon, hopefully for his own benefit. Because this is a terrible and wildly ignorant “hot take”.

1) You don’t need to be a citizen to get a pardon.

2) Ver was a citizen and specifically renounced his U.S. citizenship in…— Viva Frei (@thevivafrei) January 27, 2025

A few hours after Musk’s tweet, Ver took X to post a video in which he briefly explained why he was prosecuted and asked Trump for a pardon.

In the video, Ver stated that he is American and that renouncing his citizenship was one of the “hardest and saddest decisions [he] ever made.”

After Ulbricht, Hayes, Delo, and Reed received presidential pardons, others, including Angela McArdle, who currently serves as Chair of the national Libertarian Party, called for freeing Ver as well.

“Let’s pray Roger Ver is next!” she declared on Friday.

It remains to be seen whether Musk made skeptical comments over the possibility of Ver’s clemency on Trump’s behalf or if it was only his view of the situation.

At last check Saturday, Trump hasn’t commented on Ver’s situation.

Source link

Bitcoin

Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future

Published

4 days agoon

March 29, 2025By

admin

Donald Trump’s upcoming “Liberation Day” tariff announcement is being framed by some experts as a reset of global trade and could have negative implications for crypto.

While much of the attention is focused on the political fallout and trade disruptions, the broader consequences for digital assets, and the global frameworks that support them, deserve a closer look.

Heidi Crebo-Rediker, senior fellow at the Council on Foreign Relations, recently described on Bloomberg TV U.S. President Donald Trump’s plans as a “tearing up” of existing free trade agreements with America’s closest allies. This includes the so-called “Dirty 15”, a group of major trading partners that together make up 80% of U.S. trade.

Trump’s proposed system, built on unilateral tariffs and non-tariff barriers, represents a complete shift away from the cooperative global order that has defined the last several decades of international trade.

Why does this matter for crypto?

Crypto is inherently cross-border. Its infrastructure, users, capital flows, and regulatory frameworks depend on global alignment and relatively open markets. Any shift toward economic fragmentation risks disrupting that progress.

Crebo-Rediker notes that countries like Canada are already preparing to diversify away from the U.S., bracing for a reconfiguration of trade and investment relationships. In this new era, markets could become more closed, regulation more inconsistent, and capital controls more common.

She may agree (I don’t know), but these are all hostile conditions for crypto adoption. She also warns of a broader retreat from the multilateral frameworks that underpin both global finance and regulatory cooperation.

If America turns inward while allies look elsewhere, especially towards China, which is positioning itself as a defender of the global system – it could weaken the West’s influence over digital asset standards.

Crypto advocates have cheered Trump’s recent embrace of stablecoins and digital finance, but they should be cautious. A fragmented world, with each country pulling in a different direction on trade and tech, is not a world where crypto can thrive.

Forget about Michael Saylor’s vision of Bitcoin surpassing a $200 trillion market cap and we can only hope it can hold on to a $1 trillion valuation.

If global coordination erodes, so too might the prospects for crypto’s next wave of adoption. If so, it was a fun run. If not, I’ll be glad to admit being wrong.

Source link

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Human Rights Foundation Donates 1 Billion Satoshis To Fund Bitcoin Development

Dogecoin, Cardano Lead Gains as Crypto Majors Rally

Fartcoin price surges 35% as recovery gains momentum

$1M Premium Paid for $70K Bitcoin Put Option

How DePIN’s Revenue Growth is Attracting Equity Investors – DePIN Token Economics Report

Bitcoin Poised For A Q2 Recovery? Analyst Points 2017 Similarities

Binance ends Tether USDT trading in Europe to comply with MiCA rules

Crypto Trader Warns of Potential 33% Dogecoin Drop, Unveils Downside Price Target for Ethereum

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x