24/7 Cryptocurrency News

BlackRock Bitcoin ETF (IBIT) Records Largest-Ever Outflow of $188M

Published

3 months agoon

By

admin

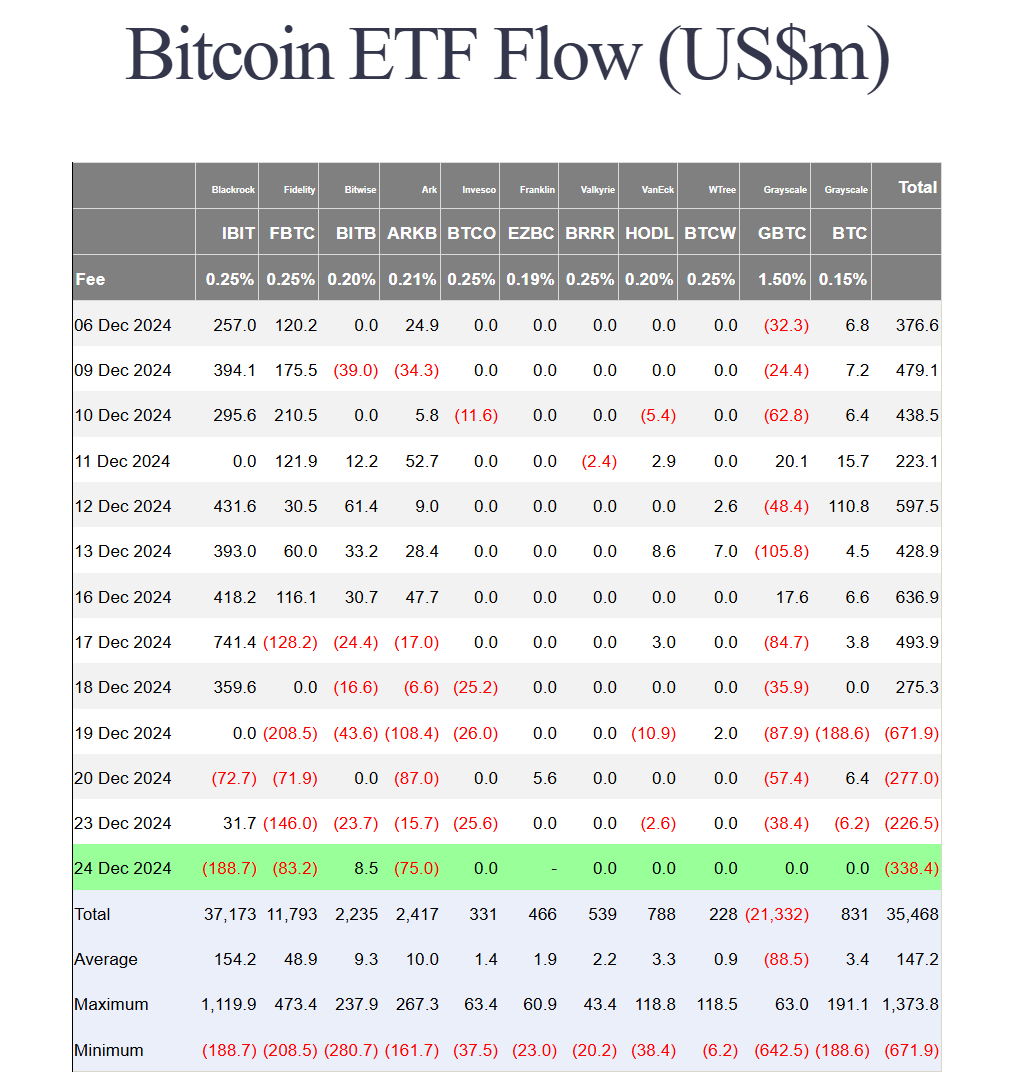

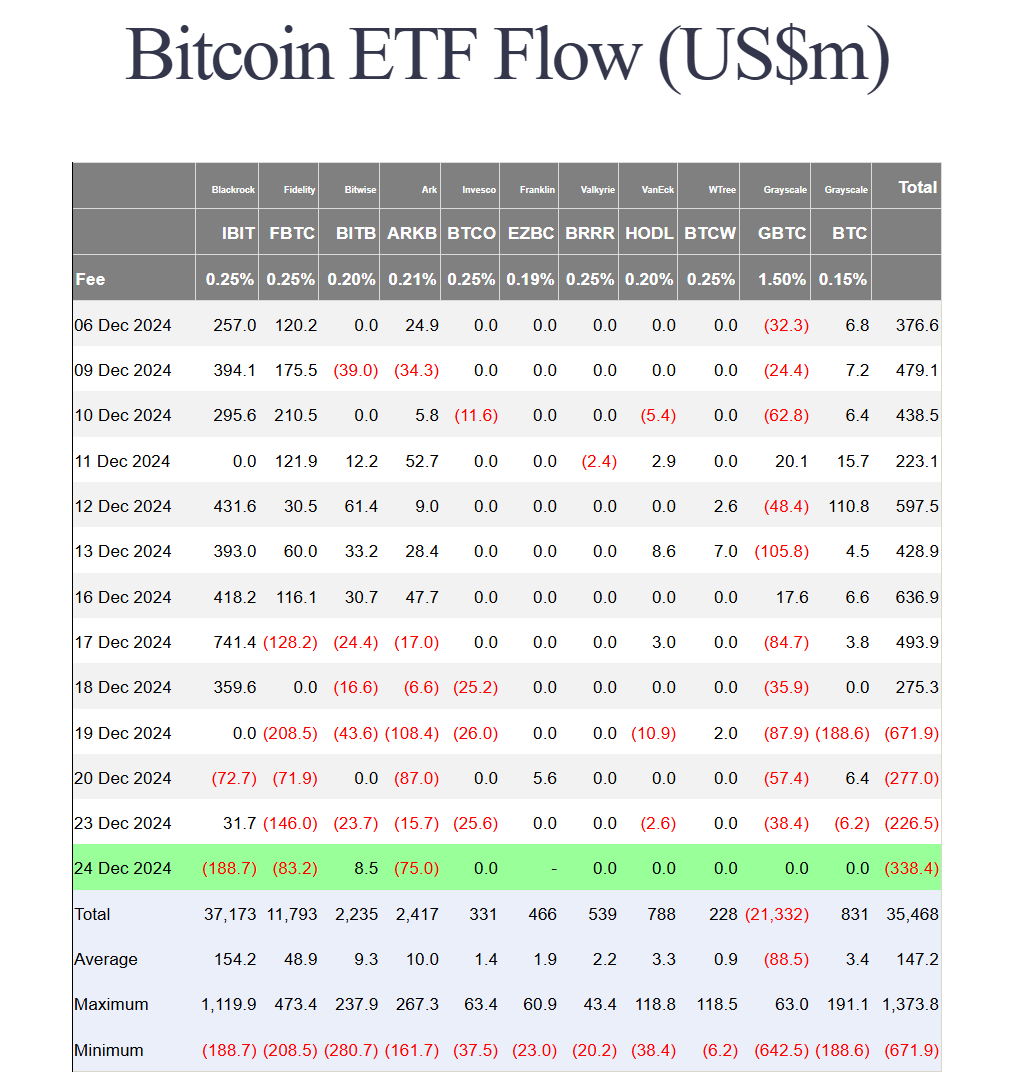

BlackRock’s iShares Bitcoin ETF (IBIT) has recorded its largest-ever $188.7 million in outflow on Tuesday, raising concerns over future implications. Also, US-based spot Bitcoin ETFs saw consecutive outflows for the fourth day as Fidelity’s FBTC and Ark Invest’s ARKB continued weak performance amid holidays. Bitcoin ETFs have now recorded over $1.5 billion in outflow in last 4 days.

BlackRock Bitcoin ETF Sees Biggest Outflow Since Launch

The crypto market showed signs of recovery as Bitcoin, Ethereum and other altcoins rebounded over the last 24 hours. Bitcoin price recovered from $94K to $99K today likely as traders FOMO Santa Claus rally. BTC currently holds above $98K, but a change in sentiment can trigger profit booking.

The promising factors for the change in sentiment could come from BlackRock Bitcoin ETF, which recorded its largest-ever outflow since launch on Tuesday, as per Farside Investors data on December 25. iShares Bitcoin ETF (IBIT) witnessed $188.7 million in outflow, almost double its previous largest outflow of $72.7 million last Friday.

The total outflow from US spot Bitcoin ETFs was $338.4 million, the fourth consecutive outflow. Fidelity’s FBTC saw $83.2 million and Ark 21Shares’ ARKB recorded $75 million in outflows. The flows for other crypto exchange-traded funds were negligible.

This has raised concerns among traders, raising problems for them as the year-end crypto expiry is almost here. While analysts and investors are primarily bullish, the recent prediction by experts including BitMEX co-founder Arthur Hayes about a potential crypto market crash near Donald Trump’s inauguration day sparked sell-offs.

However, crypto firms such as MicroStrategy, Metaplanet, Matador Technologies, and others buy the Bitcoin price dip. In fact, MicroStrategy’s Michael Saylor announced a special shareholder meeting to vote on a proposal for its 21/21 Bitcoin plan and boost its treasury.

What’s Next for Bitcoin Price?

BlackRock Bitcoin ETF’s largest-ever outflow and consecutive outflows from spot Bitcoin ETFs made investors to think about their next move.

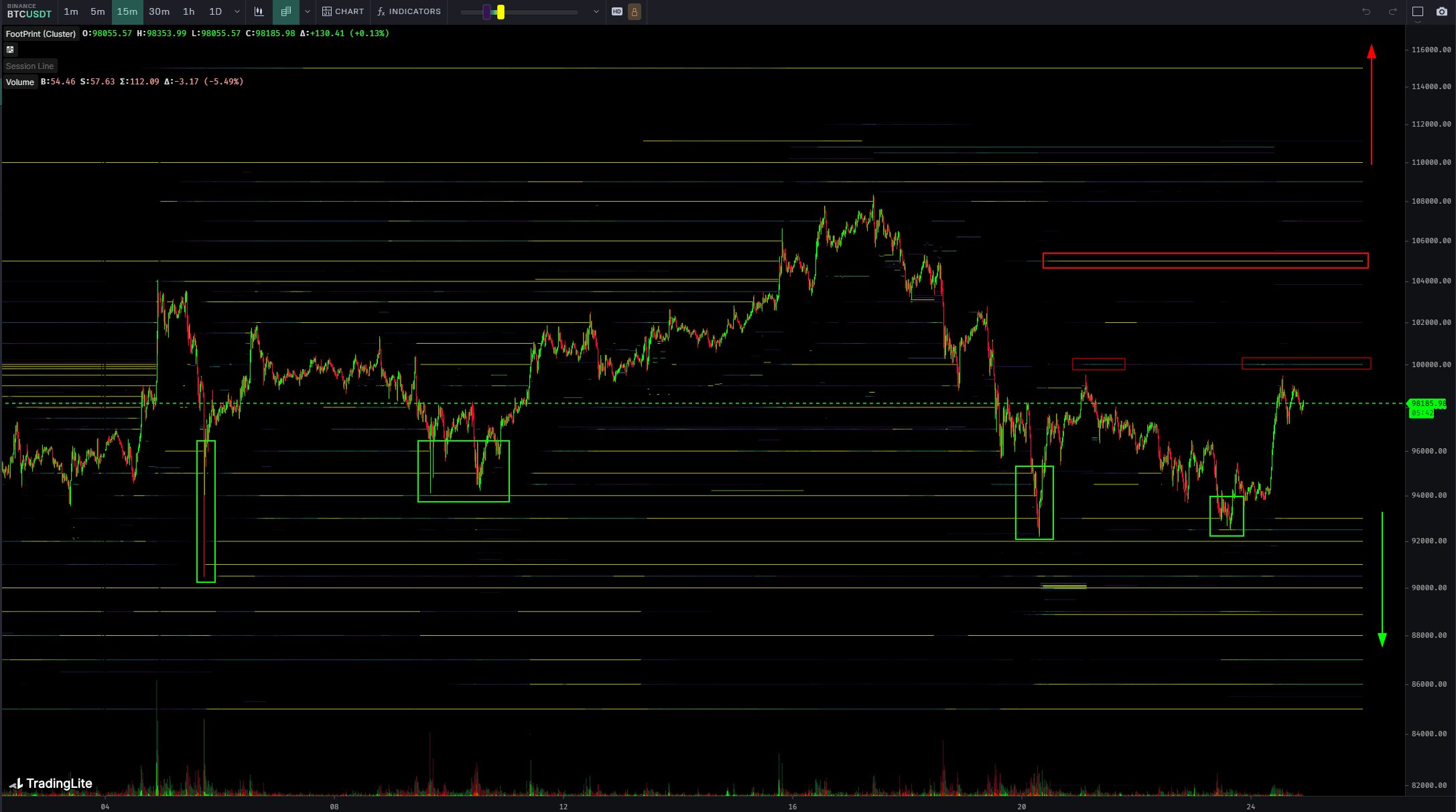

Crypto analyst Skew revealed that the current passive ask liquidity is around $100K given quoting and previous LTF high, which is an important price area. Besides, ask liquidity and spot supply is around $105K. He believes flows and volatility will be a key factor here.

“Dynamic use of taker & limit bid for acquiring BTC here, likely a strategic play by some large market entity that expects higher prices into year end & early Q1.”

BTC price jumped 4% in the past 24 hours, with the price currently trading at $98,014. The 24-hour low and high are $93,744 and $99,404, respectively. Furthermore, the trading volume has decreased by 24% in the last 24 hours, indicating a decline in interest among traders.

Traders must keep an eye on volume and sentiment in the market for cues on direction in upcoming days, with BlackRock Bitcoin ETF also a major factor. Notably, 147 BTC options with $14.40 billion in notional value to expire on Deribit this Friday. The max pain price is $84,000 and put-call ratio is 0.68.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

24/7 Cryptocurrency News

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Published

3 hours agoon

April 1, 2025By

admin

Crypto expert Egrag Crypto has again predicted that the XRP price could rally to as high as $27. The analyst has also revealed the exact timeline for when the altcoin could record this massive price surge.

Expert Reveals Time For XRP Price To Hit $27

In an X post, Egrag Crypto asserted that the XRP price can hit $27 in 60 days. The expert remarked that historical patterns indicate that the altcoin can reach this target within this timeframe.

Based on this price prediction, XRP could reach this $27 target by June, marking a 1,250% gain for Ripple’s native crypto. The expert’s accompanying chart showed that he was alluding to the 2017 bull run as to why the altcoin could record such a parabolic rally.

In 2017, XRP recorded a historic gain of over 60,000% as it rallied to its current all-time high (ATH) of $3.8 the following year. As such, based on history, a 1,250% increase is nothing for the altcoin.

In the meantime, the XRP price still boasts a bearish outlook thanks to the sentiment in the broader crypto market. As CoinGape reported, Ripple’s coin could drop to the next major support levels at $1.79 and $1.56 if it fails to hold above $2.03.

Decision Time For The Altcoin

In an X post, crypto analyst CasiTrades stated that it is decision time for the XRP price. She noted that the altcoin is showing strength with a bounce right back to the first key test at $2.17. She added that this is the resistance level she wants to see flip into support, as it might be the “most important price of the week.”

The analyst stated that XRP must reclaim this level to build momentum. She added that the $2 level remains a valid target if the $2.17 level rejects. Meanwhile, CasiTrades revealed that $2.70, $3.05, and $3.80 are the major resistance zones once the upward trend is confirmed.

The analyst also mentioned that the XRP price is now fully inside the Fibonacci Time Zone 3, which spans most of April. She affirmed that this is the breakout window market participants have been preparing for and that all signs point to a macro wave.

CasiTrades affirmed that the structure is clean. The RSI divergence has confirmed the bottom, while the subwaves are aligning well with the larger targets. If the next leg pushes XRP back above $2.17 with momentum, she claimed that market participants may finally see obvious signs of Wave 3. Interestingly, the analyst added that if the altcoin clears $2.70 this week, it may break the $1,000 price extension.

For now, investors may remain cautious, especially seeing how XRP fell after the PMI and JOLTS data release earlier today. Donald Trump is also set to announce reciprocal tariffs tomorrow, which could spark a massive price crash.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several topics and niches. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover, a traveler and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

ChatGPT To Launch Next Big Model, New Studio Ghibli Ahead?

Published

19 hours agoon

April 1, 2025By

admin

OpenAI, the firm behind ChatGPT, has disclosed its plans to introduce a new open-weight language model in the coming months.

This will be the firm’s first open-weight release since GPT-2, a decision that had been delayed due to other priorities but now feels essential. Per the update, the novel model is expected to bring strong reasoning capabilities and provide simplicity for developers and organizations.

From OpenAI ChatGPT to Sora

It is worth mentioning that Sam Altman, OpenAI’s CEO, shared the news on X, expressing excitement about making the model highly effective. More importantly, this announcement follows OpenAI’s history of launching novel AI products.

Since the release of ChatGPT in 2022, the tool has become widely used for text-based tasks. This Large Language Model transformed how people from different parts of the world interact with artificial intelligence.

As reported by CoinGape, In 2024, OpenAI introduced Sora, an advanced video generation model. In addition, the release of voice Chat further improved AI’s role by allowing seamless spoken interactions.

Interestingly, these notable innovations have redefined how AI integrates into daily life. Now, OpenAI is moving toward open-weight models. This will allow greater customization.

For example, businesses, developers, and governments that prefer self-hosted AI solutions will be able to modify the model for specific needs. This new project could lead to wider adoption and new applications across various industries.

ChatGPT Developer Involvement and Future Trends

Before releasing the project to the public, OpenAI seeks developers’ input through a series of sessions.

According to Sam Altman, the events will begin in San Francisco, followed by meetings in Europe and the Asia-Pacific region. As detailed, developers will gain early access to prototypes, providing insight into potential applications.

Altman confirmed that OpenAI will evaluate the model using its preparedness framework. Since open-weight models can be altered post-release, additional security measures will be implemented.

By involving developers early, OpenAI intends to fuse innovation and responsibility. This will ensure that the model is both effective and safe for people to use.

Another Studio Ghibli Trend Ahead?

It is important to add that AI-generated Studio Ghibli-style artwork has shown how artificial intelligence can shape creative industries.

For context, when OpenAI added image generation to ChatGPT-4o, people started making Studio Ghibli-style portraits, and the trend quickly spread. Even Elon Musk joined the Ghibli trend. Still, this new trend has raised certain questions about the future of creative art.

Still, with OpenAI’s new model on the way, another wave of AI-generated content could take off. As AI keeps improving, it may bring new ways for people to create and share.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Japan Set To Classify Cryptocurrencies As Financial Products, Here’s All

Published

2 days agoon

March 30, 2025By

admin

Cryptocurrency investors in Japan are bracing for impact following a plan to reclassify digital assets as financial products. While the plan has elicited excitement from cryptocurrency enthusiasts in the Far East, the ambitious plan will have to scale several legislative hurdles.

Japan Targets Reclassification Of Cryptocurrencies As Financial Products

According to a report by Nikkei, Japan’s Financial Services Agency (FSA) is inching toward classifying cryptocurrencies as financial products. Per the report, the FSA intends to achieve the reclassification via an amendment to the Financial Instruments and Exchange Act.

Currently, digital assets in Japan are considered crypto assets conferred with property rights and seen as payment means. Under the FSA’s plans, cryptocurrencies in Japan will be treated as financial products in the same manner as traditional financial products.

The FSA says it will adopt a slow and steady approach toward the reclassification, carrying out “a private expert study group” to test the waters. If everything goes according to plan, the FSA will submit the amended bill to Parliament in early 2026.

The classification of cryptocurrencies as financial products will have far-reaching consequences for the local ecosystem. Experts say treating cryptocurrencies as financial products will bring Japan closer to a crypto ETF launch amid a changing regulatory landscape.

Furthermore, the move may lower current cryptocurrency taxation for local investors since existing capital market rules will apply to the asset class.

A Fresh Bill For Crypto Insider Trading Is Underway

Apart from the reclassification, the FSA disclosed plans for new legislation against insider trading. The move flows treating cryptocurrencies as financial products and will strengthen existing investor protection rules.

“It is a direction to establish a new insider trading regulation that prohibits trading based on unpublished internal information,” said the FSA. “We will develop laws to prevent unfair transactions.”

However, Japan’s cryptocurrency scene is heating up to a boil, driven by local and international players. Last week, stablecoin issuer Circle secured approval from the FSA for USDC with top exchanges set to list the stablecoin.

Japan’s Metaplanet has tapped Eric Trump to join its Strategic Board of Advisors as it continues to load up Bitcoin.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Human Rights Foundation Donates 1 Billion Satoshis To Fund Bitcoin Development

Dogecoin, Cardano Lead Gains as Crypto Majors Rally

Fartcoin price surges 35% as recovery gains momentum

$1M Premium Paid for $70K Bitcoin Put Option

How DePIN’s Revenue Growth is Attracting Equity Investors – DePIN Token Economics Report

Bitcoin Poised For A Q2 Recovery? Analyst Points 2017 Similarities

Binance ends Tether USDT trading in Europe to comply with MiCA rules

Crypto Trader Warns of Potential 33% Dogecoin Drop, Unveils Downside Price Target for Ethereum

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: