blog

WhiteBIT Adds Pepe, Bonk, Sui & 57 New Crypto to Expand Collateral Options to 80

Published

3 months agoon

By

admin

WhiteBIT, a leading European cryptocurrency exchange has significantly expanded its collateral offerings by adding 60 new cryptocurrencies. This raised the total number of collateral assets supported to over 80 and added more versatility to the trading platform. Amongst those newly included assets were the likes of PEPE, BONK, SUI, DAI, AAVE, and many more, allowing access to numerous strategies touching borrow, margin, and futures trading.

With the expansion, it looks to focus on remaining relevant in the changing cryptocurrency market. The exchange boasts up to 5.5 million users and brands itself as a one-stop solution for retail and institutional traders. Moreover, through expansion and offering an expanded range of collateral assets on the platform, it seeks to enhance the user’s ability to risk manage while using many other trading strategies.

WhiteBIT Expands Collateral Offering with 60 New Cryptocurrencies

WhiteBIT’s expansion in offerings is largely driven by the growing demand for such features within the industry as noted by the company. With the new additions, It supports more than 80 collaterals, allowing users to choose a variety of assets for their margin and futures trading. This further highlights the increasing demand for the assets including PEPE, BONK, SUI, DAI, AAVE, as well as many others.

While other traders like the niche collaterals of newer tokens that are in contrast to major leans on trading such as bitcoin and Ethereum, such flexibility WhiteBIT is propagating this through its extension. When it tosses these assets into its system, then WhiteBIT has expanded platform capabilities that enable different types of trading. With new opportunities coming in, users can now use tokens such as PEPE or BONK for more questionable trades or for stablecoins like DAI to encrypt trade in case of fluctuating prices.

The focus on bringing in these new collateral assets points to the ability of this exchange to adapt and innovate in a competitive surrounding. The exchange is based on the customer-focused approach which allows both retail clients as well as institutional customers getting access to many advanced trading features that require greater liquidity, such as leveraged trades and margin loans from a very limited number of tokens.

The Growing Importance of Collateral in Cryptocurrency Trading

The fact that there are more than 80 assets integrated as collateral on WhiteBIT shows how important this collateral is in our cryptocurrency exchange era. The key benefit that WhiteBIT will benefit from is the opportunity to provide users with options that would best fit their risk profiles by using different assets. This is largely due to the use of collaterals in margin, futures trading, and other activities through leveraging cryptocurrency ownership as a crucial aspect of the ecosystem.

Currently, with a new type of collateral framework introduced in WhiteBIT, users can now diversify their risk on a relatively wider range of assets instead of basing it on a few. Additionally, the system allows immediate marking to market of collateral that helps traders keep track of their open positions in case their trades were liquidated. This comes in especially handy where prices become very volatile and change promptly.

The increase in collateral that is provided over the counter exchange is a strategy that more and more of the cryptocurrency exchanges are adopting as they seek to improve their platforms and reach more people. By allowing several collaterals, WhiteBIT becomes a simple exchange that meets the needs of both first-time traders and those relatively familiar with trading.

Additionally, 60 new assets can be used for crypto lending, unlocking new opportunities for those looking to invest and earn income effectively. Crypto Lending allows you to lend your cryptocurrencies to WhiteBIT by selecting a flexible plan of 30, 90, 180, or 360 days. It offers the opportunity to earn up to 13.49% annual income in the same cryptocurrency you lend. This unique tool is ideal for crypto traders seeking to grow their assets with minimal risk.

WhiteBIT Spot and Futures Trading Volumes, and WBT Token Performance

WhiteBIT has become the first cryptocurrency exchange to obtain a Level 3 certification under the Cryptocurrency Security Standard (CCSS). It continues to perform strongly in both spot and futures trading markets. The platform’s spot trading volume has surpassed $6.1 billion in the last 24 hours, reflecting its prominence in the European cryptocurrency market. This robust volume is fueled by the recent expansion of collateral options, attracting a wide range of traders.

Apart from spot trading, WhiteBIT’s future market has also been quite active as it has registered over $17.2 billion in trading volume in the last 24 hours. The exchange also provides 181 futures contracts and this makes it easy for traders who wish to take up leveraged positions and apply more intricate strategies.

Meanwhile, its native token WBT price has maintained a solid performance. Trading at $25, WBT experienced a slight 1% dip in the last 24 hours. Despite this, the token boasts a market cap of $2.17 billion and remains a key component of its ecosystem. The combination of strong trading volumes and WBT’s steady performance reinforces its status as a leading platform for both retail and institutional traders.

Source link

You may like

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

blog

More is Less: Feature Fatigue is Driving Web3 Users Away

Published

1 week agoon

March 24, 2025By

admin

Prominent Web3 platforms have attempted to be all things to all people, including Decentraland, The Sandbox, and Theta. Unfortunately, the bloated experiences that resulted from their well-intentioned integration of DeFi, NFTs, DAOs, and gaming confused users and reduced interest. Originally promoted as a metaverse for social, gaming, and virtual real estate experiences, Decentraland’s attempt to integrate play-to-earn, DAOs, and NFTs led to a convoluted and slow user interface.

In a similar vein, the Sandbox attempted to integrate social interactions, NFT-based assets, play-to-earn gaming, and land ownership. Although it was successful in creating hype, the technological complexity and learning curve made it unaffordable for the general public.

When NFTs, staking, and edge computing were added, Theta’s original goal of decentralized video streaming was abandoned.

Although Steemit presented the novel idea of a blockchain-based social media platform, users were eventually overwhelmed by its intricate staking procedures and curation incentives.

Flow was intended by Dapper Labs to be a one-stop shop for decentralized apps (DApps), gaming, and NFTs. But developer uptake was poor, and the environment was disjointed.

The “Ethereum killer” EOS, which attempted to support DeFi, DApps, and other things, is the last example. Although it had some success, its governance mechanism was still difficult to operate, and staking made it difficult to manage resources like CPU and RAM.

Where did they go wrong?

These platforms were characterized by poor user experiences and interfaces, a steep learning curve, excessive features, an unsuccessful attempt to offer an all-in-one Web3 solution or a combination of these downsides. Trying to be a marketplace, a game, a DAO, and a DeFi hub at once leads to scattered focus. Overly complex interfaces make engagement difficult, and mainstream users tend to struggle with concepts like staking, governance, and tokenomics. Web3 platforms that succeed hone in on a single, well-defined use case before expanding. They are full-featured, robust solutions that focus on a specific problem.

A mission to simplify and improve user experience

SONEX, an AI-powered decentralized exchange hub, was founded to simplify and improve users’ experience with top DeFi, making the segment more accessible across ecosystems. SONEX optimizes AI integration and provides automated trading and predictive analytics, giving users a more effective and potentially lucrative trading experience.

With cross-chain integration, flexible solutions, and a ZK coprocessor, it achieves its goal. The modular solutions are designed for developers, guaranteeing uptake, while the coprocessor improves DeFi smart contract hooks for security, performance, and scalability. With data-driven insights, AI-driven strategies will maximize return and capital efficiency. By combining multichain assets with ease, SONEX strengthens its standing as a cutting-edge DeFi aggregator and fosters innovation.

Beyond fulfilling its main purpose, SONEX’s status as the AI-powered DeFi hub on Sony’s Soneium blockchain allows it to benefit from the conglomerate’s vast resources, global presence, and technical expertise. Soneium has been dubbed “the entertainment blockchain” and combines blockchain tech with Sony’s entertainment portfolio to create more demand and markets for DeFi services. SONEX combines DeFi and GameFi, enabling users to trade digital assets while enjoying blockchain games, and the hub also hopes to become the leading memecoin launchpad on Soneium.

Addressing complexity, security, and regulatory uncertainty

While some Web3 platforms have done well for themselves, mass adoption of Web3 technologies will largely remain an uphill battle. Blockchain, as a super-complex technology, undergirds Web3. Cryptocurrency, smart contracts, and digital wallets are concepts that are not unfamiliar anymore, so they remain somewhat intimidating. This complexity spills over into the UI. In Web2, you just buy something online with a few clicks and your credit card information. In Web3, you buy cryptocurrency, load it on a digital wallet, and manage it there. That whole process is something only a highly tech-savvy person would be able to pull off.

Uncertainties in regulation deter companies from investing in the adoption of Web3 technologies, as they fear change or complexity in law. Cryptocurrencies are at the center of any transaction in Web3, but with extreme volatility, they come with price fluctuations that have deterred many from using them. According to analysts, Trump has announced the intention of establishing a strategic government-backed crypto reserve to facilitate more effective regulation, thereby stabilizing the market rather than damaging it recently. This stability might be extended to crypto prices, as well.a

Security remains a concern. The FBI recently accused North Korean-linked hackers of stealing Ethereum worth $1.5 billion from Dubai-based exchange Bybit. The theft was perpetrated by distributing cryptocurrency trading apps infected with malware.

In a changing world of cyber threats, effective protection of digital assets requires the secure communication solution. Decentralized backup systems, which do not use mnemonics instead of phone number or email for authentication. End-to-end encryption ensures full security and privacy, preventing third-party access, including the security solution itself. Centralized systems hold undeniably sensitive content that removes the possibility of abuse and secures it from another centralized platform’s surveillance. Thus, all third parties are kept from accessing the content within the encrypted layer, including the security solution itself.

Further, cryptocurrencies require different wallets, setting up a barrier to interactivity across ecosystems. Shared communication and common environment that allow interoperability are given by Polkadot and Cosmos. The development of interoperability enhances scale efficiency across systems, as many blockchains struggle with scale. Low scalability is majorly limiting for any technology aiming toward mass adoption, as it severely restricts the performance when handling high volumes of transactions. Thus, it is expected that the drop of transaction fees with Layer-2 integration like Soneium will open the availability of network use to more projects and ordinary users.

According to a survey by Deloitte, 86% of senior executives believe blockchains are broadly scalable and will eventually go mainstream. Private and consortium blockchains are currently more scalable than public ones. The scalability of PBFT-based (Practical Byzantine Fault Tolerance) blockchains is limited, while those utilizing delegated PoS enable scalable governance. Operators can simulate high-volume transactions (e.g., over 10,000) using Hyperledger Caliper or a similar tool to assess scalability.

Source link

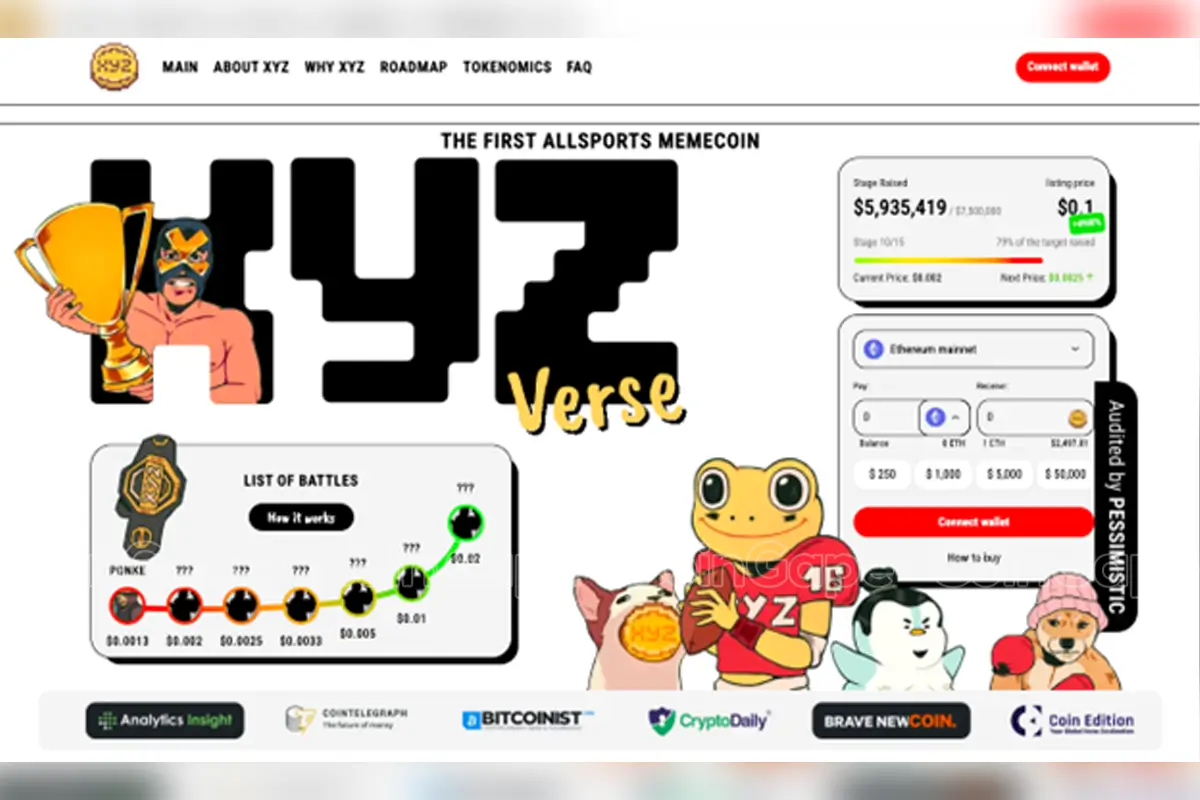

With the presale still underway, XYZVerse has already sold out 9 out of its 15 stages and raised over $6 million – covering 79% of its presale token allocation. The project has also landed on CoinMarketCap in December, which brought it even more visibility and provided easier access to price tracking and updates.

XYZVerse has more than 30,000 followers on X and over 15,000 subscribers on Telegram. On top of that, it successfully passed an audit by Pessimistic, achieving 31 out of 31 security checks, and also has partnerships with major companies like Polygon Studios.

XYZVerse’s momentum is undeniable, yet skepticism about its legitimacy remains, with some accusing it of being a scam. The crypto space has a history of scams, from Squid Game token collapses to fake DeFi projects, prompting investors to thoroughly vet every new project before committing. Interestingly enough, even Ethereum, the top platform for decentralized applications, faced early skepticism and accusations of being a fraud. So, these kinds of allegations are nothing out of the ordinary – most new projects, like XYZVerse, have to deal with them.

Based on a surface look, XYZVerse appears to be far from a scam and the claims appear to be a victim of FUD (Fear, Uncertainty, Doubt). But we will not get ahead of ourselves and assume this is right without doing our own research. So to separate speculation from reality, let’s dive deeper and dissect the facts.

What Is XYZVerse?

XYZVerse’s goal is to create a “memeverse” where sports fans engage through play-to-earn games, governance voting, and NFT collectibles. It’s native token, XYZ, is a sports-themed meme coin built on Polygon, blending gaming, sports, and crypto.

XYZVerse connects two big cultural trends here. First, it gets involved with sports fans by teaming up with MMA leagues and eSports teams. Second, it brings back memories of early meme coins like Dogecoin, but with extra utility for users. One of the project’s mascots is a strong frog in a jersey, representing its theme of going from an underdog to a champion.

For example, many in the crypto community compare XYZ to Chiliz (CHZ), a sports-focused cryptocurrency that surged 1,200% during bull markets. This suggests that XYZVerse could similarly attract a significant level of interest from the crypto-sports community.

Fact-Checking the Allegations Against XYZVerse

XYZVerse’s critics highlight three red flags:

- Hype-driven marketing,

- An anonymous team,

- Unproven utility of the XYZ token,

So let’s see what’s the truth here based on the facts that we have found.

| Allegation | Fact Check |

| Allegation 1: XYZVerse’s overhyped marketing creates FOMO to lure investors. | XYZVerse’s clever marketing is centered on showcasing its features and future plans, giving investors clear insights into the potential value of the XYZ coin. While there’s some hype, the goal isn’t merely to create excitement but to ensure the community truly understands the project. Moreover, FOMO isn’t necessarily a bad thing – it’s a natural part of any multi-stage presale that highlights the benefits of getting in early and the potential rewards that come with it. |

| Allegation 2: The XYZVerse team is anonymous, making it untrustworthy. | Anonymity is common in the crypto world, and many reputable projects much larger than XYZVerse operate this way. Even the creator of Bitcoin himself, Satoshi Nakamoto is still anonymous up to this day. So what really matters is that XYZVerse’s technology, roadmap, and token details are clear and well-documented. |

| Allegation 3: The XYZ token has no real utility beyond speculation. | XYZ token fuels transactions, powers staking for rewards (a feature most meme coins lack), and drives governance decisions. Unlike typical meme coins that offer little more than buzz, the XYZ token delivers value with tangible benefits and a solid foundation. |

XYZVerse’s Whitepaper, Tokenomics, and Roadmap

A common warning sign in the crypto world is when projects don’t have clear and easy-to-understand documentation. Scam projects often skip publishing whitepapers or details about their tokenomics, relying instead on hype and vague promises. However, from the beginning, XYZVerse has focused on being transparent. It has published a whitepaper, with a well-organized tokenomics model and a detailed roadmap. These documents aren’t just for show; they provide a clear path for the project’s long-term vision and demonstrate its legitimacy, as well as the team’s commitment.

Tokenomics

XYZ token’s allocation is really well-thought-out, designed to keep the project growing steadily and staying stable. Among other initiatives, the team will set aside 25% for liquidity and incentives like airdrops to support future listings and extra income opportunities. Plus, with a 17.13% deflationary burn, the total supply will shrink over time, helping boost the token’s long-term value.

Source: XYZVerse

Roadmap

XYZVerse’s roadmap is straightforward and practical; it’s a detailed action plan with specific timelines. Covering the years 2023 to 2025, it outlines important milestones in manageable phases:

Source: XYZVerse

This phased approach promotes accountability. Each milestone is linked to specific goals, which reduces the chance of “roadmap drift,” where projects often delay or fail to meet their promises. For example, the P2E games planned for Q2 2025 are already being tested with select community members, as mentioned in recent Ask Me Anything (AMA) sessions.

By offering interactive participation similar to prediction markets among other things, XYZVerse can tap into a massive Web2 audience, think millions of sports fans, and has the potential to become the next Polymarket, unlocking new revenue streams for the ecosystem and rewarding early presale investors.

Polymarket demonstrated record-breaking success during the 2024 U.S. presidential election period, with trading volumes exceeding $3 billion dollars and dynamic odds that swung dramatically in real time. Its prediction market model not only provided rapid, transparent insights into the political race but also highlighted a model that projects like XYZVerse can emulate, especially if they blend it with engaging P2E mechanics.

Audits and Security Checks

Scams usually don’t pass third-party audits. However, as already mentioned, XYZVerse went through a thorough review by Pessimistic. The audit found:

- No Vulnerabilities in Smart Contracts: Pessimistic confirmed that XYZVerse’s code has no serious flaws or hidden backdoors. This is uncommon in meme coins, where rushed development can lead to security issues.

- Multi-Signature Wallets for Treasury Funds: The treasury, which holds presale funds and revenue, requires multiple authorized signatures to access. This reduces the risk of a single point of failure, making sure that no one person can withdraw funds on their own.

- Non-Upgradable Code: Unlike some projects that can change their contracts after launch (a tactic sometimes used in scams), XYZVerse’s smart contracts are fixed. Once they are deployed, even the developers cannot change the core functions, which protects investors from unexpected changes.

Even credible crypto aggregators, including CoinCodex, CoinCarp, and CoinSniper have added the token to their lists, underscoring its legitimacy since these platforms are highly selective about the assets they feature.

Source: Pessimistic

Having clear tokenomics, a detailed roadmap, and passing the Pessimistic audit is important, but it’s also important to consider how the market has reacted to the project. Let’s take a look at the community aspects of XYZVerse and how it has been discussed in the media.

Social Media Presence

XYZVerse has been very active in engaging its community. The project has run various initiatives, like meme contests, airdrops, and AMA sessions, which encourage community participation and excitement. These activities not only keep current supporters engaged but also attract new users who want to learn more about XYZVerse.

Media Coverage

Some of the most reputable media outlets that have expressed their willingness to collaborate with XYZVerse include Brave New Coin, Finbold, Bitcoinist, crypto.news, Crypto Daily, Coinspeaker, and more.

Website Revamp

XYZVerse has recently announced a fresh website design, intended to deliver a better, interactive, and pleasant experience for anyone interacting with the project for the first time. Typically, scam presales do not invest significant money or effort into creating polished websites and narratives.

Source: X

This actually demonstrates the team’s commitment to their idea: they are not simply treading water, waiting for the presale to conclude. They are evolving and taking every aspect of their project seriously.

Final Verdict: Is XYZVerse a Scam?

When evaluating XYZVerse, it’s important to weigh both the positives and negatives.

The positives include:

✅ The project is audited, secure, and transparent, which helps build trust.

✅ It has an active and genuine community, adding to its credibility.

✅ XYZVerse has established real partnerships with well-known companies like Polygon.

On the downside:

❌ The team behind XYZVerse is anonymous, which might make some traditional investors feel uneasy.

❌ Some features, like play-to-earn games, are still in development and haven’t been released yet.

Conclusion: Don’t Let Fear Cloud Your Judgment

While no investment in crypto is entirely risk-free, labeling XYZVerse as a scam overlooks its many strengths, such as its audits, clear roadmap, and active community.

As skeptics wait for clear evidence of success, XYZVerse is busy building its platform and is just about to start rolling out updates in the near future.

Source link

blog

Crypto in 2024: A Game-Changing Year for Investors

Published

3 months agoon

December 24, 2024By

admin

This year, the crypto world entered a new era of growth, accessibility, and opportunity. Bitcoin and Ethereum continue to lead the charge, but it’s the introduction of smarter, more versatile tools like savings wallets that’s redefining how investors approach digital assets. If you’re looking for ways to grow your portfolio without riding the market volatility rollercoaster, 2024 is your year.

What’s Driving the Crypto Market in 2024?

The numbers tell the story: 2024 became a landmark year for cryptocurrencies. Bitcoin, the flagship digital asset, smashed through its previous ceilings to hit an all-time high of $107 000, driven by global adoption and institutional enthusiasm. Ethereum didn’t lag too far behind — it crossed the $4 200 mark, with $2.7 billion in inflows into Ethereum-focused products, cementing its role in decentralized finance (DeFi).

The crypto market cap surged to $2.4 trillion, supported by groundbreaking financial products like Bitcoin and Ethereum exchange-traded funds (ETFs). Bitcoin ETFs, in particular, attracted $10.5 billion in inflows in just one month, bringing total ETF assets to $110 billion. These products simplify access to digital assets for both individual and institutional investors, driving the sector’s incredible growth.

At the same time, stablecoins, including USDT and USDC, now valued at $200 billion, are emerging as key tools for risk management and steady returns. Investors increasingly use them in savings wallets to generate reliable income while protecting their portfolios from market turbulence.

Where Is the Money Flowing?

Bitcoin ETFs: The New Gold Standard

Bitcoin ETFs have opened the door for mainstream investors to access crypto without the complexities of wallets and private keys. With $110 billion in total assets, these ETFs have become a crucial driver of Bitcoin’s meteoric rise.

Ethereum Staking: Rewards for Long-Term Holders

Ethereum is winning over passive income enthusiasts with staking rewards of 5% to 10% annually. These returns, combined with Ethereum’s expanding role in DeFi, make it an attractive choice for those seeking both growth and regular payouts.

Savings Wallets: Where Stability Meets Profitability

Savings wallets like Coinhold offer a balanced solution for investors who want predictable returns. These wallets provide up to 14% annual interest on stablecoins and 8% on major cryptocurrencies like Bitcoin and Ethereum, making them ideal for both cautious savers and ambitious growth seekers.

Why Coinhold Is Your Best Bet

Coinhold by EMCD is redefining what it means to earn passive income in crypto. Designed to combine ease of use, competitive rates, and robust security, Coinhold gives your digital assets the chance to grow steadily — whether you’re a beginner or a seasoned crypto investor.

What Sets Coinhold Apart

Impressive Rates: Coinhold offers up to 14% annual interest on stablecoins and 8% on Bitcoin and Ethereum, putting it ahead of most other investment tools.

Flexible Options: Choose flexible deposits for instant access to funds or fixed-term deposits for higher returns.

Security and Reliability: Powered by EMCD, a trusted name in the crypto industry, Coinhold keeps your assets safe while delivering consistent returns.

How to Get Started with Coinhold

Starting your journey with Coinhold is quick and easy. Here’s your 5 steps to passive income:

1. Sign up on the EMCD site or app

2. Verify your identity to secure your account and comply with regulations

3. Select a plan — decide between flexible or fixed-term deposits based on your financial goals

4. Top up your wallet with Bitcoin, Ethereum, or stablecoins like USDT and USDC

5. Earn rewards as soon as your deposit is confirmed — track your growth through Coinhold’s simple and intuitive dashboard

2024: The Year to Invest Smarter

Crypto’s 2024 evolution isn’t just about record-breaking prices — it’s about empowering investors with tools that balance risk and reward. Bitcoin ETFs and Ethereum staking are rewriting the playbook for growth, while savings wallets like Coinhold offer the consistency and flexibility needed in a volatile market.

With Coinhold, your assets don’t just sit idle — they work for you. Whether you’re planning for the long haul or seeking short-term gains, Coinhold provides the perfect blend of security and profitability. Start earning smarter today — because your crypto deserves to grow as much as you do.

Source link

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Human Rights Foundation Donates 1 Billion Satoshis To Fund Bitcoin Development

Dogecoin, Cardano Lead Gains as Crypto Majors Rally

Fartcoin price surges 35% as recovery gains momentum

$1M Premium Paid for $70K Bitcoin Put Option

How DePIN’s Revenue Growth is Attracting Equity Investors – DePIN Token Economics Report

Bitcoin Poised For A Q2 Recovery? Analyst Points 2017 Similarities

Binance ends Tether USDT trading in Europe to comply with MiCA rules

Crypto Trader Warns of Potential 33% Dogecoin Drop, Unveils Downside Price Target for Ethereum

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x