Animoca Brands

Standard Chartered teams up with Animoca Brands to issue Hong Kong dollar-backed stablecoin

Published

1 month agoon

By

admin

Standard Chartered, Animoca Brands, and HKT have formed a joint venture to apply for a Hong Kong dollar-backed stablecoin license.

Standard Chartered‘s Hong Kong branch, crypto venture firm Animoca Brands, and HKT have teamed up to launch a joint venture focused on issuing a Hong Kong dollar-backed stablecoin as the region signals its readiness to strengthen its position in the digital asset market.

In a Feb. 17 blog announcement, Animoca said the new joint venture entity will apply for a license under the Hong Kong Monetary Authority’s updated regulatory framework, though didn’t elaborate on the timeframe.

Animoca will help the venture tap into crypto-native opportunities and “explore innovative use cases across the web3,” while HKT will bring its mobile wallet expertise to “enable the JV to develop innovative stablecoin use cases,” according to the announcement.

Bill Winters, group chief executive, Standard Chartered, says the development of different forms of tokenized money is “integral to the advancement of this industry.”

“That is why we are actively involved in various central bank digital currencies, tokenized deposits and, of course, stablecoins projects. We are introducing solutions and instruments that service this market and meet the growing client demand.”

Bill Winters

Although Winters didn’t mention the network for the HKD-backed stablecoin, he noted that stablecoins play a critical role like “public chain instruments with proven use cases.” Mary Huen, CEO of Standard Chartered’s Hong Kong and Greater China & North Asia, stated that the aim is to launch a stablecoin “that can be used securely by institutions and individuals across a wide number of use cases.”

Source link

You may like

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

24/7 Cryptocurrency News

Moca Network (MOCA) Price Rockets 370% Today, Here’s Why

Published

4 months agoon

December 16, 2024By

admin

Moca Network (MOCA), Mocaverse ecosystem native utility and governance token, price has skyrocketed 370% today. This follows after South Korean crypto exchanges announced the listing of the token in Korean Won (KRW) pair. MOCA Foundation took to X and claimed it signifies an important milestone for MOCA. Will the sudden spike in the token sustain?

South Korean Exchanges Lists Moca Network

Upbit and Bithumb, the top crypto exchanges in South Korea, have revealed support for Mocaverse and listed the MOCA token. This has triggered a massive sentiment among investors causing Moca Network price to spike suddenly by 370%.

According to Upbit’s announcement, users can trade the token in KRW, BTC and USDT spot pairs. The trading will start at 14:00 KST on December 16. MOCA token deposits and withdrawals through networks other than Ethereum are not supported.

“Deposits and withdrawals are only possible with personal wallet addresses that have completed ‘ownership verification’, and even if the deposit is made through a linked personal wallet, a deposit return may need to be processed depending on the network of the asset.”

Moreover, Bithumb has also announced the listing of Moca Network. The digital asset exchange has listed MOCA in KRW pair on the Ethereum network.

As per the official listing announcement, the trading will commence on December 16 at 2:00 PM. The base price will be 136 won. The exchange has also listed MOODENG in KRW pair.

Both top crypto exchanges have changed the name of the token to Mocabus in consistent with the South Korean market.

Animoca Brands Co-founder Yat Siu Reacts

Yat Siu, co-founder of Animoca Brands, commented on the support of South Korean exchange to its Mocaverse and MOCA token. He said “Thank you Upbit and welcoming Korea to the Moca Network bringing mass adoption to web3.” Yat Siu spoke about Mocaverse in an exclusive interview with CoinGape recently.

MOCA Foundation said the listing signifies a milestone as the team continues to support the expansion of Moca ecosystem to the South Korean market. Furthermore, Mocaverse added that South Korea is a key market, with its mission to onboard over 28 million retail consumers.

MOCA Token Shoots 370%

MOCA price jumped 370% after the South Korean exchange announced the listing. Currently, Moca Network price is trading at $0.40, with a 24-hour low and high of $0.08 and $0.41, respectively. Furthermore, the trading volume has shot up by more than 600% in the last 24 hours, indicating a massive interest among traders.

Total MOCA futures open interest climbed almost 1000% in 4 hours and 1250% in 24 hours. The 134.26 million futures OI are now valued at $33.27 million, signaling support for a further upside move.

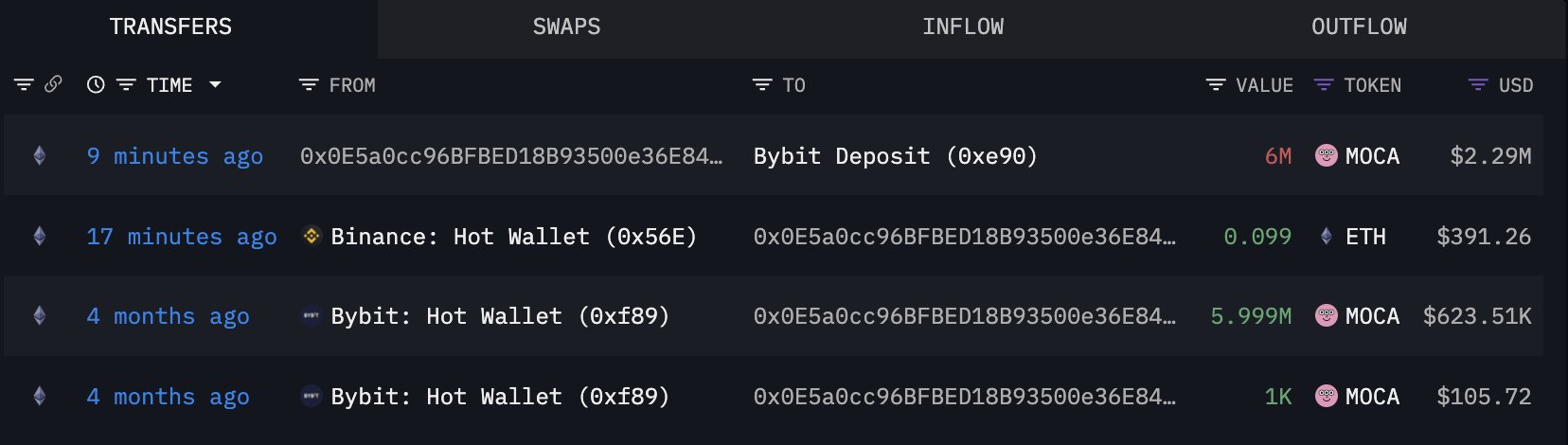

Notably, Lookonchain revealed that two wallets have deposited 9.5 million MOCA tokens valued at $3.55 million to Bybit. The wallets are likely controlled by the same whale, to make $2.55 million in profit if sold completely.

Varinder Singh

Varinder has over 10 years of experience in the Fintech sector, with over 5 years dedicated to blockchain, crypto, and Web3 developments. Being a technology enthusiast and analytical thinker, he has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers. With CoinGape Media, Varinder believes in the huge potential of these innovative future technologies. He is currently leading the news team to cover latest updates and developments in the crypto industry.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Human Rights Foundation Donates 1 Billion Satoshis To Fund Bitcoin Development

Dogecoin, Cardano Lead Gains as Crypto Majors Rally

Fartcoin price surges 35% as recovery gains momentum

$1M Premium Paid for $70K Bitcoin Put Option

How DePIN’s Revenue Growth is Attracting Equity Investors – DePIN Token Economics Report

Bitcoin Poised For A Q2 Recovery? Analyst Points 2017 Similarities

Binance ends Tether USDT trading in Europe to comply with MiCA rules

Crypto Trader Warns of Potential 33% Dogecoin Drop, Unveils Downside Price Target for Ethereum

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: