Altcoins

Technical Indicator Suggests DeFi Altcoin Maker (MKR) Primed for a Pullback, According to Crypto Trader

Published

1 month agoon

By

admin

A technical analysis indicator suggests the decentralized finance (DeFi) altcoin Maker (MKR) could be poised for a correction, according to a popular crypto analyst.

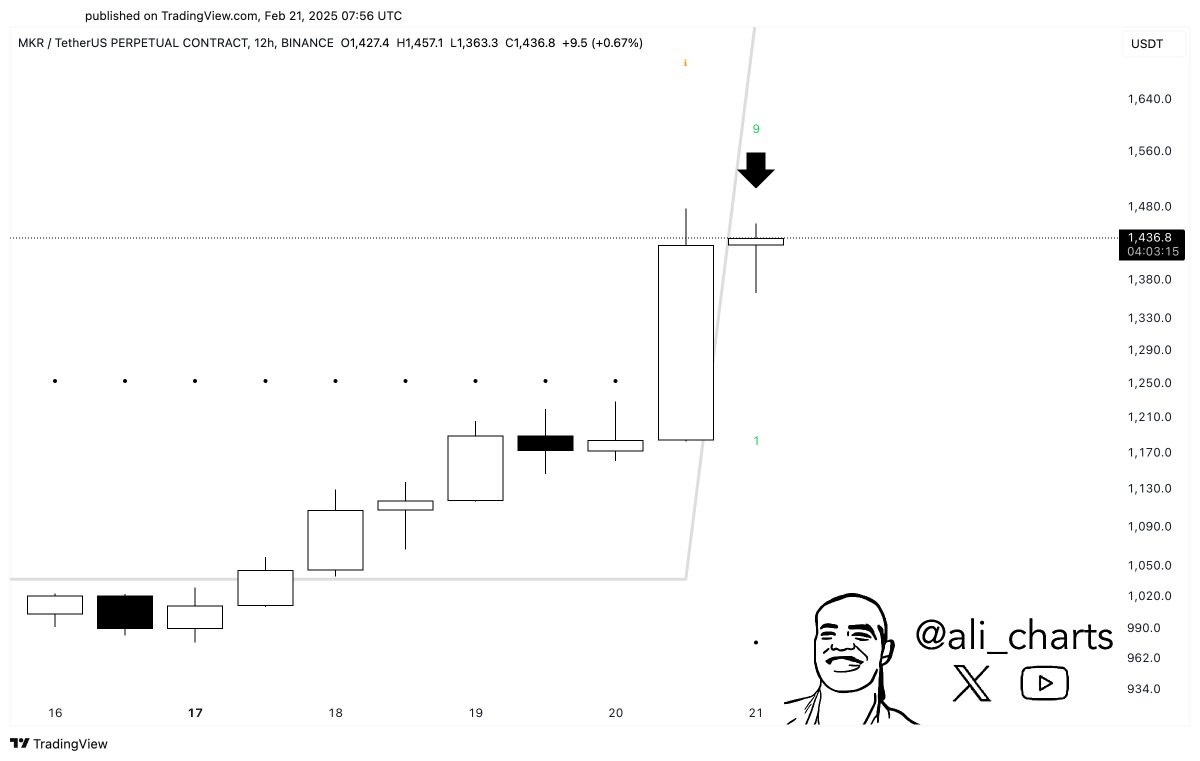

Trader Ali Martinez tells his 128,100 followers on the social media platform X that MKR’s Tom DeMark (TD) sequential indicator flashed a bearish signal on its 12-hour chart.

Traders use the TD Sequential Indicator to predict potential trend reversals for tokens based on the closing prices of their 13 previous bars or candles.

“Maker MKR could be gearing up for a pullback, as the TD Sequential indicator flashes a sell signal on the 12-hour chart!”

MKR is trading at $1,441 at time of writing. The 85th-ranked crypto asset by market cap is down nearly 1.5% in the past 24 hours but is up nearly 45% in the past seven days.

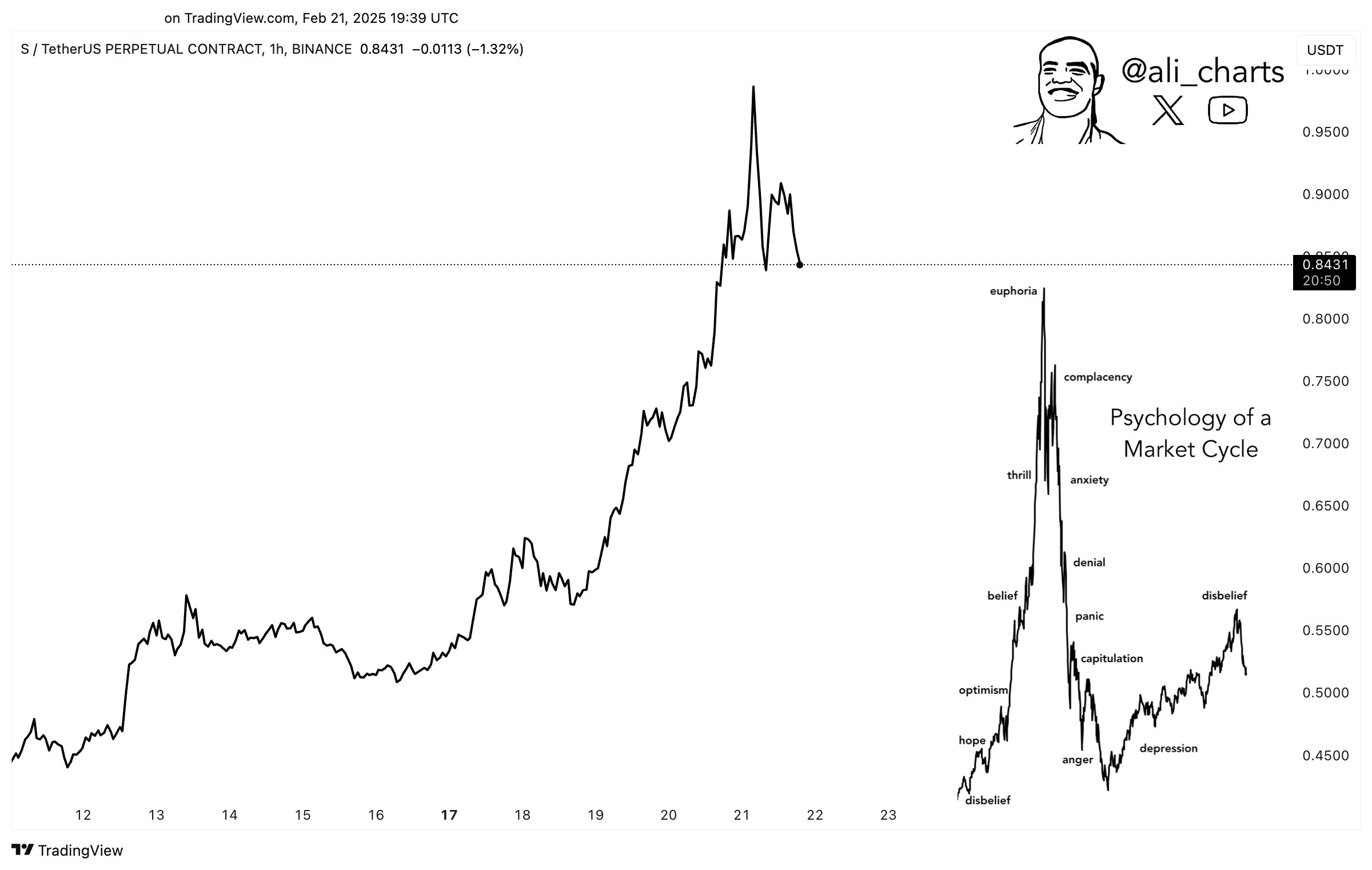

Martinez also shares his outlook on the newly rebranded layer-1 blockchain Sonic (S), which was previously known as Fantom.

“I wonder if Sonic has just completed a mini market cycle and is now entering the ‘anxiety’ phase.”

S is trading at $0.854 at time of writing. The 50th-ranked crypto asset by market cap has been trading sideways in the past day but is up nearly 56% in the past week.

Martinez also notes that crypto whales have been accumulating Ethereum (ETH).

“Whales have accumulated another 140,000 Ethereum ETH in the [24 hours]!”

At time of writing, ETH is worth $2,679.

The trader also says deep-pocketed investors are gobbling up the payments altcoin XRP.

“Whales bought over 20 million XRP in the [24 hours]!”

XRP is trading at $2.53 at time of writing and is down more than 5% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Altcoins

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Published

7 hours agoon

April 1, 2025By

admin

A closely followed crypto strategist believes that the native asset of a layer-2 scaling solution could witness an over 3x rally this year.

Pseudonymous analyst Inmortal tells his 231,000 followers on the social media platform X that he’s bullish on Mantle (MNT), noting that he believes the altcoin has already printed a 2025 bottom at around $0.6.

According to the trader, a 279% rally for MNT this year is a high-probability scenario.

“Starting to feel like bottom is in.

Big players have been buying over the last few weeks, and it shows.

$3 in 2025 is very likely, high-conviction play for me.”

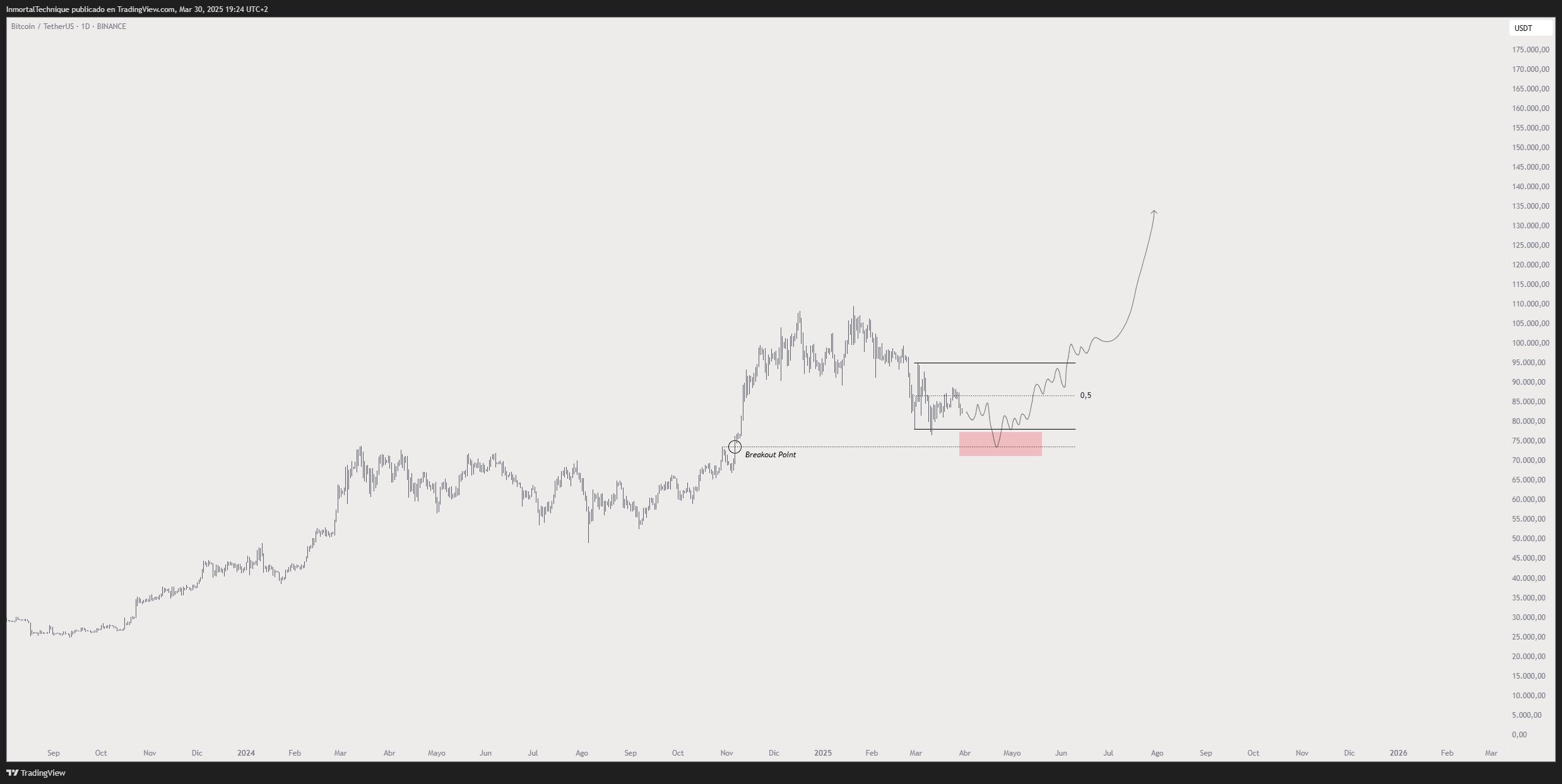

Based on the trader’s chart, he seems to predict that MNT will surge to $1.30 in the coming months.

At time of writing, MNT is worth $0.79.

Turning to Bitcoin, the trader unveils a potential path for BTC to print a durable bottom this year. According to Inmortal, BTC could temporarily drop below $70,000 before igniting the next stage of the bull market en route to a new all-time high of $135,000.

“They will try to shake you out, but this is the bottom.

Save the tweet.

BTC.”

At time of writing, BTC is trading for $82,374.

As for Ethereum, Inmortal predicts that the price of ETH may plummet below $1,500 before sparking a short-term rally toward $2,000.

“Expansions lead to retraces. Retraces lead to bounces.

Bounce soon.”

At time of writing, ETH is trading at $1,822.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

‘Positive But Cautious’ Investors Pour Capital Into Ethereum, Solana, XRP and Sui: CoinShares

Published

23 hours agoon

March 31, 2025By

admin

Crypto asset manager and research firm CoinShares says institutional investors poured millions of dollars into altcoin digital asset investment products last week.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares says crypto products enjoyed inflows last week after record-setting levels of outflows.

“Digital asset investment products saw US$226m of inflows last week suggesting a positive but cautious investor. Following the largest outflows on record, ETPs have seen 9 consecutive trading days of inflows.

Last Friday was the exception, seeing minor outflows totaling US$74m, likely in reaction to core personal consumption expenditure in the US coming in above expectations, implying the US Federal Reserve is likely to remain hawkish despite recent data alluding to weak growth.”

Bitcoin (BTC) products, as usual, led the charge with $195 million in inflows. The king crypto was followed by altcoins, which broke a month-long streak of outflows. Leading inflows were Ethereum (ETH), Solana (SOL), XRP and Sui (SUI).

“Altcoins in aggregate saw their first week of inflows totaling US$33m, following 4 consecutive weeks of outflows totaling US$1.7bn. The key beneficiaries being Ethereum, Solana, XRP and Sui, with inflows of US$14.5m, US$7.8m, US$4.8m and US$4.0m respectively.”

Regionally, the US led the world with $204 million in inflows. Switzerland and Germany also pitched in $14.7 and $9.2 million in inflows, respectively.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

MELANIA Insider Hayden Davis Selling Millions of Dollars Worth of Memecoin Amid 95% Drop: On-Chain Data

Published

2 days agoon

March 31, 2025By

admin

A memecoin creator notorious for being involved with several controversial projects is continuing to dump his coins even after a 95% drop.

New data from the blockchain tracking firm Bubblemaps is shedding light on on-chain activity of Hayden Davis, who admitted to having a role in both Libra (LIBRA), a memecoin originally backed by Argentinian President Javier Milei before he quickly disavowed it, and Melania Meme (MELANIA), a coin inspired by Melania Trump.

MELANIA began a steep descent the very day it was launched in January and is now down 95.3%.

Says Bubblemaps,

“Hayden Davis is STILL selling MELANIA

He recently sent $1 million to exchanges and extracted over $2 million from the liquidity pools…

For weeks, his MELANIA wallets were inactive – until now…

In total, Hayden sent $1,065,153 worth of MELANIA to centralized exchanges and extracted $2,050,666 from the liquidity pool over the last 14 days.

And many wallets haven’t sold yet.

Why act now?

Hayden may have seen the recent drop in attention as a window to quietly move funds while fewer people were watching

We’ll keep monitoring for further activity.”

At time of writing, MELANIA is trading for $0.615.

Argentinian authorities are reportedly attempting to have Davis arrested by Interpol for his role in LIBRA.

Says prosecutor Gregorio Dalbón,

“I’m here to request the immediate detention of Hayden Mark Davis, a citizen of the United States, who is accused of being one of the principal actors behind the launch of the cryptocurrency LIBRA…

The possibility that Davis will abandon his country of residence or hide to avoid answering for his alleged acts appears to be aggravated by the economic resources he possesses, which he can use to move or remain in hiding, hindering our investigation.”

President Milei quickly disavowed LIBRA, claiming that he was tricked into supporting its launch.

Said Milei in Spanish,

“I was not aware of the details of the project and after having become aware of it I decided not to continue spreading the word (that is why I deleted the tweet).

To the filthy rats of the political caste who want to take advantage of this situation to do harm, I want to say that every day they confirm how vile politicians are, and they increase our conviction to kick them in the a**.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Human Rights Foundation Donates 1 Billion Satoshis To Fund Bitcoin Development

Dogecoin, Cardano Lead Gains as Crypto Majors Rally

Fartcoin price surges 35% as recovery gains momentum

$1M Premium Paid for $70K Bitcoin Put Option

How DePIN’s Revenue Growth is Attracting Equity Investors – DePIN Token Economics Report

Bitcoin Poised For A Q2 Recovery? Analyst Points 2017 Similarities

Binance ends Tether USDT trading in Europe to comply with MiCA rules

Crypto Trader Warns of Potential 33% Dogecoin Drop, Unveils Downside Price Target for Ethereum

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x