Bitcoin

A Very Bitcoin Christmas

Published

3 months agoon

By

admin

Twas the night before Christmas, and all on the chain, Bitcoin was soaring, with no hodler in pain.

The bulls had returned, sleighing bears left and right, now six figure Bitcoin was an everyday sight.

All miners were buzzing, hash rates on the rise, securing the network under wintery skies.

Our Lambos were gleaming, parked under the stars, proof that HODLing beats shitcoins by far.

El Salvador kept buying, more coin for their stocking, before dreams of more sats inevitably come knocking.

The ETFs rallied, their bids filled the air, it’s Bitcoin’s new era, Satoshi did declare.

Our on-chain data, so bright and so clear, Screamed “HODL through 2025, vast wealth will appear!”

With supply getting tighter, few coin left to sell, it’s the sound of adoption; Bitcoin’s doing swell.

When out on the charts there arose such a cheer, “A new all-time high! This is our year!”

To the exchanges we flew, with wallets in tow, the institutional FOMO already began to show.

Investors wondered if we could Supercycle, breaking the system with cheap debt from Michael.

Then who should appear in a sleigh trimmed with gold? Who else but Trump with a plan so bullish and bold.

“A strategic reserve!” he proclaimed with a roar, “America’s future is with Bitcoin I’m sure!”

He winked at the bulls as his sleigh took its flight, “Merry Christmas to hodlers, and to hodlers, a good night!”

If you’re looking for a last-minute gift for that special someone or feel like treating yourself, then how about giving the gift of a Bitcoin data analysis platform subscription, now with a whopping 30% off holiday discount:

https://www.bitcoinmagazinepro.com/subscribe/

Thanks for reading, and Merry Christmas!

Source link

You may like

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Bitcoin

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

Published

4 hours agoon

April 1, 2025By

admin

Recently very shaky risk assets — crypto among them — are attempting a rally on Tuesday, perhaps. buoyed by chatter that Donald Trump’s tariffs won’t be as stringent as feared.

In early afternoon U.S. action, bitcoin (BTC) had climbed to just above $85,000, ahead 2.1% over the past 24 hours. Previously really roughed up crypto majors like ether (ETH), dogecoin (DOGE) and cardano (ADA) had put in gains of roughly twice that amount.

Crypto stocks are also performing well, with bitcoin miners Core Scientific (CORZ) and CleanSpark (CLSK) jumping almost 10% on the day. Strategy (MSTR) is up 5.4% and Coinbase (COIN) 2.1%.

U.S. stocks reversed early session losses to turn higher as well, with the Nasdaq now ahead just shy of 1% for the day.

The action comes ahead of the Trump administration’s so-called “Liberation Day” tariff rollout set for tomorrow after the close of U.S. trading.

Hope?

A report from NBC News suggested the market’s most feared option — blanket 20% tariffs across the board — is “less likely” to be the direction taken by the White House. Instead, according to the report, a “tiered system” of different rates or country-by-country rates could be announced.

Also maybe helping is what appears to be the first acknowledgement that the administration is aware of the market tumult resulting from all the tariff chatter. Speaking today at her daily briefing, White House Press Secretary Karoline Leavitt said that there were legitimate concerns about market swings.

Meanwhile, Israel’s Minister of Finance Bezalel Smotrich announced on Tuesday that a process had been launched to get rid of tariffs on U.S. imports in that country.

Source link

adx

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Published

6 hours agoon

April 1, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

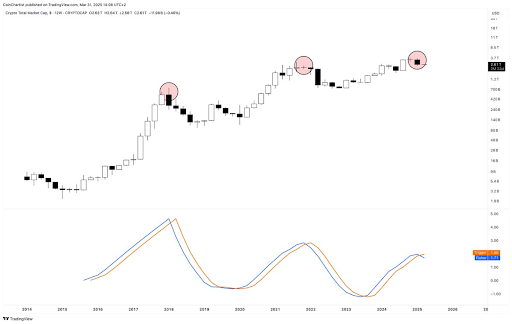

Technical expert Tony Severino has warned that the Bitcoin and altcoins Fischer Transform indicator has flipped bearish for the first time since 2021. The analyst also revealed the implications of this development and how exactly it could impact these crypto assets.

Bitcoin And Altcoins Fischer Transform Indicator Turns Bearish

In an X post, Severino revealed that the total crypto market cap 12-week Fisher Transform has flipped bearish for the first time since December 2021. Before then, the indicator had flipped bearish in January 2018. In 2021 and 2018, the total crypto market cap dropped 66% and 82%, respectively. This provides a bearish outlook for Bitcoin and altcoins, suggesting they could suffer a massive crash soon enough.

Related Reading

In another X post, the technical expert revealed that Bitcoin’s 12-week Fischer Transform has also flipped bearish. Severino noted that this indicator converts prices into a Gaussian normal distribution to smooth out price data and filter out noise. In the process, it helps generate clear signals that help pinpoint major market turning points.

Severino asserted that this indicator on the 12-week timeframe has never missed a top or bottom call, indicating that Bitcoin and altcoins may have indeed topped out. The expert has been warning for a while now that the Bitcoin top might be in and that a massive crash could be on the horizon for the flagship crypto.

He recently alluded to the Elliott Wave Theory and market cycles to explain why he is no longer bullish on Bitcoin and altcoins. He also highlighted other indicators, such as the Parabolic SAR (Stop and Reverse) and Average Directional Index (ADX), to show that BTC’s bullish momentum is fading. The expert also warned that a sell signal could send BTC into a Supertrend DownTrend, with the flagship crypto dropping to as low as $22,000.

A Different Perspective For BTC

Crypto analyst Kevin Capital has provided a different perspective on Bitcoin’s price action. While noting that BTC is in a correctional phase, he affirmed that it will soon be over. Kevin Capital claimed that the question is not whether this phase will end. Instead, it is about how strong Bitcoin’s bounce will be and whether the flagship crypto will make new highs or record a lackluster lower high followed by a bear market.

Related Reading

The analyst added that Bitcoin’s price action when that time comes will also be trackable using other methods, such as money flow, macro fundamentals, and overall spot volume. The major focus is on the macro fundamentals as market participants look forward to Donald Trump’s much-anticipated reciprocal tariffs, which will be announced tomorrow.

At the time of writing, the Bitcoin price is trading at around $83,000, up around 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Source link

Altcoins

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Published

8 hours agoon

April 1, 2025By

admin

A closely followed crypto strategist believes that the native asset of a layer-2 scaling solution could witness an over 3x rally this year.

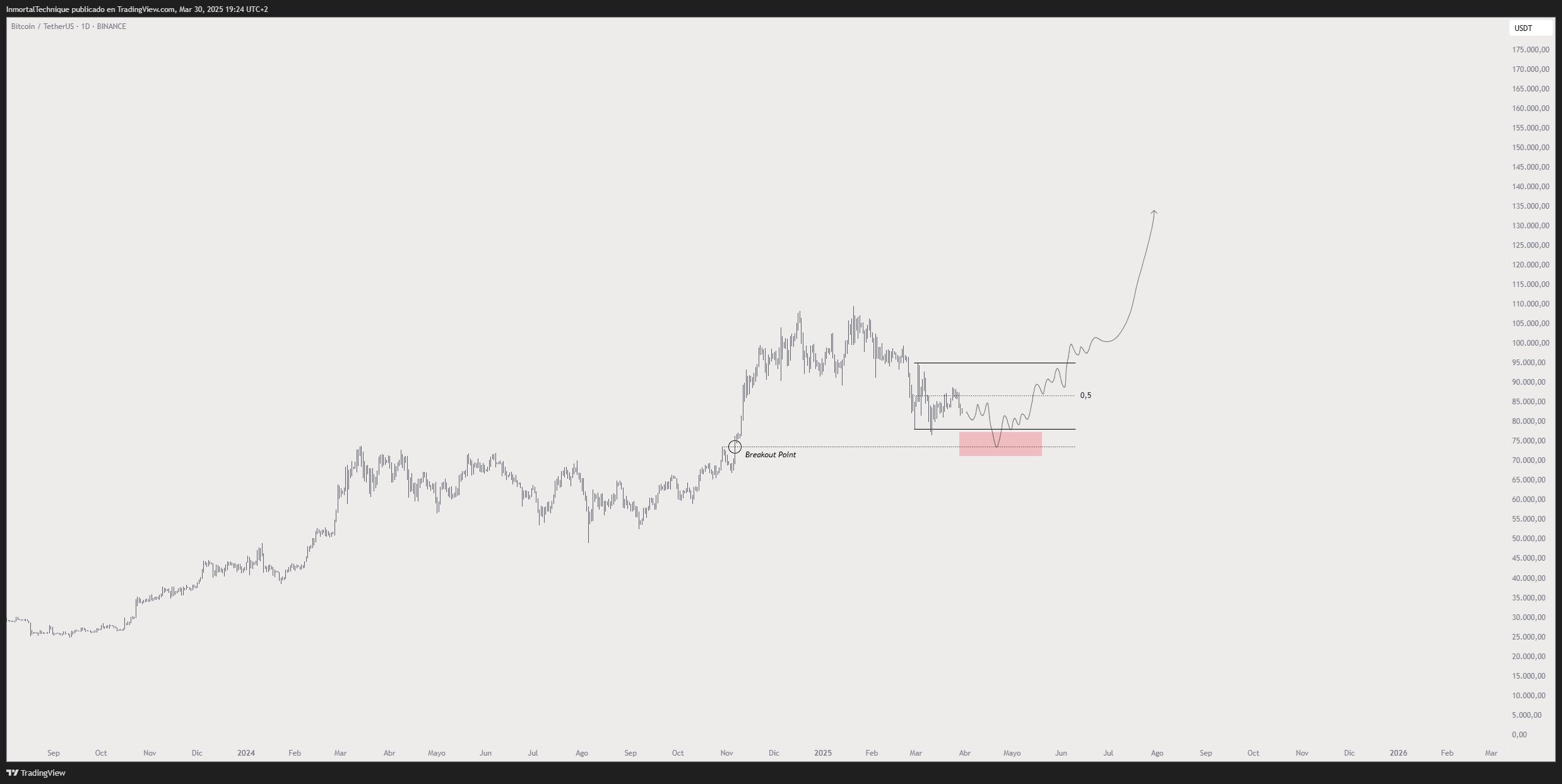

Pseudonymous analyst Inmortal tells his 231,000 followers on the social media platform X that he’s bullish on Mantle (MNT), noting that he believes the altcoin has already printed a 2025 bottom at around $0.6.

According to the trader, a 279% rally for MNT this year is a high-probability scenario.

“Starting to feel like bottom is in.

Big players have been buying over the last few weeks, and it shows.

$3 in 2025 is very likely, high-conviction play for me.”

Based on the trader’s chart, he seems to predict that MNT will surge to $1.30 in the coming months.

At time of writing, MNT is worth $0.79.

Turning to Bitcoin, the trader unveils a potential path for BTC to print a durable bottom this year. According to Inmortal, BTC could temporarily drop below $70,000 before igniting the next stage of the bull market en route to a new all-time high of $135,000.

“They will try to shake you out, but this is the bottom.

Save the tweet.

BTC.”

At time of writing, BTC is trading for $82,374.

As for Ethereum, Inmortal predicts that the price of ETH may plummet below $1,500 before sparking a short-term rally toward $2,000.

“Expansions lead to retraces. Retraces lead to bounces.

Bounce soon.”

At time of writing, ETH is trading at $1,822.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Human Rights Foundation Donates 1 Billion Satoshis To Fund Bitcoin Development

Dogecoin, Cardano Lead Gains as Crypto Majors Rally

Fartcoin price surges 35% as recovery gains momentum

$1M Premium Paid for $70K Bitcoin Put Option

How DePIN’s Revenue Growth is Attracting Equity Investors – DePIN Token Economics Report

Bitcoin Poised For A Q2 Recovery? Analyst Points 2017 Similarities

Binance ends Tether USDT trading in Europe to comply with MiCA rules

Crypto Trader Warns of Potential 33% Dogecoin Drop, Unveils Downside Price Target for Ethereum

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x