Aave

Akash Network surges 20%; AAVE, KASPA eye further upside

Published

6 days agoon

By

admin

Akash Network (AKT) has shown strong price performance, with a notable 20% increase over the past week, amid widespread market fluctuations.

The token has successfully reclaimed the 20-day exponential moving average (EMA), indicating potential for further upward movement. AAVE and KASPA are also in the green this week.

Akash Network (AKT) rebounds

Looking at the charts, AKT has rebounded from its support level at $2.80 and has surged more than 20% in the past week, indicating a bullish trend likely to continue. Analysts observe that the token can potentially extend its gains towards the 50-day EMA mark.

Price analysis suggests a possible five-wave pattern on the AKT/USDT chart, with the current movement seen as a correction within a broader wave structure. This pattern could pave the way for a significant upward move during the upcoming altcoin season.

At press time, Akash is trading at around the $3.60 mark.

Fundamentally, Akash Network is focused on leading a transformation in cloud computing by leveraging blockchain technology to create a decentralized, open-source marketplace for cloud services.

As the ecosystem expands, the AKT token is expected to play a crucial role in facilitating and securing these decentralized cloud services.

In April, Akash boomed over 50% to nearly $7 after listing on South Korean exchange Upbit. This pushed its market cap to above $1 billion.

Additionally, Crypto.com introduced on-chain staking for AKT via their app, offering users rewards of up to 19%. Furthermore, Akash partnered with Coinbase Prime to offer institutional-grade custody services for AKT, aiming to increase institutional involvement.

AKT has a market capitalization of $871.91 million and a 24-hour trading volume of over $21 million.

Aave up by 18%

Aave (AAVE) spiked 18% in the past week. It went from approximately $79 to over $96, outpacing the broader cryptocurrency market, which has declined by 3.8% over the same period.

This strong performance underscores Aave’s robust momentum despite the overall market downturn.

Aave is currently trading at around $94.96 in a horizontal channel pattern. This suggests a sideways trend with potential resistance levels at $155.44 and support at $90.23 and $50.39.

Meanwhile, technical indicators for this year show promising signs: the 50-day moving average (50MA) indicates an uptrend, the relative strength index (RSI) is neutral at 69.77, and although relative volume (RVOL) is low, the relative volatility index (RVI) indicates high market volatility with an ADX of 22.11, signaling weak trend momentum.

Throughout 2023, Aave introduced significant updates, including enhanced lending and borrowing features, improved security measures, and the integration of new DeFi protocols. The community also endorsed Seamless, a protocol fork to provide an alternative decentralized lending solution.

Earlier this year, AAVE surpassed $100, and a wallet-holding staked AAVE held 17.09% of the token’s supply by June, indicating growing adoption.

Analysts predict continued growth, forecasting a price range from a minimum of $82.11 to an average of $187.04, potentially reaching a maximum of $200.33 by year-end.

Kaspa records 20.5% gain

Kaspa (KAS) has surged by more than 20% in the past week, now trading above the critical resistance level of $0.15. The recent price movement has formed a “falling wedge” pattern, with significant support identified around $0.123.

Technical analysis shows that breakthroughs above the lower trendline could signal a potential retest of higher resistance levels. This signals improved market sentiment for Kaspa.

As per technical indicators, the 50-day moving average (50MA) suggests a potential uptrend, positioned above the current price; it’s relative strength index (RSI) is currently in the overbought zone at 75.2, hinting at a potential pullback in the price, the average directional index (ADX) at 35.7 indicates strong trend momentum, while the relative volatility index (RVI) at 68.4 shows moderate volatility within the market. Several factors drive Kaspa’s potential growth.

An upcoming Rust upgrade is expected to enhance network efficiency and compatibility, making Kaspa more attractive. The increasing hash rate also indicates stronger network security and greater miner engagement, bolstering confidence in the project.

At the time of writing, Kaspa (KAS) is trading at $0.18, with a 24-hour trading volume of over $47.2 million.

Source link

You may like

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

Aave

$1 Billion in High-Risk Loans Spread Correction Fear

Published

4 weeks agoon

June 10, 2024By

admin

AAVE Price Prediction: The cryptocurrency market witnessed a renewed supply pressure this week as the Bitcoin price plunged below the $70000 mark. The overhead supply hints at an extended consolidation for several top assets, including AAVE as it loses the $100 psychological level. Moreover, the volume of high-risk loans on the Aave Protocol reaching new heights creates a liquidation risk for buyers if the broader market takes another dip.

Also Read: “Inflation Is A Hidden Tax on Your Money” Bitcoin Exchange Knocks Fiat in New Ad

High-Risk Loans on Aave Soar to $1 Billion Amid DeFi Market Surge

The near-term trend in the AAVE coin is bearish displayed by the lower-high formation in the daily chart. These swing highs connected by a downsloping trendline create a key resistance that bolsters the sentiment of selling the bounces among traders.

Moreover, the Bitcoin price has wavered in low volatility for the past two weeks resulting in a sideway action for several altcoins. However, the AAVE took a major toll in this consolidation as it plunged 18.5% from $114.7 to $91.5, while the market cap fell to $1.39 Billion.

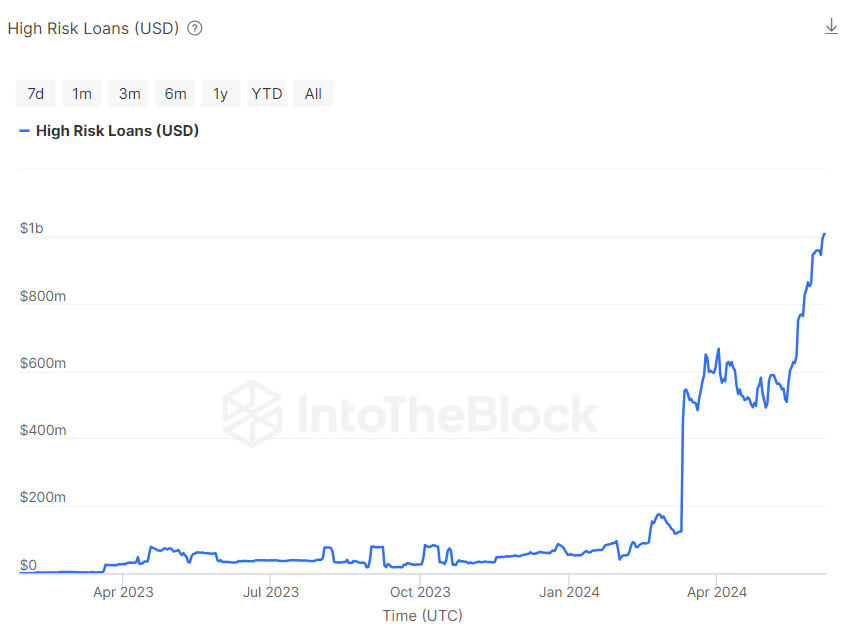

As the decentralized finance (DeFi) sector experiences unprecedented growth, concerns are mounting over the swelling volume of high-risk loans. According to a recent analysis by IntoTheBlock, a leading crypto analytics firm, the total volume of high-risk loans on the DeFi lending platform Aave has alarmingly reached $1 billion.

As DeFi loans hit multi-year highs, the volume of high-risk loans is also surging.

On Aave, the total volume of high-risk loans has reached $1 billion. These loans are secured against volatile collateral and are within 5% of the liquidation threshold, posing significant risks. pic.twitter.com/sLBtm6yerW

— IntoTheBlock (@intotheblock) June 8, 2024

The data provided by IntoTheBlock highlights a sharp increase in these risky assets, which are secured against volatile collateral and are now perilously close to the liquidation threshold. This situation poses significant risks, as the loans are only within 5% of triggering liquidation events that could impact the broader market.

If the correction trend continues, the AAVE price could witness heavy liquidation bolster a downfall to $80. The falling could also trigger a panic selling among traders and may plunge the asset to $61.

Also Read: Bitcoin Price: Hedge Funds Heavily Shorting BTC, Will It Outshine GameStop Saga?

AAVE Price Prediction Hints Rally to $250 As Triangle Pattern Emerges

An analysis of the weekly chart shows the long-term trend in AAVE price is sideways resonating within two converging trend lines. The lateral movement hints at the formation of a symmetrical triangle pattern— a chart leading consolidation trend is built of momentum for direction.

Thus, for buyers to regain control over this asset, a breakout above the pattern’s overhead trendline is needed. The potential breakout will signal a major trend reversal and bolster a rally to surpass the $250 mark.

Technical Indicator:

- Exponential Moving Average: The AAVE price breakdown below the 200-day EMA signals the sellers strengthening their grip over this asset.

- Relative Strength Index: The daily RSI slope falling to 42% accentuates a bearish sentiment among market participants.

Related Articles

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Aave

Liquidation Alert As High Risks Loans On Aave Reach $1 Billion

Published

4 weeks agoon

June 9, 2024By

admin

According to a report by data analytics company IntoTheBlock, the volume of high-risk loans on the prominent Aave Protocol is reaching high levels as general loan volume in the DeFi space records multi-year highs. This development is believed to stem from investors exploring various investment strategies in a bid to maximize profits in a highly anticipated crypto bull run.

Related Reading

Aave’s High-Risk Loans 5% Short Of Liquidation Threshold

In its weekly newsletter on June 8, IntoTheBlock highlights that DeFi loans are currently estimated at $11 billion representing the peak value seen in the last two years. As the largest lending protocol, Aave accounts for over 50% of these figures with its users having borrowed about $6 billion.

Notably, $1 billion of this debt is categorized as high-risk loans which are placed against volatile collateral. Currently, these loans present substantial risk, with the values of their collateral asset within 5% of their set liquidation threshold.

For context, the margin call level or liquidation threshold is a predetermined point at which an asset’s value falls to a level where the lender or broker requires the borrower to add more collateral to maintain the loan or position. Failure to meet this requirement may result in the automatic liquidation of such collateral.

When collateral assets hover around this critical threshold as with the high-risk loans on Aave, any minor dip may lead to widespread liquidations. This normally results in the loss of such assets for the borrower. However, in certain conditions where a rapid price decline occurs, the borrower may incur additional losses which may be transferred to their account balance on the lending platform.

Furthermore, liquidations from these high-risk loans may exacerbate market volatility, which may result in more price loss, leading to more liquidations in a downward spiral. In addition, many assets getting liquidated at once can create liquidity crunches which can prevent the Aave protocol from operating smoothly.

Related Reading

AAVE Price Overview

Meanwhile, AAVE has declined by 5.30% in the last day after facing serious resistance at the $98.20 price zone. The DeFi token is currently valued at $92.30 after an overall negative performance in the past week resulting in an 11.53% price loss.

However, according to price prediction site Coincodex, the general sentiment around AAVE remains positive. The team at Coincodex backs AAVE to make a remarkable comeback hitting a price point of $303.87 in the next one month.

Featured image from LinkedIn, chart from Tradingview

Source link

Aave

Analyst Nicholas Merten Says XRP Competitor Could Go Up by 200%, Updates Outlook on Aave, Compound and Uniswap

Published

4 months agoon

March 9, 2024By

admin

Widely followed analyst Nicholas Merten is offering his forecast on four crypto assets amid an industry-wide market rally.

Starting with payments-focused blockchain network Stellar (XLM), Merten tells the 510,000 YouTube subscribers of the DataDash channel that the XRP rival is sitting at a “typical discount range”.

According to Merten, XLM could appreciate by around 200% against Bitcoin (XLM/BTC).

“You’ve got an opportunity here [with XLM] to have a 3X against Bitcoin, right from 0.00000200 BTC to 0.00000600 BTC. I like those kind of plays.”

XLM is trading at 0.00000210 BTC ($0.14) at time of writing.

Turning to decentralized finance (DeFi), the widely followed analyst says that some of the altcoins in the sector such as Aave (AAVE), Compound (COMP) and Uniswap (UNI) are oversold.

On Aave, Merten says that the decentralized lending protocol is in a “nice trend” against the US dollar, signifying the potential for more upside.

AAVE is trading at $130 at time of writing.

On Compound, the crypto analyst says,

“Nice solid momentum. Solid foundation here built up on some of these plays, far away from those prior May 2021 highs [of ~ $854]… And I’m not saying it’s going to go all the way up there.”

Compound is trading at $87.07 at time of writing.

Turning to decentralized exchange Uniswap, Merten says that UNI is “another really strong play.” According to the crypto strategist, Ethereum (ETH) could act as a catalyst for Uniswap and other DeFi tokens that are built on the second-largest blockchain by market cap.

“I think some of these plays could really start to pick up as Ethereum is starting to pick up as well on the market.”

UNI is trading at $14.95 at time of writing. Ethereum is trading at $3,975 at time of writing, up about 150% since mid-October.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin’s quick dip below $57k forces beginners to capitulate, CryptoQuant says

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: