Features

Are they a good thing?

Published

4 days agoon

By

admin

While industry advocates have welcomed the finalized crypto tax measures after years of wrangling, messy deliberations about non-custodial providers still lie ahead.

It’s been a long time consuming, but the Internal Revenue Service and the Treasury Department have finally agreed upon new crypto tax reporting rules for investors.

At first, you may assume that these new guidelines would send shivers down the spine of exchanges and customers alike.

But given there’s long been exasperation over a lack of clarity in the space, the policy — which attracted a whopping 44,000 comments during a consultation — has been pretty well-received.

Why, you may ask? Because there are now clearer rules of the road to follow… and there are arguably benefits for everyone concerned.

Trading platforms will now be tasked with reporting the gains and losses of their customers, with measures gradually coming into force over the next three years.

It’s hoped this will help taxpayers — who have long had the responsibility of reporting the profits made from crypto investments — to file accurate returns with less fuss.

Meanwhile, it could also deliver a chunky windfall to the IRS, with some estimates suggesting it could boost tax income by $28 billion in the space of a decade.

Are there any losers? Yes… those who have been failing to declare their gains for the past few years on the erroneous assumption their crypto trades can’t be traced.

The IRS said it had sought to “close the tax gap related to digital assets” while ensuring the toughened rules could be implemented practically by the crypto sector.

“These regulations are an important part of the larger effort on high-income individual tax compliance. We need to make sure digital assets are not used to hide taxable income, and these final regulations will improve detection of noncompliance in the high-risk space of digital assets.”

IRS Commissioner Danny Werfel

Officials went on to make clear that there is more work to be done here. A glaring omission from these new guidelines are decentralized brokers — in other words, platforms that don’t end up taking custody of coins on behalf of users.

The IRS and the Treasury went on to admit that they need “more time to consider the nuances” of such transactions — but in any case, most taxpayers use centralized brokers anyway.

‘A game-changer’

In a statement sent to crypto.news, TaxBit’s VP of tax, Erin Fennimore, said the newly inked rules “mark an important step for digital assets in the U.S.”

Arguing they bring “much-needed clarity and legitimacy to a rapidly growing financial market,” she added:

“[This] is a game-changer for the industry. This newfound regulatory certainty empowers enterprises and traditional financial institutions to navigate the digital asset sector with confidence.”

Erin Fennimore

She went on to argue that this could make digital assets “a more accessible investment option” for individuals and enterprises alike — building on the momentum of exchange-traded funds based on Bitcoin’s spot price, with rumors that Ether could follow suit soon.

“These updates offer enterprises, specifically custodial exchanges, the guidance needed for proper compliance, further solidifying crypto’s position within the broader financial ecosystem.”

Erin Fennimore

She went on to call for businesses in the crypto space to “streamline compliance internally” — ensuring that reports aren’t doubled up and cut the chance that customers will end up falling afoul of the taxman.

A messy fight

Coin Center also welcomed the finalized reporting rules, but argued that a hell of a lot of time has been wasted in getting to this point.

A particular sticking point concerned who should be defined as a “broker” in the crypto space, with the nonprofit arguing for more than six years that it should only apply to centralized exchanges like Coinbase and Kraken.

That has finally happened now — but the IRS and the Treasury might have foregone a lot of tax revenue as they wrangled with Congress.

“By now we could have verifiable records of taxpayer gains from centralized exchanges for half a decade. We don’t.”

Coin Center

The group went on to order that, if the definition of a broker had remained “vague and unreasonable,” everyone from miners and validators to software developers would have ended up in a position where they might have had to surveil fellow crypto users and report private transactions — or face criminal punishment. Warning this could have amounted to a constitutional violation, they added:

“Had it been adopted, the broker definition would have made the US non-competitive in the field of open blockchain technologies.”

Coin Center

Unfortunately, the question of what should happen with non-custodial entities remains unanswered. What lies ahead could get messy.

Source link

You may like

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

Donald Trump

predicting the next president and making money with decentralized markets

Published

5 days agoon

July 3, 2024By

admin

What’s the buzz around decentralized prediction markets for the 2024 elections? See how you can predict the next president and cash in on your insights.

Ever wondered if you could predict the outcome of an event and profit from your foresight? Decentralized prediction markets make that possibility a reality. Recently, these markets have seen explosive growth, particularly with the 2024 U.S. presidential elections approaching.

Polymarket, a leading crypto-based prediction market platform, has experienced a dramatic surge in activity. According to Dune Analytics, Polymarket’s volume surpassed $100 million in June alone, marking a record month in the platform’s breakout year.

The surge continued into July, with bets worth $9.3 million placed on the first day alone. This single-day volume exceeded typical monthly volumes seen on Polymarket last year, which ranged between $3 million and $8 million.

From January to May 2024, monthly volumes at Polymarket ranged between $40 million and $60 million, marking a gigantic increase of 7 to 12 times compared to the previous year’s monthly volumes. In June, $111 million in bets were placed, the highest ever for the platform.

One of the most popular contests on Polymarket is the “Presidential Election Winner 2024,” which has attracted bets worth over $208 million since its inception. Currently, the odds favor Donald Trump at 66% and Joe Biden at 21%.

Analysts at research and brokerage firm Bernstein note that blockchain-based platforms like Polymarket are amplifying the efficiency of election markets by providing transparency and liquidity. They mentioned this in a recent note to clients, highlighting how Polymarket, built on blockchain technology, is increasing public appreciation of crypto’s role in politics.

With such heightened interest in these platforms, let’s delve deeper into how they operate, explore notable bets, identify the leading platforms, and discover how you can participate and potentially profit without placing bets.

What are decentralized prediction markets and how do they work?

Decentralized prediction markets are betting platforms that allow people to bet on the outcomes of real-world events using blockchain technology.

These markets operate on decentralized networks, which means there is no central authority controlling the transactions. Instead, they use smart contracts—self-executing contracts with the terms of the agreement directly written into code. This ensures that all transactions are transparent, secure, and tamper-proof.

One of the most popular decentralized prediction markets is Polymarket. Polymarket runs on the Ethereum (ETH) Layer 2 (L2) network, Polygon (MATIC), and allows users to speculate on various events, such as political outcomes, entertainment, and sports, using the stablecoin USDC. This integration ensures liquidity and stability in transactions.

Polymarket uses an automated market maker (AMM) pool model similar to Uniswap (UNI). Liquidity providers supply on-chain market liquidity, and users trade these tokenized shares to place their bets.

For example, if you believe a particular candidate will win an election, you can buy “Yes” shares at a price reflecting the current market odds. If the event occurs as you predicted, you gain profits. If not, you suffer losses. This system allows you to profit from your knowledge and predictions about various events.

Polymarket isn’t the only player in the decentralized prediction market space. Platforms like Augur and Hedgehog also offer similar services, allowing users to speculate on a variety of events.

Augur, for instance, operates on the Ethereum blockchain and uses a native token (REP) for betting. Hedgehog is another emerging platform, leveraging the same principles of decentralized betting with a focus on user-friendly interfaces and diverse market offerings.

Popular bets on polymarket

The buzz around the 2024 US presidential election has driven a flurry of activity on Polymarket. Let’s delve into some of the most popular bets making rounds and what they reveal about public sentiment.

Biden’s lackluster debate performance

The first presidential debate on June 27, 2024, marked a critical change in betting patterns on Polymarket. Joe Biden’s performance, widely criticized as one of the weakest since the era of televised debates began, sparked a surge in bets.

Before the debate, Biden had a 91% chance of being the Democratic nominee. However, following his performance, this dropped to 71%, with over $21.2 million bet on Biden and $5.06 million on Kamala Harris, who has garnered 11% support until now.

Simultaneously, the probability of Biden dropping out of the race increased sharply from 19% before the debate to 44% by July 1. Although it has slightly improved to 35%, the volatility reflects the uncertainty surrounding his campaign.

On the Republican side, the betting sentiment is overwhelmingly in favor of Trump. With over $6.6 million in bets, Trump is predicted to have a 99% chance of becoming the Republican nominee, contrasting sharply with the fluctuating confidence in Biden’s campaign.

Swing states predictions

Swing states are crucial in determining the election outcome, and Polymarket’s prediction polls indicate a Republican sweep in key states.

For instance, Republicans are predicted to win Nevada (71%), Michigan (53%), Pennsylvania (58%), Arizona (73%), Wisconsin (56%), Georgia (80%), and North Carolina (83%).

With over $3 million in total bets backing these predictions, the Republican Party has emerged as the clear winner in all these battleground states.

There’s also a notable prediction regarding international affairs: there’s a 56% chance that Israel will invade Lebanon before September, adding fuel to the already complex geopolitical situations across the world.

How to make money from decentralized betting markets?

Decentralized prediction markets offer opportunities to make money, but they also come with very high risks. Here’s how you can profit from these platforms, along with some important advice.

Becoming a liquidity provider

One of the easiest ways to make money on platforms like Polymarket is by becoming a liquidity provider. Here’s how it works:

- Deposit USDC: You can deposit USDC into the platform’s liquidity pool.

- Earn fees: By providing liquidity, you earn a share of the trading fees whenever users place bets.

- Automated market maker (AMM): The platform uses an AMM model, ensuring that your funds are used to facilitate trades and bets efficiently.

This method provides a steady stream of income without directly betting on events, making it a lower-risk option compared to direct betting.

Making direct bets

Another way to make money is by placing direct bets based on the odds of specific events. For example:

- Choose an event: Select an event you want to bet on, such as the outcome of the presidential election.

- Analyze the odds: Consider the current odds and make your prediction.

- Place your bet: Bet an amount you are comfortable with, knowing that if your prediction is correct, you can earn a significant return.

Besides Polymarket, several other platforms offer decentralized prediction markets. These platforms work similarly, allowing you to provide liquidity or place direct bets on various events.

While these opportunities can be lucrative, they come with very high risks. If the odds don’t go in your favor, you can incur substantial losses.

It’s crucial to trade cautiously and never invest more than you can afford to lose. Always do thorough research and consider seeking advice from financial experts before diving in.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

crypto regulation

Can Trump’s return to power and pro-crypto policies spark a historic bull run?

Published

1 week agoon

June 29, 2024By

admin

Could the increasing support for Trump within the crypto community and his pro-crypto policies lead to a historic bull run if he wins the 2024 election?

The current political climate in the U.S. is charged with uncertainty. Voters are deeply divided, and the economic challenges facing the nation are substantial.

As President Joe Biden and former President Donald Trump prepare for the upcoming 2024 U.S. Presidential election face-off, the stakes are high, not just politically, but economically and technologically.

The U.S. is grappling with persistent inflation, de-dollarization risks, geopolitical tensions, and a polarized political environment. Amid this uncertainty, the role of crypto assets has emerged as a key issue for voters.

According to a recent survey by Grayscale, nearly half of the voters now expect to include crypto in their investment portfolios. This growing interest is particularly pronounced among younger voters, with 62% of Gen Z and Millennials seeing crypto as the future of finance.

Recent developments suggest that crypto tides seem to be shifting towards Trump. What are those reasons, and could his revival herald a long-awaited bull run in the crypto market?

Changing stances and political wars

As the election draws near, both Biden and Trump offer starkly different visions for the country’s future, each with distinct implications for the economy and, by extension, the crypto market.

Former President Donald Trump, once a vocal critic of cryptocurrencies, has made a surprising pivot. Previously describing Bitcoin (BTC) as a “scam” and cryptocurrencies as a “disaster waiting to happen,” Trump has now embraced the digital asset industry.

He recently proclaimed on social media that he is “very positive and open-minded to crypto companies and all things related to this new and burgeoning industry.”

Trump’s new stance is a marked departure from his earlier views and suggests a strategic move to align with the growing pro-crypto sentiment among voters.

In contrast, President Joe Biden’s administration has maintained a more skeptical stance towards crypto. Biden recently vetoed a resolution that had passed through both the House and Senate, which was widely supported by the crypto industry.

The resolution aimed to repeal an SEC decision that would have imposed stricter regulations on financial institutions holding crypto assets.

Biden argued that the resolution would undermine the SEC’s ability to set necessary guardrails for the industry, stressing on the need to protect consumers and investors.

The rise of pro-crypto sentiment and Trump’s influence

As the 2024 U.S. Presidential election approaches, Trump’s backing from crypto billionaires and social media influencers is becoming increasingly apparent.

Tyler and Cameron Winklevoss, well-known figures in the crypto world, have openly declared their support for Donald Trump. Tyler Winklevoss tweeted about donating $1 million in Bitcoin to Trump’s campaign, citing the Biden administration’s “war against crypto” as a key reason.

I just donated $1 million in bitcoin (15.47 BTC) to @realDonaldTrump and will be voting for him in November. Here’s why:

Over the past few years, the Biden Administration has openly declared war against crypto. It has weaponized multiple government agencies to bully, harass, and… pic.twitter.com/qOQSpmanBR

— Tyler Winklevoss (@tyler) June 20, 2024

His brother, Cameron, echoed this sentiment, advocating for Trump’s pro-Bitcoin, pro-crypto, and pro-business stance.

Meanwhile, social media influencers like Wendy O have also voiced their support for Trump. She pointed out the regulatory uncertainty and stressed how crucial this election is for the future of the industry.

Trump supports the future of BITCOIN and CRYPTO

I also do not believe he launched the meme coin that’s all over the feed based on various factors covered earlier

We are in a time of regulatory uncertainty where our livelihood depends on this election…pic.twitter.com/kKLr6io9V3

— Wendy O (@CryptoWendyO) June 18, 2024

Trump has cleverly integrated cryptocurrency into his campaign. He is reportedly in talks to speak at the Bitcoin 2024 convention, the largest BTC event of the year, scheduled for July 25-27 in Nashville, Tennessee.

This event, following the Republican National Convention, could provide Trump with a huge platform to solidify his pro-crypto stance.

Earlier this month, Trump also met with leading Bitcoin miners in the U.S., advocating for all remaining BTC to be mined domestically.

Moreover, during a recent rally, he promised to end Joe Biden’s “war on crypto” and ensure that the future of Bitcoin and crypto would be shaped in America.

Trump’s pro-crypto stance has already resulted in substantial on-chain donations. Before the Winklevoss brothers’ contributions, Trump’s campaign had received roughly $60,000 in on-chain crypto donations.

With the recent influx, total on-chain donations now stand at around $1.75 million. This figure is expected to rise as more contributions made via exchanges are accounted for.

The growing support for Trump within the crypto community is also reflected in prediction markets.

Platforms like Polymarket show Trump leading with 60% odds compared to Biden’s 34%, with bets amounting to around $185 million, indicating a strong belief among bettors that Trump’s pro-crypto policies will resonate with voters.

As the political climate heats up, the crypto market is seeing a surge in a new category: Politifi. This sector, which combines politics and finance, has quickly amassed over $1.25 billion in market cap as of June 27.

The majority of this market cap is dominated by Trump-related meme coins, reflecting the influence of the former president on the crypto community.

The most trending of all Trump-related meme coins is MAGA (TRUMP), which has seen a staggering rise of over 540 times since its inception in September 2023. As of June 29, it is trading at around $7,35.

Another coin gaining ground is MAGA (MAGA), which has increased more than 34 times since its inception in May 2024, currently trading at $0.0002374.

Both of these coins are based on Trump’s famous slogan “Make America Great Again” (MAGA) and are experiencing huge trading volumes and investor interest amid the ongoing political drama.

Amid this, social media is abuzz with speculations and bullish predictions about the impact of Trump’s potential return on the crypto market.

For instance, one user tweeted, “Trump is going to send crypto to new highs. 2025 will be the greatest bull market of all time.”

Trump is going to send crypto to new highs

2025 will be the greatest bull market of all time

— borovik (@3orovik) June 27, 2024

This sentiment is echoed by another user, who tweeted, “A Trump victory would send the SP500 to 6000 and $BTC to $250k IMO and it’s going to happen.”

A Trump victory would send the SP500 to 6000 and $BTC to $250k IMO and it’s going to happen. America will never forgive the Biden administration for the terror their border polices have caused American families. And the crypto population of 100M will never forgive Gary Gensler… https://t.co/k6Nj4Ph1vn

— Satoshi Flipper (@SatoshiFlipper) June 26, 2024

The optimism surrounding Trump’s potential victory and its impact on the crypto market is palpable, with many believing it could spark a bull run. But is it possible?

Can Trump’s arrival ignite a crypto bull run?

Amid all this political drama, the question on everyone’s mind is: can Trump ignite a crypto bull run? To answer this, we need to consider several factors, starting with the necessity of regulations.

No matter who wins the election, clear and balanced regulations are crucial for the crypto market’s growth. The lack of regulatory clarity has been a major hurdle, causing uncertainty among investors and hindering innovation.

Both Trump and Biden have different approaches, but the core issue remains: the need for sensible and neutral policies that support growth while protecting consumers.

Politics is often a game of lies, deceit, and changing sides, and Trump is a prime example. He has shifted from being a vocal critic of crypto to its staunch supporter.

While Trump’s newfound pro-crypto stance is attracting attention and support, it is essential to remember that his views could change again based on political convenience.

Under the Biden administration, the SEC has been criticized for its stringent approach, which many believe has stifled innovation.

However, it’s important to note that neither Trump nor Biden can be seen as saints in this context. What truly matters is the implementation of regulations that strike a balance between innovation and protection.

Without such balanced policies, the crypto market may find a more welcoming environment in other countries. Nations like Switzerland and Singapore are already vying for the lead in the crypto race by offering more favorable regulatory frameworks.

Without clear regulations, the U.S. risks losing its edge in the global crypto landscape, regardless of who occupies the White House.

Source link

Crypto scam ads promising wild riches have appeared on Facebook for years, yet there seems to be little progress in stopping them once and for all.

With every passing week, the number of audacious crypto scam ads online — and the unsuspecting victims losing eye-watering sums of money — continues to grow.

And to make matters worse, they’re often found on the social networks we trust the most, Facebook and X among them.

Both tech giants are losing in the battle to protect their users from fraudsters attempting to entice them with too-good-to-be-true crypto investments.

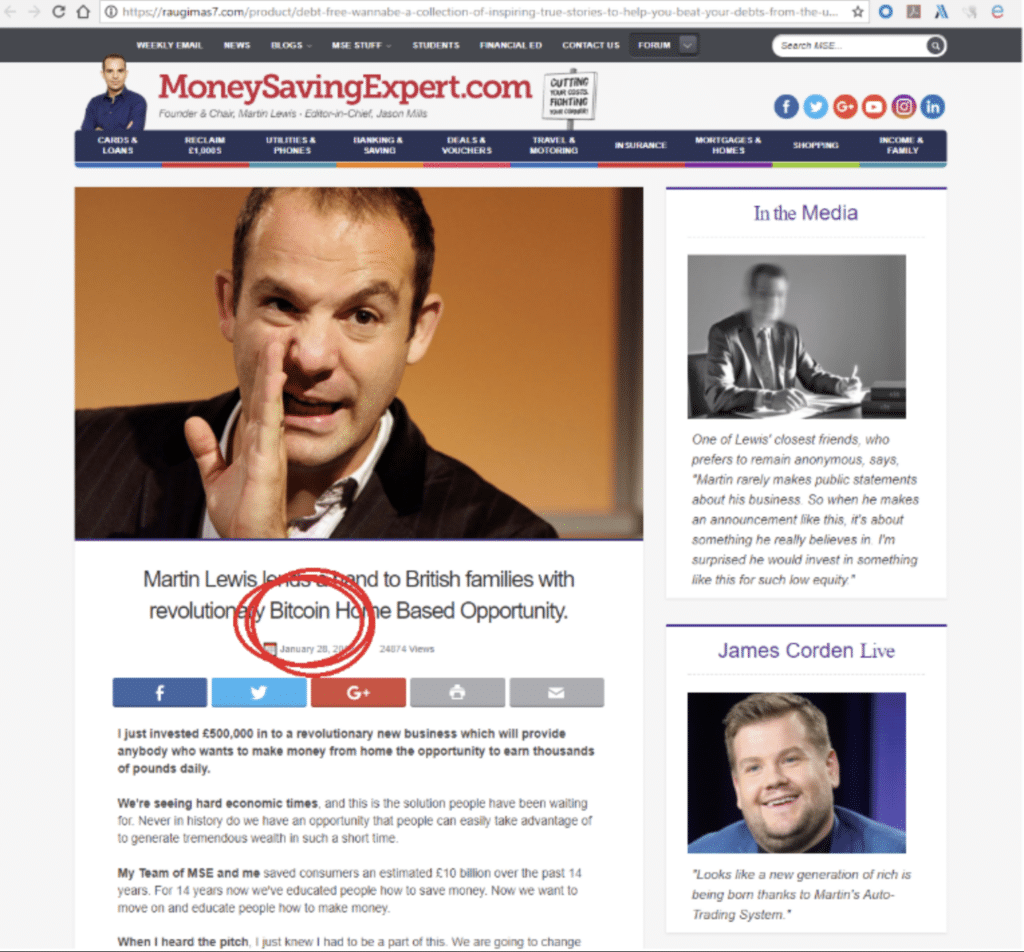

Many of these bogus ads mimic official news sites and contain false quotes from celebrities in an attempt to generate a sheen of credibility.

And while they are rapidly taken down after being reported, it’s like a game of Whac-A-Mole, with dozens more subsequently popping up in their place.

But how big of a problem is this, and what can social networks do to eradicate scam ads once and for all?

Lawsuits galore

High-profile individuals are fed up with their names and pictures being used in scam ads — prompting some to take legal action against the sites they appear on.

One of the first to head to the courts was Martin Lewis, a British journalist who is known as “Money Saving Expert” for his personal finance tips.

Given how he has long been a trusted voice on money matters, it’s easy to see how someone could be drawn into a bogus ad touting a once-in-a-lifetime opportunity.

Back in April 2018, he sued Facebook for defamation with a goal of pressuring the company into stepping up its efforts in preventing these ads from appearing.

By January 2019, Lewis had reached a settlement that included a $3.8 million donation to a new, independent project tasked with clamping down on scams.

This was certainly a step in the right direction. But more than five years on, Facebook users around the world are still being bombarded with these dangerous pages.

In a sign that history is repeating itself, an Australian billionaire has now been given the green light to sue Meta, amid claims Facebook has also profited from these adverts.

Andrew Forrest has alleged that thousands of people ended up losing millions of dollars after over 1,000 ads were plastered on the social network last year.

A common defense used by U.S. internet companies is Section 230 of the Communications Decency Act, which states it cannot be liable for content released by third parties. But Meta’s efforts to dismiss the case on this basis were rejected by a judge.

How is this happening?

BBC News recently wrote a deep dive into these scam ads, noting that its branding had often been used by criminals.

It explained that scammers are able to dupe Facebook’s detection systems by launching ads that appear to be going to a legitimate source, then quickly redirecting users.

The company says it’s now taking action to stop fraudsters using this technique.

Scam ads have also become much more prolific on X since Elon Musk’s takeover — and at times, has even rendered the site borderline unusable.

But this particular social network has a distinct problem of its own: malicious actors managing to take over the accounts of people with millions of followers.

Just last week, 50 Cent revealed that his X profile and website had been taken over by hackers to promote a crypto pump-and-dump scam — with the rapper stressing he had nothing to do with the project.

“Whoever did this made $3,000,000 in 30 minutes,” he claimed on Instagram.

Put together, it doesn’t seem like there’s been much success in making crypto scam ads a thing of the past.

That’s a big problem for the crypto industry in particular as it attempts to win round the public and shake off its image of being a “Wild West.”

So… what can be done about all of this?

Well, regulators might need to step up more.

In the U.K, one policy that’s being considered could see social networks face a fine of 10% of their global annual revenue if they fail to protect users. That could make them sit up and take notice.

And while artificial intelligence is widely being used to create these bogus ads, AI tools could also play a valuable role in tracking them down before they gain traction.

Meta’s previously said that scam ads are increasingly sophisticated, and it has ensured that fake ads can be easily reported by any of its users. Meanwhile, X says its teams “work around the clock to safeguard the platform.”

Unfortunately though, this is likely to be a problem that gets worse before it gets better.

Source link

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Pepe Price Analysis Reveals Bullish Strength As Bitcoin Plummets

Taiwan is not in a CBDC rush as central bank lacks timetable

Will SHIB Price Reclaim $0.00003 Mark By July End?

The power of play: Web2 games need web3 stickiness

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs