ADA

Base Chain TVL Surpasses Cardano As Interest Swells

Published

11 months agoon

By

admin

Ethereum Layer 2 network “Base” has surpassed Cardano in terms of Total Value Locked (TVL) in just two weeks after its official launch, despite Cardano experiencing a multi-year head start in growth and development.

Base TVL And Trading Volume Rises Above Cardano

Presently, Cardano is facing criticism from users due to its TVL falling below that of the newly launched project “Base” built by Coinbase. One individual who has publicly criticized the project is Evan Van Ness, a Consensys member and Ethereum advocate.

Van Ness took to his X (formerly Twitter) account which boasts over 103,000 followers to call Cardano a “Zombie chain” because it was below Base by TVL despite being years ahead of the latter.

Base was launched on August 9 and it has experienced impressive growth and momentum since it was introduced to the public. According to Data from DeFillama, the layer 2 network Base recorded a higher trading volume ($26.23 million) than that of the layer 1 network Cardano ($20 million) in less than 24 hours after its official launch.

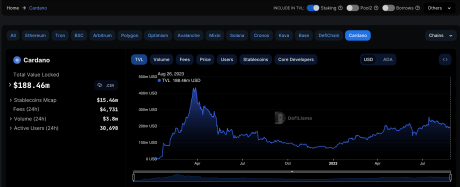

In terms of TVL, at the time Van Ness’s chart was shared on X, Base had managed to secure $188 million in TVL since it was introduced, surpassing Cardano which sat at the 14th position by TVL with $160 million.

However, these figures have since been flipped especially since ADA is seeing a green day on Saturday. DefiLlama data currently shows a TVL of $188.46 million for Cardano versus $185.53 million for Base.

Cardano TVL overtakes Base once more | Source: DeFiLlama

Nevertheless, data from L2beat points Base’s rise in TVL over the past week puts it ahead of StarkNet and others which made it the fifth largest layer-2 network.

Base TVL is, however, not the only impressive thing about the L2, as the network has outperformed Cardano by completing more transactions in its first week than Cardano’s transactions in a month.

Although Base’s TPS may be lower than that of other layer 2 networks like Optimism (OP), investors and market observers believe that the network will experience more adoption as its ecosystem grows.

Rising Average Transactions Per Second

Base has recorded over 11 million transactions in less than a month since its official launch. Base’s average transactions per second over the past few days has been reported to be 15.88, surpassing other layer 2 blockchain Abritrum (AB) and Optimism (OP). The network’s 15.88 also shows an increase of almost 160% in daily Transactions Per Second (TPS).

Base’s TPS rise was no coincidence as more investors engage in Base’s Friend.tech. Friend.tech is a social market that allows users to buy and sell shares in public figures. It has reportedly garnered more than 100,000 users since its release.

Other protocols such as Synthenix have also shown interest in the Base network, as the protocol recently concluded a governance vote to deploy on Base. Another development is the on-chain analytics firm Arkham Intelligence announcing on X earlier in the week that it will be adding support for Base.

ADA price recovers during the weekend | Source: ADAUSD on Tradingview.com

Featured image from Bitcoinist, chart from Tradingview.com

Source link

You may like

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

ADA

Cardano Faces Make-Or-Break Price Level For Bullish Revival

Published

2 months agoon

May 8, 2024By

admin

The Cardano (ADA) price is down 46% since its yearly high and is currently facing a make-or-break price level for a bullish reversal. Here’s what you need to know:

Cardano Price Analysis: Daily Chart

The daily ADA/USD chart is currently charting a path within a descending channel, which has defined the bearish trend since the beginning of March. On Monday, the ADA price peaked near $0.475, encountering substantial resistance at the channel’s upper boundary and from the critical 20-day Exponential Moving Average (EMA), which stands currently at $0.47.

In the short-term, this resistance level is crucial as it coincides with historical price rejection points, confirming its significance. As of press time, ADA is trading at approximately $0.44.

The convergence of the 20-day EMA ($0.47), 50-day EMA ($0.54), and 100-day EMA ($0.51) above the current price level illustrates a dense zone of resistance. The 200-day EMA at $0.52 reinforces this barrier, emphasizing a strong bearish momentum.

The Relative Strength Index (RSI) on the daily chart is currently at 38, which does not venture into the oversold territory (below 30) but indicates a bearish momentum with potential for further decline unless a reversal occurs.

For a bullish reversal, ADA needs a sustained break above the $0.47 mark (20-day EMA) with accompanying high volume to confirm the breakout from the descending channel and shift the market sentiment. Then, the cluster of EMAs becomes the central resistance zone.

Crossing this band is of utmost importance in order to build up bullish momentum for a break above the yearly high of $0.81 from March. If not, the ADA price could trend towards the midline of the channel and drop below $0.40.

In-Depth Weekly Chart Overview

Transitioning to the weekly chart, the broader picture also underscores the bearish sentiment that has dominated ADA since it reached its peak at $3.17 in late 2021. The series of lower highs and lower lows is a textbook representation of a downtrend.

The price action currently remains suppressed below the long-term moving averages: the 20-week EMA at $0.52, 50-week EMA at $0.48, 100-week EMA at $0.51, and 200-week EMA at $0.52, all of which slope downwards, underscoring the persistent selling pressure in recent weeks.

The Fibonacci retracement levels, drawn from the high of $3.17 to the low of $0.22, provide further insights. Currently, ADA trades near $0.44, which is above the major psychological and technical support at $0.40.

The closest significant Fibonacci retracement level is the 0.236 level at $0.918, which ADA has struggled to surpass. A breach above this level could open the path toward higher Fibonacci levels at $1.348 (0.382) and $1.697 (0.5), which would require a significant shift in momentum and buying interest.

Overall, for ADA to shift from its bearish constraints, attention should be focused on the daily resistance at roughly $0.47 (descending channel breakout). Overcoming this barrier would be pivotal for confirming a bullish reversal. Until this level is decisively broken with substantial volume, the outlook remains tilted towards bearish continuation.

Featured image from Bitget, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Cardano (ADA) might be going through a lackluster price action at the moment, but analyst Ali Martinez believes the crypto might be gearing up for a parabolic run. While taking to social media platform X, Martinez talked about an intricate price analysis that ADA investors might find appealing.

Particularly, the analyst noted that the cryptocurrency’s current price formation is showing signs of a comeback, according to its price history.

Cardano Price History Shows Signs Of Comeback

The price of Cardano has been on a correction path since the middle of March when it peaked at $0.79. Interestingly, current price levels means that the cryptocurrency has corrected over 40% from this peak.

This has led to concerns from some investors about the ADA’s price trajectory for the rest of the years, particularly considering different inactivity concerns and others surrounding the cryptocurrency. However, according to Martinez, this cycle is normal for the cryptocurrency.

The renowned analyst’s take on ADA is based on its historical trend. According to the 1M ADA/USD timeframe chart shared by Martinez, the 50% price drop ADA recorded in the past month could be a golden opportunity for crypto investors to position themselves for a price surge.

Looking at ADA’s price history shows this may just be a temporary setback before the next rally. A similar price action played out between 2019 and 2020 before the surge to new all-time highs in 2021.

Total crypto market cap currently at $2.29 trillion. Chart: TradingView

After breaking out of a consolidating channel in 2020, ADA went on a 75% surge and then corrected by 56% over three months. This correction was soon forgotten as ADA bounced up and went on an impressive 4,095% bull run to reach its current all-time high of $3.09.

As Martinez noted, a similar price action seems to be playing out. ADA recently broke out of a consolidating channel which played out for almost the entirety of 2023. This break above the channel saw ADA performing a 72% surge before its recent correction.

If history were to repeat itself, ADA might kickstart a parabolic run in May and push up to new highs in the coming months. Martinez predicted a 2,480% price surge to $9.98 within the next nine months.

History doesn’t repeat itself, but it often rhymes!

If that is the case for #Cardano, we should be positioning ourselves for what’s coming, understanding that the recent price correction might just be one of the last buy-the-dip opportunities $ADA will give you. pic.twitter.com/wlKs7fNhb8

— Ali (@ali_charts) May 3, 2024

What To Expect In Cardano’s Next Bull Run

It is important to note that the crypto market has evolved significantly since 2021 and crypto assets have become less volatile, especially during uptrends. Many things have to be put in place in order for a $9 ADA price to become a reality.

For instance, there needs to be a wider inflow and mainstream adoption of cryptocurrencies. According to crypto prediction website Telegaon, Cardano could reach the $9 price level by the end of the decade.

Martinez believes the recent price correction might actually be one of the last buy-the-dip opportunities for investors to get on ADA. At the time of writing, ADA is trading at $0.4638 and is down by 1% in the past 24 hours.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

ADA

Is Not Holding ADA A ‘Red Flag’? Cardano Founder Thinks So

Published

3 months agoon

April 6, 2024By

admin

Cardano (ADA)’s founder is a man of many words and many GIFs. Charles Hoskinson’s comments, whether you agree or disagree with them, tend to spark discussions in the crypto community.

Hoskinson’s latest X reply spree covered issues from dating advice to his confidence in the ecosystem to Solana’s recent struggles. As a result, several conversations regarding those topics and Cardano’s founder’s perspectives on them spread across the X platform.

Charles Hoskinson’s Dating Advice

Charles Hoskinson offered some crypto-related dating advice in a reply to Lily Brodi, the creator of the viral ‘Cardano Girls’ video. The content creator asked whether it was weird to ask someone on the first day if they held ADA.

Cardano’s founder replied that not holding ADA was a “major red flag” at this point. Hoskinson jokingly insinuated that the person might “not be a cannibal,” but if they don’t hold Cardano’s native token, you should be alert anyway.

At this point, not holding ada is a major red flag. I mean I’m not saying they are cannibals, but… pic.twitter.com/s2CzXr2Hxr

— Charles Hoskinson (@IOHK_Charles) April 4, 2024

Later, he suggested he might know one or two eligible “Cardano bachelors.” The community found Hoskinson’s comments funny, with some agreeing with his perspective on potential partners.

Nonetheless, not all Hoskinson’s replies during his Wednesday spree were well received. Cardano’s founder seemingly took a jab at Solana after learning of the blockchain’s recent struggle to process transactions.

The post informed us of the levels of congestion that the Solana network is experiencing. According to Dune data, the Solana blockchain currently has a non-vote transaction failure rate of over 75%.

Three out of four transactions are experiencing issues before even making it to the block. The failure rate seems to occur “because many bots engaging in arbitrage generate spam transactions.” To the news, Hoskinson replied with a popular gif of actor Pedro Pascal enjoying himself.

This guy is exactly why Cardano ngmi

Cardano has a douchebag founder https://t.co/Xn0Dj1VDsG

— LawrenceOfCrypto.sol (@LawrenceCrypt0) April 5, 2024

This reply prompted some X users to criticize Cardano’s Founder. Some even called him a “douchebag founder” and claimed that answers like that are the reason why the project “won’t make it.”

However, the ADA community joined in the criticism of the Solana network. Some community members deemed the chain as “useless.” Another ADA holder stated: “The Solana team does not know the basic principles of how blockchain works.”

The comments don’t come as a surprise as both communities’ ongoing “feud” tends to end in a jab and poking fun at each other’s struggles.

“Cardano Always Wins” Or Does It?

As part of Hoskinson’s recent “insight,” he commented on a recent poll ranking the best Layer-1 networks. In said poll, the Cardano ecosystem had the second-highest number of voters.

Nonetheless, its founder didn’t seem pleased, claiming that “It was engineered to produce an outcome prior to a single vote being cast.” To Hoskinson, in a “fair vote,” it is clear that “Cardano always wins.”

Despite his confidence in the project, the ADA price has recently shown a subpar performance. The token has exhibited red numbers in several timeframes, with an 11.5% drop in the last seven days and a 20.5% decrease in the past month.

The token’s current performance has not gone unnoticed by analysts either. Renowned crypto analyst Ali Martinez raised some concerns about ADA’s whale activity.

According to Martinez, “Cardano is experiencing a lull in whale activity.” The analyst considers that this could signal a potential for further price consolidation or an impending drop.

The unclear trajectory of ADA’s price seems concerning to its holders, as some consider its current performance to be “extremely bearish right now.” At the time of writing, ADA is trading at $0.5748, a level not seen since Valentine’s Day.

Cardano (ADA) performance in the weekly chart. Source: ADAUSDT on Tradingview.com

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs