Bitcoin

Between Bitcoin Layers: Boltz Builds Trustless Transfers

Published

3 weeks agoon

By

admin

Company Name: Boltz

Founders: Kilian and Michael

Date Founded: Project began in 2019 | Incorporated in 2023

Location of Headquarters: Remote | Incorporated in El Salvador

Amount of Bitcoin Held in Treasury: 100% of treasury is BTC

Number of Employees: 5

Website: https://boltz.exchange/

Public or Private? Private

Swapping sats between Bitcoin layers can be difficult, but Boltz makes it easier.

Boltz is a non-custodial exchange that lets users send their bitcoin between the Bitcoin base chain, the Lightning Network and the Liquid Network.

While Boltz is now used by both everyday bitcoin users and institutions alike, the platform, which is almost as old as the Lightning Network itself, was born out of necessity and was foundational in helping the Lightning Network function in its early days.

The History of Boltz

“Boltz as an idea started in 2018,” Kilian told Bitcoin Magazine.

“I was working on a Lightning-based decentralized exchange and realized pretty quickly that it was very tough to keep Lightning channels balanced,” he added.

“Boltz was really born as a band-aid to fix this, a service provider that would take care of your Lightning channel balances and keep them balanced for you.”

In creating Boltz, one of the primary non-negotiables Kilian and his team established was that it had to be non-custodial so to best align with the Bitcoin ethos of decentralization.

The Boltz mainnet launched in April 2019 and facilitated Bitcoin base chain to Lightning swaps only until early 2023, when Kilian and Boltz’s other co-founder, Michael, realized that Boltz needed more attention.

“We saw it organically growing and we felt that it deserved more,” said Kilian.

“We decided in early 2023 to go in full time and that the next major feature would be Liquid Swaps, which we then launched in May 2023,” he added.

It was around this time that Kilian and Michael turned Boltz into a proper business, as opposed to a passion project, which it had been up until that point. In doing so, they went after a new user base and experienced some growing pains in the process.

Liquid Swaps

“In 2023, when we started Liquid Swaps, we targeted more professional users, specifically for the channel rebalance use case in a fee sensitive [environment],” explained Kilian. “We launched it during the fee spike in May 2023.”

The fee spike to which Kilian referred was the result of the introduction of Ordinals onto the Bitcoin base chain. Bitcoin transaction fees had reached all-time highs by late-April 2023.

As fees rose to 500-600 sats/vByte, resulting in transaction fees hitting over $100 in some cases, things began to break and even Boltz felt the heat.

“We had to shut down Boltz for three or four days,” recalled Kilian.

“Boltz was not available because we had all our working capital locked up in the mempool and we were not able to pump it out because fees kept on rising. A lot of similar services had this problem,” he added.

Kilian then pointed out that Liquid was a solution for many companies facing this predicament.

“If you imagine the typical use case of getting inbound liquidity on Lightning, you can do so multiple times with Liquid,” explained Kilian.

“You send out via Lightning, thus getting inbound liquidity, and get Liquid LBTC back. This really made a lot of sense to users when we launched it. The launch was successful, [and we] breathed a little bit of life into the Liquid ecosystem,” he added.

Kilian also shared that Boltz’s swap service underpins the Aqua Wallet, a wallet that enables Liquid to Lightning swaps that became popular in mid-2023.

Boltz — Behind the Scenes

Aqua isn’t the only Bitcoin-related product that employs Boltz on the backend.

Breez Wallet, a non-custodial Lightning wallet, was actually the first bitcoin wallet that utilized Boltz’s swap service.

“Sometimes Breez users want to send to an on-chain regular Bitcoin address because the merchant only accepts on-chain,” said Kilian. “So, Breez integrated our open, publicly-available API in order to offer these swaps directly within the app.”

For a Breez Wallet user to spend some of their sats on Lightning for an on-chain purchase, they simply have to scan a Bitcoin QR code and the bitcoin swap from Lightning to the Bitcoin base chain happens in the background via Boltz.

Kilian said that Boltz plans to work with more companies in providing its service behind the scenes.

“It’s crucial for great UX that users do not have to open our website but can stay in whatever product/wallet they [are using] and move their bitcoin between layers right where they are,” Kilian said. “Our non-custodial API is something we pioneered and we are very proud of.”

How Boltz Works — Atomic Swaps

According to Kilian, creating a non-custodial service — especially one that integrates well with other non-custodial services — was not an easy task.

As mentioned, keeping the service non-custodial was a must for Kilian and the Boltz team, partially because they didn’t want to be regulated as an entity that custodies user funds and partially because they didn’t want users to have to trust intermediaries to execute the transactions.

“You do not want to trust a random website, a random project that you find on the internet,” explained Kilian.

“We also want to be available to users that say, ‘Okay, I don’t know them necessarily, but I hear these guys saying it’s non-custodial. Probably some technical person checked that it’s actually non-custodial, so I’m going to give it a shot,’” he added.

The key technology that enables Boltz to be non-custodial is the Atomic Swap. And Boltz utilizes a subcategory of Atomic Swap called the Submarine Swap.

Submarine Swaps employ hash time-locked contracts (HTLC), which in layperson’s terms, enable two transactions (both sides of the swap) to happen simultaneously by linking them together cryptographically inside of a smart contract. Using this technology, there is no way for one exchange to occur without the other occurring at the same moment.

This is the most trustless solution that exists for moving sats between Bitcoin layers.

And in January of this year, Boltz took this technology to the next level when it enabled Taproot Swaps, which has helped make issuing refunds on failed Lightning transactions more efficient.

“Until January, when a swap to a Lightning invoice or to a Lightning destination failed, you had to wait until you could get your refund back,” said Kilian.

“That’s a drawback and just bad UX in the end. With Taproot, there’s a new way you can spend coins. It’s called ‘key path.’ And with this key path spent, basically what we could do is we could issue refunds immediately,” he added.

Kilian added that Taproot Swaps also enhance privacy, as they don’t reveal anything about the swap on-chain.

“If a chain observer is looking at the chain, one cannot tell that this is part of an Atomic Swap or even a Boltz swap,” explained Kilian. “There’s no way to do that.”

A “Privacy-Respecting” Solution

After Kilian said the “P” word — privacy — I inquired as to whether or not he was worried that Boltz might end up in the crosshairs of the authorities, especially in the wake of the US Department of Justice (DoJ) pressing charges against the Samourai Wallet developers.

“I’d be lying if I’d be saying we’re not worried at all because everyone is worried and everyone was very worried, especially in the first couple of days after the Samourai incident happened,” responded Kilian.

However, he was quick to point out that Boltz itself isn’t a privacy solution but a “privacy-respecting” solution.

“We are in no way to be compared with a coinjoin or with a solution that you are using in order to gain privacy,” said Kilian.

“When you do a swap on Boltz, there’s minimum one party that has the information of incoming and outgoing payments — and that is us. You shouldn’t trust us to not reveal this information one day,” he added.

“That being said, we are respecting privacy in the sense that we are not requiring more information than is strictly necessary — the destination address or the destination invoice — in order to do this work. We do not need your email address. We also do not need your IP address. And you can access our service via Tor.”

The Future of Boltz

Moving forward, there’s one main role Kilian would like for Boltz to play.

“Our vision really is to be the bridge between the Bitcoin layers,” he said.

“We’re seeing Bitcoin layer 2 sidechains, different sorts of layers are gaining traction, and this box won’t just close. This is unstoppable now, and we want to be the place that connects these layers,” he added.

At the same time, Kilian stressed that Lightning will continue to be Boltz’s primary focus as he considers it the “connecting tissue” between Bitcoin layers. On that note, he mentioned that Boltz recently launched a new client that automates the task of rebalancing Lightning nodes.

It’s clear that while Kilian and the team at Boltz are keeping their eyes open for new opportunities, they will continue iterating on what they do best.

Whatever the future holds for Boltz, Kilian said repeatedly that it will continue to focus on being “the easiest place with the best UX to non-custodially move [sats] in between Bitcoin layers.”

Source link

You may like

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

Bitcoin

Bitcoin ATM installations reach 38k, below the all-time high

Published

6 hours agoon

July 1, 2024By

admin

The global Bitcoin ATM market has seen significant growth. There are now over 38,000 Bitcoin ATMs worldwide, up from just over 10,000 in October 2020 and down by 2,000 from its all-time high (ATH) of nearly 40,000 in December 2022.

According to data available on Coin ATM Radar, the global tally of installed Bitcoin ATMs stands at 38,279 as of the latest count.

This expansion is driven by factors such as accessibility and ease of use, profitability for operators who earn transaction fees above the Bitcoin spot price, and favorable regulatory environments in many countries that support setup and expansion.

Additionally, Bitcoin ATMs provide enhanced privacy and security, allowing users to transact without divulging personal information and enabling direct deposits into digital wallets.

Despite their advantages, the industry faces challenges. Many operators lack the necessary experience, financial backing, or business acumen required for success, compounded by regulatory uncertainties in certain regions.

To address these issues, industry leaders emphasize the importance of public education on the benefits of cryptocurrencies and the need for reliable customer support. Building greater understanding and trust among users could encourage broader adoption of Bitcoin ATMs and digital assets.

As demand grows for convenient and secure cryptocurrency transactions, the Bitcoin ATM market is poised for further expansion. Strategic approaches and supportive regulatory frameworks could propel this industry into a pivotal role in the global adoption of digital assets.

Bitcoin holds steady at $60k

Bitcoin’s (BTC) price trajectory in 2024 has been marked by significant volatility and a bullish momentum. March saw Bitcoin achieving a new all-time high, surpassing $69,000 and briefly touching $73,000 before undergoing a correction.

This surge was driven by pivotal events this year: regulators approved the first spot Bitcoin ETFs in January, and April’s halving event reduced the block reward from 6.25 BTC to 3.125 BTC.

Experts anticipate a new growth cycle in the crypto market, potentially peaking between 2024 and 2025, in line with the four-year market cycle theory.

However, external factors such as global developments and regulatory changes could also influence Bitcoin’s price trajectory. Despite ongoing scrutiny of Bitcoin’s long-term prospects, its historical resilience suggests the possibility of a rebound.

Analysts maintain optimism regarding Bitcoin’s future price movements, with some forecasting it could surpass $80,000 in the coming years.

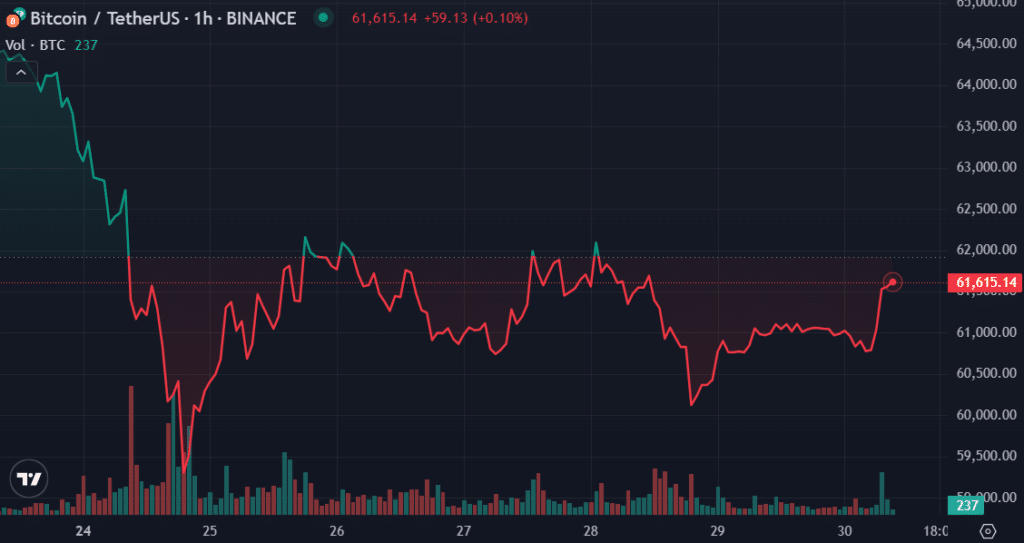

Over the past 60 days, the Bitcoin price has risen by 7.3%, climbing from approximately $57,000 to its current level of $61,532.

Source link

Bitcoin

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

Published

16 hours agoon

June 30, 2024By

adminJune was much rougher for Bitcoin than many expected at the beginning of the month. This is because the price of Bitcoin virtually declined throughout the month, leaving many investors, especially short-term holders, disappointed.

Related Reading

However, despite the price decline, on-chain data suggests that Bitcoin adoption is growing. New data shows the number of new Bitcoin addresses being created has surged to the highest level in two months. This growth suggests the long-term prospects for Bitcoin remain strong.

New BTC Addresses Surge To 2-Month High

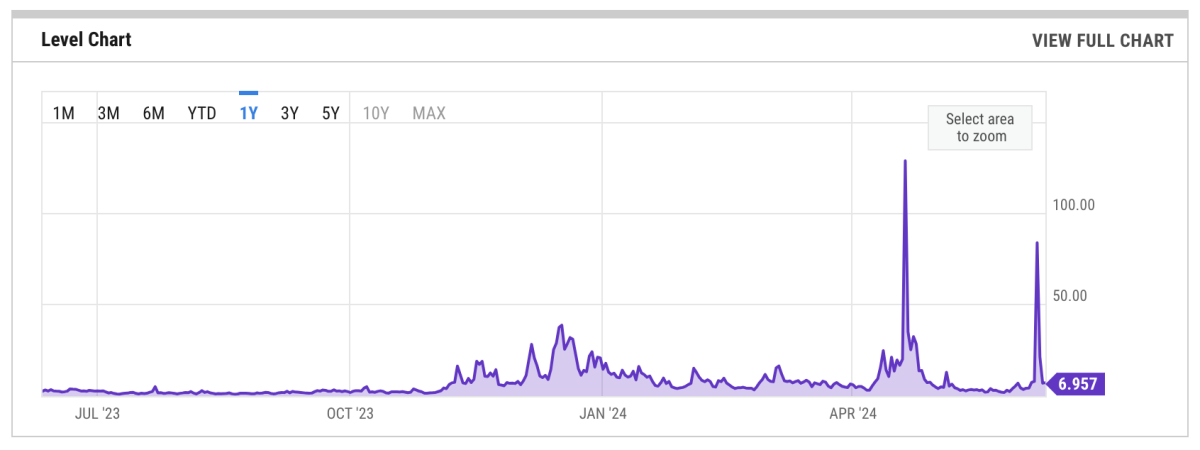

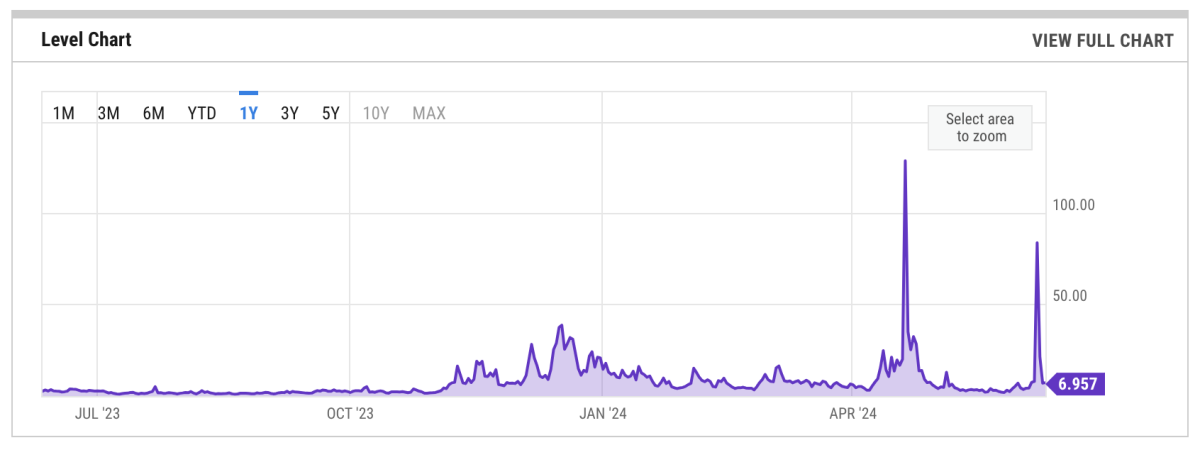

Despite the price slump, the network is exhibiting a promising trend that signals future growth for the world’s largest cryptocurrency. According to Glassnode chart data initially shared on social media platform X by crypto analyst Ali Martinez, new BTC wallet addresses have risen steadily over the past week to reach 352,124, their highest level since April.

Interestingly, the chart shows that the recent uptick in new addresses contrasts with a larger decrease in the creation of new addresses since November 2023. This new increase points to an influx of new users entering the crypto space. As more people adopt Bitcoin, demand will inevitably grow, which is a catalyst for price surges down the line.

Furthermore, Martinez suggested that the uptick in new addresses is from retail investors making a comeback. While institutional investors often drive major market moves, retail interest is crucial for Bitcoin’s mainstream adoption.

Retail #Bitcoin investors are making a comeback! The number of new $BTC addresses on the network surged to 352,124, marking the highest level since April. pic.twitter.com/GFOHnsokz0

— Ali (@ali_charts) June 29, 2024

A major part of the increase in new addresses can be attributed to recent adoption in the Brazilian market. Nubank, Brazil’s biggest neobank, recently announced plans to integrate Bitcoin’s lightning network into its services. As the largest fintech bank in Latin America, this integration could potentially expose a significant portion of its 100 million customers to the digital asset.

What’s Next For Bitcoin?

At the time of writing, Bitcoin was trading at $61,446. The leading digital asset has lost over 10% of its market cap in a 30-day time frame and the bulls are struggling to break above $61,000. This downtrend could be attributed to a selloff by miners and many long-term holders. Specifically, around 40,000 BTC were sold by long-term holders in June.

Bear markets are temporary. Bull runs will return. It’s just a matter of when, not if. With the second half of the year now approaching, time can only tell how the price of Bitcoin unfolds. Of course, new wallet addresses don’t directly impact price, but they are a leading indicator of growing Bitcoin adoption.

Related Reading

This adoption and demand, coupled with a recent decrease in the number of new Bitcoins entering the market, points to an increase in the price of Bitcoin in July.

Featured image from CNBC, chart from TradingView

Source link

bear market

Bitcoin ‘tends to bounce back’ in July after negative June

Published

21 hours agoon

June 30, 2024By

admin

Crypto market analyst Ali Martinez expects a price rebound for the Bitcoin (BTC) price in July after a month of bearish momentum.

According to Martinez’s X post on Sunday, the Bitcoin price recorded an average price rebound of 7.98% in July after a “negative June.” Data shows that the BTC price plunged by 9.25% over the past 30 days.

Historically, when #Bitcoin has had a negative June, it tends to bounce back strongly in July. In fact, $BTC has shown an average return of 7.98% and a median return of 9.60% during this month. pic.twitter.com/fJaIwc7Eob

— Ali (@ali_charts) June 30, 2024

Bitcoin recorded a 30-day-high of $71,907 and a low of $58,554 in the mentioned timeframe.

Moreover, data provided by Martinez shows that Bitcoin’s largest average price return of 46.81% happened in November.

Bitcoin gained a slightly bullish momentum over the past 24 hours, rising by 0.94%. The flagship cryptocurrency is currently trading at $61,450 at the time of writing. BTC’s market cap again surpassed the $1.2 trillion mark with a daily trading volume of $13.1 billion.

Due to the declining trading volume, lower price volatility and liquidations would be expected for Bitcoin.

On the other hand, Billionaire entrepreneur and Bitcoin supporter Peter Thiel believes that the BTC price might not witness a dramatic rally. Thiel’s comments come while he still holds a portion of Bitcoin.

Last year, Thiel’s Founders Fund invested roughly $200 million in Bitcoin when the asset’s price was hovering at around $30,000.

Bitcoin’s downward momentum started on June 10 when the spot BTC exchange-traded funds (ETFs) in the U.S. recorded their first set of net outflows in one month.

Last week, spot BTC ETFs saw $137.2 million in net inflows in their last four trading days. This pushed the total amount of ETF net flows past the $14.5 billion mark.

Source link

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

XRP Price May Soar Past $6, Here’s Why

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs