Binance

Binance Futures updates leverage and margin tiers for multiple USDⓈ-M perpetual contracts

Published

3 months agoon

By

admin

Binance’s updated leverage and margin tiers offer improved trading options for select trading pairs, bringing both potential rewards and risks for crypto traders.

The leverage and margin levels for USDⓈ-M perpetual contracts, including DAR, ME, CAKE, IOTA, LPT, ONE, and ZEN, will be updated by Binance Futures today, with effect from 08:15 UTC on Dec. 19, 2024.

USDⓈ-M stands for USD-Margined Futures, a type of cryptocurrency futures contract offered on platforms like Binance. It refers to stablecoins such as USDT (Tether) or BUSD (BUSD), which are pegged to the US dollar. These contracts are settled in these stablecoins, rather than traditional fiat currency or the underlying crypto asset.

Depending on the contract and position size, the revised leverage tiers will vary from 1x to 75x, enabling traders to fully benefit from their leveraged positions in the crypto market.

Leveraged positions of traders will be impacted by the new maintenance margin rates, which range from 1.00% to 50.00%.

Margin is the total amount of collateral needed to open and sustain a trading position, whereas leverage is the borrowing of funds to increase the size of a position. The possible return increases with leverage, but the chance of loss also goes up.

By adjusting the margin and leverage tiers, Binance Futures continues to give traders more choices to control risk and profit from volatile crypto market movements.

Traders must keep themselves updated with Binance Future trading rules and exercise risk management, particularly when working with high-leverage instruments over several contracts and margin holdings.

Source link

You may like

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Altcoins

Whales Abruptly Deposit Ethereum Altcoin to Binance and OKX, Causing Price To Plummet 50%: On-Chain Data

Published

1 week agoon

March 25, 2025By

admin

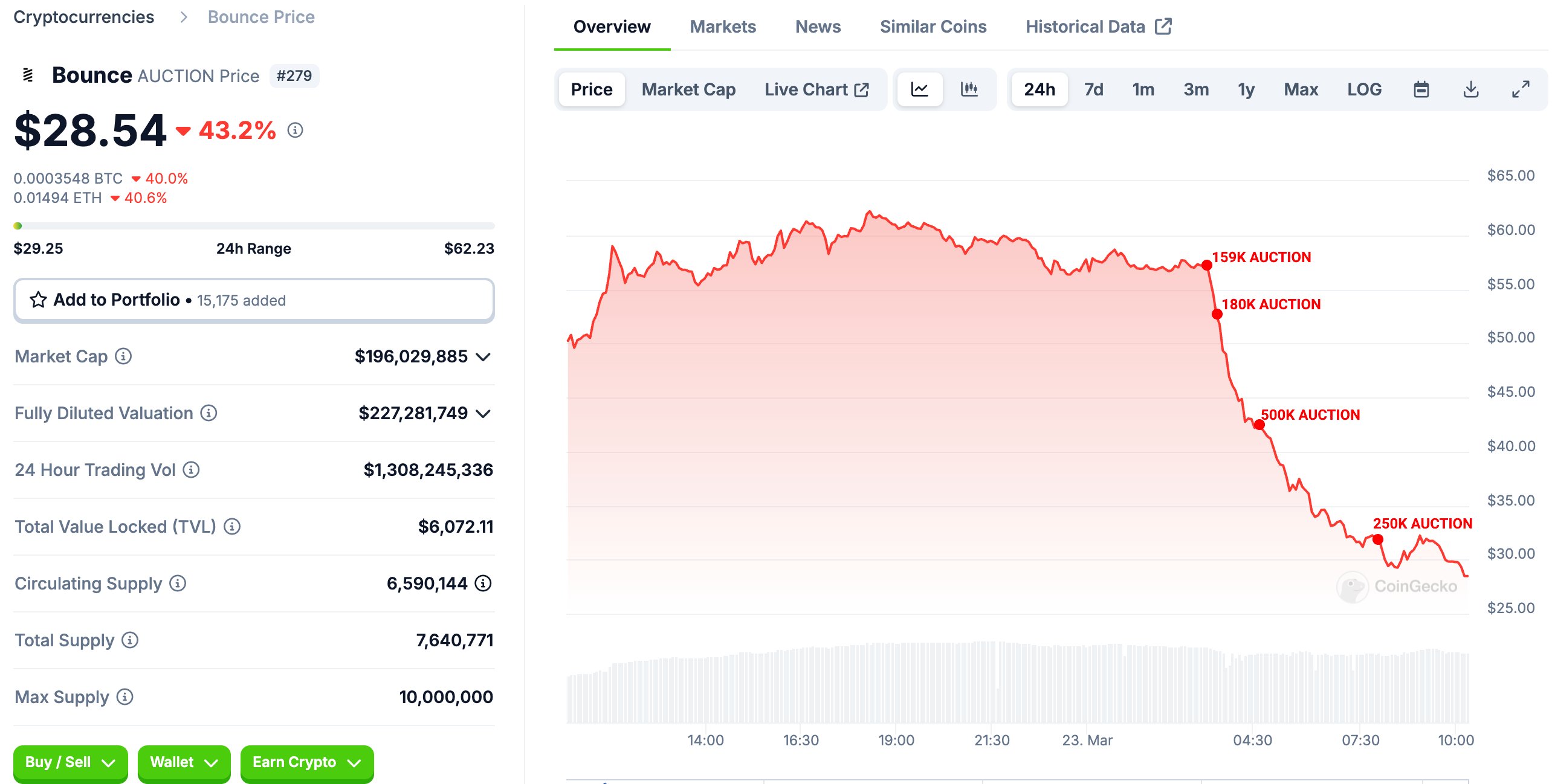

Deep-pocketed traders triggered a price crash over the weekend after depositing a huge chunk of an altcoin’s supply to digital asset exchanges.

According to blockchain tracking firm Lookonchain, whales in the Bounce (AUCTION) market have been greatly influencing the altcoin’s price action for the past week, causing massive swings in both directions.

Bounce Finance is a decentralized auction platform enabling auctions for various assets, such as physical assets tokenized on the blockchain and non-fungible tokens (NFTs).

AUCTION tokens are used for governance, staking, and fees for participating in auctions or creating NFTs on the platform.

Lookonchain says that in the last several days, whales sent over 14% of the circulating supply of AUCTION to Binance, the largest crypto exchange in the world by volume, and OKX. Those deposits presumably led to coins being sold on the open market, which ultimately caused prices to plummet.

Says Lookonchain,

“AUCTION Whales deposited 1.08 million AUCTION ($48.6 million, 14.26% of the total supply) into Binance and OKX again, causing the price to plummet by 50%.

Pay attention to price changes.”

At time of writing, AUCTION has not recovered, currently trading at $20.93 with a market cap of $137 million. AUCTION is ranked as the 363rd-largest crypto asset by market cap.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Ali Martinez

Analyst Sets Dogecoin Next Target As Ascending Triangle Forms

Published

1 week agoon

March 24, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst CobraVanguard has revealed the next price target for Dogecoin as an ascending triangle forms for the foremost meme coin. A rally to this price target could pave the way for the new highs, especially with the crypto market looking to be in rebound mode.

Next Target For Dogecoin As Ascending Triangle Forms

In a TradingView post, CobraVanguard set $0.197 as the next target for the Dogecoin price with an ascending triangle forming. He noted that this ascending triangle indicates a potential price increase. The analyst added that it is anticipated that the price could rise, aligning with the projected price movement of AB=CD.

Related Reading

Meanwhile, CobraVanguard warned that it is crucial to wait for the triangle to break before taking any action. His accompanying chart showed that Dogecoin needs to break above $0.177 to confirm a break above the ascending triangle. A break above that target would then lead to a rally to the $0.197 target.

Dogecoin already looks to be in rebound mode at the moment, alongside Bitcoin, which is nearing the $90,000 mark again. The foremost meme coin is nearing the $0.177 target for a break above the ascending triangle. As crypto analyst Kevin Capital suggested, DOGE will likely rally as long as BTC is in bullish territory.

Crypto traders are also betting on a Dogecoin rally to the upside. Crypto analyst Ali Martinez revealed that 76.26% of traders with open DOGE positions on Binance futures are leaning bullish. This is particularly bullish because Binance traders have a good track record of being right most of the time. In another X post, Martinez revealed that whales bought over 120 million DOGE last week, which is also bullish for the foremost meme coin.

DOGE’s Market Structure Has Shifted

In an X post, crypto analyst Trader Tardigrade revealed that Dogecoin’s market structure has shifted. This came as he noted that Dogecoin is recovering from an ascending triangle, forming higher highs and higher lows from lower highs and lower lows.

Related Reading

Based on this, the analyst affirmed that Dogecoin had shifted the market structure from a downtrend to an uptrend on the hourly chart since it just formed the second higher high. His accompanying chart showed that DOGE is eyeing a rally to $0.177 as it continues to form higher highs.

Martinez raised the possibility of the Dogecoin price rallying to as high as $4 or even $20 in the long term. He stated that if DOGE holds above the $0.16 support at the lower boundary of an ascending channel, history suggests that it could rebound toward the mid-range at $4 or upper range at around $20.

At the time of writing, the Dogecoin price is trading at around $0.174, up over 3% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pexels, chart from Tradingview.com

Source link

Altcoins

Binance Launchpool To Roll Out Support for New Native Token of Private Data ‘Blind Computer’ Project

Published

1 week agoon

March 23, 2025By

admin

Binance is planning on launching trading support for the new native asset of a decentralized network focused on secure data storage.

Binance Launchpool, which lets users stake coins to farm new assets, says its 65th project will be Nillion (NIL), a secure computation network that decentralizes trust for high-value and private data.

Explains the project,

“Nillion is Humanity’s First Blind Computer – a whole new category of decentralized network designed for AI and the future of the Internet. Nillion makes new applications possible by providing storage and computation on high-value, encrypted data without ever seeing it. Whether a user, an app, or an enterprise, your data stays yours – always.”

Between March 21st and 24th, Binance users can lock their BNB, the crypto exchange platform’s native asset, as well as the stablecoins First Digital USD (FDUSD) and USDC, to receive NIL airdrops.

The top global crypto exchange then plans to list the asset on March 24th. Binance will attach a seed tag to NIL, which the exchange applies to lower-liquidity projects that may exhibit higher volatility compared to other listed tokens.

Binance requires users who own assets with seed tags to pass quizzes every 90 days to ensure they’re aware of the risks before trading the tokens.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Kristin Smith Steps Down as Blockchain Association CEO to Lead Solana’s Policy Push

crypto eyes ‘good news’ amid fragile market psychology

Bitcoin Price (BTC) Rises Ahead of President Trump Tariff Announcement

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Bitcoin And Altcoins Fischer Transform Indicator Turn Bearish For The First Time Since 2021

Grayscale files S-3 for Digital Large Cap ETF

279% Rally in 2025 for One Under-the-Radar Altcoin ‘Very Likely,’ According to Crypto Analyst

Human Rights Foundation Donates 1 Billion Satoshis To Fund Bitcoin Development

Dogecoin, Cardano Lead Gains as Crypto Majors Rally

Fartcoin price surges 35% as recovery gains momentum

$1M Premium Paid for $70K Bitcoin Put Option

How DePIN’s Revenue Growth is Attracting Equity Investors – DePIN Token Economics Report

Bitcoin Poised For A Q2 Recovery? Analyst Points 2017 Similarities

Binance ends Tether USDT trading in Europe to comply with MiCA rules

Crypto Trader Warns of Potential 33% Dogecoin Drop, Unveils Downside Price Target for Ethereum

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x