Bitcoin

Bitcoin Crashes To $65,000, Expert Unpacks Drivers Of Crypto Market Bloodbath

Published

2 weeks agoon

By

admin

The cryptocurrency market has been experiencing a significant downturn, with Bitcoin leading the way by retracing to the $65,000 mark after failing to retest its all-time high of $73,700 reached in March.

Market expert Michael van de Poppe has shed light on the reasons behind this ongoing bloodbath, highlighting several key factors that have contributed to the current state of the market.

Crypto Market Battles Uncertainties

A key event highlighted by van de Poppe is last Wednesday’s release of the Consumer Price Index (CPI) data, which has a major impact on the Federal Reserve’s decision on interest rates.

The data, which came in lower than expected, favored risk assets. A lower-than-expected headline CPI of 3.3% (vs. 3.4% expected) and core CPI of 3.4% (vs. 3.5% expected) pointed to potential rate cuts or a positive outlook for future rate cuts, providing favorable market conditions.

Related Reading

Another significant event was the release of the Producer Price Index (PPI) data, which provides inflation data from the producer’s perspective. The data revealed a lower-than-expected regular PPI score of 2.2% (versus an expected 2.5%) and Core PPI Y/Y score of 2.3% (versus an expected 2.4%).

Additionally, the monthly data showed negative figures, further favoring risk-on assets. However, van de Poppe contends that despite these positive indicators, the crypto market has continued its downward trend.

According to van de Poppe, the release of consumer sentiment data on Friday also impacted the market. Consumer sentiment is considered a market leader and a gauge of market strength or weakness. The data came in lower than expected, with a score of 65.6 (versus an expected 72.1).

This data signaled a lack of economic strength, potentially fueling bullish sentiments for risk-on assets and a shift toward crypto-native markets.

However, Federal Reserve Chairman Jerome Powell delivered an unexpectedly hawkish speech. Despite data pointing towards the need for rate cuts and worsening economic conditions, Powell maintained a hawkish tone and revised the potential rate cuts in 2024.

According to Michael van de Poppe, this outlook did not bode well for the markets, adding to existing uncertainties and the notorious price volatility seen in recent days.

Bitcoin Price’s Struggle Continues As Bond Yields Drop

The analyst further pointed out that Market indicators, such as Treasury Bond Yields, declined. The 2-year Treasury Bond Yield dropped to the lowest point in two months, while the 10-year Yield continued its fall to the lowest point since the beginning of April.

These indicators typically suggest favorable conditions for Bitcoin and risk-on assets, implying a higher probability of a potential rate cut. However, the strength of the US Dollar persisted due to the rate cut by the European Central Bank (ECB).

Van de poppe believes that this unexpected Dollar strength, driven by the ECB’s actions, further complicated the market dynamics, as rate cuts are usually necessary for economic stability.

Related Reading

In sum, the cryptocurrency market, particularly Bitcoin, has substantially declined as it struggles to regain its previous highs. Despite positive economic data pointing towards potential rate cuts and market indicators favoring risk-on assets, the market has failed to respond positively.

The ongoing uncertainties surrounding events, such as the listing of the Ethereum ETF, have contributed to the market’s weakness. With rate cuts on the horizon and the Dollar’s strength persisting, the upcoming weeks will likely be critical in determining the market’s direction.

When writing, Bitcoin was trading at $65,280, down by 2% in the past 24 hours and over 5% in the past seven days.

Featured image from DALL-E, chart from TradingView.com

Source link

You may like

Book of Meme sees gains as Pepe Unchained ICO raises $1 million

Coinbase Won’t Support Upcoming AI Token Merger Between Fetch.ai, Ocean Protocol and SingularityNET

BTC Back To $60K Amid ETF Outflows, Top Cryptos Prices Fall

21Shares files spot Solana ETF with SEC

Google Releases Supercharged Version of Flagship AI Model Gemini

Coinbase, MicroStrategy, and Crypto Stocks Record Weekly Upswing

Bitcoin

Three Bitcoin Metrics Are Flashing Bullish Signals for BTC, Says VanEck Executive Matthew Sigel

Published

17 hours agoon

June 28, 2024By

admin

One financial analyst says Bitcoin (BTC) is showing three important bullish metrics.

In a new interview with Scott Melker, VanEck Head of Digital Assets Matthew Sigel says recent indicators are making him bullish on BTC.

“I got renewed bullish on Tuesday just you know noticed some capitulation indicators in the space like realized losses by short-term holders for example over 500 million like that’s a top five print of all time for Bitcoin. And then I saw BTC volatility hit 21 that’s a 30-day annualized VA that is also a very low number…”

According to Sigel, the metrics that he sees flashing bullish for BTC are realized losses, volatility, and drawdown.

The realized losses metric is the difference between the buying and selling prices of BTC holders. The volatility refers to how prices are scattered historically for BTC. Drawdown refers to how far down BTC is from its peak of $73,737, reached four months ago.

BTC is worth $61,846 at time of writing.

Last week, Sigel also suggested that Ethereum (ETH) could explode by 4,225%.

In the report released earlier this month, VanEck set a base case target for Ethereum of $22,000, a potential gain of 518% from the current level. To hit the bull case target, Ethereum would have to appreciate by 4,225% from the current price.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

24/7 Cryptocurrency News

Bitcoin (BTC) and Gold Converge In New ETF Filing

Published

1 day agoon

June 27, 2024By

admin

A newly filed Exchange-traded Fund (ETF) aims to bring the duo of Bitcoin (BTC) and Gold together as a single product.

100% Leveraged Bitcoin And Gold ETF

Henry Jim, the popular analyst of ETF Hearsay shared the news of a stacked Bitcoin and gold ETF on X. According to the description of the proposed offering which was submitted to the United States Securities and Exchange Commission (SEC), it uses leverage to simultaneously provide 100% exposure to BTC and gold.

New stacked Bitcoin and gold ETF filed

STKD Bitcoin & Gold ETF

ticker and fees tba

effective date: Sep 9, 2024Using leverage, provides simultaneously exposure to performance of #Bitcoin and gold via bitcoin futures and ETFs, and gold futures and ETFs.

Investment Sub-Adviser… pic.twitter.com/9GyOYuwqKv

— ETF Hearsay by Henry Jim (@ETFhearsay) June 27, 2024

It is designed to achieve this through Bitcoin futures and ETFs as well as Gold futures and ETFs. This would be the first of its kind for such ETF products. Notably, the sub-adviser for the proposed offering is Quantify Chaos.

The STKD Bitcoin & Gold ETF, as it was named in the filing, is designed for long-term capital appreciation. As a newly organized offering, the portfolio turnover information is currently unavailable.

Speaking of the STKD Bitcoin and gold ETF, the filing system noted that “the Fund uses leverage to ‘stack’ the total return of holdings in the Fund’s Bitcoin strategy together with the total returns of holdings in the Fund’s Gold strategy.”

Mitigating Short-term Market Fluctuation Impact

Based on its design, every investment is designed to follow and potentially profit or lose from two different investment strategies.

Noteworthy, the decision to launch this product and adopt the STKD’s investment strategy is based on the belief that the combination of Bitcoin strategy and Gold strategy investments could offer complementary benefits. This theory was promulgated after considering both assets’ historically low correlation. It is worth noting that their historical price movements have not been closely related.

Ultimately, the product is just focused on mitigating the impact of short-term market fluctuation on the overall investment outcome by combining assets with low correlation. In the long run, this will potentially contribute to the prevalence of a more stable investment trajectory.

On its own, spot Bitcoin ETFs are doing well, grabbing a significant share of the broader ETF market. On Wednesday, the Bitcoin ETF market saw positive inflow which came to a total of over $21 million. This influx was led by Fidelity while BlackRock remained stagnant, recording zero inflows. On the other hand, Grayscale’s GBTC grabbed the eyeballs with its positive flows after an outflow streak.

Read More: Wall Street Embraces Altcoins with New Solana ETF: Pompliano

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture. Follow him on Twitter, Linkedin

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Binance

Dormant Crypto Whale Wakes Up, Moves $3,050,000 Worth of Bitcoin (BTC) to Binance

Published

1 day agoon

June 27, 2024By

admin

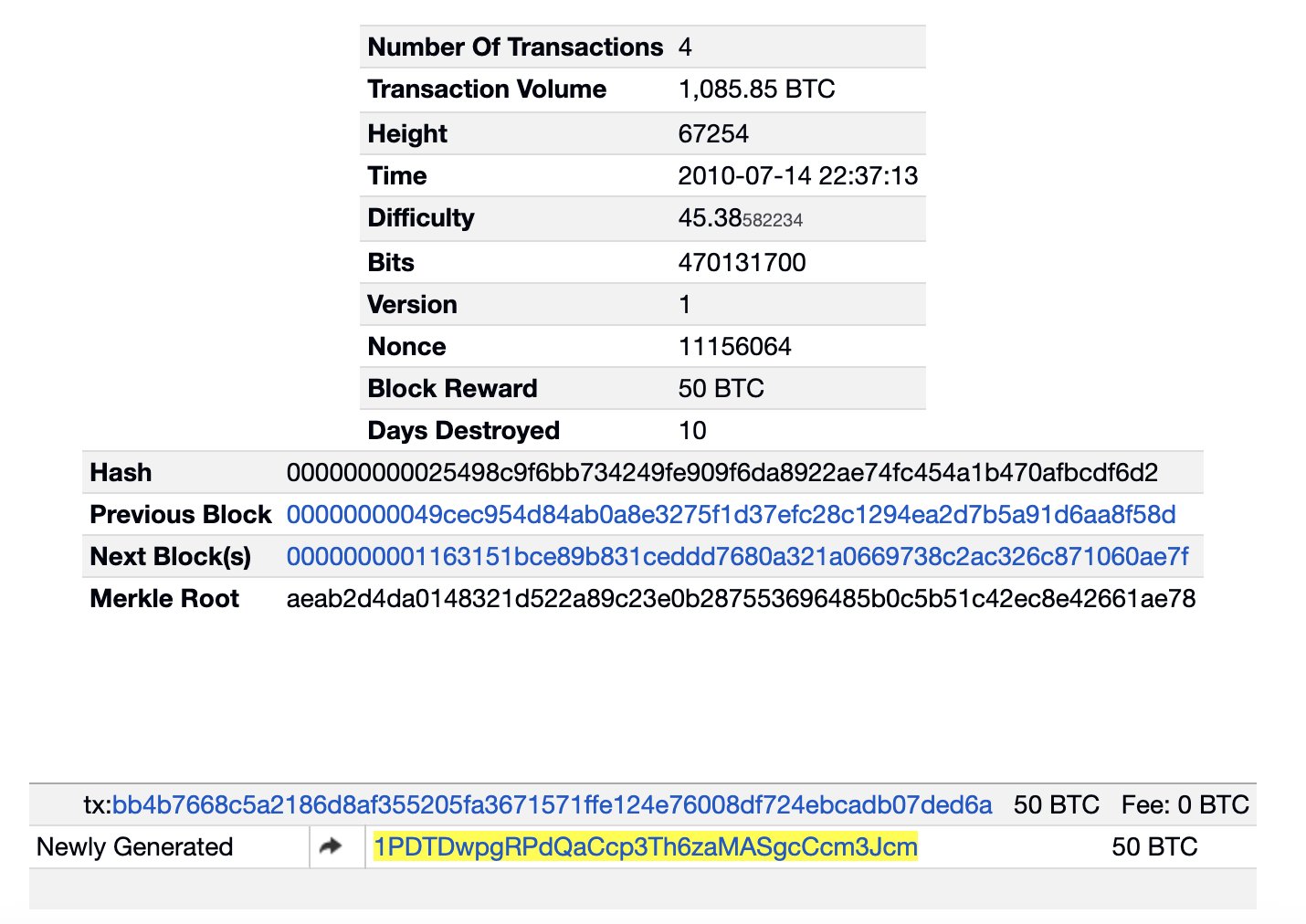

A long-dormant crypto whale has woken up after years of slumber to move millions of dollars worth of Bitcoin (BTC) to Binance, the world’s largest crypto exchange platform by volume.

New data from market intelligence firm Lookonchain reveals a crypto mining wallet that has been asleep for 14 years has abruptly woken up and deposited 50 BTC, worth about $3.05 million at time of writing, to Binance on June 26th.

According to the crypto analytics platform, the miner earned the tokens during July 2010 when the crypto king was trading for under $1.

“A miner wallet woke up after being dormant for 14 years and deposited 50 BTC ( $3.05 million) to Binance seven hours ago. The miner earned 50 BTC from mining on July 14, 2010.

Address: 1PDTDwpgRPdQaCcp3Th6zaMASgcCcm3Jcm”

Earlier this year in May, Lookonchain also found that two wallets that had seen no activity since 2013 also suddenly shifted around millions of dollars worth of BTC.

At the time, Lookonchain found that the deep-pocketed investors moved a combined $61 million worth of Bitcoin 11 years after purchasing 500 tokens for just $124 each. According to the on-chain data, the wallets printed staggering gains of nearly 50,000%.

The top crypto asset by market cap is trading for $61,630 at time of writing, a marginal increase during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong

Source link

Book of Meme sees gains as Pepe Unchained ICO raises $1 million

Coinbase Won’t Support Upcoming AI Token Merger Between Fetch.ai, Ocean Protocol and SingularityNET

BTC Back To $60K Amid ETF Outflows, Top Cryptos Prices Fall

21Shares files spot Solana ETF with SEC

Google Releases Supercharged Version of Flagship AI Model Gemini

Coinbase, MicroStrategy, and Crypto Stocks Record Weekly Upswing

CleanSpark’s acquisition of GRIID reiterates CLSK as a Buy

Treasury and IRS Finalize Broker Rule, Defers DeFi Decision

U.S. Treasury Issues Crypto Tax Regime For 2025, Delays Rules for Non-Custodians

Lido and Rocket Pool tokens tank after SEC sues Consensys

Consensys Responds to SEC Lawsuit Over MetaMask

BREAKING: 21Shares Joins Race To Launch Spot Solana ETF

Supreme Court Decision Overturns Chevron: A Victory for Judicial Authority and Bitcoin

ADA short positions spike; experts double down on Dogecoin, Angry Pepe Fork

Crypto Airdrops To Watch Out For in July

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: