business

Bitcoin Financial Platform Lava Unveils Exchange And Stable Payments

Published

2 weeks agoon

By

admin

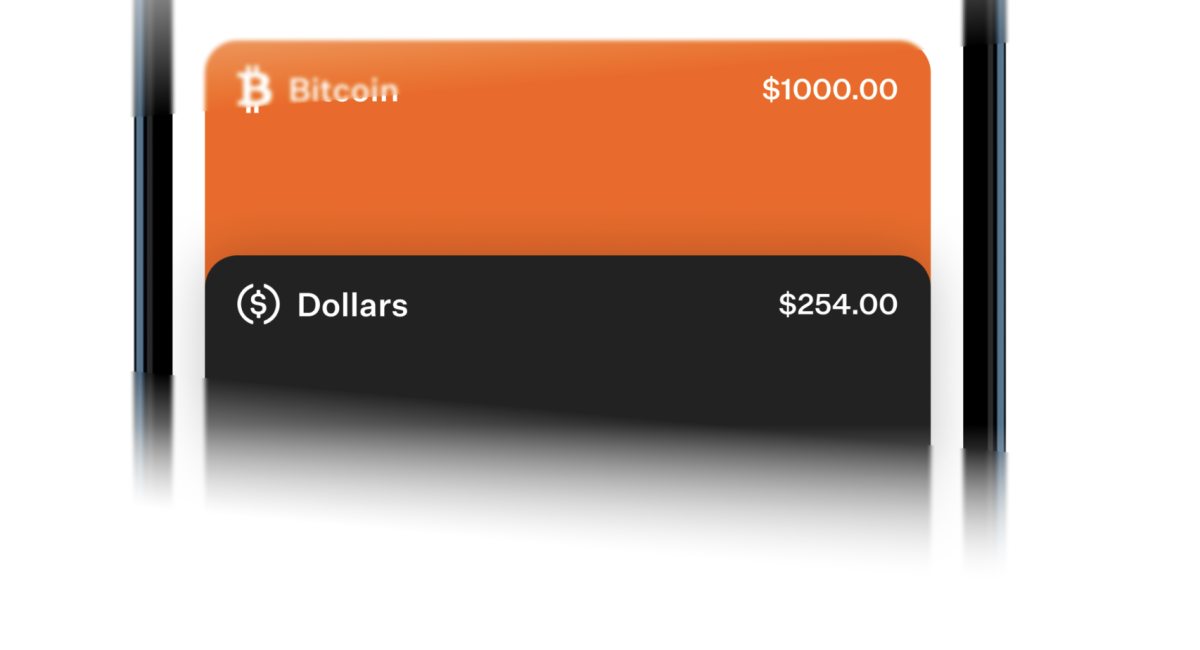

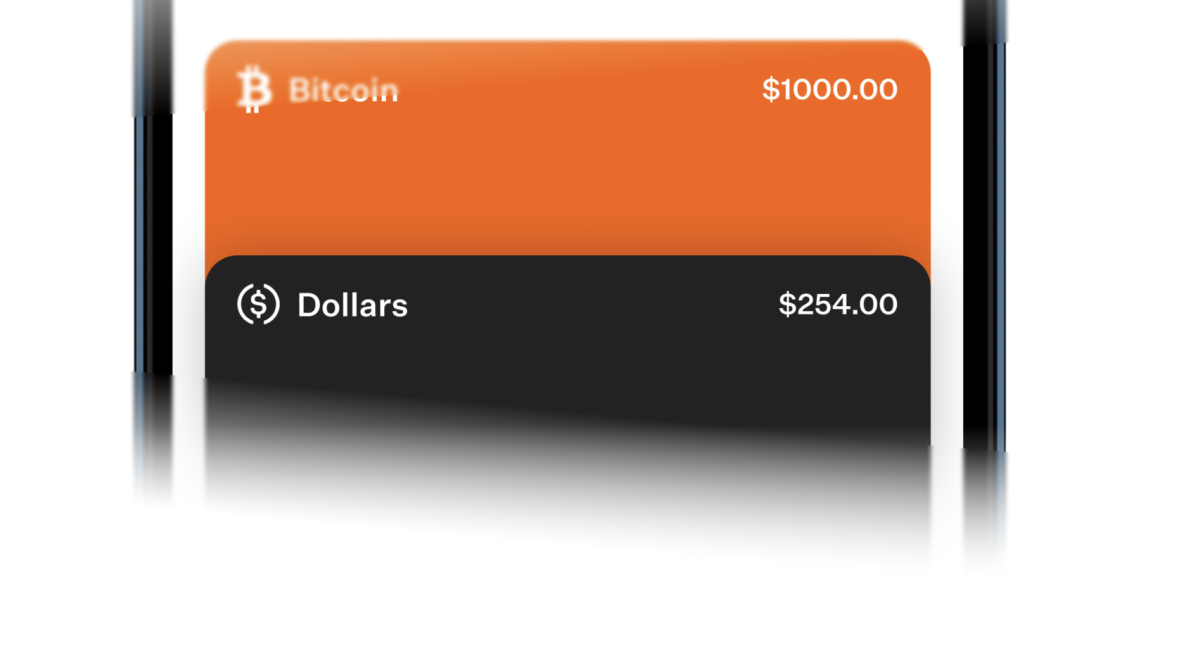

Following a year of stealth development, Lava is introducing the first two of its suite of financial products—Lava Free Pay and Lava Exchange—poised to transform how we handle digital dollars and access to Bitcoin. In a conversation with Bitcoin Magazine, Lava CEO Shezhan Maredia provided an in-depth look at what these new offerings bring to the table and how he hopes they can redefine the mobile self-custodial experience.

Lava Free Pay: Liberating Global Payments

The promise of digital dollars has always been seamless, global payments. However, Maredia argues the current user experience falls short. “Imagine if every time you wanted to send money on Venmo, you first had to buy volatile VenmoBucks, incurring fees, and then pay an additional transaction fee in those same volatile VenmoBucks.”

Lava abstracts those issues to provide Bitcoin users seamless access to stablecoins. “The traditional friction of having to deal with other chains has been completely removed. No unnecessary detail is exposed in the app.”

Lava Free Pay is a trustless broadcasting service for users that provides best-in-class stablecoin integration of any Bitcoin wallet in the marketplace. This innovation unlocks free, instant, and global payments, making digital dollars more practical and accessible for everyday use.

Maredia explains he plans to support multiple networks and eventually allow users to send payments across all of them. “Bitcoin-based alternatives may be considered once they mature.” These upgrades will integrate smoothly into Lava’s existing infrastructure, ensuring users don’t have to worry about the technical details.

Lava Exchange: Your Gateway to Self-Custody Asset Management

Navigating the world of Bitcoin and digital assets can be overwhelming, especially when it comes to finding the best exchange rates and lowest fees. Lava Exchange addresses this challenge by enabling users to buy assets directly to self-custody and withdraw money to their bank accounts with minimal fees.

“We thought long and hard about how to offer users a cheap and convenient way to onboard into Lava self-custodially,” says Maredia.

After considering every market option, his team decided to build their own exchange aggregator. Using your location and market data, Lava can connect you to the exchange that offers the best rates and lowest fees for your desired transactions. Those services are directly embedded in the Lava Vault, reducing the steps necessary for the user to acquire Bitcoin.

“We think people should continue to save Bitcoin and spend dollars and we want to give them the best tools to achieve this. I built Lava for those that live a Bitcoin-based lifestyle.”

Underneath the hood, Lava is supported by a state-of-the-art self-custody solution called the Lava Smart Key. Building on a decade of mobile Bitcoin development, Maredia believes his company offers the most secure mobile key custody system available today.

Lava plans to continue rolling out new products and is already getting ready to launch its awaited loans protocol using trustless Bitcoin smart contracts.

Users can get started by downloading the Lava Vault from the App Store on iOS or Android, or by visiting lava.xyz.

Source link

You may like

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Bitcoin mining

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

Published

5 hours agoon

July 3, 2024By

admin

Digital Shovel Holdings Inc. has filed a lawsuit against RK Mission Critical LLC, RK Mechanical LLC, and RK Industries LLC in the US District Court for the District of Colorado, accusing them of patent infringement, according to a press release sent to Bitcoin Magazine. The dispute revolves around Digital Shovel’s V-Shape technology, designed to increase miner density in crypto mining containers.

Digital Shovel developed the V-Shape technology in 2018, securing patents in 2022, 2023, and 2024. These patents enable a 30% increase in miner density, providing significant operational advantages. According to the complaint, Compute North, a client of RK Mission Critical, initially sought to license this technology from Digital Shovel in 2019 but was refused. Despite this, RK Mission Critical allegedly produced containers strikingly similar to Digital Shovel’s, with some staff initially mistaking them for their own products.

“Instead of competing fairly, defendants are exploiting the innovative technologies that Digital Shovel has worked hard to develop and protect through patents,” the complaint stated.

Digital Shovel’s CEO, Scot Johnson, stated that based on RK Mission Critical’s marketing, they believe they’ve sold approximately 850 units which were sold for over $200,000 per unit, resulting in sales of $170 million worth of product.

“A variety of publicly traded mining companies are using the product from RK,” Johnson said. “However, our focus is not on them or any other end user at this time. It’s on enforcing our intellectual property on the company that is building products using our technology and stealing customers from us.”

Despite being aware of the pending patents since 2021, Digital Shovel claims RK Mission Critical continued its production without authorization, and their refusal to engage in settlement negotiations has led Digital Shovel to seek legal redress. The company aims to obtain compensation and a court order to prevent further sales of the infringing containers.

Bitcoin Magazine will be interviewing Johnson in an upcoming spaces on X later today at 1:15PM EST, where those interested in learning more about this lawsuit are encouraged to attend.

Source link

Bitcoin ETF

Spot Bitcoin ETFs Saw Largest Inflow in a Month

Published

21 hours agoon

July 2, 2024By

admin

Bitcoin exchange-traded funds (ETFs) in the U.S. saw their largest daily inflow in almost a month on Monday, totalling $129 million. Based on historical price trends, Bitcoin appears poised to start July on a bullish note.

NEW: 🇺🇸 #Bitcoin ETFs saw $130 million in inflows yesterday, the largest in 3 weeks.

We are so back 🚀 pic.twitter.com/ahvdm0hoS2

— Bitcoin Magazine (@BitcoinMagazine) July 2, 2024

This marked the fifth straight day of positive flows and the highest daily amount since June 7th.

Much of Monday’s inflow went to Fidelity’s Wise Origin Bitcoin Trust, which saw $65 million enter the fund. Bitwise’s Bitcoin ETF took in $41 million, while Ark Invest’s fund attracted $13 million. The two largest Bitcoin ETFs, BlackRock’s iShares Trust and Grayscale’s fund, saw no flows.

The fresh inflows are a welcome sign after a tumultuous June that saw Bitcoin ETFs bleed nearly $1 billion in total outflows. The selling pressure mirrored Bitcoin’s price, which dropped below $20,000 briefly in June.

But historically, July has started a bullish period for Bitcoin. Over the last decade, Bitcoin has posted average returns above 11% in July, with positive performance 70% of the time.

Some analysts think seasonality could kick in again this July if spot ETF inflows persist. The theory suggests predictable cycles driven by investors selling around tax season and reentering the market later in the year.

Starting in July, Bitcoin could also face potential selling pressure from unlocked Mt. Gox coins. Its price trajectory depends on whether bullish seasonality can outweigh the bearish macro landscape.

Source link

Bitcoin Exchange

$105 Billion Electronics Giant Sony To Launch New Bitcoin Exchange

Published

2 days agoon

July 1, 2024By

admin

Sony Group is preparing to launch a Bitcoin and crypto exchange in Japan after acquiring Amber Group’s local subsidiary, Amber Japan. The revamped exchange will be called S.BLOX and aim to boost Sony’s presence in the Bitcoin and crypto space.

JUST IN: 🇯🇵 $103 billion Sony to launch #Bitcoin and crypto exchange. pic.twitter.com/wUAE1l8eq5

— Bitcoin Magazine (@BitcoinMagazine) July 1, 2024

Sony purchased Amber Japan in 2023 through its subsidiary Quetta Web. Amber Japan was originally known as DeCurret before Singapore-based Amber Group took over the Japanese exchange in 2022.

Sony has rebranded its acquired exchange as S.BLOX and plans to upgrade its user interface and mobile app significantly. The exact launch date remains unannounced.

The move reflects Sony’s growing push into Bitcoin and crypto. By leveraging the Amber Japan exchange, Sony can capitalize on its brand recognition and global reach to boost the adoption of its future Bitcoin and crypto offerings.

Japan has emerged as a leading Bitcoin market due to proactive regulation and high consumer awareness. This makes it an ideal place for Sony to debut and expand services.

Major corporations like Sony embracing Bitcoin and crypto signal wider mainstream momentum. Sony’s past acquisitions of companies like CBS Records and Columbia Pictures transformed it from an electronics firm into a global media titan. Its latest acquisition could spark a similar evolution for Bitcoin.

Source link

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs