24/7 Cryptocurrency News

Bitcoin Miners Are Selling, Will High Liquidity Derail BTC Push?

Published

3 weeks agoon

By

admin

Bitcoin (BTC) miners are facing intense heat with the growing cost of production with many now selling their BTC holdings.

Bitcoin Miner Revenue Slump: the Post-Halving Drawdown

Blockchain analytics platform CryptoQuant recently identified a significant uptick in mining pool transfers. This is in addition to a surge in Over-the-counter (OTC) desk sales.

#Bitcoin miners are under pressure and they’ve begun selling.

Let’s explore the recent uptick in mining pool transfers, the surge in OTC desk sales, and why even major publicly traded mining companies are reducing their holdings. 🧵👇

— CryptoQuant.com (@cryptoquant_com) June 13, 2024

Top crypto analyst, Ali Martinez on X linked this current market outlook to the Bitcoin halving event that went live in April. Precisely, Ali stated that the mining cost for the lead cryptocurrency grew significantly right after the halving. Currently, it cost an average of $77,000 to mine a single $BTC today.

“This spike in expenses has led to a wave of capitulation among #BTC miners in the past month,” Ali Charts mentioned.

These Bitcoin miners have ramped up selling as the price of Bitcoin fluctuates between $69,000 to $71,000. At the time of this writing, BTC was trading at $66,618.03 with a drop of 4.39% in the last 24 hours. A few days ago, transfers from mining pools to Binance surged to the point that it hit a 2-month peak of over 3,000 BTC. This shift is in alignment with a price correction that dropped Bitcoin to $66,000.

The situation is the same on OTC desks as the platform also saw a surge in sales. On Monday, miners sold 1,200 Bitcoin through OTC desks, marking the highest daily volume in over two months. Several United States Bitcoin companies have been busy offloading their Bitcoin holdings.

With June just two weeks gone, Marathon Digital Holdings Inc has offloaded 1,400 Bitcoins compared to May when it sold only 390 units. The sales represents 8% of its Bitcoin holdings.

Low Mining Revenue Triggers Selling Pressure

Miners are selling because of the negative turn that mining revenue took post-halving. In March, just around the time that Bitcoin hit its current all-time-high (ATH), miners revenue sat at $78 million. Today, this value has dropped by approximately 55% and is now at $35,000. This plunge in miners’ revenue is fueling the selling activity.

It is worth noting that Bitcoin transactions fees have also dropped reasonably to around 65 Bitcoin from 117 prior to April 18.

There are several expectations that Bitcoin could reach $100,000 by the end of June, however the selling pressure may impact negatively on the price in the short-term. With time, it is expected that the market would balance out with more liquidity.

At this point, BTC could head for its bull run if the demand from spot Bitcoin ETF issuers remains intact.

Read More: FINMA Orders Closure of Crypto Bank FlowBank, Begins Liquidation

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture. Follow him on Twitter, Linkedin

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Reasons Why Bitcoin Falls To $60K After A Weekend Pump

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

24/7 Cryptocurrency News

Reasons Why Bitcoin Falls To $60K After A Weekend Pump

Published

15 mins agoon

July 3, 2024By

admin

Bitcoin price slips to $60,000 today, sparking concerns in the broader crypto market. Following the downturn trend in BTC price, several other major cryptos also witnessed a decline today.

However, what has piqued the market interest is the potential reason behind the recent dip. Besides, the discussions further intensify, especially after the recent pump in Bitcoin over the weekend.

Why Bitcoin Slips To $60K Today?

The recent decline in Bitcoin price to $60,000 raised eyebrows across the cryptocurrency landscape. However, amid this, a new report by 10X Research sheds light on the key factors driving this sluggish performance in the flagship crypto.

Their report outlines that the weekend pump was likely a technical reset, alleviating oversold conditions in the short term. This reset paved the way for the downtrend to resume as longer-term technical signals point to a potential topping formation.

In addition, the report suggests that despite short-term bullish sentiments driven by factors such as U.S. Presidential Election tailwinds and anticipated interest rate cuts, these were overshadowed by deeper technical and structural concerns. Analysts from 10X Research highlight the significant role of on-chain signals, market flows- particularly from Bitcoin miners’ inventory, and market structure data in this downturn.

These factors collectively contributed to a bearish outlook for Bitcoin, outweighing temporary bullish influences. Besides, one crucial aspect noted was the impact of low trading volumes over the weekend.

During these periods, even modest buying activity can trigger stop orders, leading to liquidations and amplifying price movements. This phenomenon was evident in the recent weekend’s upward surge, which swiftly turned into a correction as the upside risk from short covering diminished and downside pressures took hold.

Also Read: Fidelity & Sygnum Taps Chainlink For Tokenized Asset Data

What’s More?

Another significant driver of Bitcoin’s price decline is the impending expiration of substantial Bitcoin and Ethereum options. Data from Deribit indicates that Bitcoin options with a notional value exceeding $1.04 billion are set to expire on July 5, with a put/call ratio of 0.80 and a maximum pain price of $63,000.

On the other hand, Ethereum options worth $479.30 million, featuring a put/call ratio of 0.38 and a max pain price of $3,450, are also due to expire on the same date. These expiries are generating uncertainty, prompting traders to adjust their positions ahead of the deadline. The approaching expiry date increases market volatility, as participants hedge their bets and recalibrate strategies in response to the significant options contracts that are about to mature.

In addition, the July 2 outflow in the U.S. Spot Bitcoin ETF following a 5-day winning streak also weighed on the investors’ sentiment. According to recent data, the U.S. Spot Bitcoin ETFs recorded an outflow of nearly $14 million on Tuesday, following an influx of about $130 million in the prior day.

Further Liquidation Ahead?

Several market experts appear to have remained bullish despite today’s slump. However, it’s worth noting that the liquidation warning from 10X Research as well as from other prominent analysts have weighed on the sentiment.

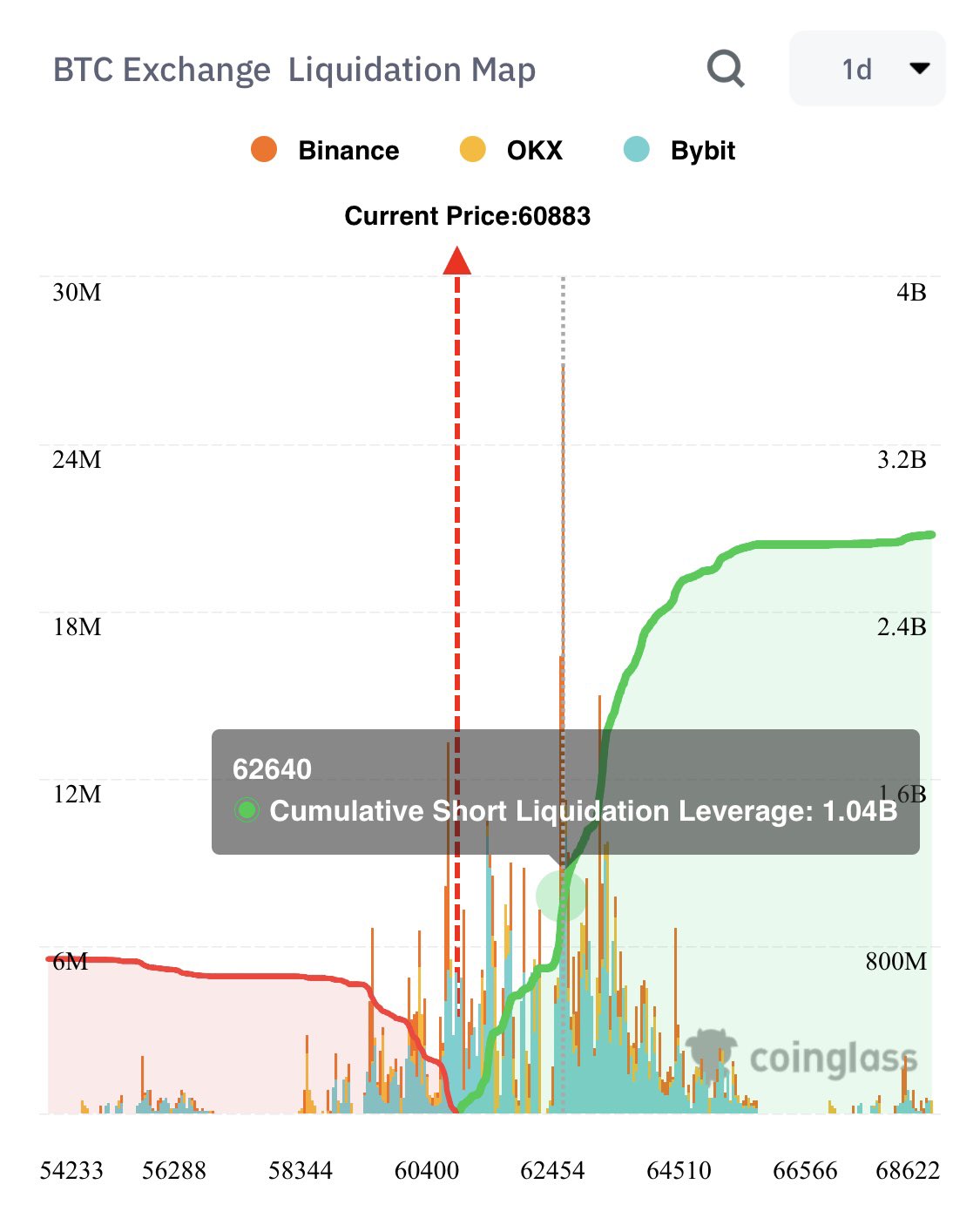

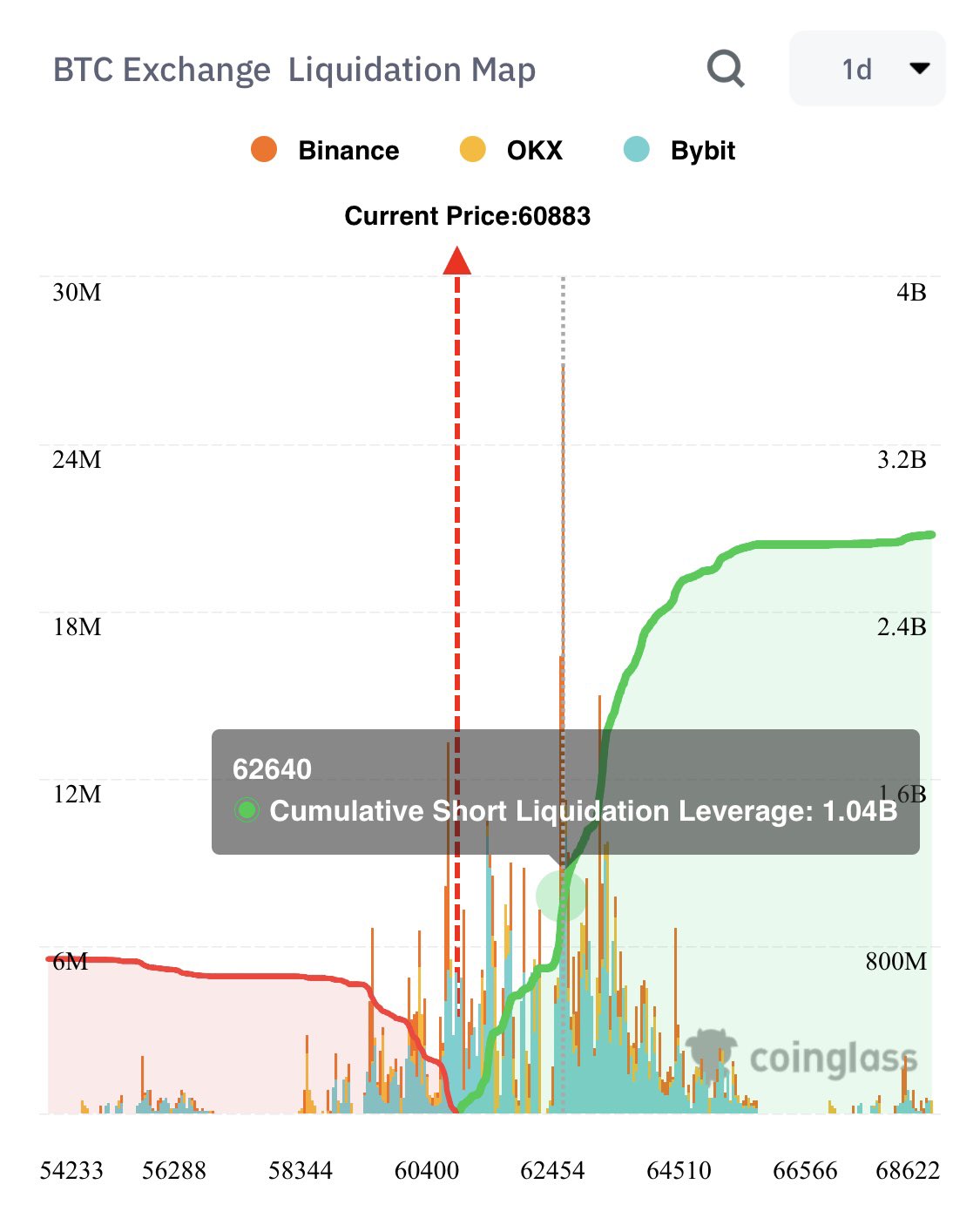

For context, Ali Martinez said that Bitcoin may recover from its current phase while revealing a warning. Martinez, while analyzing the Bitcoin Exchange Liquidation Map, said that BTC risks witnessing over $1 billion in liquidation if it reaches the $62,600 level.

As of writing, Bitcoin price was down more than 3% and hovers near the $60,500 range. Its one-day trading volume rose 7% to $23.54 billion, while the crypto has touched a 24-hour high of $63,015.03. Furthermore, CoinGlass data showed a slump of more than 4% in Bitcoin Futures Open Interest from yesterday.

Also Read: Binance Announces Delisting Of Key Crypto Pairs, Brace For Market Impact

Rupam, a seasoned professional with 3 years in the financial market, has honed his skills as a meticulous research analyst and insightful journalist. He finds joy in exploring the dynamic nuances of the financial landscape. Currently working as a sub-editor at Coingape, Rupam’s expertise goes beyond conventional boundaries. His contributions encompass breaking stories, delving into AI-related developments, providing real-time crypto market updates, and presenting insightful economic news. Rupam’s journey is marked by a passion for unraveling the intricacies of finance and delivering impactful stories that resonate with a diverse audience.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Published

7 hours agoon

July 3, 2024By

admin

The crypto market fluctuations continue to dominate the market while assets like Toncoin and Cardano move away from bearish sentiments. In the past week, most top assets traded sideways after exits recorded by institutional investors in the market. The status quo saw Bitcoin (BTC) price hovering around $61,000 before attempts at a rebound.

Toncoin and Cardano have shown promise ahead of the market outpacing top crypto assets by market capitalization. At press time, the market cap slumped 1.42% to $2.29 trillion with Bitcoin and Ethereum posting 24-hour losses. Major drivers of TON and ADA prices are bullish on-chain factors and key industry developments.

Toncoin Leads Asset Gainers

Toncoin soared 4.5% in the last 24 hours, leaving the wider market in the dust and adding to its recovery numbers. In the last seven days, TON moved up 8% wiping out previous losses. While most monthly numbers dropped for most assets, TON continued to soar hitting 22%. The asset flipped Dogecoin to become the 8th largest crypto by market cap inching closer to a new all-time high.

TON price stands at $8.05 taking its market cap to $19.8 billion while volumes are up 57% today. Last month, Toncoin tapped a new all-time high at $8.24 and remains 2.37% behind the mark. With rising bullish interest, some users expect the asset to break that level.

Toncoin recorded traction as Kazakhstan exchanges began trading the asset following regulatory approval. Similarly, Pantera Capital also increased its investment in Toncoin.

Cardano Attracts Growth

The community dubbed ETH killer jumped 3.5% to trade at $0.418 pushing its market capitalization to $14.9 billion. Weekly numbers were up 6% while daily trading volumes saw a slight increase. Overall, ADA’s recent bullish following anticipated network upgrades and a rise in on-chain volumes. The asset is tipped by bulls to breach the current resistance level despite market fluctuations.

Also Read: Why Are Ethereum Institutional Products Depleting Before ETF Launch?

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ripple and Coinbase Use Binance Win to Contest SEC Claims

Published

11 hours agoon

July 2, 2024By

admin

Coinbase and Ripple Labs are using Binance’s pivotal legal victory to challenge ongoing cases with the U.S. Securities and Exchange Commission (SEC). Both companies argue that the SEC’s approach needs more clarity and consistency, necessitating formal rulemaking to better define the regulatory perimeter for digital assets.

Ripple, Coinbase Cite Binance Case Against SEC

Ripple Labs and Coinbase have intensified their legal defenses by referencing a recent court order involving Binance, which achieved a partial dismissal in its SEC lawsuit. The companies argue that this precedent highlights the need for the SEC to establish clear regulations. In its latest court filing, Ripple emphasized the judge’s remark that cryptocurrency does not align seamlessly with existing securities laws, such as those established by the 1946 Howey Test. This test is crucial for determining whether a transaction qualifies as an investment contract and thus falls under securities regulation.

Coinbase has concurrently voiced concerns over the SEC’s expansive interpretation of securities laws applied to the crypto industry. The exchange asserts that this broad application could be more extensive and better defined, pushing for a definitive rulemaking process to provide legal clarity. In its appeal, Coinbase cited the recent Binance ruling to bolster its case for rulemaking, arguing that the decision underscores the inconsistencies in current regulatory applications.

Also Read: Bybit Exchange Unveils Support For ASI Alliance, Will FET Rebound?

Coinbase Demands Clarity in SEC Regulatory Battle

The SEC has engaged with various cryptocurrency platforms and assets, deeming some of their operations as securities offerings without proper registration. In the case of Ripple, the SEC’s lawsuit initiated in December 2020 alleged that Ripple raised over $1.3 billion through sales of its XRP token, which the SEC classified as an unregistered security. However, in a significant turn, Judge Analisa Torres ruled that certain “programmatic sales” of XRP did not constitute securities transactions, introducing a nuanced interpretation Ripple now seeks to leverage to challenge broader SEC claims.

Coinbase faces similar regulatory scrutiny. The SEC argues that the platform operated as an unregistered securities exchange, a claim that Coinbase refutes, urging a formal rulemaking process to clarify these regulatory boundaries. Both Coinbase and Ripple use recent judicial outcomes, notably the Binance case, to argue for a more structured and transparent regulatory framework from the SEC, stressing that the current state of affairs is inefficient and unclear.

Crypto Firms Rally Around Binance Court Decision

The partial victory for Binance in its own SEC lawsuit has become a strategic reference point for other crypto entities embroiled in legal challenges with the regulator. Despite Judge Amy Berman Jackson’s decision to proceed with most of the SEC’s claims against Binance, her dismissal of the charge regarding secondary sales of Binance Coin (BNB) as securities has been perceived as a significant legal precedent. Coinbase and Ripple have particularly highlighted this aspect of the ruling in their ongoing litigation.

Further developments are anticipated, with a scheduled conference for the SEC’s case against Binance set for July 9. Meanwhile, Coinbase and Ripple continue to press for regulatory clarity, which they argue is crucial for the industry’s stability and growth.

Also Read: Genesis Digital Is Considering Going Public Via IPO In US: Report

Maxwell is a crypto-economic analyst and Blockchain enthusiast, passionate about helping people understand the potential of decentralized technology. I write extensively on topics such as blockchain, cryptocurrency, tokens, and more for many publications. My goal is to spread knowledge about this revolutionary technology and its implications for economic freedom and social good.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Reasons Why Bitcoin Falls To $60K After A Weekend Pump

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: